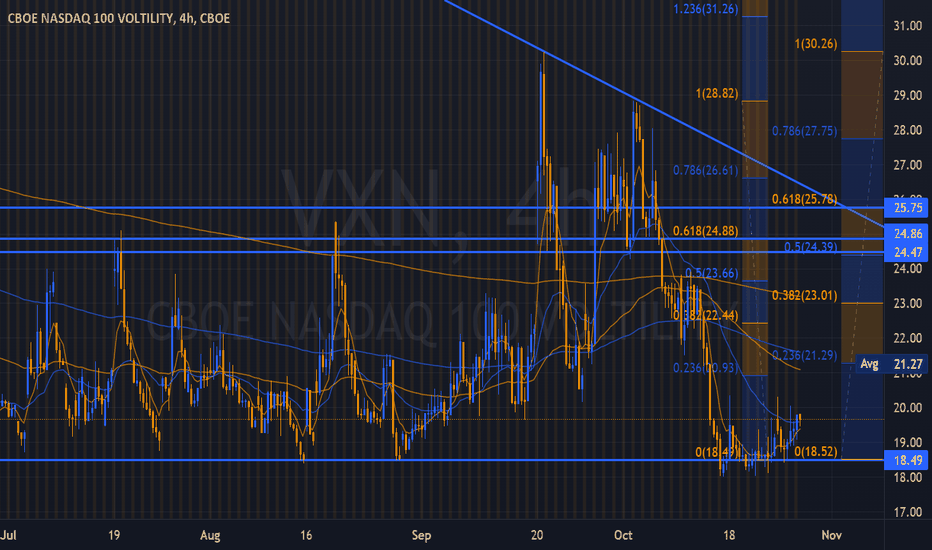

VXN - Setting the UP - 24sWe've seen Volatility Smoked repeatedly since the 2020 Highs.

One enormous Downtrend to fill the Lower Price Objective at

12.25.

It has been a long and somewhat winding road on the path, as

we have seen multiple retracements, some quite violent and

unexpected in TIME.

We suspect the same patterns will continue to repeat, although

anticipating a break from the 17 Month Trend, it will not be without

its fits and starts.

There are far too many headwinds to overcome on an Applied

Fundamental Basis.

The ARBs have taken the VX Complex down further and faster ahead

of the FOMC in early November.

The REAL issue as indicated remains - is it Early November or Late

November.

A Santa Rally is baken in according to Buyers, all be forgone,

I see it quite differently, 4/4 is not complete or 3/5 is finishing,

although I lean more to far more prolonged and Complex correction

now, TIME itself will provide the answers.

In Obeying Price, the results are always a success.

There is No real rush for us, rather we prefer to watch those in need

of the Higher Fills grab them, we follow.

Price action is eerily reminiscent of DEC 2019 - Jan/Feb 2020.

Structures are indicating the 10 - 15% correction will occur, perhaps

much more, it will depend on whether or not our Counts are correct.

The rest is up to Price.

We are setting up a Large Structured Positional SELL.

Nqvolatility

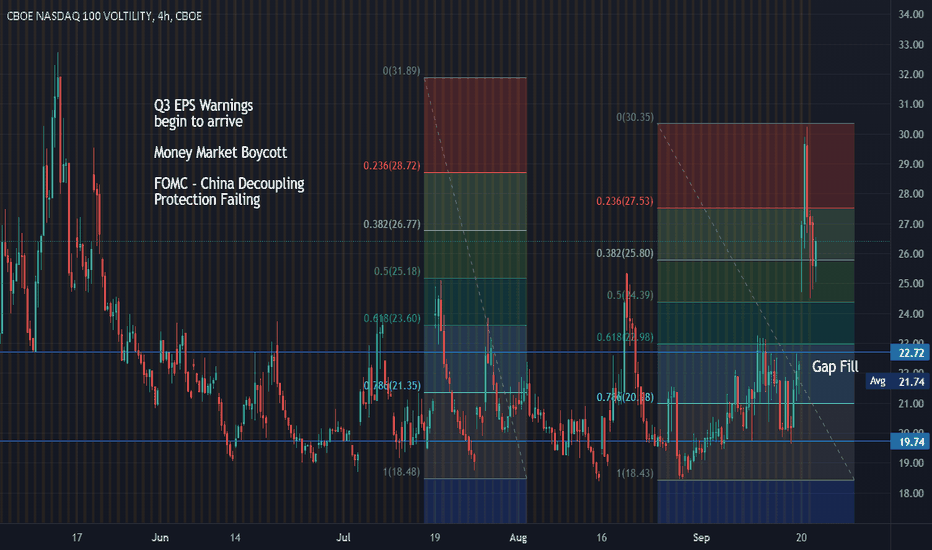

VXN - Gap FillOver 15 Months $4.7 trillion was added to the National Debt.

The Federal Reserve purchased $2.442 trillion in US government bonds.

US Central Bank monetized more than 50% of the US Debt during

the first year of the pandemic.

No single entity bought more US bonds than the Fed – Foreign Investors,

US Banks, US Corporations, and Individual Investors.

The Debt Ceiling will need to make it through the Senate, which will

use reconciliation.

It remains in stasis for the next several weeks, giving Wall Street cover

to begin further distributions as planned.

Quite often the best-laid plans come to pass, sometimes they do not

as we have seen the Price of the NQ fall below the prior consolidation

zone.

A great deal hinges on today, there will be a reactionary trade into

the final hour is when we will see the real ST trend indications.

They may well be a misdirection, patience will prevail into October.

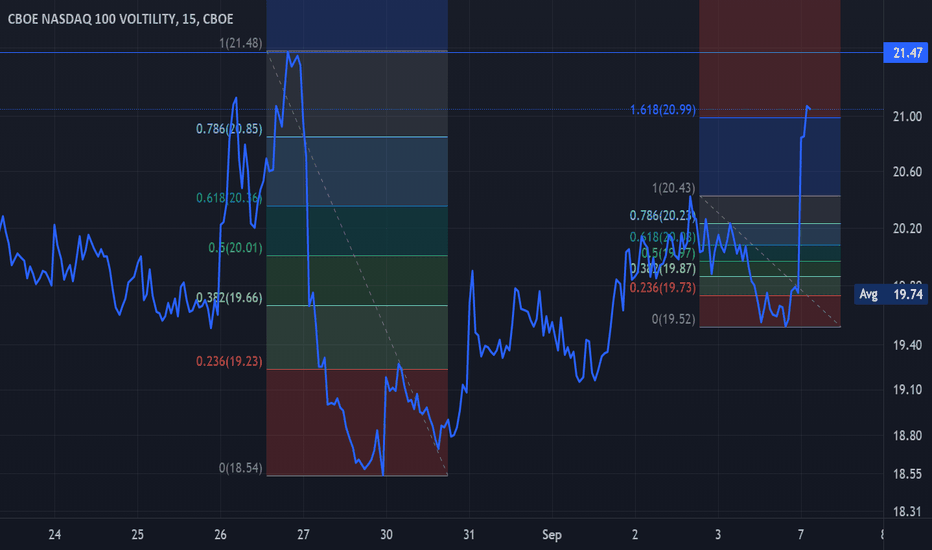

Anticipate the Gap Fill on the VXN and VIX - although the Indicies are

not moving in lockstep with a direct correlation, but wildly volatile

as this pullback in Volatility completes.

Observation Day ahead - HK