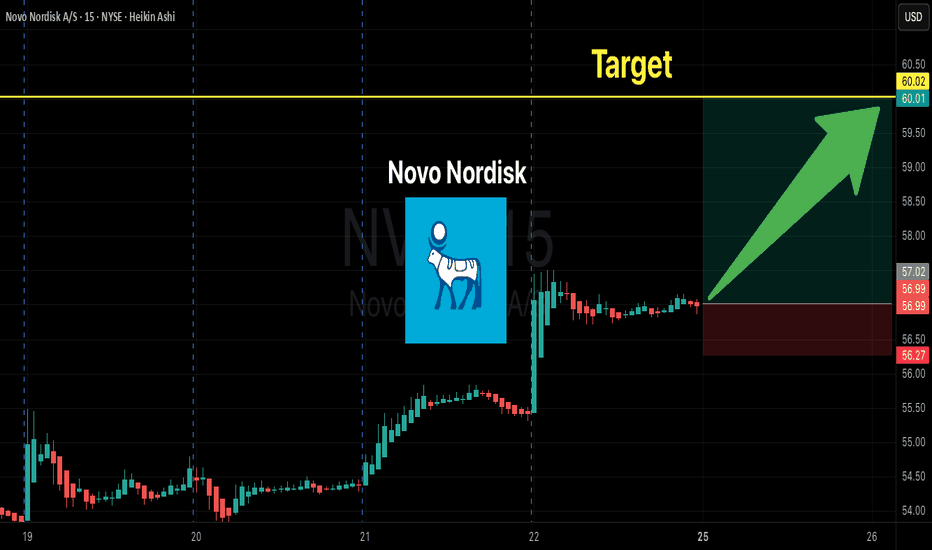

NVO Bulls Load $60 Calls for 100%+ Weekly Gains!

# 🚀 NVO Weekly Options Trade Setup (08/24/2025)

**Consensus:** 🔥 Strong Bullish — All 5 AI models favor weekly calls!

**Market Context:** Low VIX (\~14.2) ✅, Heavy Call Flow (C/P 3.43) 📈, Institutional Volume ↑ 1.3x

---

lish on weekly horizon

* **Strategy:** Single‑leg weekly CALLs

* **Expiry:** 2025‑08‑29 (exit by Thursday to avoid 1 DTE gamma/theta risk)

* **Stop/Target:** Tight stops 40–50%, profit 50–100%

* **Strike Recommendation:** \$60 CALL ✅

* Massive liquidity (Volume: 5,019; OI: 6,348)

* Cheap entry, high leverage, low slippage

* Aligns with Grok/xAI & liquidity preference

---

## ⚡ Trade Details (Ready to Execute)

```json

{

"instrument": "NVO",

"direction": "call",

"strike": 60.0,

"expiry": "2025-08-29",

"confidence": 0.78,

"profit_target": 0.68,

"stop_loss": 0.17,

"size": 1,

"entry_price": 0.34,

"entry_timing": "open",

"signal_publish_time": "2025-08-24 07:58:54 UTC-04:00"

}

```

---

## 📌 Quick-Trade Snapshot

🎯 **Instrument:** NVO

🔀 **Direction:** CALL (LONG)

💵 **Entry Price:** \$0.34

🎯 **Profit Target:** \$0.68 (+100%)

🛑 **Stop Loss:** \$0.17 (-50%)

📅 **Expiry:** 2025-08-29

📏 **Size:** 1 contract

📈 **Confidence:** 78%

⏰ **Entry:** Market Open Monday

🕒 **Signal Time:** 08/24/2025 07:59 EDT

---

## ⚠️ Risks & Notes

* **Theta decay:** Exit by Thursday to avoid gamma/theta crush

* **Binary events:** Check stock news/earnings

* **Low premium = high loss probability:** Risk only what you can afford

* **Stop execution:** Prefer mental + limit sell vs. automated stops

Novonordiskoptions

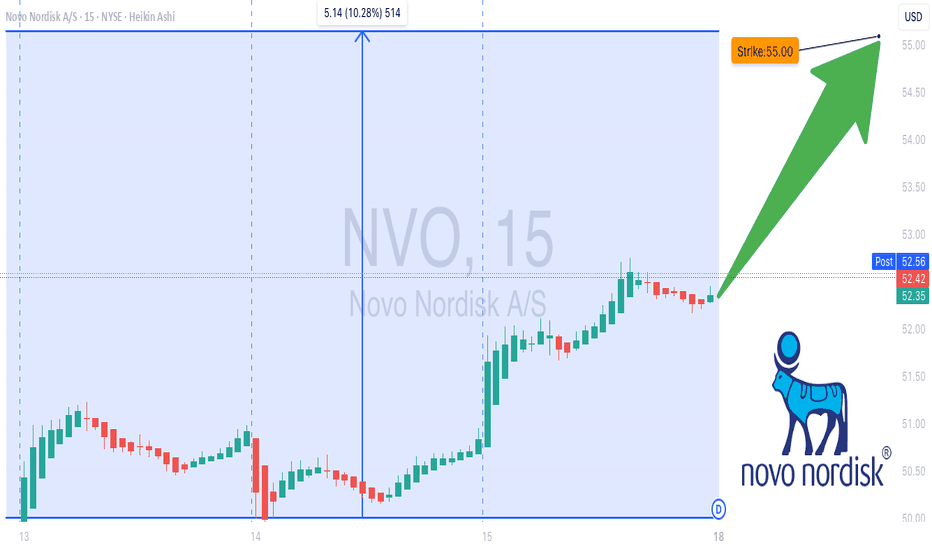

NVO Bullish Swing Incoming! Call Strike $55 🚀 NVO Swing Alert – 2025-08-15 🚀

**Sentiment:** Moderate Bullish

**Setup:** Call Option Trade

---

## 📈 Market Snapshot

* **Daily RSI:** 44.7 → Neutral but trending upward

* **5 & 10-Day Trend:** +2.94% / +9.11% → Short-term bullish momentum

* **Volume:** Avg (1.0x) → Weak breakout confirmation

* **Call/Put Ratio:** 1.00 → Neutral market expectancy

* **VIX:** 14.8 → Low volatility, favorable for directional trades

---

## ⚖️ Consensus & Conflicts

**Agreement:**

* Short-term positive performance suggests bullish potential

* Low VIX environment favorable for swing trading

**Disagreement:**

* Mixed interpretation of Call/Put ratio

* Some models caution due to weak volume and insufficient institutional support

---

## 🎯 Trade Setup – NVO CALL

**Entry Condition:** At market open

**Strike:** \$55.00

**Expiration:** 2025-08-29

**Entry Price:** \$0.91

**Confidence:** 72%

**Profit Targets:**

* Scale 50% at \$1.36 (50% gain)

* Hold remainder until \$1.82 (100% potential gain)

**Stop Loss:** \$0.54 (40% of premium)

**Key Risks:**

* Weak volume may limit momentum

* Breach of \$50 support invalidates bullish setup

---

## 📝 TRADE DETAILS (JSON)

```json

{

"instrument": "NVO",

"direction": "call",

"strike": 55.0,

"expiry": "2025-08-29",

"confidence": 0.72,

"profit_target": 1.36,

"stop_loss": 0.54,

"size": 1,

"entry_price": 0.91,

"entry_timing": "open",

"signal_publish_time": "2025-08-15 13:54:27 UTC-04:00"

}

```

---

## 📊 Quick Reference – TradingView Ready

🎯 **Instrument:** NVO

🔀 **Direction:** CALL (Long)

💵 **Entry Price:** \$0.91

📈 **Profit Target:** \$1.36 / \$1.82

🛑 **Stop Loss:** \$0.54

📅 **Expiry:** 2025-08-29

📏 **Size:** 1 contract

⏰ **Entry Timing:** Market Open

🕒 **Signal Time:** 2025-08-15 13:54 EDT

---

### Suggested Viral Title & Tags:

**🔥 NVO Swing Alert: Call Setup Ready – Strike \$55 🚀**

\#NVO #SwingTrade #OptionsTrading #Bullish #CallOption #Momentum #TradeSetup #TechnicalAnalysis #StockAlerts #Finance #TradingSignals #MarketWatch #LongTrade