NOW

NOW - Negative downward momentum short from $167.23 to $134.23NOW seems forming a negative downward momentum setup along with negative Twiggs money flow divergence. It also has Plenty of selling but mostly around 5-20%. We think it will decline from here.

To Play this August $150 Puts don’t look bad.

* Trade Criteria *

Date First Found- March 23, 2018

Pattern/Why- Negative downward momentum short

Entry Criteria- $167.23 (Hit March 23, 2018)

Exit Criteria- $134.23 or 200 day moving average.

Stop Loss Criteria- $178.23

Indicator Notes- Strong Twiggs money flow divergence

Special Note- Plenty of selling but mostly around 5-20%. August $150 Puts don’t look bad here.

Please check back for Trade updates. (Note: Trade update is little delayed here.)

EDO/BTC UPDATEThink the pattern is still strong and will form, but I've never supposed it could be so diagonal.

BTC Breaking: New Triangle Forming4am cyclic time zones indicate the most frequent time of day for large selloffs. There is a large resistance line that we will meet overnight that should bring the price down to a higher low (rising support). The support line of post-6600 trends will hopefully hold the imminent crash.

BTC Analysis 4/8/18 Undeniable Buying Opportunity NEW TRENDSBTC has broken its resistance levels and continues to wow investors with the growing sentiment of buyers in the market. Within the past few weeks the price has finally flirted with the sub 6k resistances prior to the beginning of the initial volume uptrend of the crash. The bandwagon bears may have finally sold every last penny of profit since BTC became mainstream. When looking at the exponentially decreasing selloffs since the maximum price, the trends are steadily fighting and pushing through 7k resistance levels with every passing day. These pushes are defying any previous pattern seen in the market, and we could truly be seeing the development of entirely new positive trends. Hopefully this new sentiment truly signals the reversal of a bearish market that has overstayed its visit.

NOW - Negative downward momentum short from Now seems forming a negative downward omentum setup along with negative Twiggs money flow divergence. It also has Plenty of selling but mostly around 5-20%. We think it will decline from here.

* Trade Criteria *

Date First Found- March 23, 2018

Pattern/Why- Upward channel breakdown, smart money short setup.

Entry Criteria- $52.46

Exit Criteria- $45.57

Stop Loss Criteria- $55.88

Indicator Notes- Twiggs money flow deep into the negative side.

Special Note- BIG selling - over 750 million dollars. Could consider $60 September Puts (currently $5.30)

Please check back for Trade updates. (Note: Trade update is little delayed here.)

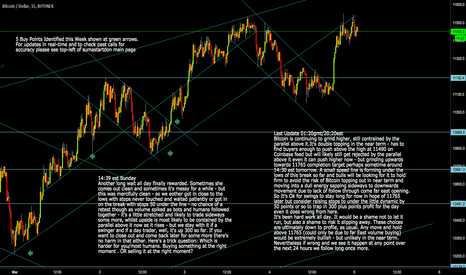

Bitcoin: BTCUSD Grinding Higher - But Raise Stops

Bitcoin: BTCUST

Last Update 01:20gmt/20:20est

Bitcoin is continuing to grind higher, still contrained by the

parallel above it.It's double topping in the near term - has to

find buyers enough to push above the high at 11490 on

Coinbase feed but will likely still get rejected by the parallel

above it even it can push higher now - but grinding upwards

towards 11765 completion target perhaps sometime around

14:30 est tomorrow. A small speed line is forming under the

lows of this break so far and bulls will be looking for it to hold

firm to avoid the risk of Bitcoin topping out in near term and

moving into a dull energy sapping sideways to downwards

movement due to lack of follow through come far east opening.

So It's Ok for swings to stay long for now in hope of 11765

later but consider raising stops to under the little dynamic by

50 points or so to trap in 300 plus points profit for the day

even it does wrong from here.

It's been hard work all day. It would be a shame not to let it

run, but also a shame to risk it slipping away. These choices

are ultimately down to profile, as usual. Any move and hold

above 11765 (could only be due to far East volume buying)

would be extremely bullish - but unlikely in the near term.

Nevertheless if wrong and we see it happen at any point over

the next 24 hours we follow long once more.