NVO

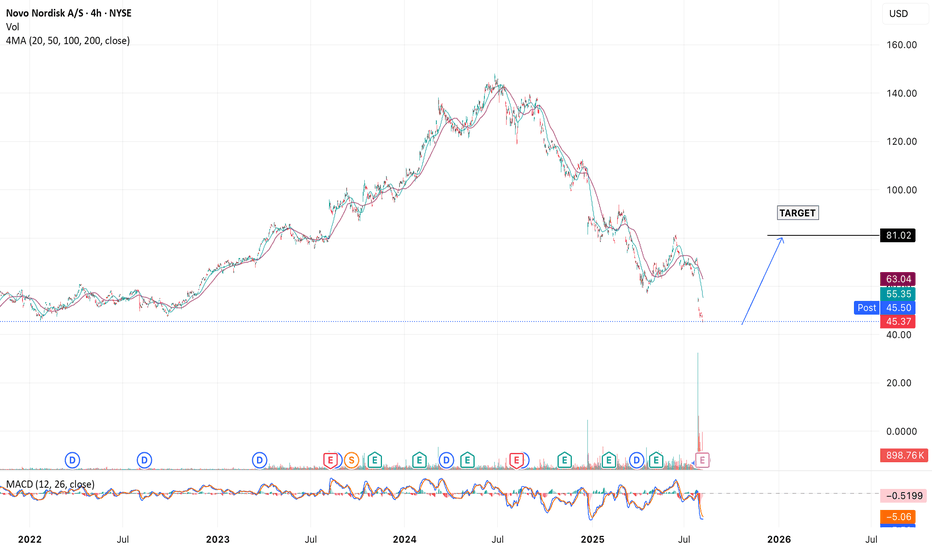

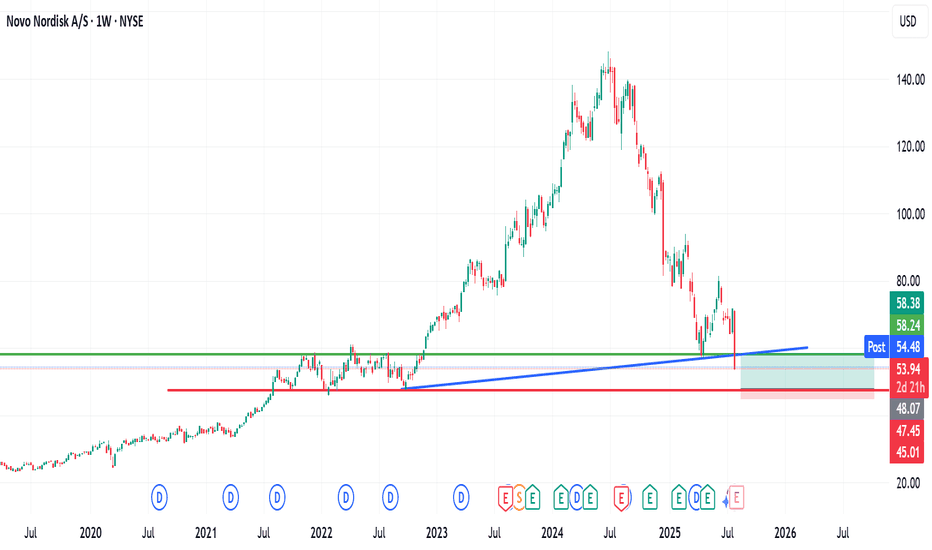

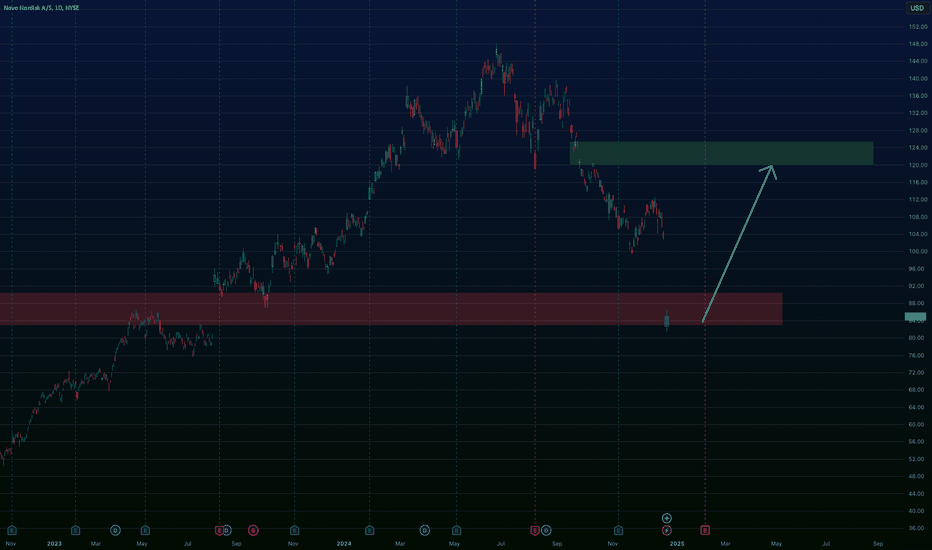

Novo Nordisk (Revised) | NVO | Long at $47.78**This is a revised analysis from February 5, 2025: I am still in that position, but added significantly more below $50**

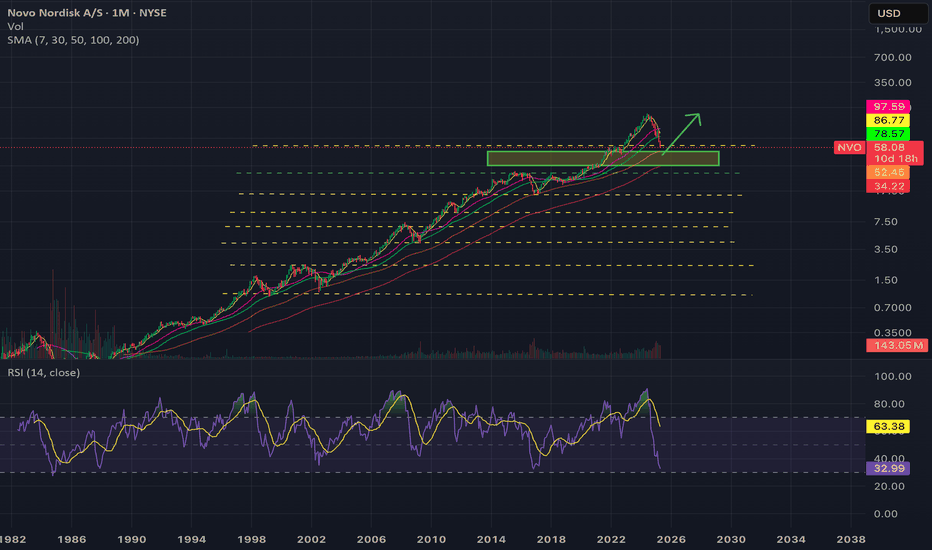

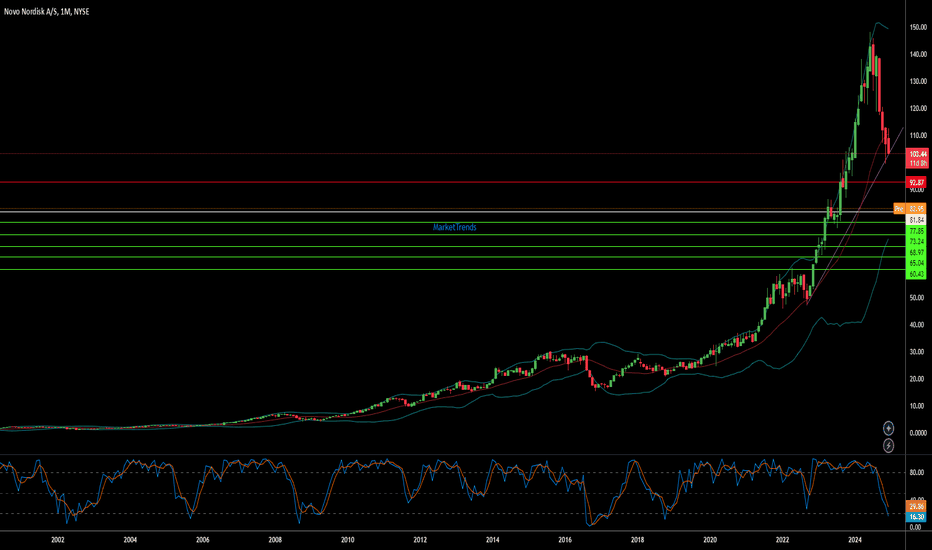

Novo Nordisk NYSE:NVO is now trading at valuations before its release of Wegovy and Ozempic... From a technical analysis perspective, it's within my "major crash" simple moving average zone (gray lines). When a company's stock price enters this region (especially large and healthy companies) I always grab shares - either for a temporary future bounce or a long-term hold. While currently trading near $47 a share, I think worst case scenario here in 2025 is near $38-$39. Tariffs may cause a recession in the second half of 2025, so no company would be immune.

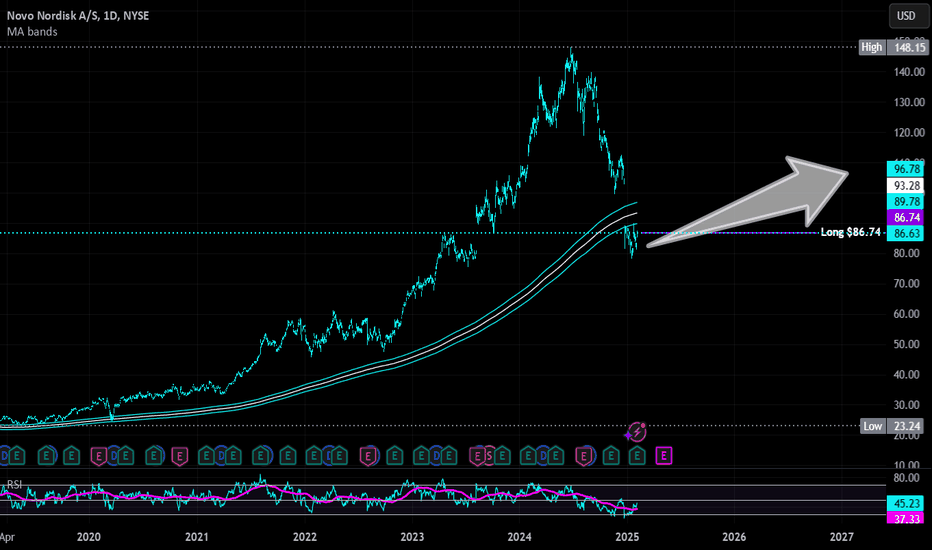

As mentioned above, I am still a holder at $86.74. However, I went in much heavier within my "major crash" simple moving average band and have a final entry planned near $38-$38 (if it drops there). My current cost average is near $55.00.

Why do I still have faith in NYSE:NVO ? Because no one else does right now, yet it generated $42 billion in revenue, $14 billion in profits, and has significant cash flow YoY. The company has a massive pipeline, despite Wegovy and Ozempic competition, and I think the market is undervaluing its position in the pharmaceutical industry.

Revised Targets in 2028:

$60.00 (+25.6%)

$70.00 (+46.5%)

$80.00 (+67.4%)

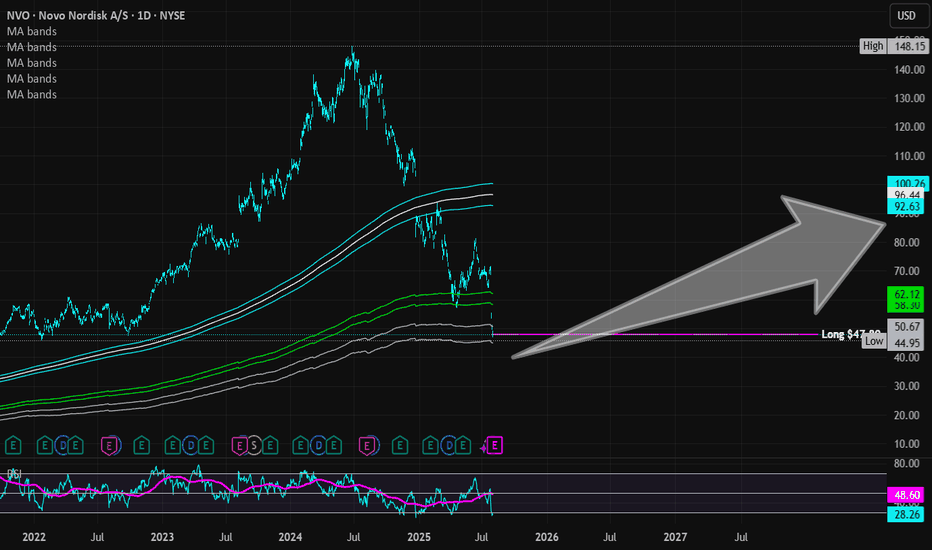

$NVO Accumulating long term compounder! - Previously, I have shorted NYSE:NVO when it was in $75-85 when moat was weakening and then went long around $58 to $75 for 40% on the long side. Everything is documented in my two posts.

- People are asking me if NYSE:NVO is cheap or not. After cutting guidance, I believe most of the estimates for EPS about NYSE:NVO are way off which would be revised downwards.

- At the same time, I believe NYSE:NVO has kitchen sinked their guidance because of new CEO transition which is very common in the publicly traded company.

- NYSE:NVO might not be cheap after cutting guidance honestly but not overvalued either.

- NYSE:NVO could be a dead money for some time 6 months, 1 year or 2 years who knows?

- But I know that weight loss industry in general is growing overall at least till 2030 and beyond.

- Some concerns I have is NYSE:NVO leadership is getting challenged by NYSE:LLY so it could be possible that NYSE:NVO might get lesser piece of the pie. However, overall piece is growing along with it so NYSE:NVO should continue to grow but at a lower rate than earlier.

- Net free cash flow should grow and company might return on investment to shareholders via share buybacks?

- Finally, I am buying NYSE:NVO in increments and have bought first lot of shares in $50.xx and will continue to add more if it drops more. I think NYSE:NVO can test 200 monthly moving average @ $35.

- I have marked the accumulation box in the chart for your reference.

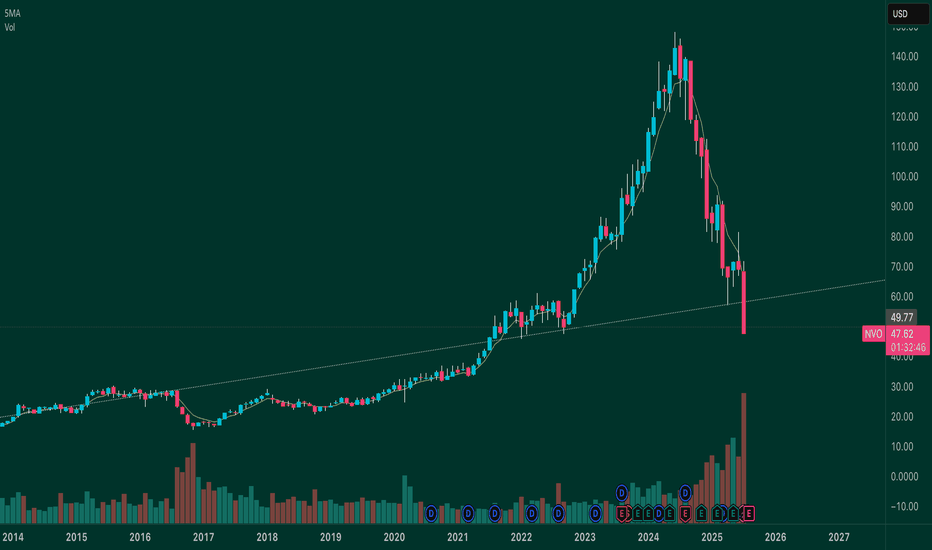

Is Novo Nordisk a buy? Novo Nordisk $NYSE: NVO plummets 22% on July 29, wiping out $57.5B in market value!

Here's what's happening and how I see it.

Here’s the breakdown on why the stock hit its lowest since Nov 2022:

Slashed 2025 Guidance: Sales growth cut to 8–14% from 13–21%, operating profit to 10–16% from 16–24%. Weak U.S. demand for Wegovy & Ozempic, plus competition from cheaper compounded GLP-1 drugs (i.e. grey market), cited as key issues.

CEO Shake-Up: Lars Fruergaard Jørgensen out, Maziar Doustdar in as CEO effective Aug 7. Investors worry Doustdar’s limited U.S. experience could hurt Novo’s edge in its biggest market (57% of sales).

Competition: Eli Lilly’s Zepbound (20.2% weight loss vs. Wegovy’s 13.7%) & Mounjaro are stealing market share. Compounded GLP-1s from Hims & Hers add pricing pressure.

Here's what I see:

There's a strong bearish sentiment, but the stock is very underpriced.

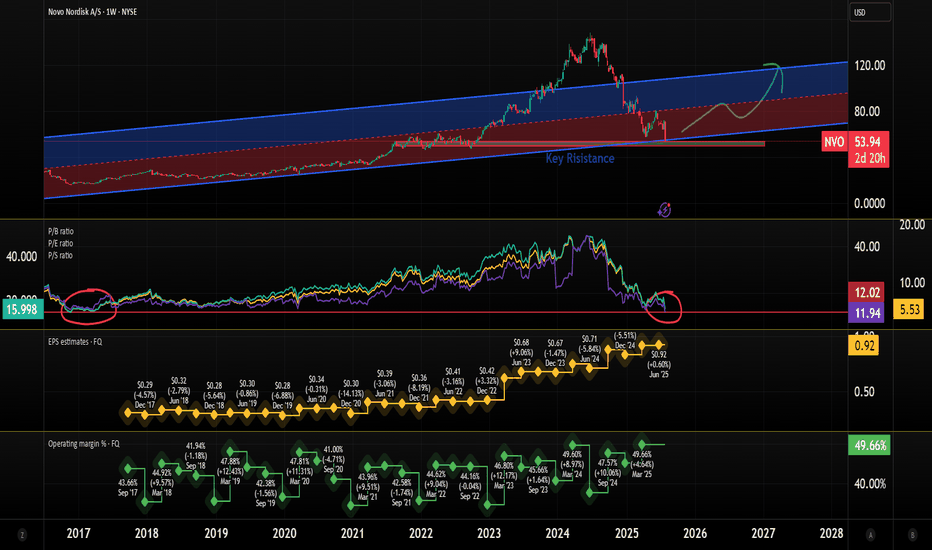

Considering the current stock price, EPS is at an all-time high. This means investors get more earnings for their stock.

P/B, P/E, and P/S ratios are at the lowest level since 2017! This is despite revenue growth of 25%+ for 3 consecutive years.

Operating margins are still quite healthy.

The company still has a very significant share (over 50%) of the GLP1 drugs worldwide.

The valuation of this company is now at the best level of the last 7-8 years.

There might be more volatility ahead, but I see the recent price drop as an opportunity to buy a pharma giant at a big discount, giving investors a margin of safety.

Quick note: I'm just sharing my journey - not financial advice! 😊

Why Did Novo Stock Fall So Sharply YesterdayNovo Nordisk shares plunged nearly 20–23% on July 29, 2025, marking its worst trading day since Black Monday in 1987.

Significant Downgrade of 2025 Financial Outlook

The company revised its sales growth forecast for 2025 down to 8–14%, from its prior guidance of 13–21%, and reduced expected operating profit growth from 16–24% to 10–16%. This adjustment was attributed to weaker-than-expected demand for Wegovy and Ozempic, and rising competitive pressures

#TheWallStreetJournal

I will start my accumulation using DCA, but will be happier to start buying this stock heavily from $47 zone.

trade with care.

I look forward to connecting with you

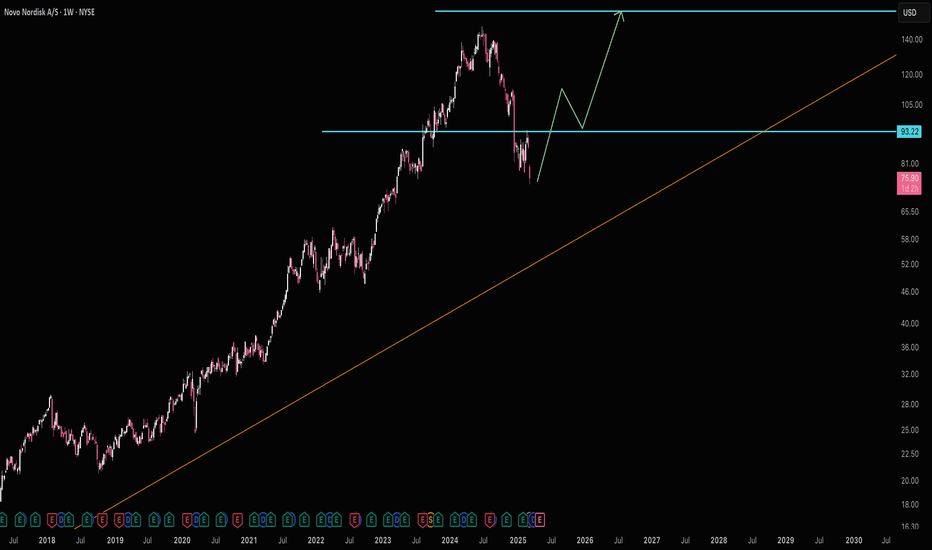

$NVO offers solid risk to reward for long term buyers! - I had previously called out that NYSE:NVO would have more pain to come when it was in $85-90s I have attached the link with this post for my reader's reference.

- Now, I am turning bullish on this name given these prices and compressed multiples for the growth prospects it offers.

Fundamentally,

Year | 2025 | 2026 | 2027 | 2028

EPS | 3.93 | 4.78 | 5.41 | 5.97

EPS growth% | 25.41% | 21.60% | 13.19% | 10.24%

For a quality name growing EPS > 20% deserves a fair forward multiple of 25.

| Year | Bear (fp/e = 15) | Cons. Base (f. p/e = 20) | Base (fpe = 25) | Bull Case (fpe=30)

| 2025 | $58.95 | $78 |. $98.25. |. $117.9

| 2026 | $71.7 | $95 |. $119. |. $143.4

| 2027 | $81.15 | $108 |. $135 | $162.3

| 2028 | $90 | $119 |. $149.25 | $179.1

As you can see, If you buy NYSE:NVO under $60 then you will be making money even if multiple remains compressed i.e bear case. Only thing you have to do is hold and returns would amplify once there is optimism back in the market which will lead to multiple expansion.

My fair value for NYSE:NVO for this year is $78 based on the conservative base case.

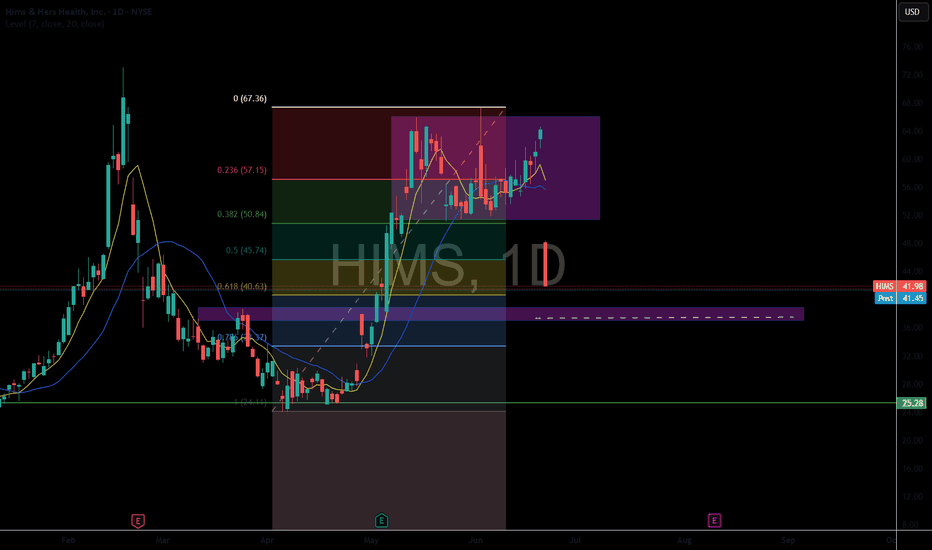

HIMS puked up its Wegovy today!Hims & Hers Health

HIMS

shares were down more than 34.63% in Monday trading, while Novo Nordisk

NVO stock was down over 5% after Novo Nordisk said it has halted its collaboration with Hims & Hers on the sale of weight loss drugs, including Wegovy.

The two companies launched a collaboration in April to bundle Wegovy through Hims & Hers' telehealth platform.

Novo Nordisk said direct access to the drug would no longer be available through Hims & Hers Health because the company "has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of 'personalization' and are disseminating deceptive marketing that put patient safety at risk."

This stock failed to catch a bid despite the equity markets strong.

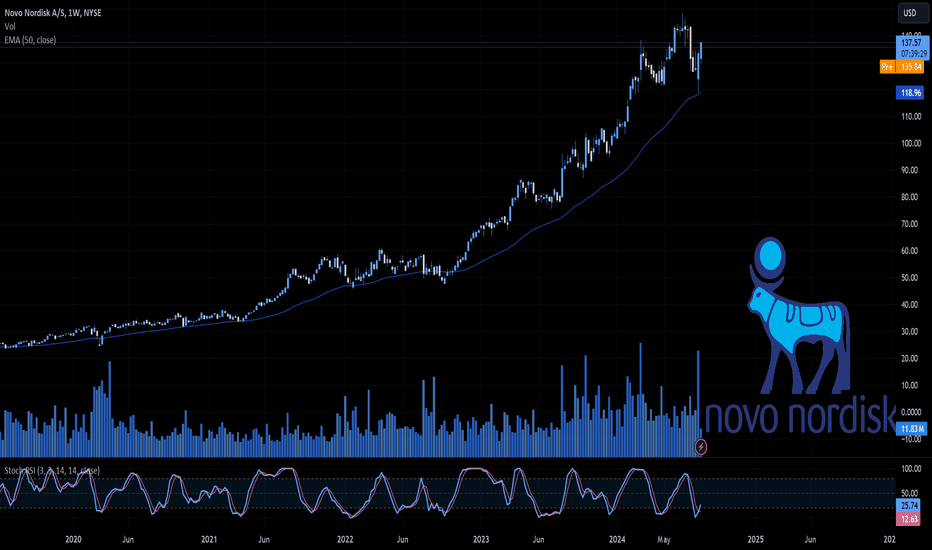

NVO Soaring Towards TargetsOur NVO call debit spreads and LEAPS options soaring towards targets at the 233 EMA here.

Beautiful thing when fundamentals, valuations and technicals align.

Impulse move from the bottom gave us a hat trick - triple green tags (white circles) for bullish A+ momentum signals into a consolidation period in which we built our position and added on the consolidation breakout

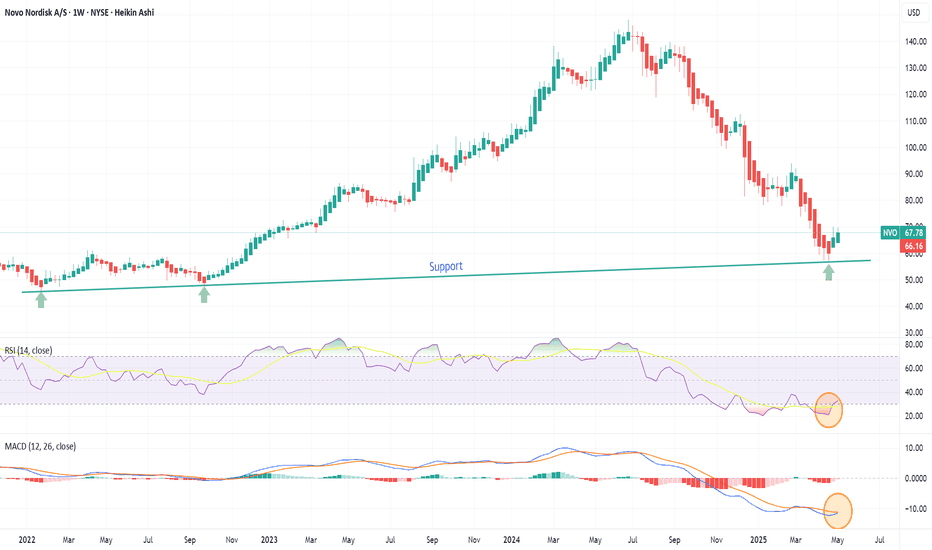

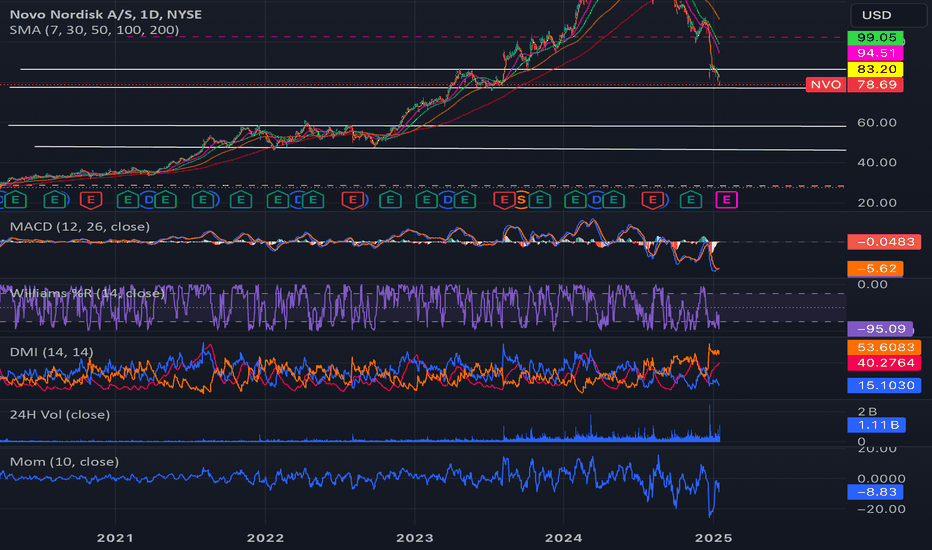

Novo Nordisk (NVO) – Oversold Reversal + Earnings CatalystNovo Nordisk (NVO) has declined 61.13% from its all-time high of $148 (June 2024), finding support at $57.55. Over the past two weeks, the stock has rebounded over 15%, currently trading around $66.30, with strong reversal signals just ahead of earnings.

This setup presents a compelling opportunity, both technically and fundamentally, for a tactical trade or a longer-term position.

Simply Wall St

🔍 Technical Highlights:

✅ Rebound from long-term ascending trendline (~$57–58 zone)

✅ RSI rising from oversold levels (28 → 32 and climbing)

✅ MACD approaching a bullish crossover, indicating momentum shift

✅ Two consecutive green weekly Heikin Ashi candles post-bottom

✅ Defined risk with invalidation below $57 support

📈 Trade Setup:

🟢 Entry Zone: $66–68 (current price range)

🔴 Stop Loss: Below $57.00 (break of structure and breakout base)

MarketWatch

+6

StockAnalysis

+6

Simply Wall St

+6

✅ TP1: $78 – previous support zone

✅ TP2: $90 – February 2025 high before the selloff

✅ TP3: $110 – around December 2024’s local top

🗓️ Earnings – May 7, 2025

🔹 Analysts project ~19.7% YoY revenue growth

🔹 Continued strong demand for Ozempic and Wegovy

🔹 Forward P/E ratio at 16.33, below industry average

🔹 Robust margins and high institutional ownership

🔹 Significant free cash flow and a promising innovation pipeline

StockAnalysis

📌 This appears to be a high-quality oversold bounce with a well-defined risk/reward structure ahead of a significant earnings catalyst. Whether you're considering a swing trade or building a core position, this setup aligns both technical and fundamental factors.

Let’s monitor how this unfolds. 📊🔬

Disclaimer: This is not financial advice – just sharing my perspective. Please conduct your own research before making investment decisions.

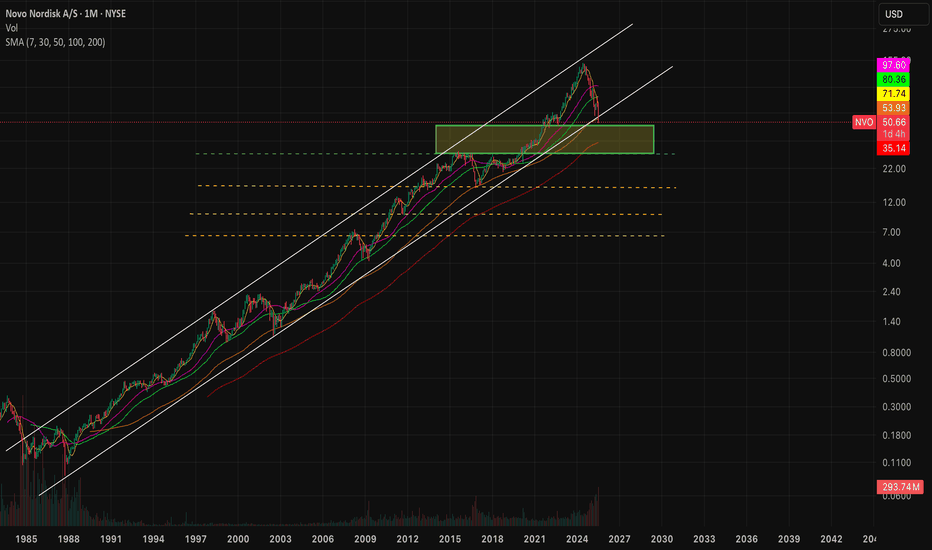

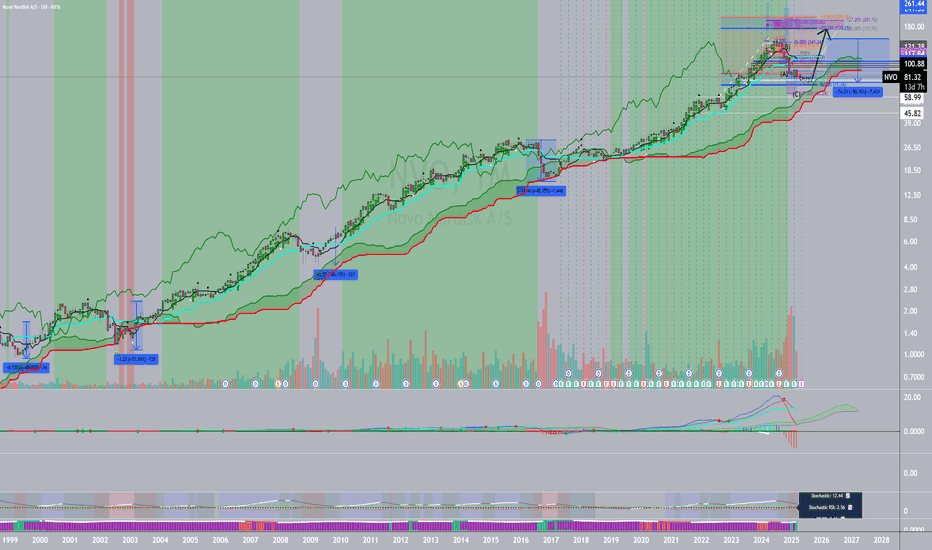

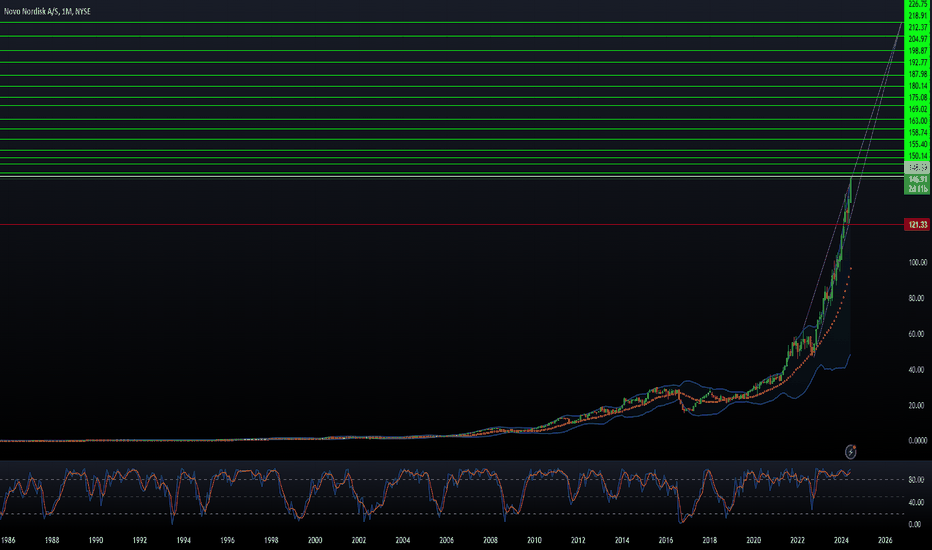

Novo Nordisk: 50% Drops Lead to Amazing GrowthFundamentals :

Take a look at NVO in 1999-2000, 2003, 2008, 2016 and June 20024-2025. Every time it dropped about 50%, that lead to a huge rally for years! NVO has secured contracts with Medicaid for their diabetes and other drugs. It is not going anywhere. It has fallen 50%. We either hold or buy more.

Technicals :

uHd + extreme indicator +u3 volume last month +horizontal support + a-b-c + key fib pb

Projection: 200 to 250 within two years, tentatively.

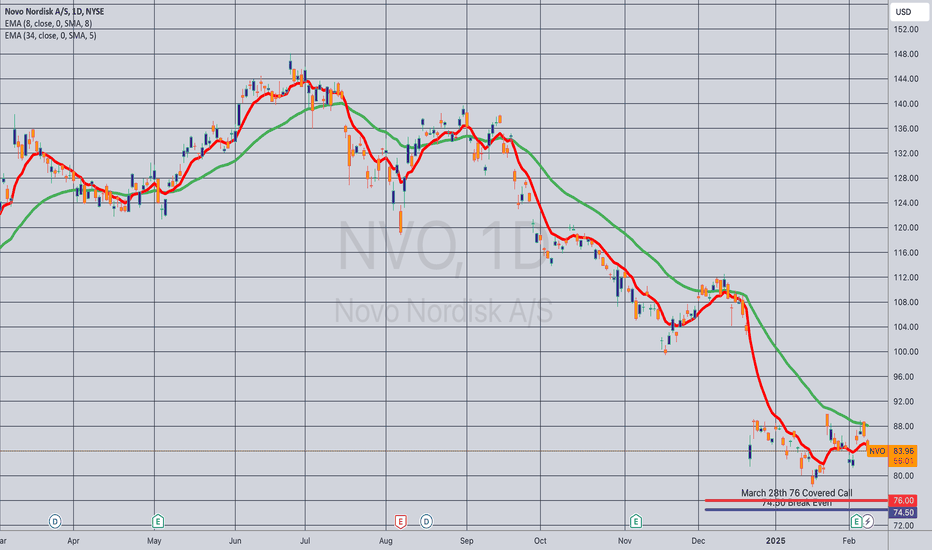

Opening (IRA): NVO March 28th 76 Covered Call... for a 74.50 debit.

Comments: Taking what amounts to a modest directional shot with a break even below the 52-week lows, selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 74.50

Max Profit: 1.50

ROC at Max: 2.01%

50% Max: .75

ROC at 50% Max: 1.00

Will generally look to take profit at 50% max and/or roll out the short call if my take profit isn't hit by expiry.

Buy Opportunity for NVONovo Nordisk A/S – Financial Summary and Outlook (2024):

Sales Growth: Up 23% in Danish kroner (DKK 204.7 billion) and 24% at constant exchange rates (CER).

Operating Profit: Increased by 21% (DKK 91.6 billion).

Net Profit: Rose 18% to DKK 72.8 billion.

Product Highlights:

Wegovy (Obesity): Sales surged 48% in Q3 (DKK 17.3 billion).

Ozempic (Diabetes): Slight sales dip but remains a key contributor.

Challenges:

CagriSema Trial: Missed expected weight-loss targets, leading to stock decline.

Outlook:

Adjusted sales growth forecast: 23%-27%; operating profit: 21%-27% (CER).

Focus remains on high-demand products (Wegovy, Ozempic) and R&D for future growth.

$NVO more pain ahead! Headed down to $46-55 - NYSE:NVO was one of the hottest stocks of 2024 is now facing immense challenges by other healthcare companies in weight loss drug.

- With weak results, it sets up for disappointment for 1-2 quarters. Quick turnaround in experiments isn't feasible and would need considerable time to show promising results.

- It's better to put it on watchlist, attend earning call however it is likely that it might underperform FY 2025 or alteast first half of FY 2025.

Novo Nordisk | NVO | Long at $86.74The Good:

NYSE:NVO expects its GLP-1 drugs Wegovy and Ozempic to soon come off the Food and Drug Administration's official shortage list.

Just reported better-than-expected net profit in Q4 2024, amid soaring demand for its obesity drugs.

Revenues for the Q4 2024 came in at $11.6 billion, up 30% compared to the same quarter in 2023.

From a technical analysis perspective, hovering near my historical simple moving average which may lead to a near-term price increase due to positive earnings

The Bad:

Slower growth in 2025 (16%-24% for 2025 vs 18%-26% in 2024).

Chart has been on a major run since 2020 and may be due for further correction.

Personally, the positives outweigh the negatives given the obesity drug demand. Thus, at $86.74, NYSE:NVO is in a personal buy zone.

Targets:

$96.00

$105.00

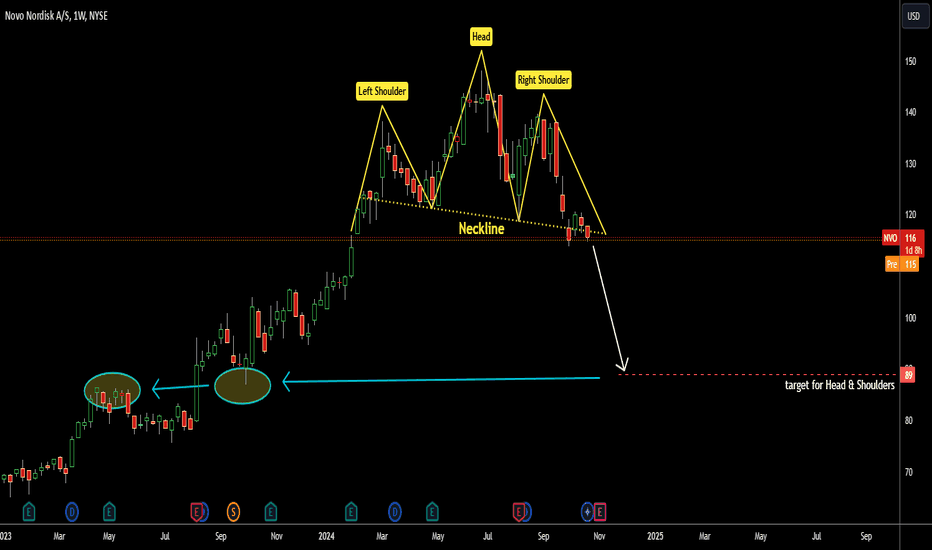

Novo Nordisk (NVO): Beautiful Reversal Pattern is emerging Novo Nordisk price has charted a famous and beautiful reversal pattern - Head & Shoulders.

We have 3 peaks with the middle one the tallest also called Head.

The Right Shoulder inclines down so the magnitude of the bearish move is strong.

The dotted line between valleys of the Head is called a Neckline.

The bearish target for this reversal is located at the distance of Head's height subtracted from the breakdown point on the Neckline.

So, the target is at $89.

This area aligns very well with the bottom of last October and the peak of last May.

Can Market Turbulence Create Future Innovation?In a dramatic turn of events that sent shockwaves through the pharmaceutical industry, Novo Nordisk's recent setback with its experimental obesity drug CagriSema presents a fascinating case study in market resilience and scientific progress. The company's stock plummeted 24% after trial results showed a 22.7% weight reduction efficacy, falling short of the anticipated 25% target. Yet, beneath this apparent disappointment lies a deeper story of pharmaceutical innovation and market adaptation.

The obesity treatment landscape stands at a pivotal crossroads, with the market experiencing exponential growth from its modest beginnings to a staggering $24 billion industry in 2023. Novo Nordisk's journey, alongside competitor Eli Lilly, exemplifies how setbacks often catalyze breakthrough innovations. The CagriSema trial, involving 3,400 participants, represents a clinical study and a testament to the industry's commitment to addressing global health challenges.

Looking ahead, this moment of market recalibration might well be remembered as a turning point in the evolution of obesity treatment. With projections suggesting a potential $200 billion market by the early 2030s, the current turbulence could drive even greater innovation and competition. The fact that only 57% of trial participants reached the highest CagriSema dose points to untapped potential and future opportunities for optimization, suggesting that today's apparent setback might pave the way for tomorrow's breakthroughs.

How To Pick Top Pharma Stocks like a ProAnalyzing the pharmaceutical industry, whose products play a key role in improving the quality of life of people around the world, is quite challenging sometimes also it requires deep knowledge and a careful approach, as I believe that investors should consider many factors, starting with evaluating the efficacy of the analyzed company's medications, including in relation to its competitors and the "gold standards," and ending with an analysis of its financial indicators

In this article you will learn how to pick Top Pharma stocks like a pro trader and which factors you should consider, so buckle up

1/ Recognizing the risks

At the very beginning, an investor you must recognize that the pharmaceutical industry is highly competitive, where a company's investment attractiveness depends not only on the rate of expansion of its portfolio of product candidates, revenue growth, margins, the amount of total debt and cash on the balance sheet but is also heavily influenced by the expiration of patents on medications and vaccines.

Moreover, in recent months, the healthcare sector has increasingly felt the impact of the upcoming 2024 US presidential elections, as some politicians are aiming to further tighten regulation of drug prices despite the existing Inflation Reduction Act.

2/ Leveraging data to your advantage

The second step use data wisely, you should check all kinda data including stock screener, transcripts of earnings calls, financial results for the last quarters, analyst expectations, options data... The goal is to filter companies in poor financial condition, as well as those that trade at a significant premium to the sector and/or competitors

I would also like to point out that in the current market environment, with Fed interest rates remaining at multi year highs, I do not recommend investing in companies with market caps below $500 million, as they typically have limited cash reserves and weaker institutional backing

Also, I'd recommend investors read 10-Ks and 10-Qs, especially the section related to debt and sources of financing of the company's operations, to reduce the likelihood of an "unexpected" drop in the share price. A striking example is Invitae Corporation aka NVTAQ which declared bankruptcy in mid February 2024!

Was there a prerequisite for this? The answer is yes since the company continued to generate negative cash flow and also had convertible senior notes maturing in 2028.

Convertible notes can involve significant financial risks if the company cannot effectively use the cash to grow the business and break even. In this case, management will not be able to pay off the bonds with cash reserves and will have to resort to significant dilution of investors. In my opinion, Pacific Biosciences of California, Inc. NASDAQ:PACB may face this problem because it has convertible senior notes maturing in 2028 and 2030.

Factors that concern me include the company's declining revenue and total cash and short-term investments in recent quarters, while its operating expenses remain extremely high at around $80 million per quarter.

Let's return to the second step in my approach to selecting the most promising assets in the healthcare sector.

When selecting companies with market caps between $4 billion and $40 billion, I use more parameters since most of them already have FDA approved drugs and/or vaccines.

As a result, it is also necessary to consider the rate of growth of operating income, net debt/EBITDA ratio, and how management copes with increased marketing and production costs.

Finally, let's move on to the last basket, which contains pharmaceutical companies with market capitalizations exceeding $40 billion. I think, this group is best suited for more conservative investors looking for assets offering attractive dividend yields and growing net income, supported by a rich portfolio of FDA approved and experimental drugs.

So, from Big Pharma, I like Pfizer Inc NYSE:PFE , AbbVie Inc NYSE:ABBV , Merck & Co NYSE:MRK and AstraZeneca PLC NASDAQ:AZN . I also want to include Novartis AG NYSE:NVS and Roche Holding AG OTC:RHHBY in this group

sometimes investors need to make exceptions, namely if one larger company buys out a smaller player and/or when a major partnership agreement is concluded, as was the case between Merck and Daiichi Sankyo Company, Limited OTC:DSKYF in 2023.

Also, in the event of a major acquisition or merger, the company's debt may temporarily increase sharply. If its management has previously implemented effective R&D and financial policies, the "net debt/EBITDA ratio"

A remarkable example of a company falling into the "value trap" is Takeda Pharmaceutical Company Limited NYSE:TAK , which overpaid for Shire. This deal did not significantly strengthen or rejuvenate the Japanese company's portfolio of drugs.

As a result, it had to sell off billions of dollars in assets to pay off its debt partially. However, despite all the efforts of Takeda's management, its net debt/EBITDA ratio, although it fell below 5x, remains high, namely about 4.7x at the end of March 2024.

3/ Identifying promising therapeutic areas

In general, the more prevalent a disease is, the larger the total addressable market for a drug and, as a result, the higher the chances that it will become a commercially successful product.

Global spending on cancer medications will reach $377 billion by 2027, followed by immunology, and diabetes will come in third with an estimated spending of about $169 billion

What challenges arise when choosing pharmaceutical companies?

you should also keep in mind that the larger the market, the higher the competition between medicines, as companies strive to grab as big a piece of the pie as possible.

As a result, for drug sales to take off, they need to have significant competitive advantages over the "gold standard." These competitive advantages may include greater efficacy in treating a particular disease, less frequent administration, a more favorable safety profile, and a more convenient route of administration.

So, in recent years, competition in the global spinal muscular atrophy treatment market has intensified. Spinal muscular atrophy is a genetic condition. Currently, three drugs have been approved to combat the disorder, including Biogen Inc.'s (BIIB) Spinraza, Roche/PTC Therapeutics, Inc.'s (PTCT) Evrysdi, and Novartis AG's (NVS) gene therapy Zolgensma.

All three products have similar efficacy, but Evrysdi has a more favorable safety profile and is the more convenient route of administration, namely the oral route, which is reflected in its sales growth rate from year to year.

The second pitfall is the company's pipeline of experimental drugs.

I believe that financial market participants opening an investor presentation that presents a company's pipeline, especially if its market cap is below $5 billion, should also pay close attention to what stage of clinical trial activity its experimental drugs are in.

if a pharmaceutical company has most of its product candidates in the early stages of development, this represents a significant risk because, in this case, institutional and retail investors are often overly optimistic about the prospects for the drugs' mechanisms of action and/or clinical data obtained in a small group of patients. Simultaneously, as is often the case, the higher the optimism, the less favorable the risk/reward profile.

In most cases, the larger and more diverse the patient population, the weaker the efficacy of a drug relative to what was seen in Phase 1/2 clinical trials. This ultimately leads to a downward valuation of its likelihood of approval and casts doubt on its ability to take significant market share from approved medications.

This may subsequently reduce the company's investment attractiveness, making it more difficult to attract financing for its operating activities.

As a result, I recommend excluding any company that, instead of focusing its financial resources on the most promising product candidates, conducts multiple early-stage clinical trials to evaluate the efficacy of its experimental drugs.

In my experience, the most successful pharmaceutical companies focus their efforts on bringing up to three product candidates to market and then reinvesting the revenue from their commercialization into developing the rest of the pipeline.

The table below highlights the following parameters that I use to screen out the least promising companies.

A third factor that investors, especially those new to the investment world, should consider is that large pharmaceutical companies are leaders in certain therapeutic areas, with a rich portfolio of patents covering various mechanisms of action and delivery methods of drugs, making it more difficult and more prolonged for smaller players to find product candidates that could potentially have the competitive advantages.

So, Novo Nordisk A/S NYSE:NVO and Eli Lilly and Company NYSE:LLY have long been leaders in the global diabetes and weight loss drugs markets, and only very recently, they may be joined by Amgen Inc. NASDAQ:AMGN , Roche Holding, and several other companies

4/ Assessing a company's drug portfolio in comparison to competitors

Evaluating the effectiveness, safety profile, and mechanism of action of a medication, as well as comparing clinical data with its competitors, takes a lot of time and effort. I provided examples of drugs and the most promising mechanisms of action in the obesity treatment market. Their manufacturers are Eli Lilly, Novo Nordisk, Roche Holding, Viking Therapeutics, Inc, Amgen, Pfizer, Altimmune, Inc, OPKO Health, Inc, Boehringer Ingelheim, and Zealand Pharma A/S

5/ When market exclusivity for a company's key medications ends

Every financial market participant who is considering investing in pharmaceutical companies should consider the expiration time of key patents of medicines.

Marketing exclusivity represents protection against the entry of a generic version and/or biosimilar of a branded drug into the market, thereby allowing the company to recoup the resources spent on its development and, in the event of its commercial success, also reinvest the money received to accelerate the development of the remaining product candidates.

Where can you find information about patent expiration dates?

All the necessary information is either in 20-Fs/10-Ks or on the FDA website, namely in the "Orange Book" section. let's take Eli Lilly as an example. Open the latest 10-K. Then, the CTRL + F combination opens the ability to find specific words in the document. I usually enter "Expiry Date" or "compound patent" to find the patent section.nvestors can also find information about patents on the FDA website.

As an example, I enter "Mounjaro" in the top line, and a list of patents opens that protect Eli Lilly's blockbuster from the introduction of its generic versions onto the market.hen, clicking on "Appl. No." will open information about the submission date of the patent and when it will expire.

6/ Evaluating the impact of insider share transactions

The next step in selecting the most interesting assets in the healthcare sector is to analyze Form-4s. The CEO, CFO, and other key members of the company's management buy or sell shares from time to time.I am only interested in analyzing purchases since, most often, sales by management are option exercises carried out to pay taxes.

When management starts making large outright purchases of a company's shares, it can signal that it believes in its long-term growth potential.if more than two top managers buy a large block of shares within two weeks of each other, it significantly increases the likelihood of the company's stock price rising in the next two months from the moment of their transactions

But as with everything, there are exceptions, such as in the case of OPKO Health, which is developing a long-acting oxyntomodulin analog for the treatment of obesity together with LeaderMed Group.Over the past 12 months, OPKO's management, especially CEO Phillip Frost, has purchased over 12 million shares.

However, despite this, its stock price has fallen by 27% over the same period. I believe that the key reasons for the divergence between these two facts are investors' lack of confidence in Phillip Frost's ability to make the company profitable again, as well as its low cash reserves. Therefore, companies like OPKO Health have already been eliminated at the second step of selection using Seeking Alpha's screener.

7/ CEO Performance in Business Development

The CEO plays a crucial role in the success of a pharmaceutical company since the pharmaceutical industry is highly dynamic, and the competition between Big Pharma is especially high, I advise readers to pay attention to the track record of the CEO, especially how he copes with force majeure situations, as well as how effective the R&D policy is carried out under his leadership.

8/ Identifying Entry and Exit Points for Long-Term Investments

The eighth step is in addition to the information that was obtained in the previous steps, as well as the analysis of financial risks and various financial metrics of the company, including its net debt, maturity dates of bonds, historical revenue growth rates, EBIT, gross margin, I build a DCF model with the ultimate goal of determining the price target.

it is necessary to conduct a technical analysis of them, as well as the main ETFs that include them. In my opinion, the key ETFs are the SPDR® S&P Biotech ETF AMEX:XBI , Fidelity Blue Chip Growth ETF AMEX:FBCG , iShares Biotechnology ETF NASDAQ:IBB , and VanEck Pharmaceutical ETF $PPH. The purpose of technical analysis is to determine the stop-loss level and entry points at which the risk/reward profile is most favorable. taking profit is not that easy cuz you must master your emotions and greed which damn hard

9/ Creating a Watchlist Based on Risk/Reward Ratio

The purpose of which is to create a watchlist of the companies I have selected based on the previous steps. I make several lists of companies based on their market caps and also rank them according to risk/reward profile, that is, in the first place is the stock that I think has minimal risks and at the same time can bring the greatest potential profit.

I also advise creating small notes on each company, which can include information about risks, support/resistance zones, dates of publication of clinical data, and any thoughts you have that will make your decision more conscious when opening a position

“What’s your secret sauce for choosing pharma stocks?”

Novo Nordisk's Wegovy Secures China Approval, Poised for Major MDanish pharmaceutical giant Novo Nordisk gains significant access with the approval of its weight-loss drug Wegovy in China. This move grants Novo Nordisk entry into the world's second-largest economy, targeting a growing population facing obesity challenges.

Key Considerations:

Wegovy targets patients with a Body Mass Index (BMI) of 30 or higher alongside weight-related comorbidities like hypertension and type 2 diabetes.

The approval coincides with the impending expiration of the semaglutide patent in 2026, potentially intensifying competition with generic alternatives.

Novo Nordisk adopts a strategic initial focus on self-pay patients in China, mirroring its approach in other regions for early adoption before broader insurance coverage.

Competition emerges from Eli Lilly's weight-loss product Zepbound and domestic Chinese drug manufacturers.

Wegovy's potential for success in China aligns with the remarkable growth of Novo Nordisk's diabetes drug Ozempic (sharing the same active ingredient), which saw sales double in the region last year.

Novo Nordisk demonstrates a proactive commitment to meeting the global demand for weight-loss solutions through substantial investments in production capacity. Maintaining leadership in this market requires a continued focus on innovation, strategic expansion, and effective market penetration strategies as the semaglutide patent nears expiration.

The approval of Wegovy represents a significant milestone for both Novo Nordisk and China's public health efforts in addressing obesity. While this marks a new chapter in global weight-loss treatment, the competitive landscape promises to intensify. Novo Nordisk's future success hinges on its ability to navigate this evolving market.

Novo Nordisk Stock Slipped 3.3% ThursdayNovo Nordisk ( NYSE:NVO ) stands as a beacon of innovation, continually pushing boundaries in the treatment of diabetes and obesity. However, despite its recent successes, the company finds itself navigating the delicate balance between bullish growth projections and meeting market expectations.

The latest buzz surrounds Novo Nordisk's weight-loss blockbuster, Wegovy, which witnessed a staggering nearly doubling of sales year over year, reaching an impressive $1.34 billion. Yet, the street had anticipated an even stronger performance, setting the bar at $1.49 billion. This slight discrepancy hints at the challenges Novo Nordisk ( NYSE:NVO ) faces in keeping pace with the soaring demand for its revolutionary obesity treatment.

The surge in Wegovy sales underscores the growing need for effective solutions in combating obesity, a global epidemic that continues to plague millions worldwide. Novo Nordisk's commitment to addressing this pressing health issue is evident in its strategic acquisitions and investments, such as the $16.5 billion plan to acquire drug manufacturer Catalent. This move aims to ramp up production of weight-loss and diabetes drugs, including Wegovy and Ozempic, signaling the company's proactive stance in meeting future demands.

Novo Nordisk's Chief Executive, Lars Fruergaard Jorgensen, remains optimistic about the company's trajectory, attributing the robust demand to its innovative treatments. Jorgensen emphasizes, "More patients benefit from our innovative treatments, and the agreement to acquire the three Catalent manufacturing sites will enable us to serve significantly more people living with diabetes and obesity in the future."

While Wegovy and Ozempic continue to drive substantial growth for Novo Nordisk, challenges persist in other areas. Revenue from insulin products experienced a slight downturn, falling approximately 4% to $1.91 billion. However, this dip was offset by strong performances in other segments, with sales of diabetes drugs witnessing a remarkable 74% increase.

Looking ahead, Novo Nordisk ( NYSE:NVO ) remains bullish on its prospects, forecasting sales to climb between 19% to 27% in constant currency for the year. Additionally, the company anticipates a significant jump in operating profit, reflecting its confidence in its robust product pipeline and strategic initiatives.

As Novo Nordisk ( NYSE:NVO ) works through the complexities of market expectations and innovation, it reaffirms its position as a pioneer in the field of diabetes and obesity treatment. With a steadfast commitment to improving patient outcomes and driving sustainable growth, Novo Nordisk continues to chart a course towards a healthier, more resilient future.

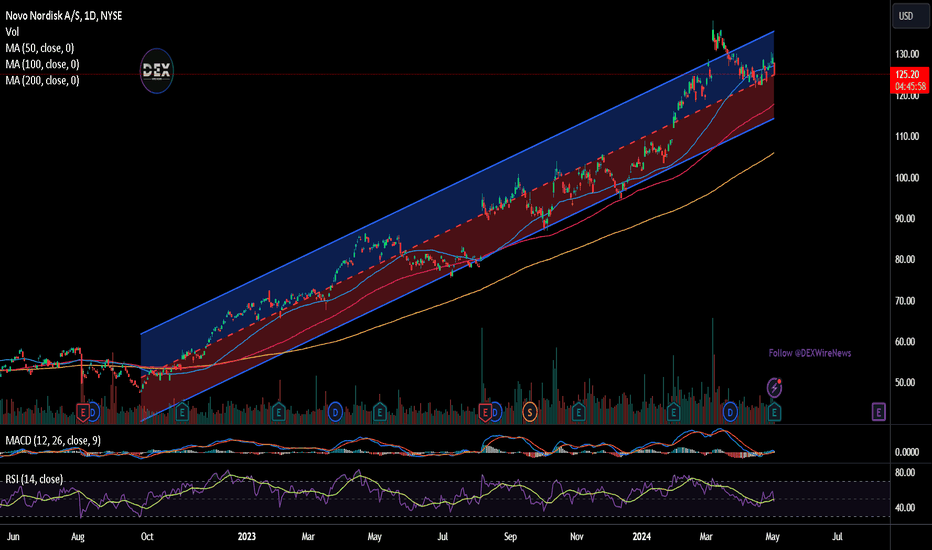

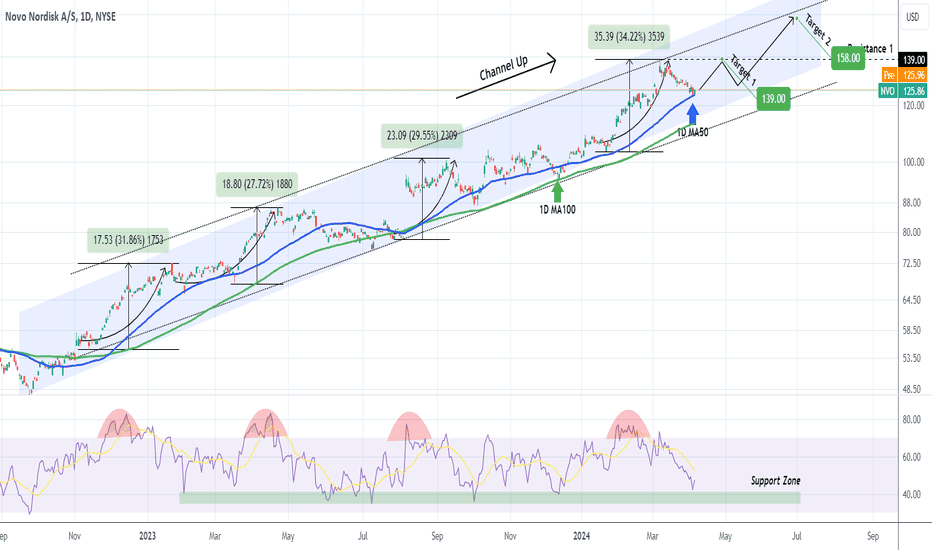

NOVO NORDISK on the 1D MA50 starts looking a buy again.Novo Nordisk (NVO) hit the 1D MA50 (blue trend-line) again for the first time since December 18 2023 and after a long time it gives buy signals again. The correction came after the March 07 rejected at the top of the (dotted) Channel Up, following overbought 1D RSI levels before that for 2 weeks.

That is a pattern consistent with all previous Higher High formation of the Channel UP and then all rebounded after the 1D RSI hit its 1 year Support Zone. The final level to buy, if the price drops that low, would be the 1D MA100 (green trend-line).

Our Targets are first $139.00 (Resistance 1) and finally $158.00 (top of the (dotted) Channel Up).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Novo Nordisk's Leap into the AI Future: With NVIDIA PartnershipIn the ever-evolving landscape of technological innovation, a new wave of AI computers is poised to revolutionize computation as we know it. With processors designed specifically for AI programs, these machines unlock a realm of possibilities for individuals, governments, and scientific organizations alike. At the forefront of this transformative wave is Danish healthcare giant Novo Nordisk ( NYSE:NVO ), spearheading a groundbreaking initiative in collaboration with tech titan NVIDIA.

The convergence of AI and healthcare represents a monumental leap forward in the quest for optimized diagnostics, treatment, and research. Recognizing the pivotal role of AI in reshaping the future of healthcare, Novo Nordisk has embarked on a visionary journey by establishing an AI Innovation Center in Denmark. In partnership with the Export and Investment Fund of Denmark (EIFO) and NVIDIA, Novo Nordisk is set to harness the power of AI to propel research and development in healthcare, life science, and quantum computing to unprecedented heights.

Central to this ambitious endeavor is the Gefion supercomputer, poised to serve as the beating heart of Denmark's AI Innovation Center. Powered by NVIDIA's state-of-the-art H100 Tensor Core GPU, purpose-built for large-scale computing tasks, Gefion is poised to unlock new frontiers in computational prowess. With an initial investment of €80 million from the Novo Nordisk Foundation and an additional €8 million from EIFO, Gefion is slated to be one of the most powerful computers in the world, equipped to tackle complex challenges such as protein structure prediction with unparalleled precision.

The significance of this collaboration extends beyond mere computational power; it represents a paradigm shift in the integration of AI into the fabric of research and development. By leveraging purpose-built AI chips, organizations can transcend the limitations of traditional computing, unlocking new realms of possibility in data analysis, pattern recognition, and workload management. As NVIDIA unveils the groundbreaking Blackwell chip, heralded as the world's most powerful AI chip, the stage is set for a new era of innovation and discovery.

However, the pursuit of AI-driven solutions is not without its challenges. The exponential growth of AI techniques necessitates substantial resources and computational power, placing a premium on investment in AI computing infrastructure and application development. As organizations vie for supremacy in the burgeoning AI landscape, the race to deliver transformative solutions is intensifying, with Novo Nordisk and NVIDIA poised to lead the charge.

As the Gefion supercomputer nears completion and the promise of AI-driven healthcare innovation looms on the horizon, the world watches with bated breath. With each milestone achieved, the boundaries of what is possible in healthcare are pushed ever further, ushering in a new era of possibility, progress, and promise. In the realm of AI-driven healthcare, the future is not just bright—it's transformative.