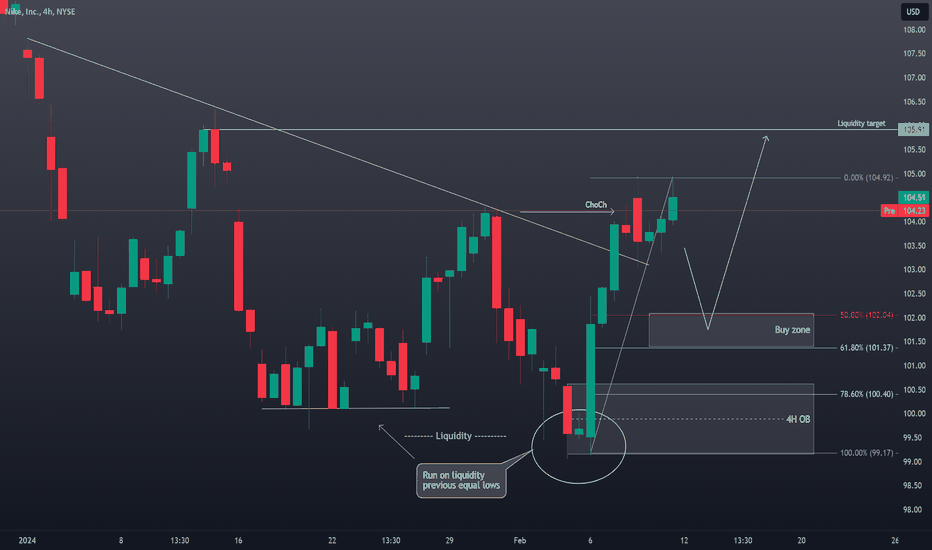

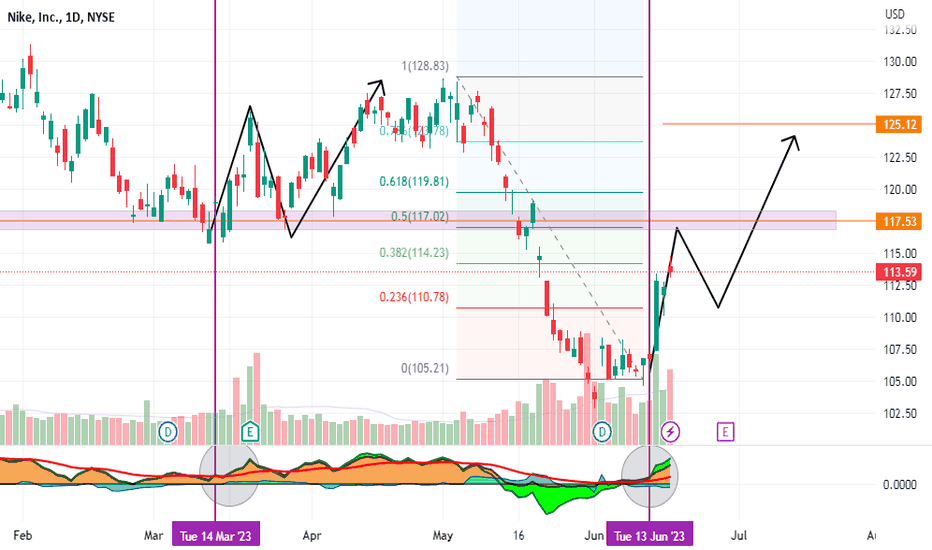

#NIKE Technical Analysis and Trade IdeaMarket Observations: NKE has decisively broken its previous downtrend, establishing a higher high. This bullish breach was further fueled by a liquidity run targeting sell stops below the recent triple-bottom (equal lows). The strong momentum accompanying this breakout signals a potential buying opportunity.

Trade Strategy: Target a buy entry upon a retracement to the 61.8% Fibonacci level. Be sure to place a stop-loss order below the recent swing low to effectively manage risk. Maintain a favorable risk-reward ratio.

Video Focus: This video explores the technical analysis principles that support this bullish perspective:

- Trend Analysis: Identify breakouts and trend reversals with clarity.

- Liquidity Runs: Understand how stops are targeted and the impact on price.

- Fibonacci Retracements: Recognize key retracement levels for optimal entries.

Disclaimer: This analysis is provided for educational purposes and should not be interpreted as financial advice. Thoroughly conduct your own research and assess your risk tolerance before making investment decisions.

Nike

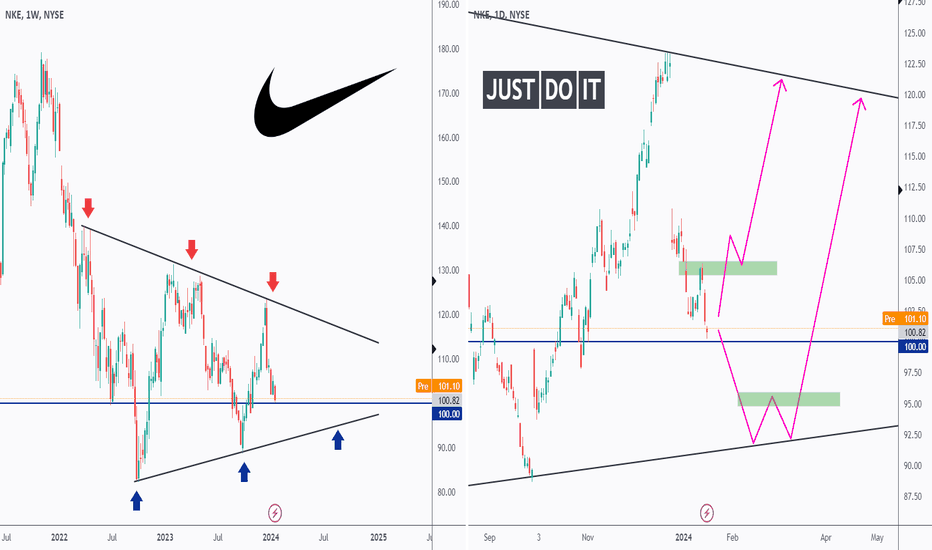

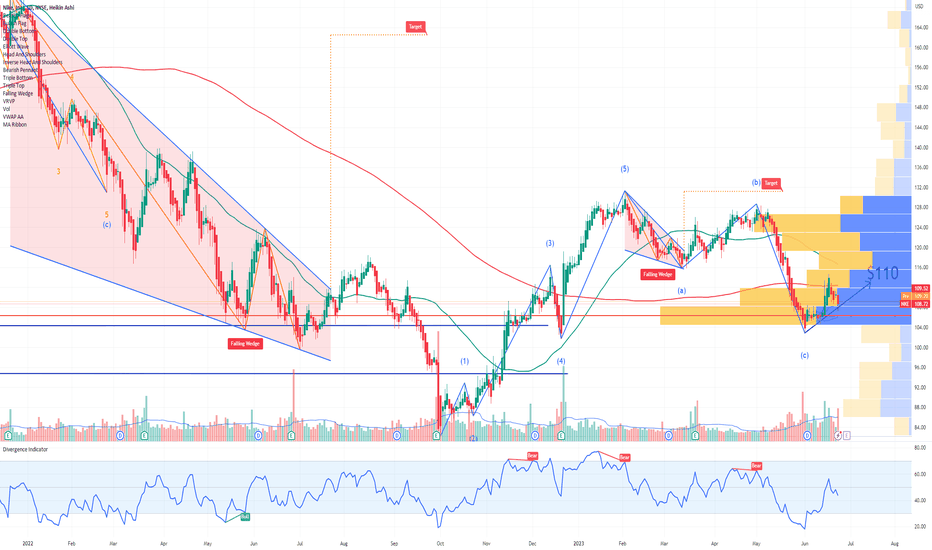

NKE - Just Do It ✔️Hello TradingView Family / Fellow Traders,

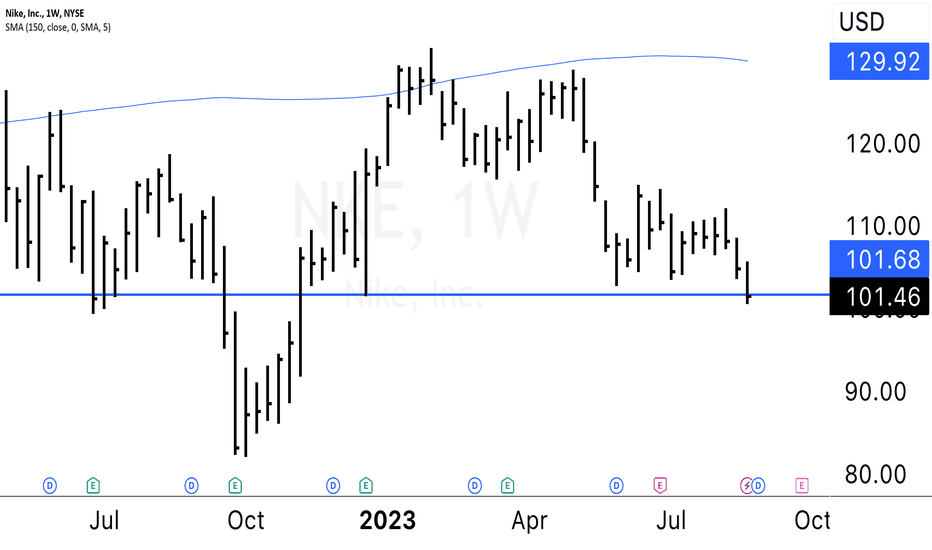

On Weekly: Left Chart

NKE has been hovering inside a range in the shape of a symmetrical triangle.

Moreover, it is currently sitting around a strong round number 100.0

🏹 Hence , as long as the 100.0 support holds, we will be looking for buy setups on lower timeframes.

On Daily: Right Chart

📈 For the bulls to take over, we need a momentum candle close above the last major high in green at 107.0

📉 Meanwhile , NKE would be bearish, and if the 100.0 support is broken downward, we can expect a bearish continuation towards the lower weekly trendline where we will be looking for new buy setups.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

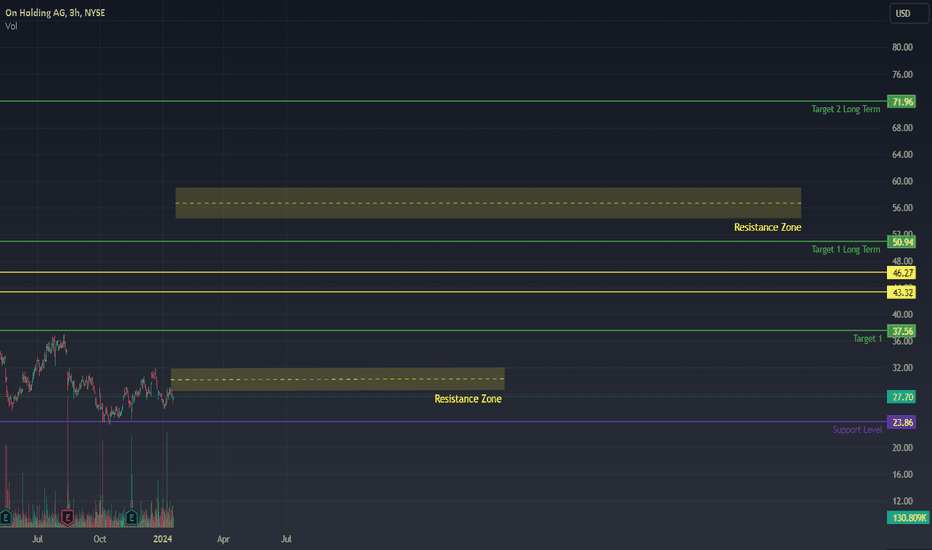

Navigating the Growth Trajectory of On Holdings, Cloud or bust?Navigating the Growth Trajectory of On Holdings, a Rising Star in Athletic Footwear

Support Level: $23.86

Current Price: $27.70

Resistance Zone: $28.53 - $31.95

Target 1: $37.56

Resistance Level 1: $43.32

Resistance Level 2:46.27

Target 1 (Long Term): $50.94

Target 2 (Long Term): $71.96

On Holdings has rapidly become a market leader with its revolutionary On-Cloud running shoes, capturing global attention and propelling the company's valuation to an impressive 7.8 billion Swiss francs. The strategic focus on marketing and brand development has positioned On as a force to be reckoned with in the athletic footwear industry.

The company's valuation metrics reveal a steep but justified premium: 6.4 times revenue, 139 times earnings, or 47 times EBITDA. This premium is a testament to On's exceptional growth trajectory. In the last 12 months, the company achieved revenue of 1.2 billion, a net income of 58 million, and an adjusted EBITDA of 165 million.

Technical Analysis and Growth Metrics:

On's exceptional growth is underscored by a staggering 69% increase in revenue from 2021 to 2022, with a further projected growth of 39% in 2023. Positive product reviews and robust Google search data further validate this growth momentum. In comparison to industry giants like Nike and Lululemon, On boasts strong gross margins of 56%, setting it apart as a formidable competitor. (Nike is just 44% and lululemon is 55%

However, rapid expansion comes at a cost, and On's negative cash flow is attributed to its aggressive expansion in China and the opening of new stores. With 371 million in cash on the balance sheet, there's a likelihood that the company may seek additional capital for sustained growth.

Sustainability as a Key Differentiator:

On Holdings not only focuses on growth but also emphasizes sustainability. The latest shoe, incorporating 44% recycled materials, showcases the company's commitment to environmental responsibility. This dual emphasis on growth and sustainability positions On as a forward-thinking brand in tune with modern consumer values.

Investment Outlook:

Despite the steep valuation and potential cash flow challenges, On's growth trajectory remains impressive. Assuming a 40% revenue growth this year, followed by 30% and 20% in subsequent years, On could reach revenues of 11.5 billion by 2033. Applying a conservative 10% net margin and a 20x multiple, the company's estimated worth would be around 24 billion, offering an investment return of approximately 11.9% per year. Although this may not seem great long term, the short-term growth is too good to pass up.

In conclusion, On Holdings presents a cautiously bullish investment opportunity, given its remarkable growth and market dynamics. However, it's essential to recognize the speculative nature of this assessment, and investors should conduct thorough due diligence before making any investment decisions. As On continues to blend innovation, sustainability, and the Athlete Spirit, it stands poised to redefine the future of athletic footwear and potentially deliver compelling returns to investors.

Nike's Bold Move: Expanding Into Virtual Fashion in Video Games

Sports apparel giant Nike ( NYSE:NKE ) is set to deepen its foray into the video game space through its blockchain and digital wearables division, .Swoosh. The company's recent announcement promises a new line of virtual products known as "Nike In-Game Wearables," which users can directly purchase and wear within their favorite video games. Despite the excitement surrounding this innovative step, the extent to which these in-game wearables will involve non-fungible tokens (NFTs) remains shrouded in ambiguity.

The Vision Behind Nike's .Swoosh:

Nike's .Swoosh division, rooted in blockchain technology, aims to redefine the virtual product landscape by emphasizing the intrinsic value of enjoyment and self-expression. The company believes that a virtual product's worth should be derived from the pleasure it brings users when expressing themselves or unlocking access to physical items, fostering a sense of genuine fanhood rather than mere transactions.

The Unveiling of Nike In-Game Wearables:

According to a blog post by .Swoosh, the upcoming year will witness a profound expansion into video gaming with the launch of Nike In-Game Wearables. Unlike digital collectibles or NFTs, these wearables can be directly purchased and worn within users' preferred video games, eliminating the need for crypto wallets. The move signifies Nike's commitment to integrating virtual fashion seamlessly into the gaming experience, blurring the lines between the physical and digital realms.

NFT vs. In-Game Wearables: Deciphering Nike's Strategy:

Despite .Swoosh's previous ventures into the NFT space with digital sneaker releases on Polygon, and hints at potential collaborations with EA Sports and Fortnite, Nike ( NYSE:NKE ) is cautious in distinguishing between its "digital collectibles" or NFTs and the new "in-game wearables." The blog post suggests that the two are inherently different, raising questions about whether the upcoming wearables will be crypto-related or more akin to traditional collaborations like the one with Fortnite.

Nike's Stance on NFTs and Marketplace Dynamics:

Notably, Nike remains circumspect about the involvement of NFTs in every .Swoosh release, emphasizing that not every product launch will result in an NFT drop. The company also clarified that owners of Nike digital collectibles (NFTs) will have the option to move their items to personal crypto wallets later this year, facilitating trading on marketplaces that guarantee royalties to creators.

The Absence of a Nike NFT Marketplace:

Contrary to industry trends, Nike asserts that building its own NFT marketplace could distract from product creation and storytelling. The company hints at a strategic decision to abstain from starting an NFT marketplace, leaving collectors to utilize existing platforms that support the exchange of Nike NFTs.

Conclusion:

As Nike ( NYSE:NKE ) steps boldly into the virtual fashion realm within video games, the blurred distinction between NFTs and in-game wearables adds an element of intrigue to the company's digital strategy. While enthusiasts await further clarification from Nike regarding the role of NFTs in these upcoming releases, one thing is certain – the sports apparel giant is poised to make a lasting impact on the intersection of fashion, gaming, and blockchain technology.

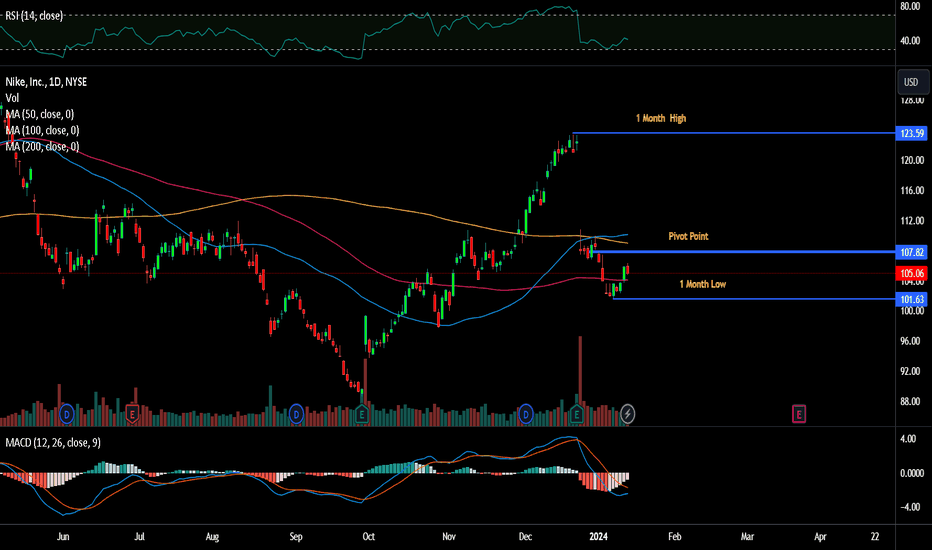

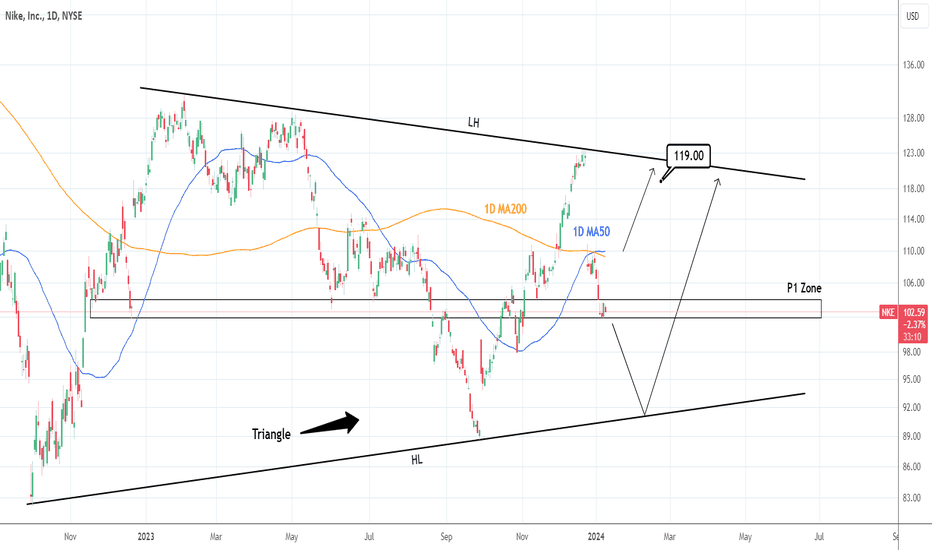

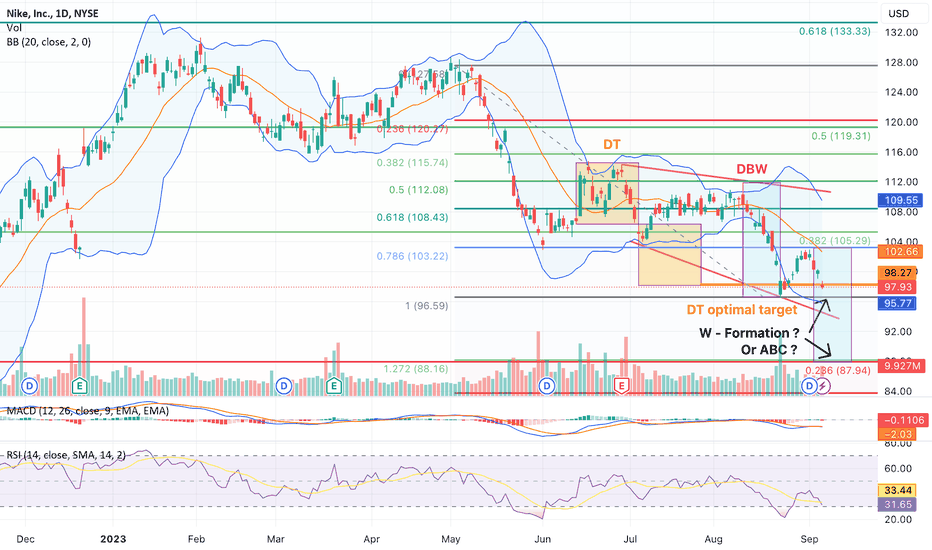

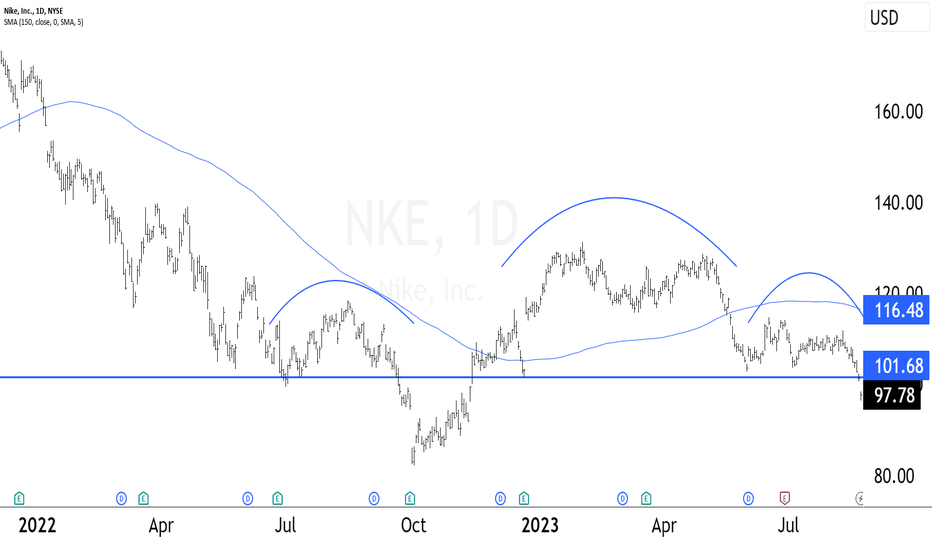

NIKE: On a key long term pivot and almost oversold.Nike is almost oversold on the 1D technical outlook (RSI = 33.787, MACD = -2.530, ADX = 53.733) and is trading sideways inside the P1 Zone, which is the Pivot Band that has started several rebounds inside this 1 year Triangle pattern. This isn't an automatic buy for us yet, we need to see the price crossing over the 1D MA50 before buying and aim at the LH trendline (TP = 119.00). If P1 breaks downwards, we will on the HL trendline and aim again at the LH trendline (TP = 119.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

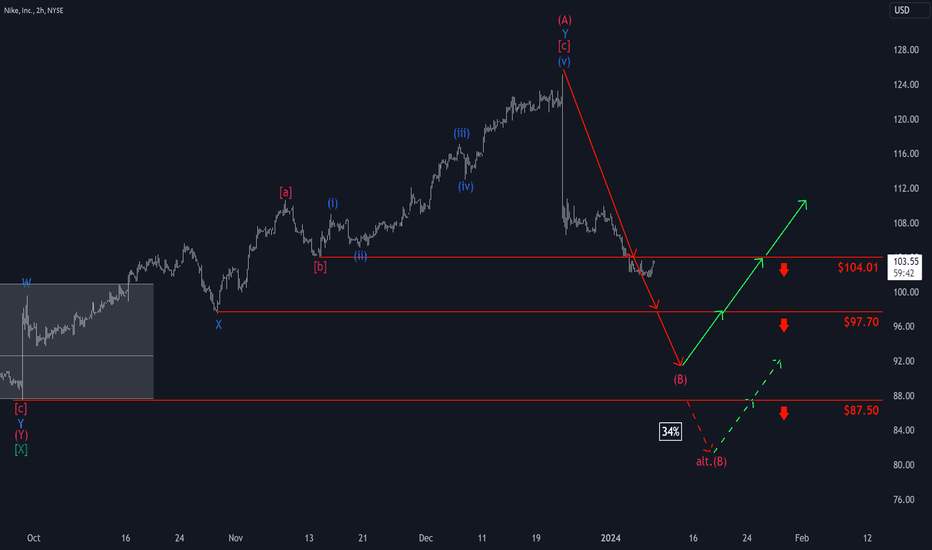

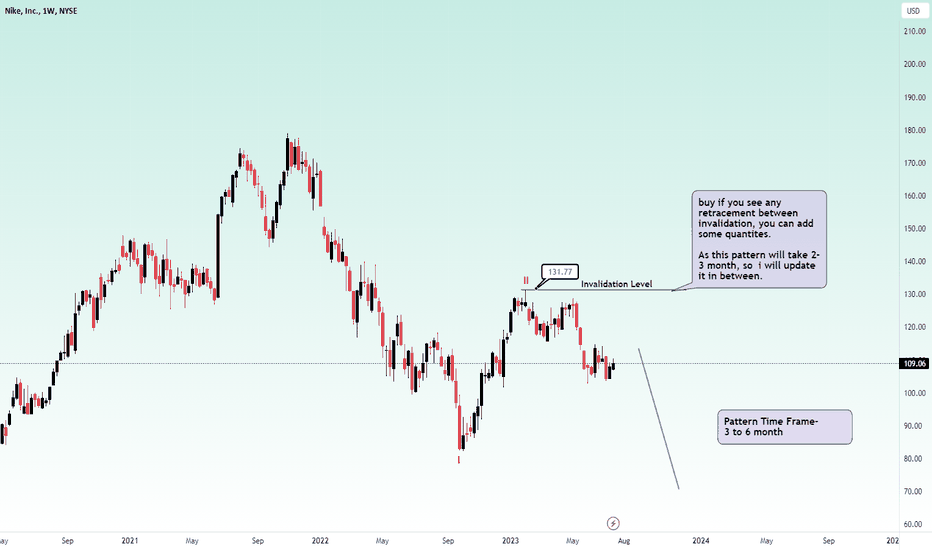

Nike: Slumped 🤕The NIKE share price fell sharply within a few hours of the presentation of the quarterly reports. We must now primarily assume that the stock has formed the top of the wave (A) in red with the last high - and has since sold off in the course of the wave of the same color (B). The bears have already been able to drag the price below the support level of $104.01. This should now generate further downward pressure, allowing the stock to extend the low of the aforementioned (B) wave below the $97.70 support level (but still above the $87.50 mark). The wave alt.(B) would extend another level lower in the context of our 34% probable alternative scenario.

Nike Will Cut $2 Billion in CostsNike, the world’s largest supplier of sports shoes, will cut costs by $2 billion over the next three years. This will involve layoffs and more automation.

Sports footwear giant Nike is planning to take cost-cutting measures to save $2 billion over the next three years in response to escalating worries about a global slowdown in consumer spending.

The company intends to take streamlining steps which include laying off employees, simplifying its range of products, and increasing the use of automation. The stock market saw Nike shares dropping by as much as 14% after the announcement.

Why is Nike taking measures to save $2 billion in costs?

Nike has cut its revenue projections for the year as they foresee more cautious consumer behavior around the world. People have been changing their buying habits, and have been spending more on basic necessities and experiences like travel instead of non-essentials like sports wear and high-priced sneakers.

Nike’s online sales have been plummeting, especially in the Greater China market, which includes Hong Kong, Taiwan, and Macau. This indicates that consumers did not follow when the company moved some of its products to become available solely online.

Up-and-coming brands like California shoemaker Hoka and Swiss company On have also managed to chip away at Nike’s dominance of the footwear market, particularly in running shoes.

Foot Locker Shares Jump More Than 15% After Earnings BeatKey Takeaway

1. Foot Locker beat third-quarter earnings and sales expectations.

2. The shoe and apparel retailer said it expects better same-stores sales this year than it previously did.

3. Foot Locker has been hit by customers dealing with inflation and Nike’s focus on direct sales.

Shares of Foot Locker rose today in premarket trading after the company posted surprise earnings and sales beats and said it saw strong results over the Thanksgiving weekend.

The sneaker and sportswear retailer narrowed its full-year forecast, reflecting slightly better sales trends. It said it now expects sales to drop by 8% to 8.5% for the year, compared with a previously issued forecast of an 8% to 9% decrease. It projects a same-store sales decline of 8.5% to 9%, compared with its previous guidance of a 9% to 10% drop.

Yet Foot Locker lowered the high end of its adjusted earnings guidance, dropping the range to $1.30 to $1.40 per share, down from the previous $1.30 to $1.50 per share.

Here’s how Foot Locker did in the three-month period that ended Oct. 28 compared with what Wall Street was anticipating, based on a survey of analysts by LSEG, formerly known as Refinitiv:

i. Earnings per share: 30 cents adjusted vs. 21 cents expected

ii. Revenue: $1.99 billion vs. $1.96 billion expected

In the fiscal third quarter, Foot Locker reported net income of $28 million, or 30 cents per share, compared with $96 million, or $1.01 in the year-ago period. Total revenue fell about 8.6% from $2.18 billion in the year-ago period.

Foot Locker’s same-store sales fell 8% year over year, which the company said reflected “ongoing consumer softness,” a change in its mix of vendors and a 3% negative impact as it closes some Champs stores. Even so, that was slightly better than the 9.7% drop that analysts expected, according to FactSet.

Digital sales fell by 5.6% year over year, Chief Commercial Officer Frank Bracken said on the company’s earnings call. Yet excluding Eastbay, a digital brand that the company wound down last year, digital sales rose 0.4%.

Like many retailers, Foot Locker has gotten hurt by shoppers cutting back on discretionary spending as inflation forces them to spend more on food, housing and everyday needs and as experiences, rather than goods, become a priority. Foot Locker has also faced company-specific troubles, such as having some stores in struggling malls and leaning heavily on merchandise from Nike, a brand that’s making a bigger push to sell directly through its own stores and website.

Too much inventory has also been a problem for Foot Locker, particularly as shoppers watch their spending. At the end of the third quarter, the retailer’s inventory was 10.5% higher than at the end of the year-ago period. Foot Locker said about 6% of that was strategic, as the company stocked up on merchandise to sell during the holiday season.

On Wednesday, Foot Locker said it will enter a new market, India, next year. It said it has struck a long-term licensing agreement with two operators in India, Metro Brands Ltd., one of India’s largest footwear and accessories specialty retailers, and Nykaa Fashion, an e-commerce retailer. Those two companies will have exclusive rights to own and operate Foot Locker stores and sell its merchandise online in India.

As of Tuesday’s close, shares of Foot Locker had tumbled by about 37% this year. That compares with the approximately 19% gains of the S&P 500 during the same period. Foot Locker’s stock closed at $23.84 on Tuesday, bringing its market value to $2.25 billion.

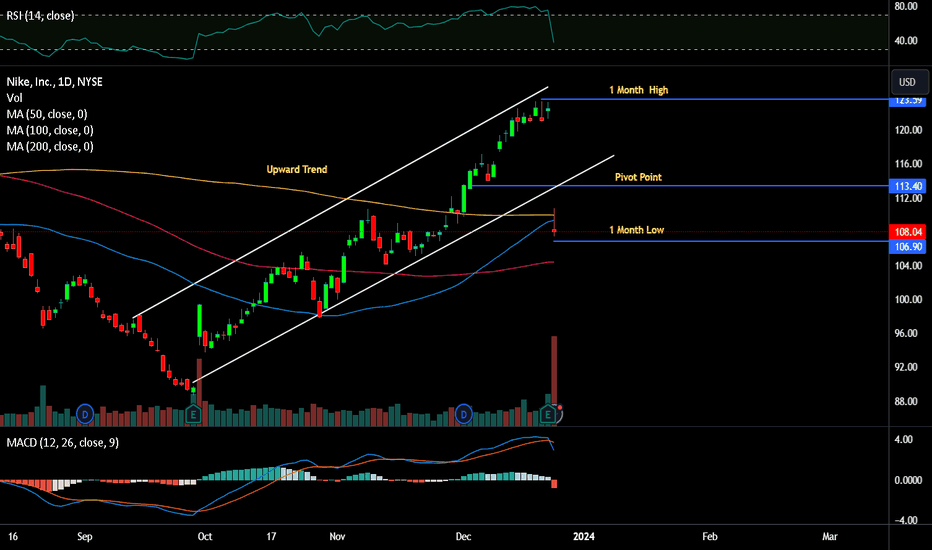

Technical Analysist

OPPORTUNITY TO BUY NIKE ! daily analysisDear Investors,

Nike is showing a strong buying signal after good fundamentals this year.

this could be your opportunity to invest in a low-risk high-reward trade.

you can contact me for more info on why this is a good trade & give you a strategy on how to manage this trade and close it in the best scenario possible.

you can check my old trades too to get an idea of my trading mentality.

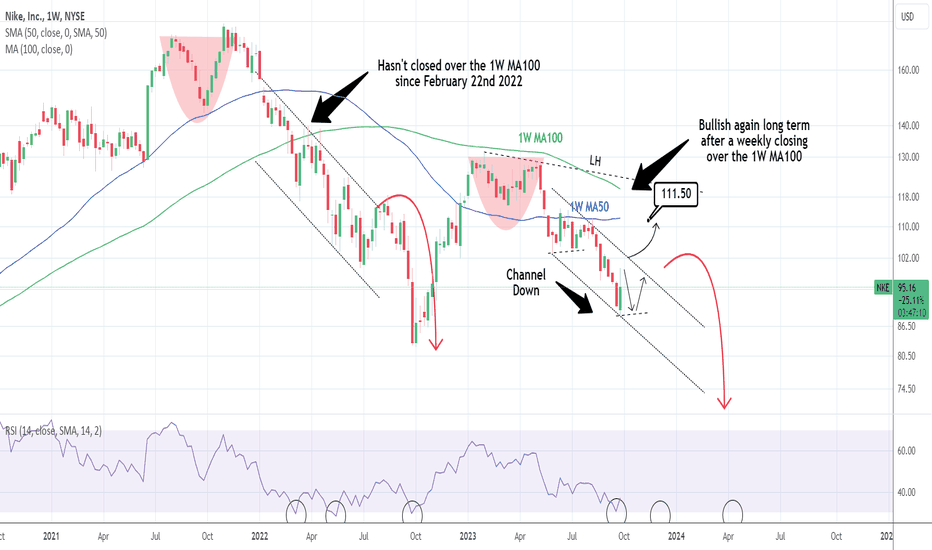

NIKE: Repeating the 2022 decline unless it crosses the 1W MA100.Nike isn't on its best long term technical outlook being neutral on 1D but bearish on the 1W timeframe (RSI = 36.926, MACD = -4.740, ADX = 46.648). The four month pattern is a Channel Down, which if broken upwards should target the 1W MA50 (TP = 111.50). That's on the medium term because on the long term, the market needs to cross over the 1W MA100 (which has been closing weekly candles under it since February 22nd 2022), if it wants to restore investor confidence. If not, we risk a repeat of the August-September 2022 selloff.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

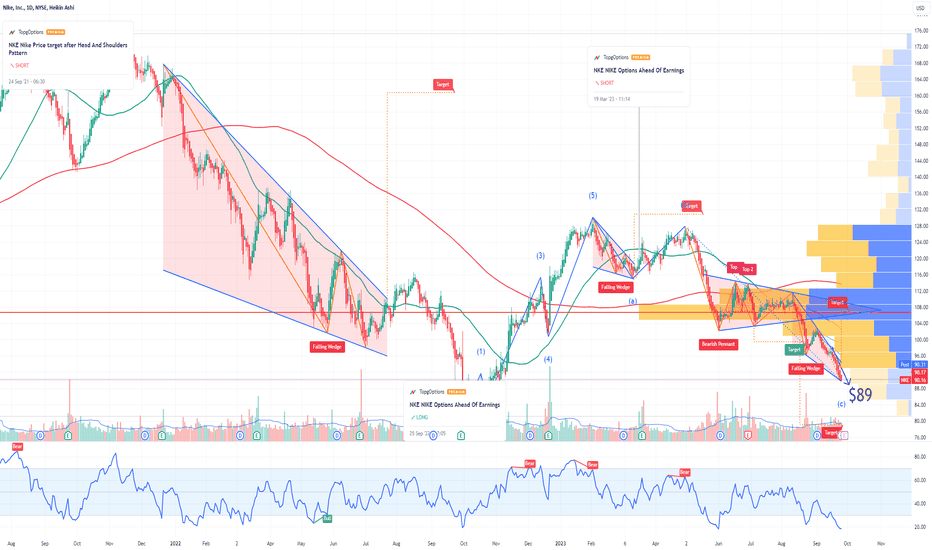

NKE NIKE Options Ahead of EarningsIf you haven`t sold NKE here:

Then analyzing the options chain and the chart patterns of NKE NIKE Options prior to the earnings report this week,

I would consider purchasing the 89usd strike price Puts with

an expiration date of 2023-9-29,

for a premium of approximately $2.13.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

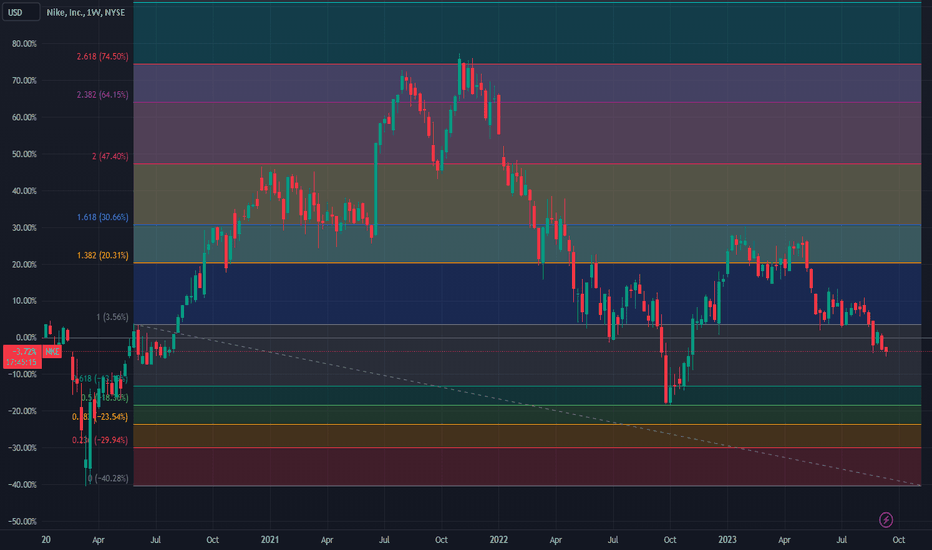

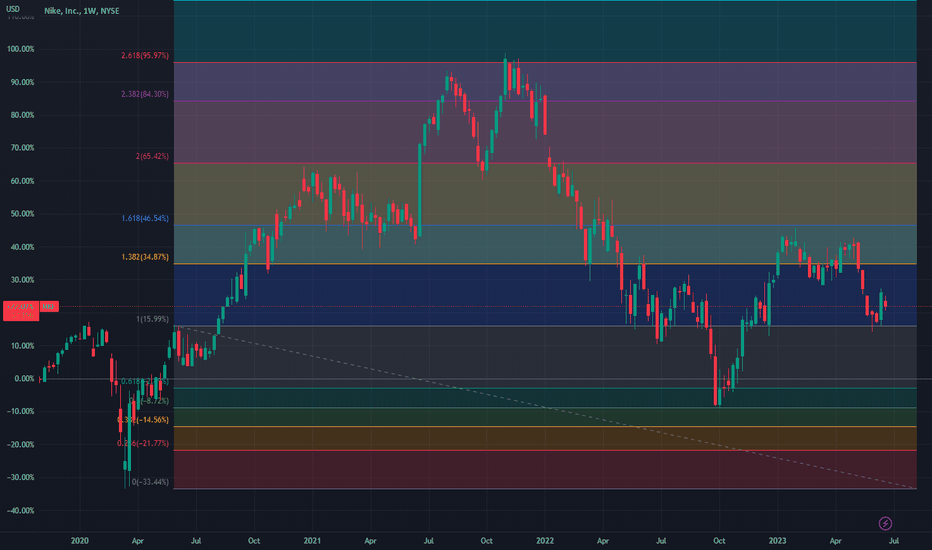

Nike is about to test strong supportNike is about to test strong support

This chart shows the weekly candle chart of Nike's stock over the past four years. The graph overlays the bottom to top golden section at the beginning of 2020. As shown in the figure, Nike's stock has hit its lowest point in recent years, hitting the 2.618 level of the bottom up golden section in the figure. The low point in October last year hit the 0.500 level of the bottom up golden section in the figure, and the high point in January this year hit the 1.618 level of the bottom up golden section in the figure! So, in the future, the bottom of the graph should be used as the dividing line for judging the strength of Nike's stock, which is 0.618 on the golden section!

Nike - Bottom or ABC?Nike is close to an important level which will determine if a bottom formation is completed or a further slump will occur. Currently a DBW formation is build after almost perfect a Dopple Top Formation has been finished. Currently we are close to the 4 level, the current local low. The RSI is close to oversell, which support the turn around idea, which may result into a W formation whose execution would probably trigger the 5 and the DBW activation. On the bearish side a potential running ABC pattern can be found fitting perfect into the chart and the Fibonacci patterns.

$NKE Head & Shoulders Pattern Triggered"Head & Shoulders" pattern, and mentioning the ticker symbol " NYSE:NKE ," which represents Nike, Inc., a well-known athletic apparel and footwear company. The "Head & Shoulders" pattern is a technical chart pattern that traders and analysts often use to predict potential trend reversals in stock prices.

The Head & Shoulders pattern typically consists of three peaks or highs: a higher peak (the "head") between two lower peaks (the "shoulders"). This pattern is considered bearish, indicating a potential reversal from an upward trend to a downward trend. The pattern is triggered when the price breaks below the neckline, which is a support level connecting the lows of the shoulders.

$NKE Double BottomNYSE:NKE recently experienced an unprecedented 9-day losing streak, marking a historic occurrence in their trading history. According to technical analysis, a Double Bottom pattern is emerging, emphasizing the significance of maintaining a weekly close above the horizontal support line. This pattern suggests potential bullish momentum if the specified level is upheld.

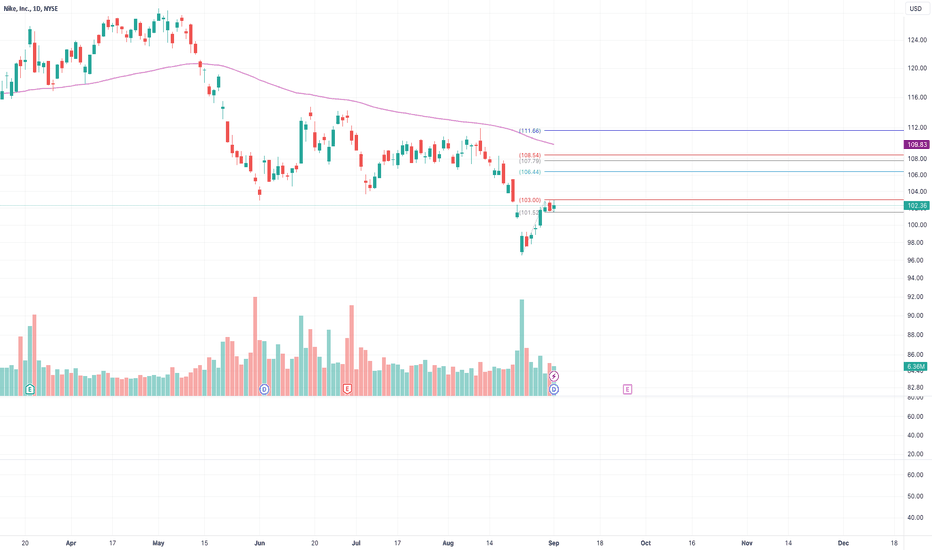

NKE NIKE Options Ahead of EarningsIf you haven`t sold NKE here:

or reentered here:

Then you should know that NKE is currently trading at $109.52, and based on the following analyst ratings, there is a slightly bullish sentiment surrounding the stock.

Barclays has maintained a Buy rating on Nike, setting a price target of $127.00.

Additionally, Goldman Sachs also maintained a Buy rating on the stock, with a higher price target of $144.00.

Furthermore, Wedbush recently raised NIKE's Q4 2023 earnings estimates to $0.73 EPS, indicating positive growth compared to the previous estimate of $0.69.

These analyst ratings and revised earnings estimates suggest a slightly positive outlook for NKE.

Now Analyzing the options chain of NKE NIKE prior to the earnings report this week,

I would consider purchasing the 110usd strike price Calls with

an expiration date of 9/15/2023,

for a premium of approximately $6.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Nike is about to accelerate its rise !Nike is about to accelerate its rise !

This chart shows the weekly candle chart of Nike stock for the past 4 years. The graph overlays the 2020 bottom to top golden section. As shown in the figure, Nike's stock took shape from the bottom of 2020, and after peaking at the end of 2021, it fell significantly! The two recent lows happen to be the 0.500 and 1.0000 positions on the bottom of the Golden Divide. In the future, Nike's stock is likely to continue to strengthen!

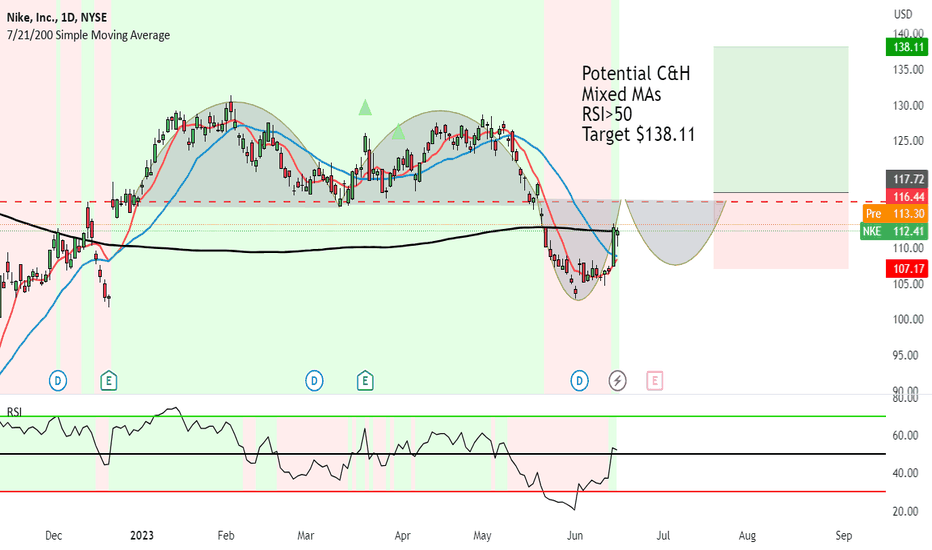

Nike potential Cup and Handle after nasty fall T - $138Potential C&H is forming on Nike.

It's definitely too soon to execute trades based on the week upside in the last few days. We need the price to break above the Resistance of the previous M Formation.

This one requires a bit of patience because anything can happen at this rate.

Either it can form a C&H, W Formation, Scallop. Or it could fail and drop further if we don't see strong buying activity from Smart Money.

We'll have to wait and see.

Mixed MAs

RSI>50

Target $138.11

ABOUT THE COMPANY

Nike, Inc. is an American multinational corporation that is one of the world's largest suppliers of athletic shoes and apparel.

Founding: Nike was founded in 1964 as Blue Ribbon Sports by Bill Bowerman, a track-and-field coach at the University of Oregon, and his former student Phil Knight.

Name Origin: The name "Nike" was adopted in 1971. It comes from the Greek goddess of victory, Nike (pronounced "Nee-key" in Greek), symbolizing the company's goal to associate its products with victory and success.

Swoosh Logo: The iconic "Swoosh" logo, representing the wing of the Greek goddess Nike, was designed by graphic design student Carolyn Davidson for a mere $35.

First Shoe: The first shoe with the Swoosh logo was a soccer shoe named "Nike," released in 1971.

Public Listing: Nike went public in 1980 and is listed on the New York Stock Exchange (NYSE).

Global Brand: As of 2021, Nike operates in more than 170 countries around the globe.

Revenue: In its 2020 fiscal year, Nike generated over $37 billion in revenue.

Sponsorships: Nike is well-known for its endorsement contracts with high-profile athletes like Michael Jordan, Tiger Woods, Serena Williams, and LeBron James, among others.

Air Jordan: Nike's Air Jordan brand, launched for Michael Jordan in 1985, has become one of the most successful and iconic shoe brands in history.

Innovations: Nike is known for its innovative products, such as Air Max, Nike+ (a collaboration with Apple), and Flyknit shoes.

Just Do It: The "Just Do It" campaign, launched in 1988, has become one of the most famous and effective marketing campaigns in history.

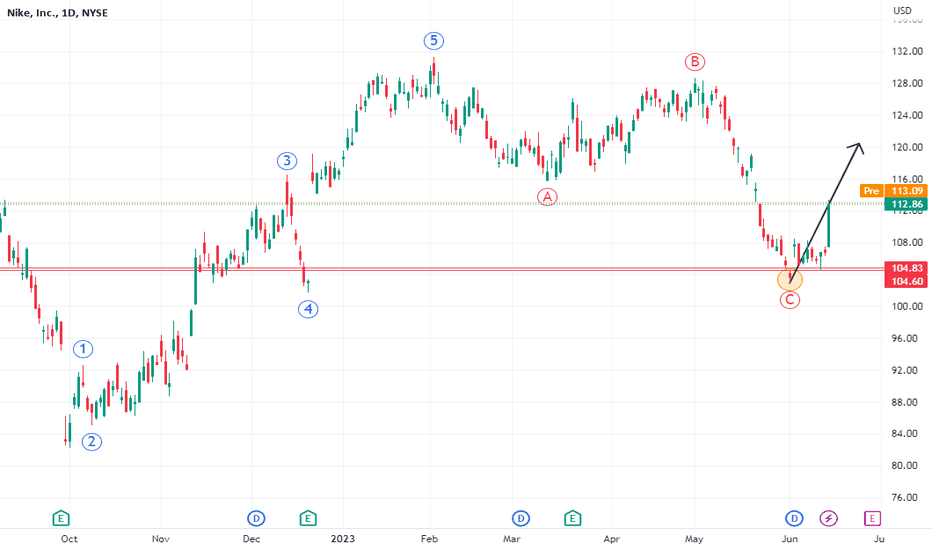

NKE - LongFrom an Elliott Wave perspective, it looks like NKE could have a nice upward move in the coming days/months after a three-wave decline since February 2023. Not only did the correction almost reach the end of the previous wave 4, we can see an island reversal on the daily chart after the low of 102.69 was reached. As long as we are trading above this level, odds favor a recovery.