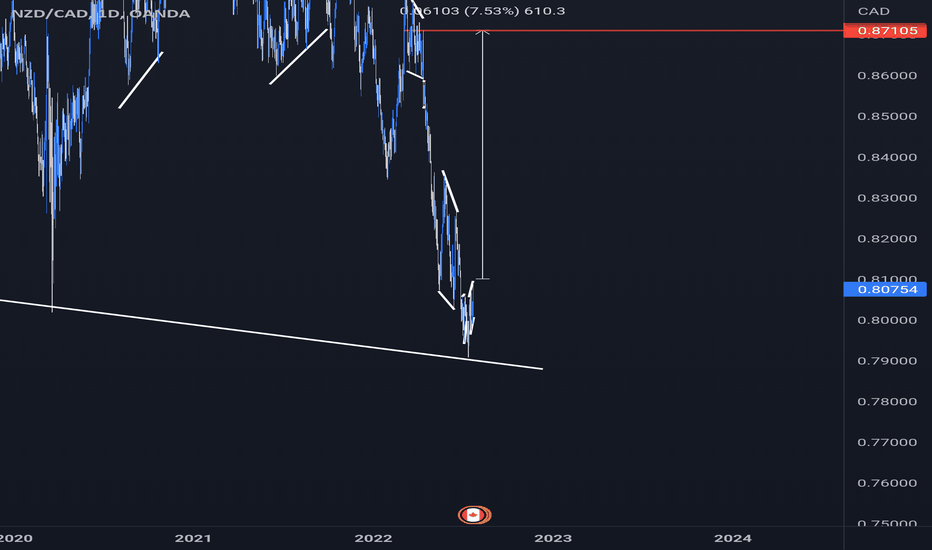

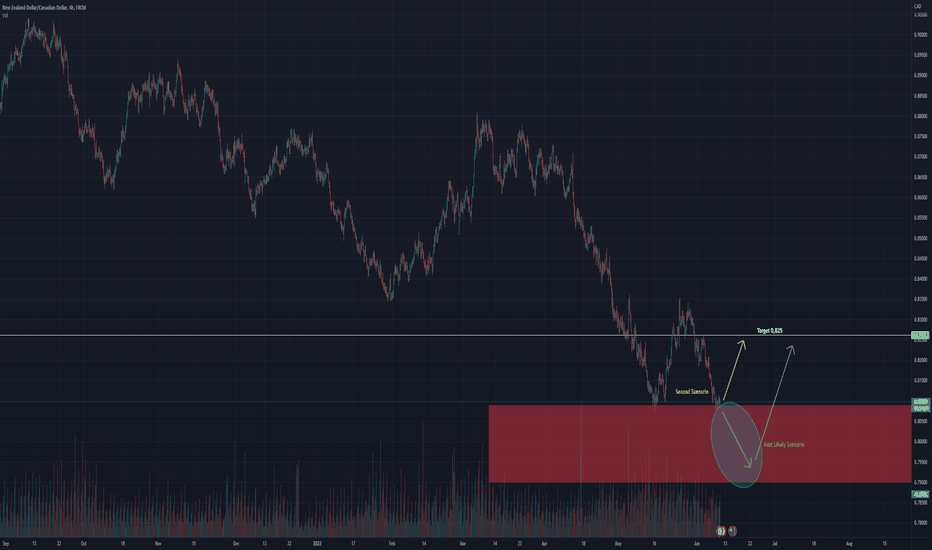

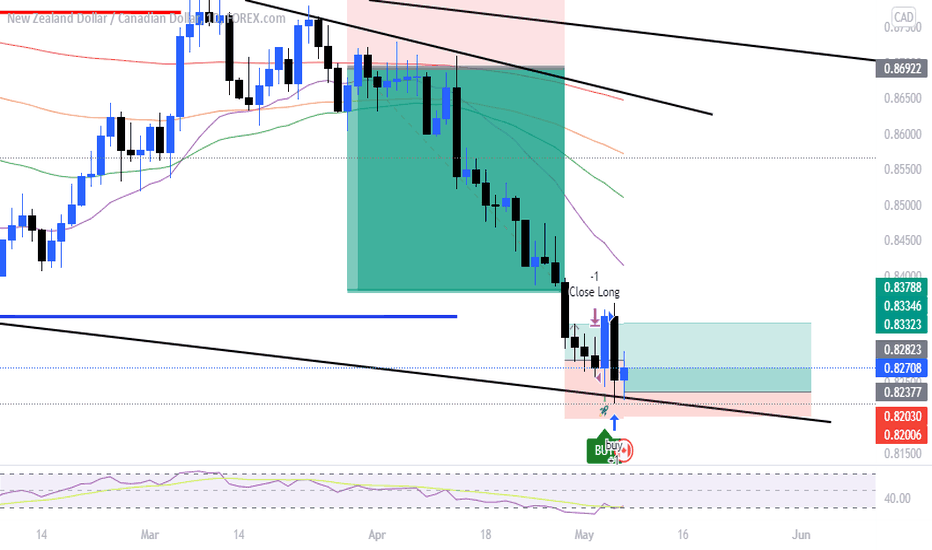

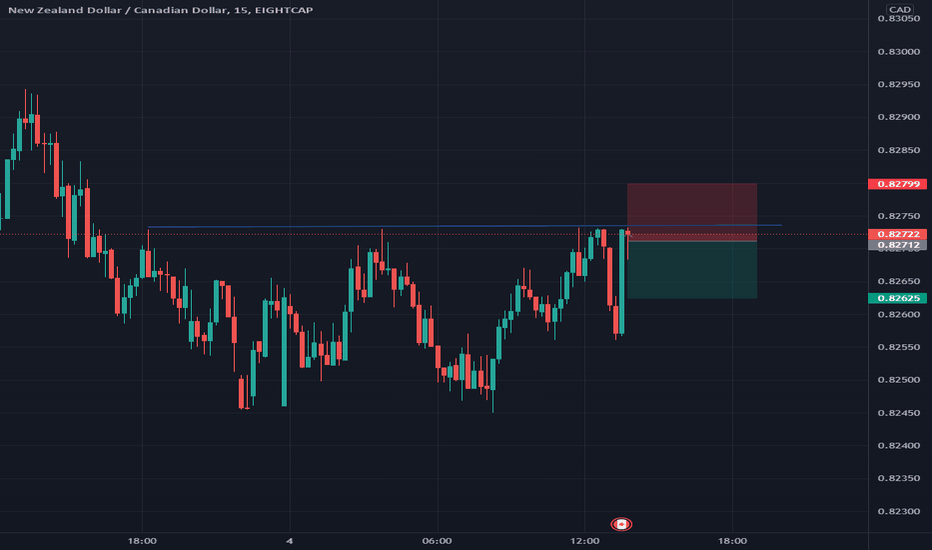

NZDCAD, next bullish impulse 600+ !Hi Traders,

Price action is shaping up to give a nice bullish impulse run. Looking at the HTF, price is at the bottom boundary of a bullish continuation structure which has already made multiple swing highs/lows with an inverted head & shoulders pattern forming. Look for entries on the LTF this upcoming week.

Trade Safe!

Nzd-cad

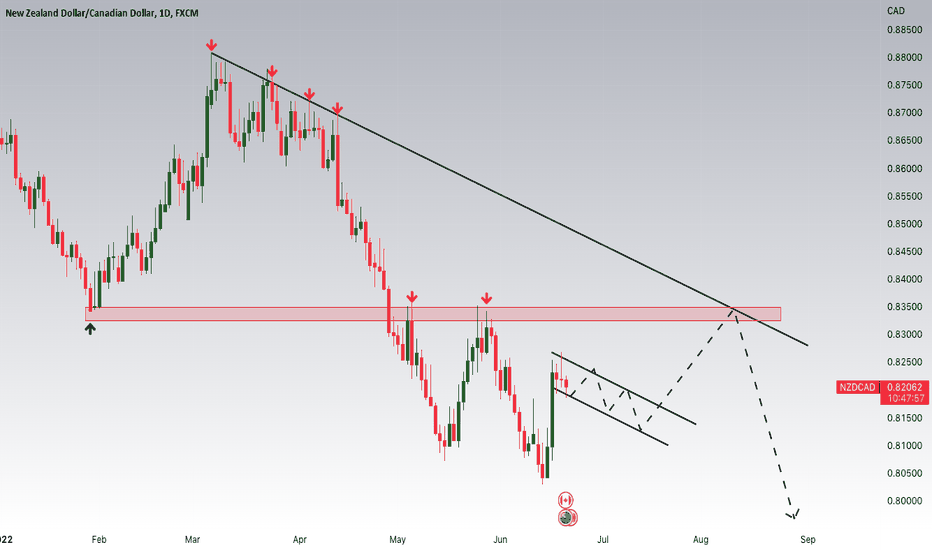

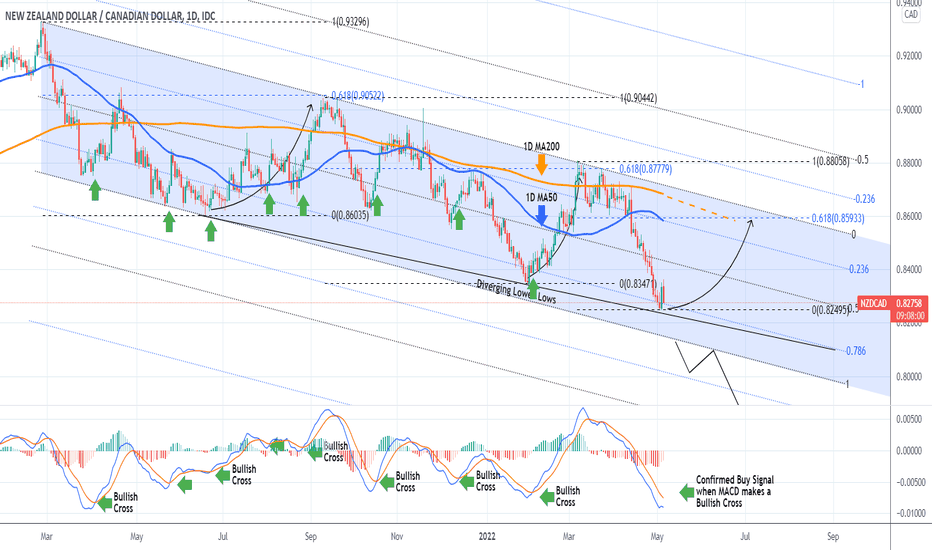

NZDCAD Buy upon a pull-back, target the 1D MA200The NZDCAD pair has been trading on a Channel Down within a Bearish Megaphone pattern. Right now the price is testing the 1D MA50 (blue trend-line) as a Resistance and is struggling, trading below it since April 13.

Both the 1D RSI and the candle action resembles the sequence at the start of the Megaphone, which after one last pull-back upon rejection on the 1D MA50, it rebounded to the Lower Highs. As a result, we will be waiting for one last opportunity to buy near the bottom of the Channel and target its top or the 1D MA200 (orange trend-line) should it come first.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

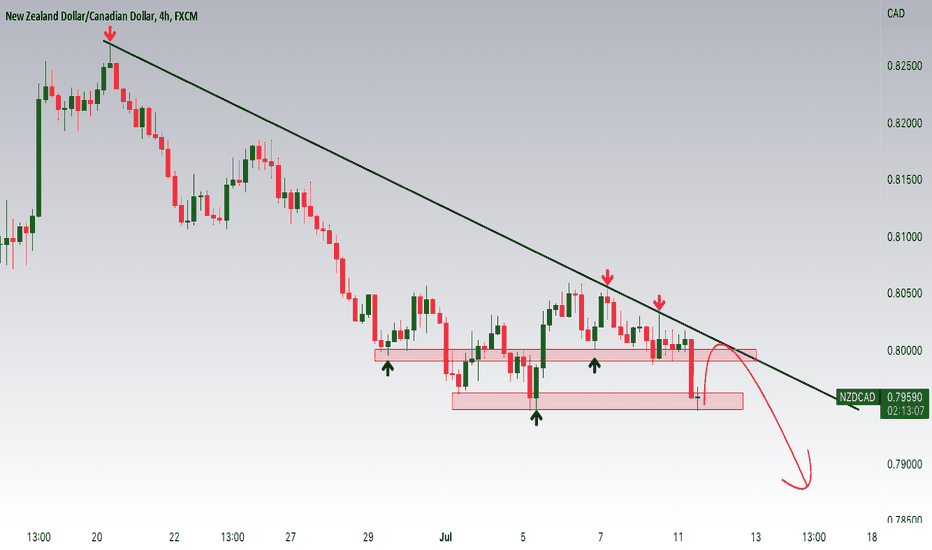

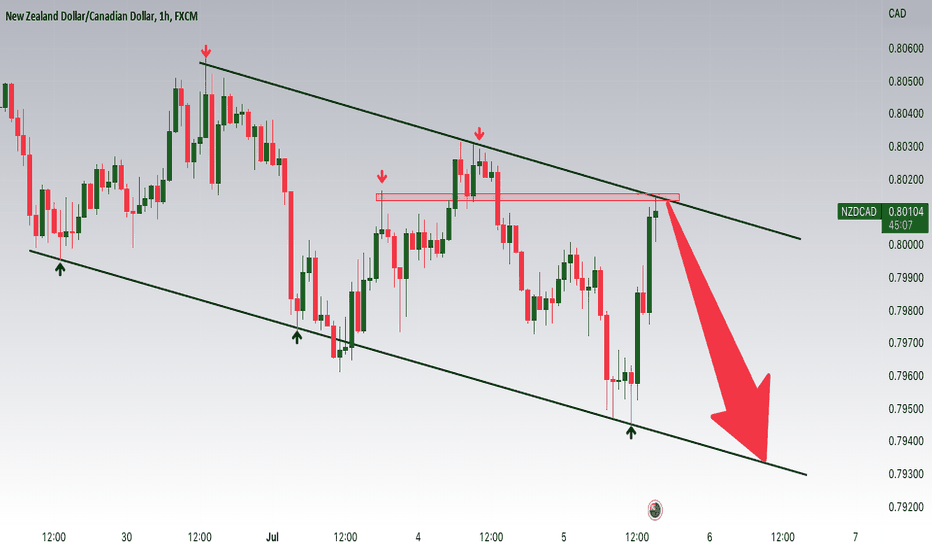

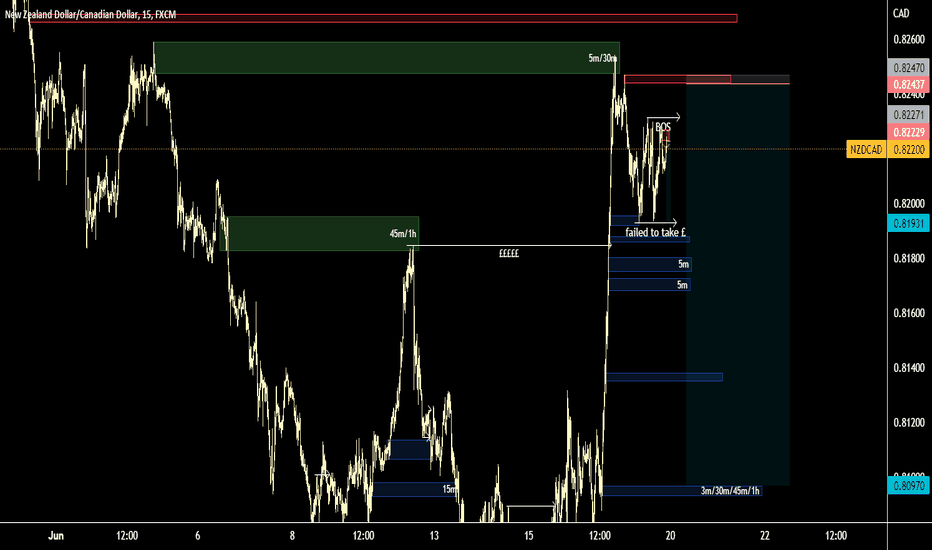

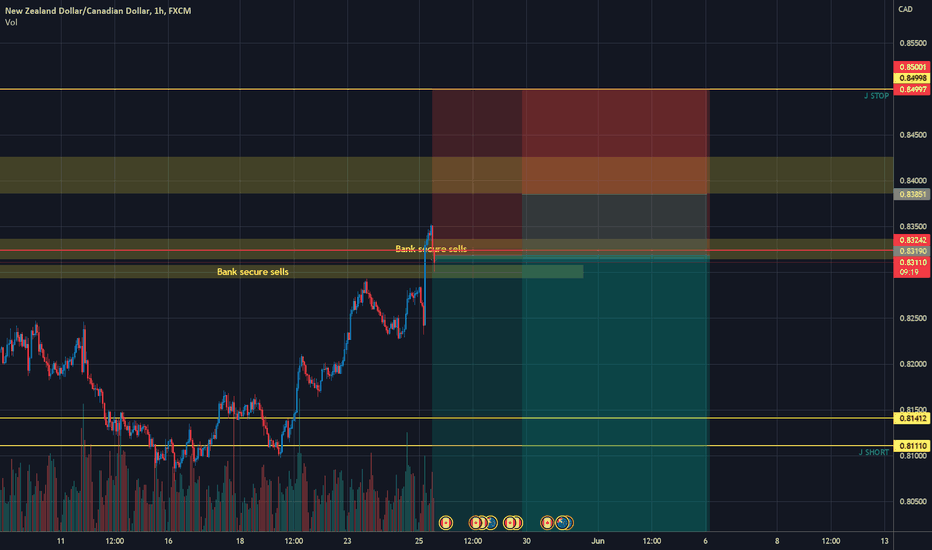

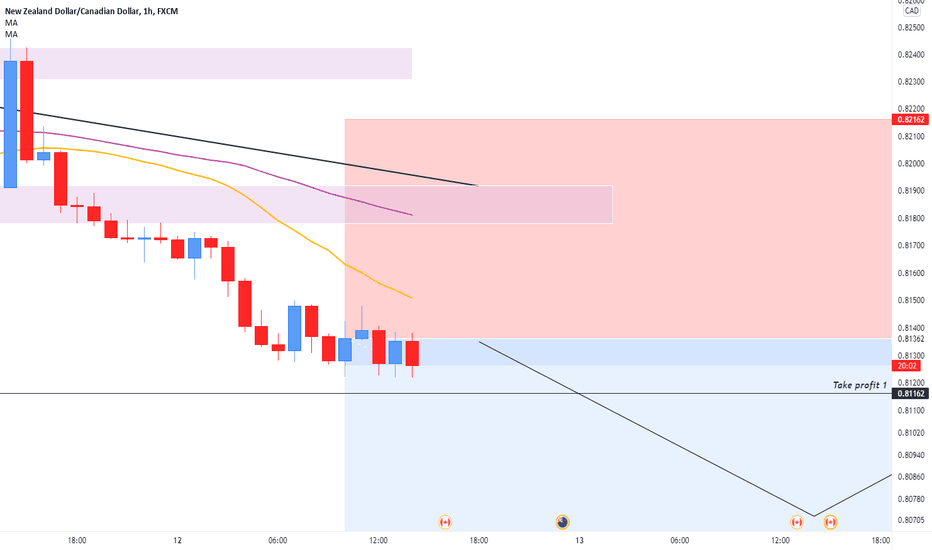

NZDCAD Swing ShortBased on COT, Outlooks + fundamentals and TA i came up with an NZDCAD short trade.

I´ll have a dynamic entry approach, my first short entry will be right now.

Banks have secured their Long Hedges since long time, so there is a high probability they want to close these Long positions at least BE, before price will drop. Thats when i will try to add my other short positions.

Be Careful, pay yourself + manage risk

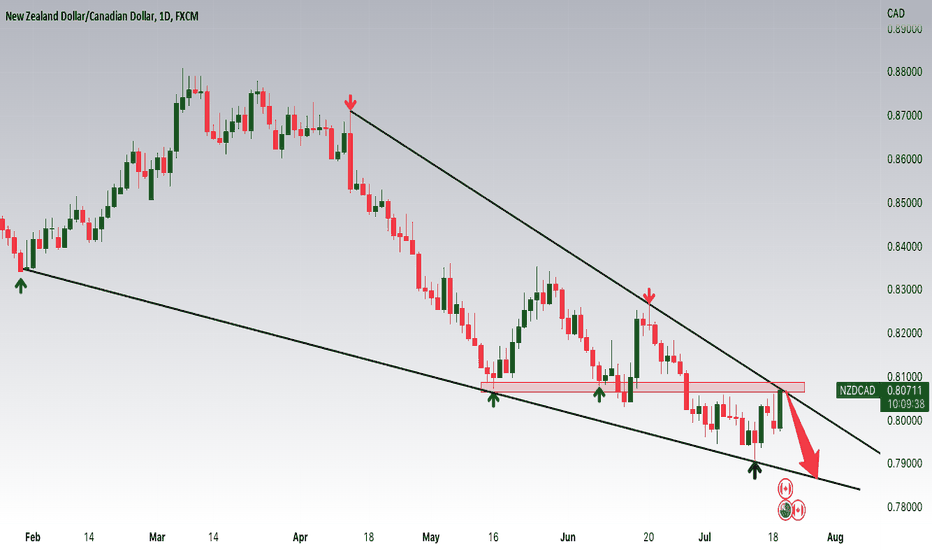

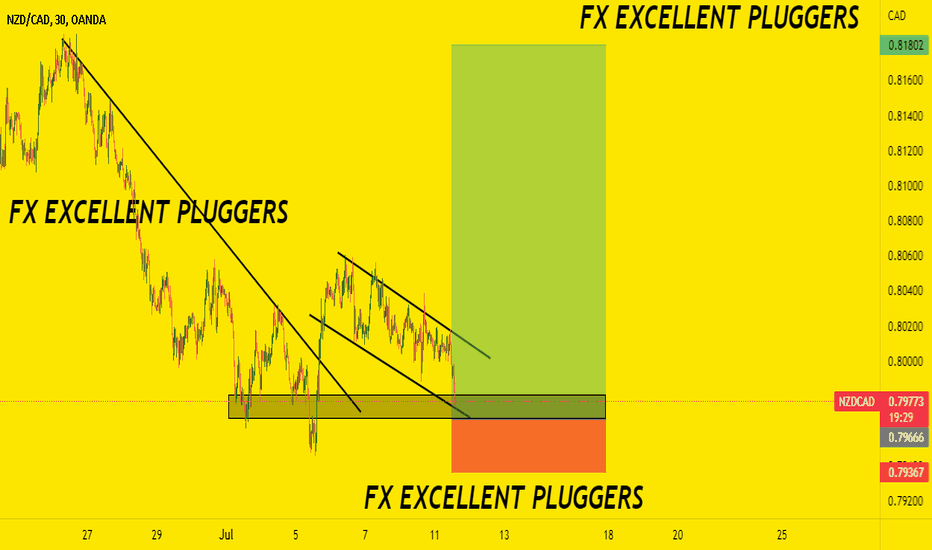

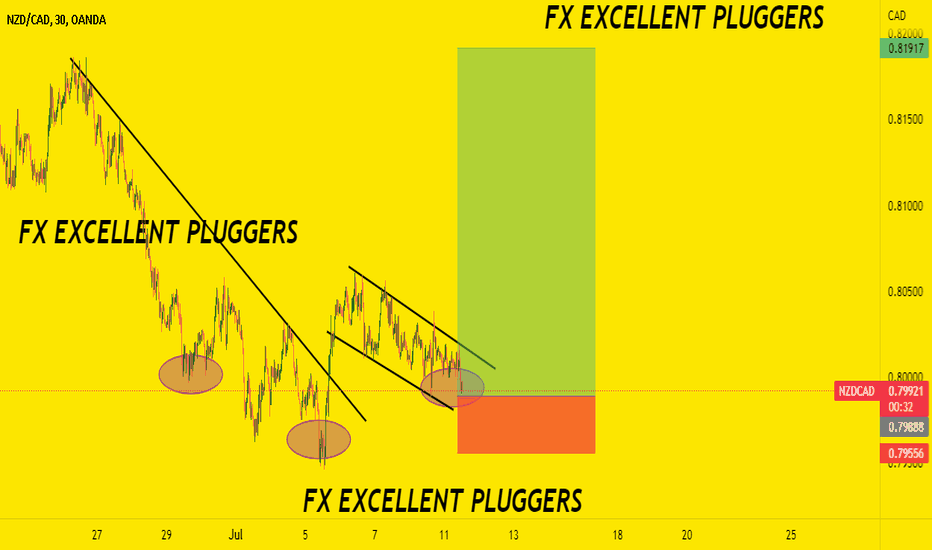

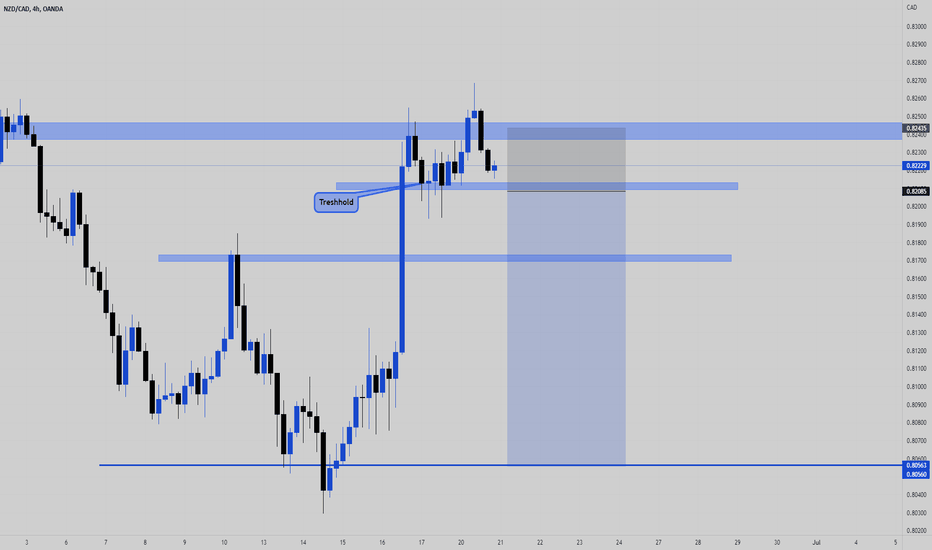

NznCad Long IdeaHello Traders, here is the full analysis for NzdCad , let me know in the comment section below if you have any questions.

The ellipse could represent a possible zone with good risk/reward to accumulate long position.

Please note that all the information and publications hera are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. What you will find here, are only views of a Cat passionate about Finance.

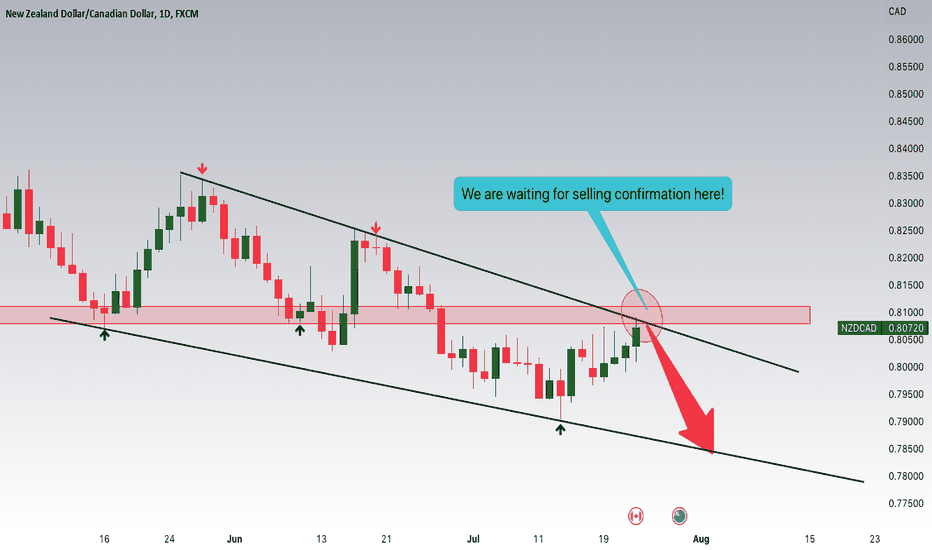

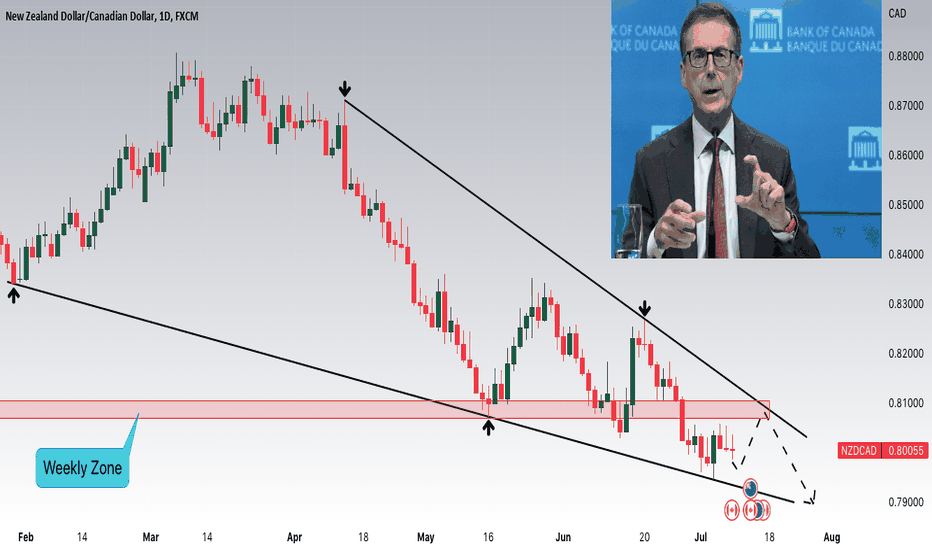

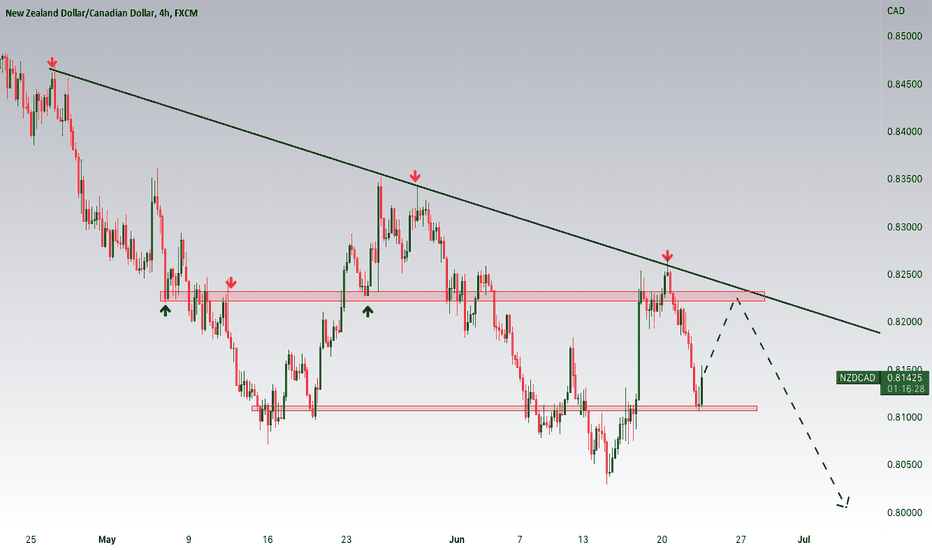

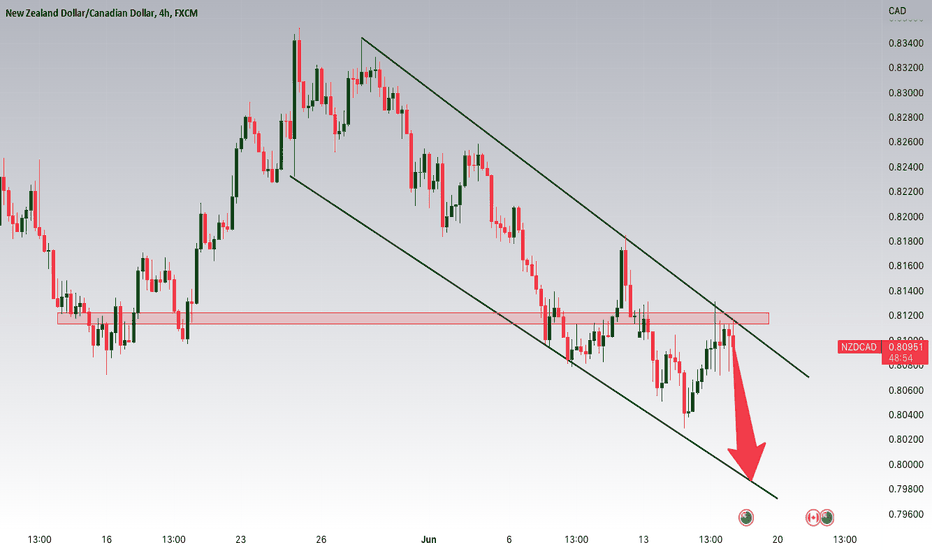

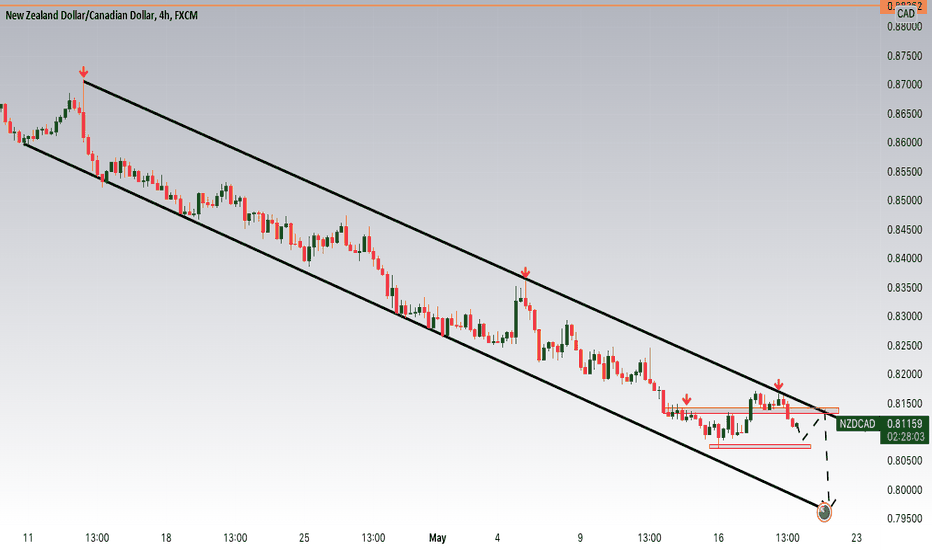

NZDCAD | BEARISH trade OPPORTUNITY 📉- NZD/CAD has a nice overall move towards the downside on multiple time frames.

- We are seeing bearish pressure on a recent bearish engulfing candle formation on the 4-hour time frame & it made a new low on the 1-hour.

- There is not much big news today that might have a huge impact on the overall trade direction as hedge funds are still showing that NZD is being sold off.

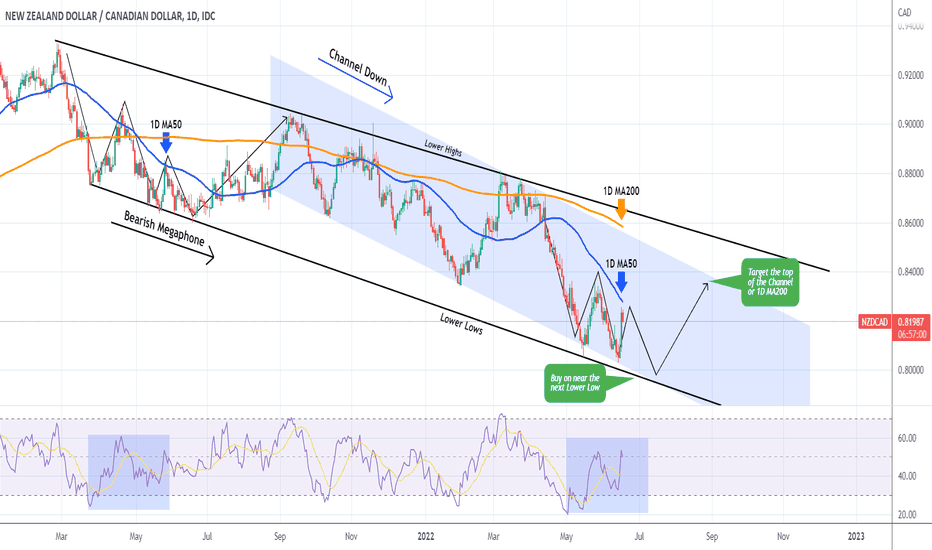

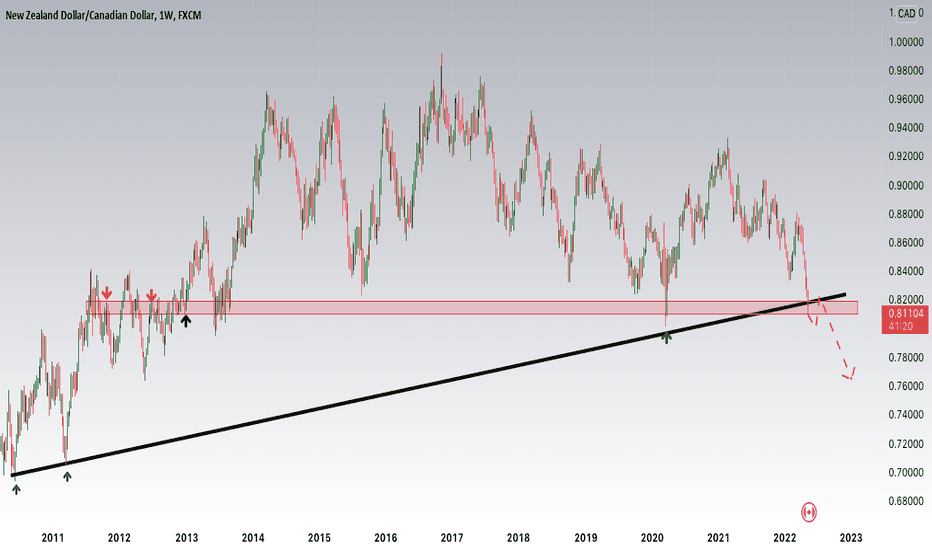

NZDCAD Close to a medium-term buy signalThe NZDCAD pair has been trading within a Channel Down since late February 2021. Yesterday it bounced off the Diverging Lower Lows trend-line that started on the June 18 2021 Low. Even though this suggests that the price is at or at least very close to the new medium-term bottom (Lower Low), the indicator that has given a confirmed buy signal since April 2021 is the MACD on the 1D time-frame.

As this chart shows, every time the 1D MACD forms a Bullish Cross, the price always makes (even a short-term) rebound. The MACD Bullish Cross is typically formed just a few days after the price bottom (Lower Low). The previous Lower Lows have rallied to the Lower Highs trend-line (top) of the Channel Down in the past two events. At the same time, almost all MACD Bullish Crosses have made the price test the 1D MA200 (orange trend-line), while all have made it test the 1D MA50 (blue trend-line).

Assuming we are at or close to the new bottom, the current 0.618 Fibonacci retracement level is around 0.85930, where the 1D MA200 is roughly projected to be by late June. On the other hand, a 1D candle close below the Channel Down, sets in motion a test of the lower Fibonacci extensions at 0.8000 even 0.78000.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------