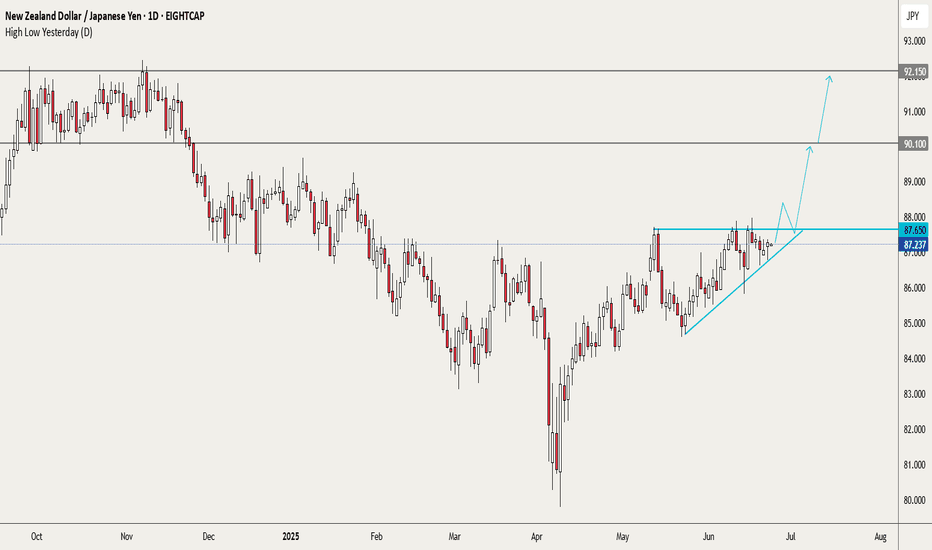

NZDJPY looks ready to breakoutThe area around 87.65 has been a solid resistance since early Feb. Time and again, price has been rejected there and recently the lows have become higher. The squeeze is on and I sense that another attempt to break out above will happen soon.

Will it succeed? I have no idea, we never do. But if there is a breakout and then a retest, I'll take the trade and take this as high as I can (within the limits of my discipline and patience) :)

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

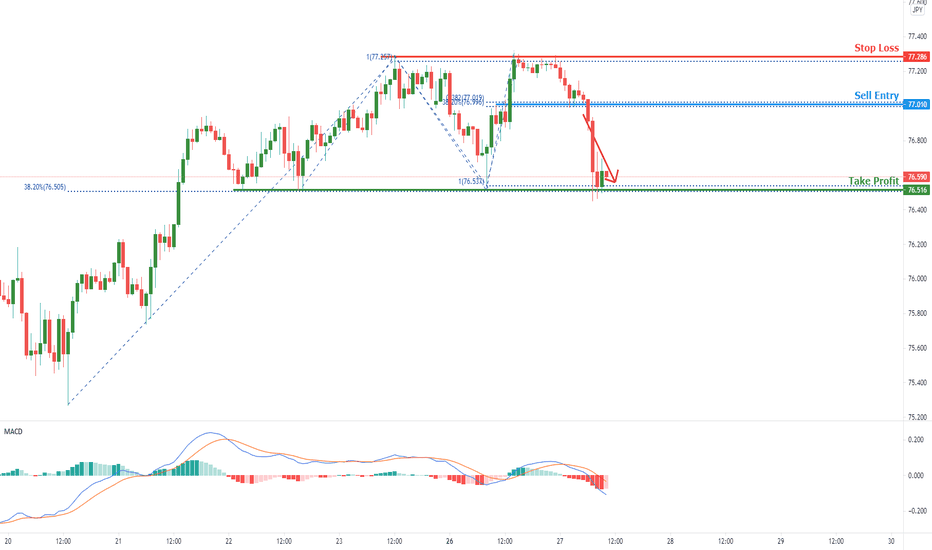

Nsdjpy

NZDJPY facing bearish pressure | 27th July 2021Price is currently testing the weak H1 horizontal overlap support which is in line with the 38.2% Fibonacci retracement and 38.2% Fibonacci extension. Should price break this level, we can expect price to drop and take support at 76.516 which is in line with the 100% Fibonacci extension. 38.2% Fibonacci retracement as well as the horizontal swing low support. Our bearish bias is further supported by how MACD is holding below the 0 line.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.