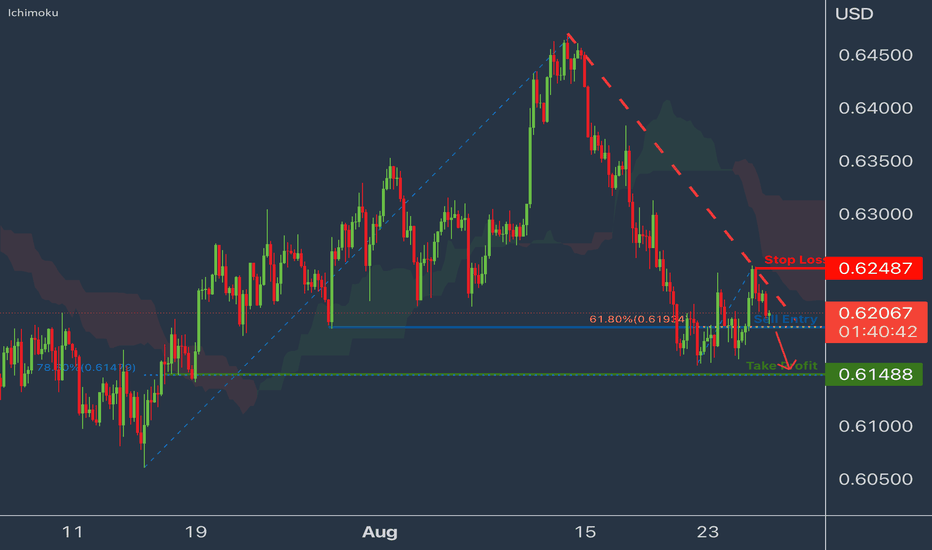

NZDUSD Potential for Bearish MomentumOn the H4, with price moving within the descending trendline and below the ichimoku indicator, we have a bearish bias that price will drop from sell entry at 0.62056, where the overlap support and 61.8% fibonacci retracement are to the take profit at 0.61488, where the swing low and 78.6% fibonacci retracement are. Alternatively, price could rise to stop loss at 0.62487, which is in line with the previous swing high.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD-USD

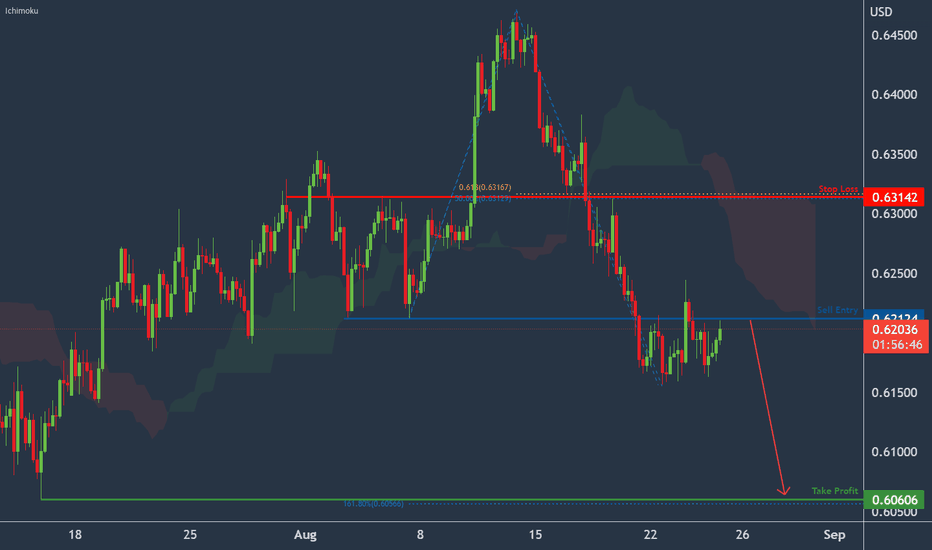

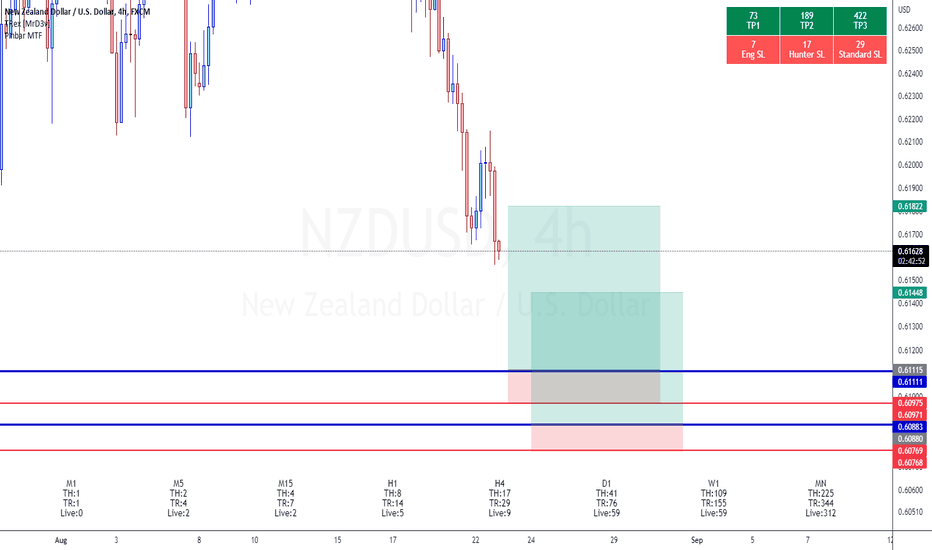

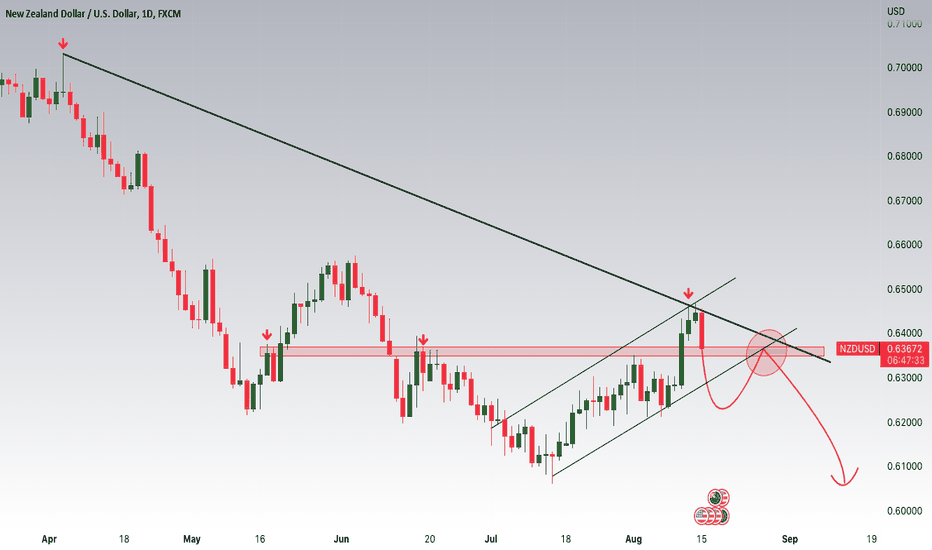

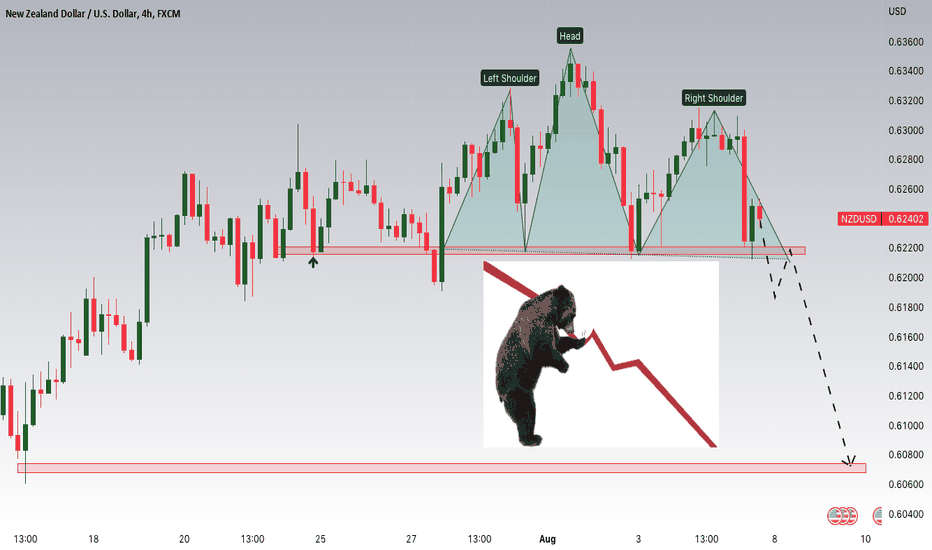

NZDUSD Potential Bearish ContinuationOn the H4, with price moving below the ichimoku indicator, we have a bearish bias that price will drop from sell entry at 0.62124 where the pullback overlap resistance is to the take profit at 0.60606 where the swing low support and 161.8% fibonacci extension are. Alternatively, price could break entry structure and rise to stop loss at 0.63142 where the overlap resistance, 50% fibonacci retracement and 61.8% fibonacci projection are.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

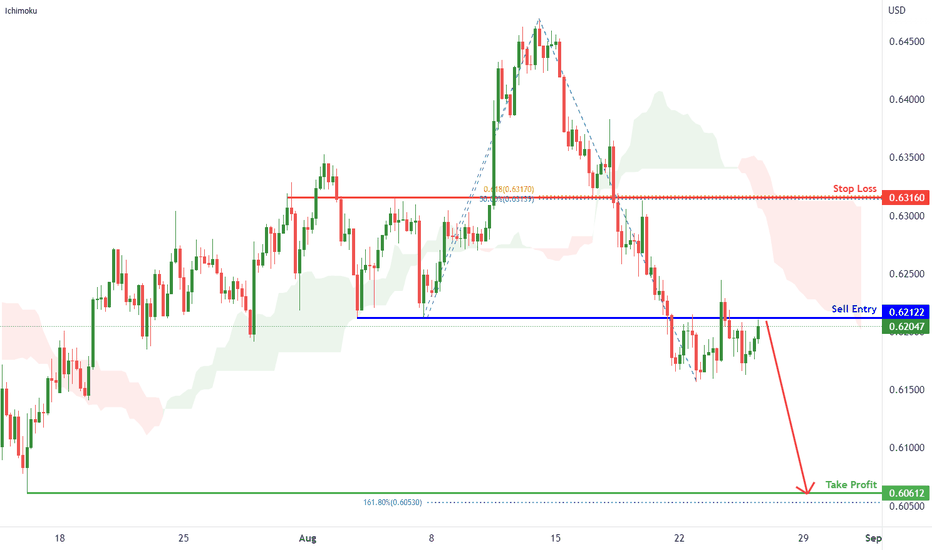

NZDUSD Potential for bearish drop | 25th August 2022On the H4, with price moving below the ichimoku indicator, we have a bearish bias that price will drop from sell entry at 0.62122 where the pullback overlap resistance is to the take profit at 0.60612 where the swing low support and 161.8% fibonacci extension are. Alternatively, price could break entry structure and rise to stop loss at 0.63160 where the overlap resistance, 50% fibonacci retracement and 61.8% fibonacci projection are.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

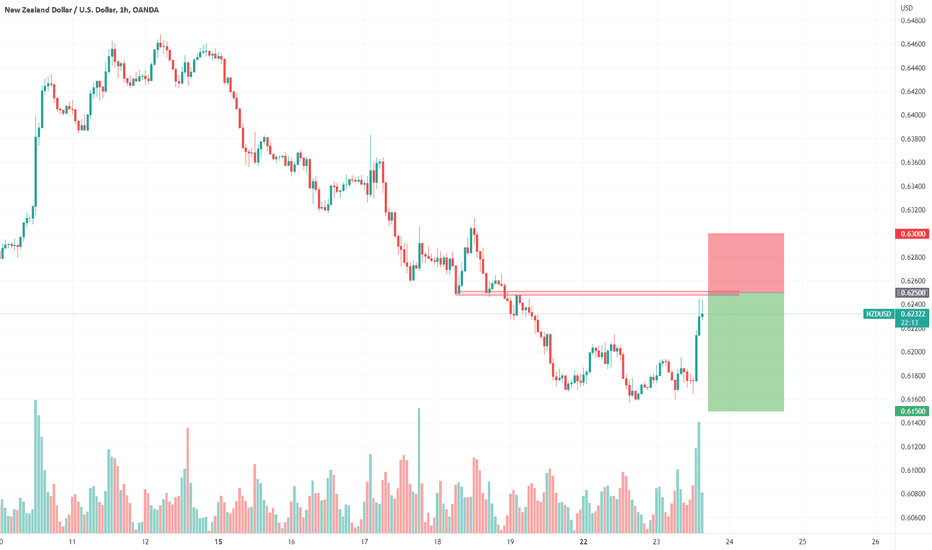

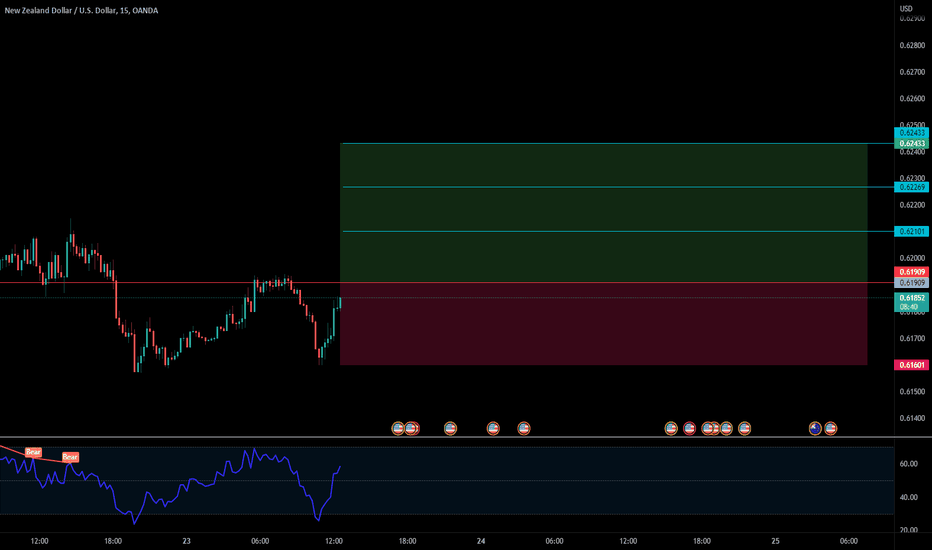

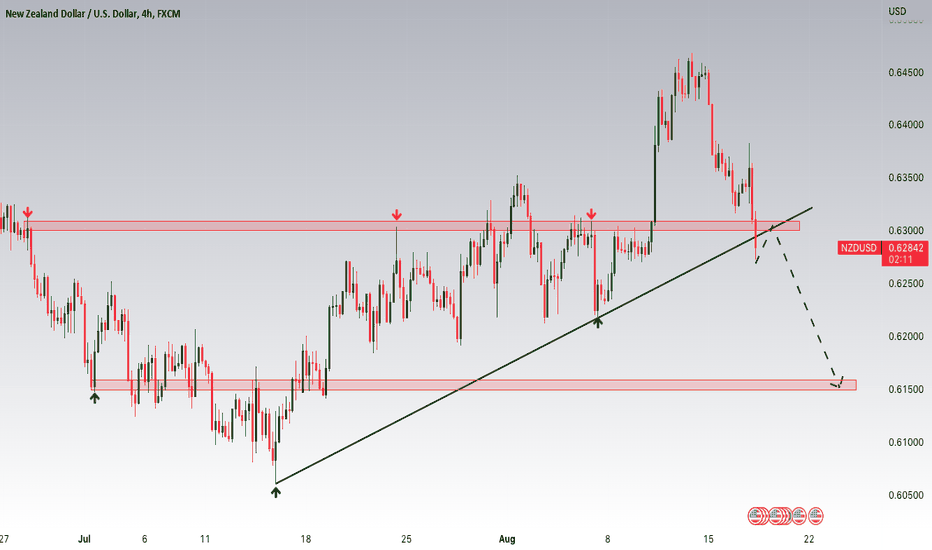

Selling rallies on NZDUSDNZDUSD - Intraday - We look to Sell at 0.6250 (stop at 0.6300)

Previous support located at 0.6200. Previous resistance located at 0.6250. Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 0.6250, resulting in improved risk/reward. A move through 0.6200 will confirm the bearish momentum.

Our profit targets will be 0.6150 and 0.6125

Resistance: 0.6250 / 0.6300 / 0.6325

Support: 0.6200 / 0.6150 / 0.6125

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

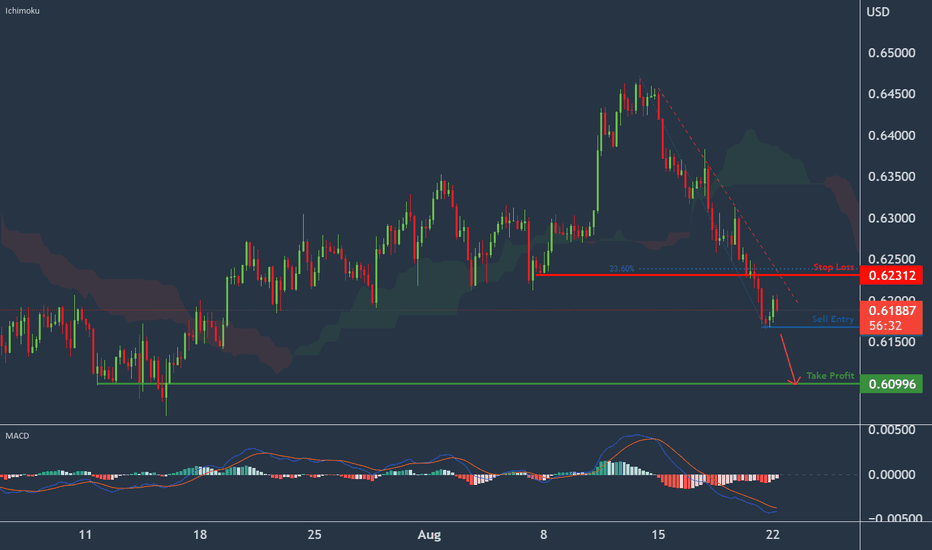

NZDUSD Potential for Bearish ContinuationOn the H4, with the price moving within the descending trendline, below ichimoku cloud and MACD indicators are below zero, we have a bearish bias that the price may drop from the sell entry at 0.61885, which is in line with the pervious swing low to the take profit at 0.60996, which is in line with the swing low. Alternatively, the price may rise to the stop loss at 0.62312, where the 23.6% fibonacci retracement is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

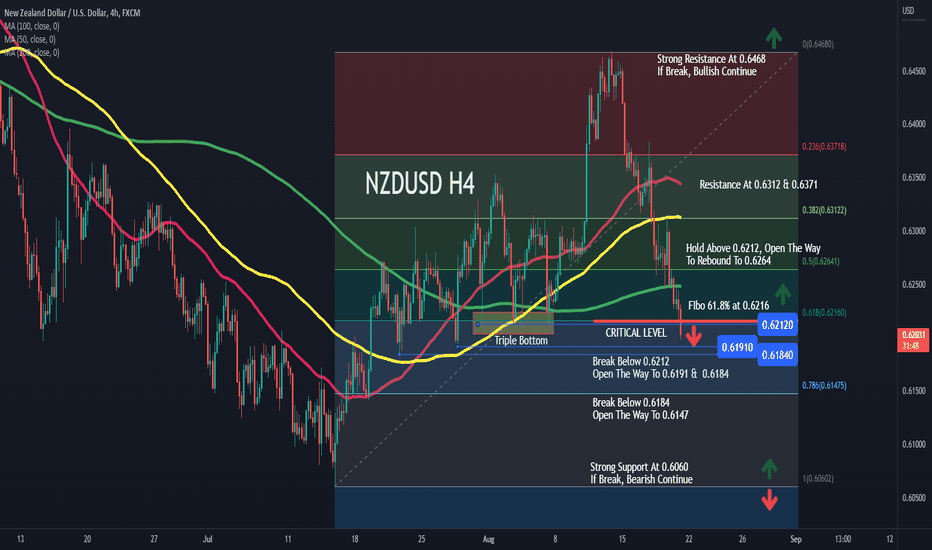

NZDUSD H4, BREAK CRITICAL POINT 0.6212 To 0.6191 & 0.6184NZDUSD Break critical level at 0.6212 and Fibo 61.8% at 0.6216.

Break Below 0.6212 then Open The Way To 0.6191 & 0.6184.

Break Below 0.6184, then Open The Way To 0.6147.

Strong Support At 0.6060. If Break, Bearish Continue.

But Hold Above 0.6212, Open The Way To Rebound To 0.6264.

Resistance At 0.6312 & 0.6371.

Strong Resistance At 0.6468, If Break, Bullish Continue.

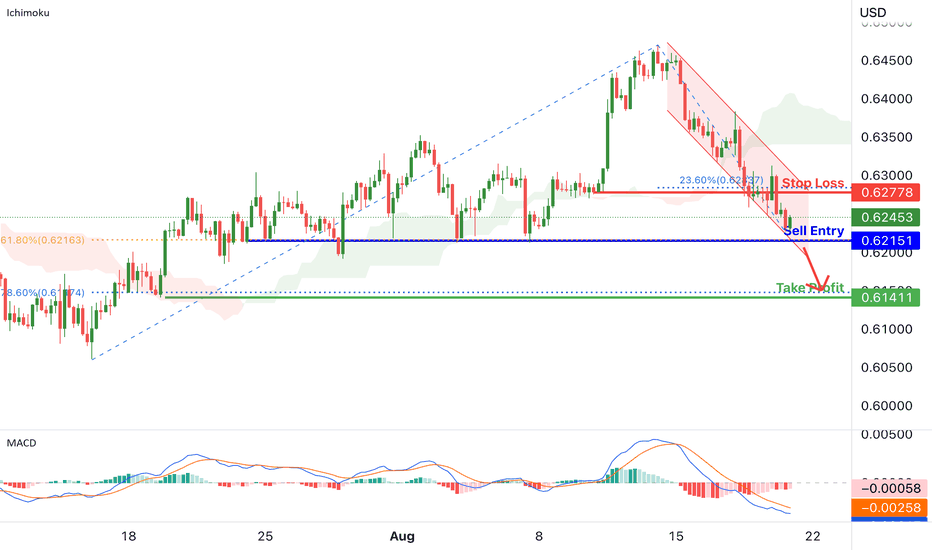

NZDUSD Potential for Bearish Drop| 19th August 2022On the H4, with the price moving within the descending channel, below ichimoku cloud and MACD indicators are below zero, we have a bearish bias that the price may drop from the sell entry at 0.62151, which is in line with the 61.8% fibonacci retracement and pervious swing lows to the take profit at 0.61411, which is in line with the swing low and 78.6% fibonacci retracement. Alternatively, the price may rise to the stop loss at 0.62778, where the 23.6% fibonacci retracement is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

NZDUSD selloff is showing no sign of endingNZDUSD - Intraday - We look to Sell at 0.6325 (stop at 0.6375)

Previous support located at 0.6250. Previous resistance located at 0.6300. There is no indication that the selloff is coming to an end. Risk/Reward would be poor to call a sell from current levels. A move through 0.6250 will confirm the bearish momentum.

Our profit targets will be 0.6225 and 0.6200

Resistance: 0.6300 / 0.6325 / 0.6350

Support: 0.6250 / 0.6225 / 0.6200

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

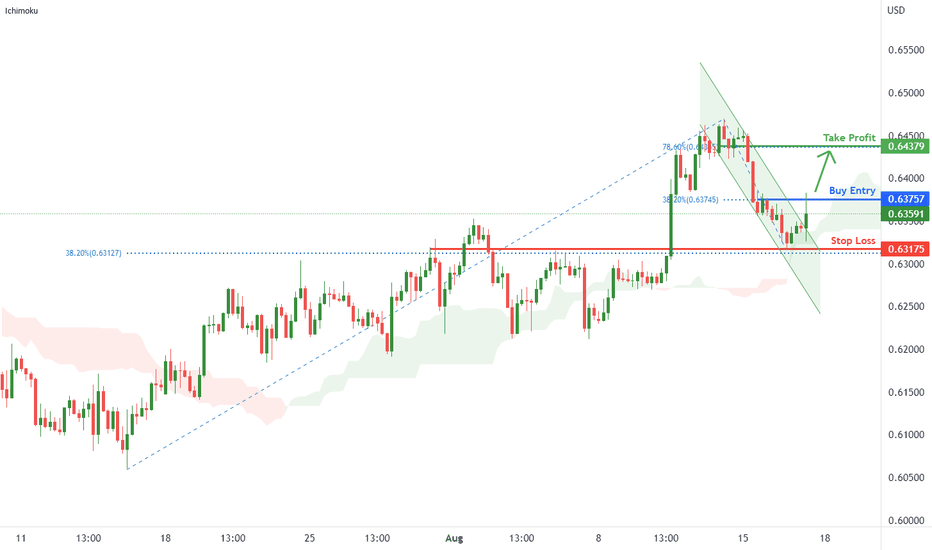

NZDUSD Potential for Bullish Rise| 17th August 2022On the H4, with the price breaking the descending channel and above ichimoku cloud, we have a bullish bias that the price may rise from the buy entry at 0.63757, which is in line with the 38.2% fibonacci retracement to the take profit at 0.64379, which is in line with the 78.6% fibonacci retracement. Alternatively, the price may drop to the stop loss at 0.63175, where the 38.2% fibonacci retracement and pullback support is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

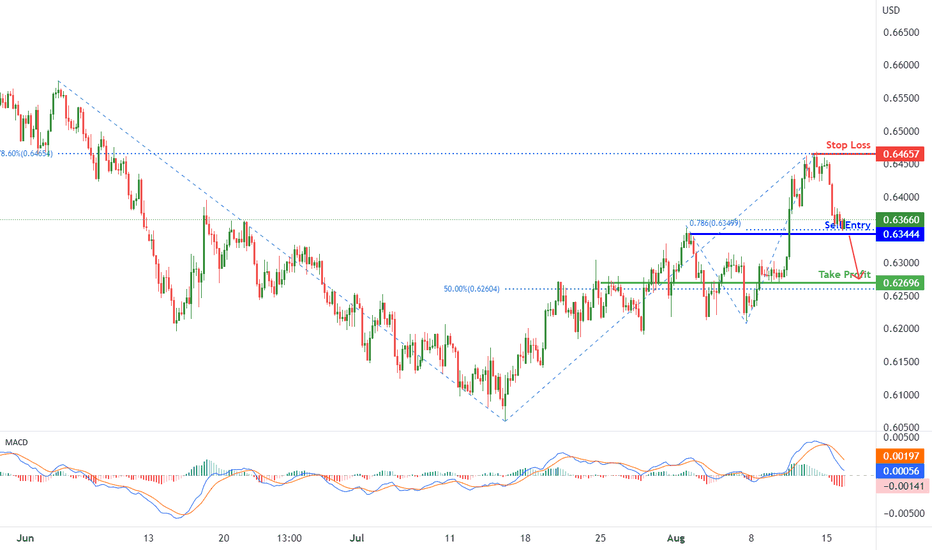

NZDUSD Potential for Bearish Drop| 16th August 2022On the H4, with the MACD histograms are under zero and DIF crossing below the signal line, we have a bearish bias that the price may drop from the sell entry at 0.63444, which is in line with the 78.6% fibonacci retracement and pullback support to the take profit at 0.62696, which is in line with the 50% fibonacci retracement. Alternatively, the price may rise to the stop loss at 0.64657, which is in line with the swing high and 78.6% fibonacci retracement.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

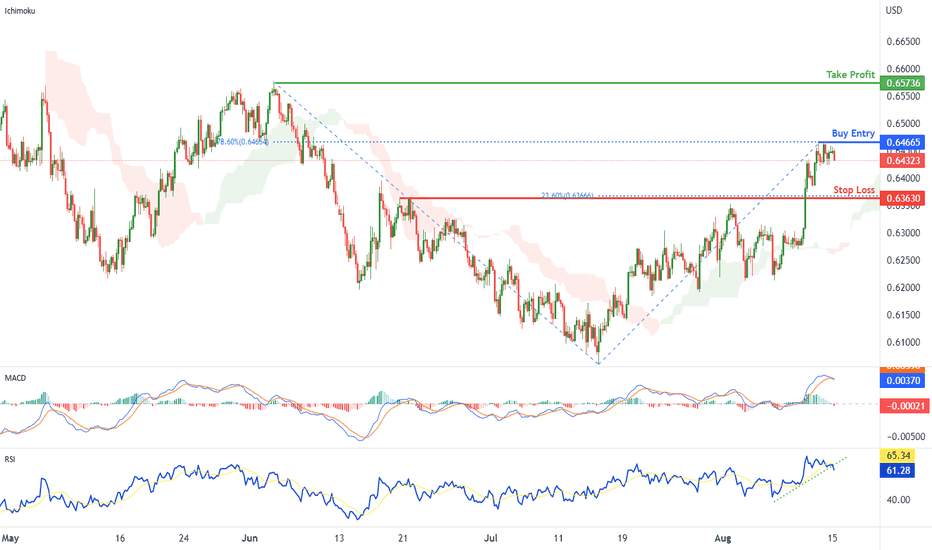

NZDUSD Potential for Bullish Continuation | 15th August 2022On the H4, with the price is over ichimoku cloud and RSI is moving along the ascending trendline, we have a bullish bias that price may rise from the buy entry at 0.64665, where the swing high and 78.6% fibonacci retracement are to the take profit at 0.65736 where the swing high is. Alternatively, as the MACD histograms are under zero, and DIF is almost crossing the signal line, the price may drop to the stop loss at 0.63630 which is in line with 23.6% fibonacci retracement and overlap support.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

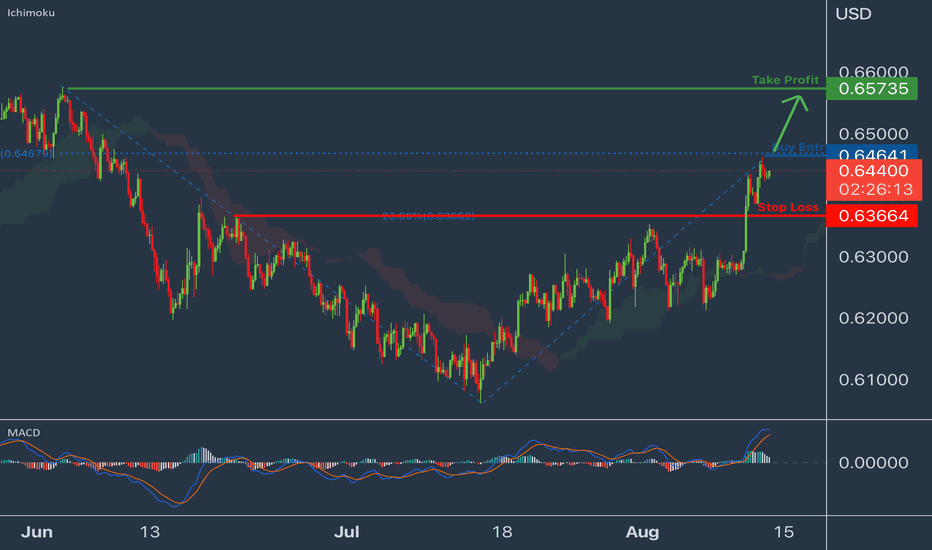

USDCAD Potential for Bullish MomentumOn the H4, with the price is over ichimoku cloud and MACD histograms are above zero axis, we have a bullish bias that price may rise from the buy entry at 0.64641, where the swing high and 78.6% fibonacci retracement are to the take profit at 0.65735 where the swing high is. Alternatively, price may drop to the stop loss at 0.63664 which is in line with 23.6% fibonacci retracement and overlap support.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

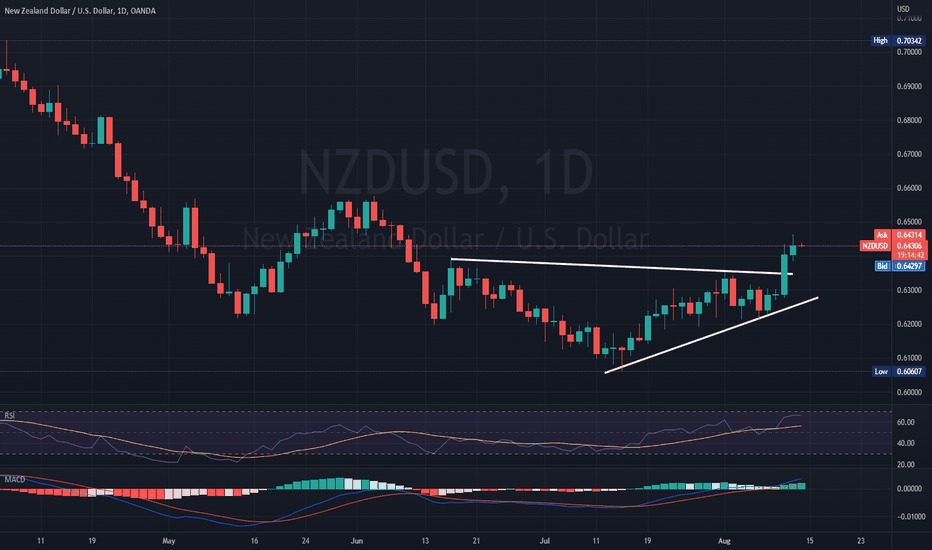

NZDUSD BULLISH PATTERNThe New Zealand dollar keeps gaining against the USD after the data that US CPI is not as high as anticipated. The pair broke the support level of the triangle pattern and it is heading for a bullish move.

If the breakthrough remains genuine the pair might strive to reach price of 0.654, but if the move does not happen, it might revert to its previous low at 0.627.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

NZDUSD Potential for Bullish Rise | 11th August 2022On the H4, with the price is over ichimoku cloud and MACD histograms are above zero axis, we have a bullish bias that price may rise from the buy entry at 0.63834, where the pullback resistance, 23.6% fibonacci retracement and swing high are to the take profit at 0.64646 where the 78.6% fibonacci retracement and pullback support are. Alternatively, price may drop to the stop loss at 0.63021 which is in line with 38.2% fibonacci retracement.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

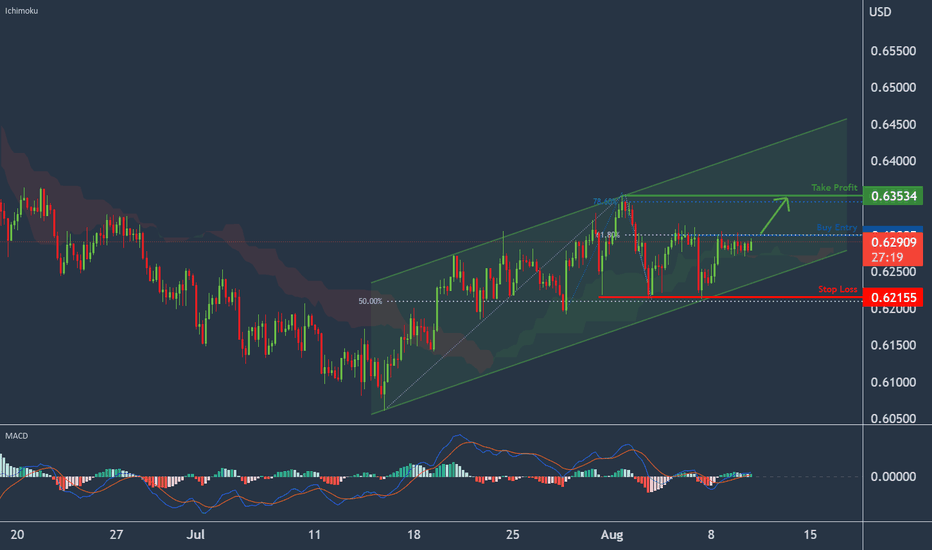

NZDUSD Potential for Bullish ContinuationOn the H4, with price moving along the ascending channel, above the ichimoku cloud and the histogram is above zero axis, we have a bullish bias that price may rise from the buy entry at 0.62995 where overlap resistance is to the take profit at 0.63534 where 78.6% fibonacci projection is. Alternatively, price may drop to stop loss at 0.62155 where the swing low support and 50% fibonacci retracement are.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

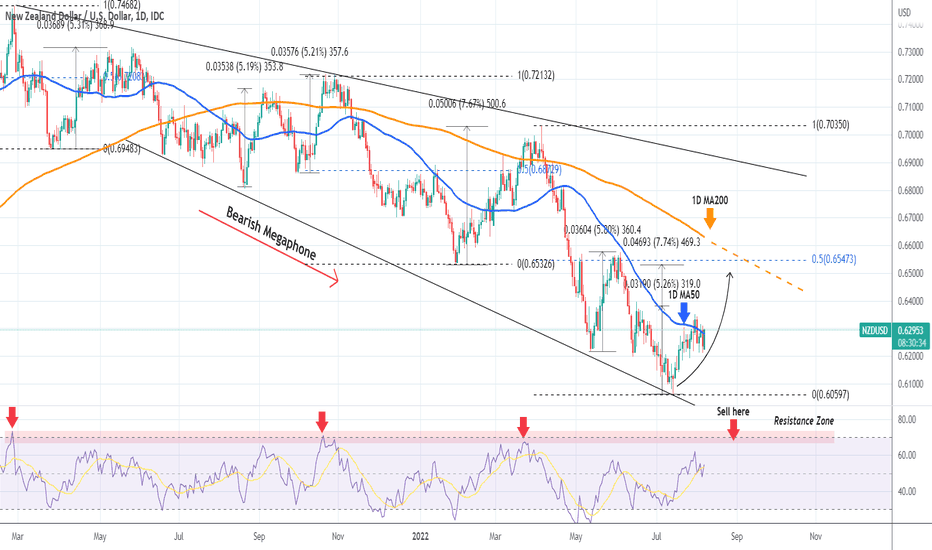

NZDUSD Resuming uptrend to 0.6500 at least.The NZDUSD pair turned bullish and reversed the medium-term sell bias exactly on the moment we wanted it last time we posted on analysis on it:

As you see, the rebound took place exactly on the Lower Lows (bottom) trend-line of the long-term Bearish Megaphone, a pattern it's been trading in for over 1 year. At the moment, the price is consolidating around the 1D MA50 (blue trend-line), struggling to stay above it but nonetheless, it closed a 1D candle above it for the first time since April 12. Every time the pair closes above the 1D MA50, the rebound is extended to at least the 0.5 Fibonacci retracement level. This time, that at 0.65470 and if that is achieved within August, the price will make contact with the 1D MA200 (orange trend-line) as well.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

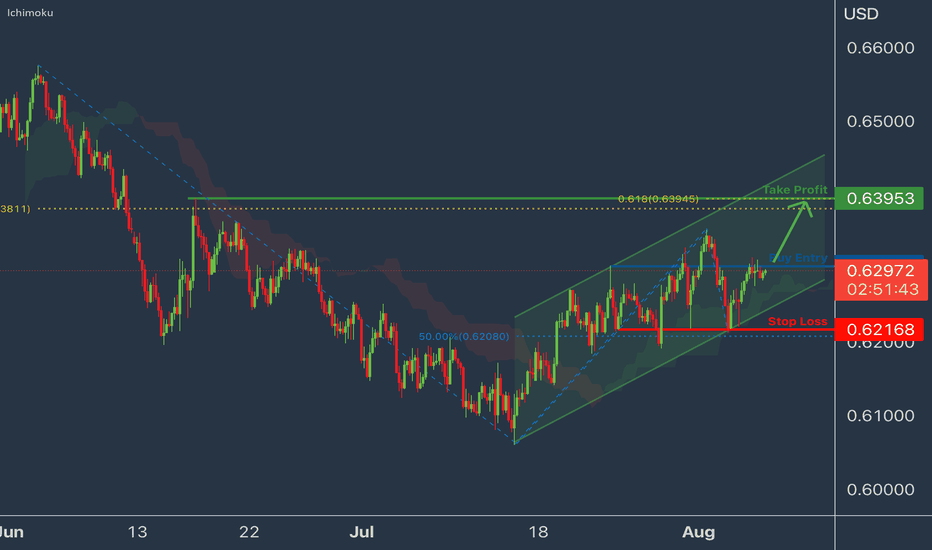

NZDUSD Potential for Bullish MomentumOn the H4, with price moving along the ascending channel and above ichimoku cloud, we have a bullish bias that price may rise from the buy entry at 0.63029 where overlap resistance is to the take profit at 0.63910 at the swing high, 61.8% fibonacci projection and 61.8% fibonacci retracement. Alternatively, price may reverse off the buy entry and drop to stop loss at 0.62168 where the swing low support and 50% fibonacci retracement are.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.