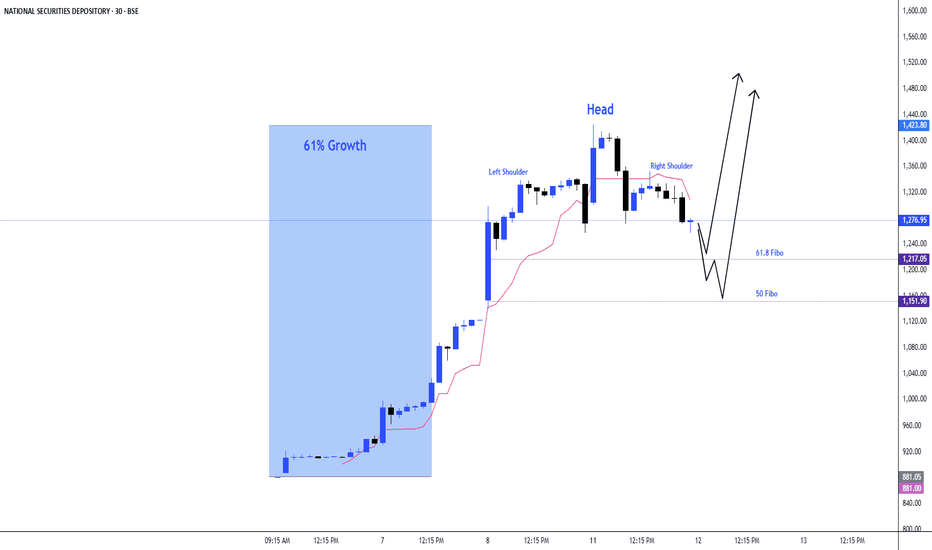

NSDL | Post‑Listing Surge Near ₹1,425Summary

After listing at ₹880 on Aug 6, NSDL rallied to ~₹1,425 within four sessions before profit‑taking; near‑term P/E ~77–79 vs peer CDSL ~66, so momentum may pause into the Aug 12 results.

Chart Thesis

Structure: Parabolic advance from ₹880 to ₹1,425, followed by intraday rejection—first meaningful pullback likely to set a higher low above ₹1,200 if the trend is to continue.

Levels:

Long zone: ₹1,200–₹1,250

Invalidation: Close <₹1,160

Targets: ₹1,360 → ₹1,400–₹1,425

Note: Event risk—board meets Aug 12 to consider Q1 FY26; expect swings.

Fundamentals

FY25 revenue +~12% to ₹1,420–1,535cr; PAT ₹343cr (+~25% YoY); near‑duopoly advantages but valuation now full post‑rally.

Plan

Avoid chasing strength; buy dips only with tight risk and take partials near prior highs. Investors with IPO gains can book some profits and hold a core for the long term.

Disclaimer: Educational, not investment advice. Manage risk.