$accesscorp Accesscorp Cup and handle pattern... bullish?This is the chart of NSENG:ACCESSCORP (Access Holdings PLC) on the weekly timeframe,

Current price: 28naira/share.

Price action is forming a cup-and-handle-like structure pattern.

* The recent move appears to be completing another **cup** formation, which is typically a bullish continuation pattern if confirmed with strong breakout volume.

* Price action is currently at neckline resistance roughly ₦28–₦29 (current level), meaning price is testing a critical breakout zone.

Key Levels to watch

Immediate Critical Resistance: ₦28 – ₦29.00 (current battle zone; a breakout here could open room for further upside).

First Target: ₦34.10 /share

Second Target: ₦40.25/share (potential measured move from fibbonacci).

Idea remains validated if this Support Zone remains respected ₦24.00 – ₦25.00 (mid-level pullback support).

#accesscorp idea is invalidated under 24naira/share

Nigeriastockexchange

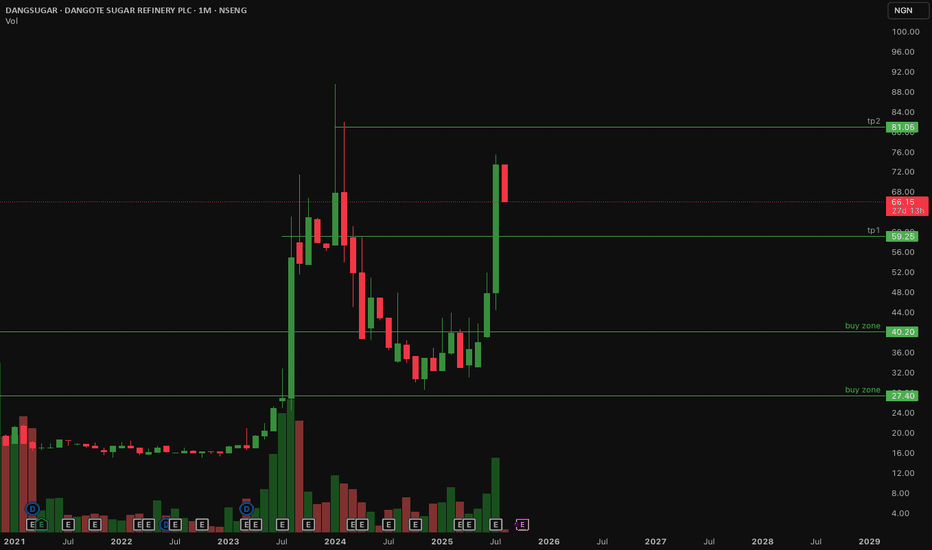

Third Quarter 2025 Nigerian share picks Update....Percentage Up!Here's a summary and update on the third quarter 2025 Nigeria stock picks based on the price comparison between July and August - 1month:

Q3 2025 Trading View: Nigerian Stock Picks Update

Strong Performers with Significant Gains:

BUACEMENT: Up 48%, showing strong momentum as a cement sector leader.

DANGSUGAR: Increased by nearly 37%, notable growth in the sugar sector.

ELLAHLAKES: Shares rose over 36%, a promising performer.

DANGCEM: Cement stock up about 20%, continuing solid growth.

ETRANZACT: Up 24%, showing steady improvement in the tech/payment sector.

MULTIVERSE: Grew by 24%, indicating healthy gains in diversified tech.

NB: +28.8%, good growth for the banking/finance sector.

Moderate or no Growth:

ARADEL: Small increase of about 1%, steady but minimal movement.

HMCALL: Stable with a minor 1.4% increase, remaining consistent.

TRANSPOWER: No price change, holding steady for now.

Overall Market Sentiment:

Average gain across all picks is approximately +22%, a strong positive trend overall.

Indicates a bullish sentiment on these carefully selected third-quarter stocks.

Opportunity exists to take advantage of higher momentum sectors like cement, sugar, and tech/payment companies.

Trading Takeaway:

The Q3 2025 picks demonstrate robust growth potential, especially in key sectors like construction materials and tech/payments. Conservative performers provide portfolio stability while high growth stocks offer upside. Continual monitoring for volume and market news is recommended to capitalize on gains and manage risks moving forward.

MTN Nigeria Stock Analysis and OutlookMTN Nigeria Stock Analysis and Outlook

MTN Nigeria has shown a strong recovery, breaking out of its prolonged downtrend in early December 2024. Since then, the stock has delivered an impressive rally, gaining nearly 70% in value.

As of the latest trading session, MTN Nigeria closed at ₦279. From a technical analysis standpoint, there is a possibility of a short-term pullback toward a key support zone (indicated in yellow on the chart). Should this level hold, the stock may continue its upward momentum with a potential push toward the ₦300 psychological resistance level.

While the medium-term trend remains bullish, it is important to approach this with caution—particularly for short-term traders. Implementing a well-placed stop loss remains crucial to manage downside risks effectively in volatile market conditions.

Disclaimer:

This analysis is for informational purposes only and should not be construed as financial advice. Always conduct your own due diligence before making investment decisions.

Please:

Follow me, like, and share my analysis. Also let me know your viee

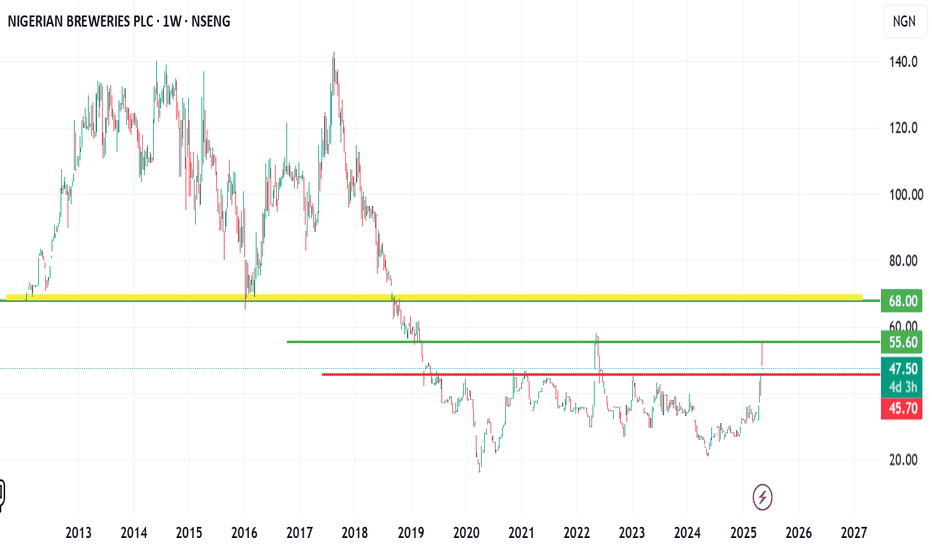

My View on Nigerian Breweries PLC (NB)My View on Nigerian Breweries PLC (NB).

This asset has made a significant ride up from its recent low, which broke the previous N45 resistance zone, and hit a new resistance zone around N56 before dropping a bit.

If the N45 support continues to hold strong, we might see this asset rally towards the ALMIGHTY resistance level around N68.

Looking at the chart, the 68 level marked yellow is a critical level for all investors.

Trade with care.

Please, if you found this helpful, kindly follow me, like, share my chart and let me know your thoughts on the comment session

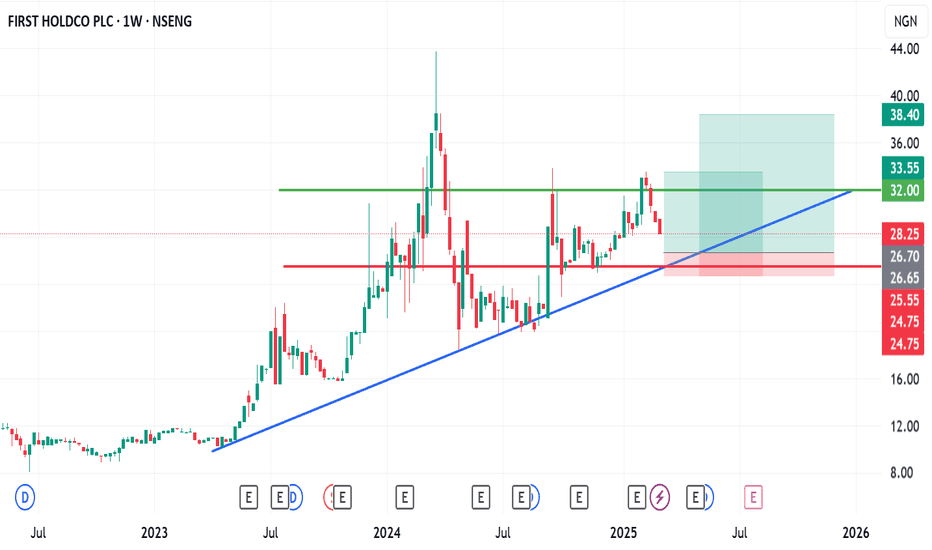

FBNH Stock Analysis and Technical OutlookFBNH Stock Analysis and Technical Outlook

First Bank Holding (FBNH) has experienced a consistent downtrend over the last four trading weeks, closing the most recent week at ₦38.25 per share. Based on current technical indicators and price action, there appears to be a strong likelihood that the stock may decline further, potentially reaching a key support zone around ₦26.65.

Should the price action confirm a reversal from this support area, a rebound towards the ₦33 and ₦38 levels may occur. These levels represent potential profit targets 1 and 2, respectively, for swing traders and medium-term investors.

From a fundamental perspective, FBNH appears undervalued at current levels, especially when considering its Price-to-Earnings (P/E) ratio of approximately 1.5. This suggests that the stock may be trading below its intrinsic value, which could attract long-term investors seeking undervalued opportunities in the Nigerian banking sector.

Caution is advised, however, as overall market sentiment and macroeconomic factors could influence short-term price movements. Investors and traders are encouraged to apply risk management strategies and conduct further due diligence before taking any position.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always consult with a certified financial advisor before making trading decisions.

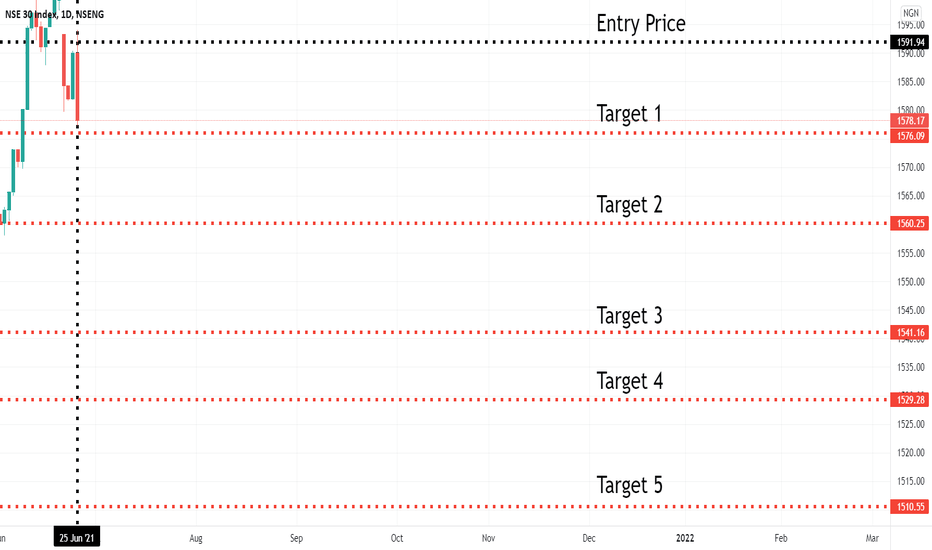

NSE Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

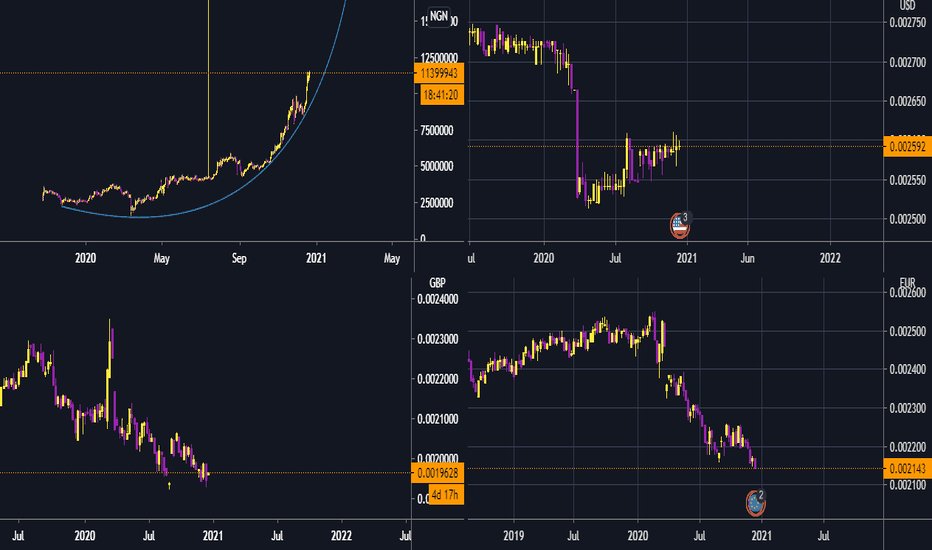

Nigerian CallIf you are Nigerian you live there you have Paper Money or Not and you want to grow it Just convert it to some satoshi

qz.com

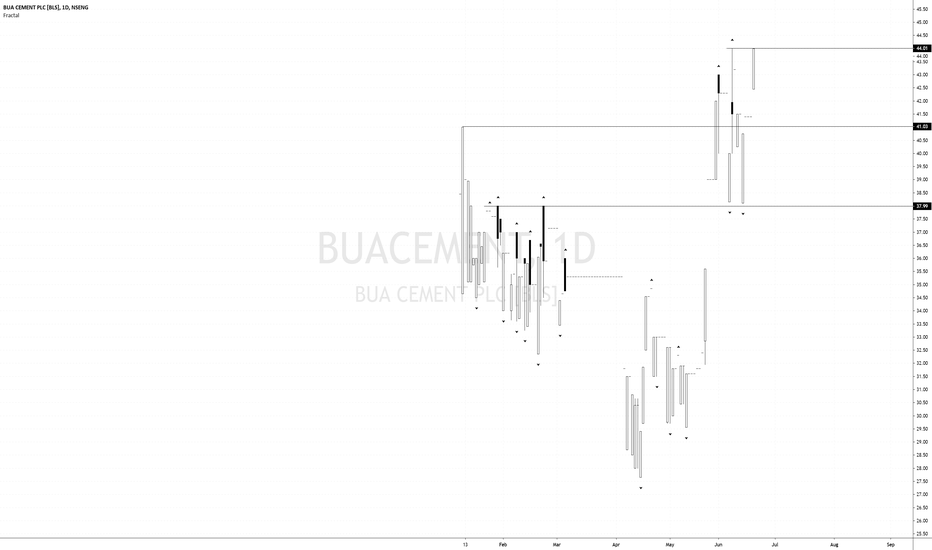

We Must Keep An Eye On BUA CementBUA Stock price is now creating a new 52 week high having closed last trading week at 44 Naira. And with book favouring future growth of the company, everything looks promising. If the price can break above 44, and re-test it in near future, its a good opportunity to key into the market otherwise, a decline to value price either at 38 or 41 even provide a better entry price.

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades