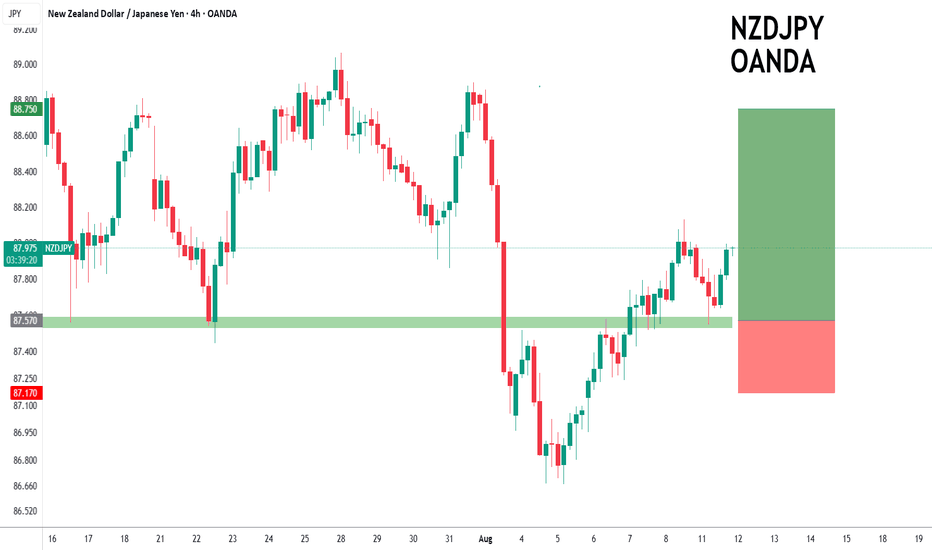

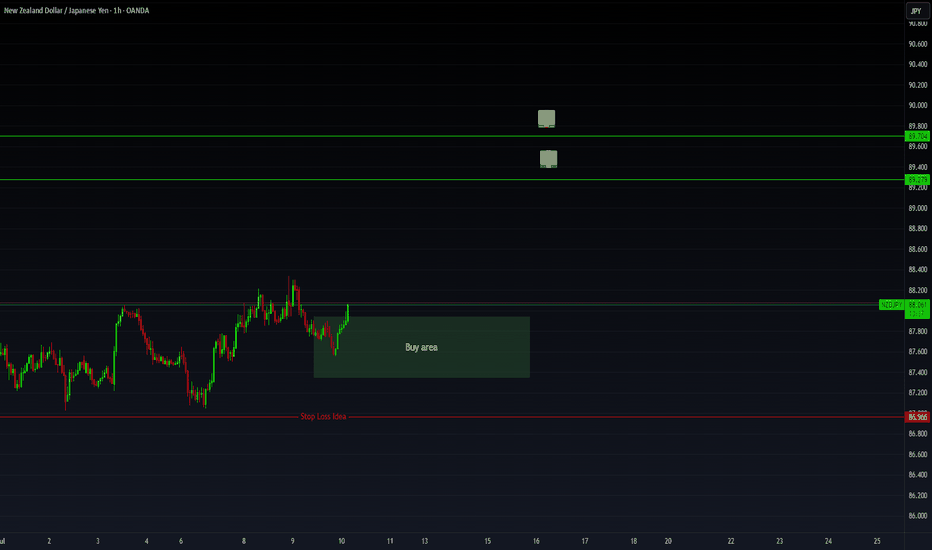

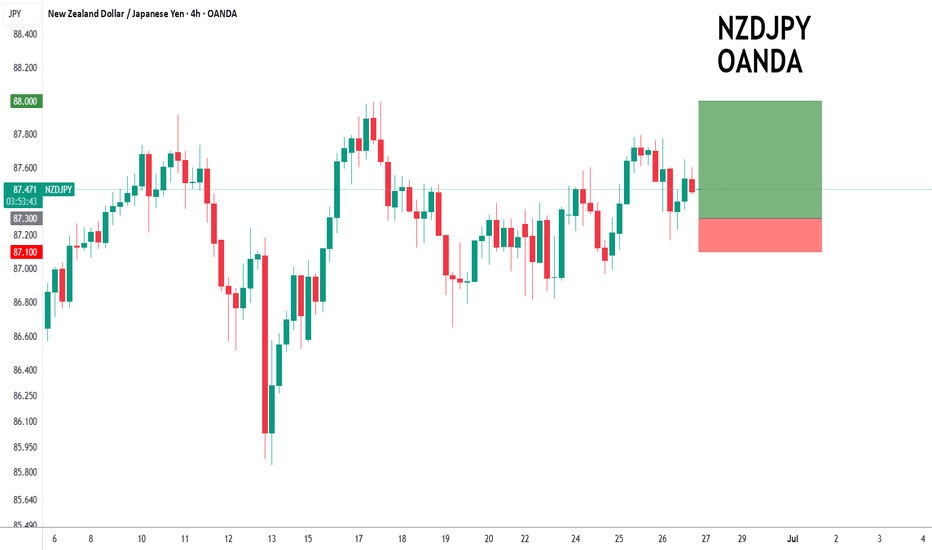

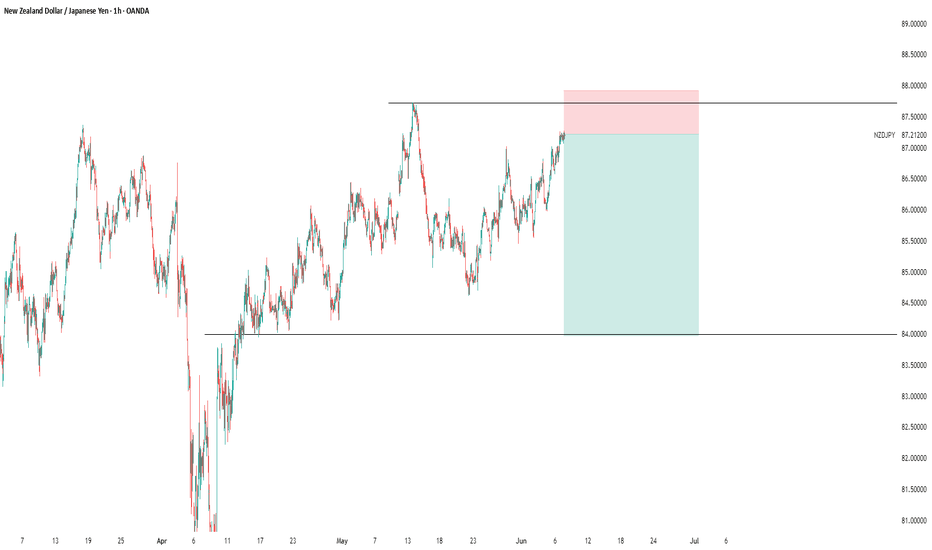

NZDJPY to find buyers at previous support?NZDJPY - 24h expiry

Previous support located at 87.60.

87.44 has been pivotal.

Dip buying offers good risk/reward.

The overnight dip has been bought into and there is scope for further bullish pressure going into this morning.

Prices have reacted from 86.67.

We look to Buy at 87.57 (stop at 87.17)

Our profit targets will be 88.75 and 88.95

Resistance: 87.90 / 88.13 / 88.50

Support: 87.55 / 87.25 / 87.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nzdjpylong

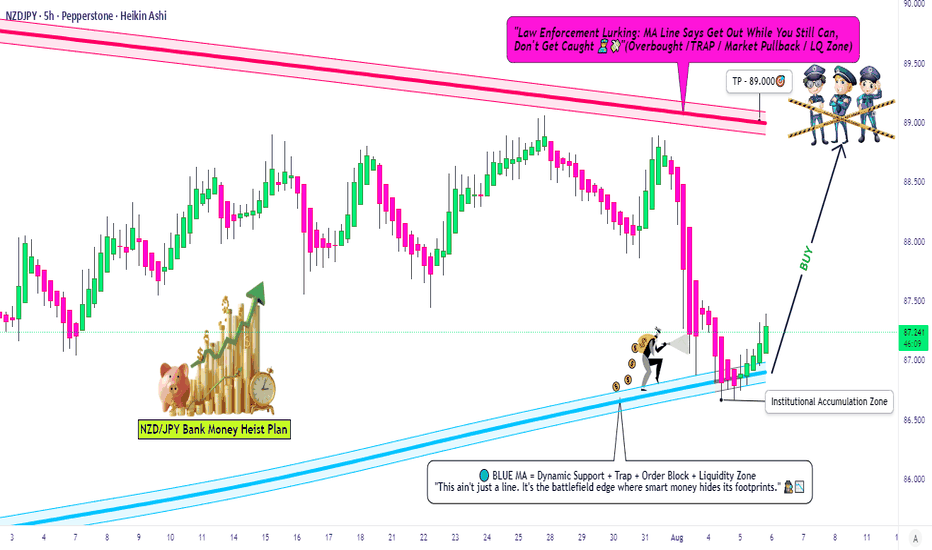

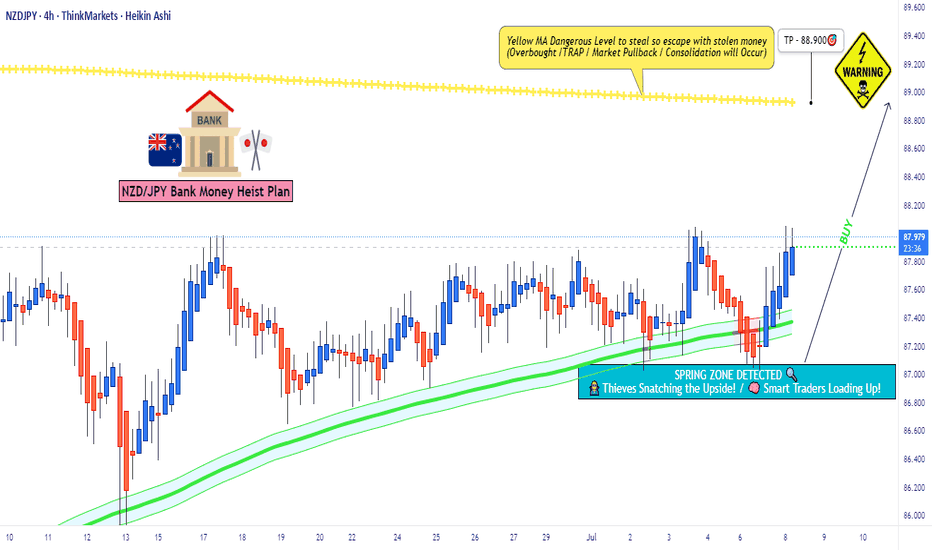

Is NZD/JPY the Next Bullish Vault Breach? Target: 89.000💰 NZD/JPY – Thief's Layered Strike Plan | Bullish FX Heist 🚀💹

🌍 What’s up, Market Bandits?!

Welcome to the Thief Trader Vault — where trades aren't guessed… they're executed with stealth 🕵️♂️💼. Today's blueprint? We're cracking into the NZD/JPY vault with a layered limit order raid – the perfect setup for real FX tacticians.

🎯 Plan: Full Bullish Operation – Precision Infiltration 🔥

The Thief Method hits different — we don't chase price, we trap it.

We’re placing multiple limit orders like laser tripwires, stacked and ready to ambush price movement on the way to our vault 💣.

💸 Entry: ANY Price Level — Layered Style 😎

This ain’t “wait for confirmation” talk — this is calculated chaos:

🔹 Multiple limit orders, like a sniper grid

🔹 Let price dip, retrace, or fakeout — we’re in regardless

🔹 Stack 'em like bricks and let price come to YOU

🔑 “Smart thieves don’t knock — they build secret doors.”

🛡️ Stop Loss: 86.500 – Guard the Loot 🎯

No games. No leaks.

Set your SL at 86.500 – below structural defense lines.

🔒 Capital protection is king. Hit, grab, bounce.

🎯 Target: 89.000 – Vault Exit Point 💎

When we hit 89.000, we unload the bag 💼

Optional: Trail your SL and squeeze more juice if momentum breaks high.

🧠 “Exit with impact. Leave no trace.”

⚙️ Strategy Style – For Real Ones Only:

👟 Scalpers:

Tap in on micro pullbacks. Hit & run style.

🎯 Ride with momentum — no shorts, no detours.

🛠️ Swing Traders:

You’re the long-haul vault opener. Stay locked in.

Use patience as your weapon — let the plan cook.

🧠 Market Backing – This Isn’t Just Hype:

🔸 JPY showing weakness across risk pairs

🔸 Global sentiment leaning risk-on

🔸 Cross-market confluence backing NZD strength

🔸 Liquidity voids above — ripe for targeting

⚠️ Risk Management = Real Trader Behavior

🚨 Avoid jumping during high-impact news

🧱 Trail your SL if you're already in profit

📉 This ain't gambling. It's probability warfare

💬 Final Words – Boost The Bandit Blueprint 📣

🔥 SMASH that ❤️ if this plan speaks your language.

🔁 DROP a comment if you’re layering up with the crew.

We don’t follow the herd — we rob the market 🥷💹

📌 Stay silent. Stay sharp. Stay rich.

— Thief Trader 💼⚡

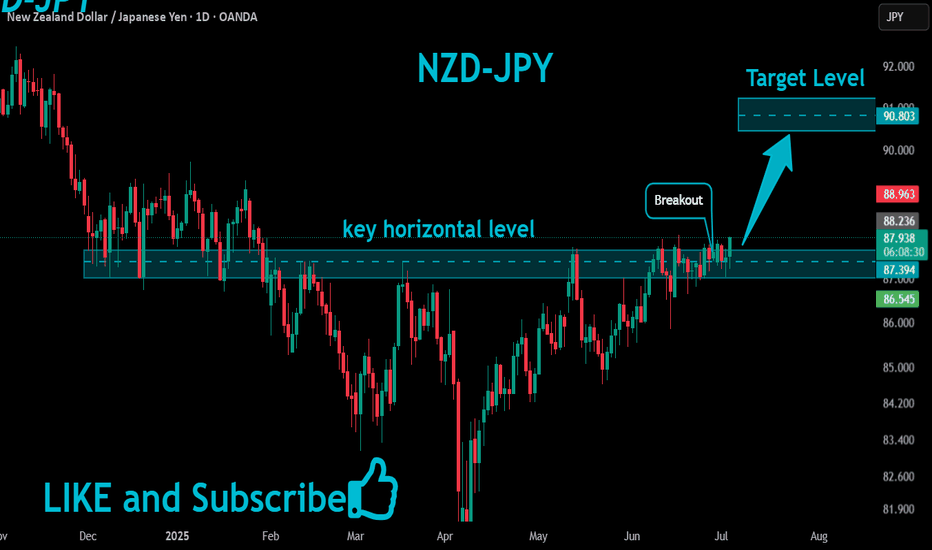

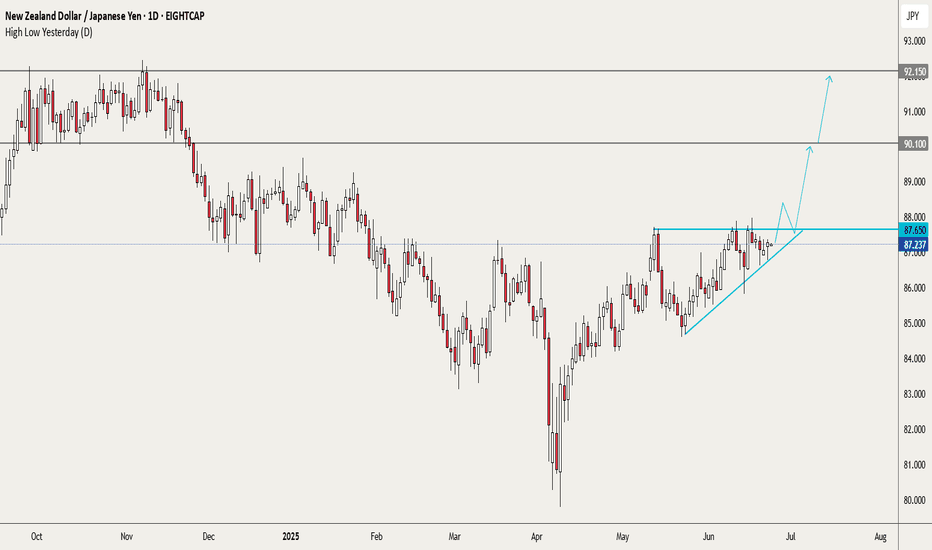

NZDJPY Long Setup: Institutional Flow Signals Upside to 89.690🗓 Seasonal Outlook

- JPY Seasonal Weakness: Historical trends show July and August tend to be bearish months for the Japanese Yen, reinforcing weakness across JPY pairs.

- NZD Seasonal Strength: July typically supports bullish momentum for NZD, while August may present challenges. However, strength in NZD versus relative JPY softness suggests continued upside potential into early August.

💼 Institutional Positioning (COT Analysis)

- JPY: Commercial traders remain net short, suggesting expectations of further depreciation.

- NZD: Also shows commercial net shorts, yet the price structure aligns more with bullish continuation, hinting at speculative flow favoring NZD upside.

🧠 Technical Analysis

- Liquidity Dynamics:

- Price has cleared multiple buy-side liquidity levels near prior swing highs.

- Sell-side zones continue to hold, indicating strong bullish intent and failed bearish follow-through.

- Market Structure:

- Higher lows and sustained bullish reactions post-liquidity sweeps reinforce an upward trajectory.

- Current structure suggests accumulation and breakout patterns toward the proposed target.

🎯 Target Projection: 89.690

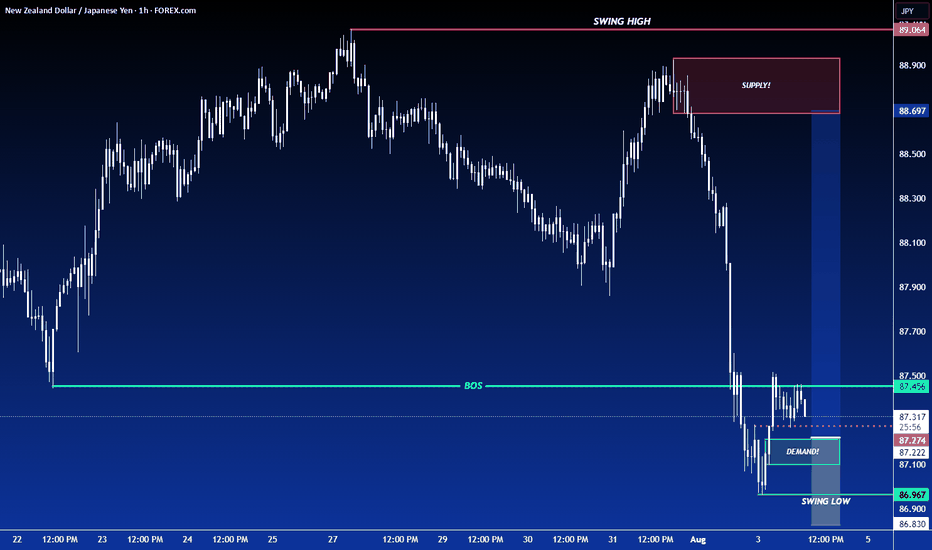

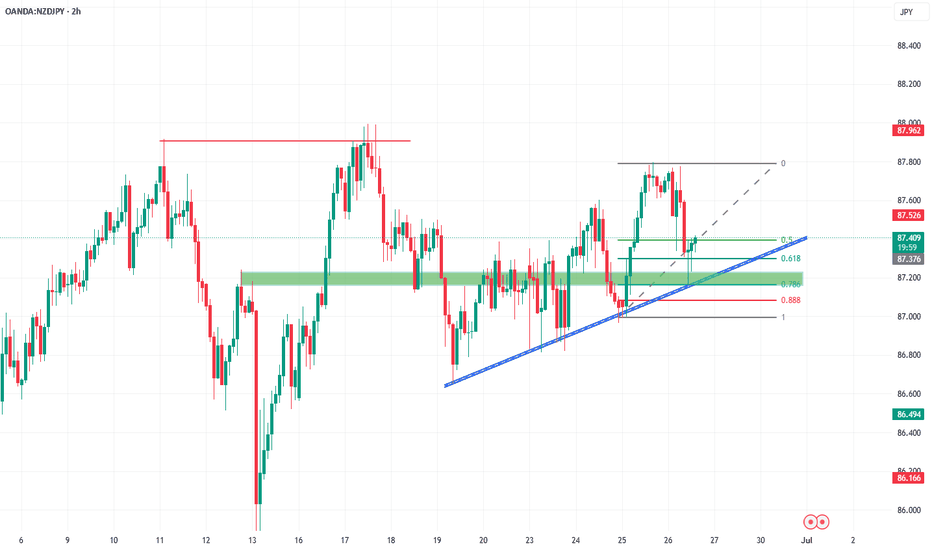

"Trap or Opportunity? NZD/JPY Smart Pullback Play?"💼🎯 NZD/JPY – The Kiwi Vault Breakout | Thief Trading Style Forex Blueprint 🔓📈

🌟Hola! Hello! Ola! Bonjour! Hallo! Marhaba, Global Market Raiders!🌍✨

Welcome to the Thief Trading Style – where smart traders strategize, strike, and secure the bag. This is not your regular trade idea... this is a market infiltration plan – a tactical move on the NZD/JPY pair, aka the Kiwi vs Yen Battle Zone.

🎯 Plan Overview – Operation: Kiwi Vault Breakout

Using a mix of technical heatmaps, smart money concepts, and macro insight, this chart outlines a bold plan for Long Position scalpers and swing tacticians.

💹 The current trend shows signs of bullish momentum, with price eyeing the upper yellow zone – a known resistance pocket where liquidity pools and trap setups often play out.

📈 Entry Strategy – The Gate Is Open

Buy Limit zones:

☑️ Watch the 15/30 min timeframe for pullbacks to nearest swing low/high.

☑️ Ideal for scalpers & swing traders aiming for precise entries.

🧠 “Enter like a shadow, exit like thunder.”

🛑 Stop Loss – Secure Your Capital

Place SL at:

☑️ Recent swing low/high (Based on 4H structure – approx. 87.200)

☑️ Adjust according to your lot size, capital exposure, and position count

Remember, SL is not fear — it's discipline.

🎯 Target – Precision Exit

🎯 TP Zone: 88.900

⚠️ Optional: Exit earlier based on reaction to key levels, or trail your stop to lock gains.

💡 "Profit isn't greed, it's your reward for precision."

⚡Trader Roles – Choose Your Mode

👀 Scalpers:

Only trade the long bias. No short-circuiting the plan.

Use trailing stops to guard gains and surf the momentum waves.

📈 Swing Traders:

You’re in for a full ride — ride the wave till the next institutional block.

Stay patient, and let price develop before jumping in.

🔍 Analysis Backdrop – What’s Fueling the Move?

The bullish push is backed by:

🔸 Positive fundamental & macro signals

🔸 Institutional positioning (check COT Reports)

🔸 Intermarket correlation strength

🔸 Market sentiment score

📊 Want full breakdowns? Dive into COT, Macro Reports, Quant Flow & more → 🔗🔗🔗 Klick

📰 Risk Reminder – News Volatility Warning

🚨 Avoid new entries during major data releases

🔒 Protect open positions with trailing SLs

⚙️ Manage risk – trading is about probability, not certainty

💬 Final Words – Boost the Blueprint

💥Hit “Like” if you vibe with this strategy and support the community of tactical traders.

This plan is designed to bring clarity, structure, and a bit of swagger to your chart screen.

See you in the next setup – stay sharp, stay stealthy. 💼🧠💪

Disclaimer:

This idea is for educational purposes only and not investment advice. Please evaluate your own risk tolerance and market understanding before entering any trades.

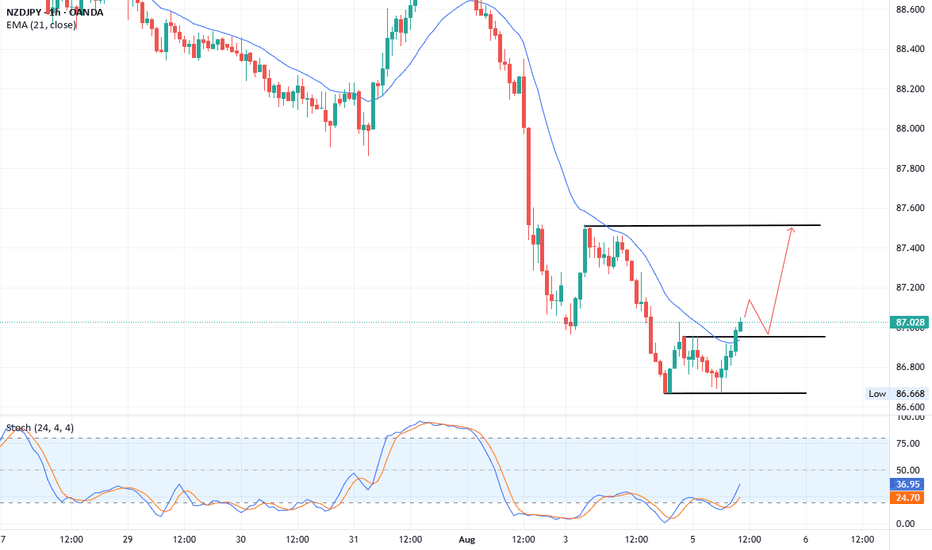

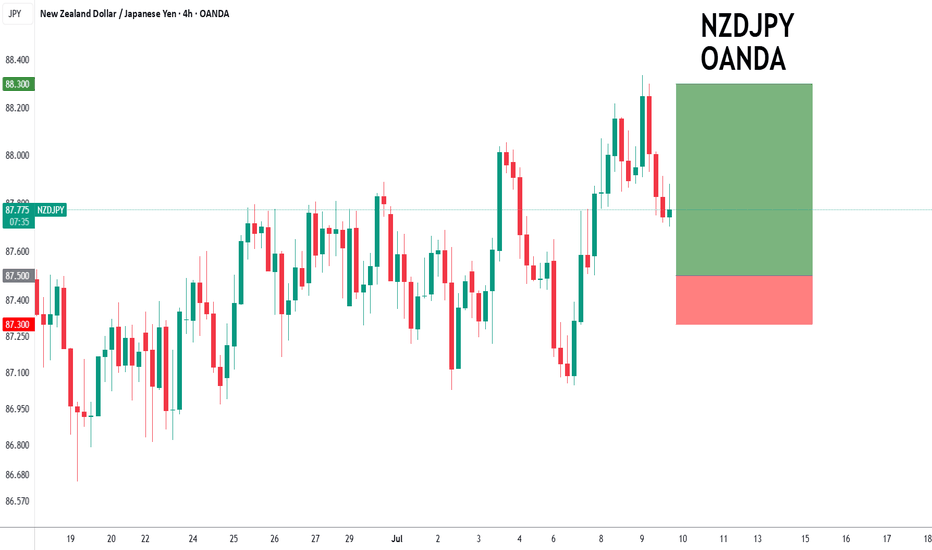

NZDJPY to find buyers at previous support?NZDJPY - 24h expiry

The primary trend remains bullish.

Short term RSI is moving lower.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 87.50.

We look to Buy at 87.50 (stop at 87.30)

Our profit targets will be 88.30 and 88.50

Resistance: 88.00 / 88.30 / 88.50

Support: 87.50 / 87.20 / 87.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDJPY to continue in the upward move?NZDJPY - 24h expiry

The primary trend remains bullish.

The selloff has posted an exhaustion count on the intraday chart.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 87.30.

We look to Buy at 87.30 (stop at 87.10)

Our profit targets will be 88.00 and 88.20

Resistance: 87.80 / 88.00 / 88.20

Support: 87.20 / 87.00 / 86.80

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

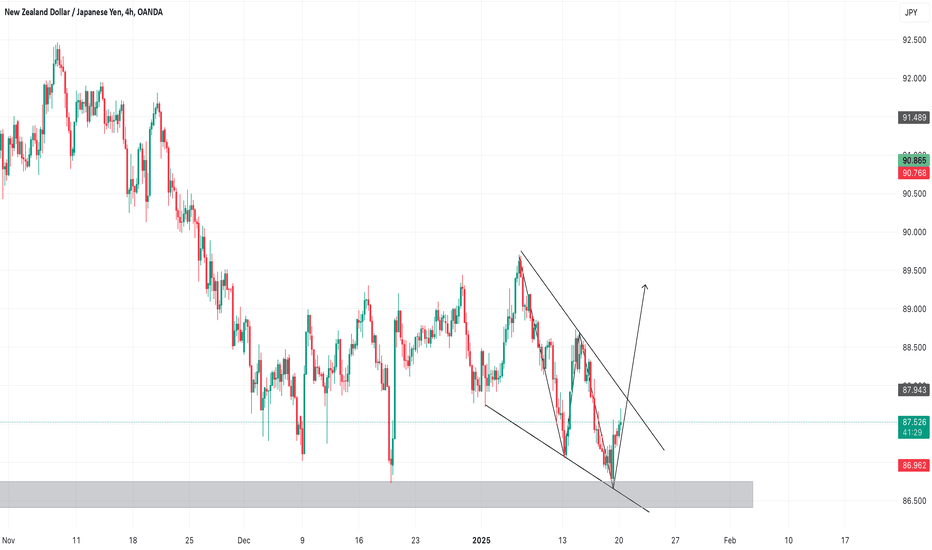

NZDJPY looks ready to breakoutThe area around 87.65 has been a solid resistance since early Feb. Time and again, price has been rejected there and recently the lows have become higher. The squeeze is on and I sense that another attempt to break out above will happen soon.

Will it succeed? I have no idea, we never do. But if there is a breakout and then a retest, I'll take the trade and take this as high as I can (within the limits of my discipline and patience) :)

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

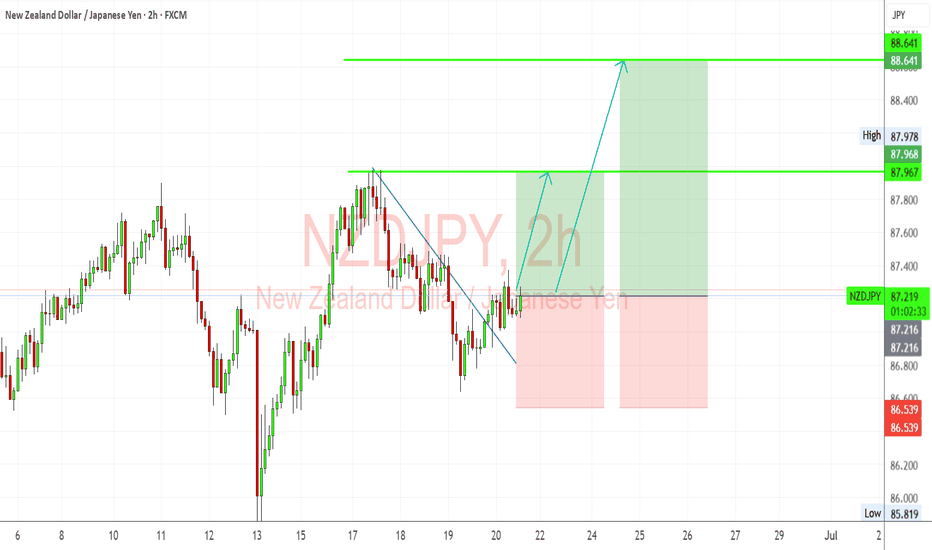

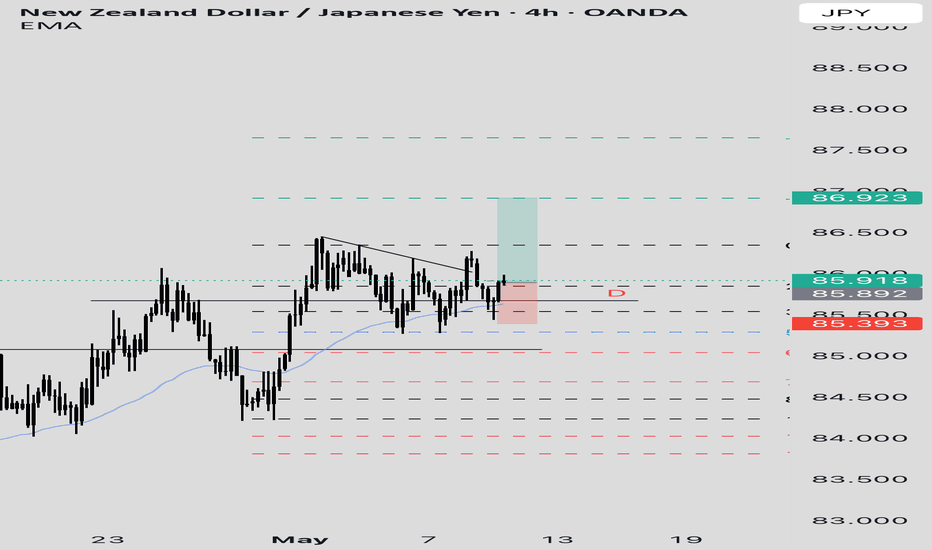

NZDJPY “Kiwi Poised to Fly as Japan Muddles ThroughNZDJPY shows a bullish breakout from a descending trendline, with bullish structure holding near 87.20–87.25.

Key resistance targets:

87.97 (Previous high)

88.64 (Next resistance / projected fib target)

Two upside scenarios are shown:

Conservative target: ~87.97

Aggressive swing: ~88.64

If 87.00–87.20 zone holds as support, expect bullish continuation.

🧩 Current Bias: Bullish

📌 Key Fundamentals Driving NZDJPY

NZD Side (Strengthening):

RBNZ hawkish hold: RBNZ recently kept rates at 5.50% and warned that inflation remains persistent, requiring prolonged tight policy.

Resilient NZ GDP: Stronger-than-expected GDP print signals economic resilience.

Terms of trade improvement: Commodity exports holding firm, China consumption rebound showing hints of demand recovery (see recent 618 festival sales data).

AUD correlation: AUD and NZD are moving together; if AUD strengthens, NZD often follows.

JPY Side (Weakening):

BoJ remains ultra-dovish: Despite inflation trends, BoJ is hesitant to tighten further, preferring gradual tapering.

Yen under pressure from yield differentials: Global central banks (like RBNZ, Fed) remain hawkish while BoJ is not.

Geopolitical funding flows: JPY used as a funding currency amid global volatility (carry trade boost for NZDJPY).

⚠️ Risks That May Reverse the Trend

BoJ surprise tightening rhetoric (e.g. bond purchase taper announcement).

China data deterioration, hurting Kiwi sentiment.

Sharp equity sell-off and geopolitical escalation (Yen safe-haven reversal).

📅 Important News to Watch

🇳🇿 NZ Trade Balance (upcoming)

🇯🇵 Tokyo Core CPI (Jun 28) – Critical for BoJ policy speculation.

RBNZ or BoJ member speeches (hawkish or dovish shifts)

Fed tone shift or US dollar strength spillover

🏁 Who Leads the Move?

NZDJPY could lead among yen crosses due to the RBNZ’s clear inflation fight versus BoJ’s passive stance. NZDJPY is also more responsive to commodity and global risk-on flows than EURJPY or USDJPY.

nzdjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

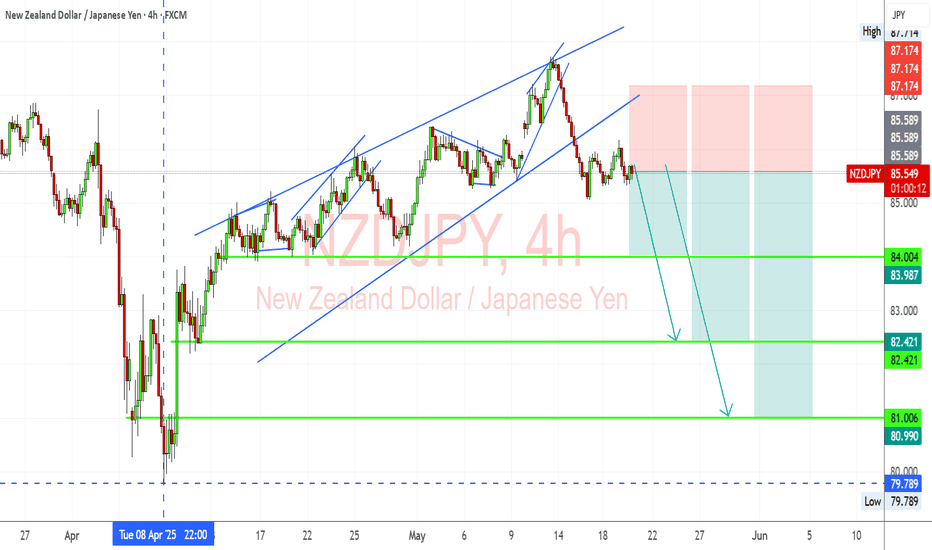

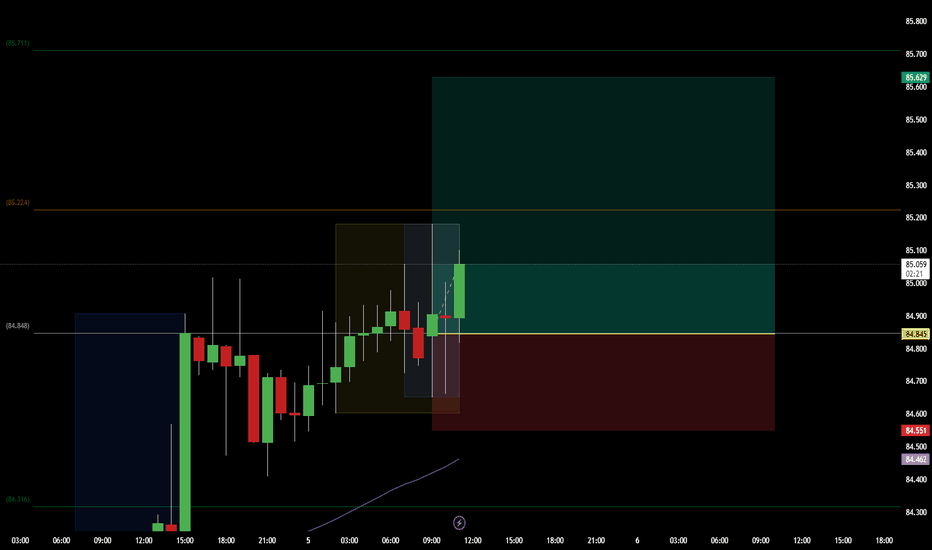

NZD/JPY Breaks Wedge Structure – Bearish Setup Targets 82.42NZD/JPY has broken down from a rising wedge and failed to reclaim upper support, now acting as resistance. The structure is cleanly bearish on the 4H chart, with rejection near 85.60 and a confirmed lower high. Weak New Zealand data and rising safe-haven demand for JPY add weight to this technical setup. Price looks poised to extend toward 82.42 and possibly 80.99 if momentum builds. Bearish bias is valid unless price closes above 87.17.

🔍 Technical Analysis

Chart Pattern: Rising wedge → broken → retest failed

Bear Flag: Forming below wedge base, suggesting further downside

Resistance Area: 85.60–87.17

Bearish Structure:

Lower highs and bearish candle formations

Price unable to reclaim former support trendline

Support Targets:

First TP: 84.00 – minor support, fib confluence

Second TP: 82.42 – March swing low

Final TP: 81.00 zone – next fib cluster

🌍 Macro Fundamentals

🇳🇿 New Zealand Dollar (NZD)

Retail Sales missed: 0.0% vs 0.9% forecast → consumer sector is slowing

Core Retail Sales weak: 0.7% vs 1.4%

Dairy auction (GDT Index) down -0.9% → key export underperforming

Implication: Risk of slower growth → RBNZ may shift toward neutral/dovish stance

🇯🇵 Japanese Yen (JPY)

JPY supported by risk-off flows due to:

U.S. credit downgrade

Iran-US nuclear tension

Declining global PMI forecasts

Yen strengthens as traders seek safe havens despite BoJ’s dovish baseline

🎯 Trade Plan

Bias: Bearish

Entry Zone: 85.50–85.60 (confirmation area)

Targets:

TP1: 84.00

TP2: 82.42

TP3: 81.00

Stop Loss: Above 87.17 (invalidates wedge breakdown)

⚠️ What to Watch

China sentiment or surprise stimulus (may support NZD)

Sharp equity rallies (could reduce JPY demand short-term)

If NZD/JPY closes above 86.00, reduce position or stay out

🧭 Conclusion

NZD/JPY has rolled over from a broken rising wedge, now forming a clean bearish continuation structure. Weak NZ data and macro risk flows into JPY favor downside extension. This setup offers clear levels, defined risk, and macro alignment — ideal for disciplined short entries.

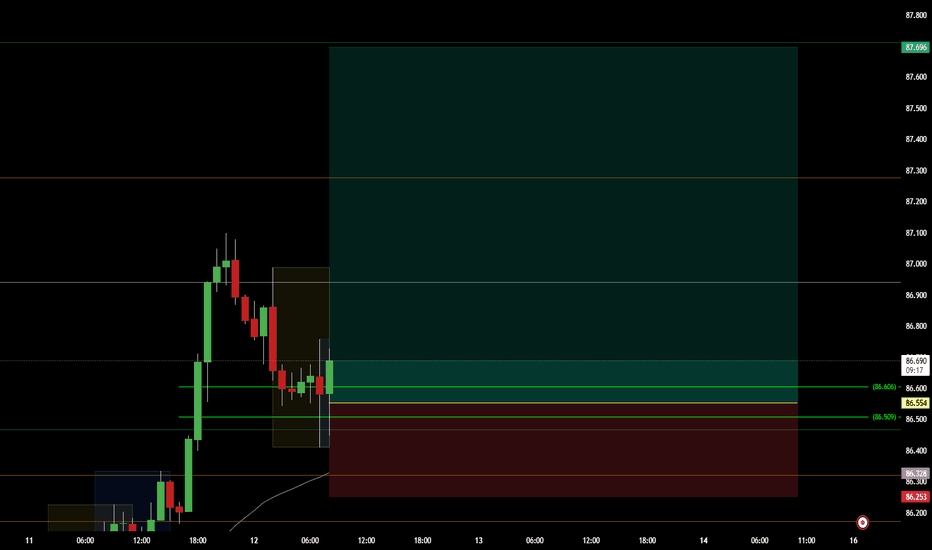

NZDJPY price action trading n a weekly timeframe, the market revisited a previously tested zone. On the 1-hour chart, it broke out of this zone, and on the 15-minute chart, a backtest of the breakout level is currently occurring. Based on this setup, I’m planning to enter a trade.

Trade Plan:

Take Profit (TP): Targeting the last swing high.

Stop Loss (SL): Placing it below the last resistance level.

Risk-Reward Ratio (RR): Aiming for a minimum of 1:3.

This setup offers a high-probability trade with a favorable risk-reward ratio, capitalizing on the breakout and backtest confirmation.

NZDJPY LONGHey everyone we looking for a long NZDJPY, we were having a uptrend for an quiet a while so this is what i see and why i will taking a buy

1) break and retest to daily support and reject few times

2) reject from a 50% Fib level

3) break our counter trend line on 4h which shows us buyer is taking over

4) shift from bearish to bullish market after break of structure on1h

5) reject Daily and 4h 50 EMA

6) engulfing bullish on 4h

Im aiming 1:2 risk to reward Ratio

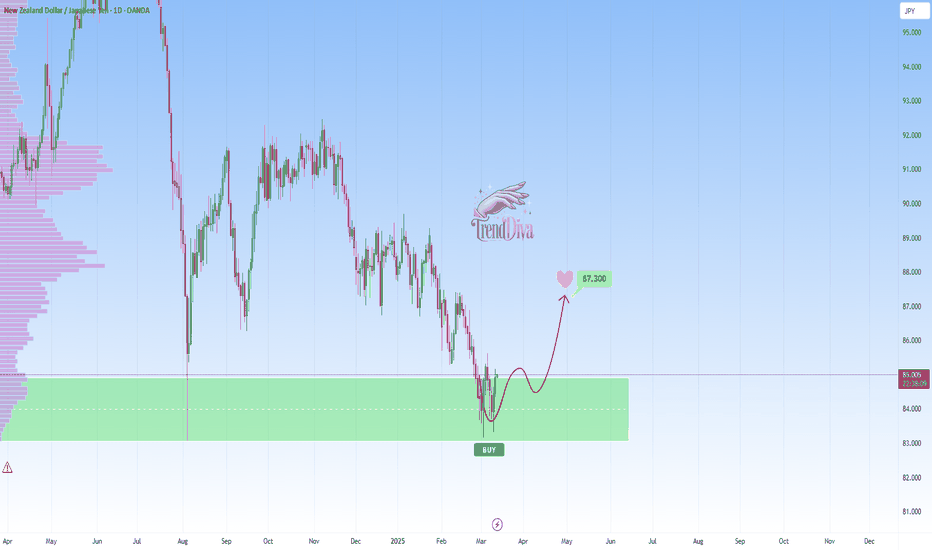

NZDJPY at Key Support Level - Rebound Towards 87.300?OANDA:NZDJPY has reached a significant support zone, highlighted by previous price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the pair toward the 87.300 level, a logical target based on previous price behavior and current market dynamics. Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

NZD/JPY At The Best Place To Buy It And Get +250 Pips !The price at a very interesting area to buy it , it`s an old support , it pushed the price very hard last time , so i will enter a buy trade with 250 pips target if i have a very good 4H Closure !

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

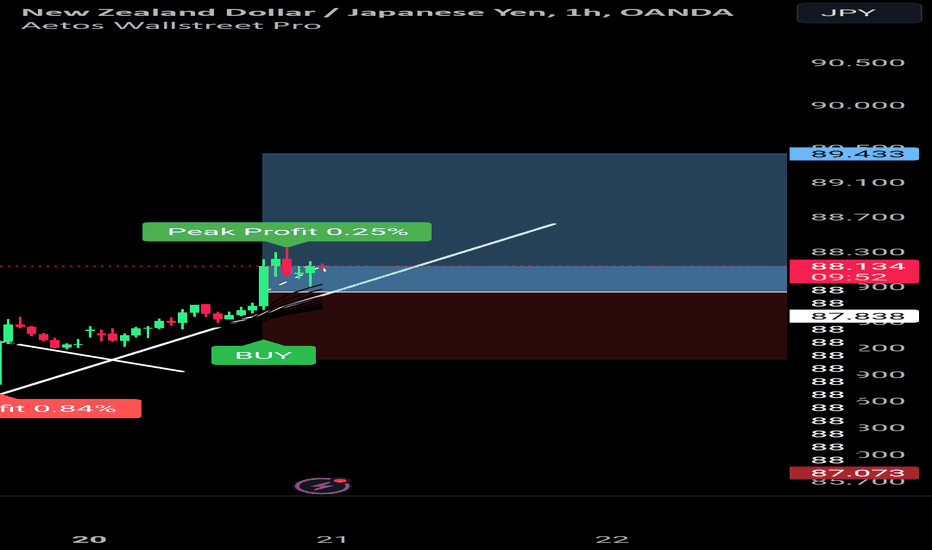

NZD/JPY Breaking Barriers and Soaring HigherNZD/JPY shows a strong bullish breakout on the 1-hour chart. A descending trendline was invalidated, indicating a shift in market sentiment. This move highlights growing buying pressure and a potential continuation of the upward trend.

The breakout occurred near 88.140, which aligns with a resistance level turned into support. Buyers are stepping in aggressively, creating a high-probability long opportunity.

The stop loss is placed at 87.073, below the recent consolidation area, ensuring protection against invalidation. The take profit is set at 89.433, derived from the measured move projection of the breakout.

This trade presents a favorable risk-to-reward ratio, backed by momentum and a clean breakout structure. With market sentiment leaning bullish, this setup aligns with trend-following principles.