Nqvx

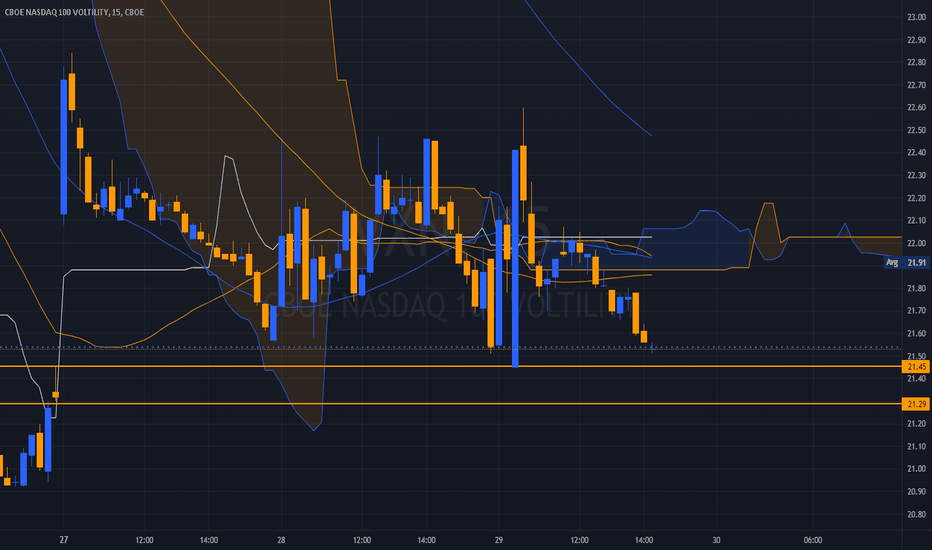

VXN - 1 Hour / CBOE Front LoadYesterday Put buyers were chased away.

The VXN held above the Gap FIll the entire Day.

The NQ used it for fuel as those who were blown

out of Puts... placed the Revenge trade all day

only to be squeezed time and again.

____________________________________________

Gamma Vs. Resistance for CASH as Buyers are limited

to Writers needing to Delta Square again.

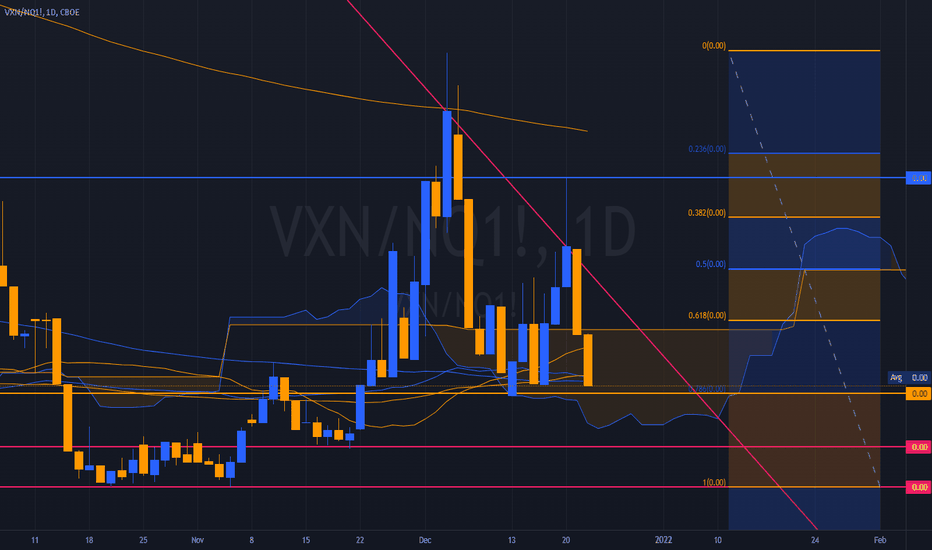

NQ/VX Continues its DivergenceUnsurprisingly - the VX Complex continues to receive the Dirty Monkey

treatment, showing a clear Negative correlation in relation to Price.

NQ continues to perform feats of Mystery and Imagination to no ones

real surprise, same game as yesterday, trap sellers at low once again

only to reverse and Monkey Hammer them.

It's becoming a farcical Daily Trade for Santa, Elon automated the Elves.

Tesla continues its Gamma Slamma Bid to provide entry for - "Hey it's Elon"

- again.

_________________________________________________________________

VXN into 22s, Joey bring the Donuts, it's Batter Up.

70+ NQ straight up in Extension.

:)

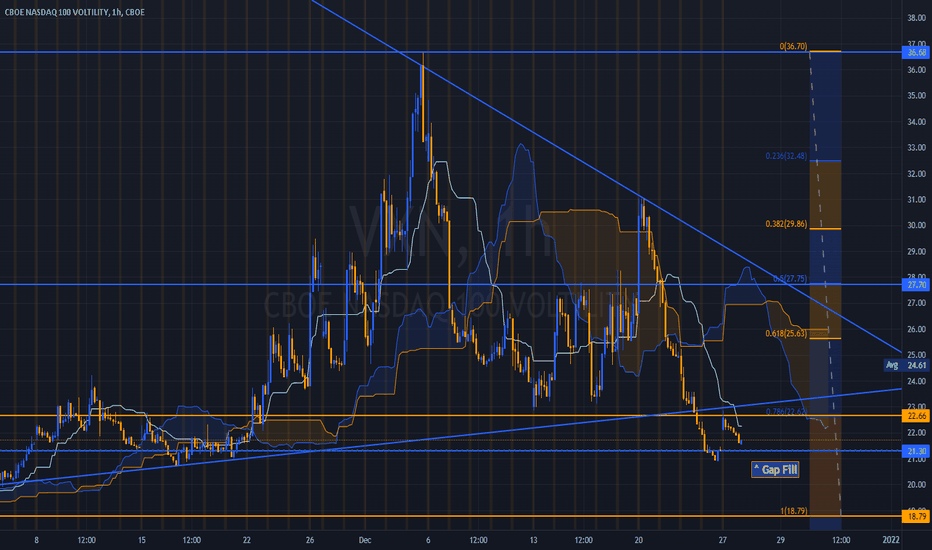

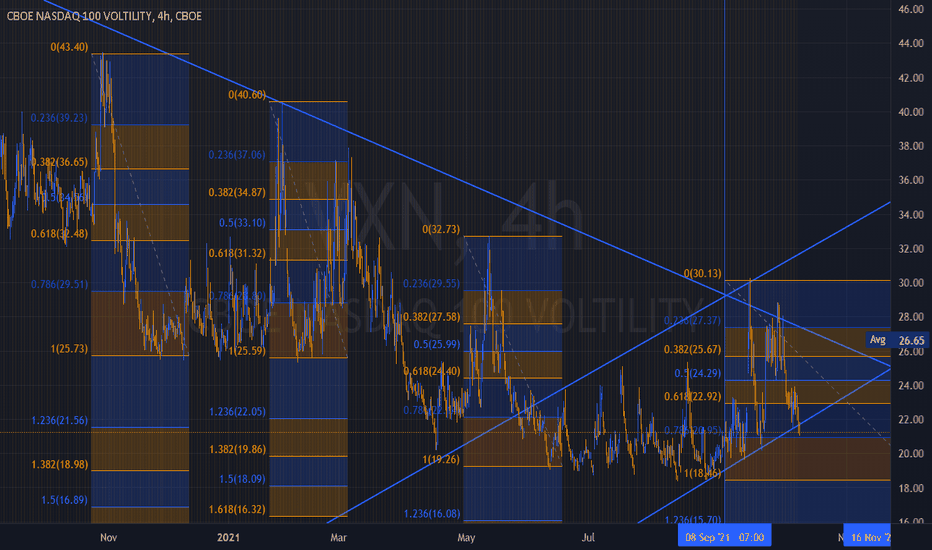

VXN - Setting the UP - 24sWe've seen Volatility Smoked repeatedly since the 2020 Highs.

One enormous Downtrend to fill the Lower Price Objective at

12.25.

It has been a long and somewhat winding road on the path, as

we have seen multiple retracements, some quite violent and

unexpected in TIME.

We suspect the same patterns will continue to repeat, although

anticipating a break from the 17 Month Trend, it will not be without

its fits and starts.

There are far too many headwinds to overcome on an Applied

Fundamental Basis.

The ARBs have taken the VX Complex down further and faster ahead

of the FOMC in early November.

The REAL issue as indicated remains - is it Early November or Late

November.

A Santa Rally is baken in according to Buyers, all be forgone,

I see it quite differently, 4/4 is not complete or 3/5 is finishing,

although I lean more to far more prolonged and Complex correction

now, TIME itself will provide the answers.

In Obeying Price, the results are always a success.

There is No real rush for us, rather we prefer to watch those in need

of the Higher Fills grab them, we follow.

Price action is eerily reminiscent of DEC 2019 - Jan/Feb 2020.

Structures are indicating the 10 - 15% correction will occur, perhaps

much more, it will depend on whether or not our Counts are correct.

The rest is up to Price.

We are setting up a Large Structured Positional SELL.

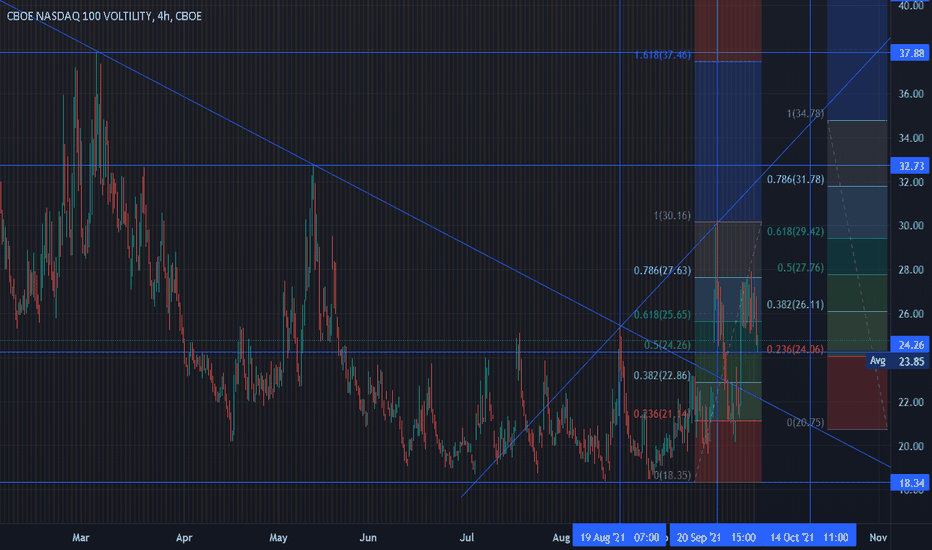

VXN - 21.51 Failure / 19.60 - 18.60The NASDAQ Volatility Crush is advancing as Price has moved through the lower

DOM Support.

It will open Lower this morning after the Globex wire to wire Bid.

AAPL is back above 142 signaling another Gamma Squeeze ahead of what

will be disappointing EPS on the EPS Warning of 10 Million Shortfall in iPhone

shipments.

Again, ZERO mention of M1X/M2 rollout, an ominous commission of what lay

ahead for AAPL - a Price Objective of $35 after 5/5 completes.

Crude Oil EIA was delayed a day due to the Monday Holiday, it will be released

@ 11AM EST. Crude and the NQ trade in some interesting patterns during RTH

and why I am mentioning it here, watch the pair and see if you observe it on

the Micro timeframes.

EPS reporting Season for Q3 opens with DOW Components, Tech begins today

as well as TSM, who missed Top Line by a small margin as reported.

IMHO, they cooked.

The fate of the Markets rests upon further fraudulent reporting to arrive.

We closed Globex BTOs form RTH close yesterday - Position @ 100% CASH.

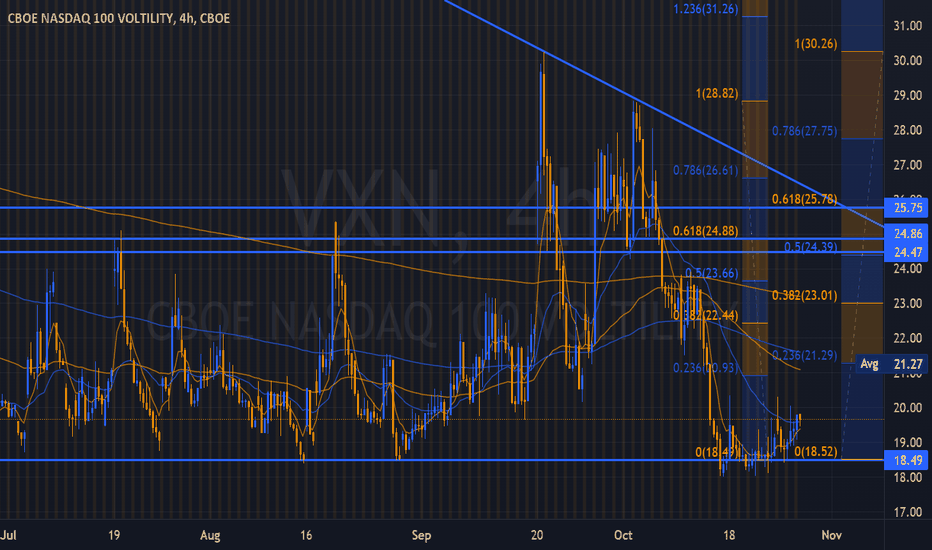

VXN - NQ Volatility / 30 Day VX ExpectationsImplied Price of options listed for the NQ.

We see a clear change in the Trend for NQ VX.

Globex is now increasing in VX as we see a 200 Tick Range

for NQ since the Globex Open.

Algos are simply running the Range capturing Ticks.

AAPL is sitting on support @ 141 and with EPS dead ahead

for the Indices - and an absence of EPS Warnings...

Bombs should begin to drop as Q3 was dismal, to be kind.

AAPL's delayed M1X rollout and M2 rollouts will have left a large

hole in 11% of the Company's EPS, iPhone lackluster demand for the

13 isn't going to assist.

The marginal iMobbers are tightening their spending significantly.

10Yr Yields will continue to provide a stiff headwind for everything

as DEBT issues compound into the 18th.

We should anticipate some Media Swings with respect to the Administrations

Agendas and Fiscal Malaiese.

The SMH continues to SELL as TSM & ASML remain @ Risk.

GOOG will enter the Mobile market with its Tensor Chips with

impressive advancements for the Pixel 6 and Pixel 6 Pro.

Samsung's Exynos 5nm chipset centered on the AI-boosting TPU and

a great many improvements for Google Fi as well. A true International

Phone is arriving Mid-October.

Alphabet is hoping to capture Market Share and we believe they will.

One Plus was our go-to for several years as they simply outperformed

everyone else until the Oppo integration.

We are switching to Pixels later this year and moving all services to Fi

as the Service is straightforward and with fully integrated Carrier

Switching... a near-perfect arrangement.

Apple's latest offering, a shallow one imho.

Although Budget offerings from Mint Mobile will see uptake, where it

counts, Fi will begin to gain share slowly until they are able to

scope/scale for a lower tier.

Chip shortages are going to wreak havoc once the Retail herd understands

how dramatically sales have gone El Cliffo.

VX is going to increase again, as uncertainty begins to unfold in a far more

dramatic fashion.

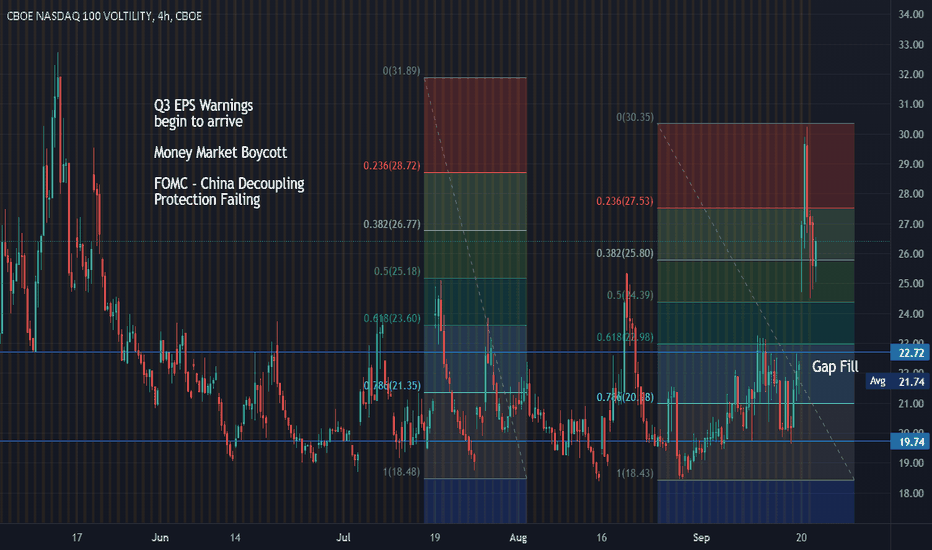

VXN - Gap FillOver 15 Months $4.7 trillion was added to the National Debt.

The Federal Reserve purchased $2.442 trillion in US government bonds.

US Central Bank monetized more than 50% of the US Debt during

the first year of the pandemic.

No single entity bought more US bonds than the Fed – Foreign Investors,

US Banks, US Corporations, and Individual Investors.

The Debt Ceiling will need to make it through the Senate, which will

use reconciliation.

It remains in stasis for the next several weeks, giving Wall Street cover

to begin further distributions as planned.

Quite often the best-laid plans come to pass, sometimes they do not

as we have seen the Price of the NQ fall below the prior consolidation

zone.

A great deal hinges on today, there will be a reactionary trade into

the final hour is when we will see the real ST trend indications.

They may well be a misdirection, patience will prevail into October.

Anticipate the Gap Fill on the VXN and VIX - although the Indicies are

not moving in lockstep with a direct correlation, but wildly volatile

as this pullback in Volatility completes.

Observation Day ahead - HK