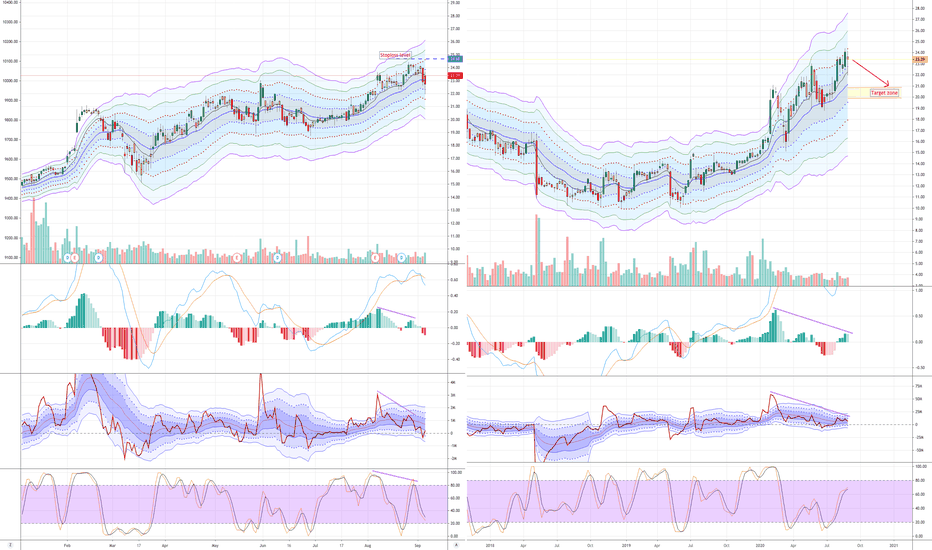

NLOK - Norton Life lock - Bearish DivergenceWeekly:

On the weekly we see the prices go higher, while EFI and MACD Histogram diverge in relation to prices.

There is a ATR channel divergence as well, the high top goes well above +4 ATR, the top after that to +2,5 ATR and the current top to +2 ATR.

Previous pullbacks dip to somewhat below the EMA, around -0.5 ATR.

That would set the targets between 21 and 20.

Daily:

It shows a divergence here as well, with EFI and MACD-H. It also shows a divergence with Stochastic RSI, with a higher price top, Stochastic RSI turns on a lower level.

In my experience, this is a strong sign as well.

Entry would be:

23.39

Target 1: 21,05

Target 2: 20,05

SL: 24,68

R/R ratio: 1:2 for target 1

R/R ratio: 1:3 for target 2

The Stop loss is outside the 2 ATR channel, 1.5 ATR away from the current price.