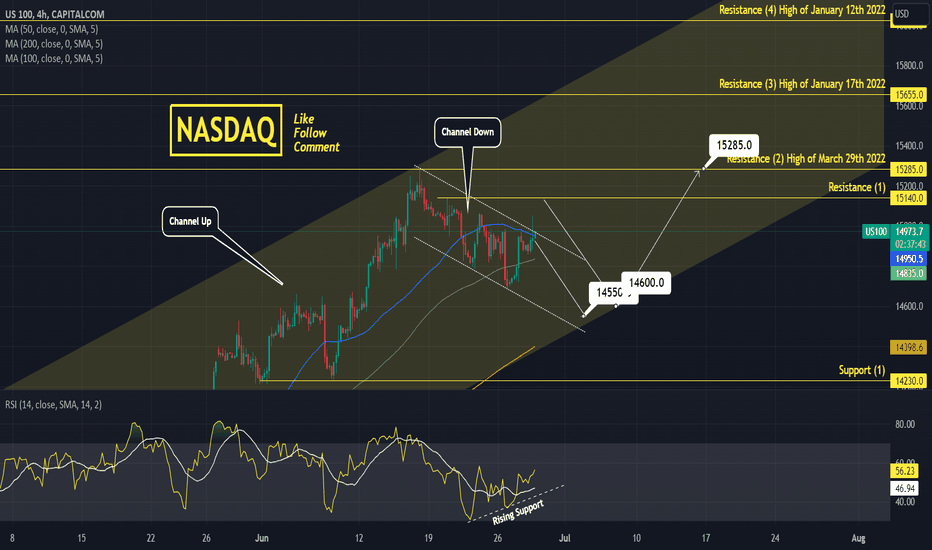

NASDAQ Two sell opportunities and a common buyNasdaq hit the MA50 (4h) today and crossed over the short term Channel Down as well, but the candle closed back inside the Channel and under the MA50.

This is a sell indication and unless it closes above it, we expect a test of the MA200 (4h) given the fact that the MA100 is already broken.

Trading Plan:

1. Sell on the current market price or at Resistance (1).

2. Buy on the MA200 (4h).

Targets:

1. 14550 and 14600 respectively (hit on the MA200 4h).

2. 15285 (Resistance 2 and Highs of March 29th 2022 and more recently June 16th 2023).

Tips:

1. The RSI (4h) is on a Rising Support, indicating a Bullish Divergence in contrast to the price's Channel Down. Attention is needed as this may indicate a bullish reversal for the index, so careful with shorting above Resistance 1.

Please like, follow and comment!!

Notes:

Past trading plan: