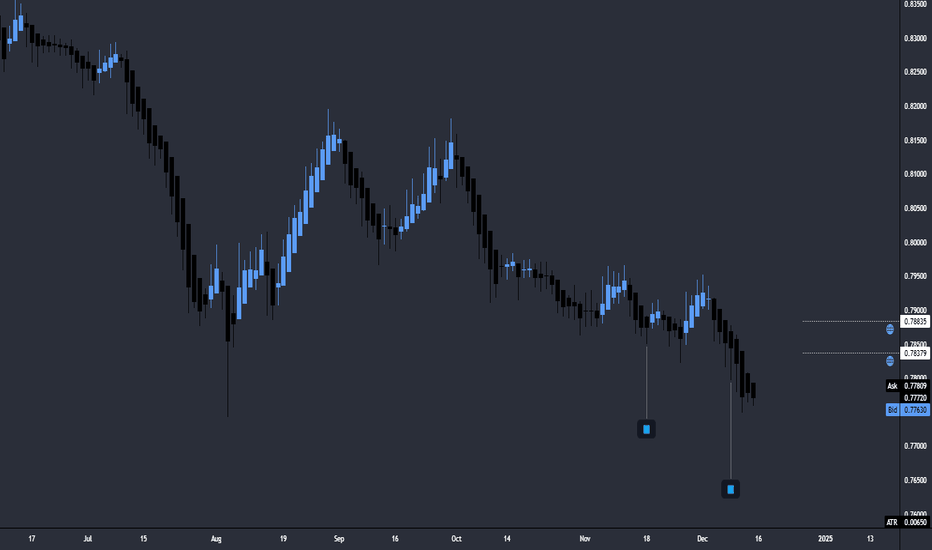

Nzd-sgd

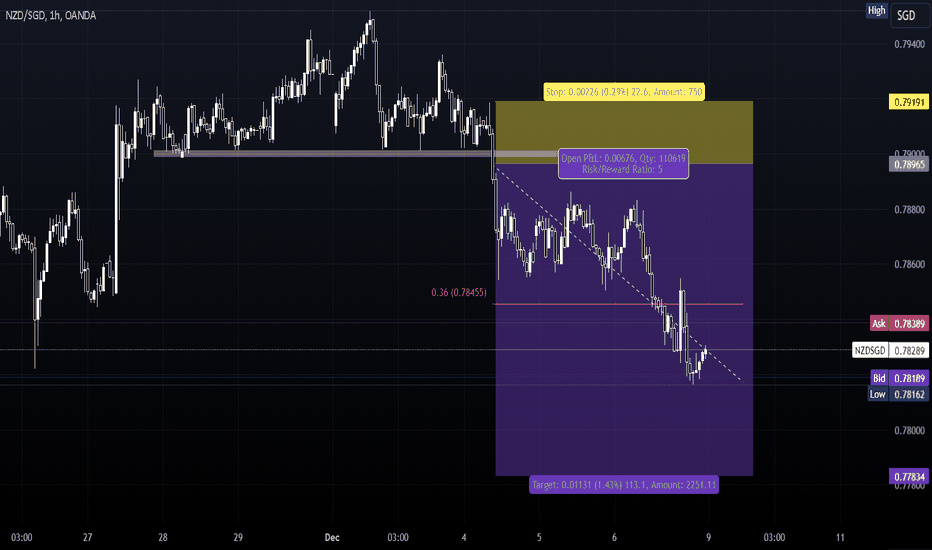

FOREX: NZDSGD Short made on 4/12/2024. 0 risk holding 1) This is a trade I am holding right now. The entry point is 0.78965. The stop loss was placed on

0.79191.

2) The current risk and reward ratio is 3 and we are still holding it.

3) We have execute of tracking take profit currently as it meets our requirement.

4) We are targeting 0.77834. It is my take profit.

Feel free to ask me anything:)

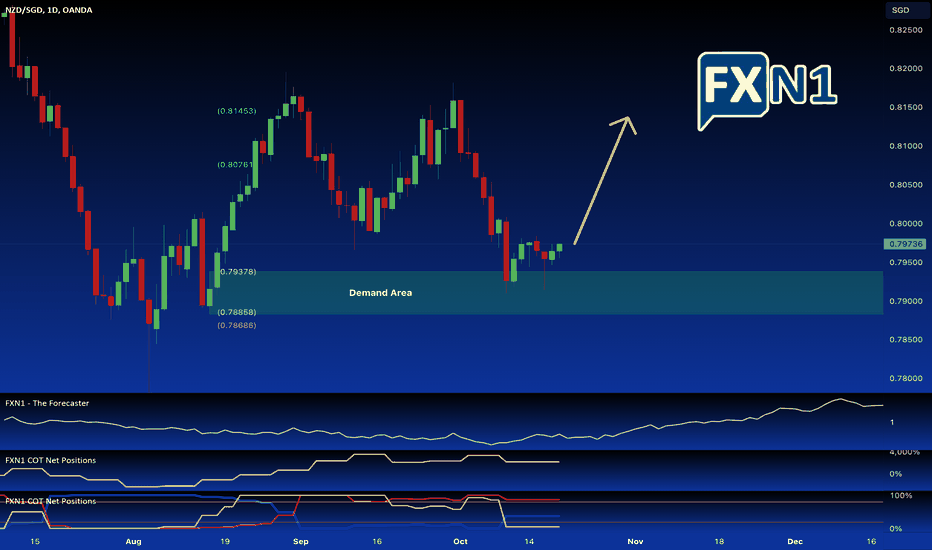

NZD/SGD Tests and Rejects Key Demand Area, Bullish Sentiment.Over the past three days, the NZD/SGD pair has retested a previous demand area and shown a clear rejection, signaling potential buying interest at this level. The Commitment of Traders (COT) report adds weight to this scenario, revealing that retail traders remain predominantly short, while "Smart Money"—institutional investors—are beginning to edge higher in their positioning.

Large speculators have already turned bullish, reflecting a growing confidence in the New Zealand Dollar (NZD) relative to the Singapore Dollar (SGD). This shift in sentiment could set the stage for a possible long setup, particularly as seasonal trends suggest further upside potential for NZD/SGD.

From a technical perspective, the rejection of the demand zone, combined with the bullish shift in institutional positioning, points to a potential upward move. Traders will be closely monitoring price action in the coming days for confirmation of a breakout, which could present an opportunity to enter long positions in alignment with the emerging bullish sentiment.

✅ Please share your thoughts about NZD/SGD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

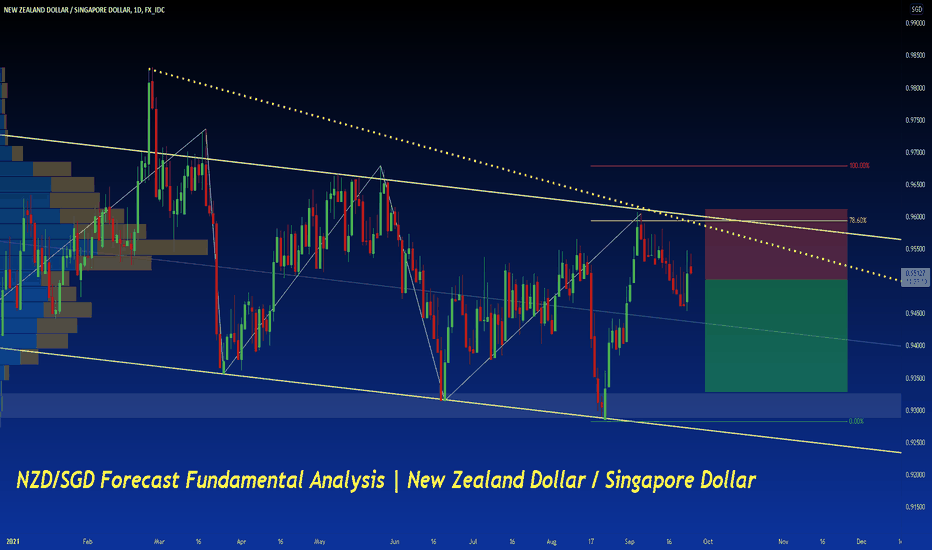

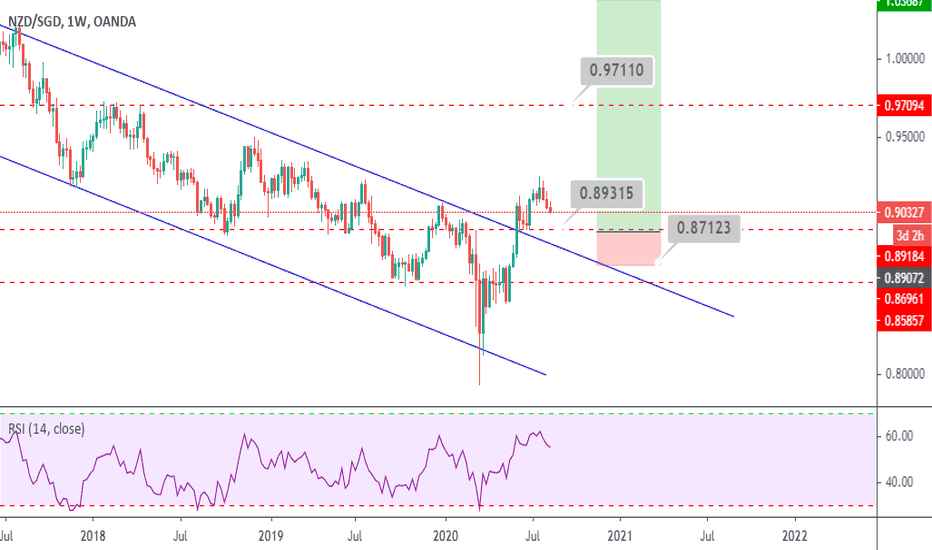

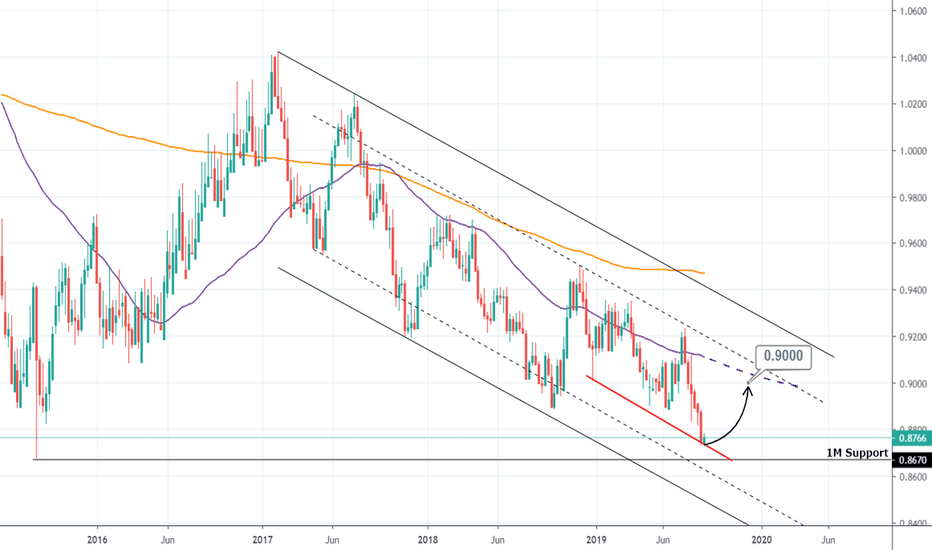

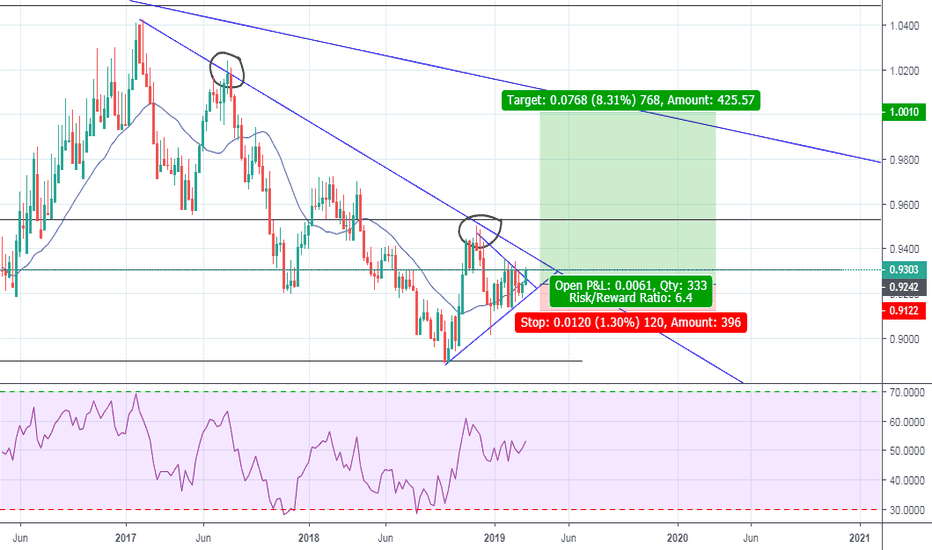

NZD/SGD : FORECAST FUNDAMENTAL ANALYSIS + NEXT TARGET POINTThe New Zealand Trade Balance for August was reported at -NZ$2,144M monthly and at -NZ$2,940M 12-month year-to-date. Forex traders can compare this to the New Zealand Trade Balance for July, reported at -NZ$397M monthly and -NZ$1,100M 12-month year-to-date. Exports for August were reported at NZ$4.35B and Imports at NZ$6.49B. Forex traders can compare this to Exports for July, reported at NZ$5.77B, and Imports, reported at NZ$6.17B.

Singapore Industrial Production for August increased 5.7% monthly and 11.2% annualized. Economists predicted an increase of 3.1% and 8.8%. Forex traders can compare this to Singapore Industrial Production for July, which decreased 2.8% monthly and increased 16.4% annualized.

The forecast for the NZD/SGD remains bearish after this currency pair has reached the top of its descending price channel.

Traders, if you like this idea or have your own opinion about it, please write your own in the comment box . We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

Have a Good Day Trading !

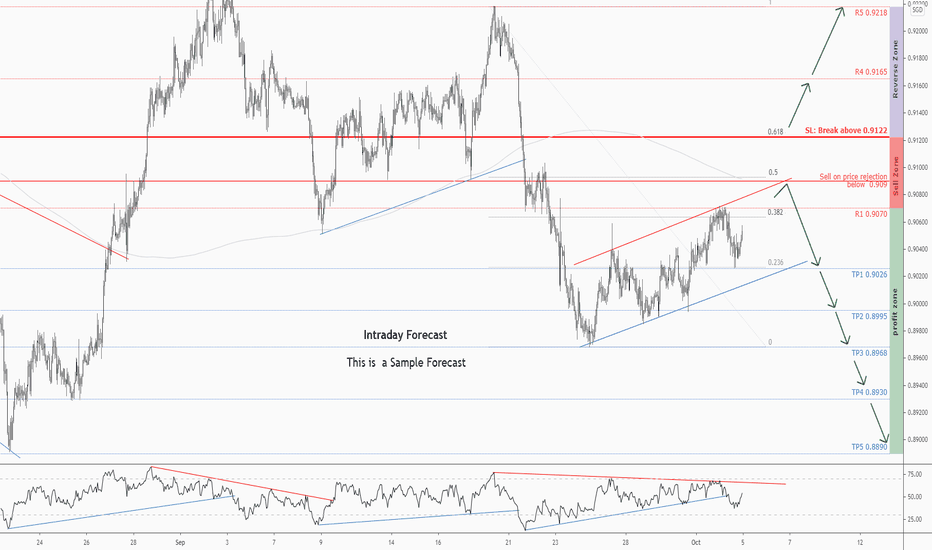

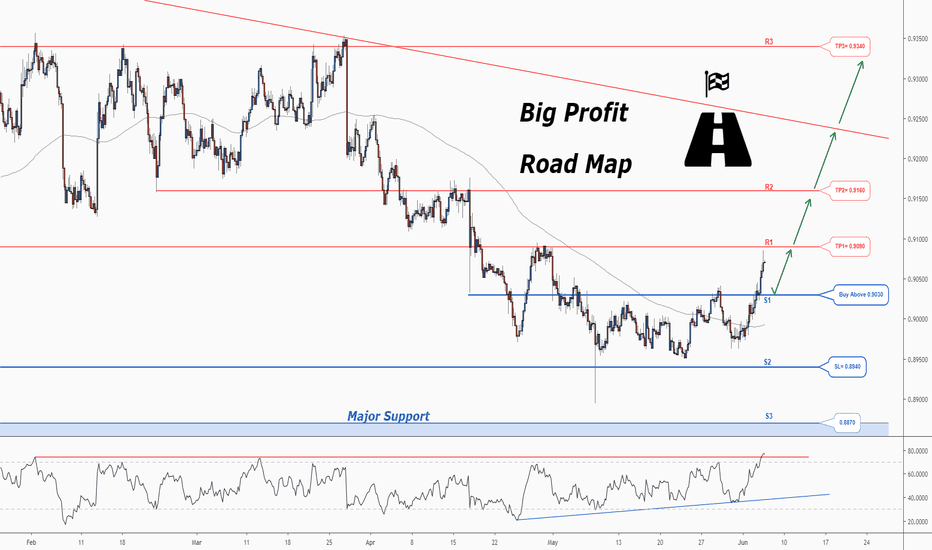

Don't miss the great sell opportunity in NZDSGDTrading suggestion:

. There is still a possibility of temporary retracement to suggested resistance line (0.909). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. NZDSGD is in a range bound and the beginning of downtrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 55.

Take Profits:

TP1= @ 0.9026

TP2= @ 0.8995

TP3= @ 0.8968

TP4= @ 0.8930

TP5= @ 0.8890

SL: Break Above R3

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

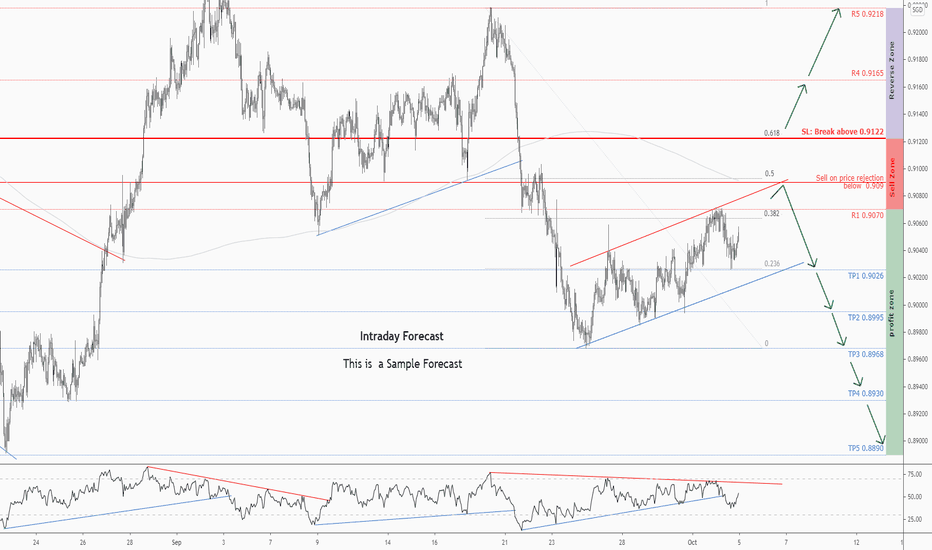

Don't miss the great sell opportunity in NZDSGDTrading suggestion:

. There is still a possibility of temporary retracement to suggested resistance line (0.909). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. NZDSGD is in a range bound and the beginning of downtrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 55.

Take Profits:

TP1= @ 0.9026

TP2= @ 0.8995

TP3= @ 0.8968

TP4= @ 0.8930

TP5= @ 0.8890

SL: Break Above R3

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

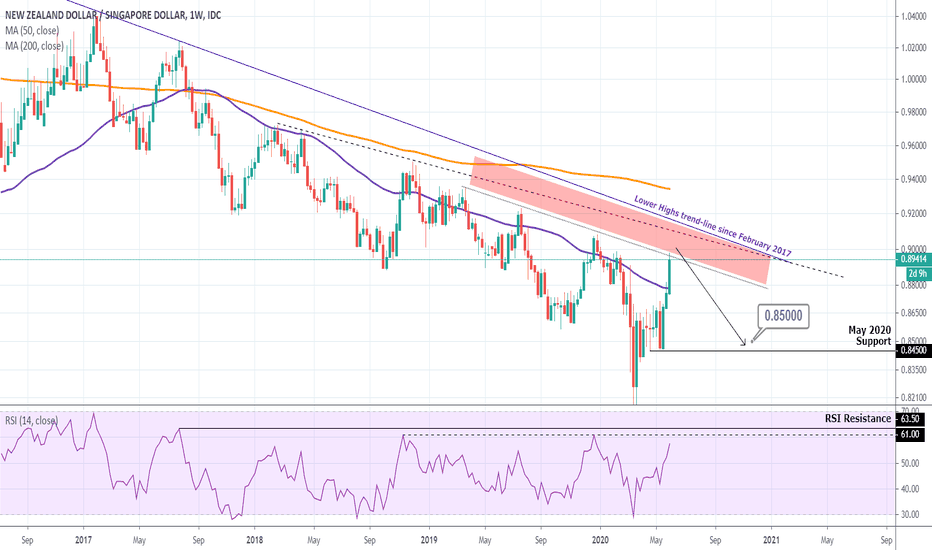

NZDSGD Sell SignalPattern: Lower Highs on 1W since February 2017.

Signal: Bearish as the price is entering the Lower Highs Zone (red Rectangle) from March 2019.

Target: 0.85000 (just above the 0.8450 May 2020 Support).

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

Previous NZDSGD signal:

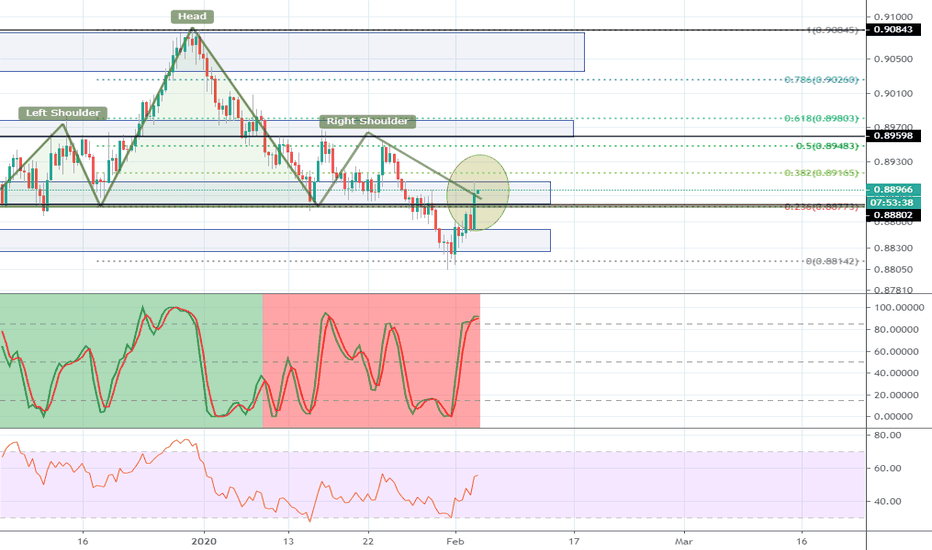

NZDSGDTF: 8 Hr

Very clean and interesting completed H and S pattern following a previous uptrend. Currently the markets for NZD/AUD (risk currencies) are pulling back from recent declines due to global fears (trade wars, coronavirus, US tension in middle east etc.).

I am looking to see if current price can close down below blue supply/demand zone (H and S neckline). If this is the case, more downtrend can be expected as this would be a rejection at the broken neckline. Fibs are on the chart for possible rejection zones.

If trend continues down I would like to see price test 0.8750 zone. This area would be thee 0.618 fib retracement of the last bull run (late november to December). A bounce here would confirm previous resistance area turned to support. From there massive upside and continuation of the uptrend in my opinion.

Keep in mind we have some high impact NZD news today and yesterday RBA held the interest rate which sparked a large bullish spike in AUD and NZD pairs. Risk off is still in play and this current correction could lead to further downside. If price spikes and continues higher, then idea is invalid

See here for 0.618 and previous resistance confluence:

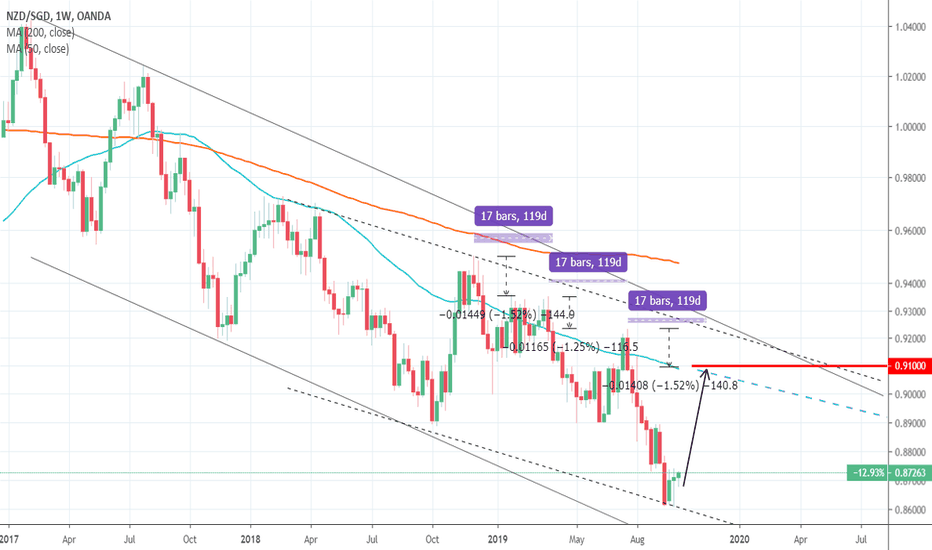

NZDSGD: Strong Buy opportunity within the Channel Down.The pair has been trading within a long term 1M Channel Down (RSI = 37.426, MACD = -0.018, Highs/Lows = -0.0198) that only recently made a Lower Low and is rebounding on the 3rd straight green 1W candle.

Based on the duration and decline of the previous Lower Highs, we are expecting the next Lower High to be towards 0.91000, where it will make contact with the 1W MA50, which has always provided a rejection in the past 2 years.

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

NZDSGD: Long opportunity within a 1M Channel Down.The pair has been trading within a 1M Channel Down (RSI = 35.152, MACD = -0.017, Highs/Lows = -0.0297) since January 2017. Currently it is closer to the Lower Low zone and since through-out this downtrend it has always made contact with the 1W MA50, we are expecting a rise towards at least 0.9000.

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

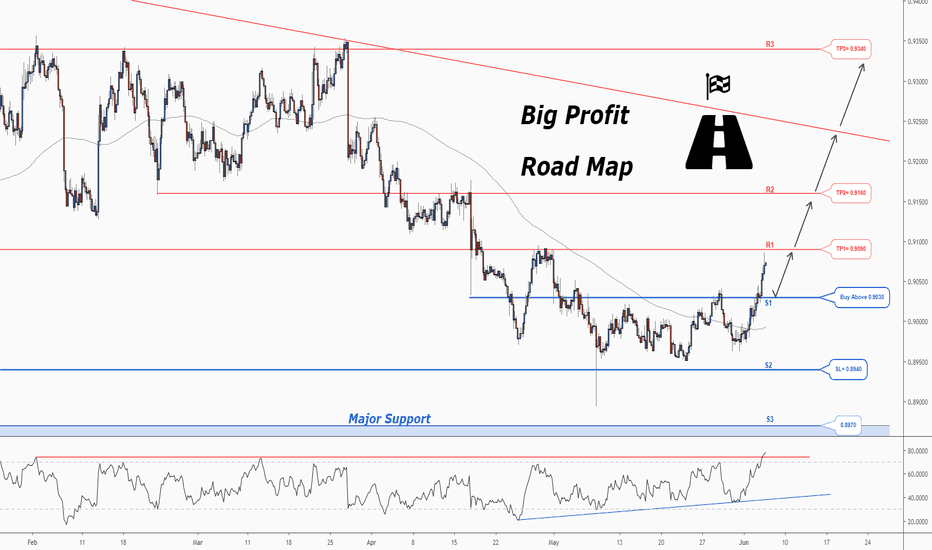

There is a trading opportunity to buy in NZDSGDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (0.9030). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. NZDSGD is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 77.

Take Profits:

TP1= @ 0.9090

TP2= @ 0.9160

TP3= @ 0.9340

SL= @ 0.8940

There is a trading opportunity to buy in NZDSGDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (0.9030). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. NZDSGD is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 77.

Take Profits:

TP1= @ 0.9090

TP2= @ 0.9160

TP3= @ 0.9340

SL= @ 0.8940

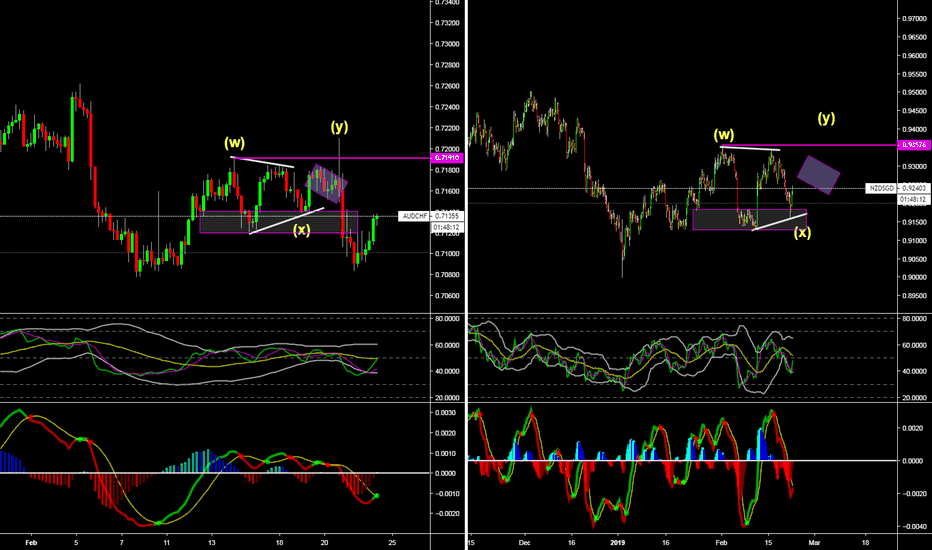

NZD/SGDJust showing you that NZD/SGD's pattern seems to be incomplete. So I would expect break of the last high. That is a contracted flat though which always means it can turn into a regular flat. But if you get a flag like Aud/Chf did, look to buy to break the high would probably be the safest type setup from here....

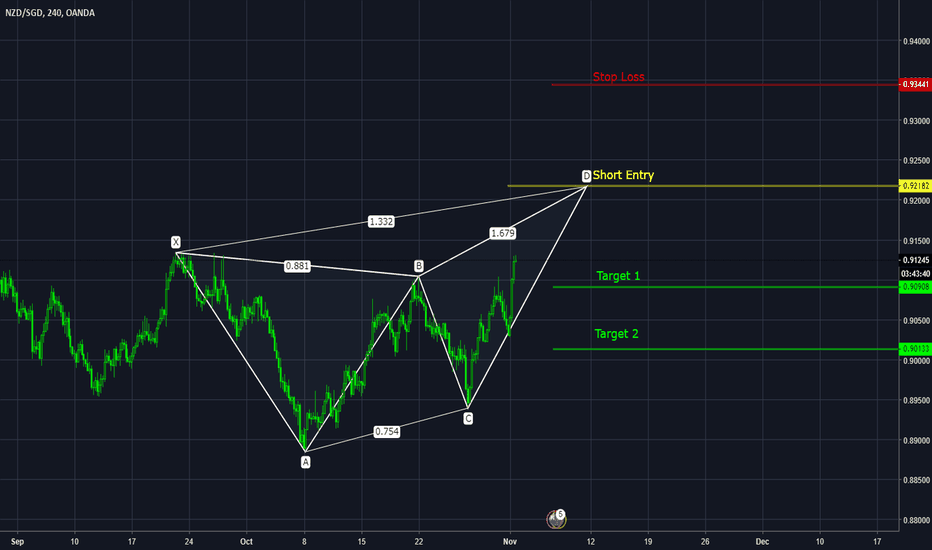

NZDSGD: Long term short opportunity.The pair has been trading inside a 12-month long Channel Down pattern on 1M (MACD = -0.013, B/BP = -0.0366) and the neutral RSI = 45.338, Highs/Lows = 0.0000 indicate that we are close to a bearish reversal point following the rise since the beginning of the year. The Channel's Lower High was placed earlier in December and we have a long term bearish leg ahead of us in search of the Lower Low. As measured, this should be within 0.85239 - 0.85750. However we are following a more sensible medium term TP of 0.8900 (the previous Lower Low).

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Lower High on 1W Channel Down. Short.NZDSGD has just priced a Lower High on its 1W Channel Down (RSI = 35.543, MACD = -0.009, Highs/Lows = -0.0089, B/BP = -0.0174). 1D has just touched its 50% Fibonacci retracement point (STOCHRSI = 54.611, ADX = 20.663, Highs/Lows = 0.0000) and is expected to make a swift 100% completion. We are targeting the cross of the channel's intermediate and Lower Low inner extension so TP = 0.89015.