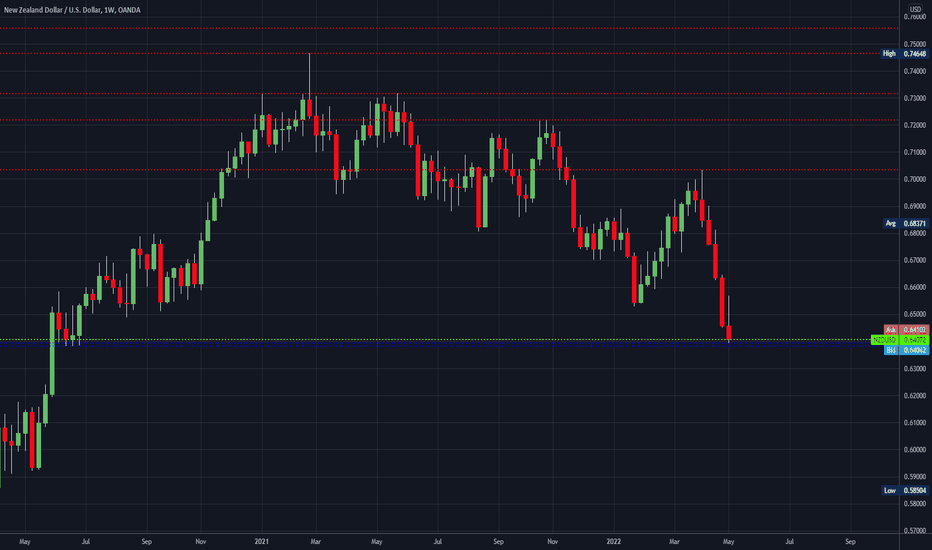

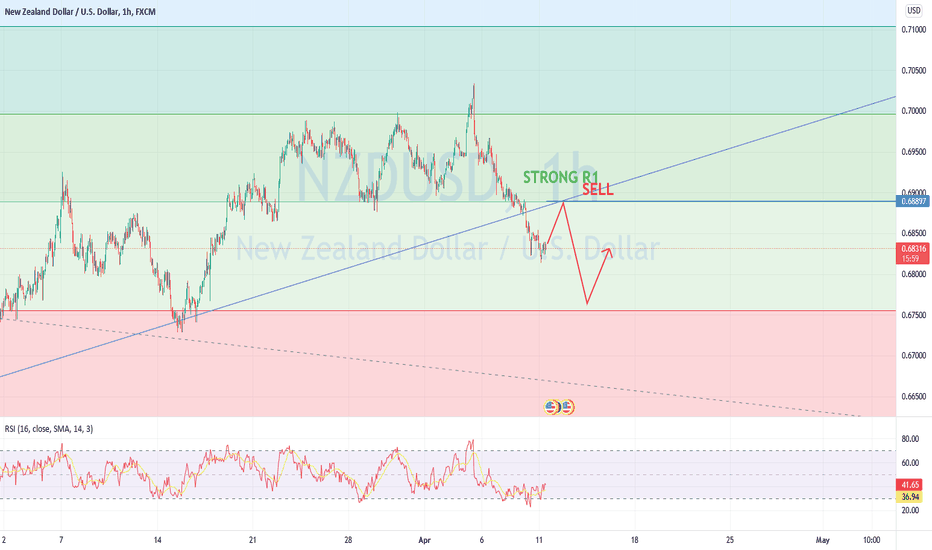

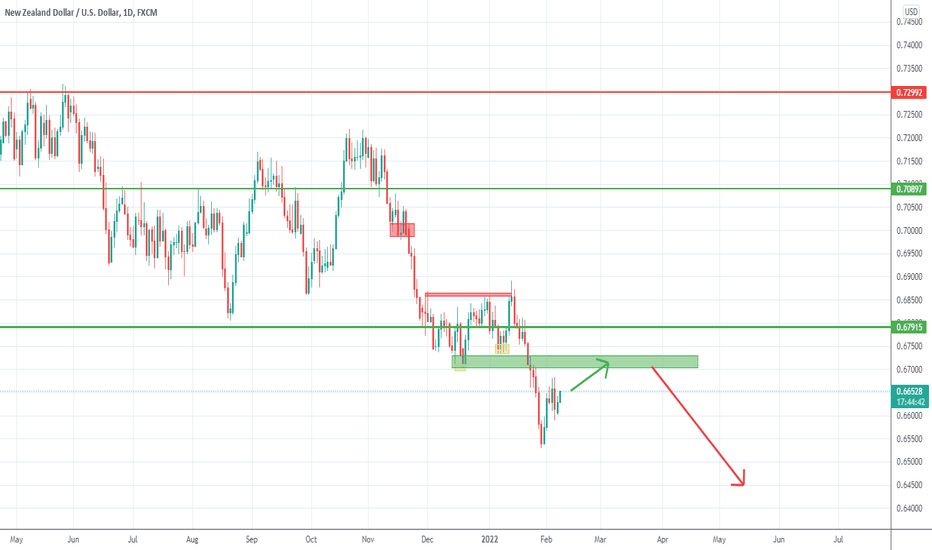

NZDUSDThe New Zealand dollar went back and forth last week but is a bit overextended to the downside. What is worth noting is that we ended up forming a bit of an inverted hammer, so it is likely that we will eventually find sellers on short-term rallies. Any sign of exhaustion on a short-term chart I will be shorting, and I do believe that it is likely that we will try to get down to the 0.63 level.

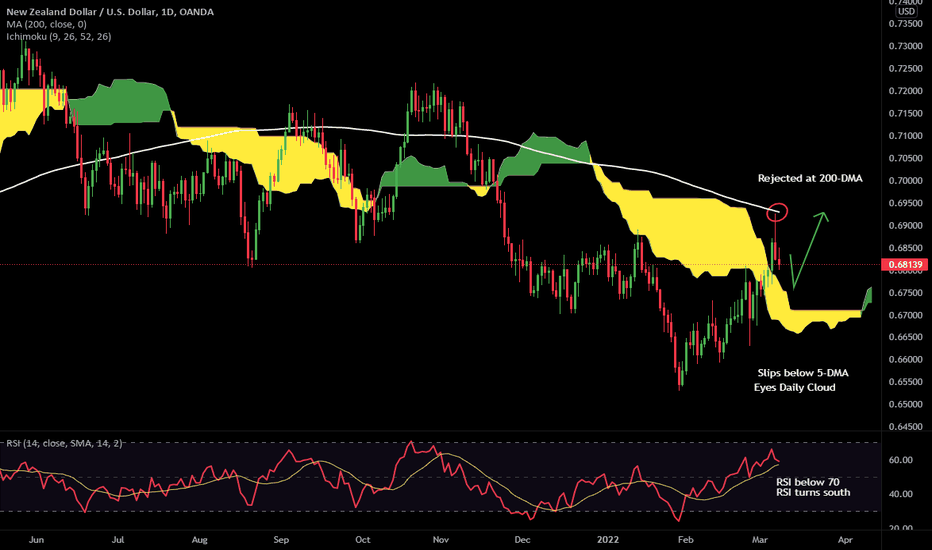

Nzdusddaily

NZDUSDThe NZD/USD hovered near the 0.64100 ratio yesterday and remains within the weakest part of its long term price range as of today. Values of the NZD/USD are traversing prices not sincerely tested since June of 2020. However it should be noted that on the 4th of April, almost one month ago, the NZD/USD was trading near the 0.70300 vicinity.

Traders are certainly aware of the downward cycle the NZD/USD has encountered the past month as financial institutions have positioned their cash holdings, as they anticipate the next interest rate hike from the U.S Federal Reserve. However in January of this year the NZD/USD was trading momentarily near a low of around 0.64850 which highlights the forex pair has moved within these lower depths before and has managed to fight upwards.

While technical traders cannot be blamed for looking at long term charts and can plainly see the NZD/USD was trading near lows of 0.54850 in March of 2020, considerations must be correlated. Downward pressure in the NZD/USD has certainly continued to make short term support vulnerable as new lows have been created. The near term will be volatile as financial houses react to the pronouncement of the U.S central bank which will be published on late Wednesday. The lows of March 2020 were made as coronavirus fears escalated two years ago.

The U.S Fed has made it clear they want to raise interest rates by half a point tomorrow. This hike has been digested into the Forex market already. What investors need to now worry about is what moves the Fed claims it will take in the months ahead and that is causing nervousness. Short term traders need to understand that volatility will be quite rampant near term and choppy trading with spikes need to be anticipated.

Traders who believe the NZD/USD is about to touch lows and start to reverse upwards cannot be blamed. However timing the moment when the NZD/USD truly turns around and starts to become positive may be quite difficult to pinpoint. Traders who think new lows will be seen in the NZD and the 0.64000 mark is in peril and lower depths will be seen cannot be faulted either.

Within the choppy conditions that are likely to be demonstrated near term, speculators would be wise to use entry price orders. Igniting positions and using stop loss and take profit orders, to get in and out of positions could prove to be very helpful in the near term.

NZD/USD Short-Term Outlook

Current Resistance: 0.64710

Current Support: 0.64090

High Target: 0.65480

Low Target: 0.63810

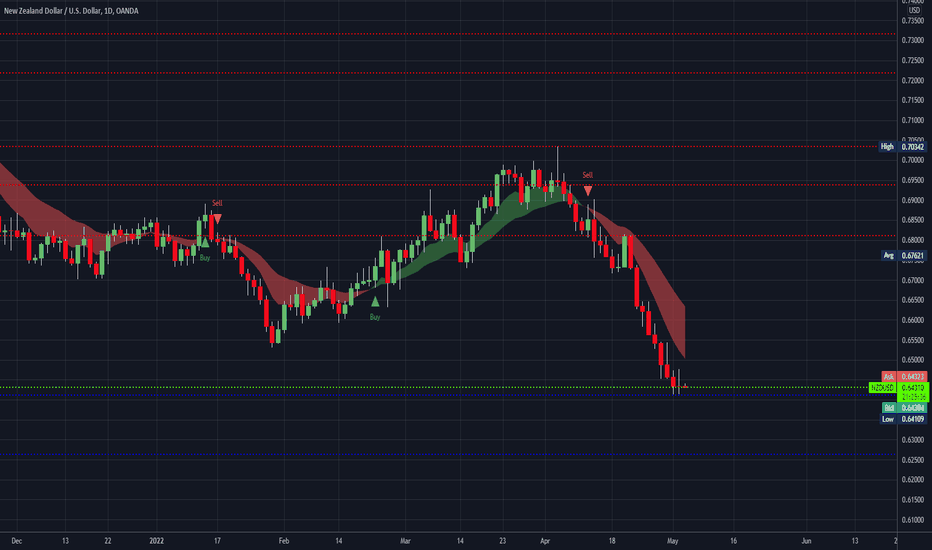

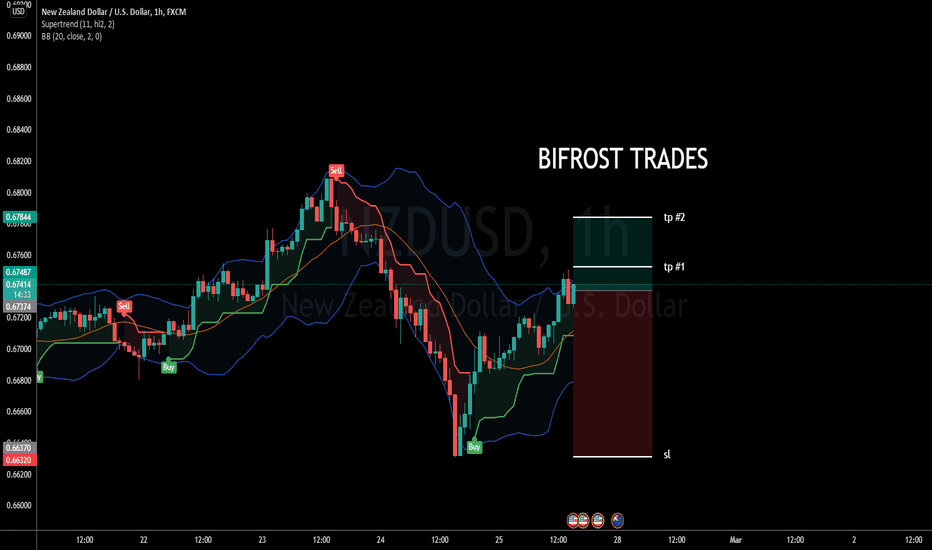

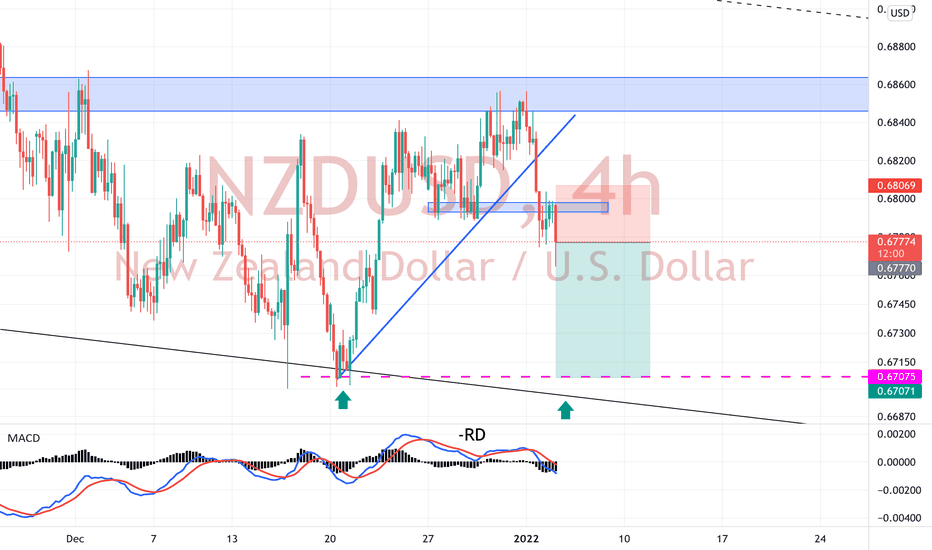

NZDUSD top-down analysis Hello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

NZDUSD top-down analysis Hello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

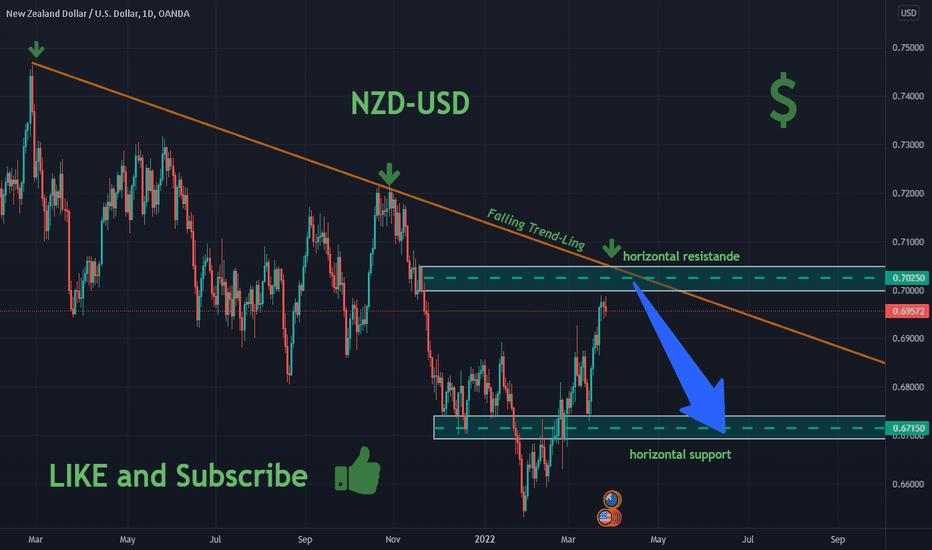

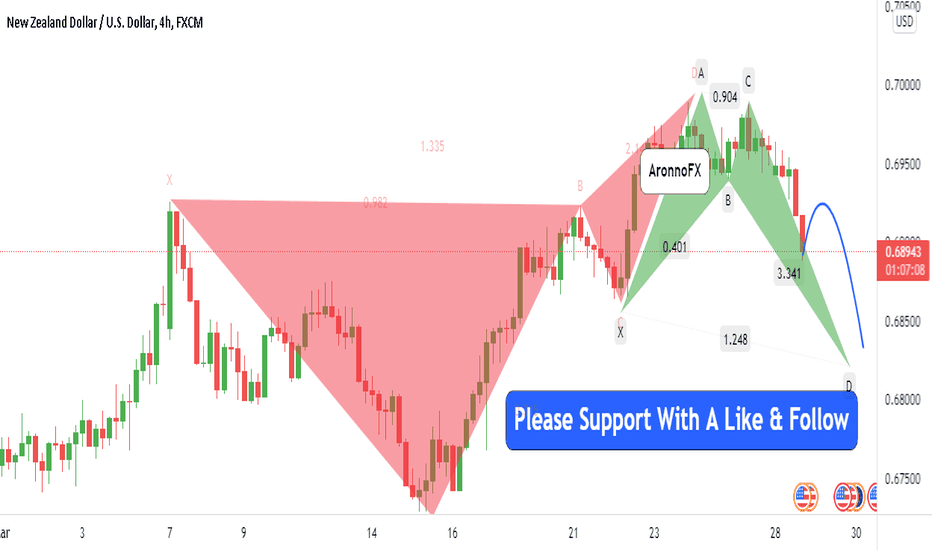

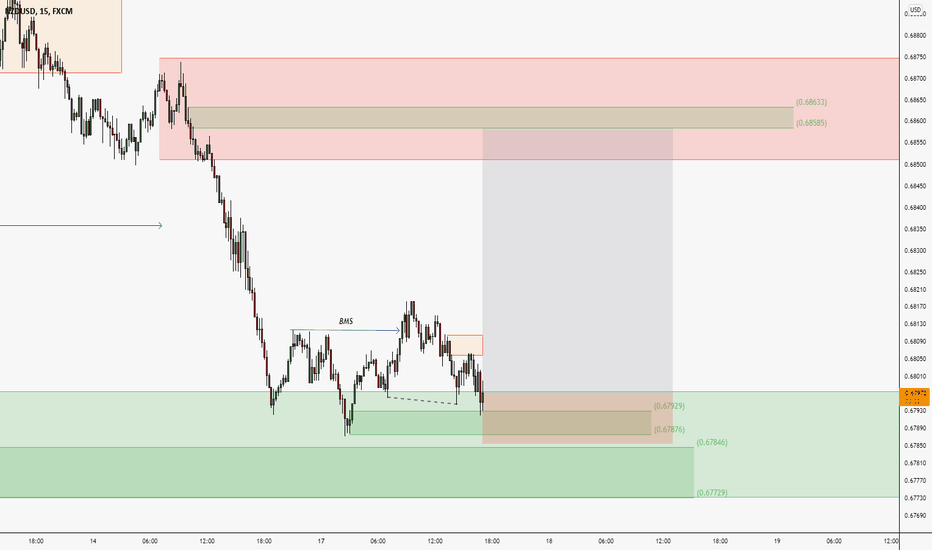

NZD/USD SHORT SELL OPPUTUNITY now......

Hello Traders, here is the full analysis for this pair,

let me know in the comment section below if you have any questions,

the entry will be taken only if all rules of the strategies will be

satisfied. I suggest you keep this pair on your watch list and see if

the rules of your strategy are satisfied.

Dear Traders,

If you like this idea, do not forget to support with a like and follow.

PLZ! LIKE COMMAND AND SUBSCRIBE ME.

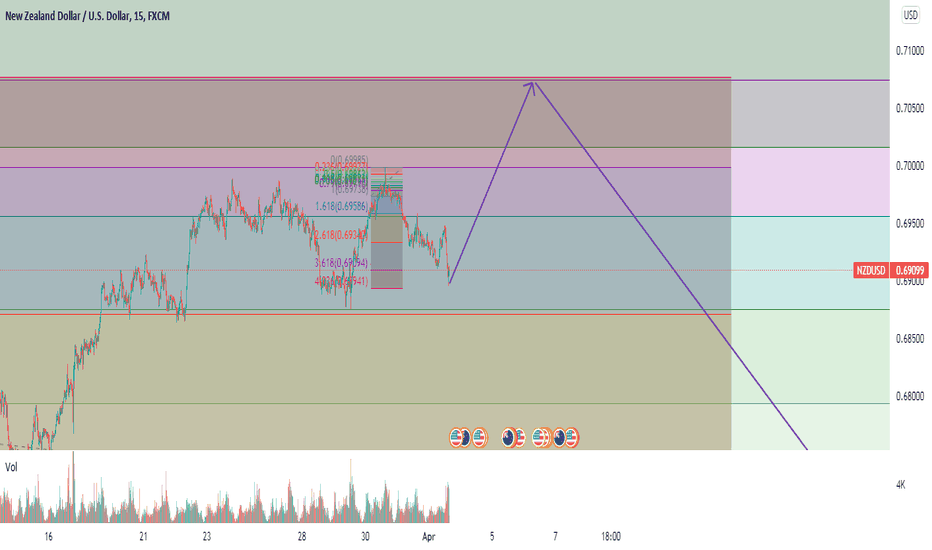

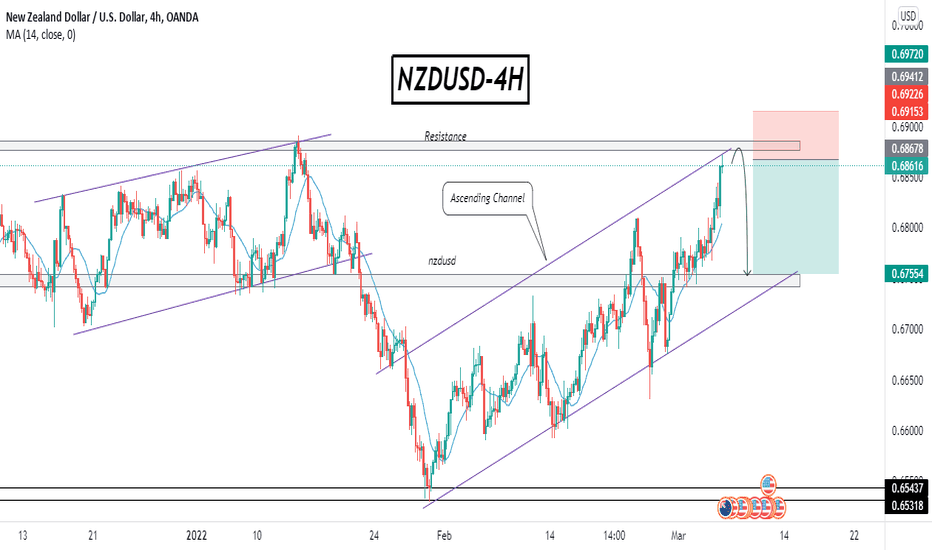

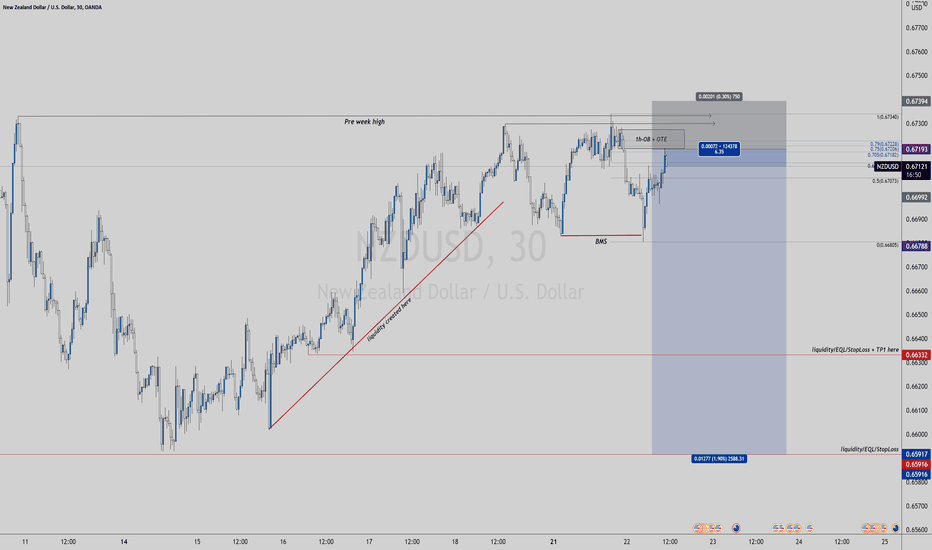

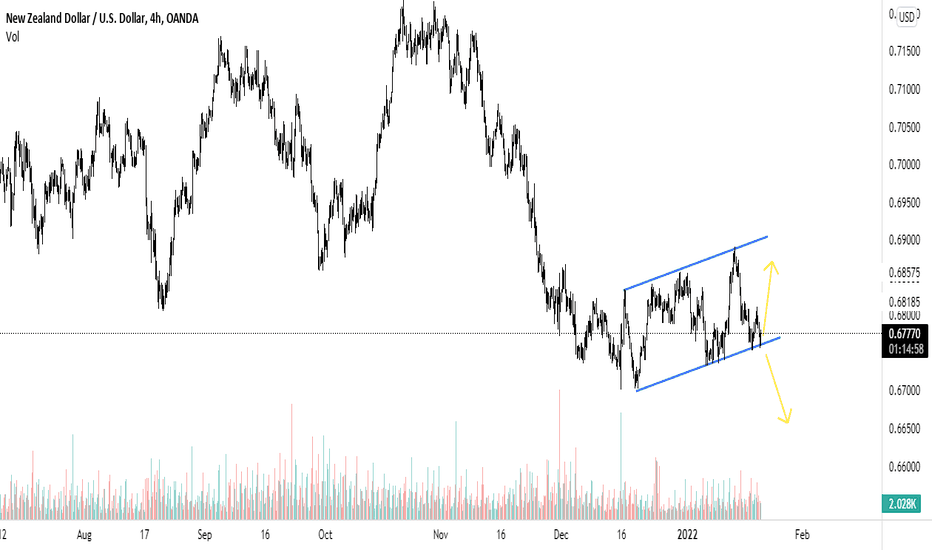

NzdUsd- First up, then down to 0.65After a recent low of around 0.6550, NzdUsd has started to recover and now is trading 100 pips above this newly formed support.

The trend for this pair si down and at this point, we can be in the middle of an ABC type correction.

Above 0.67 is strong resistance and traders can look to sell in that zone for a good R:R trade

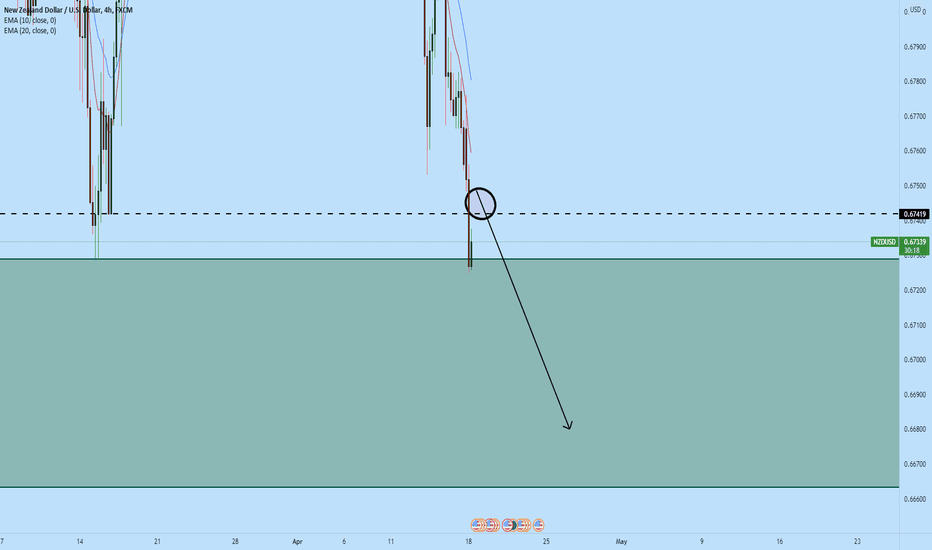

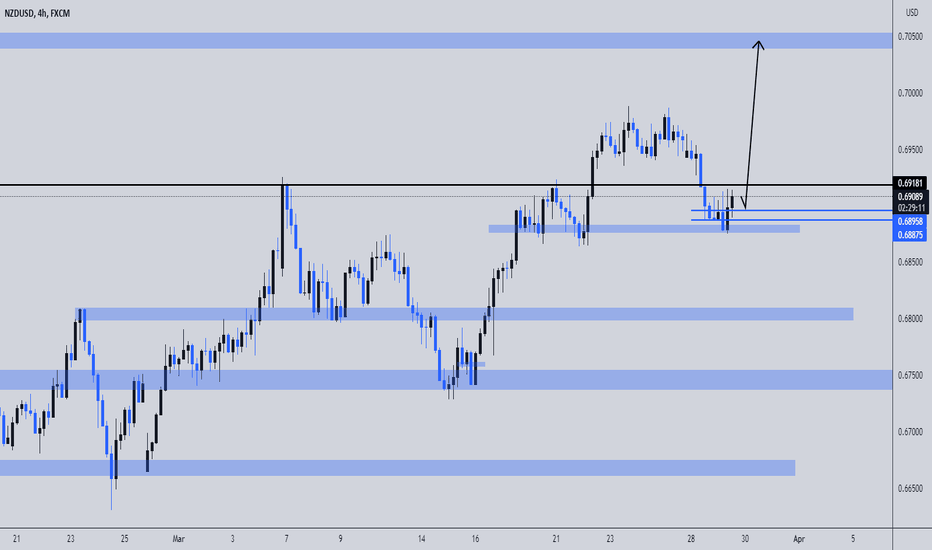

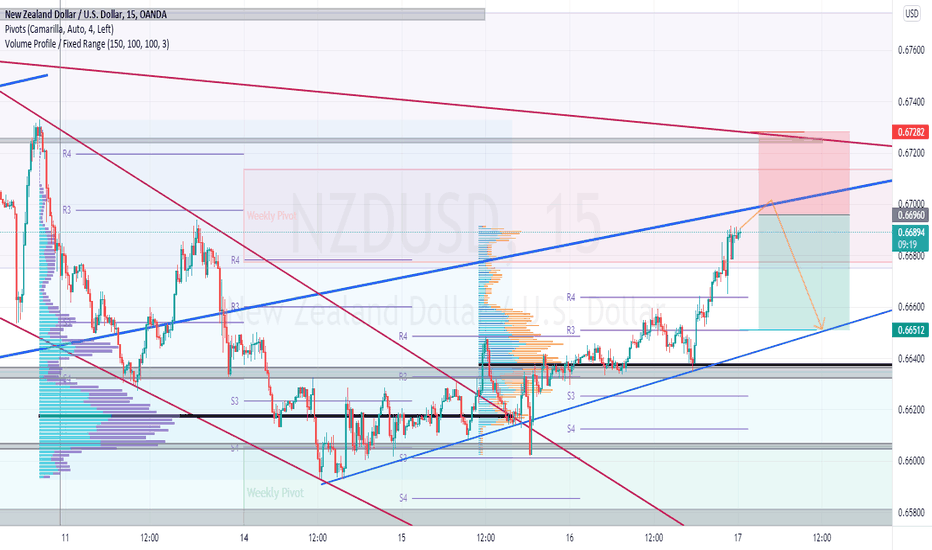

NZDUSD SetupNZDUSD is trading in a bullish parallel channel on shorter time frame. We are expecting bulls to take charge and push the price to new highs.

Alternatively, this is a bearish flag in making on daily time frame. If bears manage to break the price below, the flag pattern will come into play.

Trade your levels accordingly.

NzdUsd- Will it break resistance?Since the beginning of December, NzdUsd is trading in a range between 0.6750 and 0.6850.

Also, if we consider the spike down to 0.67 the head, we can argue an H&S pattern forming on our chart with the neckline at 0.6850

At this moment the pair is trading exactly in this resistance/neckline and, considering that the previous leg up from 0.6750 has impulse we can expect a break.

That being said, my preferred strategy is to buy dips and the target for bulls can be 0.7 important figure.

This scenario is negated by a dive under 0.6750

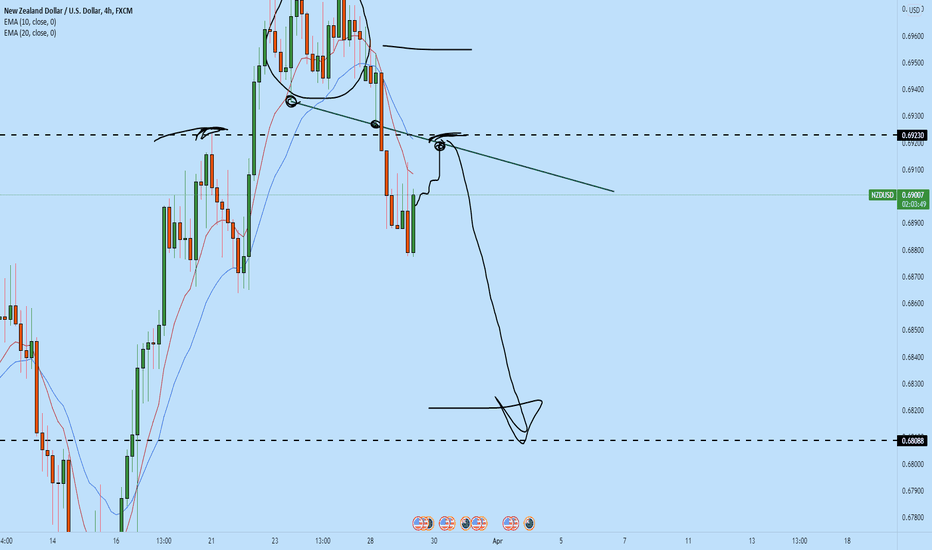

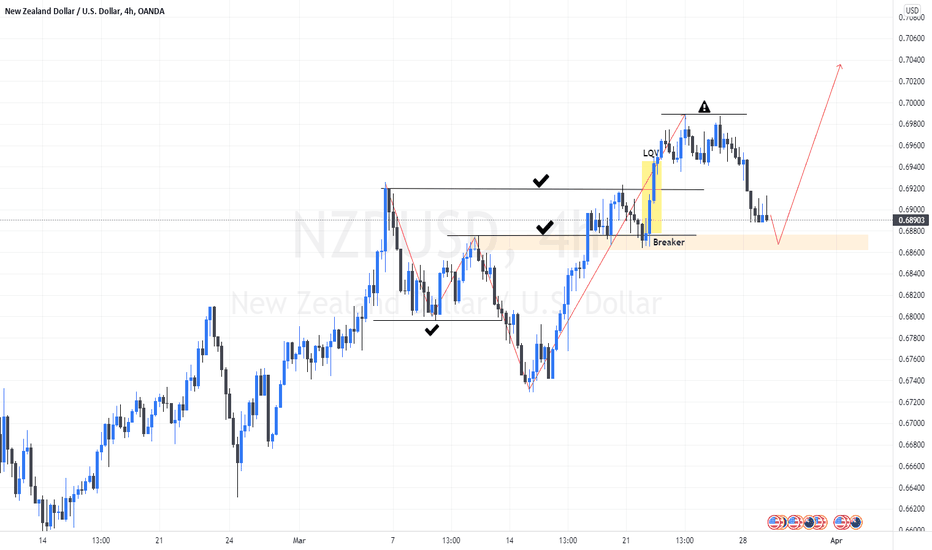

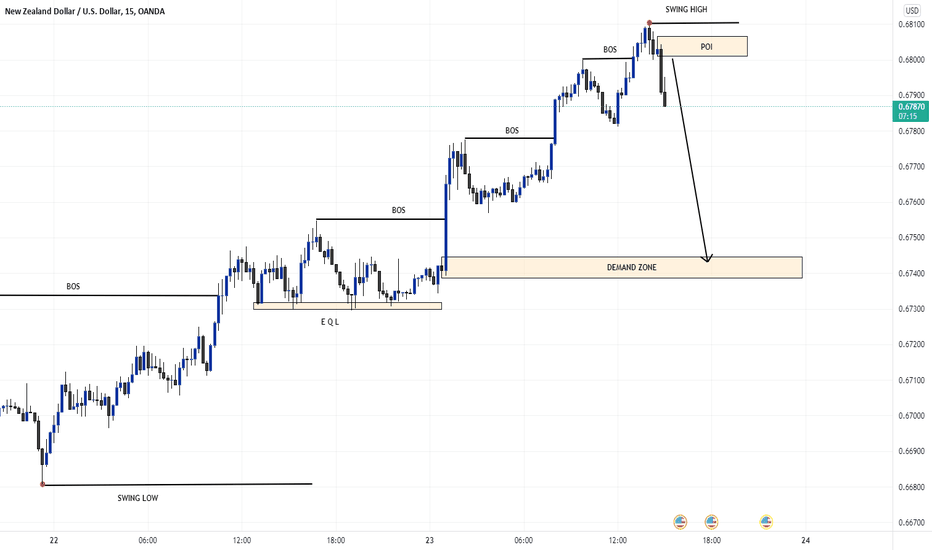

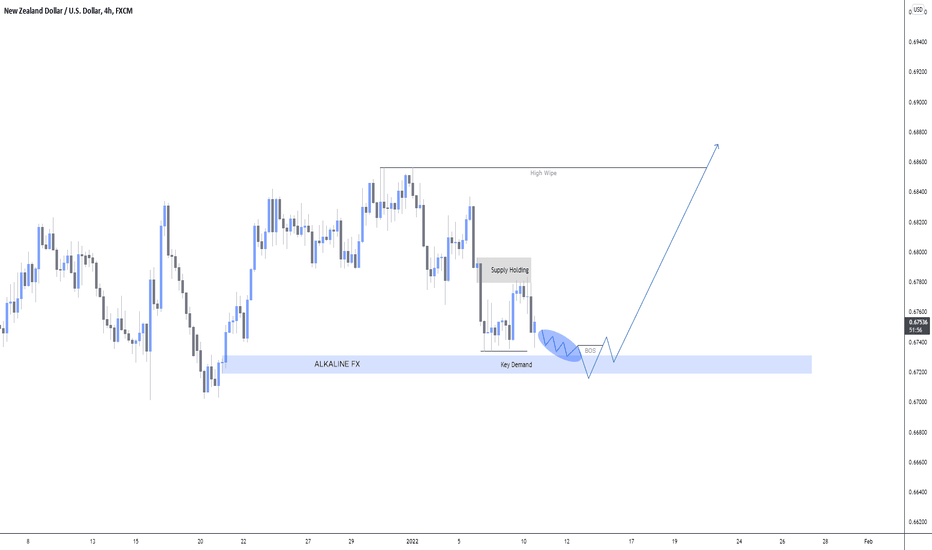

NZDUSD: Bulls IncomingOnce banks clear liquidity from this demand, price should build up enough momentum to tear through the holding supply into the highs.

Wait for a clear compression followed by a liquidity grab BOS before joining the buyers.

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others ! ⬇️

--------------------------------------------------------------------------------------------------------