Nvidia (NVDA) Share Price Growth SlowsNvidia (NVDA) Share Price Growth Slows

Equity markets are on the rise:

→ The S&P 500 index (US SPX 500 mini on FXOpen) has reached a new all-time high;

→ The Nikkei 225 (Japan 225 on FXOpen) hit a fresh record high yesterday;

→ Gains are also seen across other assets — for example, Ethereum has climbed to its highest level since November 2021.

The CNN Fear & Greed Index indicates market “greed”, but it is worth noting that one of the market leaders, Nvidia (NVDA), is not matching the broader bullish momentum.

Technical Analysis of Nvidia (NVDA)

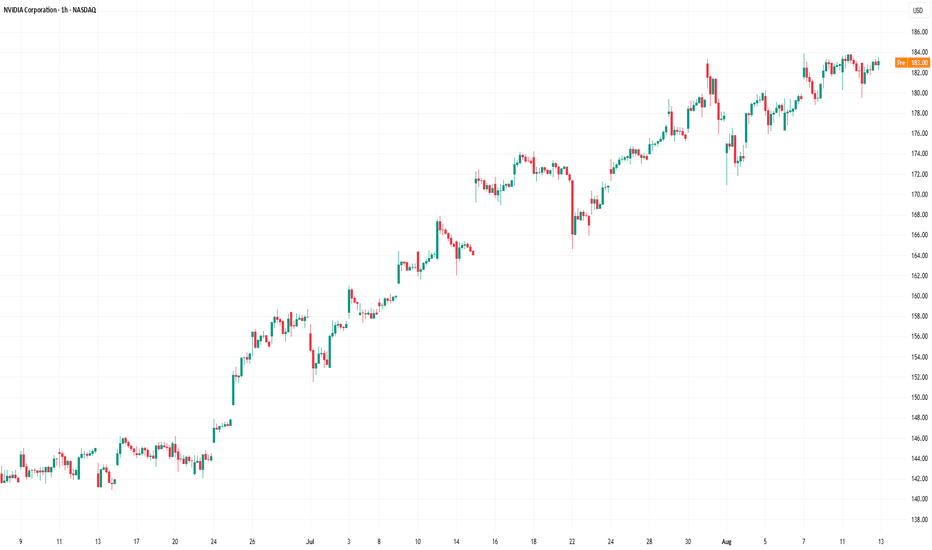

Although NVDA’s share price remains within a long-term ascending channel (shown in blue), holders have valid reasons for concern.

The NVDA chart shows that price growth is capped by the $183 resistance level, with a series of bearish signals emerging (as indicated by the arrows):

→ Following a bullish gap in late July, the price failed to sustain its highs and quickly retreated, erasing the upbeat sentiment;

→ A bearish engulfing pattern on 7 August suggests that the median line of the ascending channel is acting as resistance;

→ The RSI indicator peaked on 29 July, but subsequent price increases have not been accompanied by higher RSI highs — a sign of bearish divergence.

As a result, NVDA price is consolidating within a narrowing triangle:

→ On the one hand, higher lows indicate that buyers are still supporting the price;

→ On the other hand, the $183 level continues to cap the advance of this market leader despite the broader bullish environment.

Bulls need to show determination soon to break through the key $183 resistance; otherwise, the ascending channel in place since early July risks being breached. In that scenario, the August low near $172 could be retested.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nvidiatrade

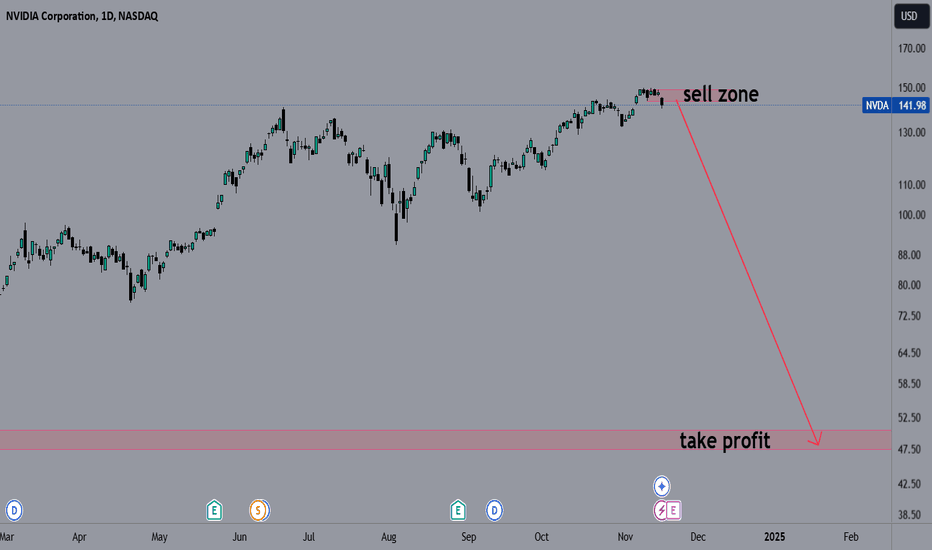

NVDA - Weekly Fall PotentialNASDAQ:NVDA ’s stock has been on a meteoric rise, fueled by the growing demand for AI technology and high-performance computing solutions. However, recent market behavior and technical analysis suggest that a significant pullback may be imminent. The company’s recent 10-for-1 stock split has made shares more accessible to retail investors, but it has also introduced increased volatility. The market has responded positively to the split, but the momentum might be slowing down.

Looking at the NVIDIA chart in a logarithmic scale, we observe three major bullish legs, each with gains exceeding 1000%. The current, third leg appears to be reaching its peak. This trend is further supported by the stock’s position within a rising channel, currently touching the upper boundary, indicating potential resistance. Additionally, lower time frame charts reveal a reversal pattern, suggesting a potential downturn.

Technical indicators show that NVIDIA’s price is at a critical juncture. The stock has demonstrated a reversal pattern in the lower time frames, which is often a precursor to a decline. Moreover, the price is at the top of a rising channel, which typically acts as a resistance level. Given these factors, a pullback seems likely, especially considering the stock’s impressive run-up without significant corrections.

In conclusion, while the broader market sentiment remains optimistic with expectations of new highs for NVIDIA, the technical indicators and recent stock behavior suggest a different story. Investors should be cautious and consider the possibility of a pullback. It is crucial to monitor the stock closely and be prepared for potential profit-taking, especially in the context of the recent stock split and the overall market dynamics.

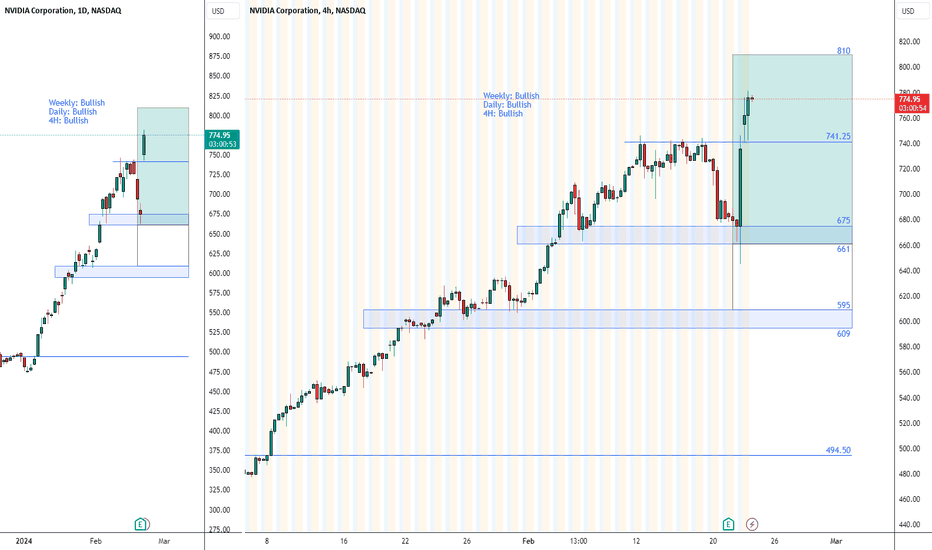

NVIDIA $NVDA - Feb. 22nd, 2024NVIDIA NASDAQ:NVDA - Feb. 22nd, 2024

BUY/LONG ZONE (GREEN): $661 - $810

DO NOT TRADE/DNT ZONE (WHITE): $609 - 661

SELL/SHORT ZONE (RED): Not Shown

Weekly: Bullish

Daily: Bullish

4H: Bullish

Not much to say, earnings and momentum speak for themselves, just thought I'd quickly throw up what I have drawn as support areas for bulls and a profit target. The target shown is roughly a +20% gain from the start of the bullish zone where my entry is it. No short zone is drawn as I do not believe something so strongly bullish should be considered for a short at this time.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!