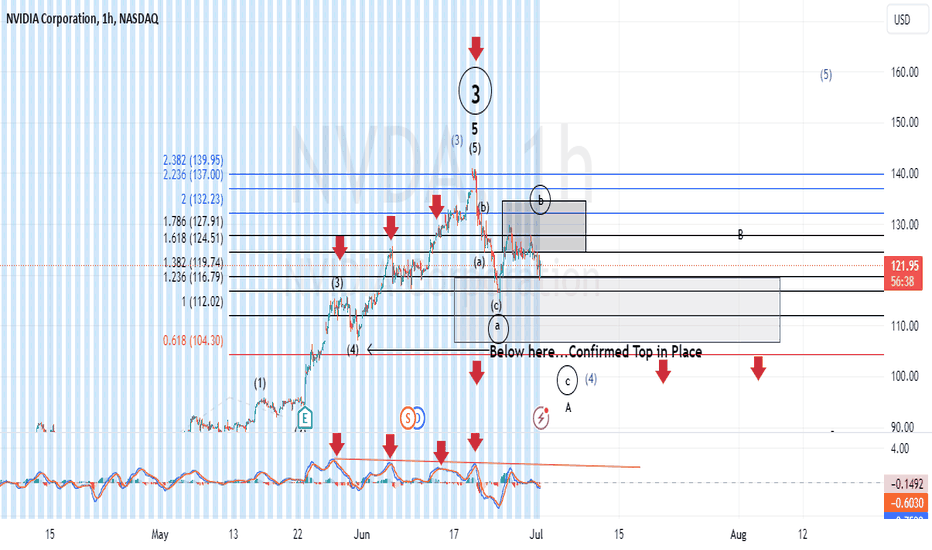

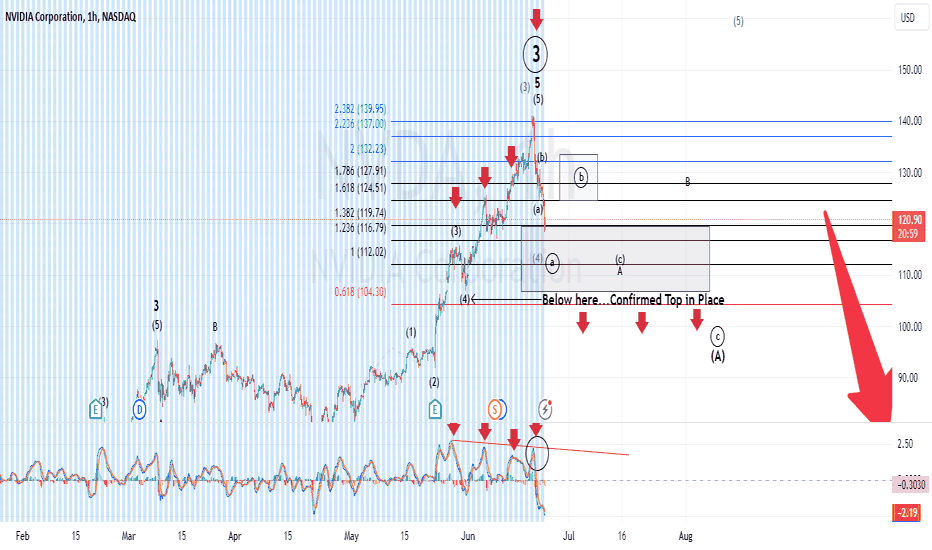

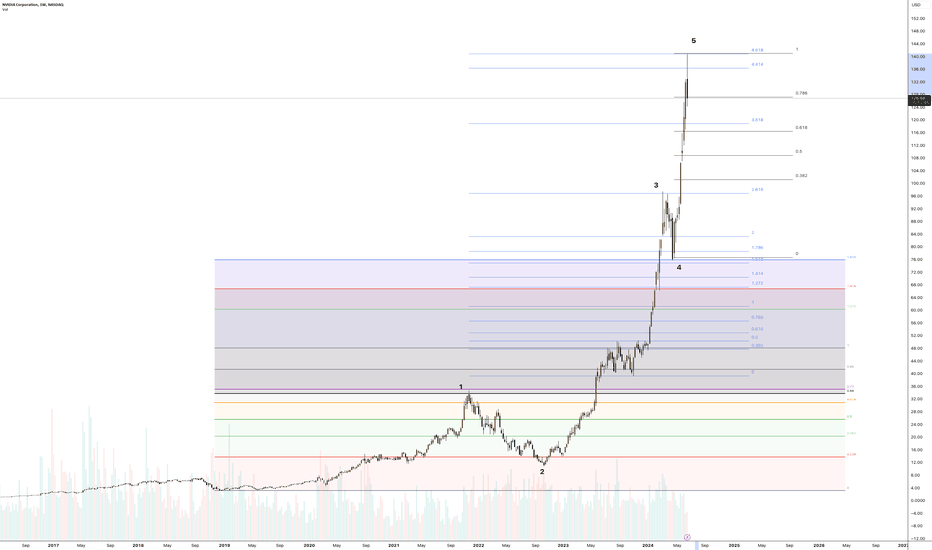

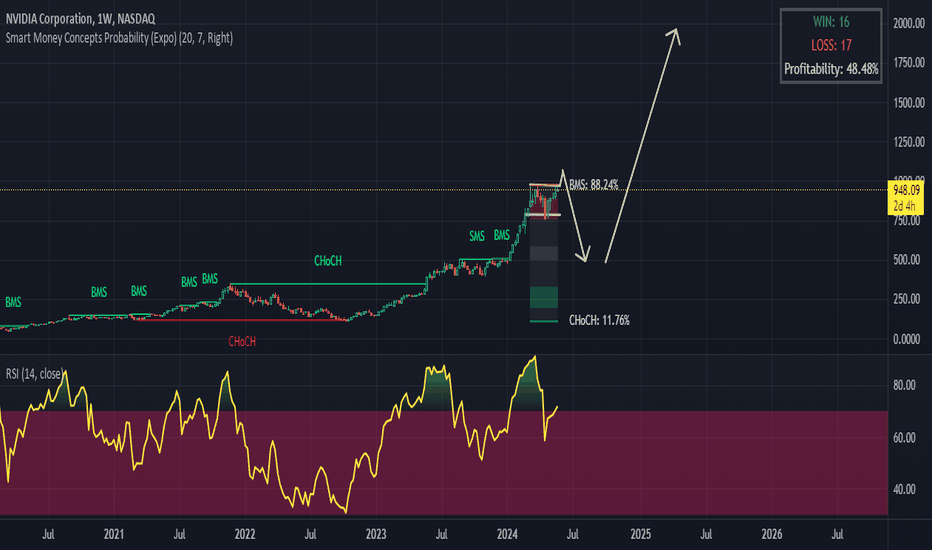

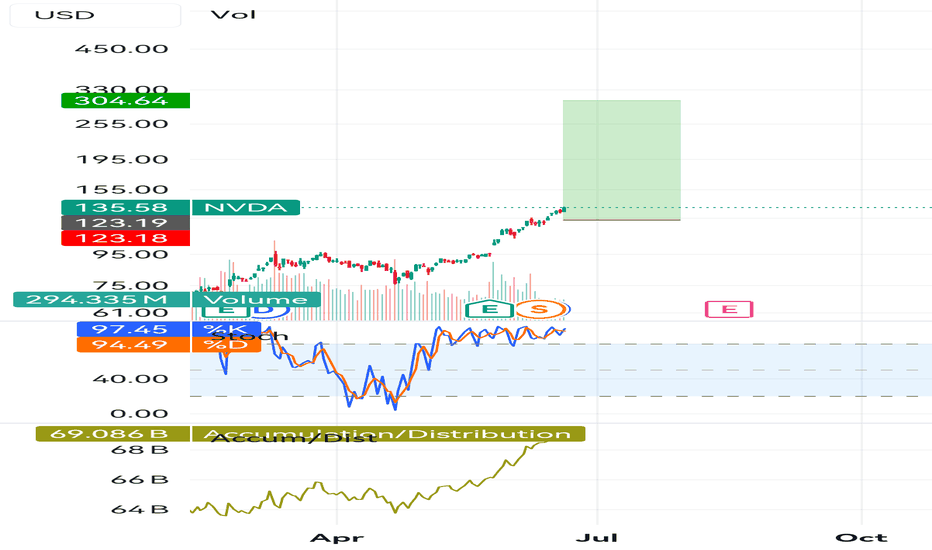

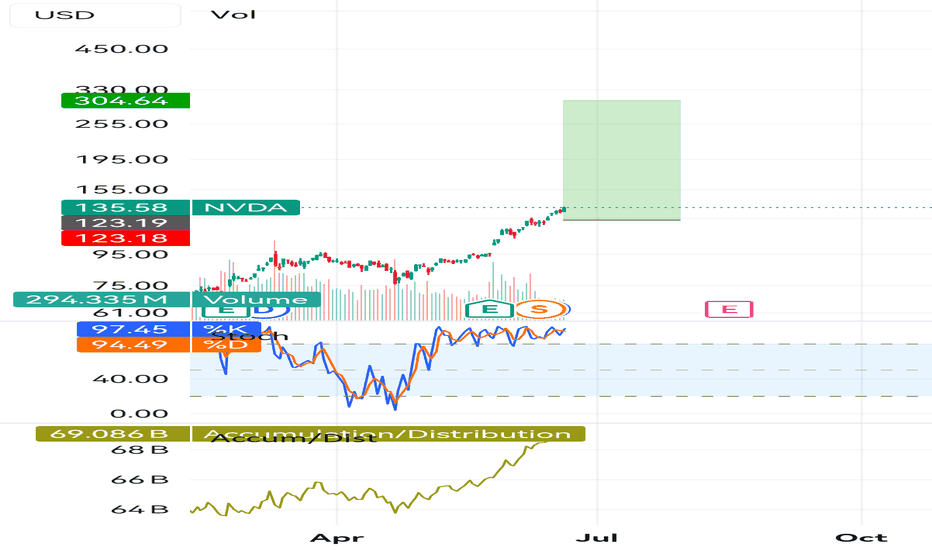

Is our circle B wave is done yet?We really cannot say we have confirmation we're in a circle c-wave until we breach the circle a-wave low. So I will repeat, we have the minimum waves in place to consider circle b done...and could begin our circle c-wave descent. However, nothing states we cannot get back into our target box for a more complex circle b.

The fact remains we also have purple wave 4 that is still valid until we breach $104.30. It is my opinion Nvidia has struck a local top but as the days and weeks progress, we'll get confirmation of whether that top was a local top, or what I believe to be a primary top, and that top would last many months to potentially a couple years.

Nvidia

NVDA / Nvidia - AI Stock Idea I.hello guys,

Yearly: Bullish

Q: Bullish

M: Slightly Bearish - Stochastic bearish divergence. close below middle line.

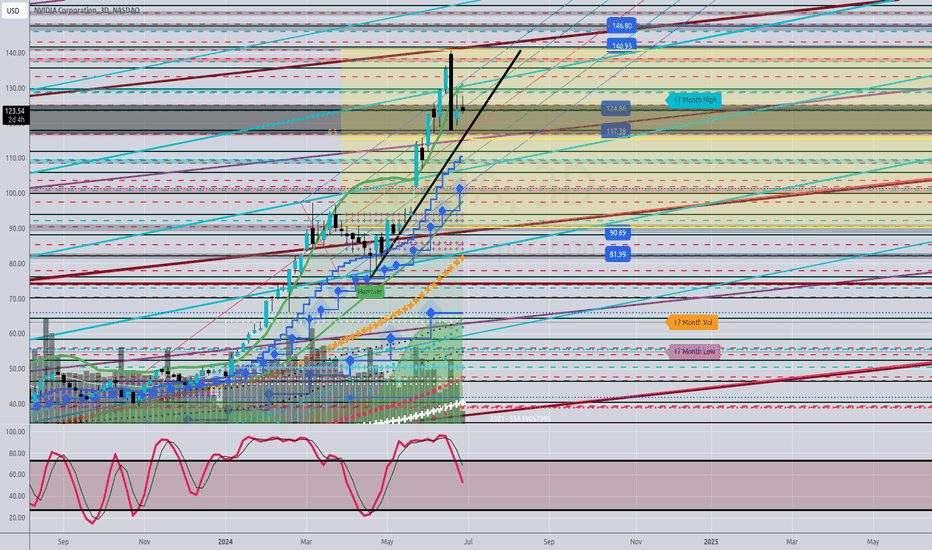

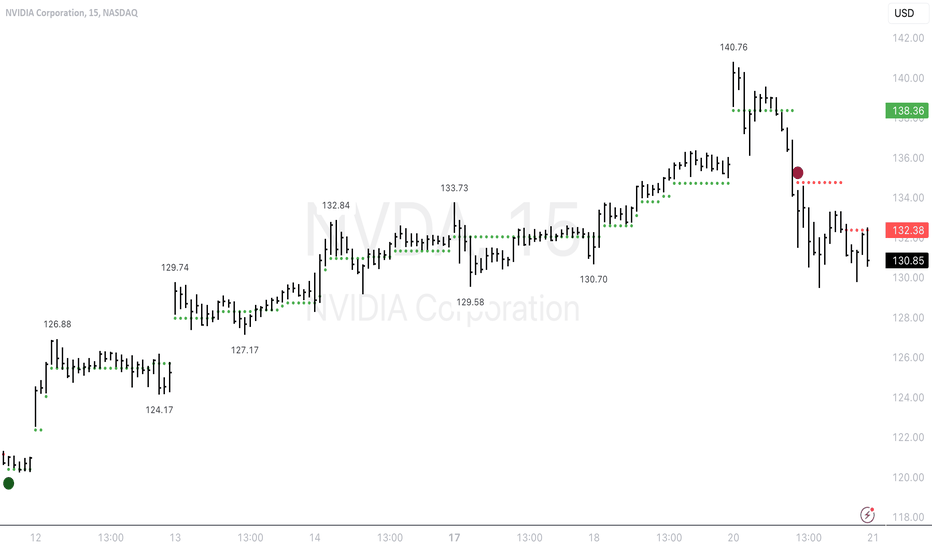

125 - 117 are the levels to watch. Up is 140 - 146, down 90 - 82

3D : Trend is clearly Up. Waiting for a retest of the grey zone on low volume and a reversal to the upside.

Thanks for reading!

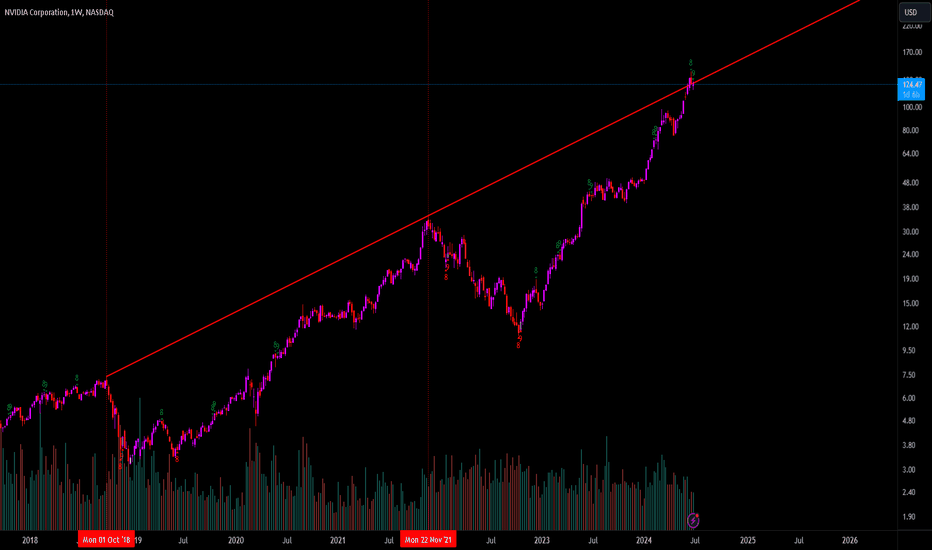

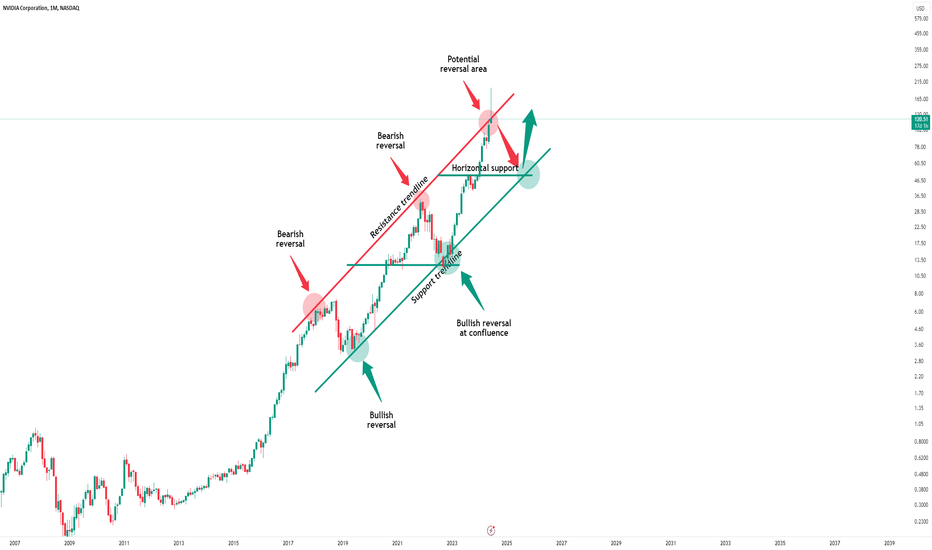

NVIDIA Fake Breakout of 2018 and 2021 - BearishNVIDIA at an interesting spot, had a fake breakout which is usually a pretty bearish sign. Curious to see if this trendline can hold. Hard to fade this beast but this would be a good spot, it's been going parabolic so if it breaks that it's probably over for NVIDIA, insiders have also been selling massive amounts in the last month. Zoomed in pic below.

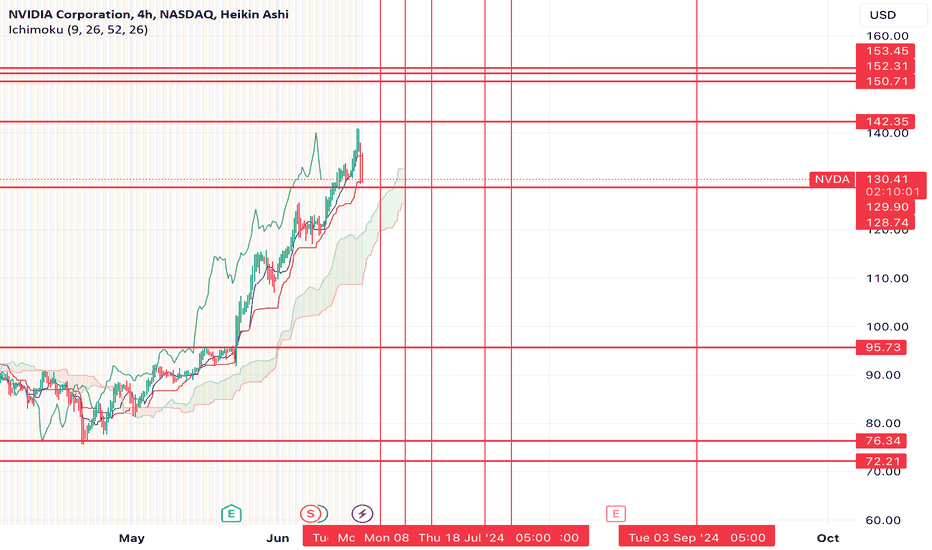

$NVDA range $153 region to $70sUpdate on the short idea:

Levels on the downside the same, timing was off.

Originally thought we'd top at $117.6. We ended up rejecting the resistance at $115.6 and going down to $107 and have since broken to new highs.

Now the chart has become much clearer with the recent price action.

Think we'll likely see another push higher tomorrow or early next week up into the $142-153ish region. Then after that, I think we'll retest the lows down in the low $70 region as price has largely just gone higher since the end of April and hasn't confirmed any support levels on the path up.

The major imbalance in the chart will get resolved to the downside. Months of gains will be wiped out quickly.

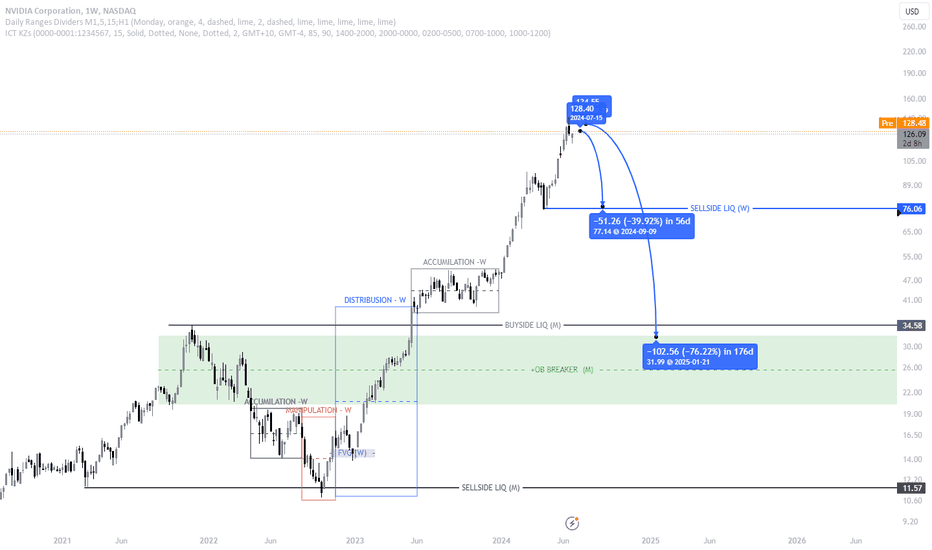

Nvidia Corporation (NVDA) Price Analysis: BEARISHHey everyone, welcome back to Insider Trader! Today, I'm analyzing Nvidia (NVDA) using ICT concepts. After a recent distribution phase, I'm expecting a bearish reversal. The price has hit an optimal trade entry at $128.40, and I’m looking at two downside targets: $77.14 by September 9, 2024, and $31.99 by January 21, 2025. Key levels include a sellside liquidity at $76.06 and a bullish order block around $34.58, which might provide support. Keep an eye on these targets and adjust your trades accordingly. If you found this helpful, like, share, and subscribe for more insights. Happy trading!

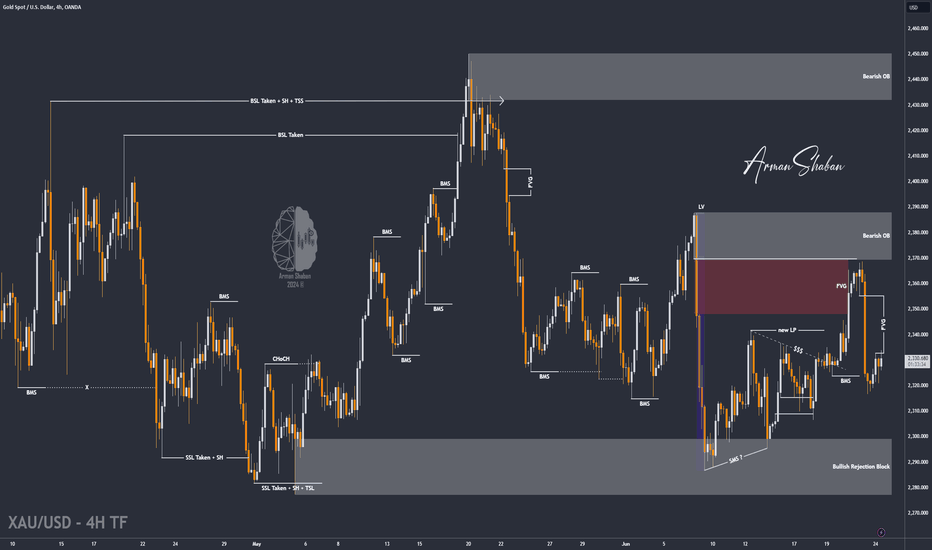

Gold Price Surge: Reaching Targets and Aiming Higher Above $2333By re-analyzing the gold chart on the 4-hour time frame, we can see that, as expected, gold started to rise and hit the targets of $2329 and $2332. Now, gold is trading around $2331, and we need to wait for a price consolidation above $2333 to confirm further growth. The next targets for #gold are $2337, $2344, $2348, $2352, and $2356.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Nvidia Subdivides Lower from Recently ATHPrice is now in the target box for our circle a wave and I am watching for the potential of a reversal higher in our circle b wave. To continue to leak lower could bolster the case for ALT purple wave 4 as price appears somewhat short term oversold. My primary is a circle b wave corrective retrace. Because of the sheer bullish of the long term chart, only a move below $104-$106 would signal a major top may have been struck.

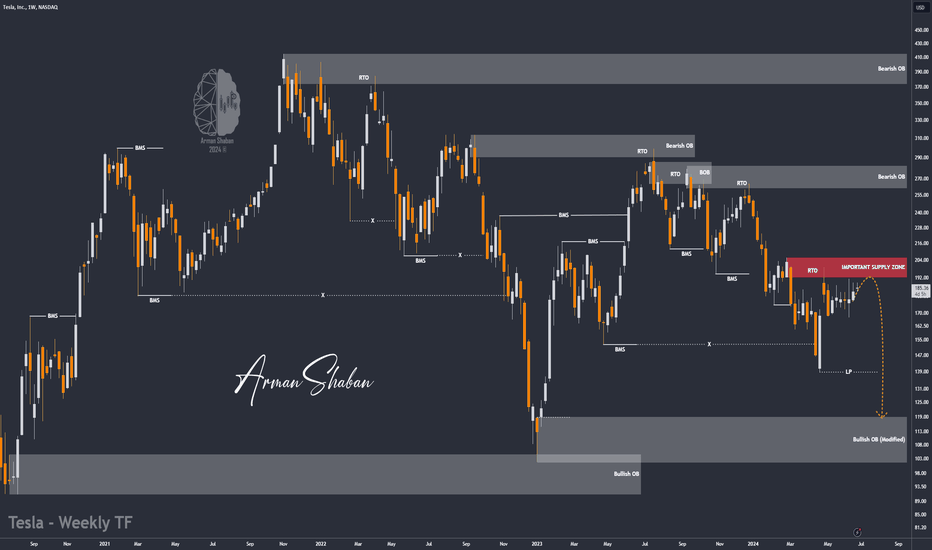

TSLA : Big Resistance Ahead ? (READ THE CAPTION)By analyzing the #Tesla stock chart, we can see that the price has once again reached the supply zone at $185 and has been unsuccessful in breaking through the resistance. For this reason, our previous analysis remains valid. We need to see when this decline will finally start! The supply zone is between $191 and $206, and the bearish targets for this stock are $168, $153, and $139 respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Why Nvidia’s Monster $3T Valuation Poses a Threat to S&P 500Too fast Nvidia climbed the ladder of success and now the broad-based S&P 500 is at risk of getting sucked into a crisis if the chip giant were to trigger it.

Nvidia Value Takes Up 7% of S&P 500

Is Nvidia (ticker: NVDA ), the massive chip company, too big to fail? Shares of the juggernaut in the AI space have soared more than 160% this year and they show no signs of slowing down. That’s all great news for traders who enjoy the daily volatility and love watching billions of dollars slosh around as markets try to figure out Nvidia’s worth.

What markets have agreed on so far is that Nvidia is worth more than $3.2 trillion. The lofty price tag, however, comes with certain dangers. One such danger is that Nvidia makes up about 7% of the S&P 500. The broad-based Wall Street darling, packaged with 500 public companies , is valued at $46 trillion.

The danger isn’t too obvious now for obvious reasons. Nvidia is yet to give back (if it ever does, right?) some of its formidable gains. But there are signs already. Last Friday, this ratio of 93:7 tipped the S&P 500 into a loss just because the hulking size of Nvidia was too much weight on the stock index.

And because the markets aren’t allowing any breathing room and shares are always on fire, we can’t know the impact a crash in Nvidia could have on the S&P 500. But since the pendulum swings both ways, it pays to be prepared.

The Big Three’s Massive Weight

The tech-focused concentration of the S&P 500 doesn’t end with Nvidia. The two other companies that are also worth over $3 trillion each have the same weight on the equity benchmark.

Add Apple (ticker: AAPL ) and Microsoft (ticker: MSFT ) next to the AI chip maker and you’ve got a nice 21% chunk of the S&P 500 concentrated in three companies. In other words, that’s more than $10 trillion of valuation in total and it dominates the large-cap rankings .

What’s the common ground between all three? AI, more or less, with Apple playing catch up pretty fast.

“Why not pick on Apple then, if it’s the same market value?” Apple brings home more than $380 billion in revenue a year while Nvidia can only do $60 billion . Moreover, the iPhone maker has 2.5 times Nvidia’s trailing 12-month free cash flow.

Doomsday Scenario

A possible doomsday scenario in the artificial intelligence corner, every permabear will tell you, can trigger a rude awakening for investors and strip those giants off their record high valuations.

They actually had a moment of victory, although a brief one. In April, Nvidia endured its biggest drop since its recognition as the purest AI play out there. Shares erased more than 10% in the span of a few days. But before permabears had a chance to sip at their mezcal espresso martini and call it a day, Nvidia had bolted past the losses and into fresh record territory.

These days, it’s largely the same few stocks pumping and driving the gains across the indexes. That doesn’t sound like much of a diversification — the narrative pushed by passive investors who choose to shove some money into an index and do nothing. If the S&P 500 served as a diversification vehicle in the past, it certainly doesn’t look like it today.

Your Thoughts?

Will we see the AI bubble burst like the dot-com bubble of the 2000s? Or will Nvidia continue lifting the sea of stocks? Leave your thoughts below.

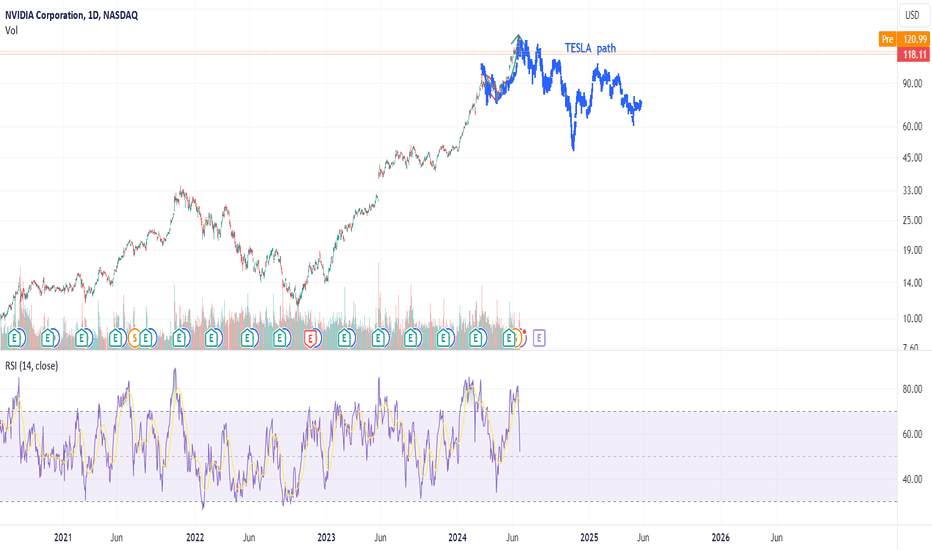

NVIDIA - Correction after stock split?NASDAQ:NVDA has been one on the strongest stocks of the past decade with a rally of +25.000%.

Today, Nvidia had a stock split of 1:10, meaning that for every 1 share of Nvidia, you recieved another 9 shares (10 in total). Therefore, Nvidia stock price was simply divided by 10 ($1.200 / 10 = $120). Nvidia stock is currently retesting a major resistance trendline and is repeating another "cycle pattern" like we saw in 2015 and 2019. A correction is simply quite likely.

Levels to watch: $120, $50

Keep your long term vision,

Philip - BasicTrading

NVIDIA is going to top out, consolidate before taking offThere's only one more meme rally left before CBDC's. I expect Nvidia to meet guidance for earnings, will spike up and then crater.

There's some cheap puts for .20 for 500 strike price for July. Will probably be 450 after it's all said and done when it bottoms out. Which is a 2,250x return if the stock did crater! Couldn't rule out a flash crash. I think if we wait till next week to buy the puts it'll be cheaper, maybe .15 which is a 3,000x.

They will definitely soar when the FED ends up cutting rates after the BOJ sells treasuries and BRICS unveil their currency.

If Trump wins our country will convert back to a gold standard. If Biden wins they will try to usher in a CBDC. Better own some food, land, ammo and precious metals comrade if you do decide to vote against "Mean Tweets"...

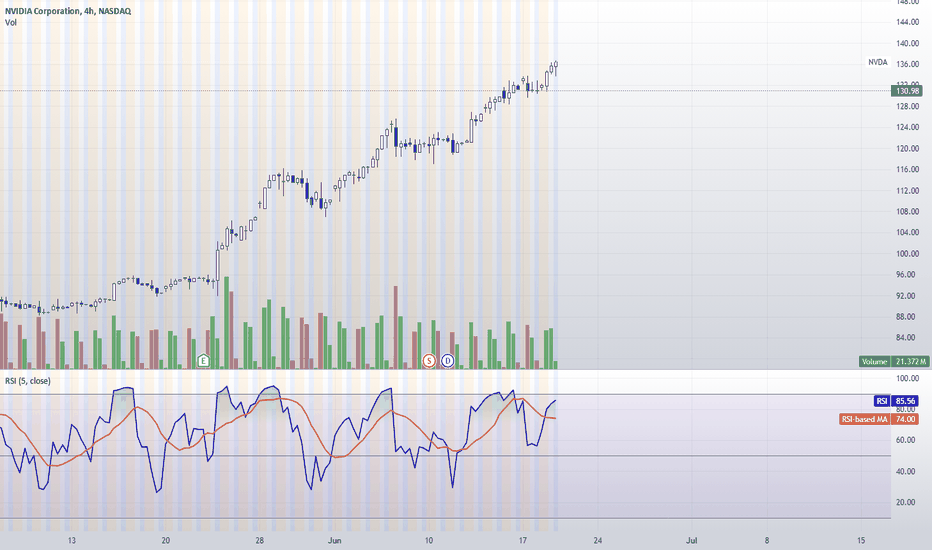

$NVDA & $GME Day Trading Strategy With Algorithm Indicator NASDAQ:NVDA We day trade two stocks: Nvidia and $GME. Our strategy is to go long only. We wait for our algorithm to alert us with a large green dot. We have been in a long position with NASDAQ:NVDA since June 11th, and as of today, we exited our position with a nice profit when we received a large red dot.

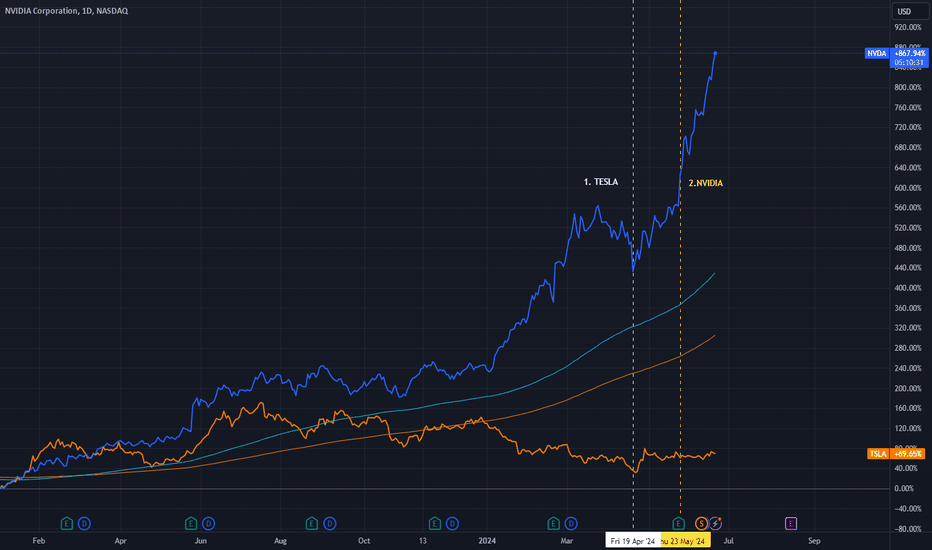

Fundament and vision over hard data ? NASDAQ:NVDA NASDAQ:TSLA

Taking a quick look at the two technological giants, we could say that NVIDIA´s massively beating Tesla in a straight line. Not only Tesla, but the whole market´s badly beaten by this huge company.

NVIDIA earned around 186% YTD . On the other hand Tesla is down around 29% YTD.

DATA

Current biggest company of the world, which NVIDIA has became few days ago, has been reporting amazing data throughout the year. Huge sales, incredible earnings and breathtaking margins !

On the other hand, Tesla´s reported the worst numbers since the meeting held in June 2023. There are many factors that have affected the numbers of these companies. Especially the uncertainty about China, the EV price war in Chinese market and the impact of tariffs imposed by US and EU on EVs. Moreover AI boom and demand for chips helped NVIDIA to rise.

RECAP

Tesla reported:

Revenue: $21.3 billion

Net Income: $1.13 billion

EPS: $0.34

Tesla's revenue and net income declined significantly compared to Q1 2023

NVIDIA reported:

Revenue: $26.0 billion

Net Income: $14.88 billion

EPS: $0.61

However there are many questions to be answered. Are Nvidia´s margins sustainable in long-term ? What if demand for chips decreases ? What if long-awaited AI bubble bursts one day ?

I highlighted with vertical lines on the graph reaction of these two stocks after last earnings reported:

1. Tesla stopped his downward plunge and stabilized between 170 and 190.

2. NVIDIA has rocketed upward

Is it all about key numbers ?

In my opinion investors still react wisely on incoming data and many of them rely on it. However other factors can move the price such as fundament, management and CEOs and their visions.

It´s the vision of Elon Musk that keeps Tesla at its current valuations. He tries to persuade stakeholders and potential investors that company is more than EV maker. He talks about software company aiming wider like building artificial intelligence, robo taxi and AI for all of us and around us.

It´s nothing new, Tesla´s basically built entirely on Elon´s vision. So far it´s paying off. Until when ? Don´t take me wrong. I´m a fan of Elon´s visions and hopefully they manage to make it true. It seems to be long run, BUT THAT´S INVESTING !

NVIDIA seems to have less persuasive vision and investors rely more on key financial numbers and definitely some of them just have jumped on trend leading by AI boom.

Who will be a winner in long-term ? We could only guess. However proofs speak clear, NVIDIA is one and only winner in battlefield.

What´s your strategy in long-term investing ? Are you "fundamental guy" , "vision guy" or "data guy " ? Or do you look at it as a whole thing ?

Let us know, feel free to share your opinion in comments

Let´s talk about it

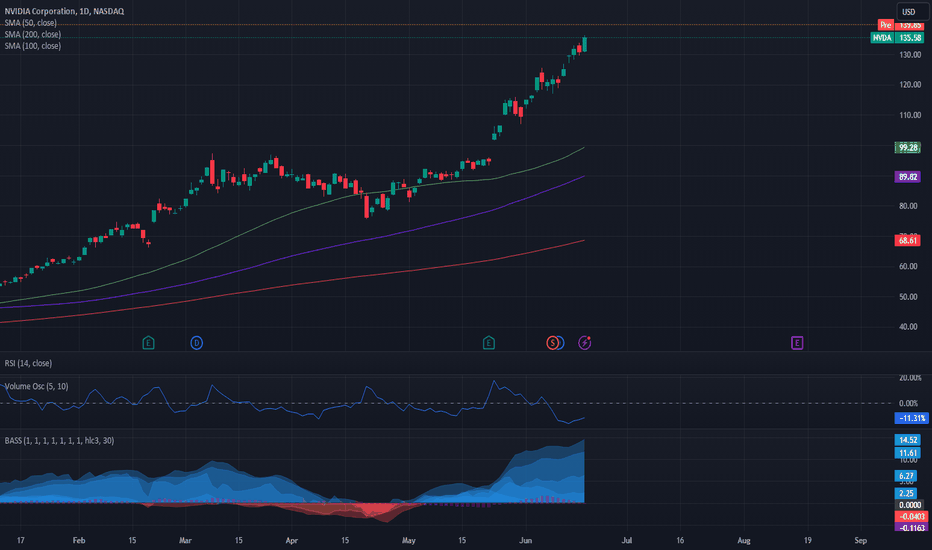

Nvidia - How high is too high?Nvidia (NVDA) continues to defy gravity, hitting $140 in pre-market trading today.

This translates to:

A 23% increase in June alone

A 55% increase in Q2

A staggering 184% increase since the beginning of the year

A 225% year-to-date (YTD) surge

These are the kinds of figures we've come to expect from Nvidia, making even impressive YTD gains of 27% by companies like Microsoft look pedestrian. Nvidia's rise has also propelled it to the top of the market cap rankings, becoming the world's most valuable publicly traded company.

The Question of Sustainability

The burning question is, can this growth be sustained?

So far, Nvidia has the numbers to back it up. The company has already generated more EBITDA this year than in all of FY2023. While its Price/Earnings Growth (PEG) ratio of 1.55 suggests a slight overvaluation, and has been increasing steadily for a year, it remains below the PEG ratios of multi-trillion-dollar peers like Microsoft and Apple.

Technical Indicators Flashing Green

The technical indicators also paint a bullish picture. The stock is well above its short-, mid-, and long-term moving averages, indicating strong momentum. The recent surge in volume further confirms heightened investor interest.

The Bias and Sentiment Strength (BASS) Indicator, a composite tool created by @mattzab combining several technical indicators, also flashes a strong buy signal for Nvidia. (For a detailed explanation, see this page: ).

The Road Ahead: Smooth Sailing or Bumpy Ride?

The big question is whether we'll see a soft landing, a minor pullback, or a significant dip. This will depend on how many investors decide to take profits and the speed at which they do so. A rapid sell-off would likely be triggered by a sudden collapse in the "AI hype" or if companies find themselves unable to effectively utilize their new AI chips, or their efforts to capitalize on LLMs fail.

It's still early days in the AI boom, but parallels have already been drawn with the dot-com bubble which many investors are old enough to remember. It took Apple more than 5 years after the crash to reach its dot-com peak, and Microsoft needed more than 14 years. While there is no looking back for these stocks now, one shouldn't forget that Cisco, which was regarded as a crucial internet infrastructure provider at the turn of the century, never reached its dotcom peak again. But then again, past market crashes do not guarantee future losses, or how did the saying go again?

For now, the status quo remains: everyone is bullish as long as everyone else is bullish as well.

As always, stay vigilant out there!

BTC vs NVDA Fractal 📈📉Hi Traders, Investors and Speculators of Charts📈

Fractals are a helpful way to identify how markets have previously moved. When identifying a similar pattern, it can be useful to speculate future potential price action.

In my previous updates, I've mentioned the two scenarios that I foresee for BTC after reaching a new ATH. The one was a correction, and the other was range trading until after the halving. Find the previous Bitcoin post here:

When we compare BTC to how Nvidia has been moving, we see a very similar corrective pattern play out, followed by a steep increase. Then, after a period of sideways/range trading on NVDA, the price continues to even higher highs as it increases parabolically. Could we possible see something similar on Bitcoin? I think it's worth keeping an eye on this fractal and expect some boring price action for a while on BTC.

If you found this content helpful, please remember to hit like and subscribe and never miss a moment in the markets.

_______________________

📢Follow us here on TradingView for daily updates📢

👍Hit like & Follow 👍

CryptoCheck

NASDAQ:NVDA MEXC:BTCUSDT

NVIDIA 176% YTD GAINS 2024 NASDAQ:NVDA 🚀 NVIDIA’s Stellar Ascent: A 176% YTD Surge! 🚀

In the high-stakes world of tech stocks, NVIDIA has emerged as the year’s undisputed champion, boasting a jaw-dropping 176% increase in its stock price year-to-date. Here’s a snapshot of why NVIDIA is the talk of Wall Street:

Market Cap Milestone: NVIDIA has not only skyrocketed in stock value but also achieved a monumental market cap of $3.335 trillion, surpassing tech giants like Microsoft to become the most valued company in the world.

Stock Split Magic: The company’s recent 10-for-1 stock split has made its shares more accessible to a broader range of investors, fueling the fire of its already impressive rally.

Generative AI Gold Rush: NVIDIA sits at the forefront of the generative AI revolution, with its GPUs being the powerhouse behind the scenes. This sector is projected to reach a staggering $967.6 billion by 2032, and NVIDIA’s leading-edge technology is poised to reap the benefits.

ETF Rebalance: A leading tech ETF has shifted its balance, significantly increasing its stake in NVIDIA. This strategic move involves a massive $23 billion stake exchange, highlighting the confidence investors have in NVIDIA’s future.

Wall Street’s Vote of Confidence: Analysts are bullish, with predictions that NVIDIA’s stock could soar to $200. The consensus is clear: NVIDIA is expected to dominate the computing market for the next decade.

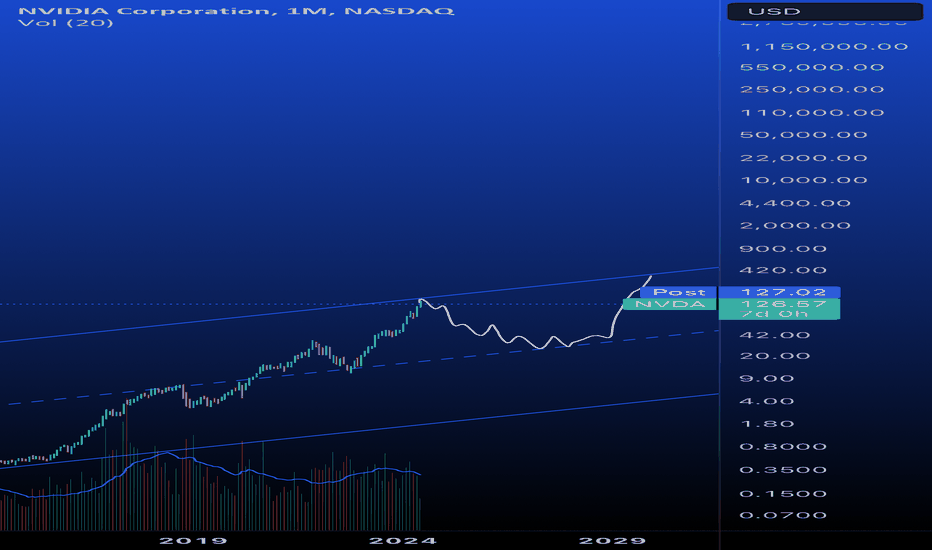

Part3: ''The Best Buy of the Decade?'' The Journey Continues... 🚀⭐ NVIDIA - The Best Buy of the Decade? The Journey Continues... 🌟📈

Part 1 and 2:

NVIDIA's incredible journey from my initial post on July 15, 2021 , proclaiming it the "Best Buy of the Decade," has exceeded all expectations. Two years later, in June 2023, we revisited this bold claim , and today, we witness NVIDIA's valuation approaching the $143.85 target, reinforcing the strong uptrend.

Oh..Have i mentioned that NVIDIA has now become the most valuable publicly traded company in the world, surpassing Microsoft with a market valuation over $3 trillion.

Supporting News:

Is NVIDIA (NVDA) a Buy After Its Recent Stock Split?

NVIDIA Overtakes Microsoft as Most Valuable Stock in the World

NVIDIA's Valuation Surges, Becoming the World's Most Valuable Company

Chart Insights:

12-Hour Heikin Ashi Candlestick Chart

Clear uptrend with a parabolic growth pattern

Target Price: $143.85 approaching swiftly

Industry Leadership:

NVIDIA's strategic moves, including stock splits and dominance in AI, gaming, and semiconductor industries, have positioned it as a market leader. CEO Jensen Huang's vision for the future continues to inspire confidence in NVIDIA's long-term growth. According to a recent article on TheStreet, Huang outlined a massive future for NVIDIA, emphasizing the company's pioneering role in AI and computing innovation.

Conclusion:

NVIDIA's journey is a testament to its robust business model and market leadership. From my initial forecast to today's historic milestone as the world's most valuable company, NVIDIA has proven to be a formidable player in the tech industry.

One Love,

The FXPROFESSOR 💙

ps. AI stocks at ATHs... AI crypto should follow