Nseindia

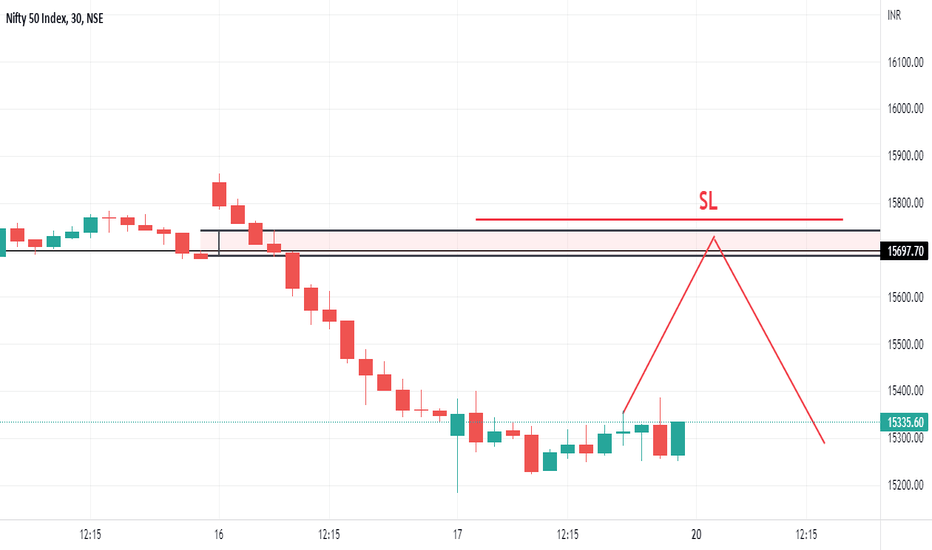

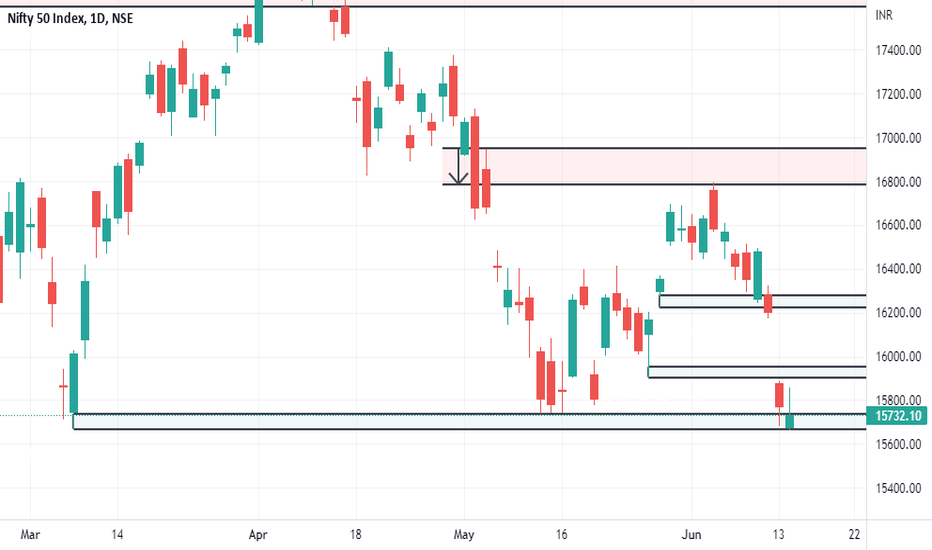

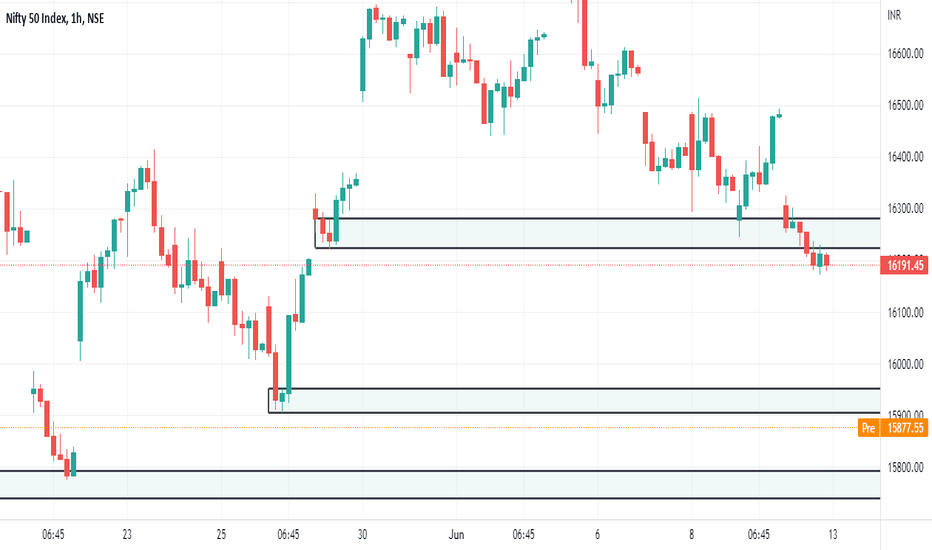

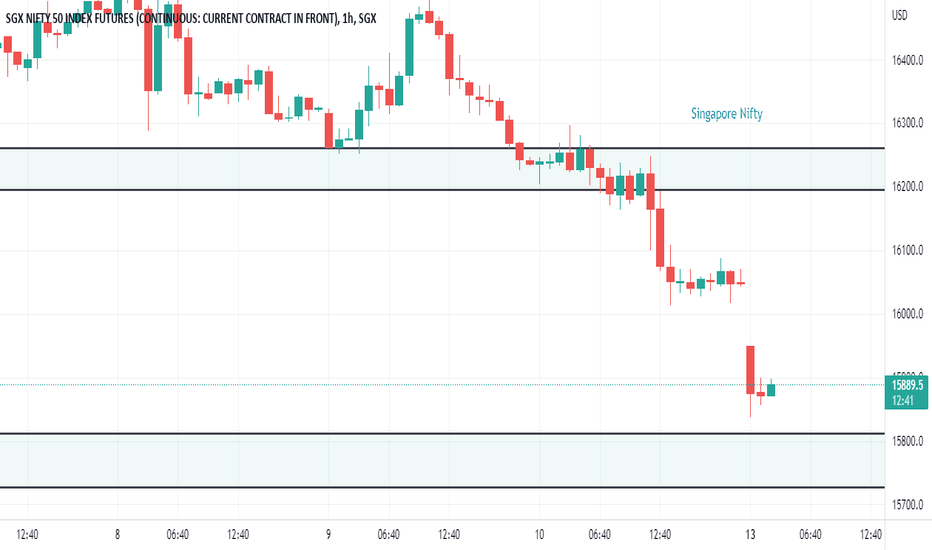

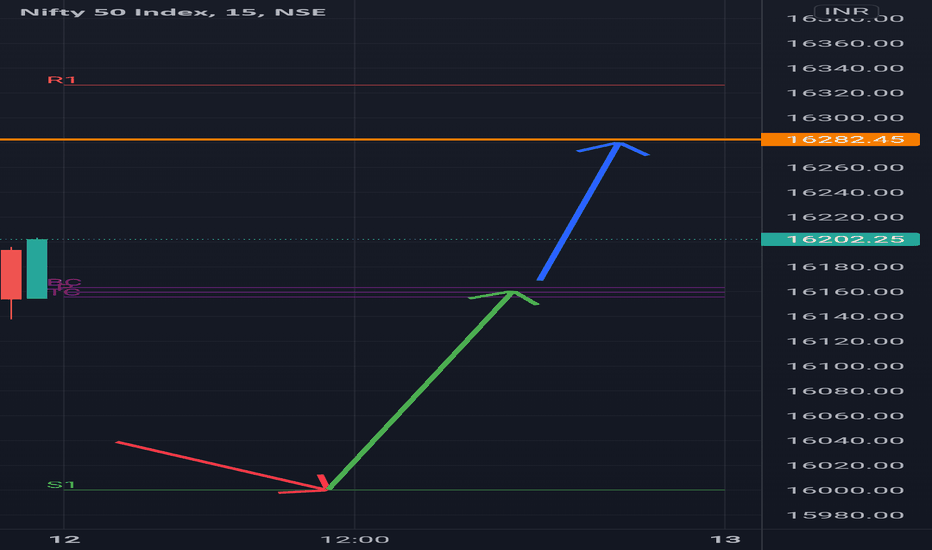

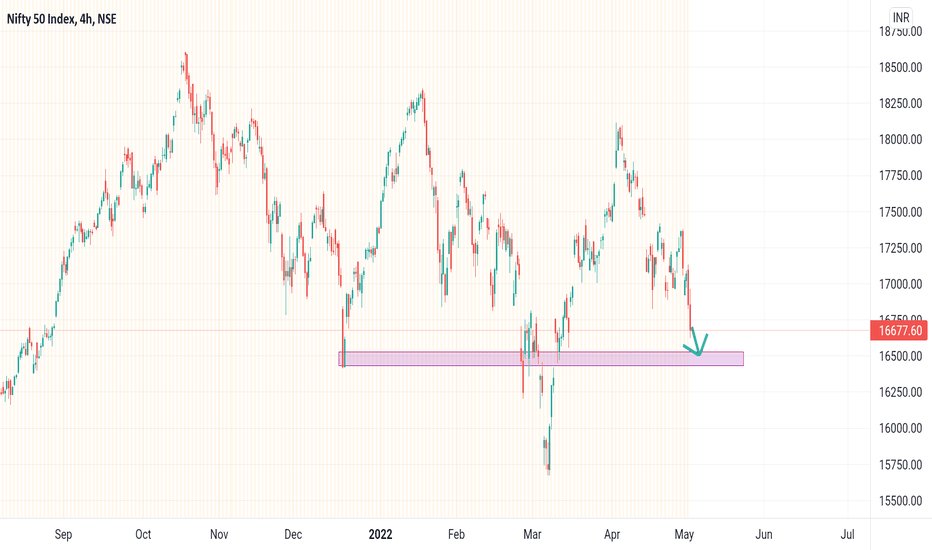

Nifty will Fall MoreNifty as broken its crutial Monthly Demand and falling we don't have any valid Support nearby the next support is at arroung 14300 to 14400 will looking for that levels. Keep your money with you that will give you better opportunity to reap huge profits with smallest amount of Risk involved. Till then every rise is a Shorting opportunity for me. Rather than trading naked in this volatile market which is very risky so get ready with your strategies. 15700 and 16000 having highest Open Intrest will also proves a hurdle not easy to break will looking to go short if reaches that level at least for this expiry. Position in SAIL and AIAENG is still on and HOLDING that positions.

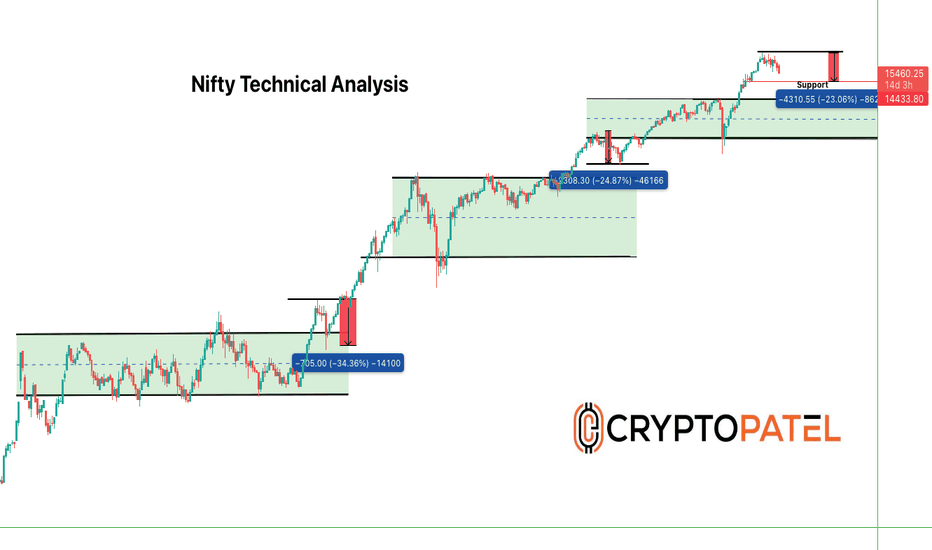

NIFTY50 Perfect Analysis done and What Next.?#Nifty 50 Technical Analysis:-

Currently Nifty50 Trading around 15460 Level.

And I aware you about Big Down Move when It was $16700 Level.

Almost 1200 Points Down from Our Level.

Now..?

Still I am expecting more Down Trend and My Target is 14400 Level will be best Entry Point for Accumulations.

2004 = -35% Correction after ATH

2015 = -25% Correction after ATH

2022 = -25% Corrections expecting

Correction is Not Bad for Market, this is Very good for Long Term Growth.

And This is Also Best Buying Opportunities for Accumulate Good Stocks.

Support:- ₹14400/₹13400

Resistance:- ₹17500

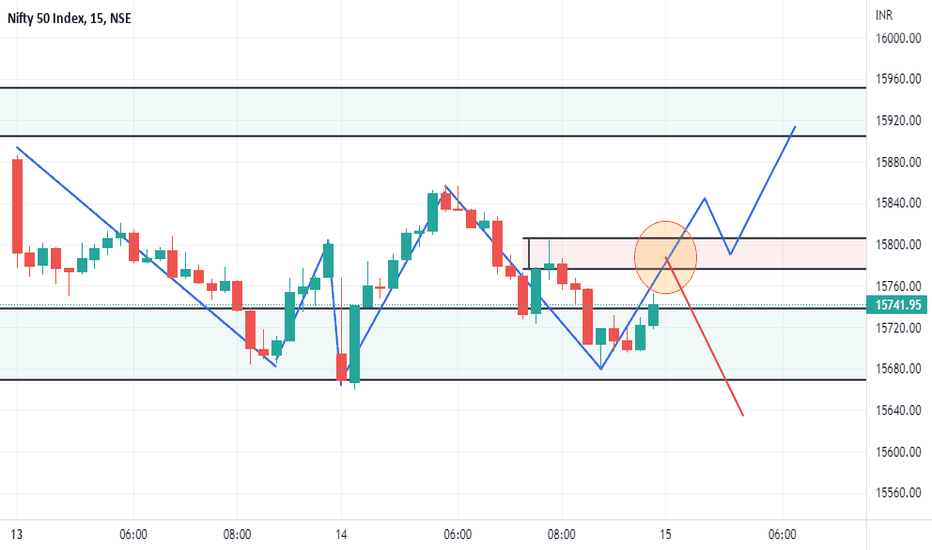

Nifty Holding its PositionAs the globals are recovering Nasdaq is +ve, Singapore Nifty is also not very -ve there are two possible outcomes whether nifty bounces and breaks the Supply made yesterday or after hitting the Supply will fall back in second scenarion " I will prefer to square of my BULL PUT POSITION" not in very profitability but not in Loss or other wise hold till today's end depending upon situation. " RISK MANAGEMENT := Managing the risk is the key to survival in the market your Asset is MONEY if you run out of your Asset you will be thrown out of market and bound to go HOME believe me over the time i realises that making negligible or no Loss is more important than making Profit in every trade. If you stand on crease Runs will come sooner or Later. It is a process over the time you learn you earn you evolve. "

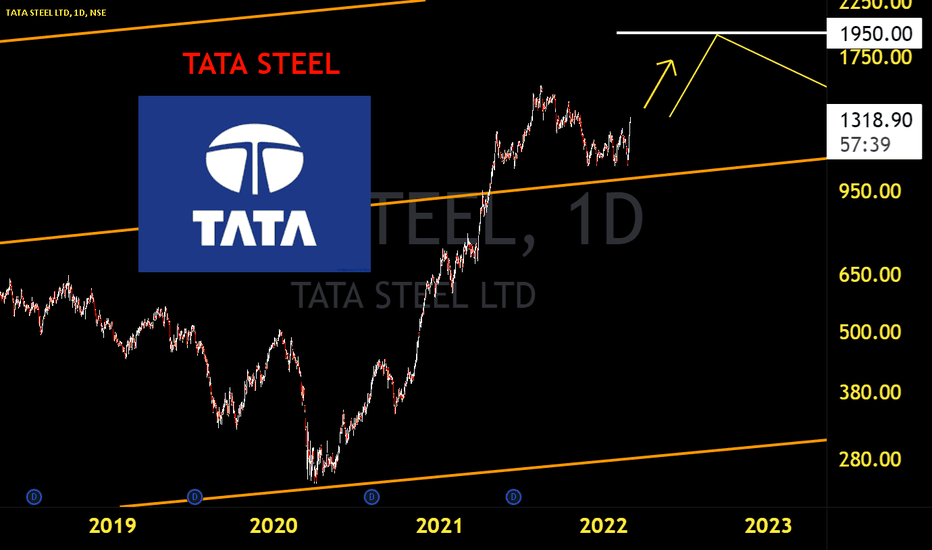

TATA STEEL www.tatasteel.com

India's largest steel co.

Tata group's second largest followed by tata motor ( JLR owner) and just behind leading IT giant TCS

Net Sales grown 16.56% annually and Operating profit at 51.09%

Low debt <20%, Commands high brand value

Presence pan India, Europe, South asia and only expanding.

Steel applications- Agriculture, automotive, engineering , construction, consumers goods etc

Fundamentals-

Its 2022, War is on in russia, west plays the sanction game, the world seeks for alternate players to supply.

India stands to gain.

If china moves next on taiwan, the game only accelerates for indian players, being a diplomatic ally of all with ease of trade and geographical advantage

Inflations at ath, commodities to only get expensive, oil trades on $118 on date, aiming 2008 recession levels.

READY FOR COMMODITY SUPER CYCLE ?

____________________________________

Short term 1950

long term- 5 years, 5x multiple

Macro view -

Nifty call analyst Put/Call ratio (PCR) is a popular derivative indicator, specifically designed to help traders gauge the overall sentiment (mood) of the market. The ratio is calculated either on the basis of options trading volumes or on the basis of the open interest for a particular period. If the ratio is more than 1, it means that more puts have been traded during the day and if it is less than 1, it means more calls have been traded. The PCR can be calculated for the options segment as a whole, which includes individual stocks as well as indices.

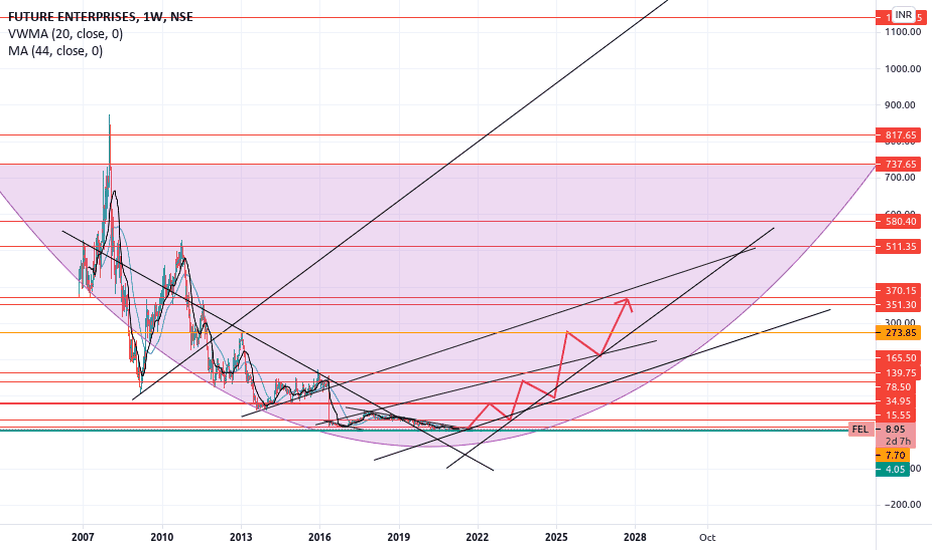

Future Enterprises FEL - India's Biggest Retail Chain is in RED<>

<>

<>

- Catch the Stocks when they are Red, they say-

- There is no INDUSTRY more BLOODY RED than 'Old Physical Retail Outlets/ Chains' these days, Like BigBazaar Retail Chain in India.

- Already under debt of 25000Cr (almost $3.8Billion). Amazon and Reliance group (India's 2nd biggest business group) literally Battling it out in every COURT available in India and in Singapore to acquire its entire share.

- India, One of the Most Crowded place in the World, under the severe Impact of Covid, is unprecedented is breaking down each day.

People are dying, govt trying hard but it is not enough. Country is short on everything from medical supplies, oxygen, to generating employment. Thus, Further Crash in Retail sector is eminent. However, India had, has and always will have very strong domestic demand to support its bounce back. India's population is 1.30 Billion V/s 0.745 Billion in Entire Europe (almost double than EU).

- Post Covid, when market will start to stablise and people will start getting back to their previous buying behaviour.

Retail sector will be the first sector to show robust growth. Imagine what will happen to Retails stores once covid is over, they will be overwhelmed and stocks will soar - BOOM.

- It (FEL) is a very very long term chart, so consider this investment as your "Retirement Plan Fund/investment". You can think of Investing a very small amount, but it needs to be with very long time holding view like min 8-10 yrs.

Research yourself,

- About BIGBAZAAR

- Future Retail + Reliance group i.e. Mukesh Ambani) V/s Amazon (Jeff Bezos)

- It is an exciting fight to watch, and is about to culminate.

<> <>