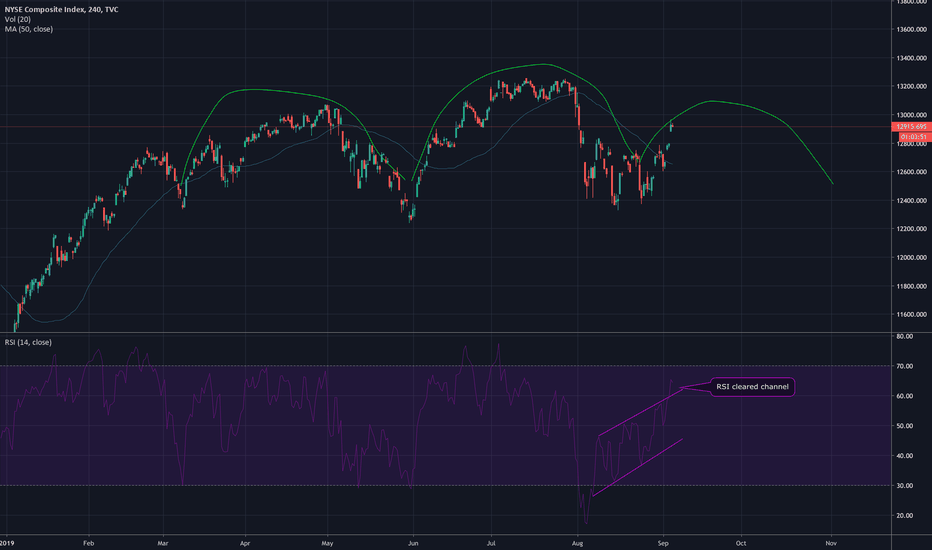

NYA

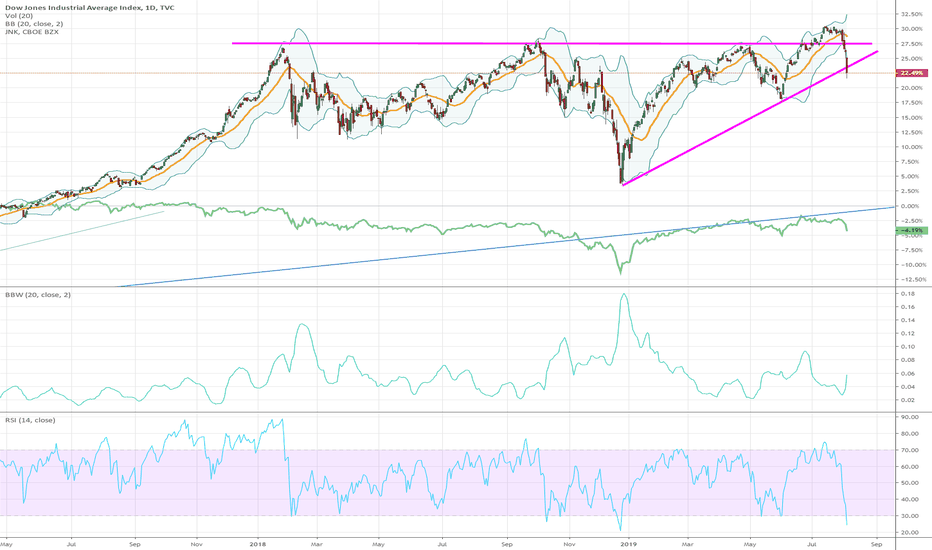

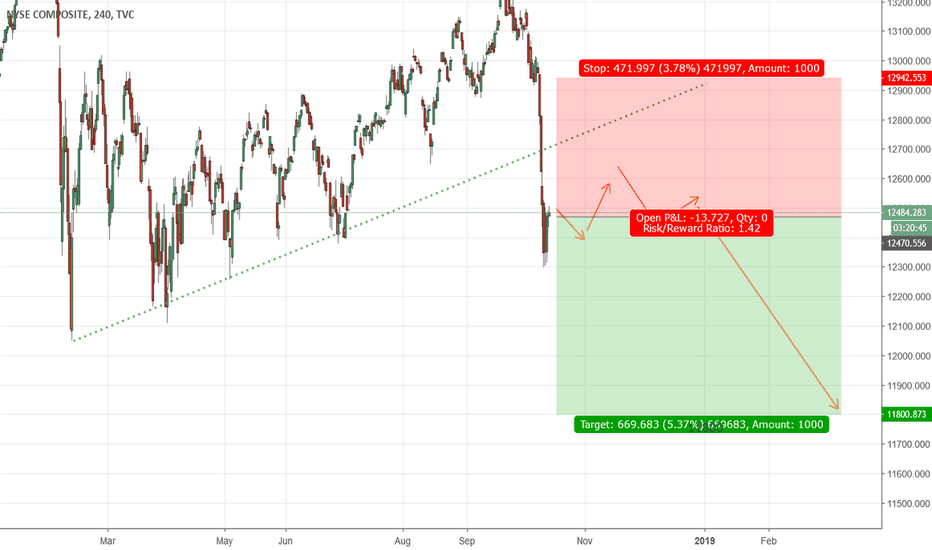

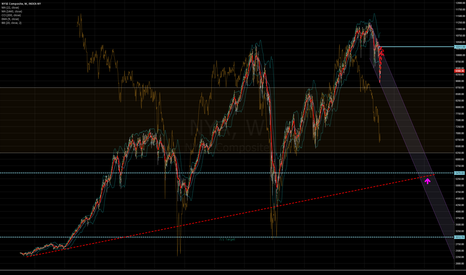

2019 trendline brokenAs with the Dow, Russell, Financials (XLF), the past couple of days have broken below their respective year long trendline support, leaving gaps. Whether markets will retrace off of these oversold conditions or continue their slide is yet to be seen, but the veracity of this downside move should give pause to market bulls. Let the dust settle and see if there are any buyers near new support levels. That said, we haven't had a 3% daily move in a long while so this may seem like the end of the world :) but let's remember that we've come a long way and we're very extended. Doesn't preclude the fact that markets may settle down, consolidate for a while and have a retry at breaking out. In the meantime, failed breakouts usually are not kind to the bulls and are not prone to reversing their course easily in the near term, so stay cautious...

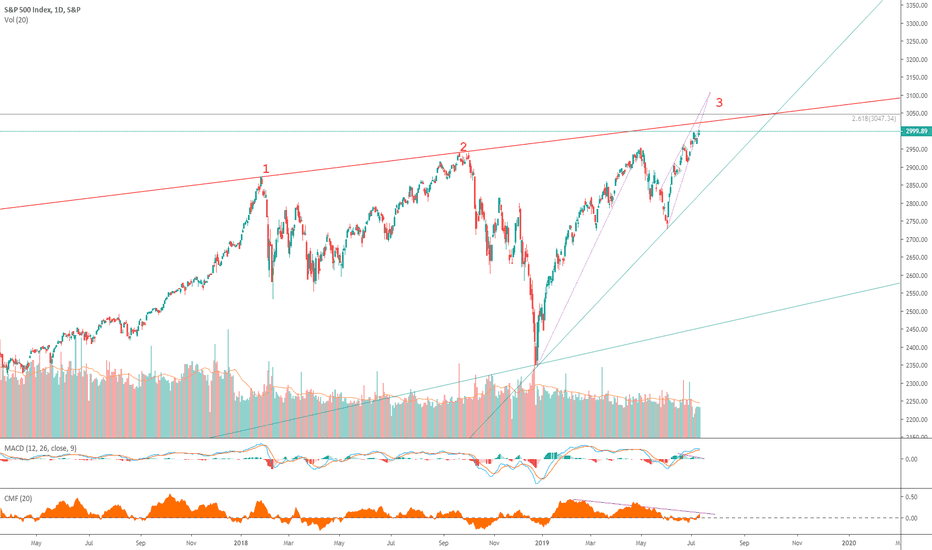

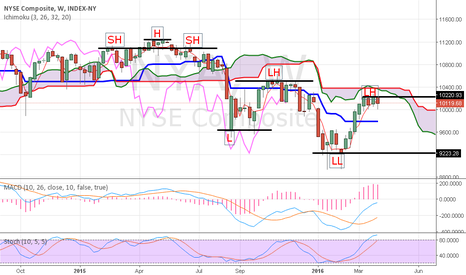

3 Little Indians Pattern + Divergence With Other Indices + More

On a long time frame, we have a “three little Indian” pattern consisting of 3 peaks and 3 rivers. Expect accelerated selling once we return to the 2nd peak high buy institutions

From $3000 - $3047.38 (The 2008 Financial Crisis 2.618 Fib Retracement Level) I expect selling pressure to be heavy.

We have already fallen out of the most recent ascending wedge 2 days ago, in which we retested the previous support and have proceeded to trade down from there:

Divergence on the MACD histogram and the CMF was negative the entire way up.

This market traded up on the idea that bad news is good in hopes of a rate cut, completely ignoring the US and macroeconomic slowdown that has begun. That and trade tensions around the globe. Don't get me wrong, I love Trump, but if you think the Chinese will actually give the US a favorable trade deal you're wrong.

Here is the current weighting of the top 10 companies in the $SPX (as of July 11, 2019):

Rank Company Ticker Weight (%) Price

1 Microsoft Corporation MSFT 4.249644 137.89

2 Apple Inc. AAPL 3.573786 202.46

3 Amazon.com Inc. AMZN 3.356436 2,007.59

4 Facebook Inc. Class A FB 1.959511 200.78

5 Berkshire Hathaway Inc. BRK.B 1.667792 213.36

6 Johnson & Johnson JNJ 1.508331 139.54

7 JPMorgan Chase & Co. JPM 1.474984 114.24

8 Alphabet Inc. Class C GOOG 1.406174 1,142.85

9 Alphabet Inc. Class A GOOGL 1.374452 1,142.67

10 Exxon Mobil Corporation XOM 1.319375 77.43

Total Weight of Top 10: 21.890485%

Weight from 12/31/2014 - 3/31/2019:

Ticker Company Name 3/31/2019 12/31/2018 12/31/2017 12/31/2016 12/31/2015 12/31/2014

MSFT Microsoft Corp. 3.83% 3.73% 2.89% 2.51% 2.48% 2.10%

AAPL Apple Inc. 3.60% 3.38% 3.81% 3.21% 3.28% 3.55%

AMZN Amazon.com Inc. 3.11% 2.93% 2.05% 1.54% 1.45% 0.65%

FB Facebook Inc. 1.68% 1.50% 1.85% 1.40% 1.33% 0.72%

BRK.B Berkshire Hathaway 1.65% 1.89% 1.67% 1.61% 1.38% 1.51%

JNJ Johnson & Johnson 1.58% 1.65% 1.65% 1.63% 1.59% 1.61%

GOOG Alphabet Inc. Class C 1.53% 1.52% 1.39% 1.19% 1.26% 0.85%

GOOGL Alphabet Inc. Class A 1.49% 1.49% 1.38% 1.22% 1.27% 0.84%

XOM Exxon Mobil Corp. 1.45% 1.37% 1.55% 1.94% 1.81% 2.16%

Total: 19.92% 19.46% 18.24% 16.25% 15.85% 13.99%

Data gathered from: www.slickcharts.com & siblisresearch.com

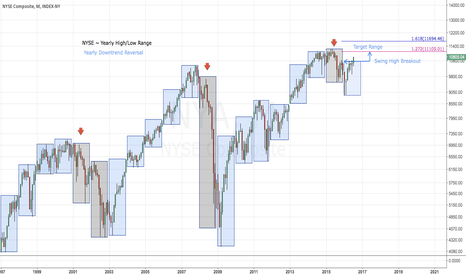

Top put this into prospective here are some charts:

Dow Jones Transports/Dow Jones Industrial Average:

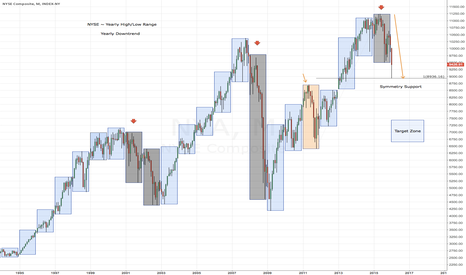

NYSE Composite:

Russell 2000:

WilShire 4500 Index:

No one can truly ever time the very top. It can definitely go higher, but please be careful when buying up here.

Best of Luck

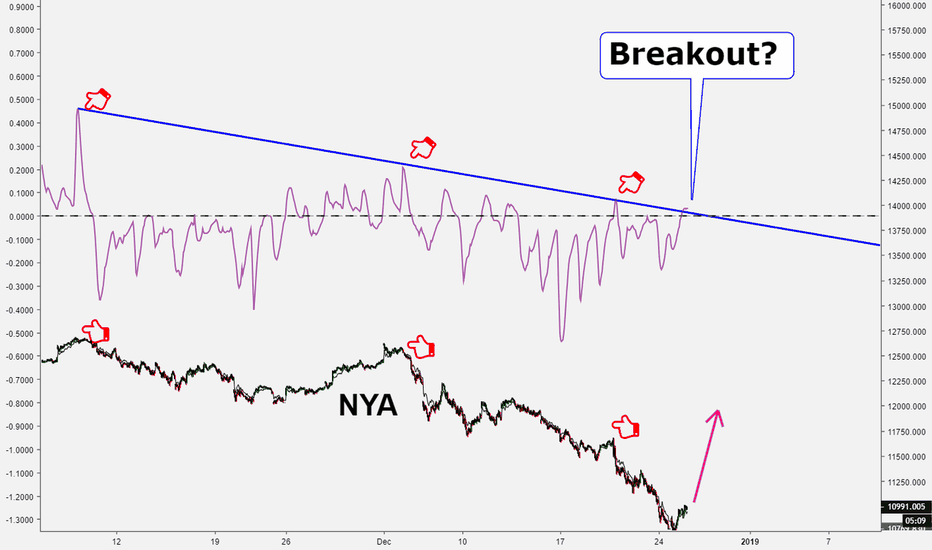

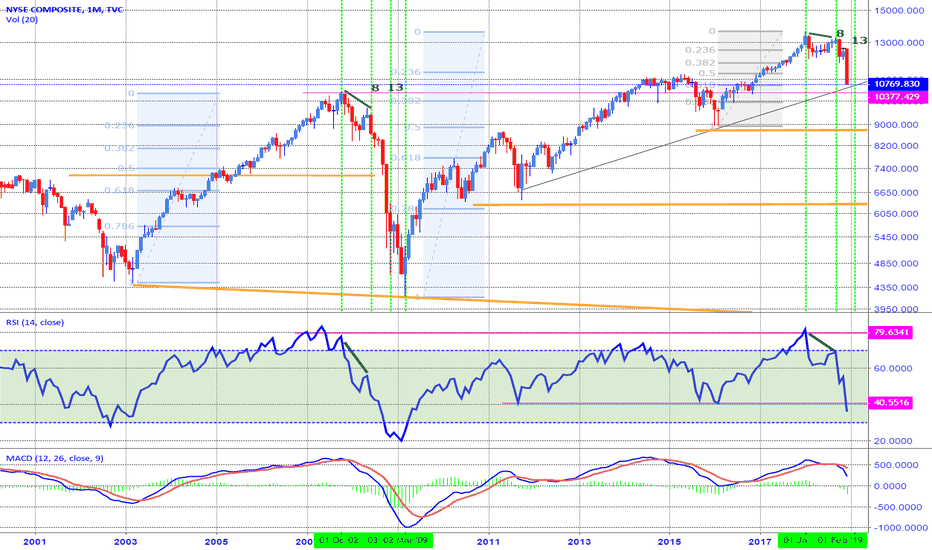

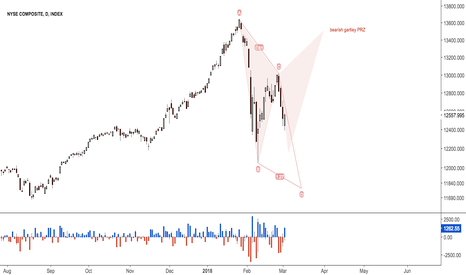

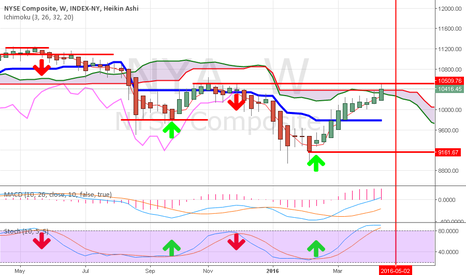

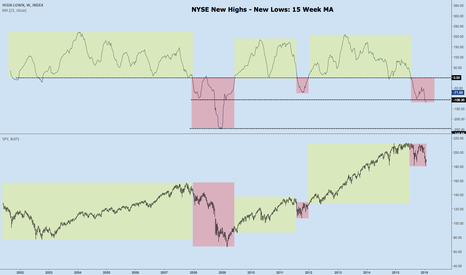

Reset of 9 years of FED pumping ?While everyone was paying attention to the SPX NDX and DJI, the NYA was showing the early divergence. Following a parallel pattern, the 13th month would be FEB 2019, which corresponds to NOV 2008. Almost every indicator I follow confirms a 3rd wave down. A 5 week average of the advance/decline line which I have been doing by hand for decades is even below the 2008-09 low. The all time bullish sentiment by Investors Intelligence had been a little over 5 at the beginning of 1987, with a secondary peak of about 3.5 in August. The reading for JAN 2018 eclipsed the 1987 peak by a small percentage. The secondary reading in SEP 2018 was about 3.2. The smart money last hour index has been going straight down since JAN. The 8 month double top was obviously a huge distribution pattern. Usually, nothing ever repeats in the same manner, but I would sell all violent rallies. After 9 years of zero percent interest rates and corporations using that free money to highly leverage their companies, this reset should be quite ugly.

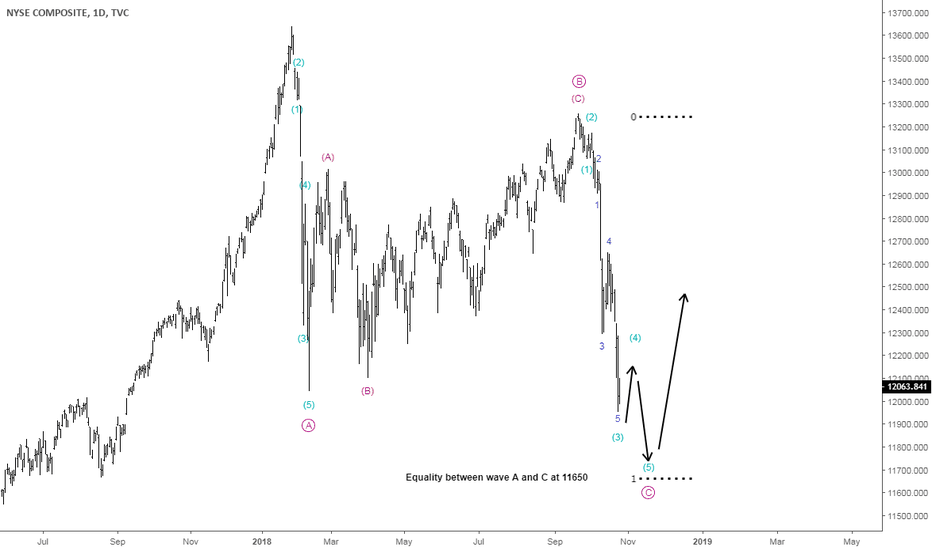

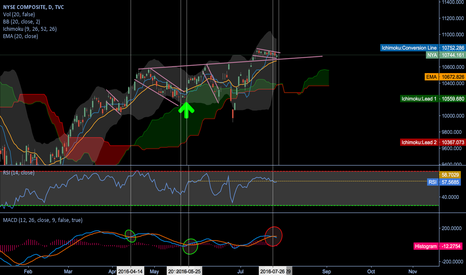

Here a good proxy for the marketI am back and back with a nice chart of the New York Average that sports a textbook ZigZag down implying a couple of things. First we should see a rally from current level with any more weakness, if needed, should be limited. Then a 3 waves down is a counter trend move meaning the long term trend is up. Though we might have to be patient. Maybe this Zig Zag is part of a larger correction that might last many more months. We just don't know.

So let's focus on the short term. I labeled the count as being not over yet but it might be. Regardless a rally is in the cards and we will keep you eye on it. Anymore weakness should be limited at 11650 where we have equality between waves.

Bottom line the bulk of the damage has been done and a good rally is in the card. Short term and long term

Keep in mind, every storm eventually runs out of rain !

BTCUSD: Bottom's in - Expecting Segwit activation and no splitI updated my last publlication when I went long again. I have a full position now, in all my crypto portfolio. Waiting to add after we get further confirmation, and after being in some profit, on each and every single trend continuation signal on the way up. Sentiment and technicals gave me a good signal today, so I closed my $ETCETH and $ETCXBT longs, and kept my $ETH as a longer term stake. Made out with 2% with it, which helps alleviate some of the loss.

Hopefully, people following me have a reduced drawdown, and are in good shape to continue following this powerful trend.

Best of luck,

Ivan Labrie.

All Targets Hit ... Expect Relief Rally | $NYA #NYSE #YellenFriends,

Following is a trade recapitulation and added analysis of Twitter:

TRADE RECAP:

On February 5th, my predictive analysis and forecasting system raised the question:

"Which Way To The Bear Party?"

-

Within a few candles, price move towards the target, as I answered:

" ... This Way, Replied The Bears."

-

On the following week, the system further defined the a new bearish target, namely: TG-2 = 40.26 - 13 FEB 2014:

"Update: Bearish; New probable Target Low"

-

PATTERN ANALYSIS:

At this point, I am expecting a relief rally to occur. Looking at price action, a pattern trader might have seen that the lowest of our target fell in line with the completion of a Shark. While a Shark pattern is what I call a "pseudo-pattern" for being defined by an unusual "Zero-X-A-B-C", it is often the gatekeeper to a "normal" pattern named by Scott Carney as a 5-0 Pattern, "normal" as it is defined by the standard X-A-B-C-D points.

Hence, if a relief rally should occur - as it seems to be on its way since hitting our secondary target dead-on - this would place a 5-0 pattern completion Point-D @ 57.21.

Taken in its exchange context, one should also consider that NYSE is effecting a rally to levels that remain sub-surface relative to its all-time high, as follows:

#NYSE - $NYA

- tradingview.sweetlogin.com

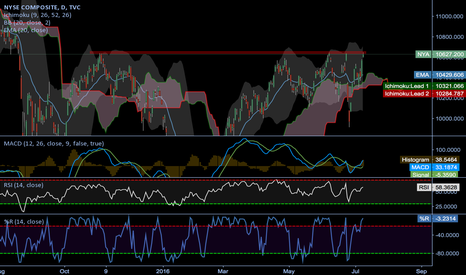

This $NYA chart demonstrates that within three daily candles, bearish advanced are being erased. However, as defined by my E.A.G.L.E range (10.624.04/10584.23), my predictive analysis and forecasting is capping this relief rally to a target in line with the upper value of that range, namely:

- $NYA Target: "TG-1 = 10624.04 - 17 APR 2014".

PREDICTIVE ANALYSIS/FORECASTING:

Looking at the TWTR chart, my predictive analysis and forecasting has defined a bullish target as:

- TWTR Target: "TG-1 = 57.81 - 17 APR 2014".

Turns out that this target is barely 0.60 points away from the 5-0 pattern (57.21) just defined above, thus adding credence to the on-going rally and the probability of this level having some restrictive merit against said rally.

OVERALL:

A relief rally seems underway, as per the TWTR chart and its illustrated exchange context, $NYA. From a broader fundamental perspective, the Fed has remained unclear as to which data it would use to effect or contradict its gradual easing removal. A surprising bearish data release could therefore carry price above the targets defined in above comments, even if Yellen was to merely jawbone the market without acting on her words.

However, I would recommend taking a closer look at both the 3-Month and benchmark 10-year treasuries for any price rallying, as this alone might suffice to time a premature rate increase. If and once this occurs, equity markets would have only one direction to chose.

For the time being, I will leave the system-defined directional indicator as "Neutral", even though my own ("human") directional bias remains neutral to bearish, based on the patterns, predictive and fundamental analyses discussed above.

Cheers,

David Alcindor

Predictive Analysis and Forecasting

Get my signals, analyses and forecasts on Twitter:

(Alias: @4xForecaster)

-------------------------------------

Disclaimer:

- All my comments are founded on unshared proprietary as well as common knowledge of technical analysis: Do your own due diligence before trading any market/asset. Additionally, my signals, forecasts, analyses and directional opinions are for educational purposes only and are not trading recommendations. Again, do your own due diligence first, then seek financial advice from a licensed professional, and only then enter the market at your own perils - David Alcindor - TradingView.com Alias: 4xForecaster

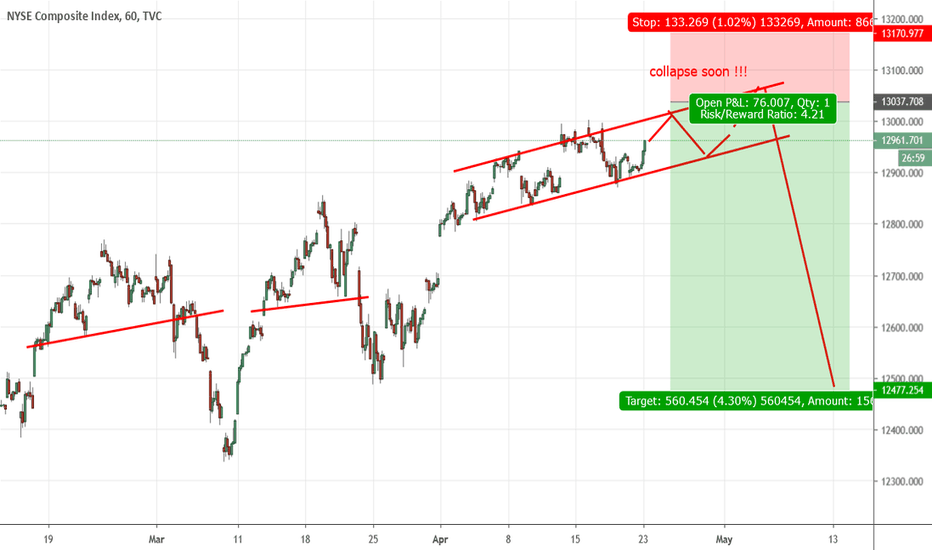

SP500 turns over hereThe NYSE ( symbol NYA) or SP500 is about to turn over here. The harmonic pattern shown and resistance at the 200ma will make the down turn expected. RSI and %R both indicate near and longer term over bought conditions. Look for a retrace of 38.2% down to the raising 50sma for support.