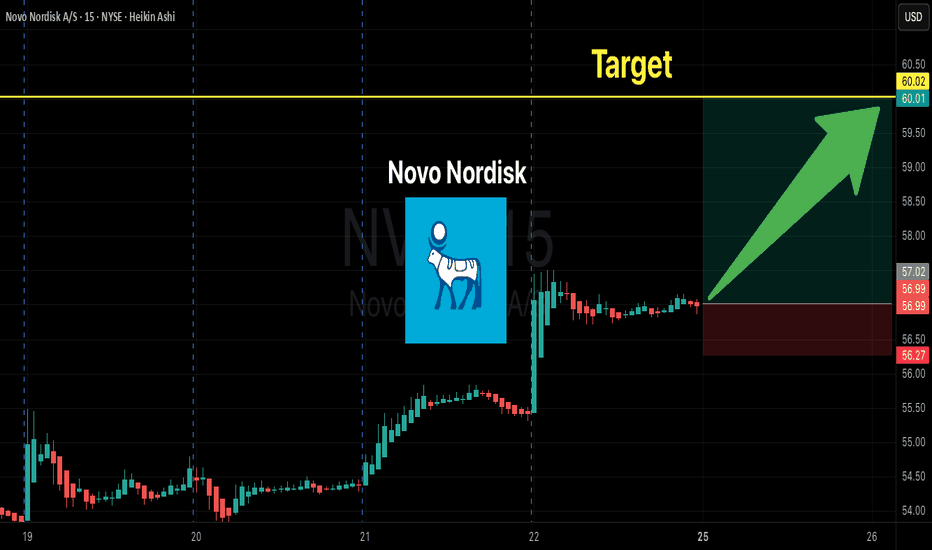

NVO Bulls Load $60 Calls for 100%+ Weekly Gains!

# 🚀 NVO Weekly Options Trade Setup (08/24/2025)

**Consensus:** 🔥 Strong Bullish — All 5 AI models favor weekly calls!

**Market Context:** Low VIX (\~14.2) ✅, Heavy Call Flow (C/P 3.43) 📈, Institutional Volume ↑ 1.3x

---

lish on weekly horizon

* **Strategy:** Single‑leg weekly CALLs

* **Expiry:** 2025‑08‑29 (exit by Thursday to avoid 1 DTE gamma/theta risk)

* **Stop/Target:** Tight stops 40–50%, profit 50–100%

* **Strike Recommendation:** \$60 CALL ✅

* Massive liquidity (Volume: 5,019; OI: 6,348)

* Cheap entry, high leverage, low slippage

* Aligns with Grok/xAI & liquidity preference

---

## ⚡ Trade Details (Ready to Execute)

```json

{

"instrument": "NVO",

"direction": "call",

"strike": 60.0,

"expiry": "2025-08-29",

"confidence": 0.78,

"profit_target": 0.68,

"stop_loss": 0.17,

"size": 1,

"entry_price": 0.34,

"entry_timing": "open",

"signal_publish_time": "2025-08-24 07:58:54 UTC-04:00"

}

```

---

## 📌 Quick-Trade Snapshot

🎯 **Instrument:** NVO

🔀 **Direction:** CALL (LONG)

💵 **Entry Price:** \$0.34

🎯 **Profit Target:** \$0.68 (+100%)

🛑 **Stop Loss:** \$0.17 (-50%)

📅 **Expiry:** 2025-08-29

📏 **Size:** 1 contract

📈 **Confidence:** 78%

⏰ **Entry:** Market Open Monday

🕒 **Signal Time:** 08/24/2025 07:59 EDT

---

## ⚠️ Risks & Notes

* **Theta decay:** Exit by Thursday to avoid gamma/theta crush

* **Binary events:** Check stock news/earnings

* **Low premium = high loss probability:** Risk only what you can afford

* **Stop execution:** Prefer mental + limit sell vs. automated stops

Nvosignals

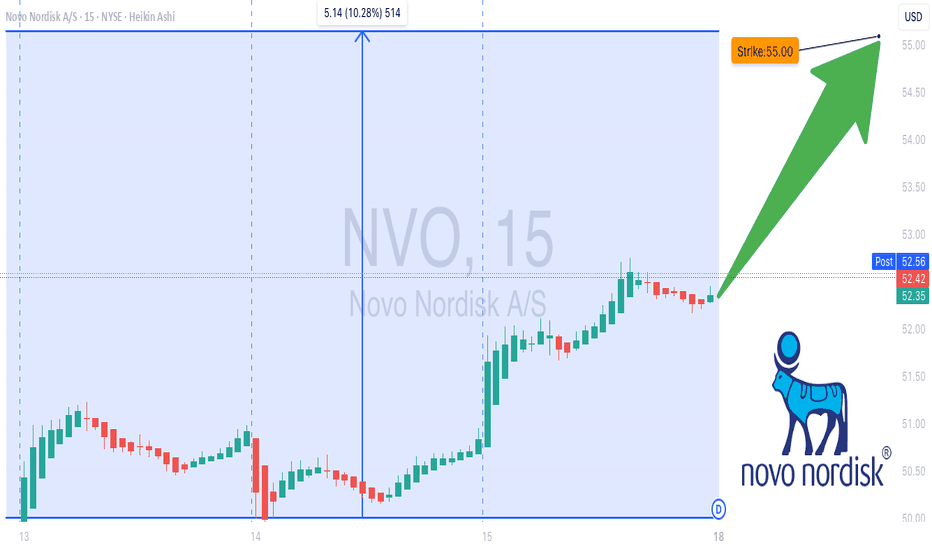

NVO Bullish Swing Incoming! Call Strike $55 🚀 NVO Swing Alert – 2025-08-15 🚀

**Sentiment:** Moderate Bullish

**Setup:** Call Option Trade

---

## 📈 Market Snapshot

* **Daily RSI:** 44.7 → Neutral but trending upward

* **5 & 10-Day Trend:** +2.94% / +9.11% → Short-term bullish momentum

* **Volume:** Avg (1.0x) → Weak breakout confirmation

* **Call/Put Ratio:** 1.00 → Neutral market expectancy

* **VIX:** 14.8 → Low volatility, favorable for directional trades

---

## ⚖️ Consensus & Conflicts

**Agreement:**

* Short-term positive performance suggests bullish potential

* Low VIX environment favorable for swing trading

**Disagreement:**

* Mixed interpretation of Call/Put ratio

* Some models caution due to weak volume and insufficient institutional support

---

## 🎯 Trade Setup – NVO CALL

**Entry Condition:** At market open

**Strike:** \$55.00

**Expiration:** 2025-08-29

**Entry Price:** \$0.91

**Confidence:** 72%

**Profit Targets:**

* Scale 50% at \$1.36 (50% gain)

* Hold remainder until \$1.82 (100% potential gain)

**Stop Loss:** \$0.54 (40% of premium)

**Key Risks:**

* Weak volume may limit momentum

* Breach of \$50 support invalidates bullish setup

---

## 📝 TRADE DETAILS (JSON)

```json

{

"instrument": "NVO",

"direction": "call",

"strike": 55.0,

"expiry": "2025-08-29",

"confidence": 0.72,

"profit_target": 1.36,

"stop_loss": 0.54,

"size": 1,

"entry_price": 0.91,

"entry_timing": "open",

"signal_publish_time": "2025-08-15 13:54:27 UTC-04:00"

}

```

---

## 📊 Quick Reference – TradingView Ready

🎯 **Instrument:** NVO

🔀 **Direction:** CALL (Long)

💵 **Entry Price:** \$0.91

📈 **Profit Target:** \$1.36 / \$1.82

🛑 **Stop Loss:** \$0.54

📅 **Expiry:** 2025-08-29

📏 **Size:** 1 contract

⏰ **Entry Timing:** Market Open

🕒 **Signal Time:** 2025-08-15 13:54 EDT

---

### Suggested Viral Title & Tags:

**🔥 NVO Swing Alert: Call Setup Ready – Strike \$55 🚀**

\#NVO #SwingTrade #OptionsTrading #Bullish #CallOption #Momentum #TradeSetup #TechnicalAnalysis #StockAlerts #Finance #TradingSignals #MarketWatch #LongTrade

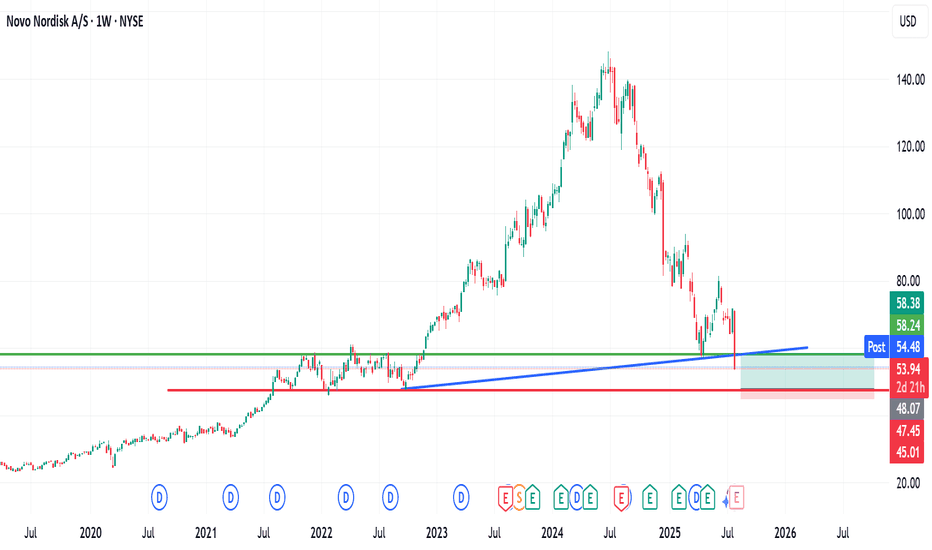

Why Did Novo Stock Fall So Sharply YesterdayNovo Nordisk shares plunged nearly 20–23% on July 29, 2025, marking its worst trading day since Black Monday in 1987.

Significant Downgrade of 2025 Financial Outlook

The company revised its sales growth forecast for 2025 down to 8–14%, from its prior guidance of 13–21%, and reduced expected operating profit growth from 16–24% to 10–16%. This adjustment was attributed to weaker-than-expected demand for Wegovy and Ozempic, and rising competitive pressures

#TheWallStreetJournal

I will start my accumulation using DCA, but will be happier to start buying this stock heavily from $47 zone.

trade with care.

I look forward to connecting with you

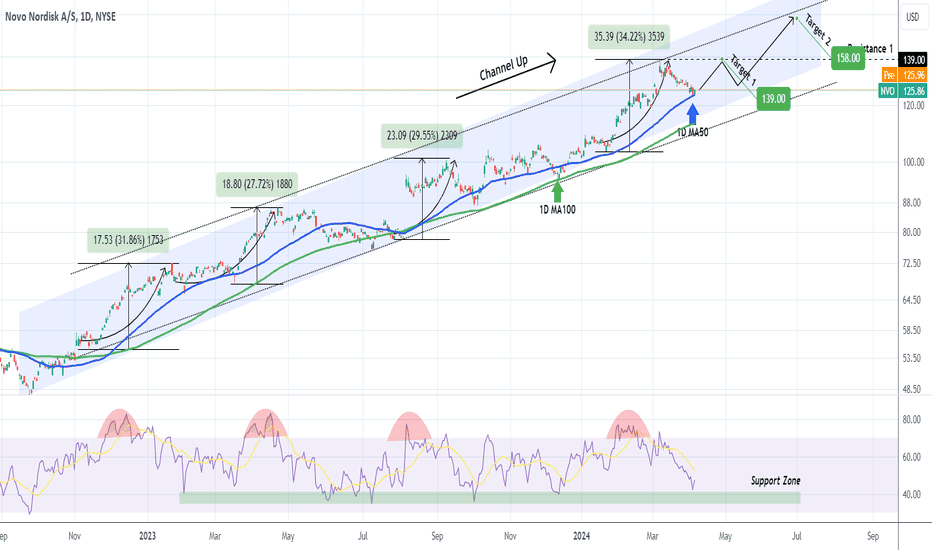

NOVO NORDISK on the 1D MA50 starts looking a buy again.Novo Nordisk (NVO) hit the 1D MA50 (blue trend-line) again for the first time since December 18 2023 and after a long time it gives buy signals again. The correction came after the March 07 rejected at the top of the (dotted) Channel Up, following overbought 1D RSI levels before that for 2 weeks.

That is a pattern consistent with all previous Higher High formation of the Channel UP and then all rebounded after the 1D RSI hit its 1 year Support Zone. The final level to buy, if the price drops that low, would be the 1D MA100 (green trend-line).

Our Targets are first $139.00 (Resistance 1) and finally $158.00 (top of the (dotted) Channel Up).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇