NZD-CHF

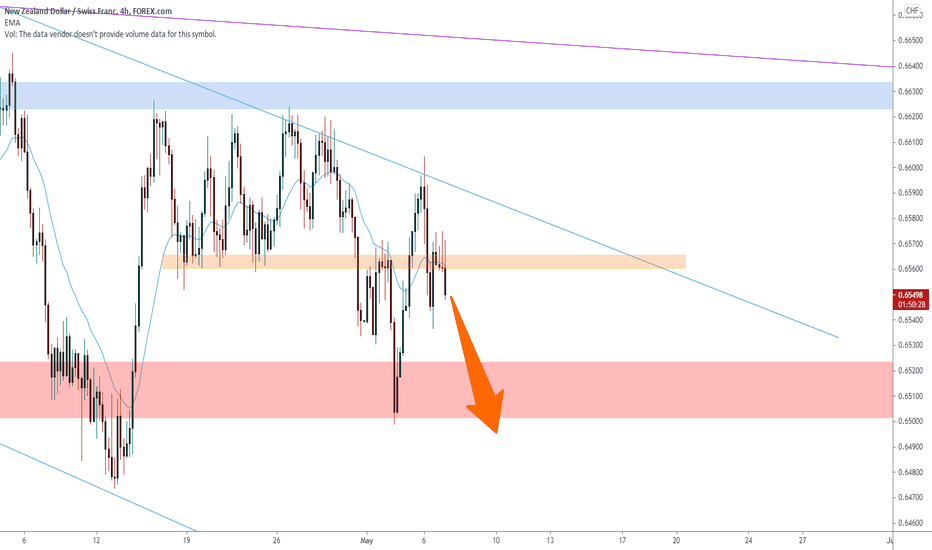

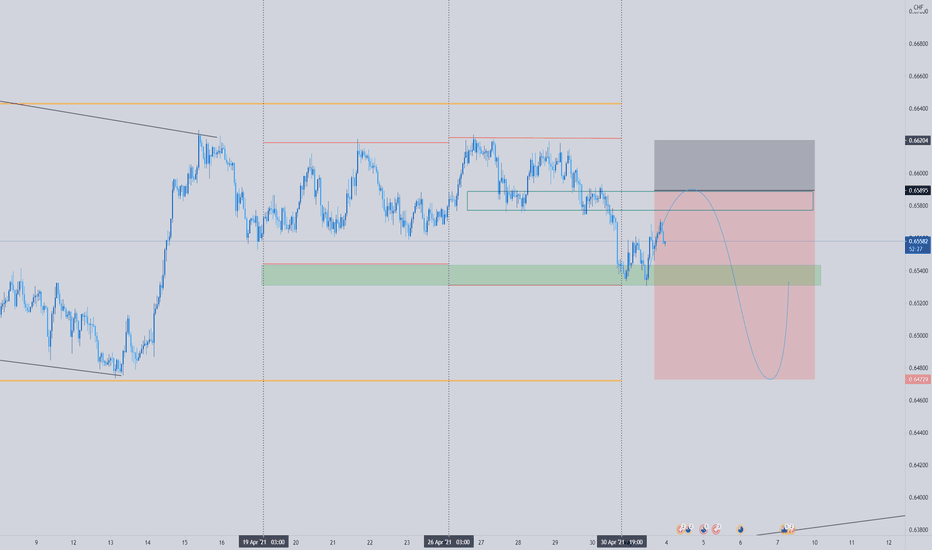

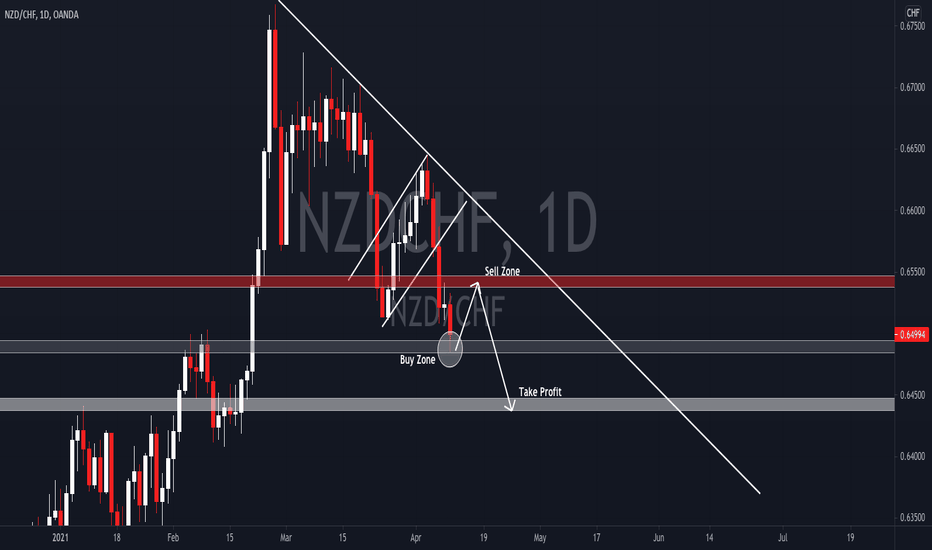

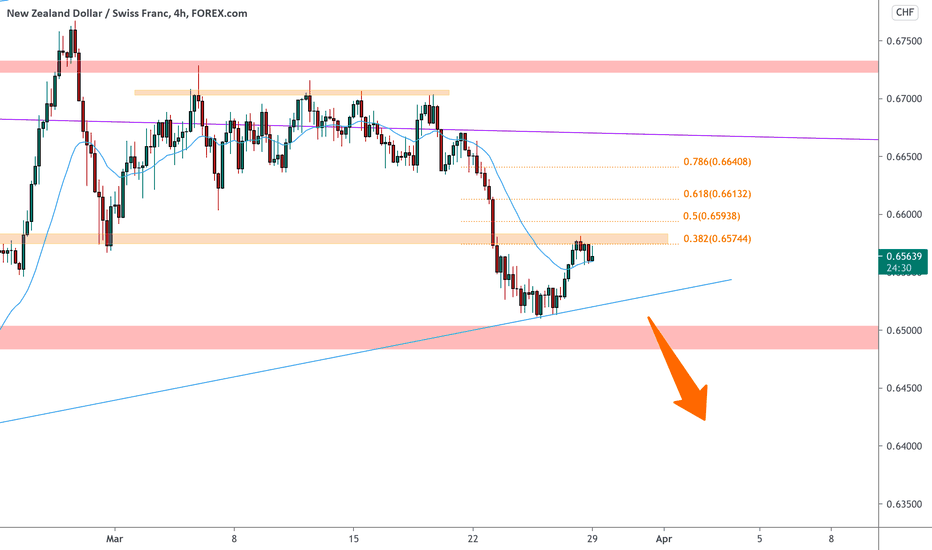

NZDCHF cutting for short 🦐NZDCHF on the 4h chart is moving on a descending channel.

The market broke below the range between 2 structures and retest the resistance.

According to Plancton's strategy if the conditions will be satisfied we will set a nice short order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

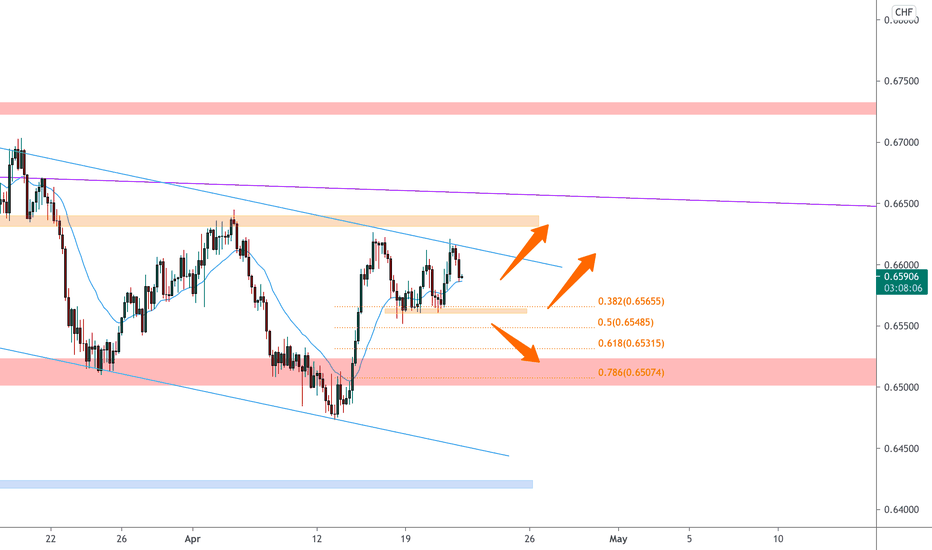

NZDCHF on a descending channel 🦐NZDCHF on the 4h chart is moving on a descending channel.

The market is moving inside a range between 2 structures below the upper trendline.

According to Plancton's strategy if the price will break below we will set a nice short order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

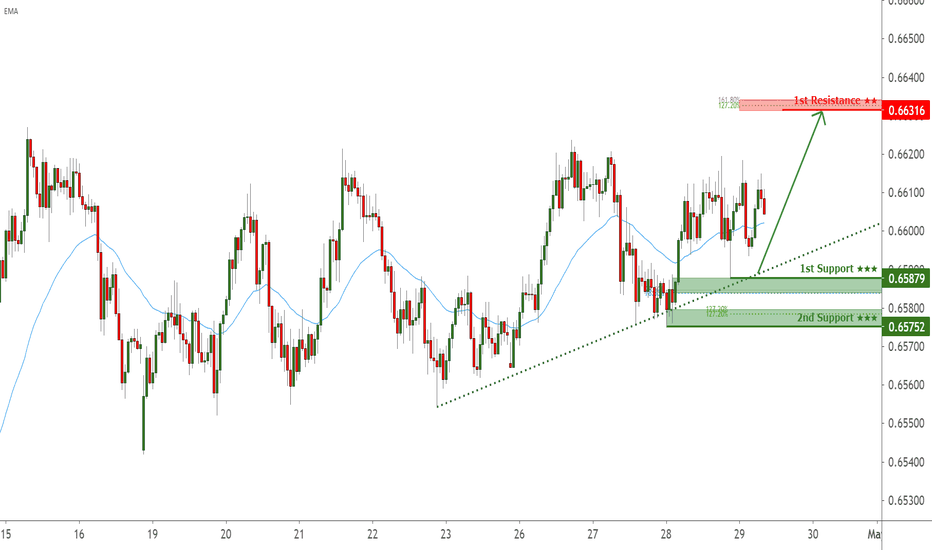

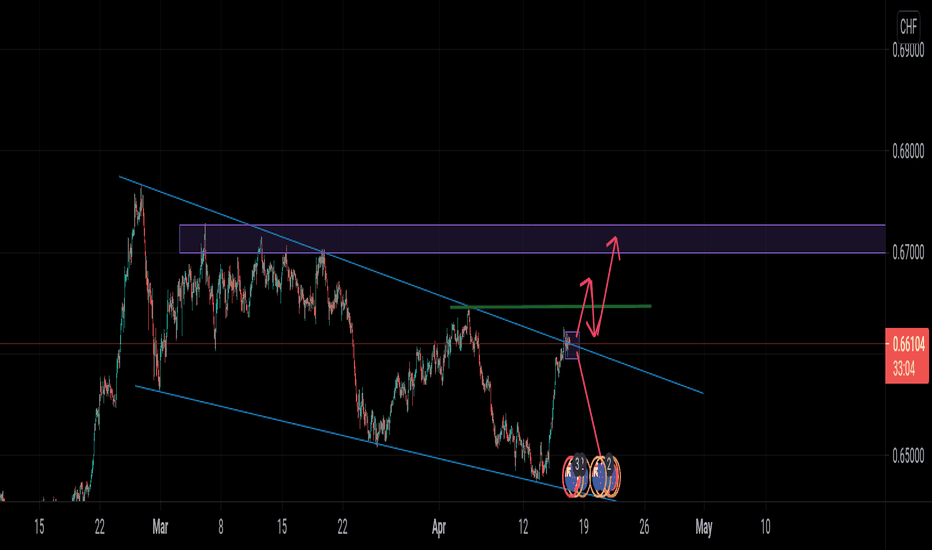

NZDCHF is facing bullish pressure, potential for further upside!Prices are facing bullish pressure from ascending trendline support and horizontal swing low support in line with 78.6% Fibonacci retracement and 78.6% Fibonacci extension. Prices might push up further towards 1st resistance in line with 161.8% Fibonacci retracement and 161.8% Fibonacci extension. If prices fall through 1st support, prices might take support on 2nd support which is in line with 127.2% Fibonacci retracement and 127.2% Fibonacci extension. EMA is also below prices, showing a bearish pressure for prices.

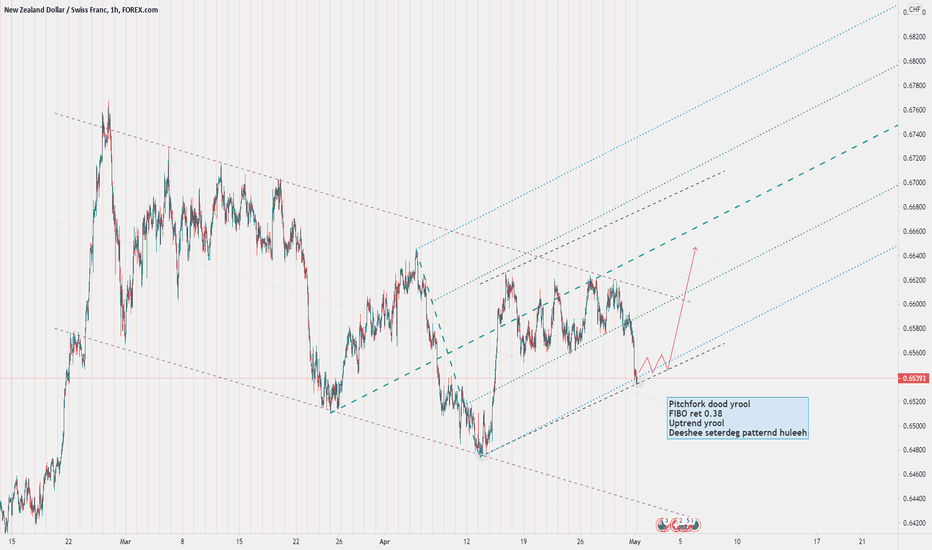

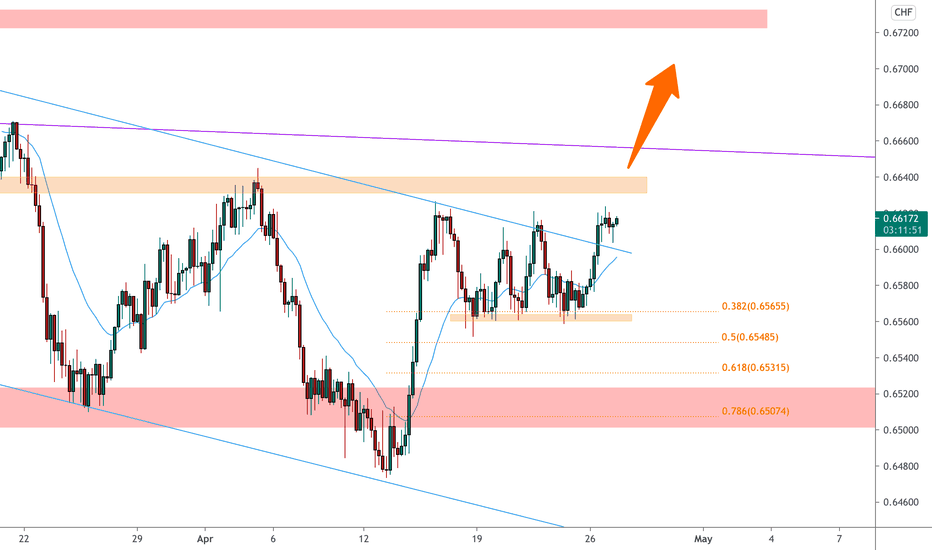

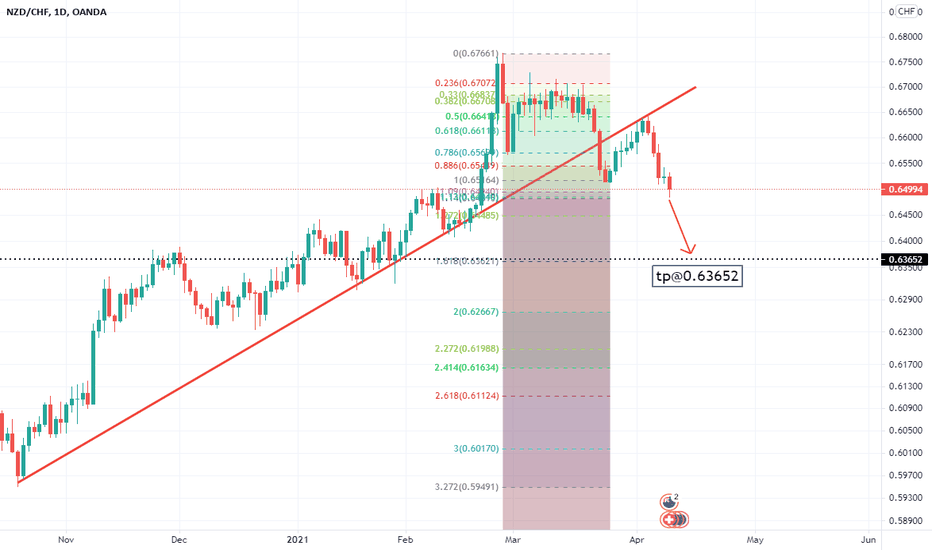

NZDCHF test the 0.382 🦐NZDCHF after the attempt to break below the weekly support started an impulse to the upside.

The market tested the descending trendline of the channel and consolidate over the 0.382 Fibonacci level.

According to Plancton's strategy if the conditions will be satisfied we will set a nice long order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

NZDCHF test the 0.382 🦐NZDCHF after the attempt to break below the weekly support started an impulse to the upside.

The market tested the descending trendline of the channel and consolidate over the 0.382 Fibonacci level.

According to Plancton's strategy if the conditions will be satisfied we will set a nice long order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

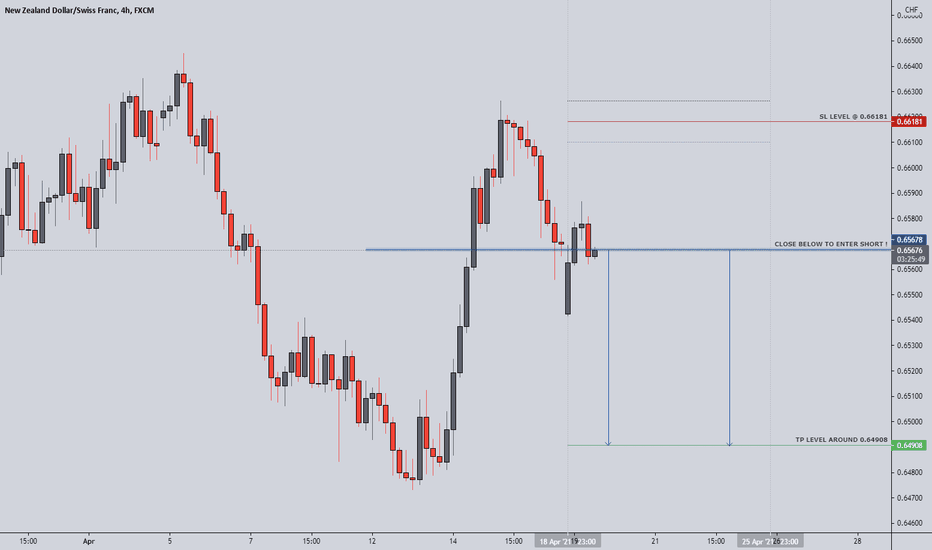

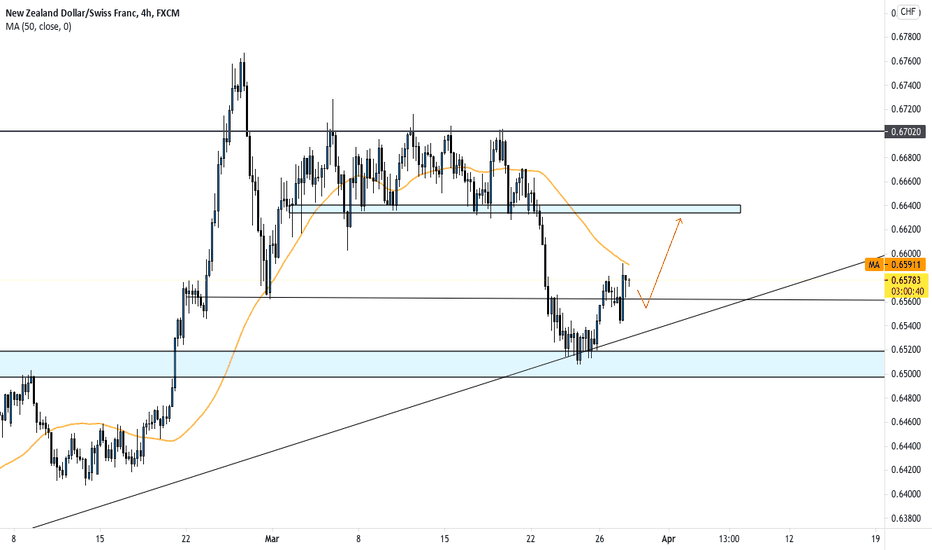

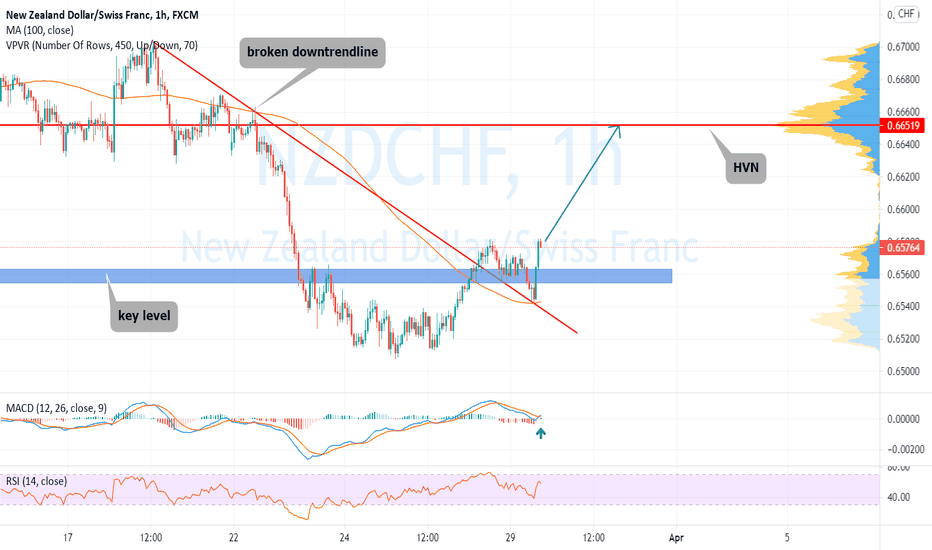

NZDCHF - FOREX - 19. APR. 2021Welcome to our weekly trade setup ( NZDCHF )!

-

1 HOUR

Bearish closure and price action.

4 HOUR

Expecting more bearish pressure.

DAILY

Looking for a break towards previous lows and support zone.

-

FOREX SETUP

SELL NZDCHF

ENTRY LEVEL @ 0.95670

SL @ 0.66180

TP @ 0.64910

Max Risk: 0.5% - 1%!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN

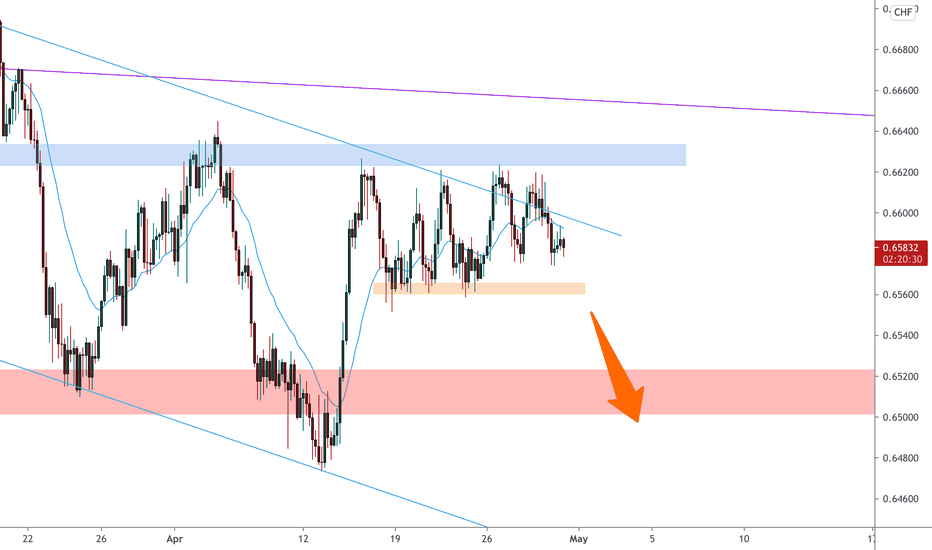

NZD/CHF AnalysisWelcome back! Please support this idea with a LIKE if you find it useful.

*** NZD/CHF - Will wait for a retracement and trend continuation to the downside.

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Brian Kenya Horton, BK Forex Academy

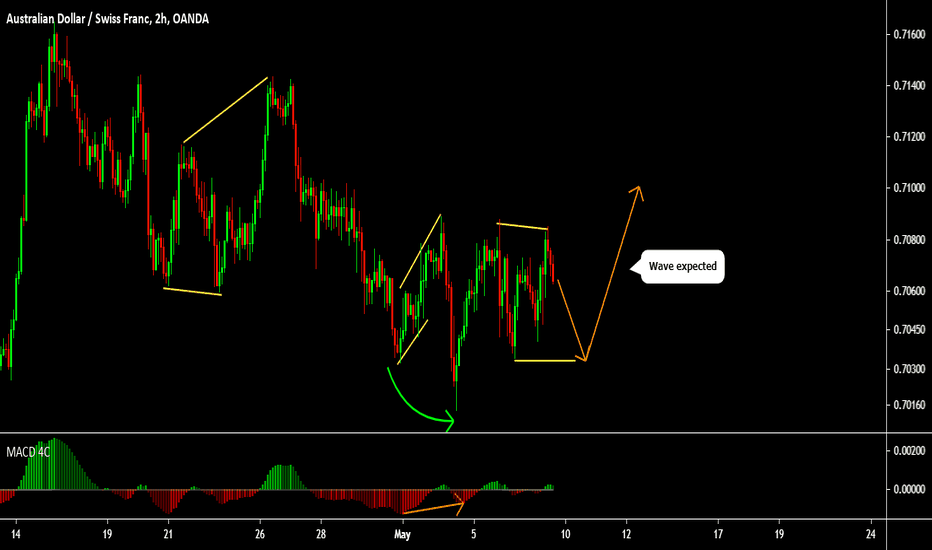

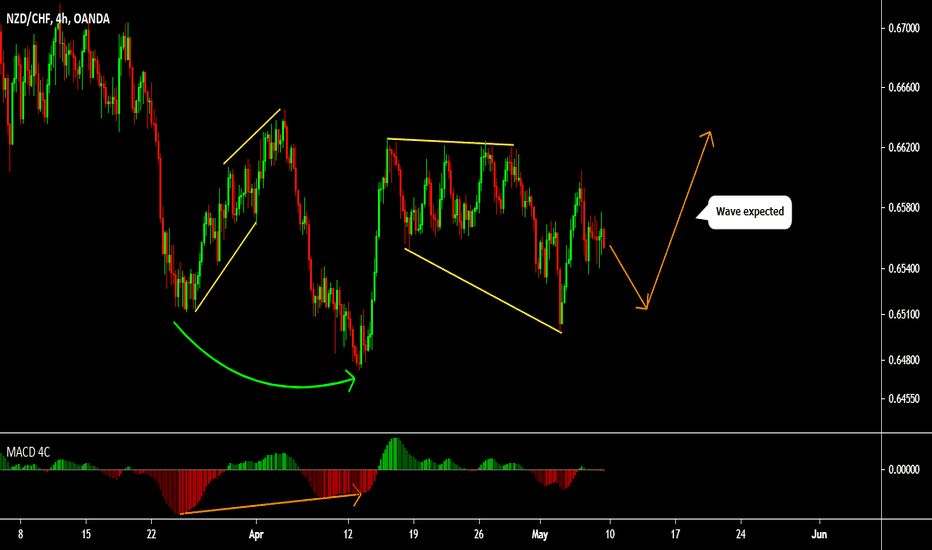

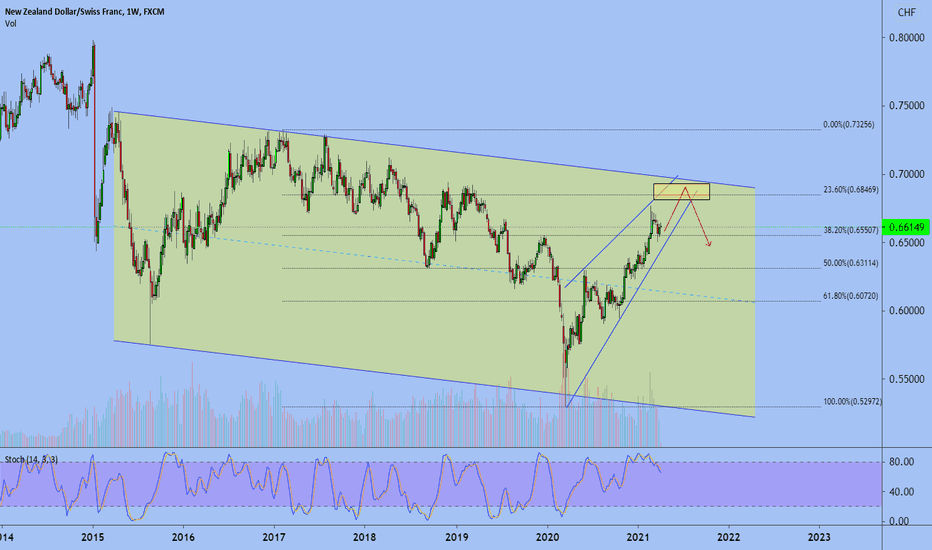

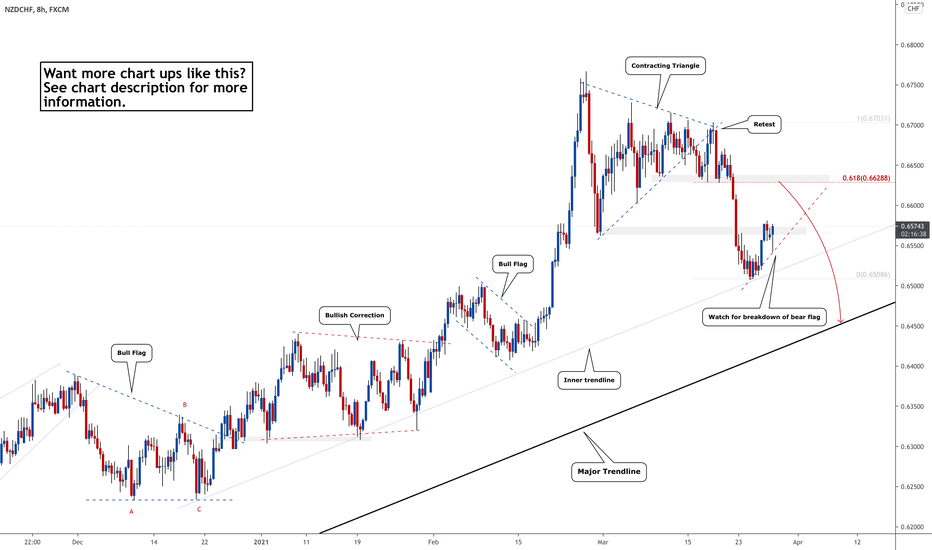

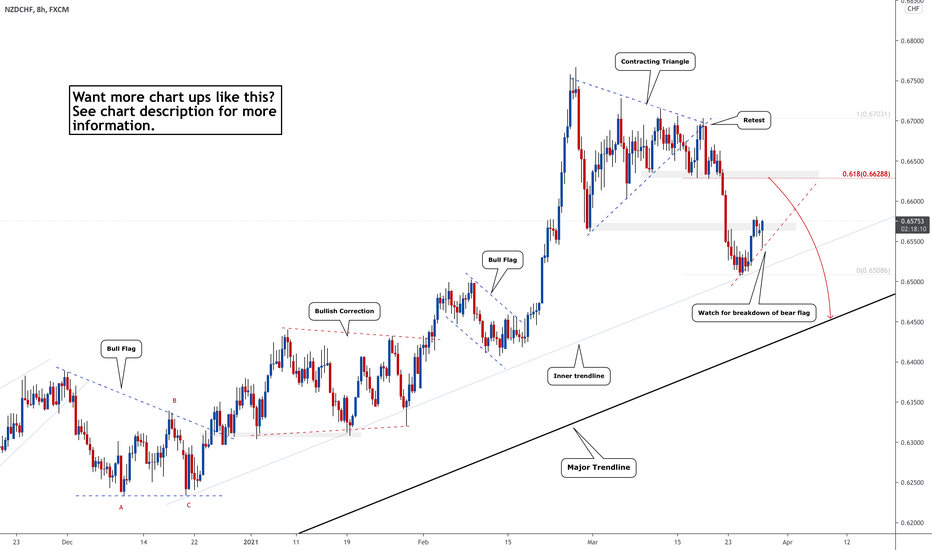

NZDCHF - Correction Overload!NZDCHF has been making beautiful bullish corrections all the way to the top. As we're anticipating NZD weakness, we can now look for shorting opportunities. We could possible be in a bear flag now leading to an area of interest. Watch for the flag to breakdown.

See linked chart on how to enter.

Goodluck and trade safe!

NZDCHF - Correction Overload!NZDCHf has been making beautiful bullish corrections all the way to the top. As we're anticipating NZD weakness, we can now look for shorting opportunities. We could possible be in a bear flag now leading to an area of interest. Watch for the flag to breakdown.

See linked chart on how to enter.

Goodluck and trade safe!

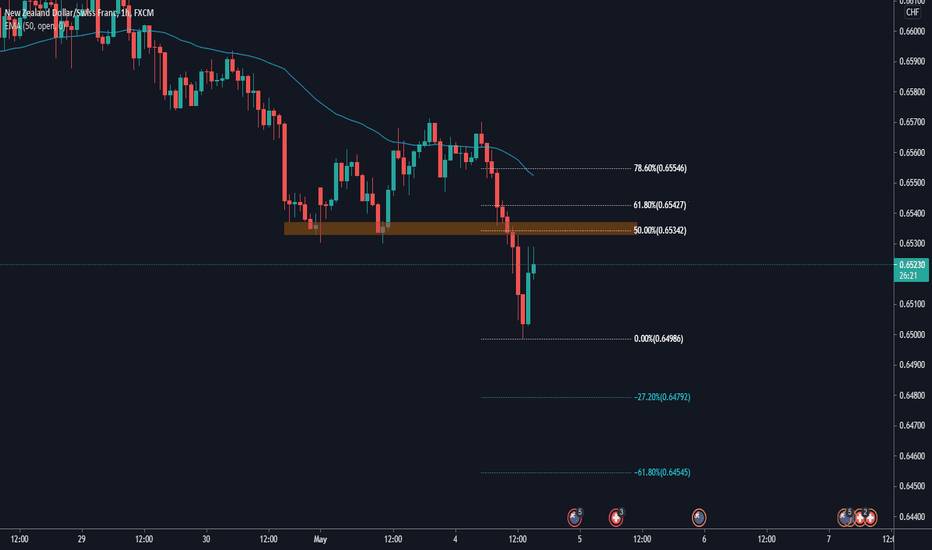

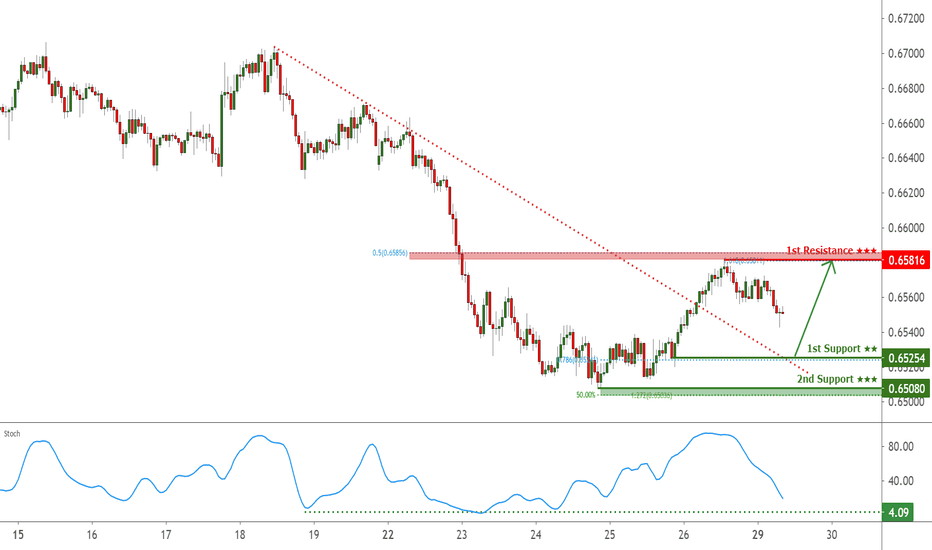

NZDCHF facing bullish pressure | 29 Mar 2021Prices are facing bullish pressure from 1st support which is in line with 78.6% fibonacci retracement and horizontal swing low support. Prices might push higher towards 1st resistance which is in line with 161.8% fibonacci retracement and 50% fibonacci retracement and horizontal swing high resistance. If prices fall through 1st support, prices might take support on 2nd support which is in line with 50% fibonacci extension and 127.2% fibonacci retracement . Stochastics is also showing that it is approaching 4.09 level support, potentially experiencing a bounce, in line with our analysis.

NZDCHF facing bullish pressure | 29 Mar 2021Prices are facing bullish pressure from 1st support which is in line with 78.6% fibonacci retracement and horizontal swing low support. Prices might push higher towards 1st resistance which is in line with 161.8% fibonacci retracement and 50% fibonacci retracement and horizontal swing high resistance. If prices fall through 1st support, prices might take support on 2nd support which is in line with 50% fibonacci extension and 127.2% fibonacci retracement. Stochastics is also showing that it is approaching 4.09 level support, potentially experiencing a bounce, in line with our analysis.

NZDCHF facing bullish pressure, potential for further upside!Prices are facing bullish pressure from 1st support which is in line with 78.6% fibonacci retracement and horizontal swing low support. Prices might push higher towards 1st resistance which is in line with 161.8% fibonacci retracement and 50% fibonacci retracement and horizontal swing high resistance. If prices fall through 1st support, prices might take support on 2nd support which is in line with 50% fibonacci extension and 127.2% fibonacci retracement. Stochastics is also showing that it is approaching 4.09 level support, potentially experiencing a bounce, in line with our analysis.

NZDCHF test the 0.382 🦐After our last analysis, NZDCHF moved lower due to a monthly trendline rejection, found a bottom and currently is retracing for a test of the 0.382 level.

The market found the resistance over a previous support area and according to PLancton's strategy if the price will break below we will set a nice short order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.