Nzdjpylong

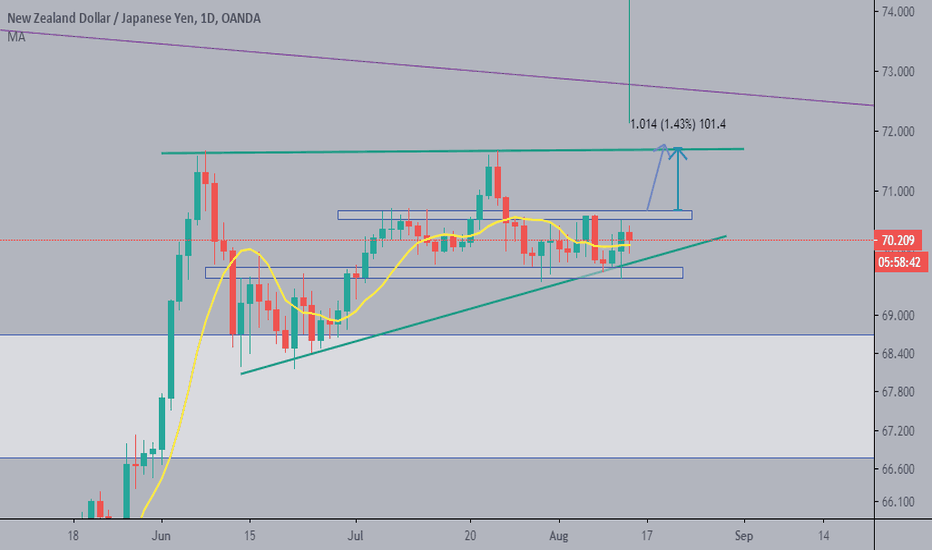

NZDJPY - Looks JuicyI expect another bearish move to continue the trend. Once we break out of this small bearish flag formation we can expect an aggressive sell-off into the 68 region. If price wants to continue rising we will have a bias change and look for buys into the 70 region after re-testing the structure marked.

According to COT Data Source, 57% are short.

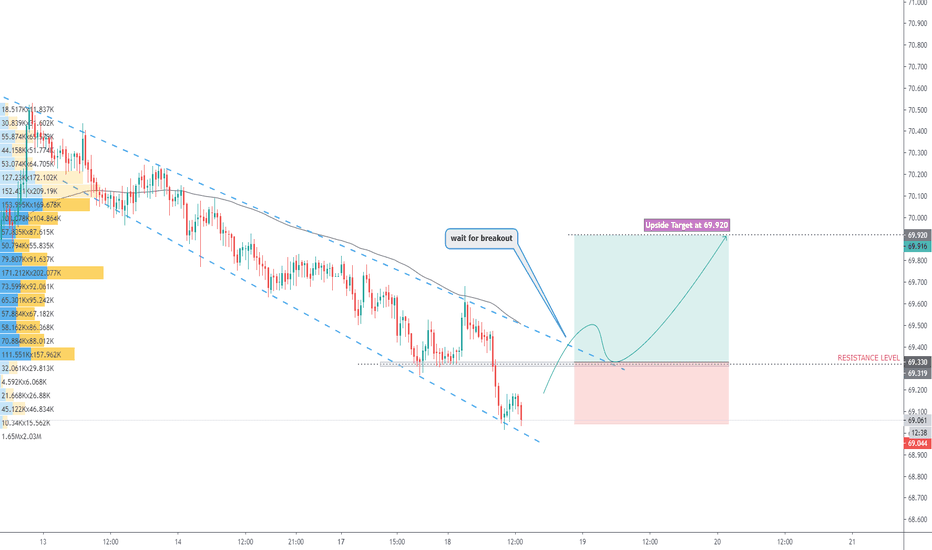

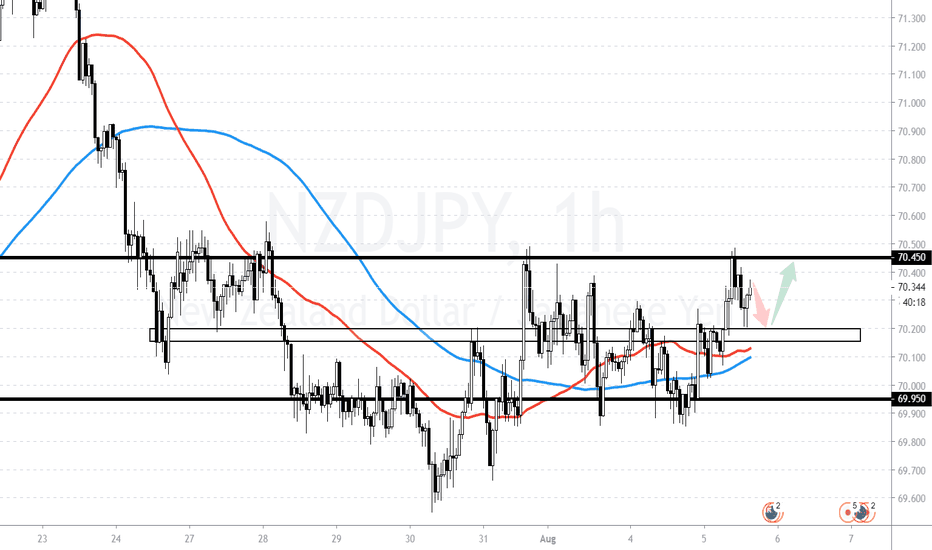

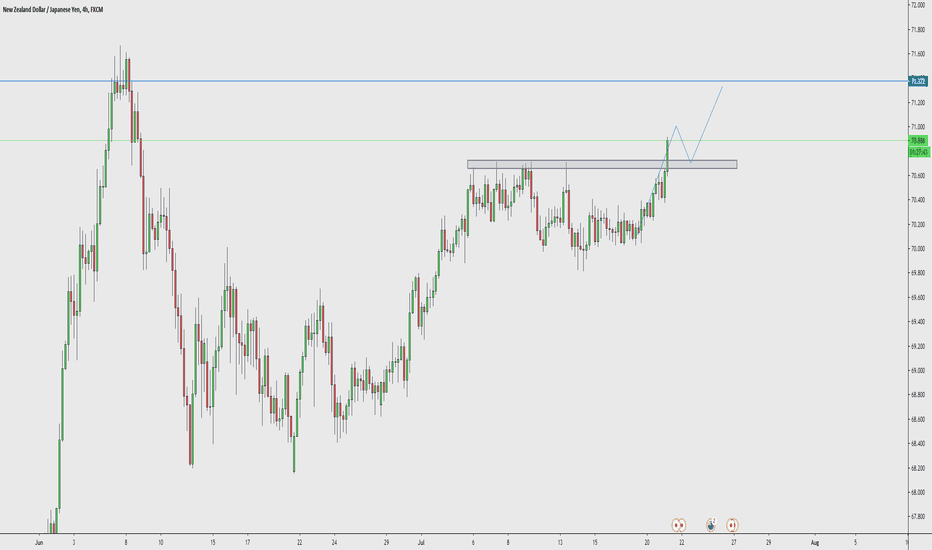

NZDJPY long trade ideaPlan: resistance level breakout --> wait for the price to bounce off from support level --> wait for the rejection candle pattern to form e.g. bullish engulfing, pinbar, etc --> BUY

**Disclaimer** the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Traders!! if you like my ideas and do take the same trade as I do, please write it in a comment so we can manage the trade together.

_____________________________________________________________________________________________________________________

Thank you for your support ;)

GWBFX

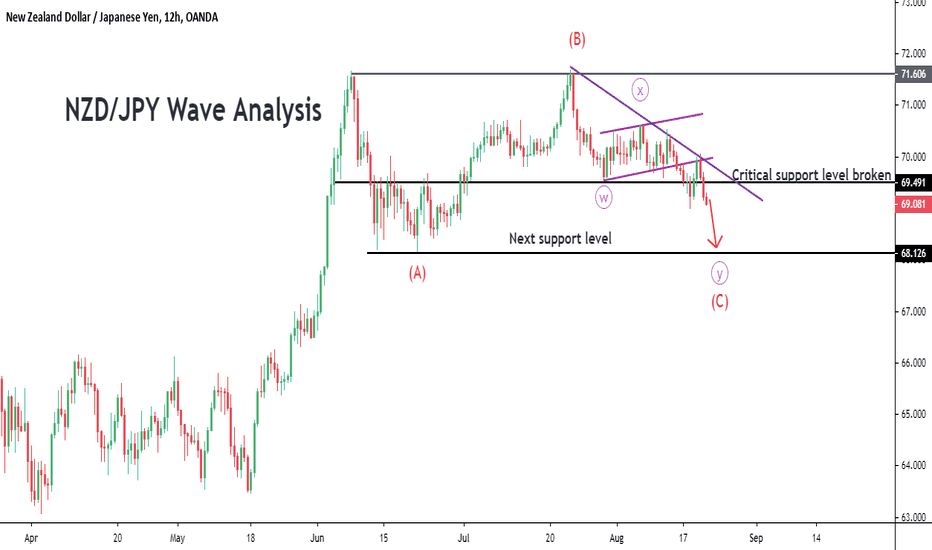

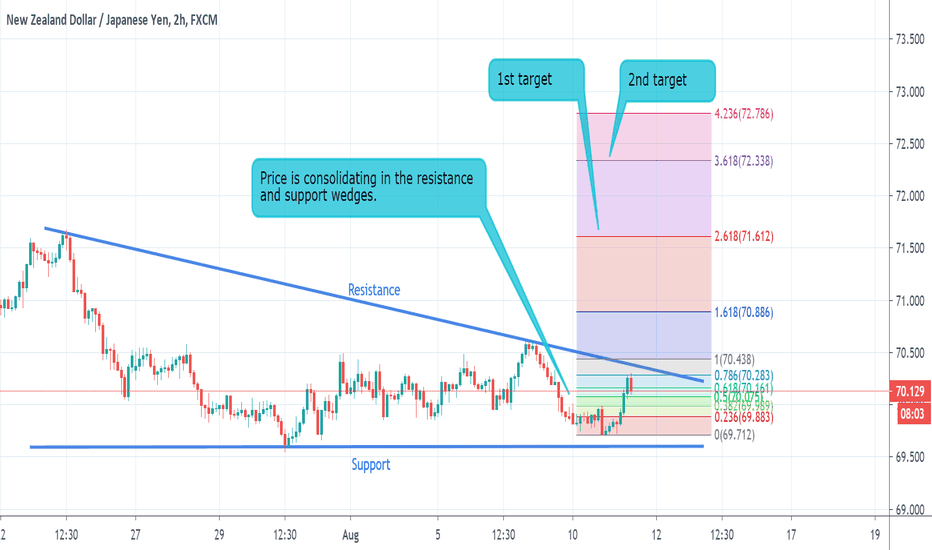

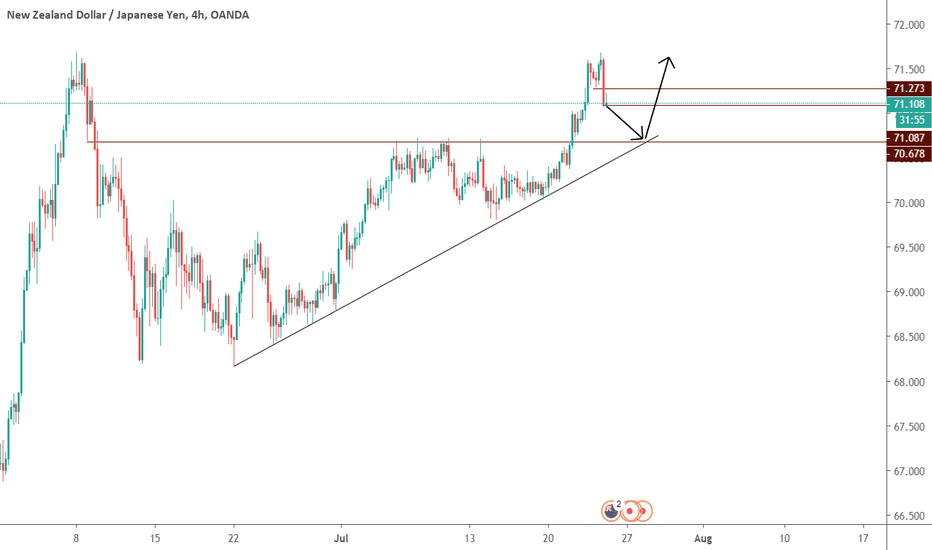

NZD/JPY Technical Analysis.Currently, NZD/JPY is trading at 70.11. The pair is consolidating in the resistance and support wedges. The pair may start a new uptrend, if it breaks the resistance level at 70.43, likely the pair might consolidate further for some time. If the pair starts a new uptrend after breaking the resistance level, then its first target price will be at 71.61 and the second target price will be at 72.33.

Follow a proper risk management strategy to avoid unnecessary losses and to increase profitability, don't risk more than 2% of your capital on each trade.

Do follow us for future Forex trend analysis and Ideas.

Thank you,

Rishikesh Lilawat

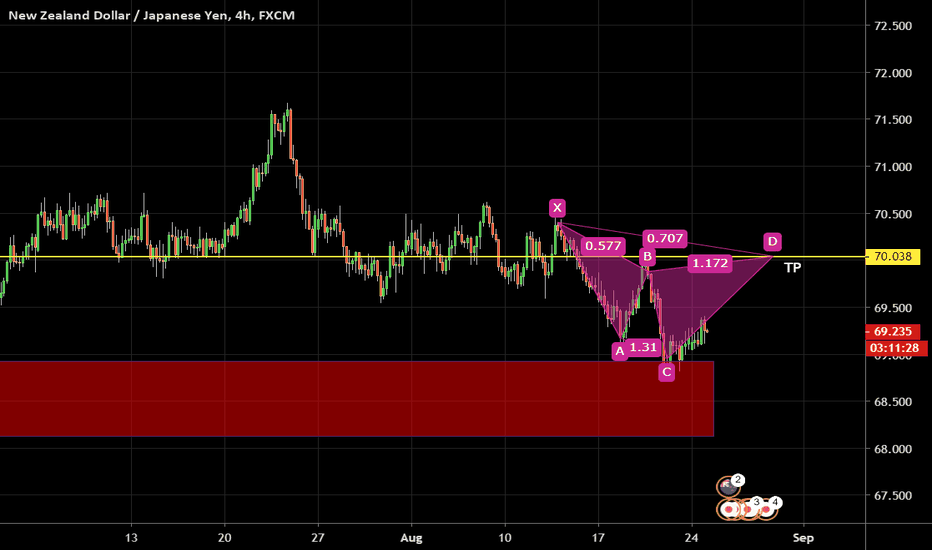

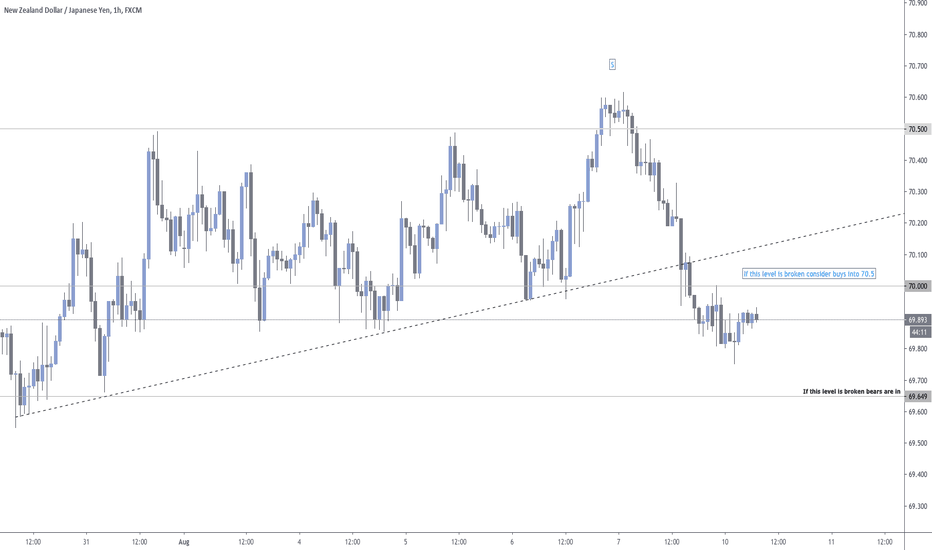

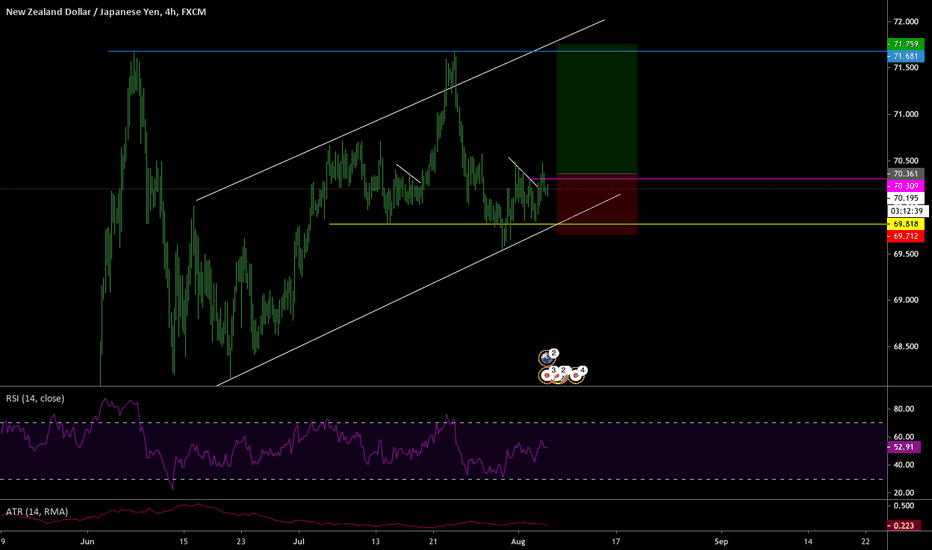

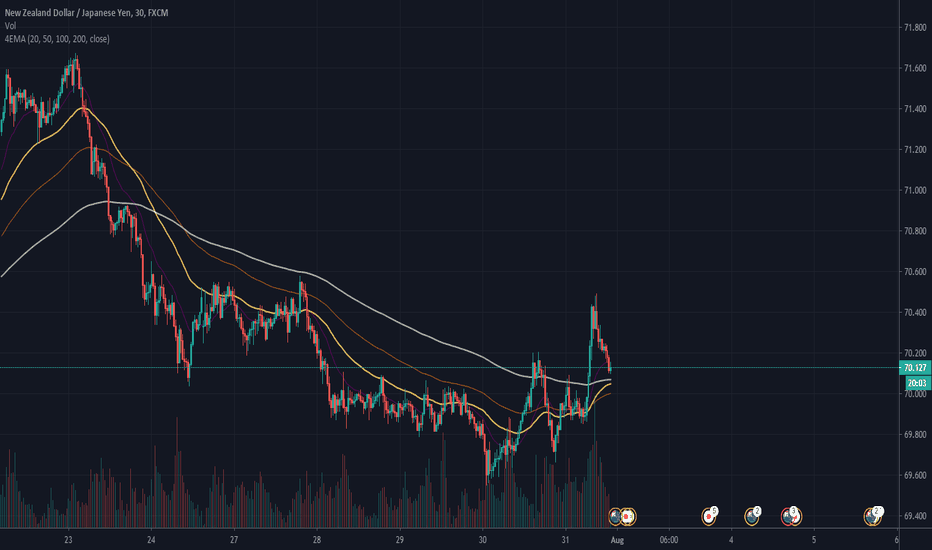

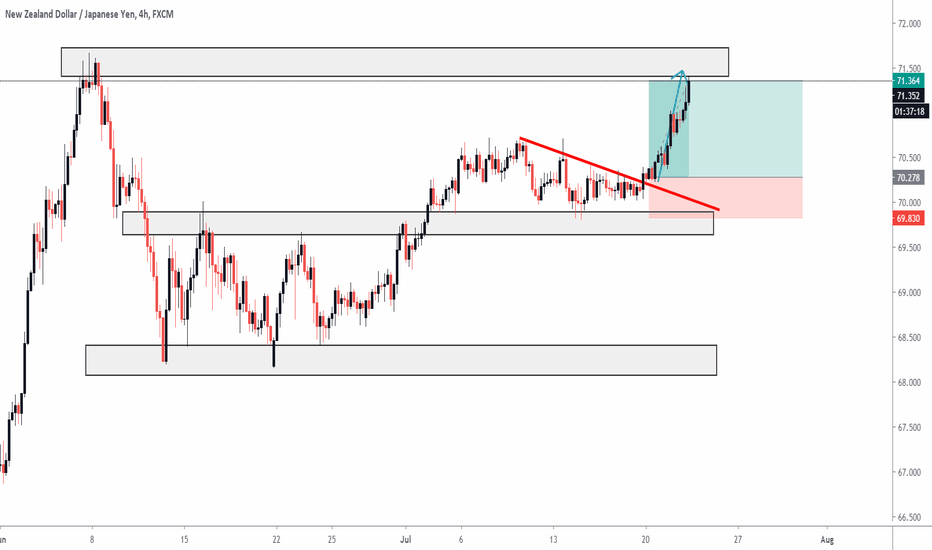

NZDJPY - Multi Time Frame AnalysisThis pair is rejecting the key level of 70.500 on the weekly time frame indicating potential failure to break higher. The last weekly candle closure may suggest the bears are ready to drive the price down. The previous daily candle closure was a bearish engulfing candle suggesting that price may want to start selling off on this pair. On the 4-hour time frame, we are seeing signs of a head and shoulders pattern forming again indicating that if we manage to break this we will see an aggressive sell-off. After breaking out of the ascending trend line on the hourly time frame we are now interested in looking for a sell position confirmation, If we don’t get that and price breaks above the key level of 70.0 we will look to buy into the 70.5 region.

67.7% of commercial players are short according to our COT Data source.

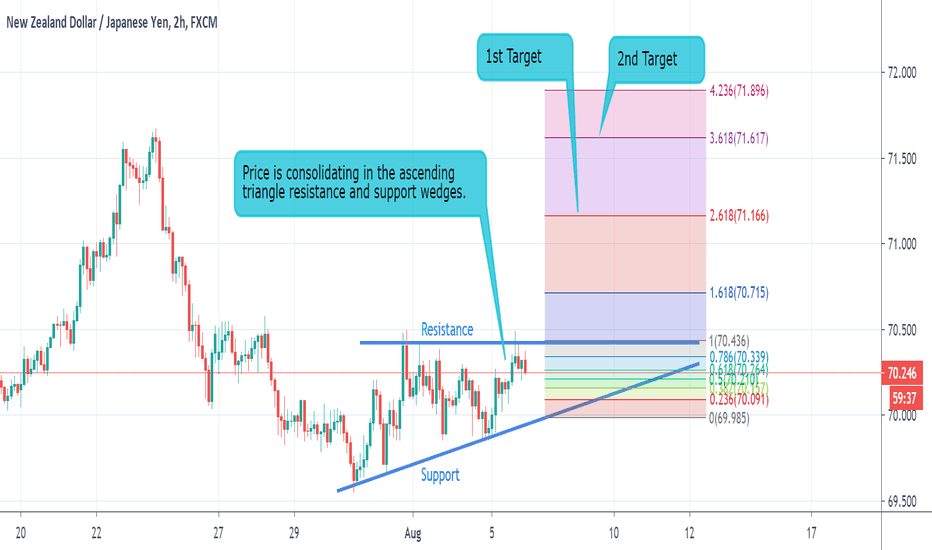

NZD/JPY Technical Analysis.Currently, NZD/JPY is trading at 70.24. The pair is consolidating in the ascending triangle resistance and support wedges. The pair may start a new up trend if it breaks the resistance level at 70.43 and it is possible that the pair may continue its consolidation between resistance and support wedges. If the pair starts a new up trend after breaking the resistance level, then its first target price will be at 71.16 and the second target price will be at 71.61.

Follow a proper risk management strategy to avoid unnecessary losses and to increase profitability, don't risk more than 2% of your capital on each trade.

Do follow us for future Forex trend analysis and ideas.

Thank you,

Rishikesh Lilawat

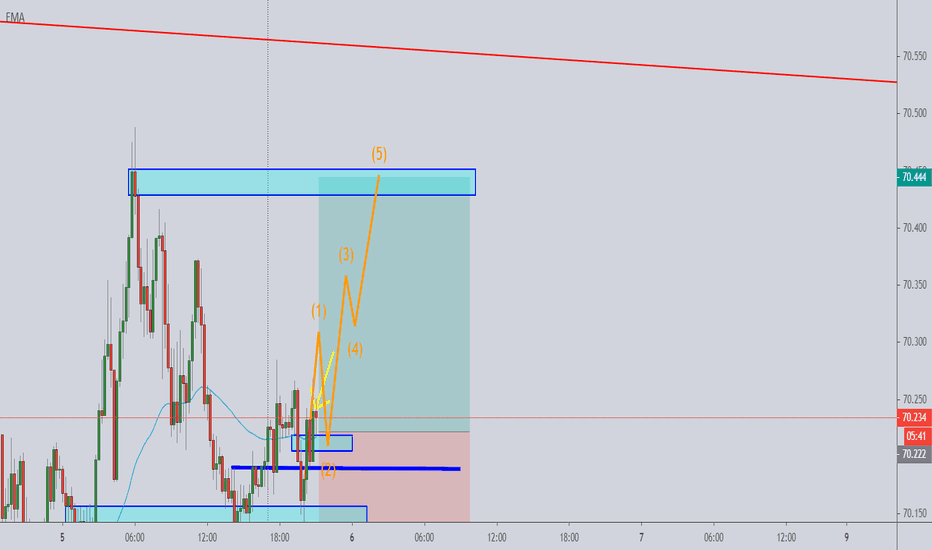

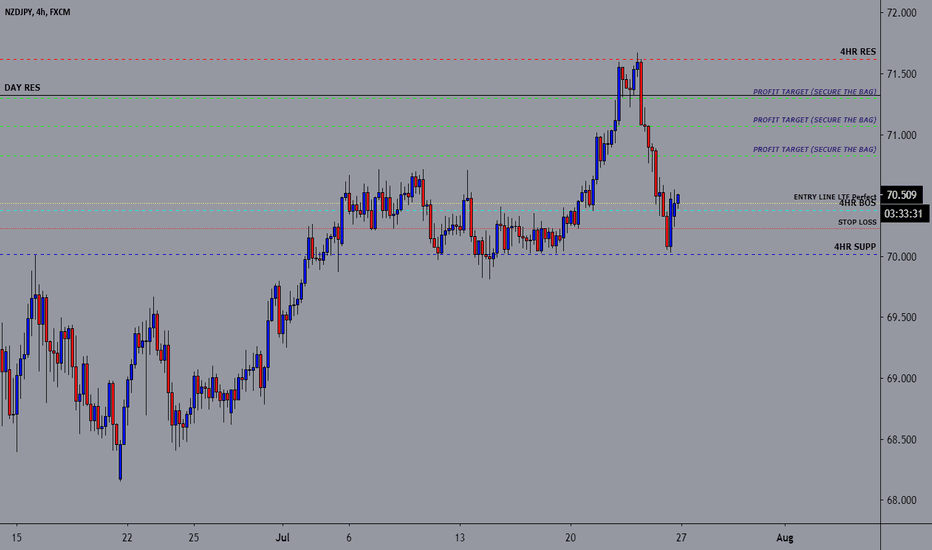

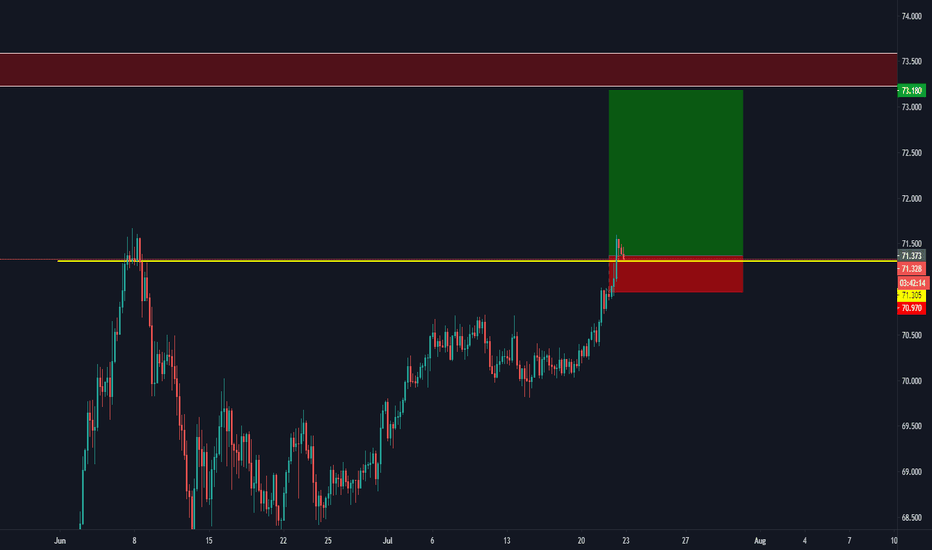

Best Entry Point For NZDJPYNZD - BULLISH

1️⃣ The unemployment rate handily beat the 5.6% forecast coming in at 4.0% and helped to push kiwi to trade well.

2️⃣ Risk-on market sentiment after top Democrats and negotiators from the White House say a deal on a coronavirus stimulus package could be reached by the end of the week and approved as early as the following week.

JPY - BEARISH

1️⃣ The Japanese government plans to decide at a cabinet meeting on Friday to use over 1 trillion Yen from its reserves for responding to the COVID-19 epidemic, after added 1,200 new cases on Tuesday.

=====

Technical

=====

📊 We're looking to long NZDJPY on RBS level + SMA50 area.

📊 NZDJPY in bullish zone.

NZDJPYGutted I did not take the AUDJPY trade I called last week...been very busy so not much chance to trade!.

This is what I am looking at for NZDJPY!

I will not be breaking down my charts or be giving in depth reasoning into why I have a bias on a trade. I feel this encourages people to take trades all over the place hoping one will come through because it sounds right! Trust in the process.

Never look to my trades for a signal...I'm not responsible for any of the trades you take.

Have a blessed Sunday!

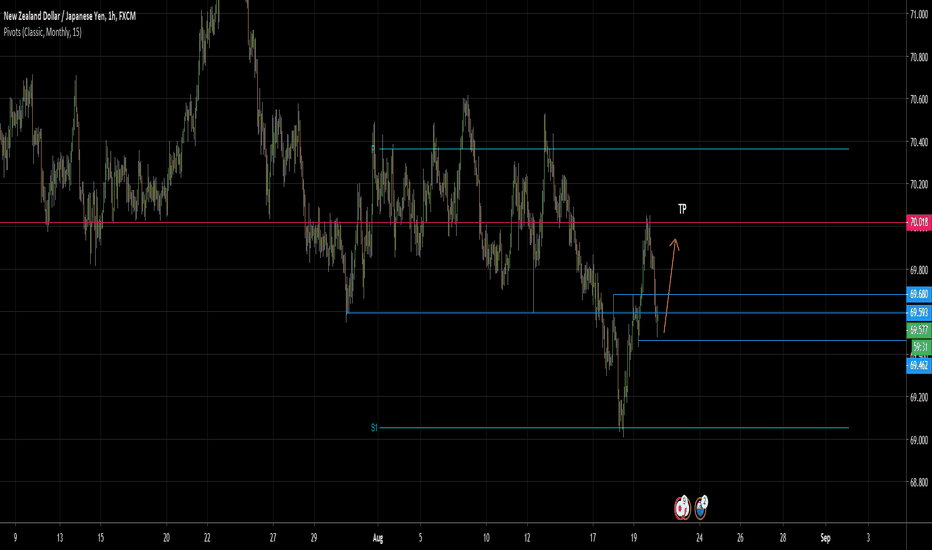

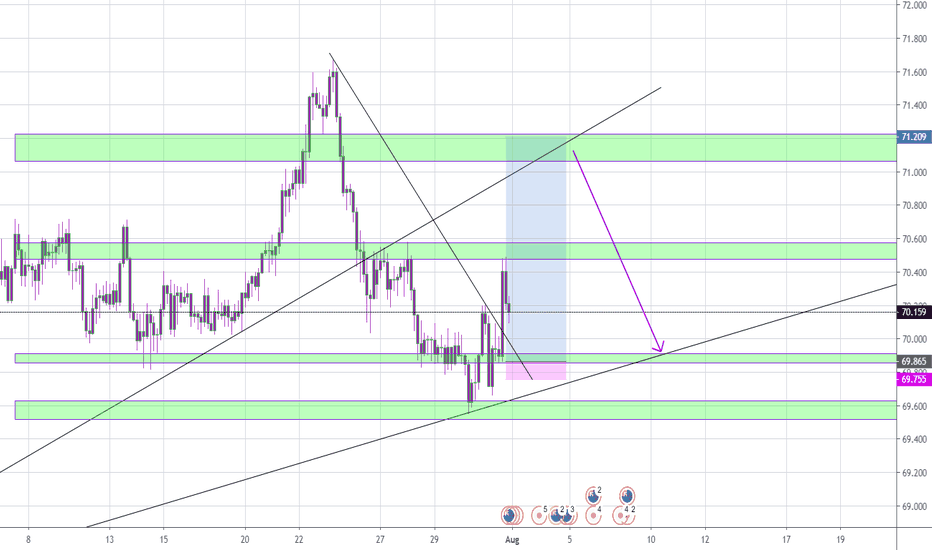

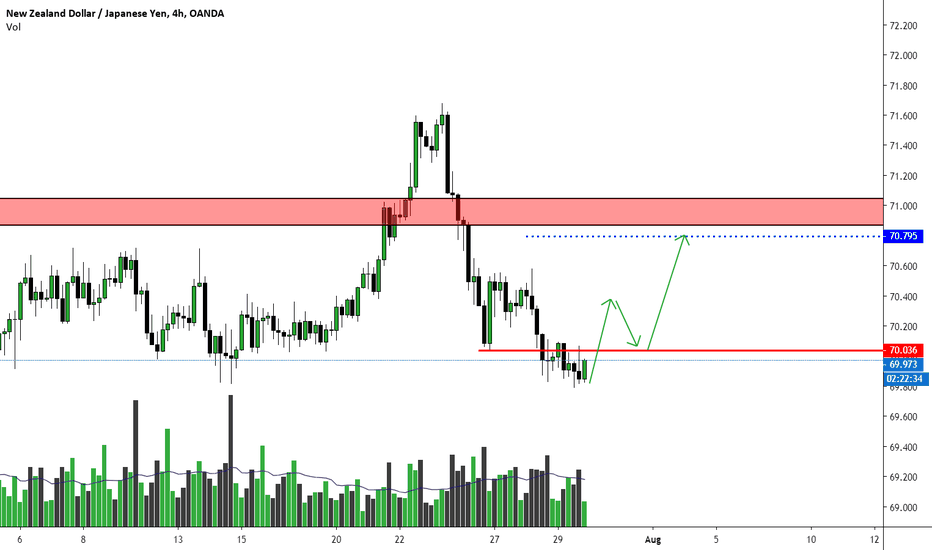

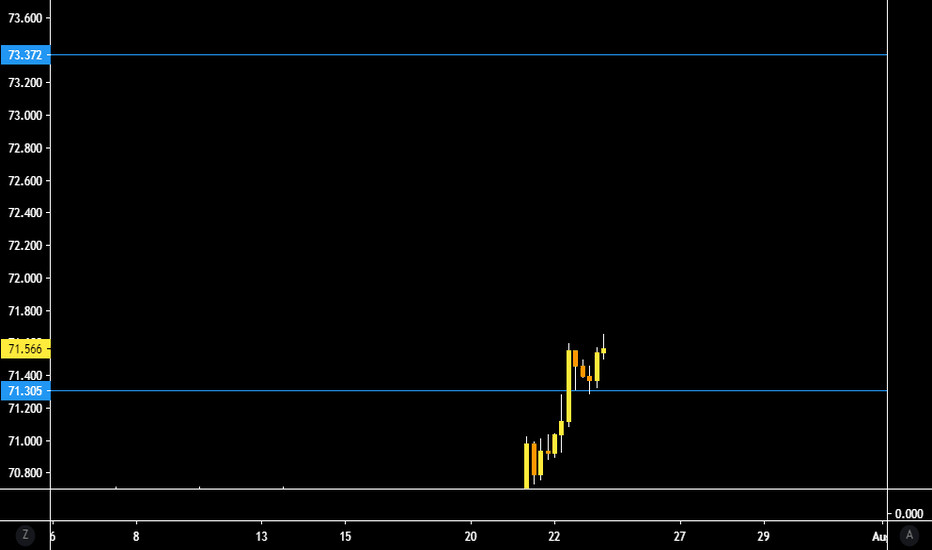

NZDJPY: possible retracement to enter a long position. Pair has signs of short term reversal. If price breaks the current minor support we can see more downside towards the support zone of the horizontal support & lower ascending trend line.

Price could potentially face more downwards pressure so it is important to wait for clear reversal pattern before going long.

Short opportunity when both the support zone is broken and gets a retest.

Long Position on NZD/JPY 4HHello Traders!

-------------------------------------------------------------

🚀BUY Execution according to the market.

-------------------------👇🏻👇🏻Look the running swing trades below👇🏻👇🏻

-----------------------------------------------------------------------------------------------------