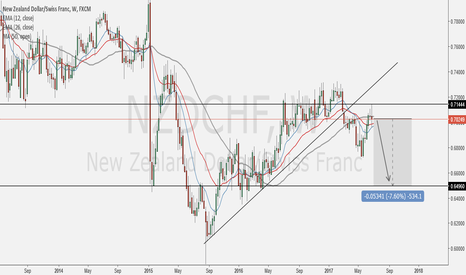

NZD/CHF could see breakoutFollowing a six-week depreciation against the Swiss Franc, the Kiwi managed to reverse early on September and recover half of the losses. This upward movement revealed the existence of a junior channel up. This pattern, however, is a part of a longer-period descending channel in force since mid-July.

The pair is gradually approaching the upper boundary of the senior pattern which is located near the 61.8% Fibonacci retracement and the weekly R2 circa 0.7120. It is likely that this area is reached on Monday. Given that ascending wedge is generally a bearish formation, the Kiwi should break out to the upside, possibly using the aforementioned 0.7120 area as a reversal point. Subsequently, the downside target could be the 200-hour SMA and the 38.2% Fibo near 0.7020 a breakout of which should pave the way for a further decline.

If nothing changes in the direction of the pair, it might test the lower boundary of the senior channel in the medium term.

NZD-CHF

Bullish NZDCHF for 8/218/18's candle closed above the 3 SMMA after closing below on 8/17. Therefore, I am expecting 8/21's candle to close above the 3 SMMA .

I will be looking for buy signals on the hour time frame that look similar the buy signal on the daily that you see here (candle close below 3 SMMA , then candle close above 3 SMMA ).

This is a day trading technique and I will not hold any position over night.

My plan is to place 2 trades once I get a buy signal on the hour time frame. One trade will have a 20 pip stop and a 20 pip take profit target. The second trade will have a 20 pip stop and no take profit target. The second trade is designed to grab any strong bullish movement for the day. Each trade is worth 1% of my beginning daily account value.

NZDCHF Wait For Break Out Then BuyNZDCHF is showing a promising buy setup in the making. The price is now approaching a resistance that has been tested twice before. So statistically the chances of it breking are only increasing. Besides that we also see that Stoch indicator has lots of upwards momentum left.

Possible target is 0.7776

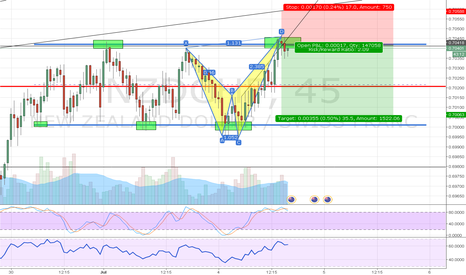

NZDCHF QUICK SHORT TO THE DOWNSIDEHi traders:

Here we have a quick opportunity to go short on NZDCHF. I am bias on bearish on all NZD pairs, and NZDCHF is one of them that gives a clearer entry point. We are seeing a nice bearish flag pattern developping on the 1 hr chart, and potential targeting the recent lows.

TP1: 0.6965

TP2: 0.0625

Thank you for your support and feedback.

NZDCHF Buy This BreakoutAfter breaking the upper range earlier today NZDCHF is now also breaking the 14 EMA, besides that the Stoch RSI also shows strong buying pressure and the ADX made a strong bullish crossover. This all together makes it very likely the NZDCHF will head to atleast the 72 EMA and possibly break it.

Buy: around 0,6770

TP: 0,6820 > 0.6890

SL: 0.6720

New Zealand Dollar / Swiss Franc DISCLAIMER: Hi everyone, I'm new to trading and this is just a log book for me on applying everything that I have learned and continue to learn as I go along. That being said, I do not advise you to base your trading on these "ideas".

Alright everyone, check this break of trend that happened these last two weeks. Didn't go too far though, hit previous support and bounced back up on the last hours of Friday's trading.

So lets wait for a break of previous support and confirmation of a trend reversal.

Here's a look at the hourly hitting the fibonacci retracement levels:

Practice patience. Safe trading!