Third Quarter 2025 Nigerian share picks Update..26Percentage Up!Third Quarter Price Movement Analysis Report - 1st September 2025

1. Overview

The analysis highlights percentage changes for individual stocks, the average change, and the overall portfolio change assuming equal investment across all 10.

2. Individual Stock Performance

| Stock | Previous (₦) | Current (₦) | % Change |

| -------------- | ------------ | ----------- | ----------- |

| **ARADEL** | 514.5 | 512.2 | **−0.45%** |

| **BUACEMENT** | 100.0 | 151.8 | **+51.80%** |

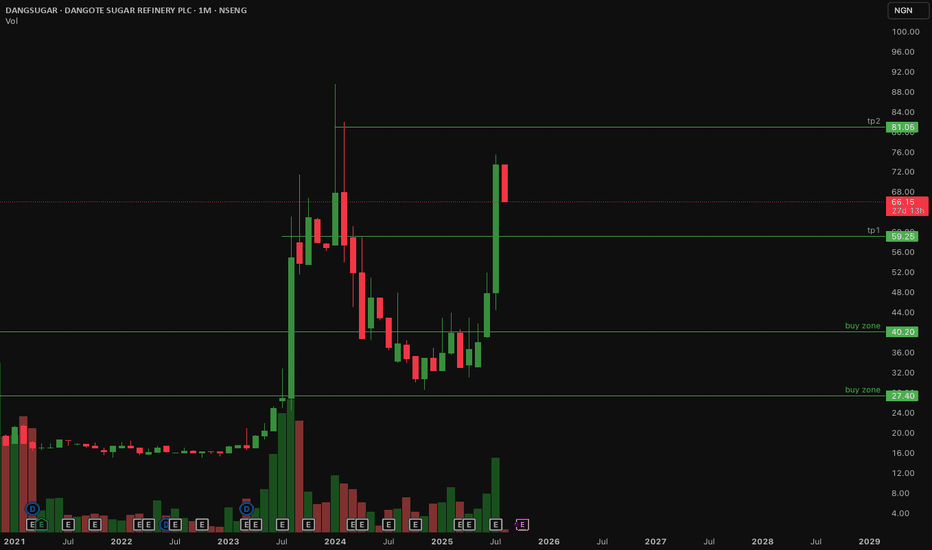

| **DANGSUGAR** | 48.4 | 58.0 | **+19.83%** |

| **DANGCEM** | 440.0 | 520.2 | **+18.23%** |

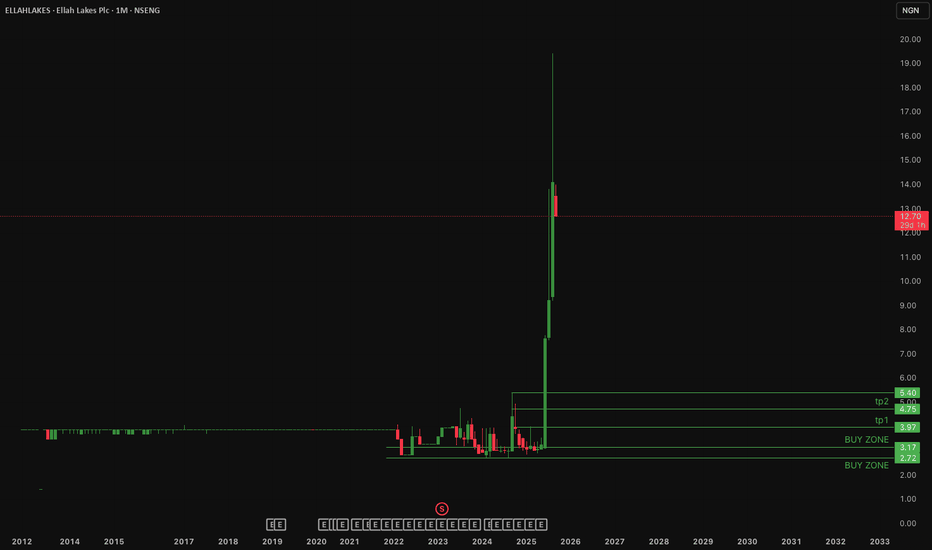

| **ELLAHLAKES** | 7.1 | 13.45 | **+89.44%** |

| **ETRANZACT** | 7.25 | 10.85 | **+49.66%** |

| **HMCALL** | 4.2 | 4.28 | **+1.90%** |

| **MULTIVERSE** | 8.75 | 10.90 | **+24.57%** |

| **NB** | 59.0 | 70.20 | **+19.00%** |

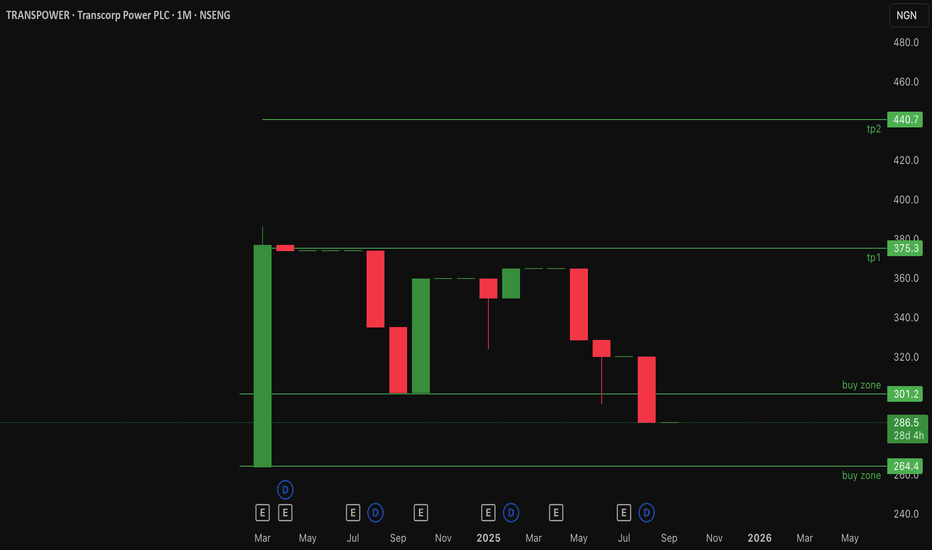

| **TRANSPOWER** | 320.0 | 286.5 | **−10.47%** |

3. Top Gainers and Losers

Top Gainers:

ELLAHLAKES** (+89.44%) — Small-cap rally, nearly doubled in price.

BUACEMENT** (+51.80%) — Strong institutional demand.

ETRANZACT** (+49.66%) — Fintech sector showing renewed momentum.

Moderate Gainers:

DANGSUGAR (+19.83%), NB (+19.00%), MULTIVERSE (+24.57%), DANGCEM (+18.23%).

Flat/Minor Move:

HMCALL (+1.90%), ARADEL (−0.45%).

Top Loser:

TRANSPOWER (−10.47%) — noticeable decline, likely on profit-taking.

4. Averages vs Portfolio Performance

Average of individual % changes:** **+26.35%**

→ Indicates the “average stock” in the basket rose strongly, pulled higher by extreme gainers like Ellah Lakes and BUA Cement.

5. Key Insights

1. **Small caps drive volatility:** Ellah Lakes’ +89% jump skews the average, but has limited effect on overall portfolio returns due to low nominal price.

2. **Cement stocks strong:** Both Dangote Cement (+18%) and BUA Cement (+52%) reflect strong sector sentiment.

3. **Fintech momentum:** ETranzact’s +49% surge suggests renewed investor confidence in payment platforms.

4. **Blue chips steady:** Nigerian Breweries and Dangote Sugar both posted \~+20% gains, showing defensive strength.

5. **Weakness in Power sector:** Transcorp Power fell −10%, the only significant drag in the basket.

Nigeriafx

Is $TRANSPOWER Transpower devalued or of no value? 25% retraced.NSENG:TRANSPOWER Transcorp Power is a gas-fired thermal generation company operating in Nigeria and internationally. It's the owner/operator of the Ughelli Power Plant, with an installed capacity of approximately 972 MW, capable of generating around 2,500 GWh annually. Founded in 2012 (as Transcorp Ughelli Power Ltd), it became publicly listed in early 2024. It's a subsidiary of Transnational Corporation of Nigeria Plc.

The Stock is currently devalued by 25% (With an all time high of 386) and could be undervalued. Current price: ₦286.5.

The last few months are predominantly bearish), showing sustained weakness.

My buy zone for #transpower (₦264 – ₦301), suggesting potential accumulation interest around this region and could attract bargain hunters.

First Resistance / Take Profit (TP1): ₦375.3

→ A break above ₦301 with strong volume could see price retesting this level.

Major Resistance (TP2): ₦440.7

→ If bullish momentum continues, this is the next realistic upside target.

Invalidation for this NSENG:TRANSPOWER idea is under 260/per share

$accesscorp Accesscorp Cup and handle pattern... bullish?This is the chart of NSENG:ACCESSCORP (Access Holdings PLC) on the weekly timeframe,

Current price: 28naira/share.

Price action is forming a cup-and-handle-like structure pattern.

* The recent move appears to be completing another **cup** formation, which is typically a bullish continuation pattern if confirmed with strong breakout volume.

* Price action is currently at neckline resistance roughly ₦28–₦29 (current level), meaning price is testing a critical breakout zone.

Key Levels to watch

Immediate Critical Resistance: ₦28 – ₦29.00 (current battle zone; a breakout here could open room for further upside).

First Target: ₦34.10 /share

Second Target: ₦40.25/share (potential measured move from fibbonacci).

Idea remains validated if this Support Zone remains respected ₦24.00 – ₦25.00 (mid-level pullback support).

#accesscorp idea is invalidated under 24naira/share

Third Quarter 2025 Nigerian share picks Update....Percentage Up!Here's a summary and update on the third quarter 2025 Nigeria stock picks based on the price comparison between July and August - 1month:

Q3 2025 Trading View: Nigerian Stock Picks Update

Strong Performers with Significant Gains:

BUACEMENT: Up 48%, showing strong momentum as a cement sector leader.

DANGSUGAR: Increased by nearly 37%, notable growth in the sugar sector.

ELLAHLAKES: Shares rose over 36%, a promising performer.

DANGCEM: Cement stock up about 20%, continuing solid growth.

ETRANZACT: Up 24%, showing steady improvement in the tech/payment sector.

MULTIVERSE: Grew by 24%, indicating healthy gains in diversified tech.

NB: +28.8%, good growth for the banking/finance sector.

Moderate or no Growth:

ARADEL: Small increase of about 1%, steady but minimal movement.

HMCALL: Stable with a minor 1.4% increase, remaining consistent.

TRANSPOWER: No price change, holding steady for now.

Overall Market Sentiment:

Average gain across all picks is approximately +22%, a strong positive trend overall.

Indicates a bullish sentiment on these carefully selected third-quarter stocks.

Opportunity exists to take advantage of higher momentum sectors like cement, sugar, and tech/payment companies.

Trading Takeaway:

The Q3 2025 picks demonstrate robust growth potential, especially in key sectors like construction materials and tech/payments. Conservative performers provide portfolio stability while high growth stocks offer upside. Continual monitoring for volume and market news is recommended to capitalize on gains and manage risks moving forward.

MTN Nigeria Stock Analysis and OutlookMTN Nigeria Stock Analysis and Outlook

MTN Nigeria has shown a strong recovery, breaking out of its prolonged downtrend in early December 2024. Since then, the stock has delivered an impressive rally, gaining nearly 70% in value.

As of the latest trading session, MTN Nigeria closed at ₦279. From a technical analysis standpoint, there is a possibility of a short-term pullback toward a key support zone (indicated in yellow on the chart). Should this level hold, the stock may continue its upward momentum with a potential push toward the ₦300 psychological resistance level.

While the medium-term trend remains bullish, it is important to approach this with caution—particularly for short-term traders. Implementing a well-placed stop loss remains crucial to manage downside risks effectively in volatile market conditions.

Disclaimer:

This analysis is for informational purposes only and should not be construed as financial advice. Always conduct your own due diligence before making investment decisions.

Please:

Follow me, like, and share my analysis. Also let me know your viee

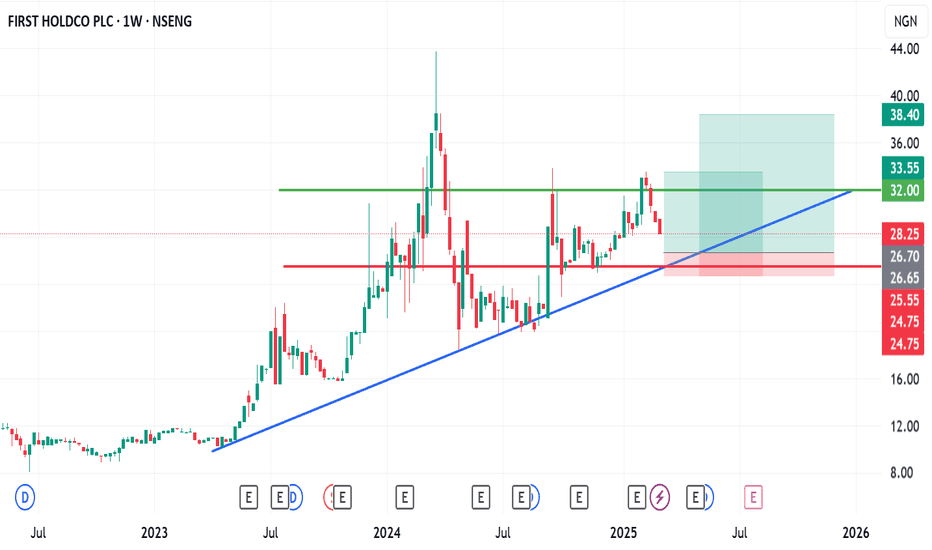

FBNH Stock Analysis and Technical OutlookFBNH Stock Analysis and Technical Outlook

First Bank Holding (FBNH) has experienced a consistent downtrend over the last four trading weeks, closing the most recent week at ₦38.25 per share. Based on current technical indicators and price action, there appears to be a strong likelihood that the stock may decline further, potentially reaching a key support zone around ₦26.65.

Should the price action confirm a reversal from this support area, a rebound towards the ₦33 and ₦38 levels may occur. These levels represent potential profit targets 1 and 2, respectively, for swing traders and medium-term investors.

From a fundamental perspective, FBNH appears undervalued at current levels, especially when considering its Price-to-Earnings (P/E) ratio of approximately 1.5. This suggests that the stock may be trading below its intrinsic value, which could attract long-term investors seeking undervalued opportunities in the Nigerian banking sector.

Caution is advised, however, as overall market sentiment and macroeconomic factors could influence short-term price movements. Investors and traders are encouraged to apply risk management strategies and conduct further due diligence before taking any position.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always consult with a certified financial advisor before making trading decisions.

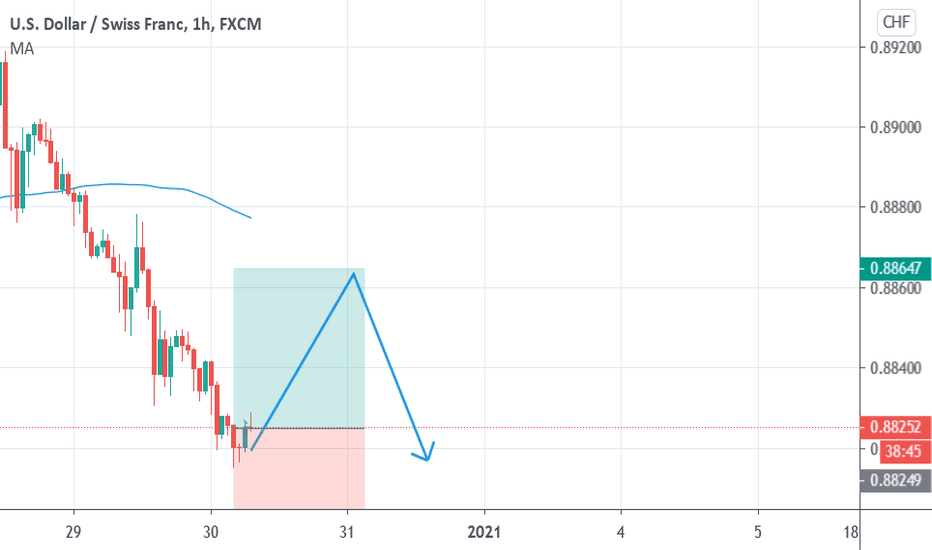

USDCHF 30'' 20''USDCHF Pair still has a huge tendency of continuing in a bearish trend. The price crossover below the 100SMA also gives room for a retest. The Intraday time frame(H4, H1) shows an oversold zone in the RSI. I would most likely bet on a profit target of 40 pips away from 0.88253 and a 30 pips stop loss in the buy direction.

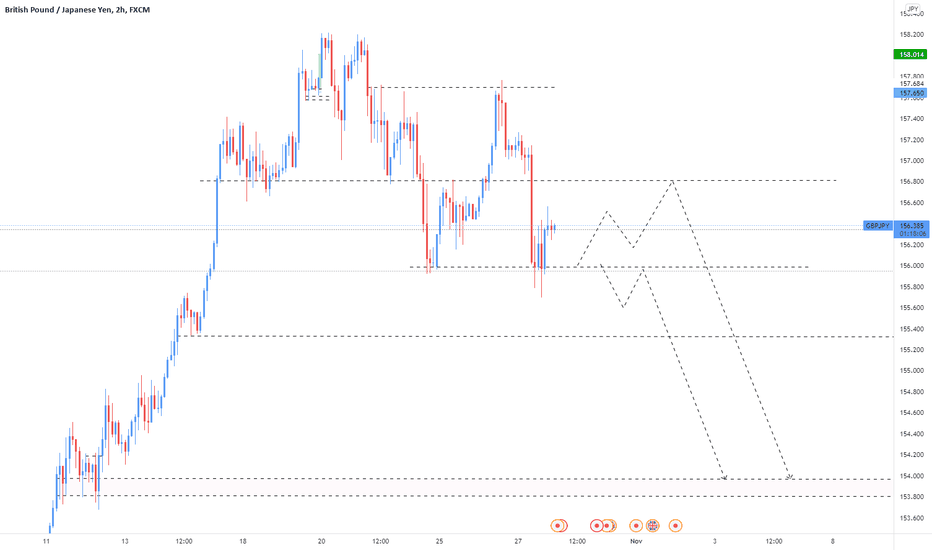

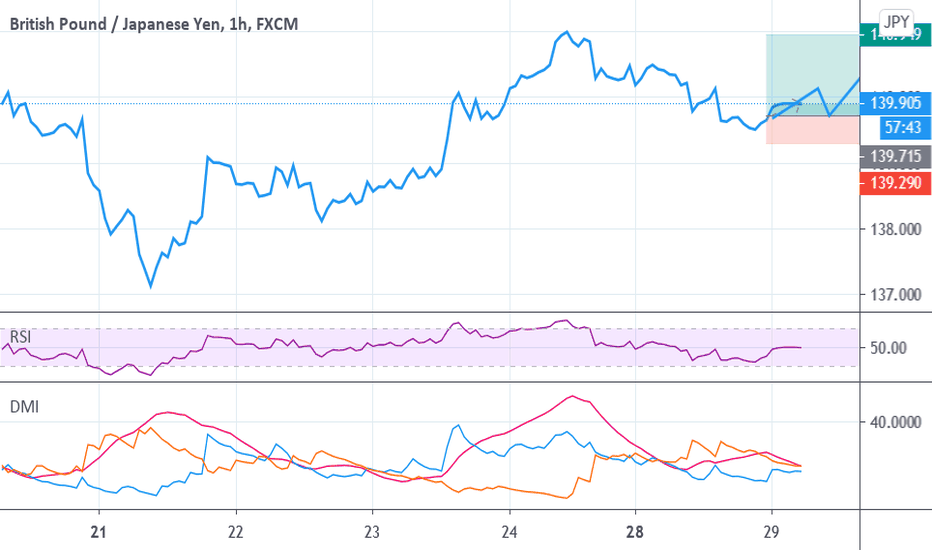

GBPJPY 29'' 12'' 20GBPJPY has been range bound between the levels 139.950 and 137.310. A recent breakout though short lived, but a retest at 139.388 shows the bulls were more likely to push pass and sustain the bullish trend. A naked analysis would favour a long entry with a profit target of 100 pips and stop loss of 30pips from 139.735.