Nzdjpylong

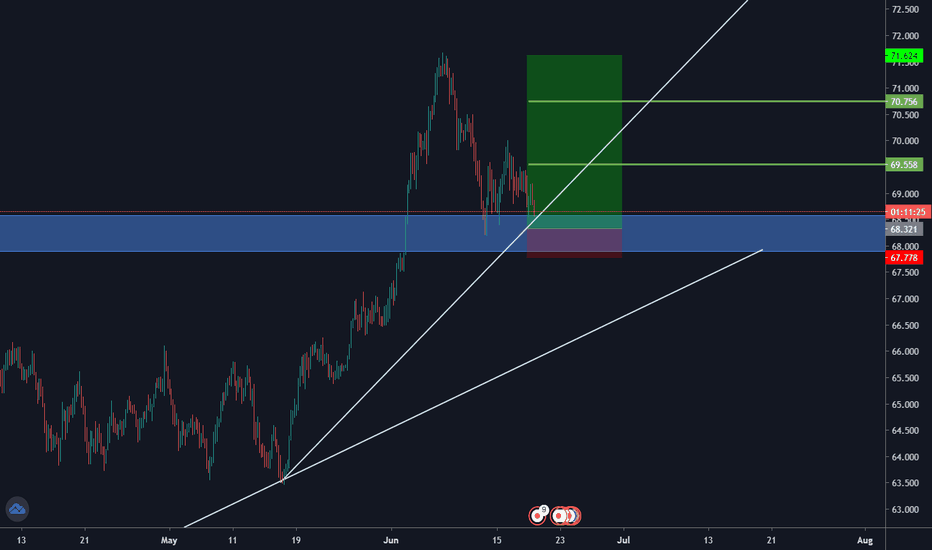

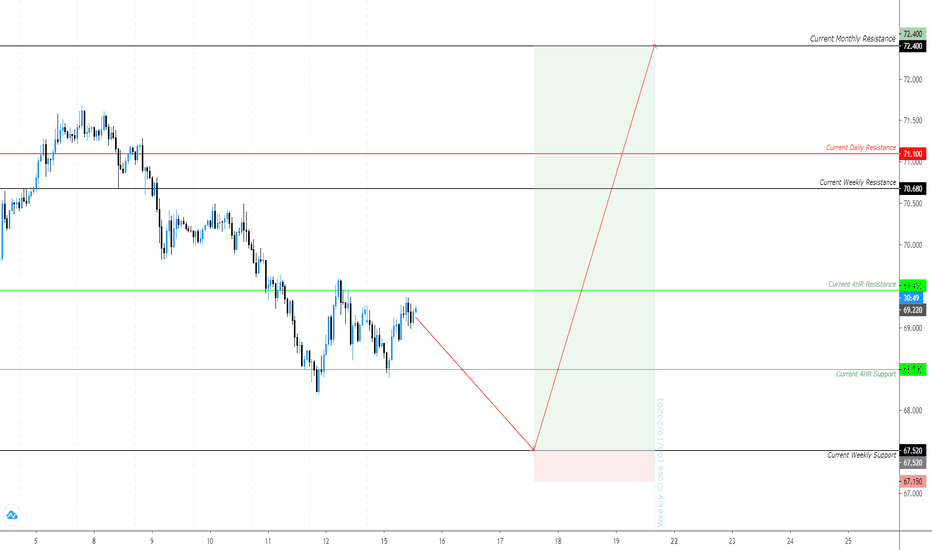

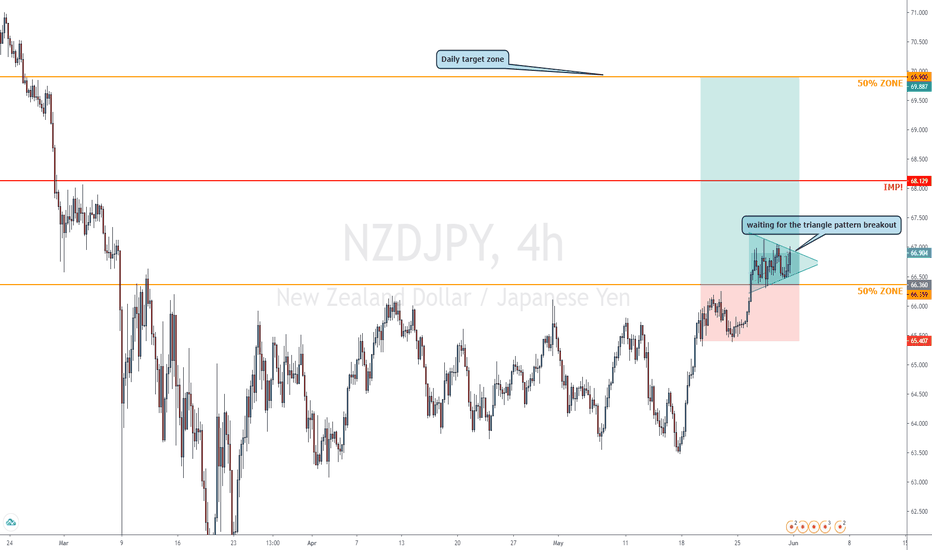

NZDJPY LONGI anticipate a formation of a triple bottom on the 4H chart and a double bottom formation on the daily chart.

Price has also reached the weekly support zone which has been tested before (blue zone). On the monthly chart the same zone has been a critical area of resistance, I anticipate this zone to be broken on the monthly chart to continue an upwards trajectory.

BUY LIMIT @ 68.321

SL: 67.778 (-54.3 pip risk)

TP1: 69.558

TP2 70.756

TP3: 71.624

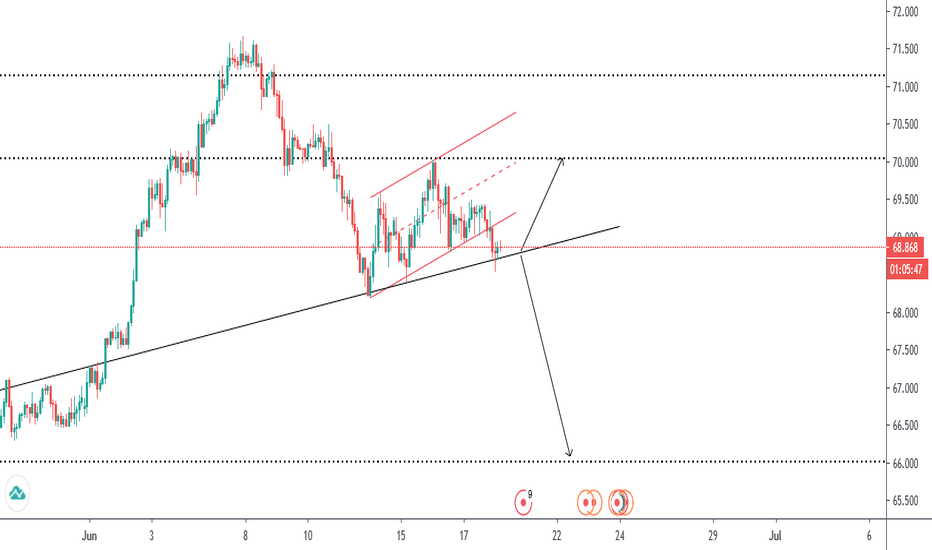

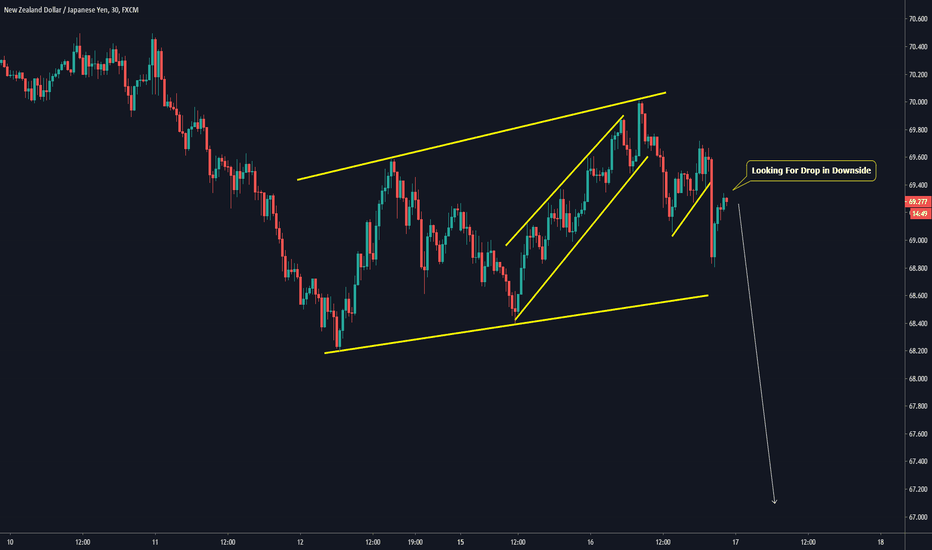

NZDJPY TRENDLINE Abtin00Good morning guys

Whats up ? Everythings all right ?

We are in a sensitive are for nzdjpy if it can break the trendline with power candle ( like maribozu or ... ) we take short position until that the target we shown it below but if trendlline can support it , it can go up to the first target then second target

But dont forget stop loss , we are in sensitive area for suggestion

Good Luck

Abtin

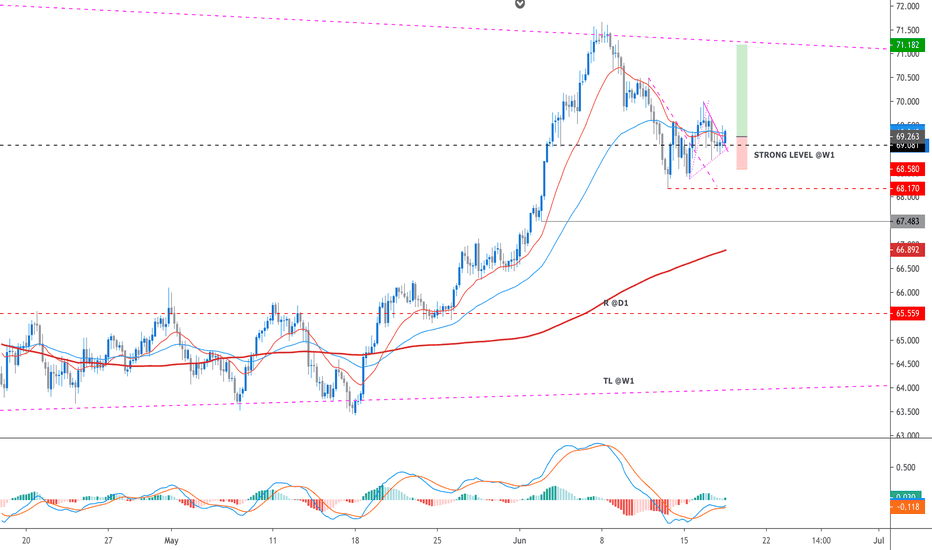

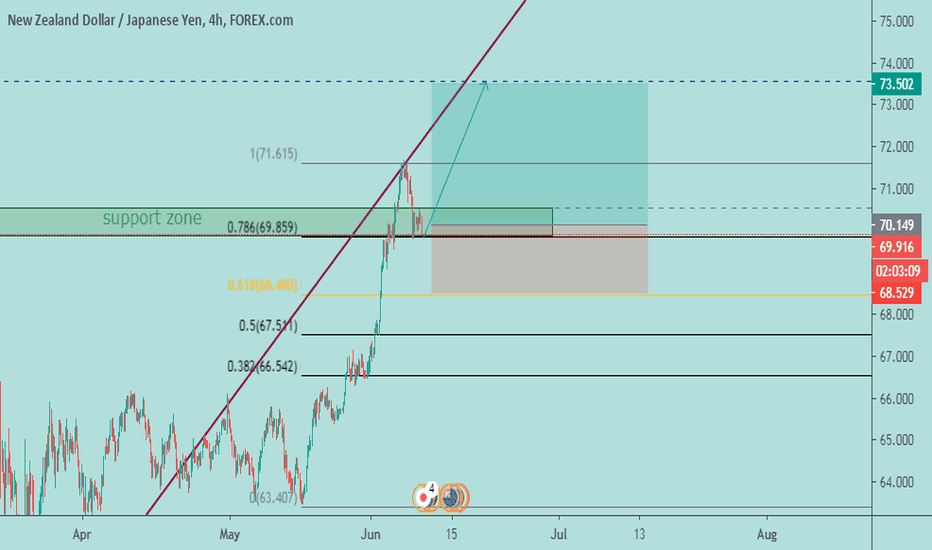

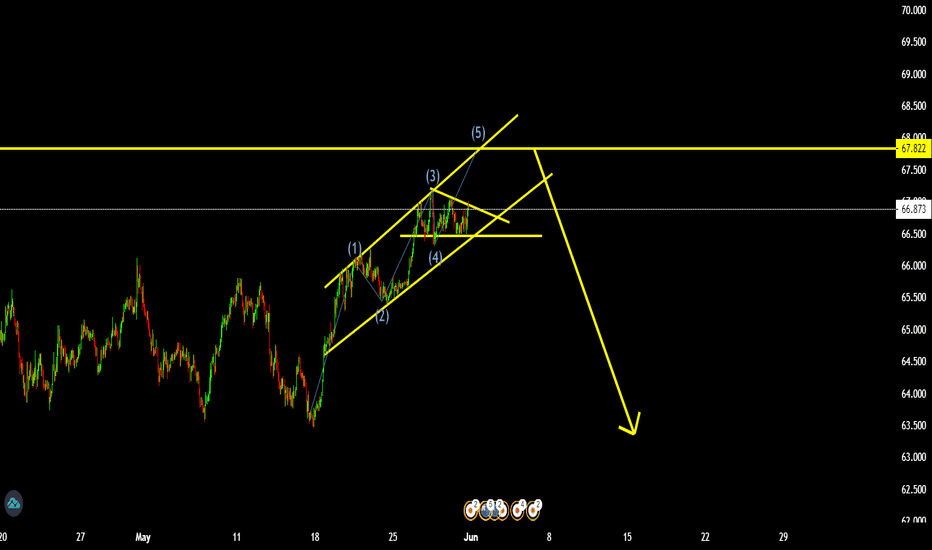

NZDJPY H4 LONG PRICE ACTION FORECAST -UPDATE-Price action fund rejection from the strong level drawn from W1 timeframe, being able to manage a breakout from the trend line, and retest of the level changed the reading of the previous post from a short-entry to a renewed long position.

The pair bullishness is supported not only by the price structure but the MACD and smooth sloping up from the 200MA

The order:

Type: buy-limit

S/L: 68 pips - R:R | 1:2.4

T/P: aiming towards the resistance trendline

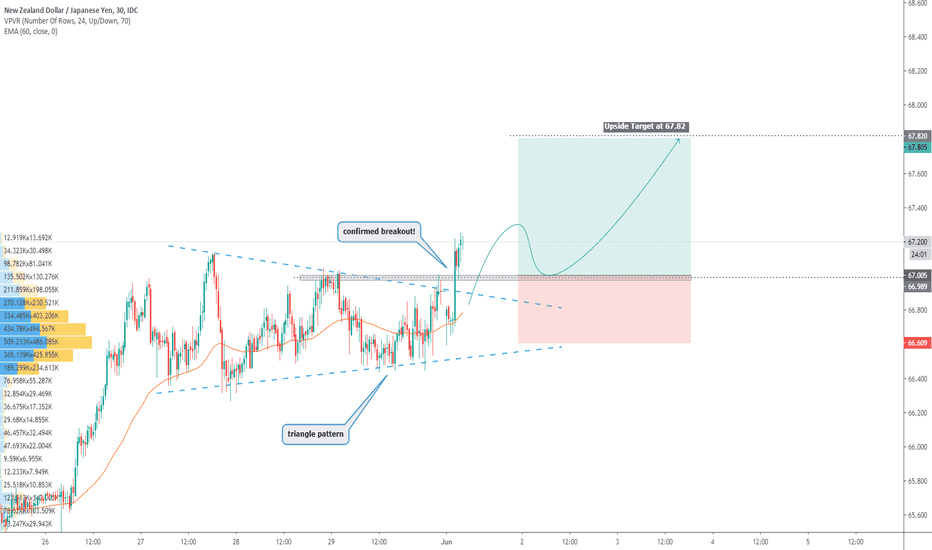

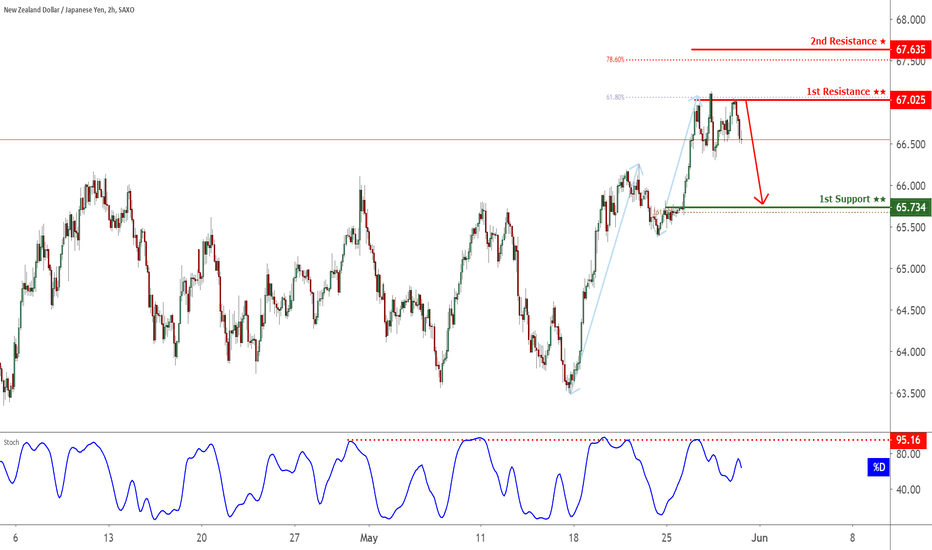

NZD/JPY: POSSIBLE BREAK OUTHello Traders!

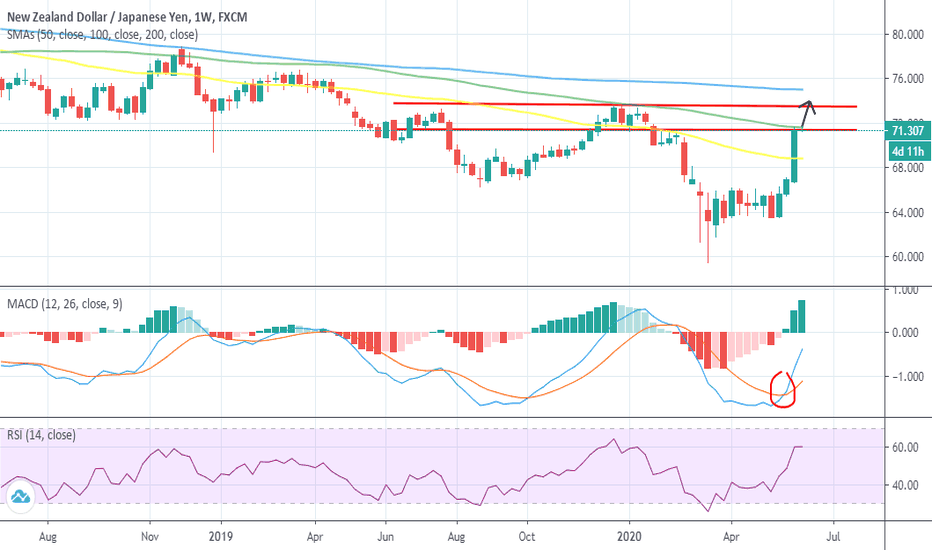

Regarding NZD/JPY, we can note that the two indicators used to analyze this currency pair are good:

- MACD line is ABOVE the SIGNAL line -> uptrend incoming

- RSI shows no overbought signals

- Huge bullish candle confirms our bullish thoughts

I think that the price will break out and touch the new resistance. We cannot exclude a further increase so keep an eye on it!

VF Investment cannot be held responsible for any financial damages suffered from following our well-funded but personal opinions and trading ideas.

Please, maintain proper position sizing and risk management!

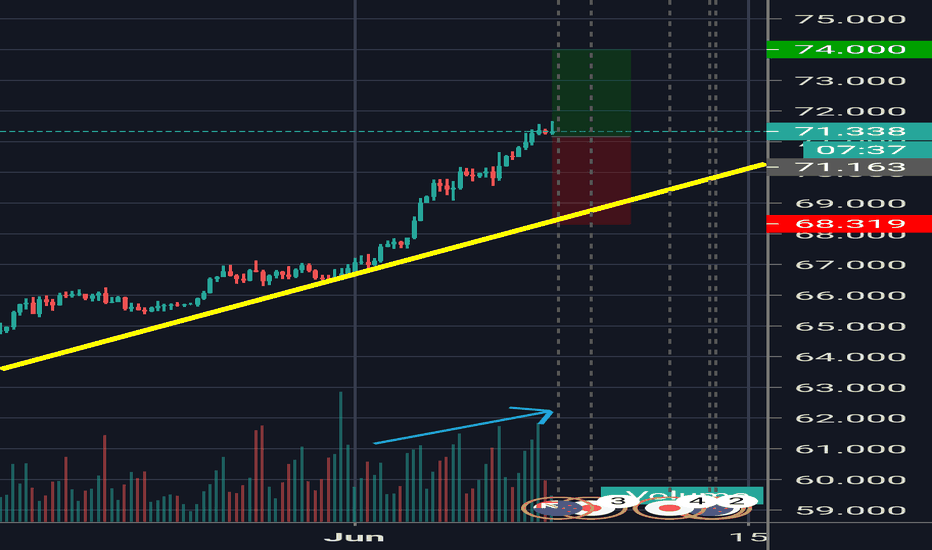

NZDJPY Expected for More Upsideb]Price Side:

#Trend line: Upside continuation

#Pice: Starting to make correction then continue up

#S/R: Strong support is expected

#Exit: if break support / SL

#Trade with care

Volume Side:

#Volume Level: High

#Volume Trigger: On current time frame

#Confirmation: Volume is supporting upside

#Exit: if volume drop or decline

#Trade with care

*Disclaimer : This is Not Financial Advice

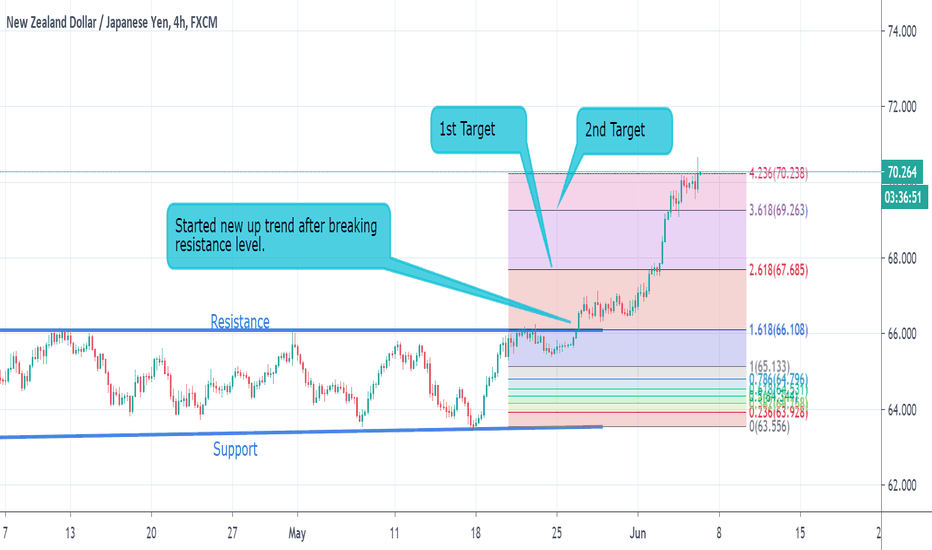

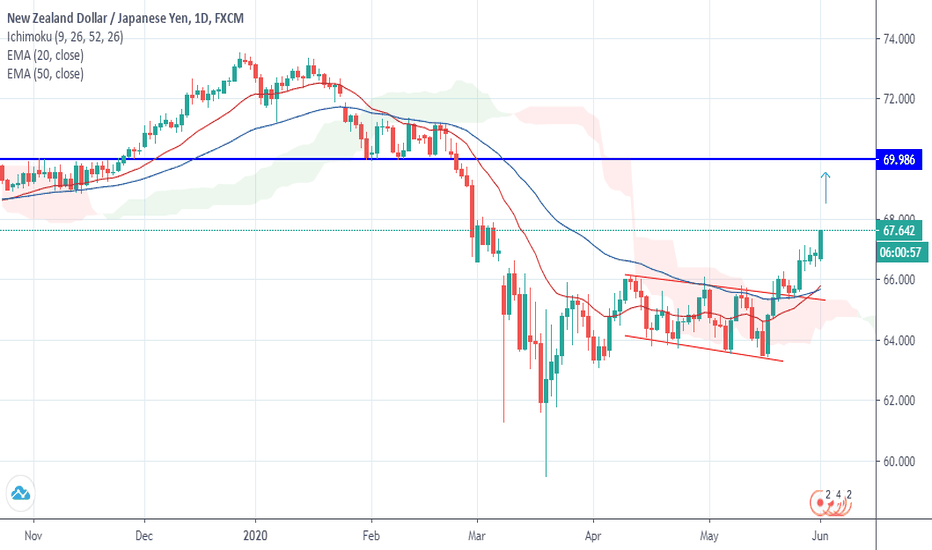

NZD/JPY Technical Analysis.Currently, NZD/JPY is trading at 70.26. The pair is trading in up trend from 26th may after breaking resistance level at 66.10. Altough, the pair has already touched its first target at 67.68 and second target at 69.26. Now the pair has already crossed its second target and entered the resistance zone.

Do follow us for future Forex trend analysis.

Thank you,

Rishikesh Lilawat

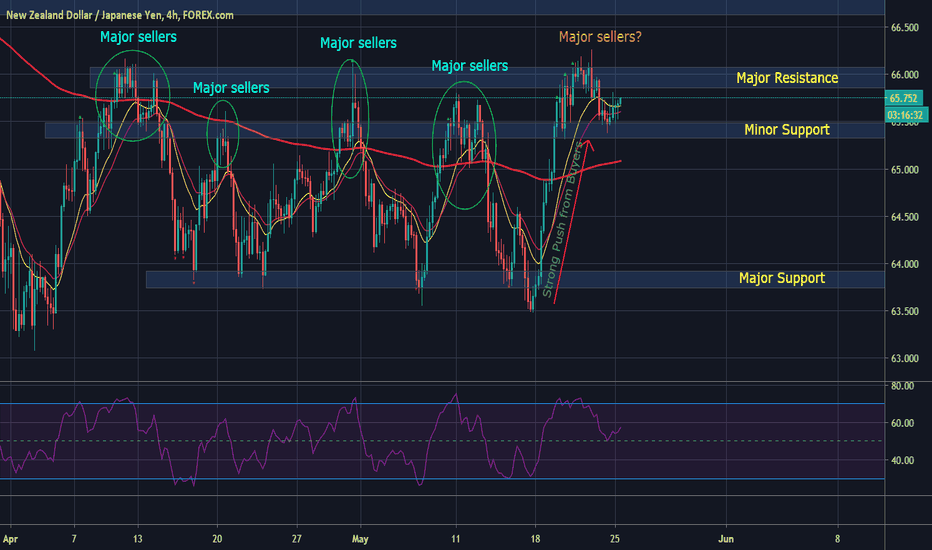

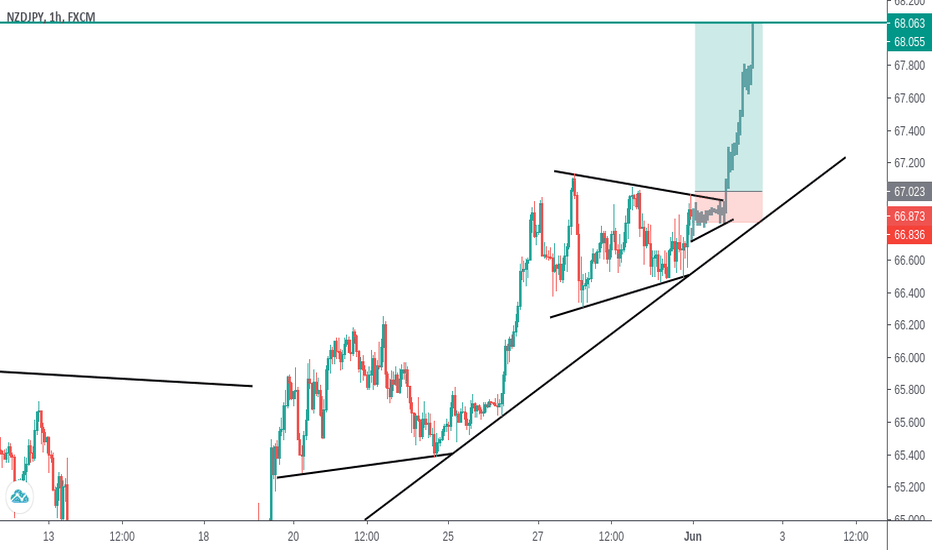

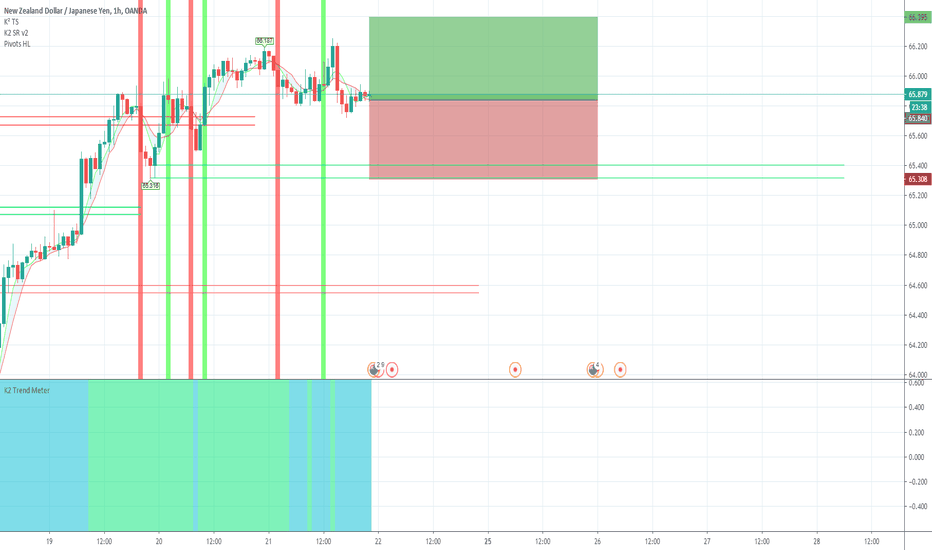

Two Simple Scenarios to Trade the NZDJPY that Needs ATTENTIONTrade Idea:

Previously, buyers have been trying to push this pair higher and above 200EMA, but we can see major sellers stepping in after price has reached the 200EMA (as highlighted from the green circle).

Last week, we saw a significant push from buyers once again and breaking thru the 200EMA and now price is consolidating between a major and minor S/R zones. So I'm expecting two potential opportunities for great trades here:

1st scenario:

200EMA will reach the minor support zone and act as support in combination with the minor support zone, and buyers will step in and push the price even higher, so my entries, TP, & SL will be as follows:

Entry:

Aggressive Entry: 65.470

Conservative Entry: 65.320

TP & SL:

TP1: 66.915

TP2: 67.978

SL: 65.020

2nd Scenario:

Sellers will once again take over this pair and push the price down again to previous major support zone. In this case, I would like to see a break of the 200EMA, in combination with favourable price action to enter the market and target the next major support zone, so my entries, TP & SL will be as follows:

Entry:

Aggressive Entry: 65.200

Conservative Entry: Break of 200EMA

TP & SL:

TP1: 64.540

TP2: 63.790

SL: 65.610

Technical Analysis:

* Range bound market.

* Price is nearing 200EMA.

* RSI currently bouncing off 50 level, indicating buyers strength for now.

Fundamental Analysis:

* De-listing of Chinese companies from US major stock exchange ( Bearish CNY = Bearish NZD)

* Rising tension between US and China relationship ( Bullish JPY)

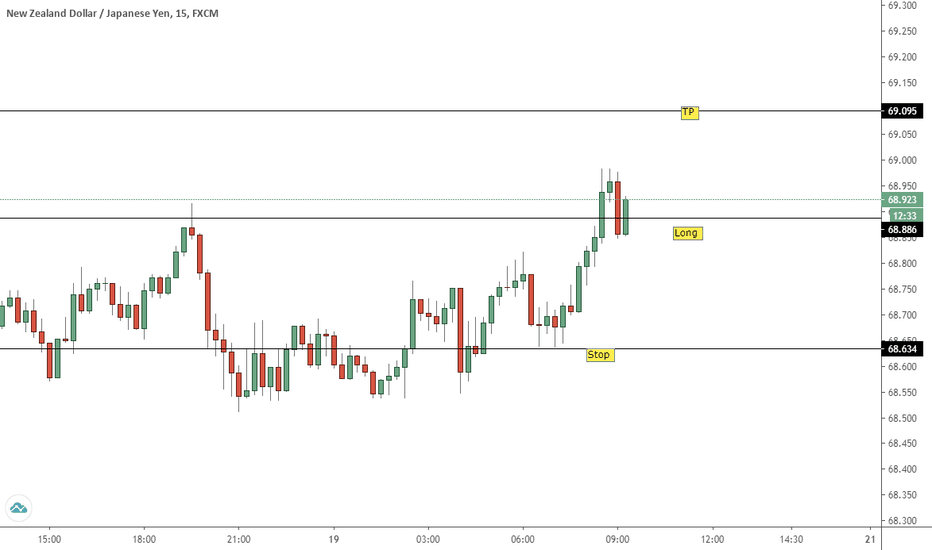

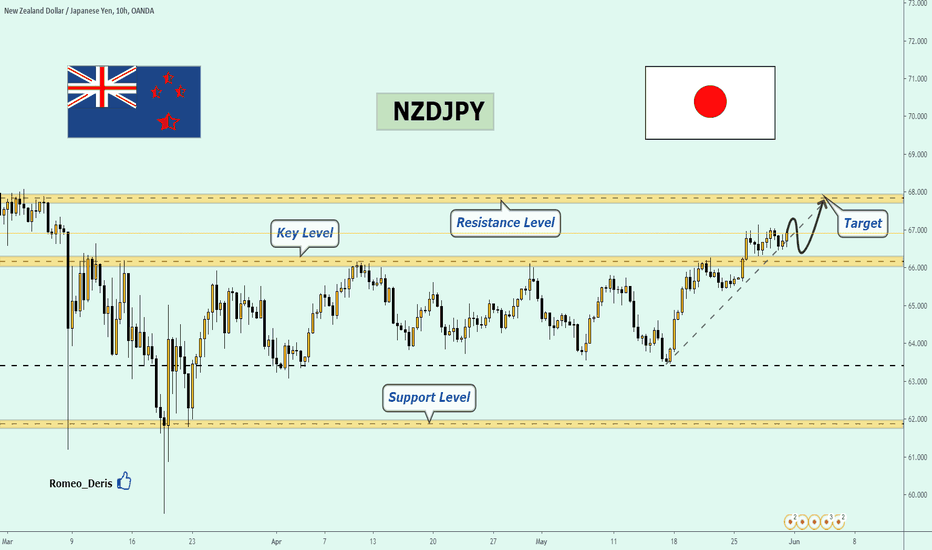

NZDJPY long trade ideaPlan: wait for the price to bounce off from support level --> wait for the rejection candle pattern to form e.g. bullish engulfing, pinbar, etc --> BUY

**Disclaimer** the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Traders!! if you like my ideas and do take the same trade as I do, please write it in a comment so we can manage the trade together.

_____________________________________________________________________________________________________________________

Thank you for your support ;)

GWBFX

NZDJPY. The price will reach the resistance level.Hello dear subscribers!

The price of the New Zealand dollar has overcome a key level.

The price will reach the resistance level,

but volatility will be observed.

Good luck to you!

If you liked this idea, please like and subscribe to my profile.

This idea does not provide the financial advice.

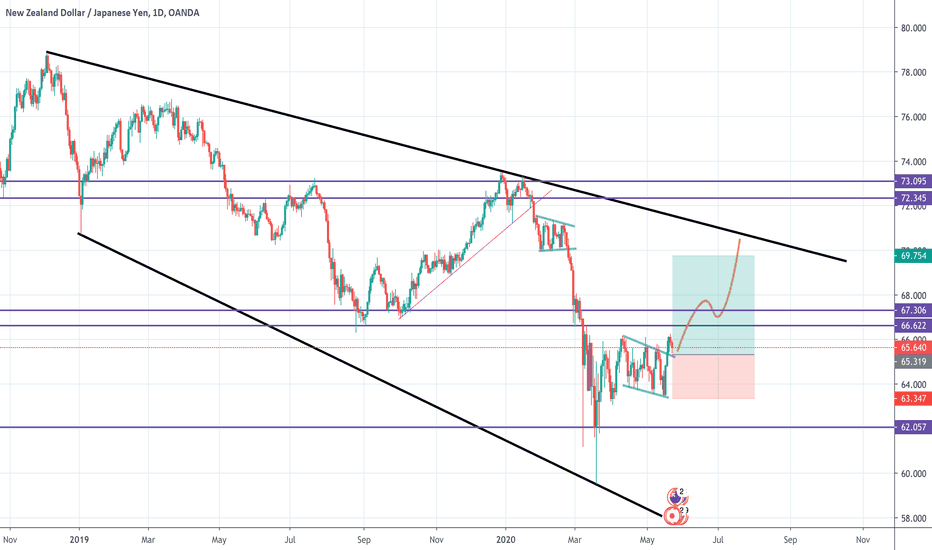

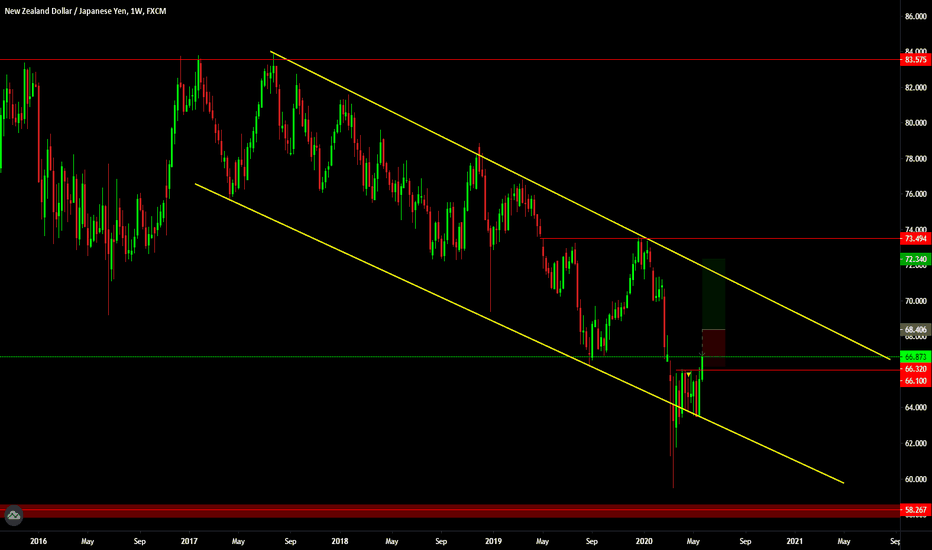

NZDJPY-- W1 Market View and Analysis Forecasting Hy! Smart Trader, Welcome to My Analysis and forecasting Section on Trading view.

We are Creative price action Trader. Join with us as we document the in's and out's of my trading journey. we are publish Multiple Time frame Analysis and forecasting (totally Free)

Never Trade alone

we really hope you enjoy All trade..

Disclaimer:

the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

_______________________________________________________________________________________________

Thank you for your support!