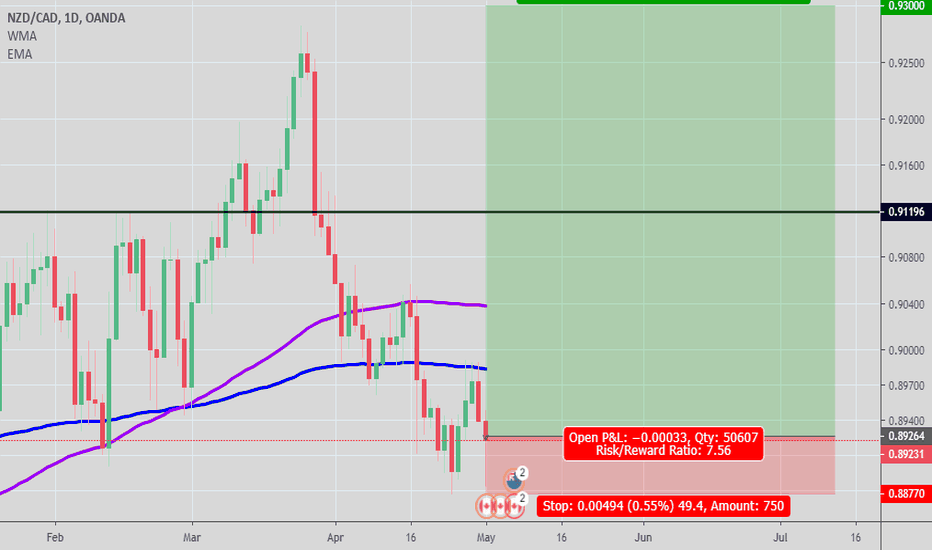

Nzd-cad

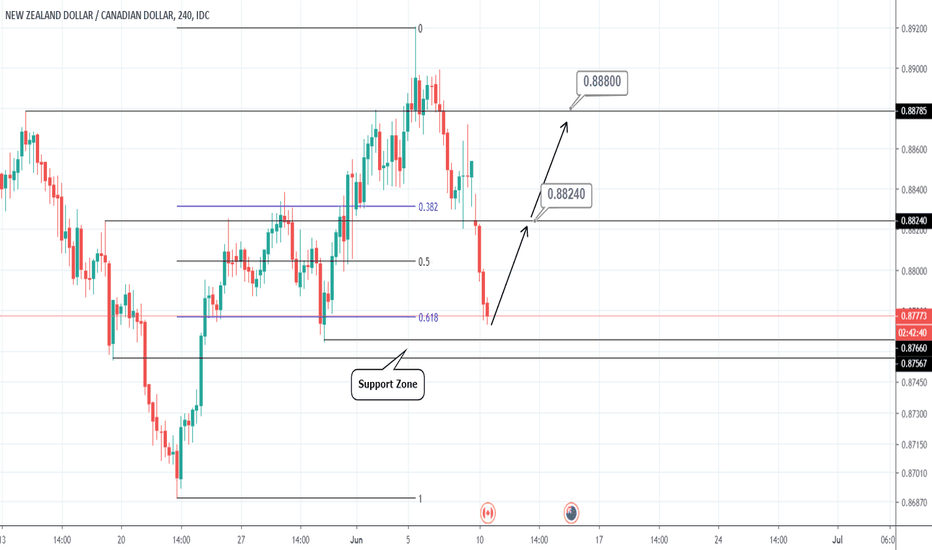

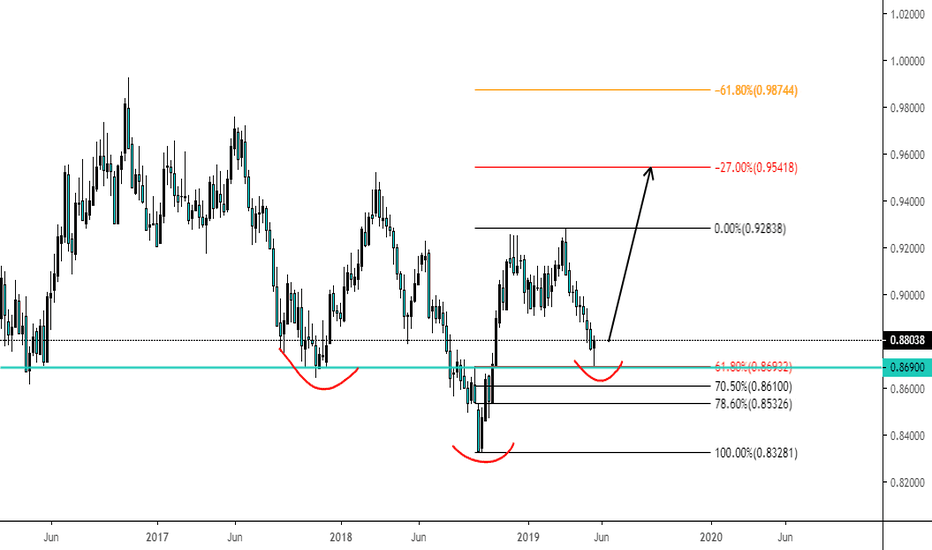

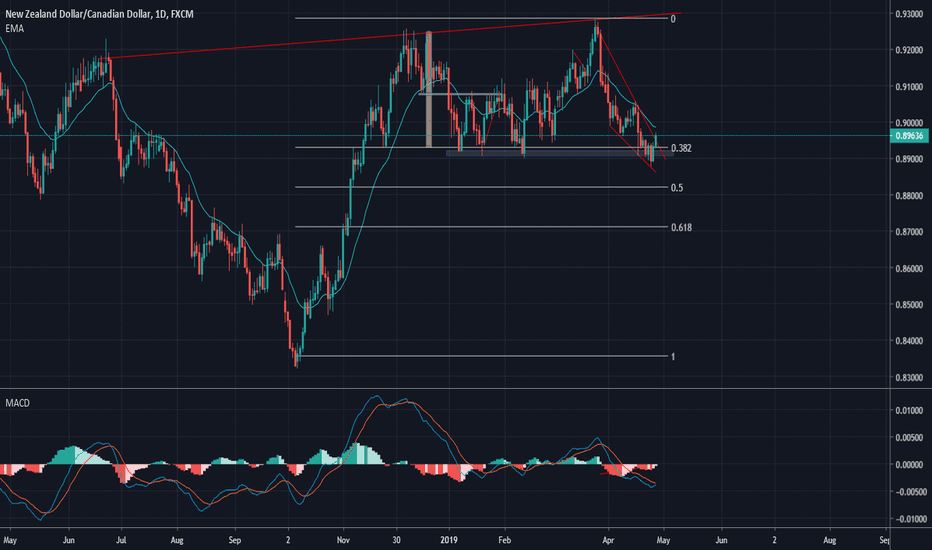

NZDCAD LongNZD - bottoming now and currently gaining upwards momentum, possible continuous bounce up to 61.8 fib esp 10-year seasonality for NZDCAD favors it being bullish this coming June

CAD - will take some time to clear out the glut in oil inventories (oilprice.com) hence the recent slide, but still must be careful to prevent getting whipsawed. Expecting oil to drop @55 psychological resistance which will also bring CAD down

Oil:

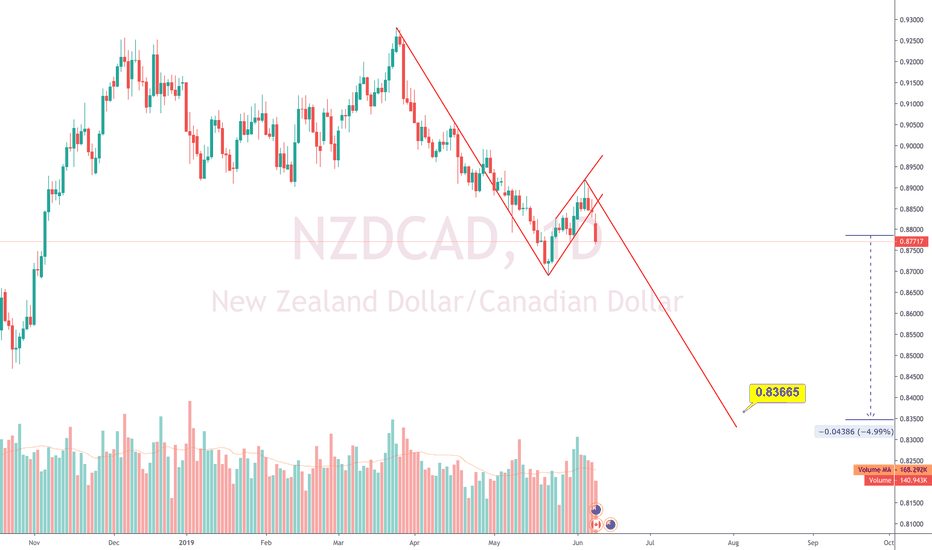

Weekly:

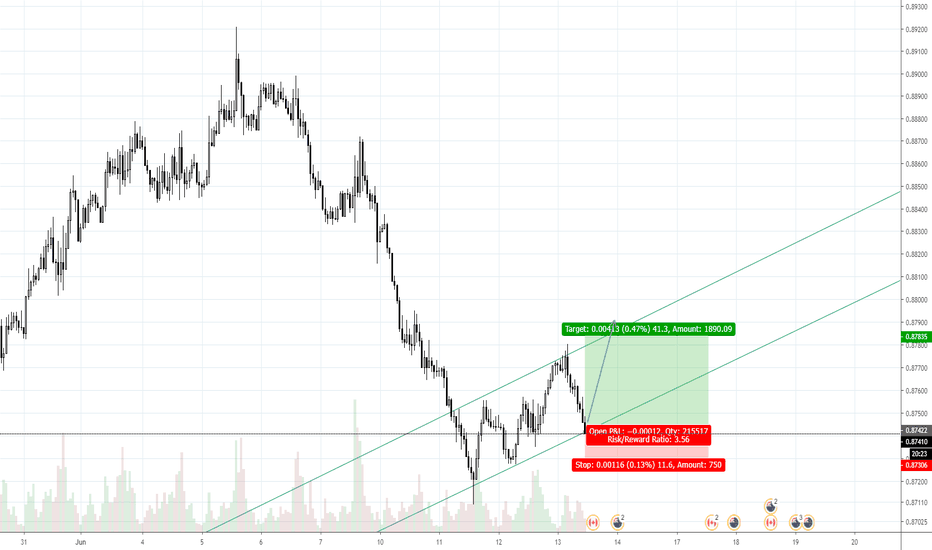

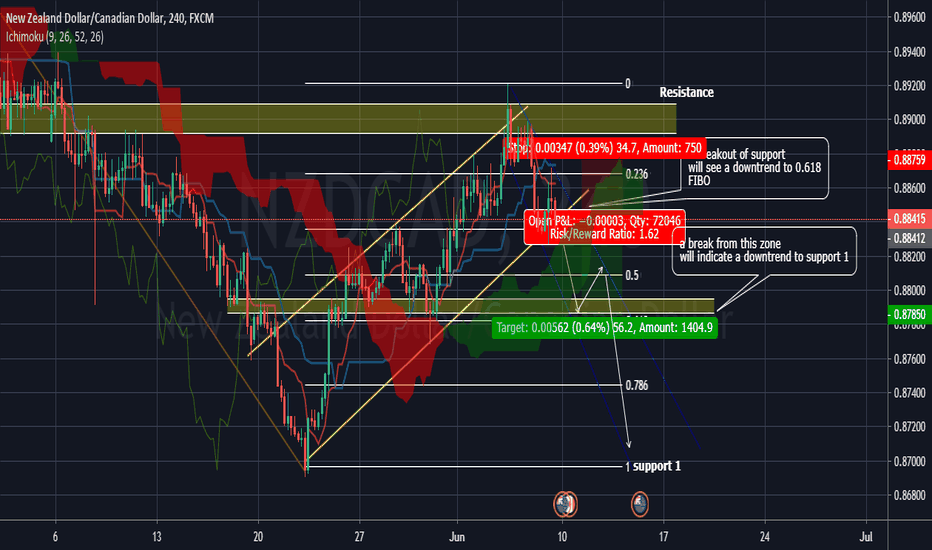

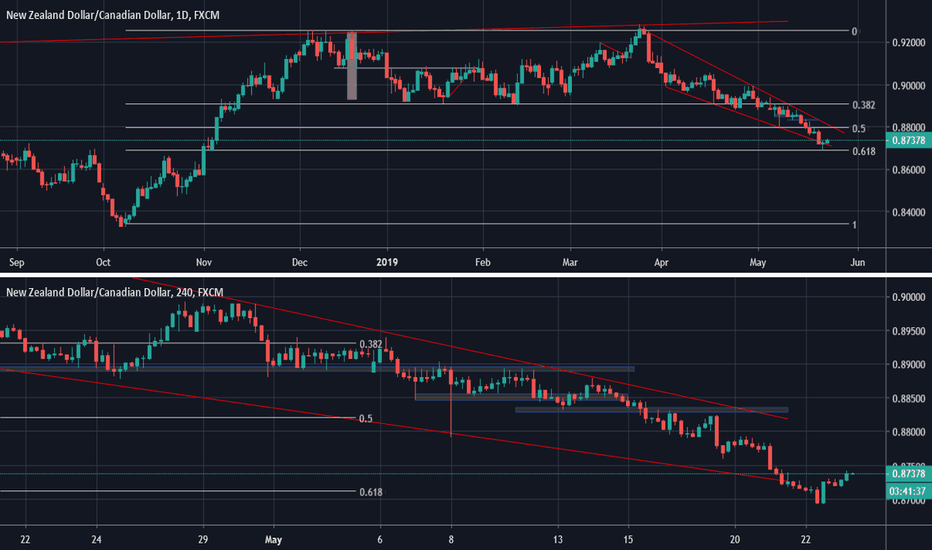

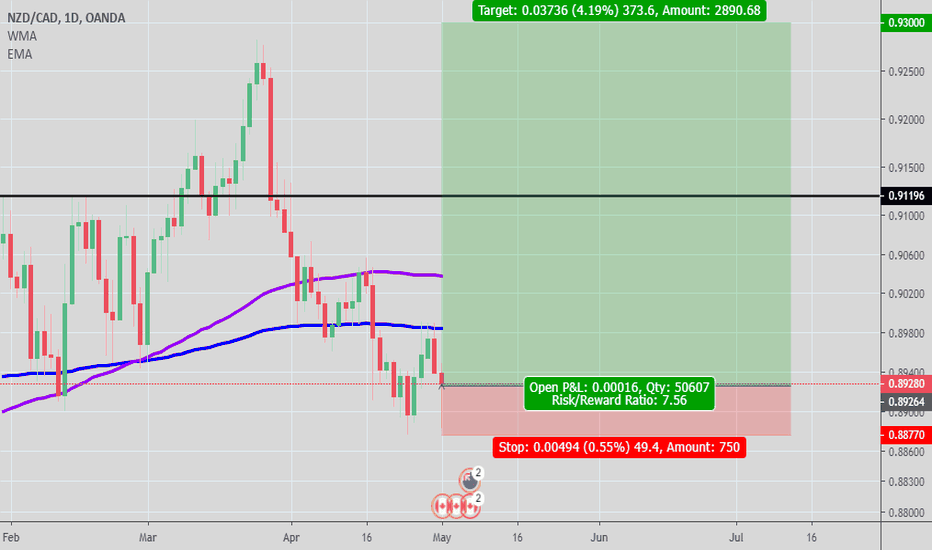

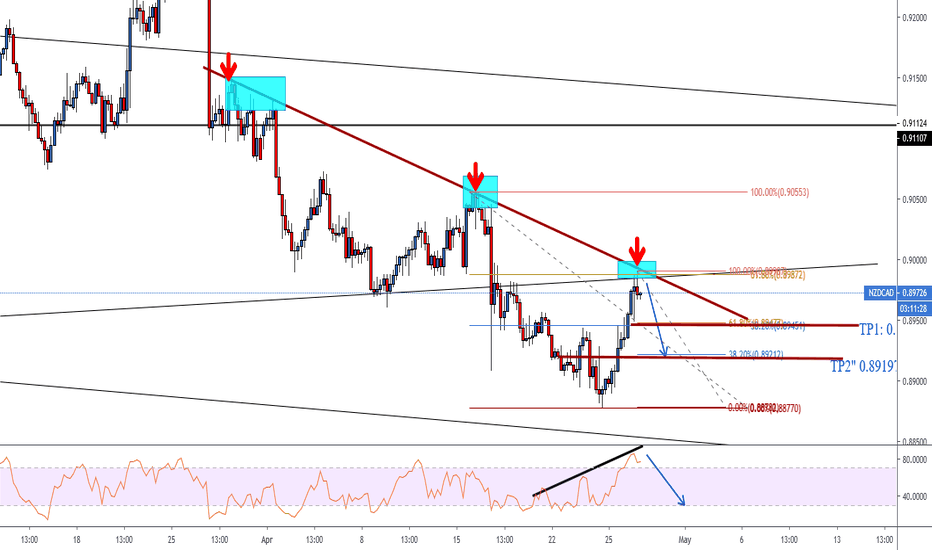

NZDCAD on the way to gain 3%A beautiful setup appeared on NZDCAD. The pair has reached the 61.8% Fib level which seems rejected with a reversal morning start forming on the daily chart.

The pair has also been trading inside a bullish wedge, and a break above the upper wedge line could send the pair to the 0.91xx area (a 3% gain).

The recent down-move on the daily seems overstretched relative to the previous range.

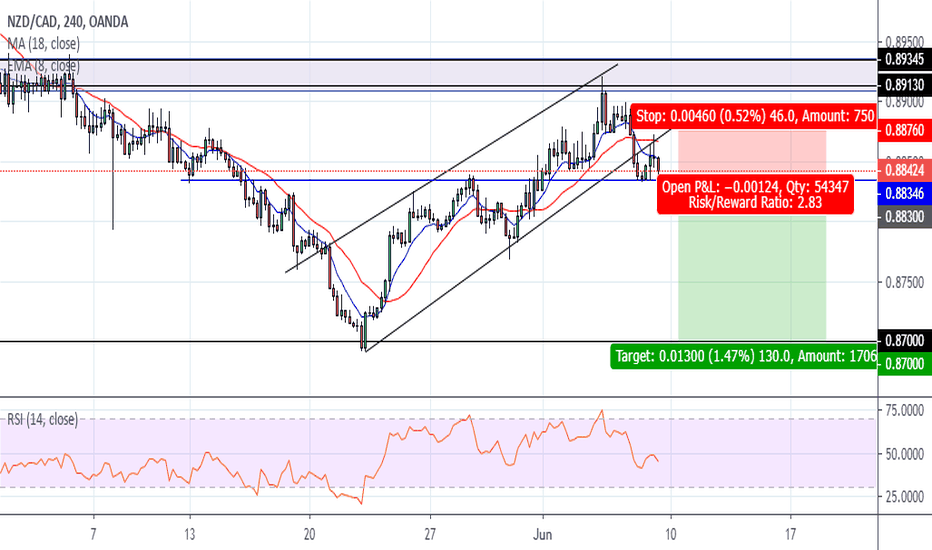

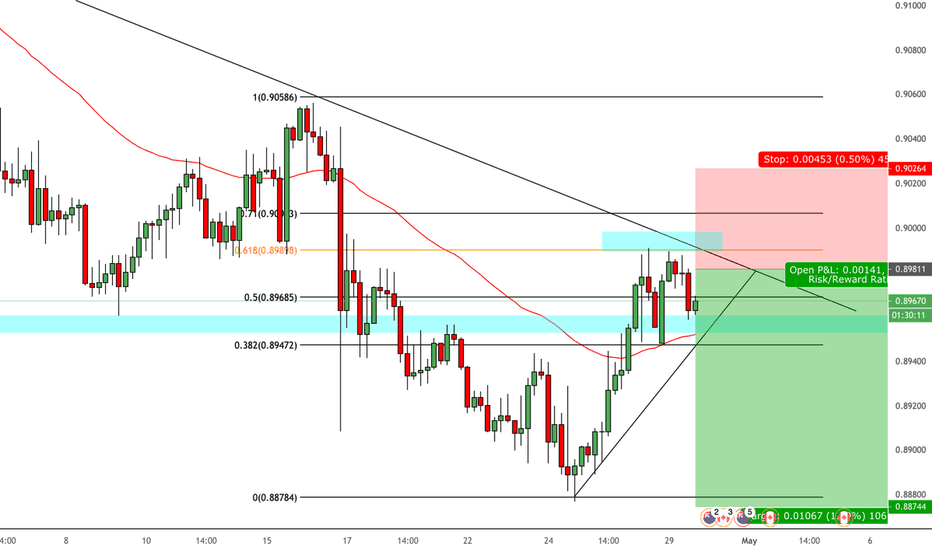

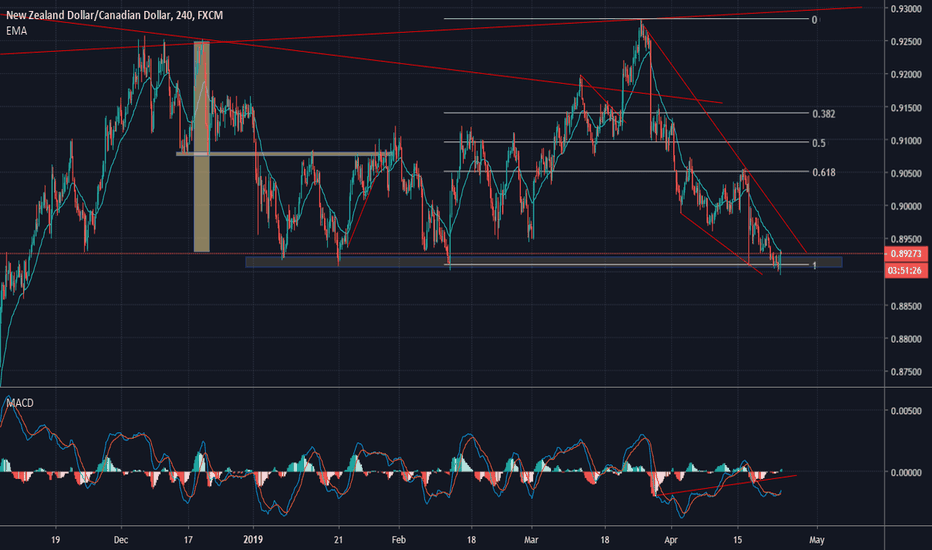

NZDCAD Long - Watch out for a bullish wedge breakoutNZDCAD is triggering a bullish wedge pattern on the daily chart, after finding strong buying power at a horizontal support zone previously. (Setup posted recently).

The bullish divergence is also still in-tact. Overall, the pair trades near the lower range levels and has more upside potential.

Today's risk-on market environment and week/month-end profit taking taking may also push the pair higher.

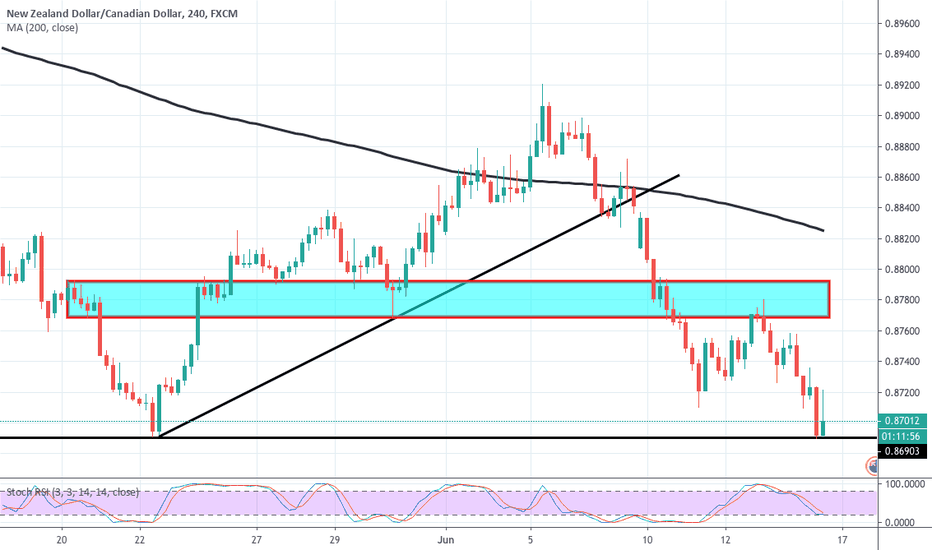

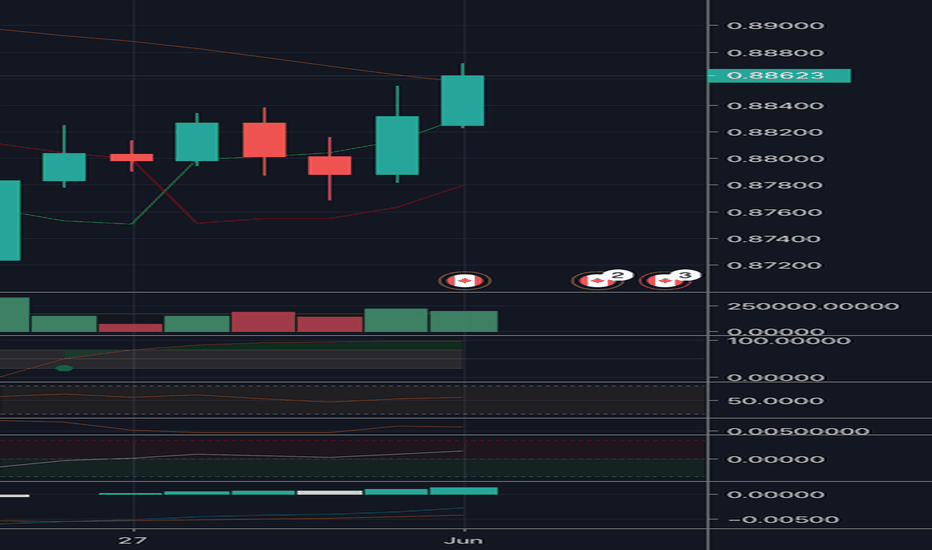

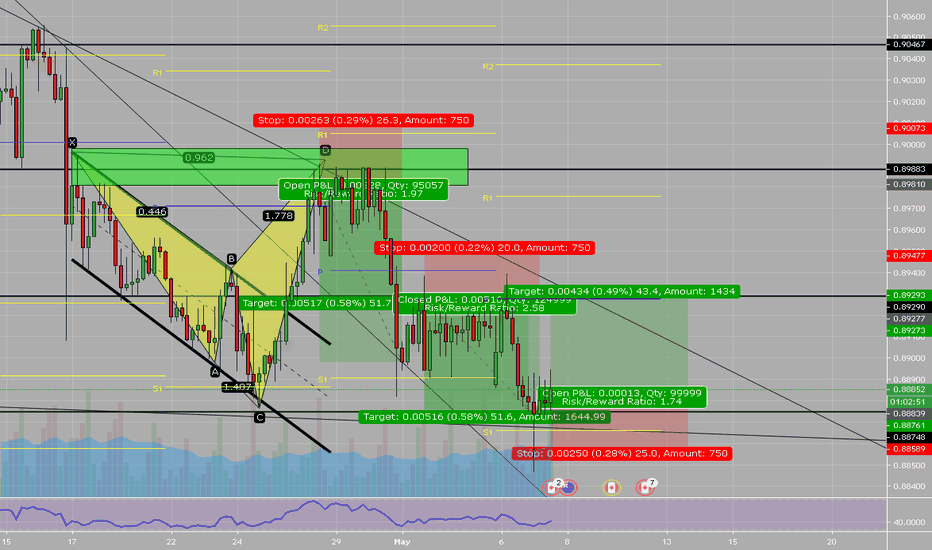

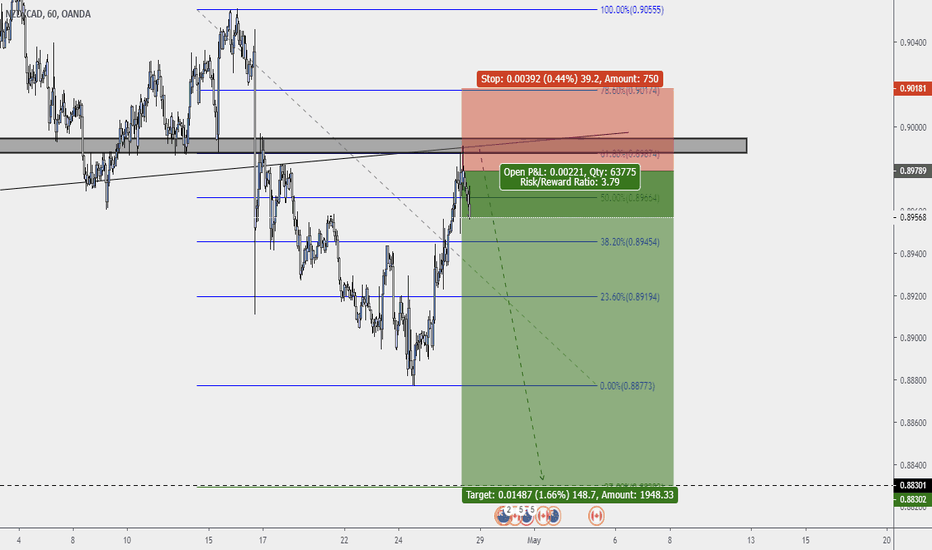

NZDCAD Buy Setup: H.Support, Divergence and MomentumNZDCAD reached a horizontal support level, near the lowest level of 2019. A strong bullish candle is forming, and a bullish view is also confirmed by a bullish divergence between the price and the MACD.

Furthermore, the pair is forming a bullish wedge pattern with the current fifth having a high probability of breaking above the upper wedge line.

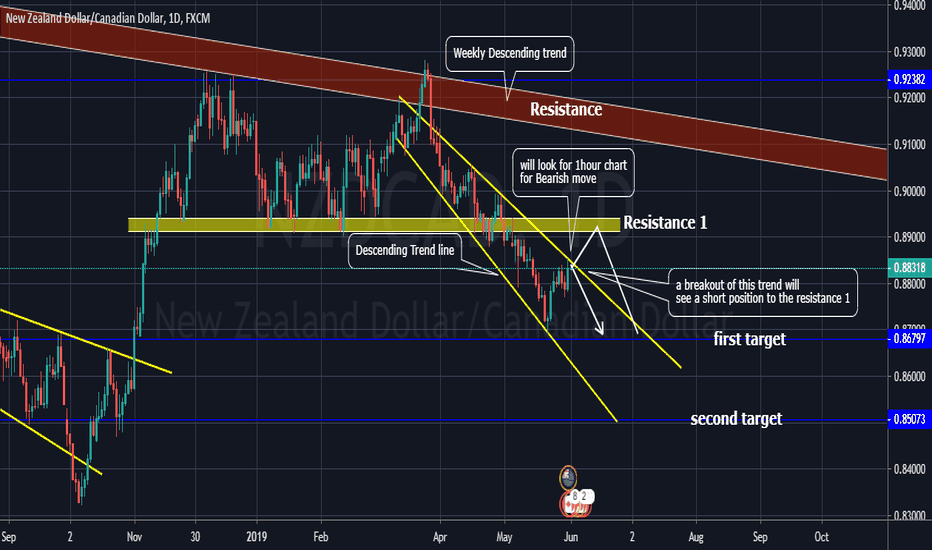

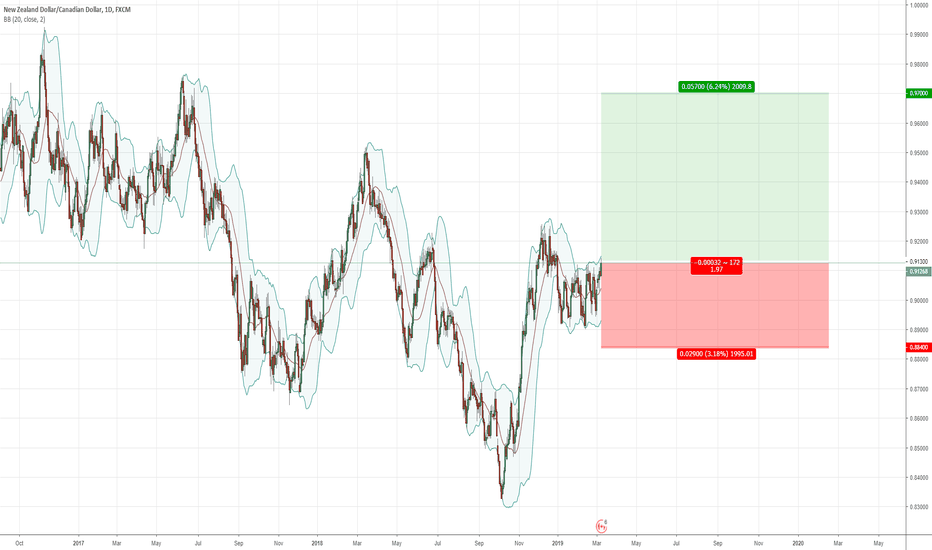

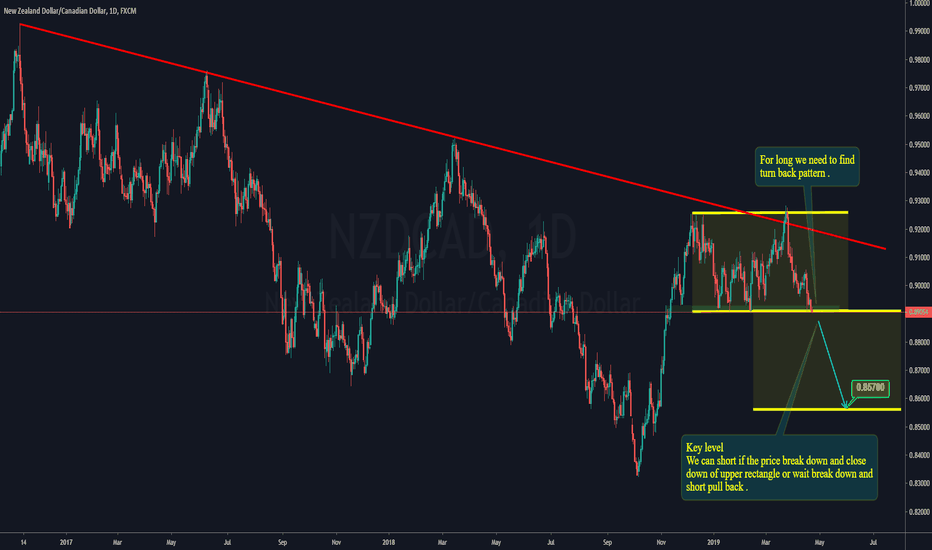

NZD/CAD Daily. the price at key level 1. We can short if the price break down and close

down of upper rectangle or wait break down and

short pull back .

2. For long we need to find

turn back pattern .

This is not an investment recommendation or any call to buy or sell

It is just an analysis based on a study of the history of price action

Behavior , that may not be a necessarily reason for the success of

the structure or repetition. So please make your decision based on your vision .

To protect capital and manage your deals and trading successfully

the maximum loss in each transaction for the same currency or

commodity in the same direction should not exceed ( 2% ) of the capital .

Good luck >>