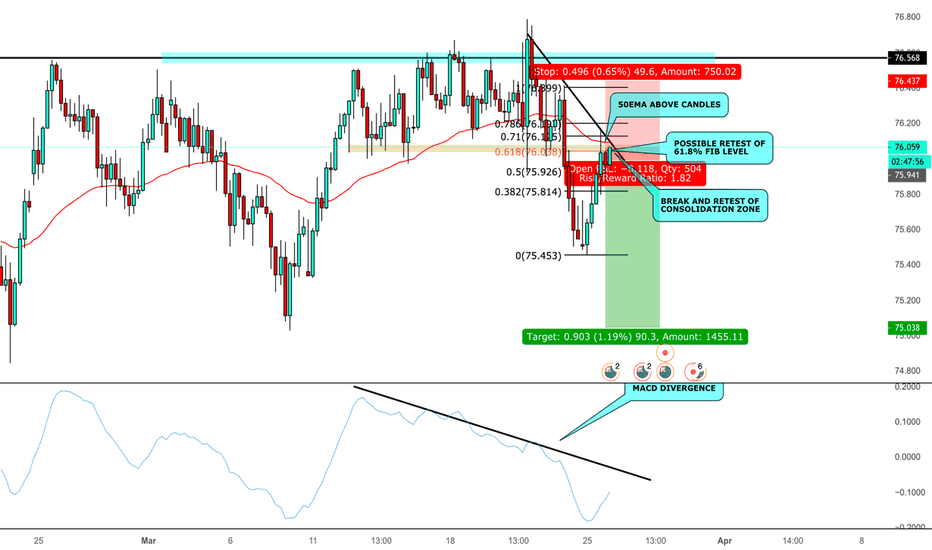

Nzdjpylong

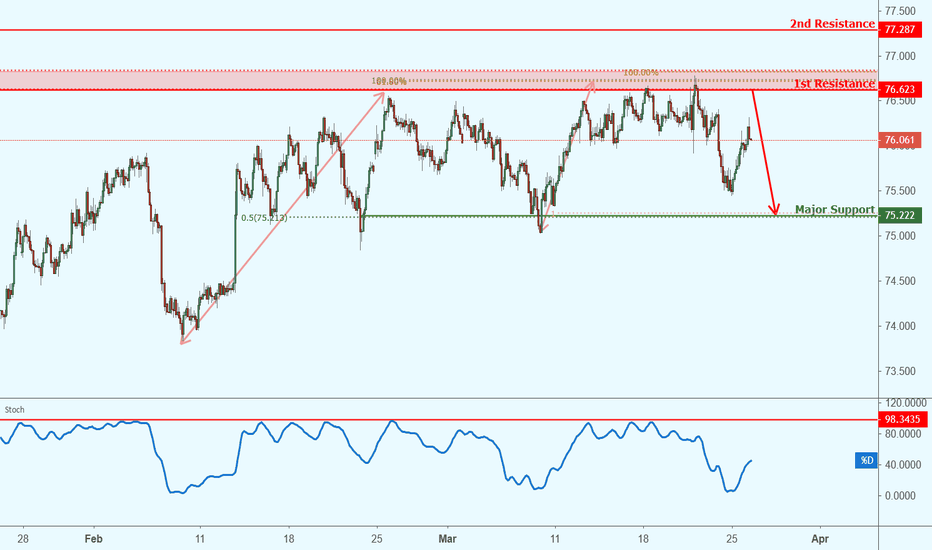

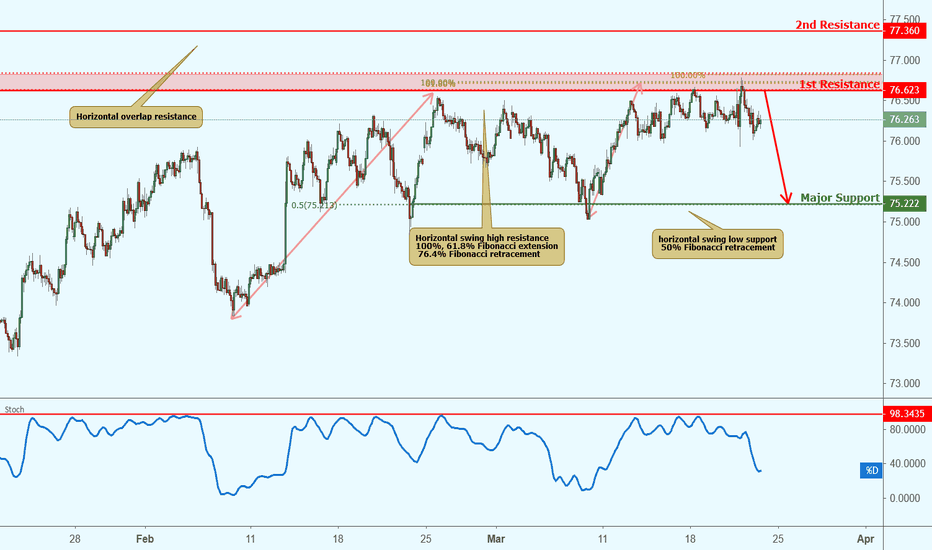

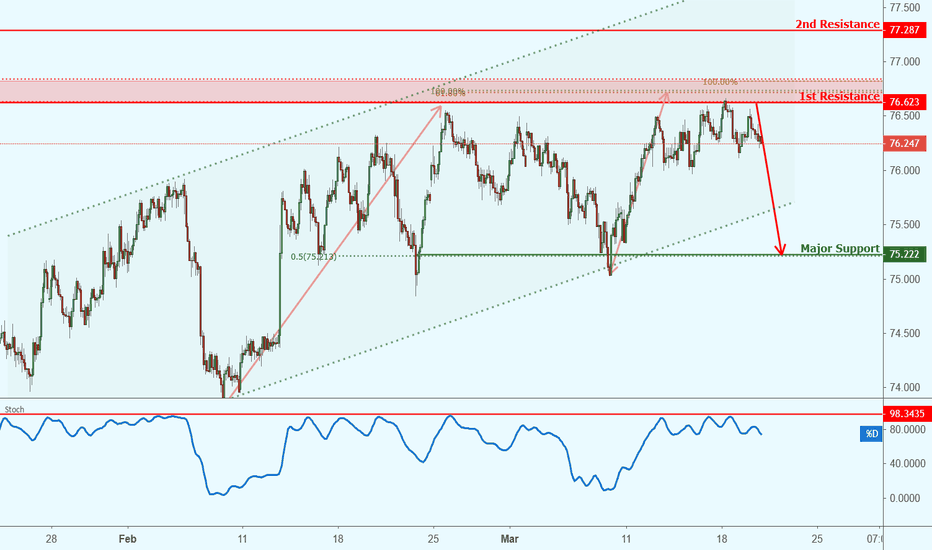

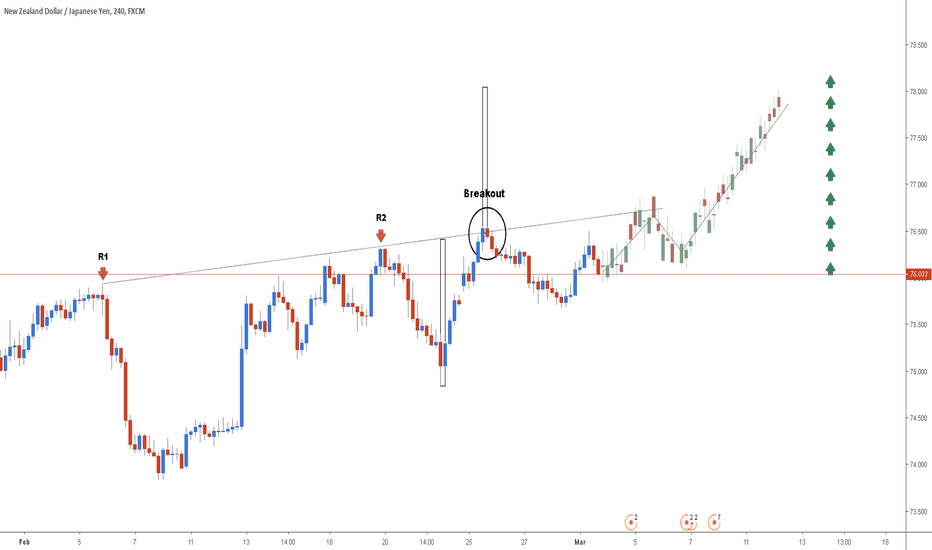

NZDJPY approaching resistance, potential drop! NZDJPY is approaching our first resistance at 76.62 (horizontal swing high resistance, 100%, 61.8% Fibonacci extension, 76.4% Fibonacci retracement) where a strong drop might occur below this level to our major support at 75.22 (horizontal swing low support, 50% Fibonacci retracement, 100% Fibonacci extension).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

NZDJPY approaching resistance, potential drop! NZDJPY is approaching our first resistance at 76.62 (horizontal swing high resistance, 100%, 61.8% Fibonacci extension, 76.4% Fibonacci retracement) where a strong drop might occur below this level to our major support at 75.22 (c).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

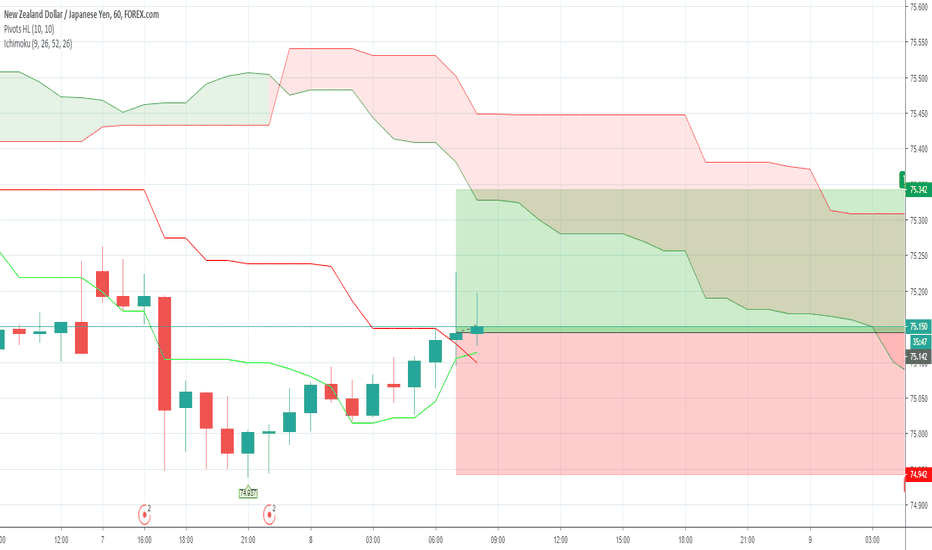

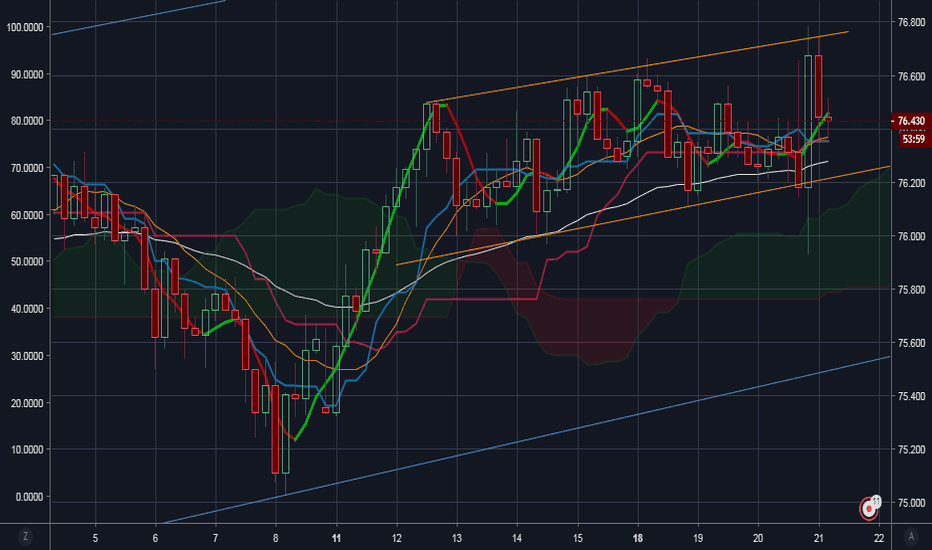

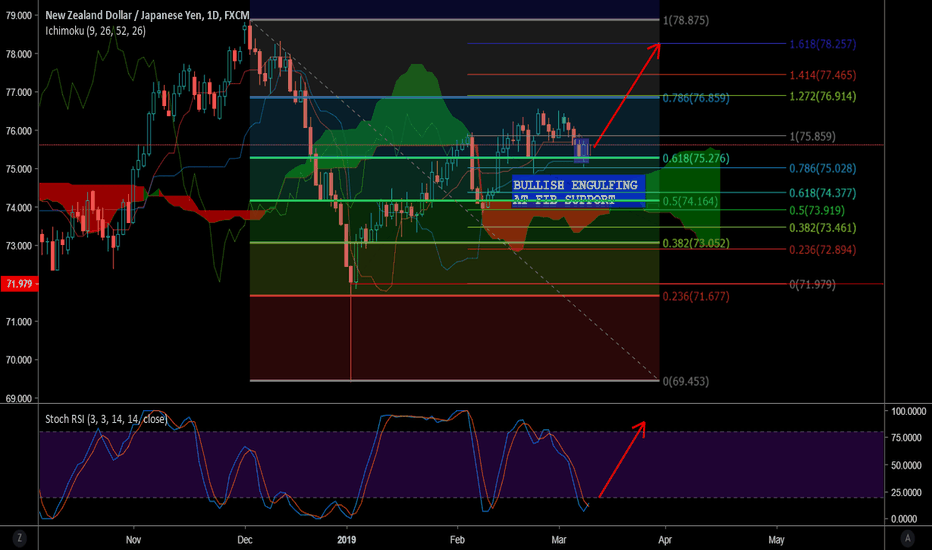

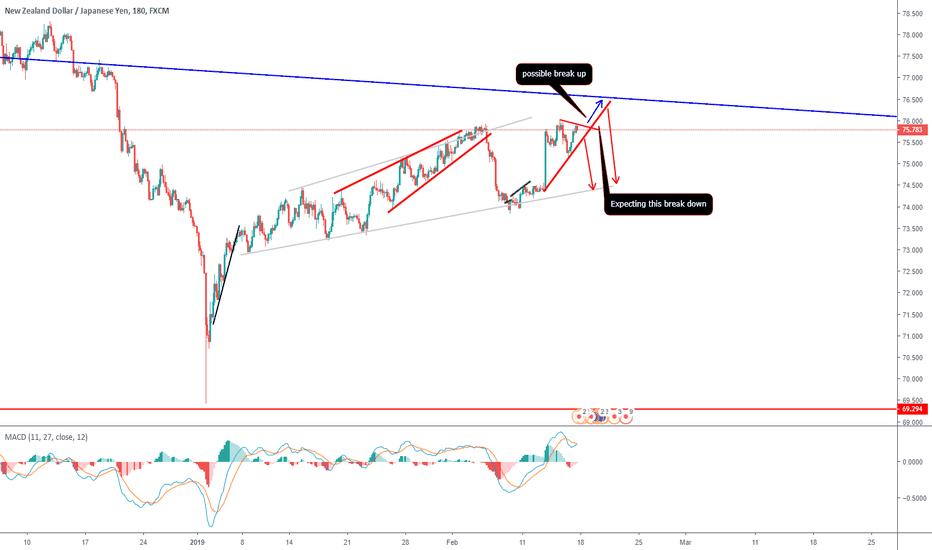

NZD/JPY MARKET VIDEO ANALYSISAbove is my verbal take on where market is headed. Market is following a channel which can be observed on the Daily and 4HR view. Prices are consolidating within the published view, so expecting a big move within a week or two.

DISCLAIMER;

Do set stop losses when trading but be generous with how much room you allow for this due to candle wicks and there is also the possibility to hedge yourself, for more confident traders.

All comments and questions welcome, if curious about indicators I use then feel free to inquire.

IF YOU SUPPORT IDEAS, LIKE, FOLLOW, SHARE ~ THANKS! ~

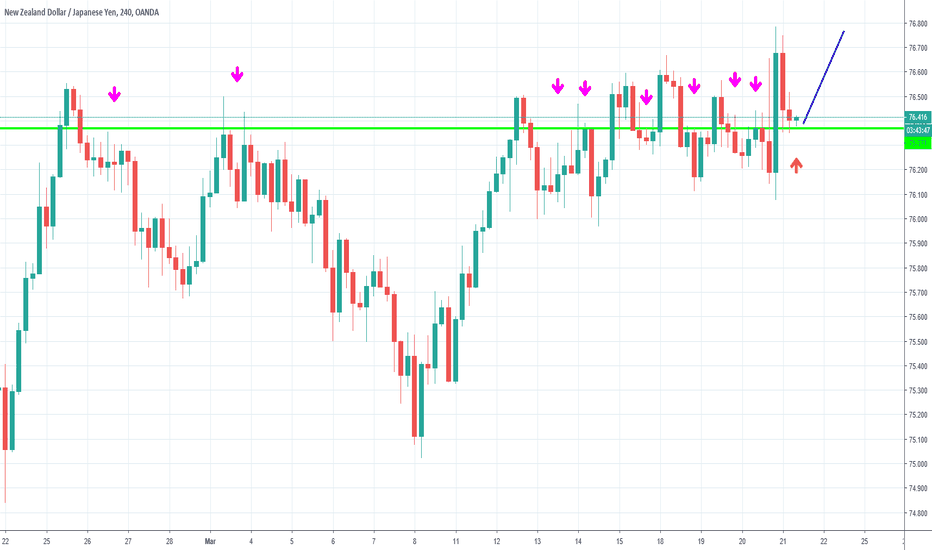

Ride the BULL all the way to the BANK ;p You don't need to be Einstein to see how strong of a level this is, but just in case you are brain dead we have pointed it out with lovely purple arrows ;p

This level has been used as strong resistance and now price is coming back down to test this as support, we can see a bounce and a bullish run coming, and we think it will be a very angry bull... so run for cover or jump on its back and let it take you all the way to the bank.

So go long.. but trade with CORRECT RISK MANAGEMENT!!!! And don't get greedy as greed in the Forex market is why 99% of people fail.

Also only use this analysis if it lines up with your own analysis.

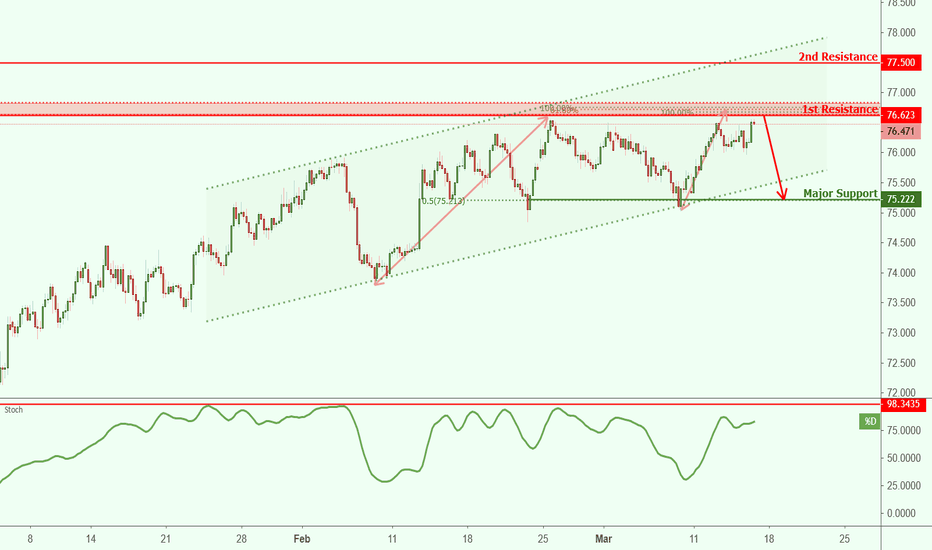

NZDJPY approaching resistance, potential drop! NZDJPY is approaching our first resistance at 76.62 (horizontal pullback resistance, 100%, 61.8% Fibonacci extension, 50% Fibonacci retracement) where a strong drop might occur below this level to our major support at 75.22 (horizontal swing low support, 50% Fibonacci retracement).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

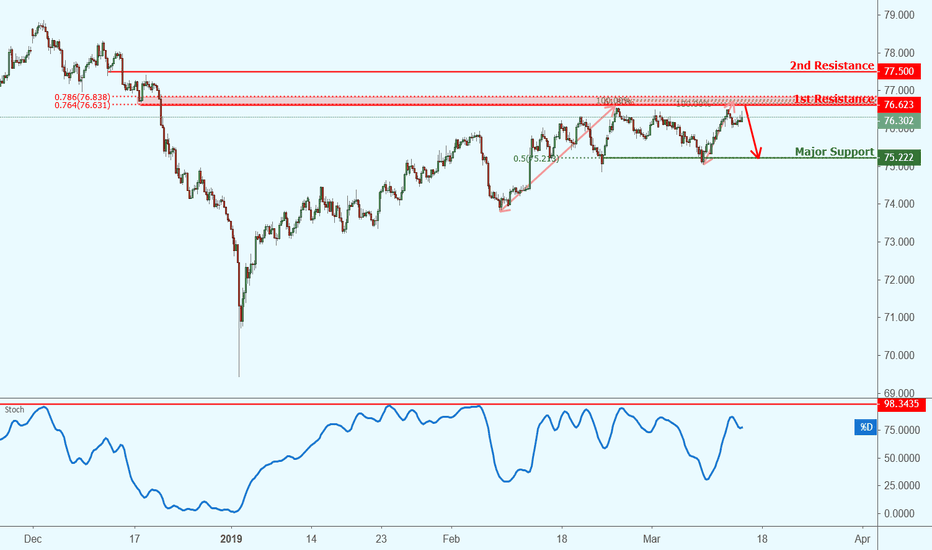

NZDJPY approaching resistance, potential drop!NZDJPY is approaching our first resistance at 76.62 (horizontal pullback resistance, 61.8%, 100% Fibonacci extension, 76.4% Fibonacci retracement) where a strong drop might occur below this level to our major support at 77.22 (horizontal swing low support, 50% Fibonacci retracement).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

NZDJPY approaching resistance, potential drop! NZDJPY is approaching our first resistance at 76.62 (horizontal pullback resistance, 61.8%, 100% Fibonacci extension, 76.4% Fibonacci retracement) where a strong drop might occur below this level to our major support at 77.22 (horizontal swing low support, 50% Fibonacci retracement).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

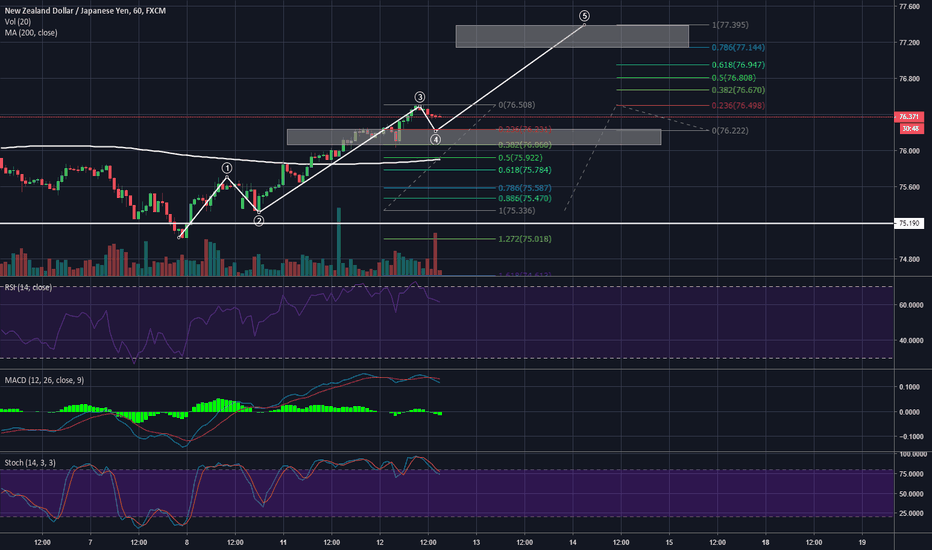

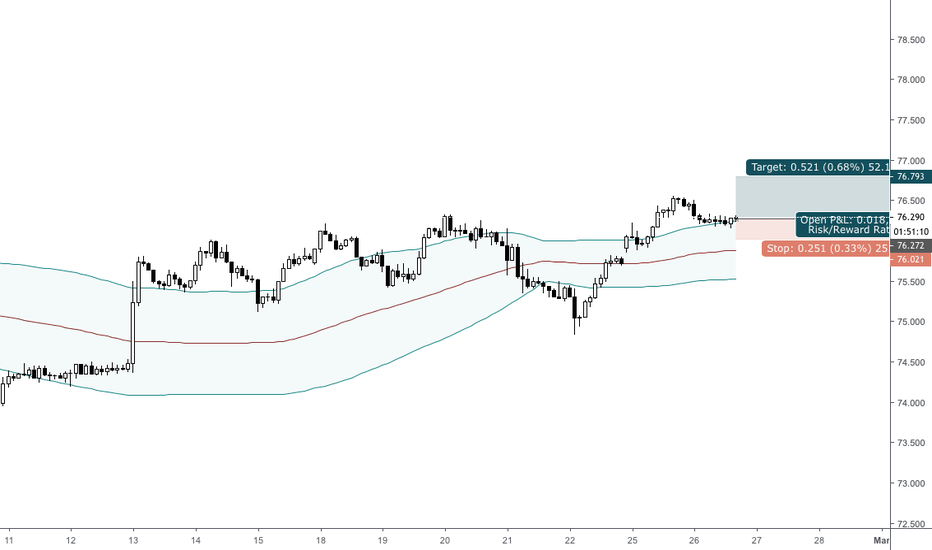

NZDJPY LongNZDJPY looks to be in a quite healthy trend at the moment.

With the daily candles closing quite bullish, I believe we may still have a bit of an upside to see.

We may very well be in a current Elliot Wave with this wave being the corrective wave number 4.

A retracement to the .236 - .382 fib level would be nice to see & it could make for a nice R/R ratio, targeting the .786 - 1-1 fib extension as for our 5th wave.

Should price break the .382 fib level, this EW probably may not be valid.

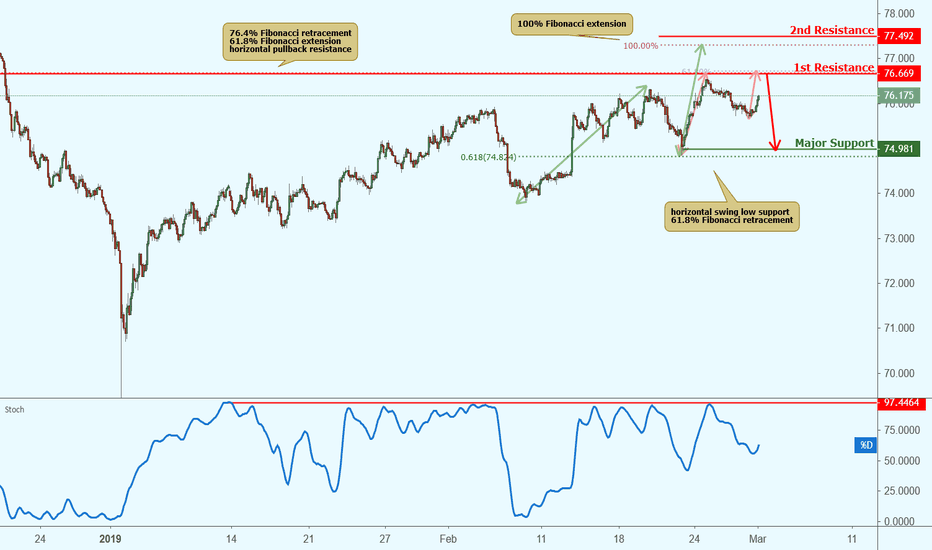

NZDJPY approaching resistance, potential drop! NZDJPY is approaching our first resistance at 76.66 (76.4% Fibonacci retracement, 61.8% Fibonacci extension, horizontal pullback resistance) where a strong drop might occur below this level pushing price down to our major support at 74.98 (horizontal swing low support, 61.8% Fibonacci retracement).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

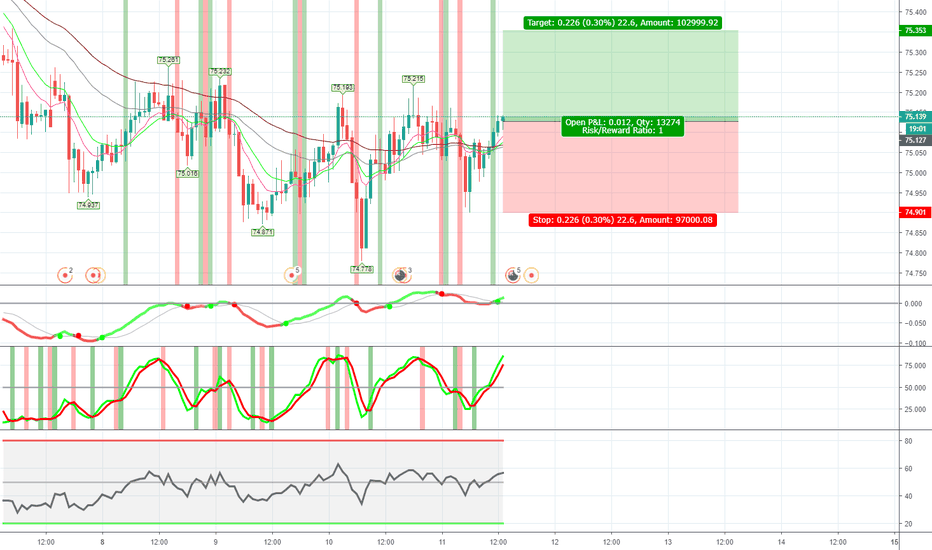

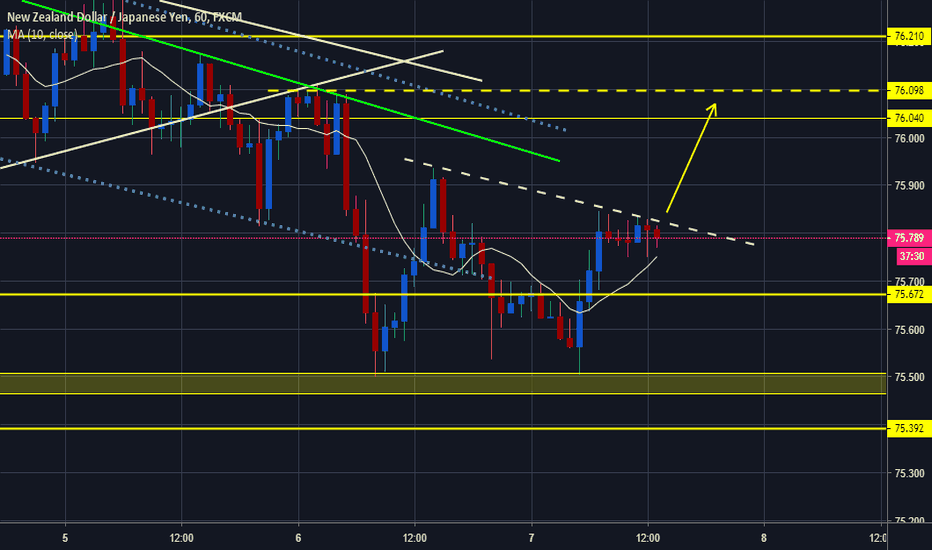

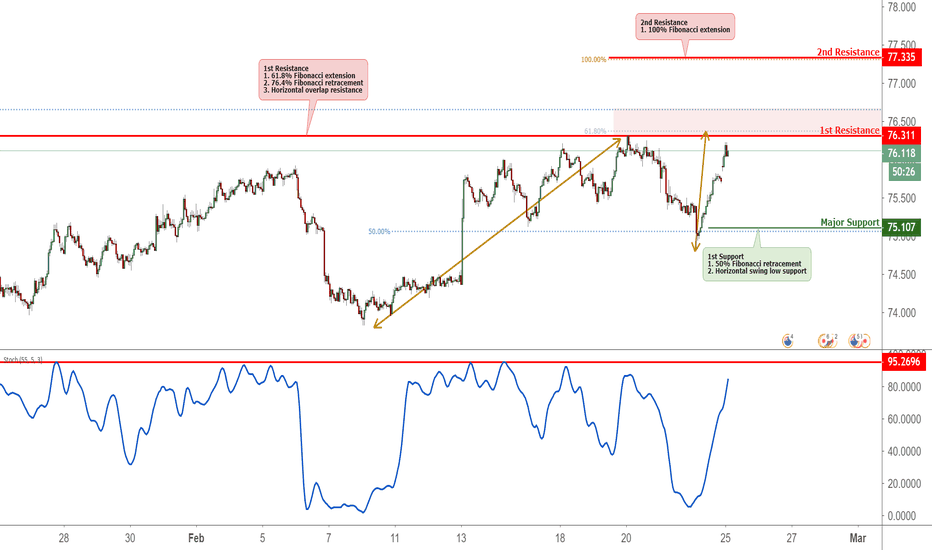

NZDJPY Approaching Resistance, Potential ReversalNZDJPY is approaching its resistance at 76.31 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap resistance) where it may reverse down to its support at 75.14 (50% Fibonacci retracement, horizontal swing low support).

Stochastic (55, 5, 3) is approaching its resistance at 95% where a corresponding reversal may occur.

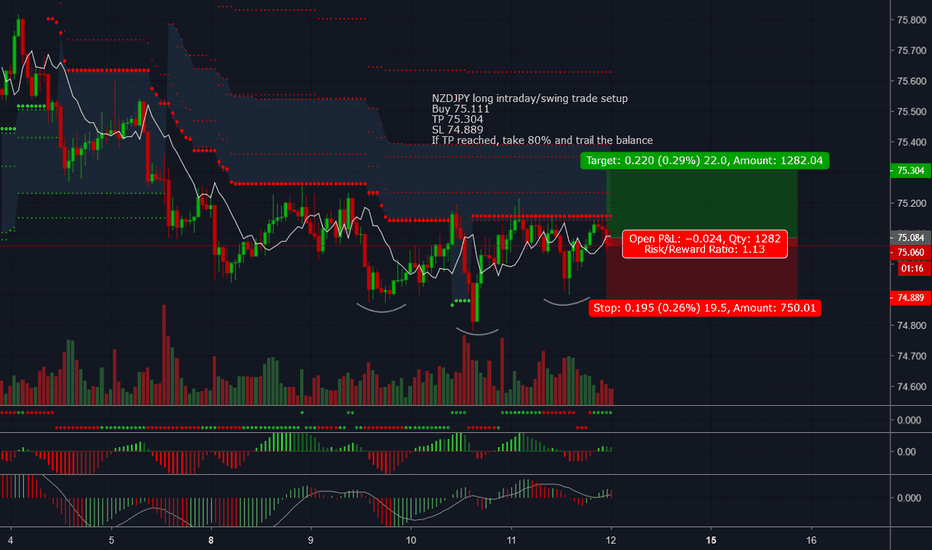

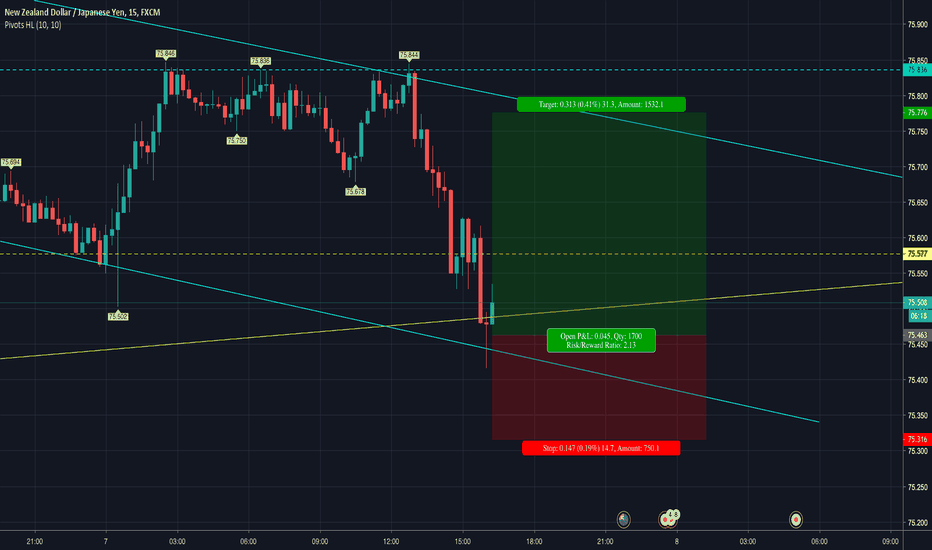

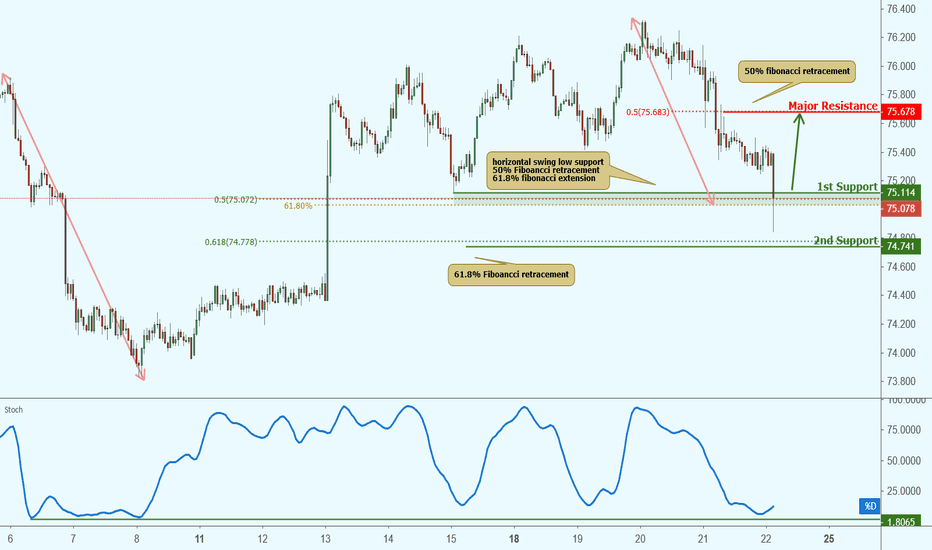

NZDJPY approaching support, potential bounce!NZDJPY is approaching our first support at 75.114 (horizontal swing low support, 61.8% fibonacci extension, 50% fibonacci retracement) where a strong bounce might occur above this level pushing price up to our major resistance at 75.67 (50% fiboancci retracement).

Stochastic (34,5,3) is also approaching support where we might see a corresponding bounce in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.