Nzdusdshort

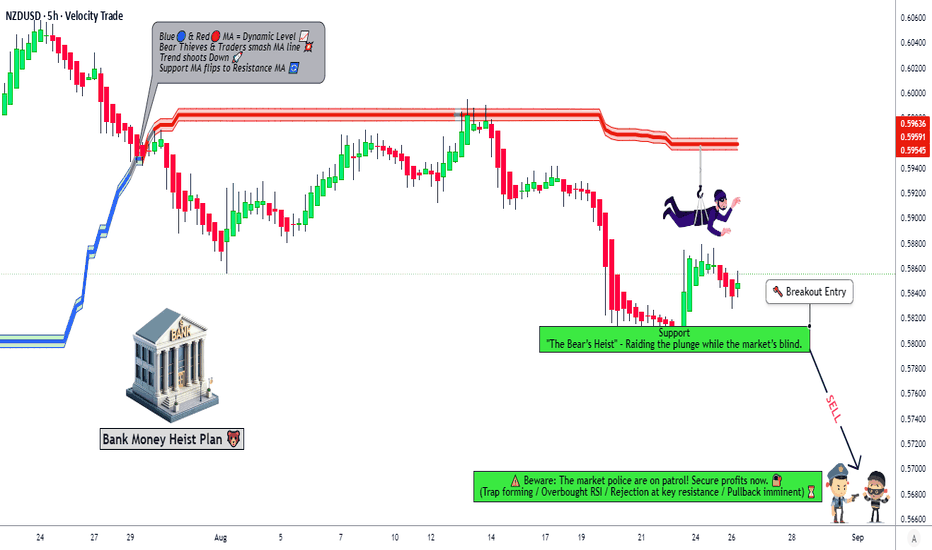

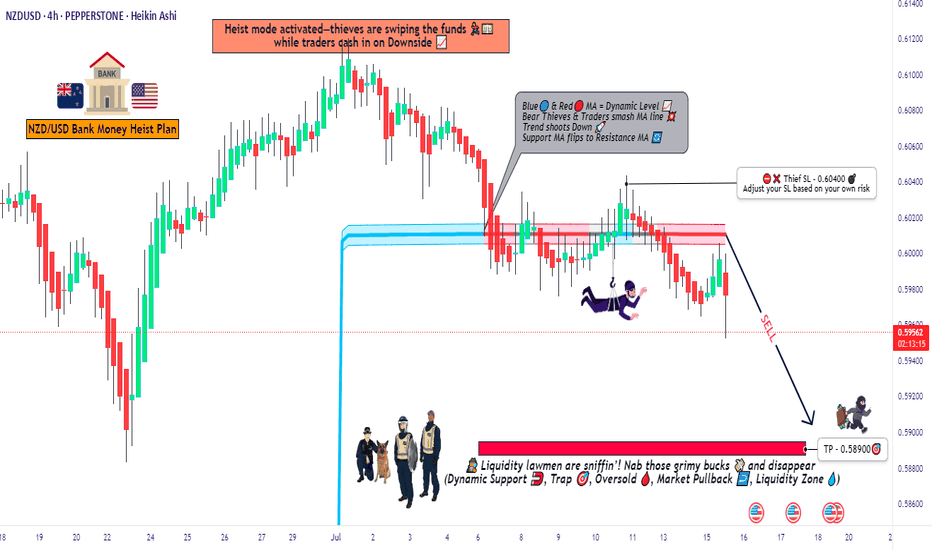

NZD/USD The Kiwi Heist Plan – Breakout or Bust?🦘 NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing/Day Trade) 🦘

🎯 MISSION: BEARISH (PENDING ORDER HEIST) 🎯

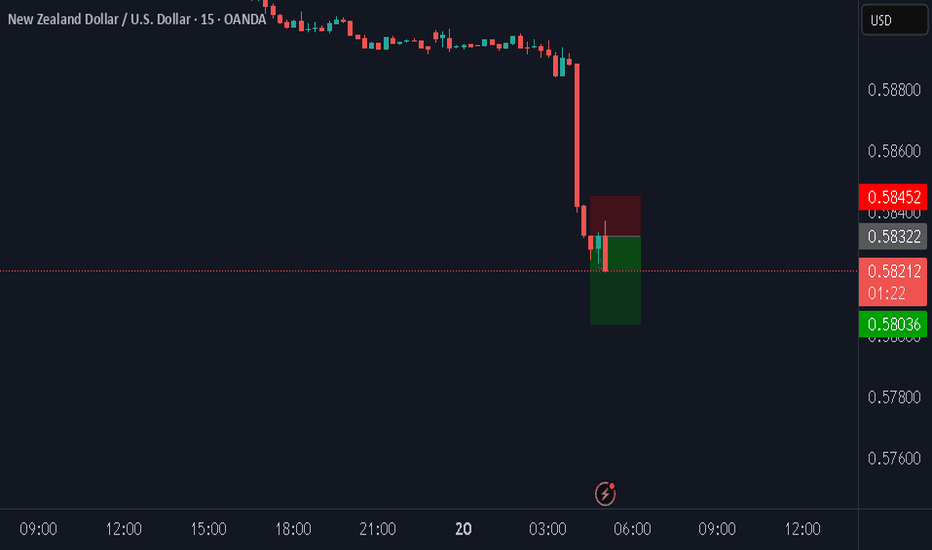

📍 THE ENTRY PLAN: THE BREAKOUT TRIGGER

⚡ MAIN ENTRY SIGNAL: Wait for the BREAKOUT & CLOSE below 0.58000! This is when the bank vault door gets cracked! ⚡

🧨 THIEF'S LAYERED ENTRY STRATEGY: Don't go all in! We use multiple SELL LIMIT orders to scale in like a pro. After the breakout, set your heist layers at:

1st Layer (Safe Loot): 0.58100

2nd Layer (Main Loot): 0.58200

3rd Layer (Ballsy Loot): 0.58400

🤑 You can add more layers based on your own risk appetite! This is the thief's way (DCA/Layering).

🛑 THE ESCAPE ROUTE: STOP LOSS

👮♂️ THIEF OG's STOP LOSS: Our getaway car is parked at 0.58800. Place your SL ONLY AFTER the 0.58000 breakout is confirmed!

📢 Attention all Thieves & Robbers: Adjust your final SL based on your own risk management, lot size, and how many layers you used! Protect your capital! 👊

💰 THE FINAL TARGET: CASH OUT & ESCAPE

🚨 Police Barricade Ahead! Don't get greedy! The mission is to escape with the stolen money at 0.57000! 🚨

🔊 THIEF'S LOOTING MANUAL (READ THIS!):

🚨 Set a CHART ALERT at 0.58000! Don't miss the heist signal!

📰 NEWS = POLICE PATROLS! Avoid opening new trades during high-impact news. It increases volatility and risk!

🔐 Manage Your Position! This is your key to survival. Use proper risk/reward ratios.

💖 SUPPORT THE HEIST CREW!

💥 SMASH THAT LIKE & BOOST BUTTON! 💥

It fuels our next robbery plan! Let's make stealing money from the market look EASY! 🤑🚀

I'll see you on the next heist, Thief! Stay sharp! 🐱👤🤝

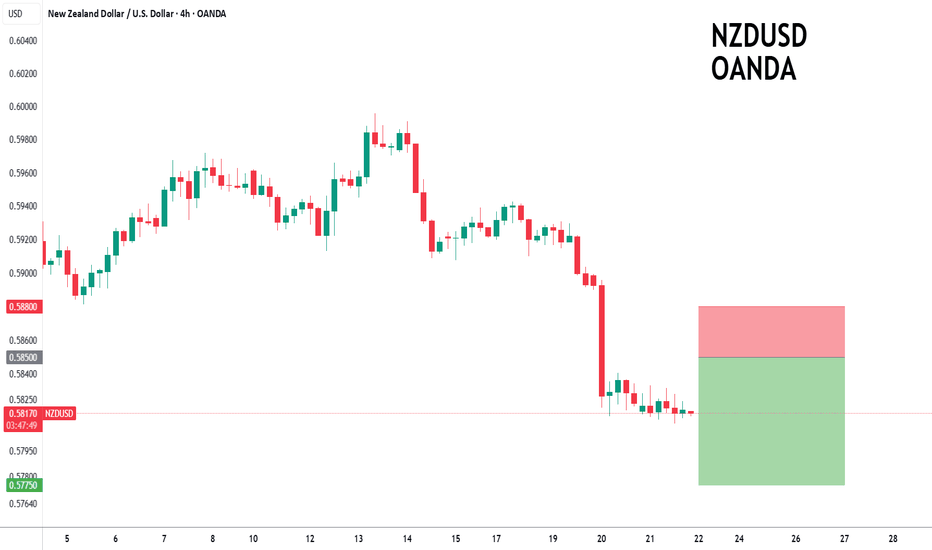

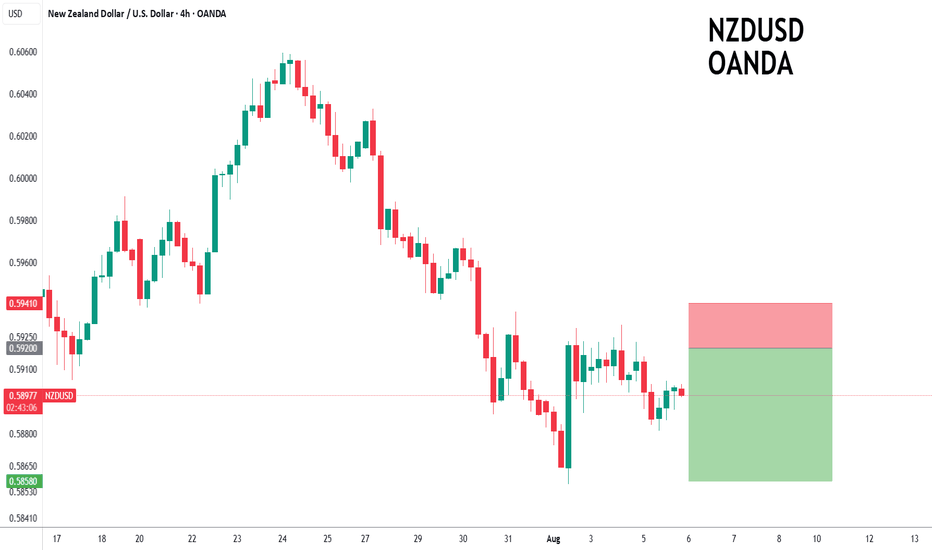

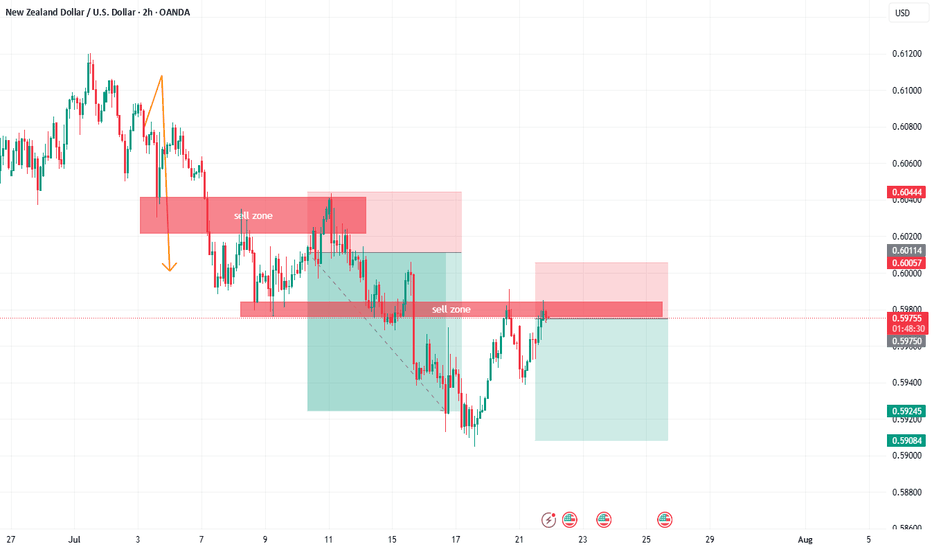

NZDUSD to continue in the downward move?NZDUSD - 24h expiry

There is no clear indication that the downward move is coming to an end.

Although we remain bearish overall, a correction is possible without impacting the trend lower.

Risk/Reward would be poor to call a sell from current levels.

A move through 0.5850 will confirm the bearish momentum.

The measured move target is 0.5800.

We look to Sell at 0.5880 (stop at 0.5910)

Our profit targets will be 0.5805 and 0.5800

Resistance: 0.5880 / 0.5900 / 0.5910

Support: 0.5850 / 0.5825 / 0.5800

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

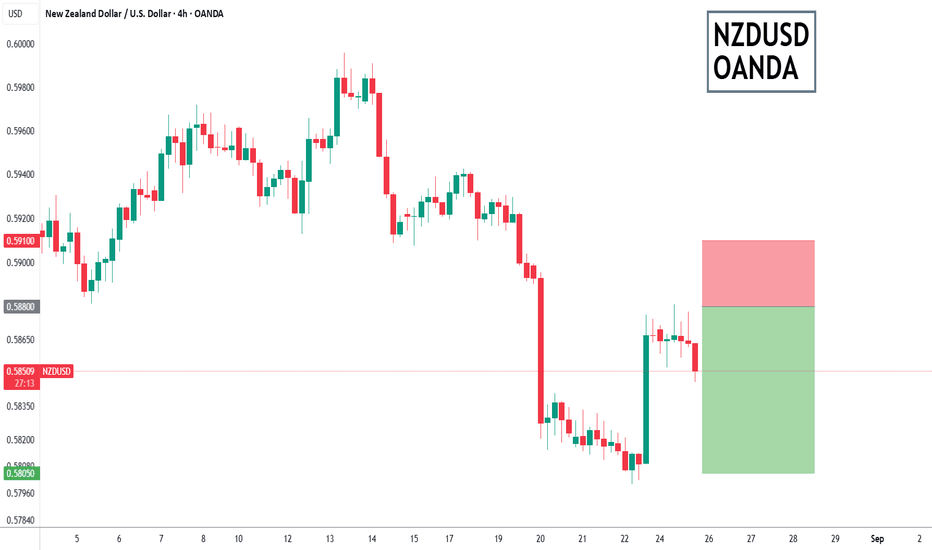

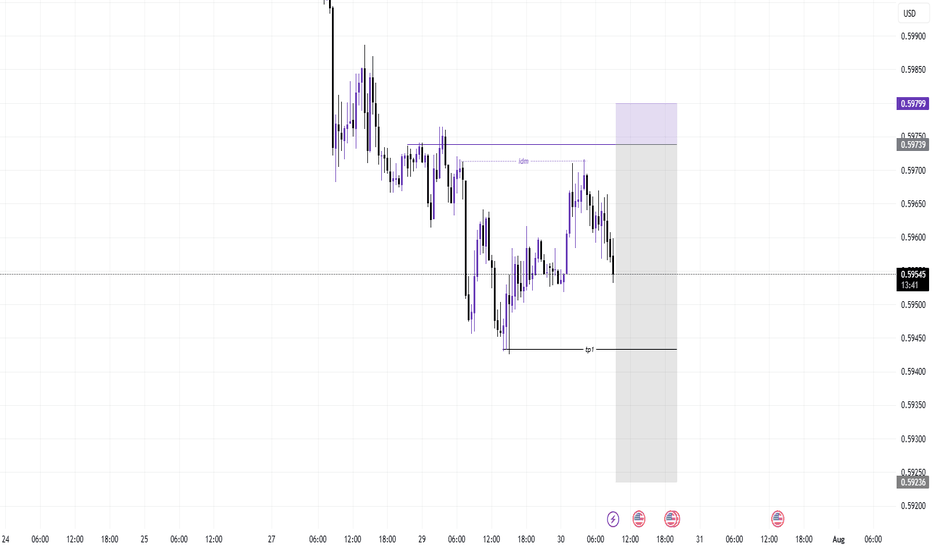

NZDUSD to see a temporary move higher<NZDUSD - 24h expiry

There is no clear indication that the downward move is coming to an end.

Although we remain bearish overall, a correction is possible without impacting the trend lower.

Risk/Reward would be poor to call a sell from current levels.

A move through 0.5800 will confirm the bearish momentum.

The measured move target is 0.5860.

We look to Sell at 0.5850 (stop at 0.5880)

Our profit targets will be 0.5775 and 0.5760

Resistance: 0.5850 / 0.5860 / 0.5875

Support: 0.5800 / 0.5775 / 0.5760

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

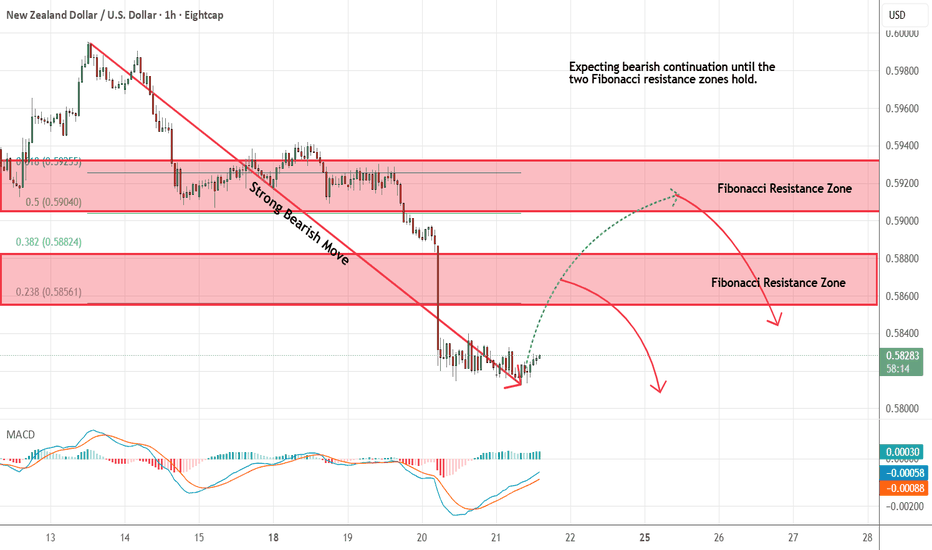

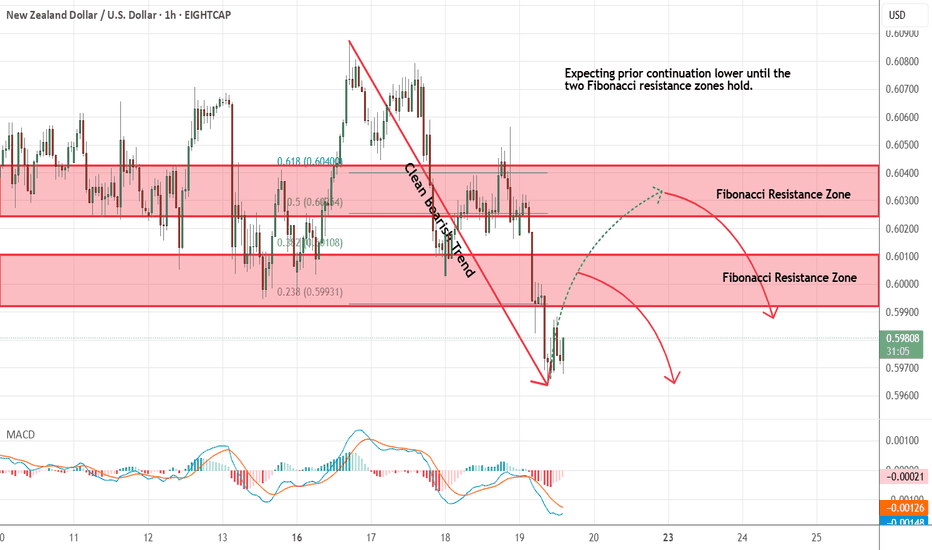

NZDUSD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

NZDUSD short due to as exptected interrest rate decion by RBNZDThe current benchmark interest rate in New Zealand, known as the Official Cash Rate (OCR), is 3.0%, as set by the Reserve Bank of New Zealand (RBNZ). This follows a 25-basis-point cut from 3.25% on August 20, 2025, marking the lowest rate since August 2022.

Due to this result, we expect NZD to weaken against the USD.

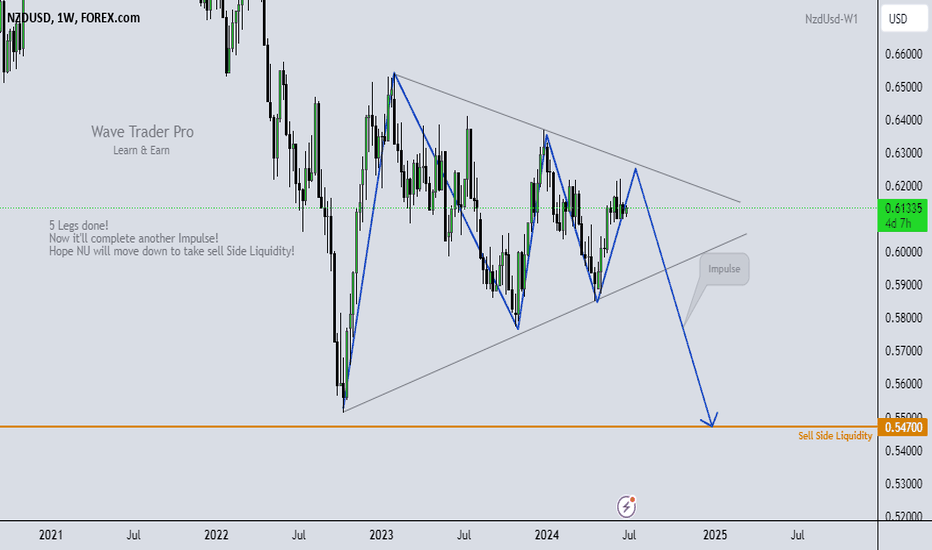

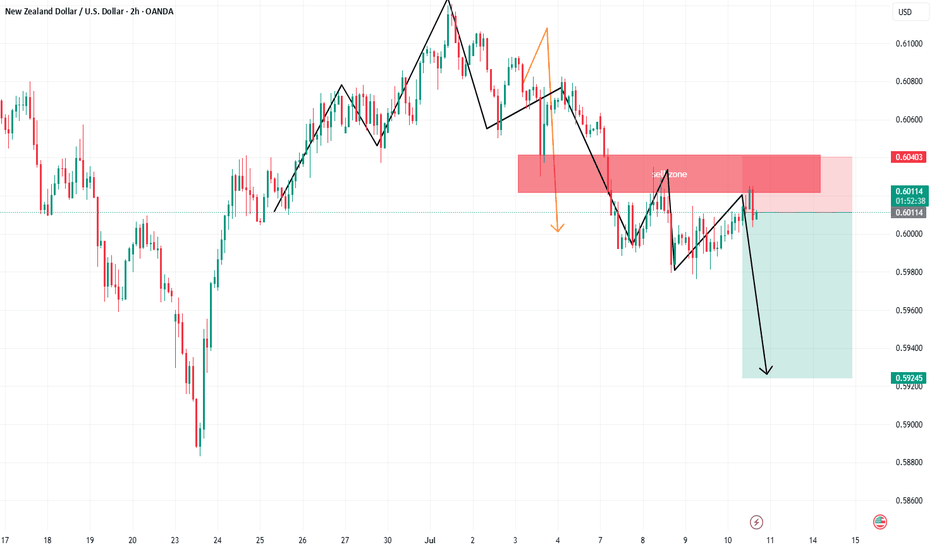

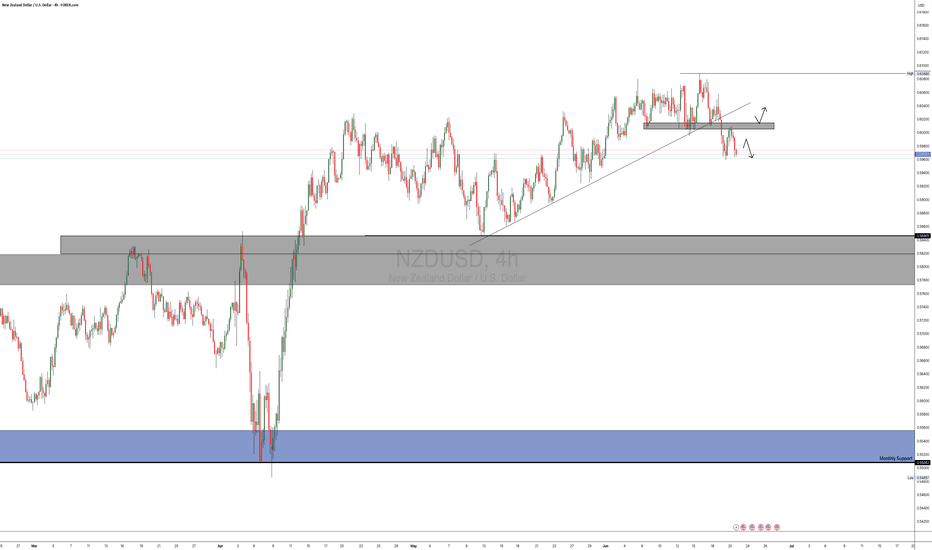

NzdUsd formed a Triangle pattern to move down. (Swing Setup)Looking for Impulse Down.

NzdUsd getting ready to move down. It completed leg 5 with a triangle pattern. Now it will follow a way to complete another impulse. It's important to have your own rules on RR and adhere to them. This trading idea is intended to assist you and enhance your knowledge. If you have any questions, please ask me in the comments.

Learn & Earn!

Wave Trader Pro

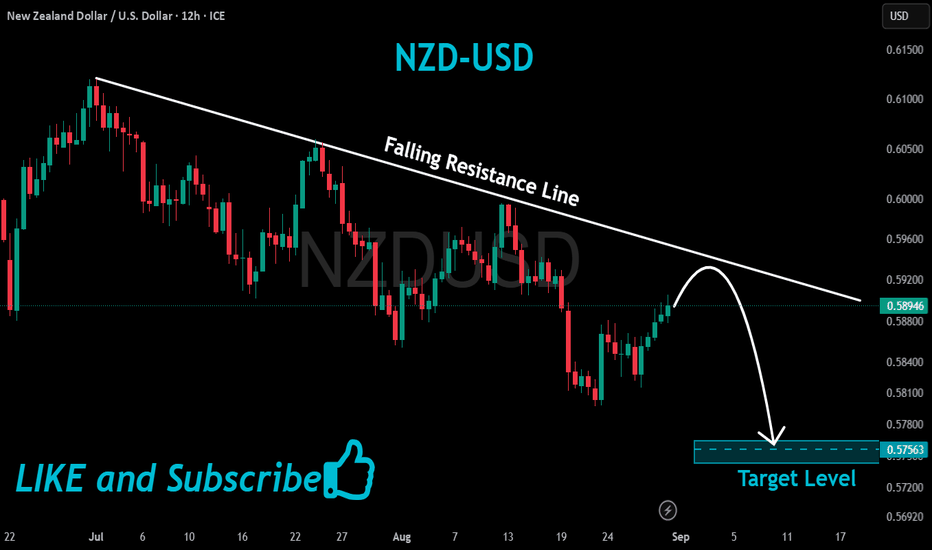

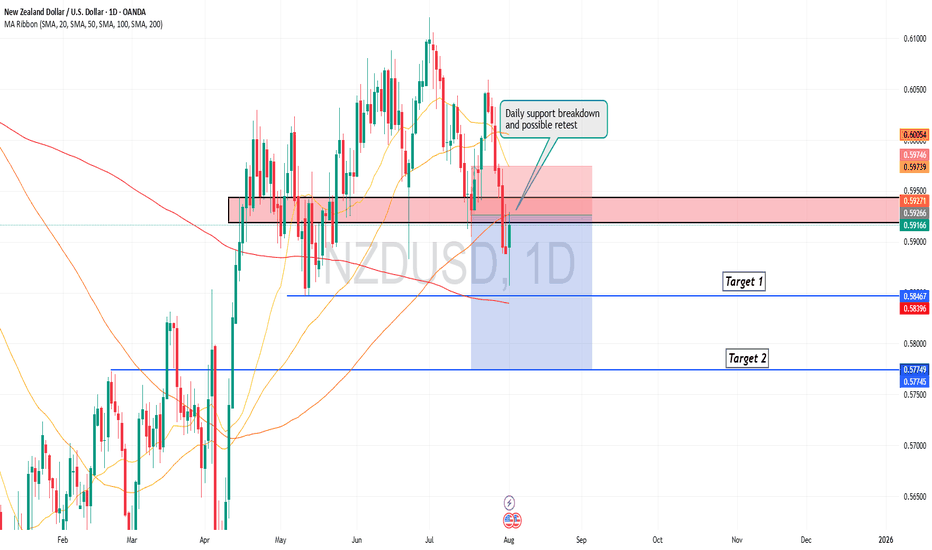

NZDUSD to find sellers at current market price?NZDUSD - 24h expiry

The bearish engulfing candle on the weekly chart is negative for sentiment.

Daily signals are mildly bearish.

20 1day EMA is at 0.5956.

Offers ample risk/reward to sell at the market.

The sequence for trading is lower lows and highs.

We look to Sell at 0.5959 (stop at 0.5984)

Our profit targets will be 0.5885 and 0.5875

Resistance: 0.5967 / 0.5986 / 0.6000

Support: 0.5943 / 0.5920 / 0.5900

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD to continue in the downward move?NZDUSD - 24h expiry

There is no clear indication that the downward move is coming to an end.

Our short term bias remains negative.

50 4hour EMA is at 0.5931.

We look for a temporary move higher.

Risk/Reward would be poor to call a sell from current levels.

We look to Sell at 0.5920 (stop at 0.5941)

Our profit targets will be 0.5858 and 0.5848

Resistance: 0.5905 / 0.5930 / 0.5950

Support: 0.5881 / 0.5857 / 0.5830

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD is in the Selling DirectionHello Traders

In This Chart NZDUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (NZDUSD market update)

🟢What is The Next Opportunity on NZDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

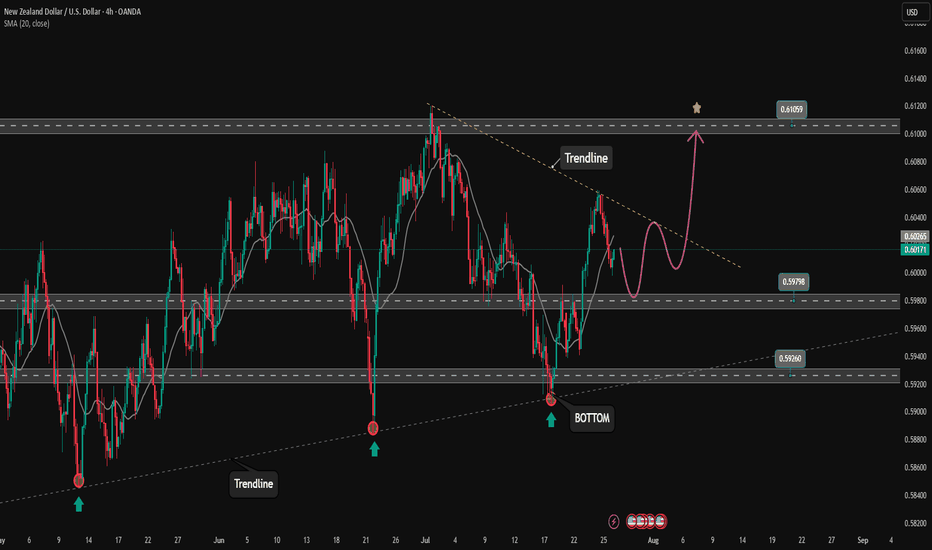

Price is heading towards the upper boundary of the price channel✏️ OANDA:NZDUSD is trading in a bullish wave on H4 chart towards the upper boundary of the ascending price channel. The trendline reaction to the support zone of 0.598 will form a nice corrective wave for the uptrend. If the nearest trendline is broken, the price will soon reach our take profit zone.

📉 Key Levels

Buy trigger: Reject and Trading above 0.598

BUY zone 0.592 ( vùng hỗ trợ biên dưới)

Target: 0.610

Leave your comments on the idea. I am happy to read your views.

NZD/USD "KIWI HEIST" – BEARISH BANK ROBBERY!🦹♂️ NZD/USD "THE KIWI HEIST" – BEARISH BANK ROBBERY PLAN! 🚨💰

(Thief Trading Style – Short Entry Strategy for Maximum Loot!)

🎯 MASTER TRADING HEIST BLUEPRINT

🔥 Thief’s Technical & Fundamental Analysis Confirms:

NZD/USD is OVERBOUGHT + TREND REVERSAL!

Police (Bulls) set a TRAP near the Red Zone (Support) – Time to ESCAPE with profits before they catch us!

✔ Entry Point (Bearish Loot Grab):

*"The vault is UNLOCKED! Swipe SHORT anywhere – but for SAFER HEIST, use Sell Limit orders (15m/30m pullbacks). Pro Thieves use DCA/Layering for max gains!"*

✔ Stop Loss (Escape Route):

"SL at nearest 4H Swing High (0.60400). Adjust based on YOUR risk tolerance & loot size!"

✔ Target 🎯 (Profit Escape):

0.58900 (or exit earlier if cops (bulls) show up!)

⚠️ THIEF’S WARNING – NEWS & RISK MANAGEMENT

📢 High-Impact News = VOLATILITY TRAP!

Avoid new trades during news releases.

Trailing SL = Lock profits & evade market cops!

💥 SCALPERS & SWING THIEVES – QUICK NOTES:

Scalpers: Only quick LONG scalp plays (use Trailing SL!).

Swing Thieves: Hold for the BIG BEARISH LOOT! 🏦

📉 WHY NZD/USD IS BEARISH? (Thief’s Intel Report)

Overbought + Trend Reversal Signals!

Bulls (Police) losing strength at Resistance!

For FULL Intel (Fundamentals, COT Report, Sentiment, etc.) – Klickk 🔗!

🚀 BOOST THIS HEIST! (Like & Share for More Loot Plans!)

💖 "Hit 👍 BOOST to strengthen our THIEF SQUAD! More heists = More profits!"

📌 DISCLAIMER (Stay Safe, Thieves!):

This is NOT financial advice. Trade at your own risk & manage positions wisely!

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🎭

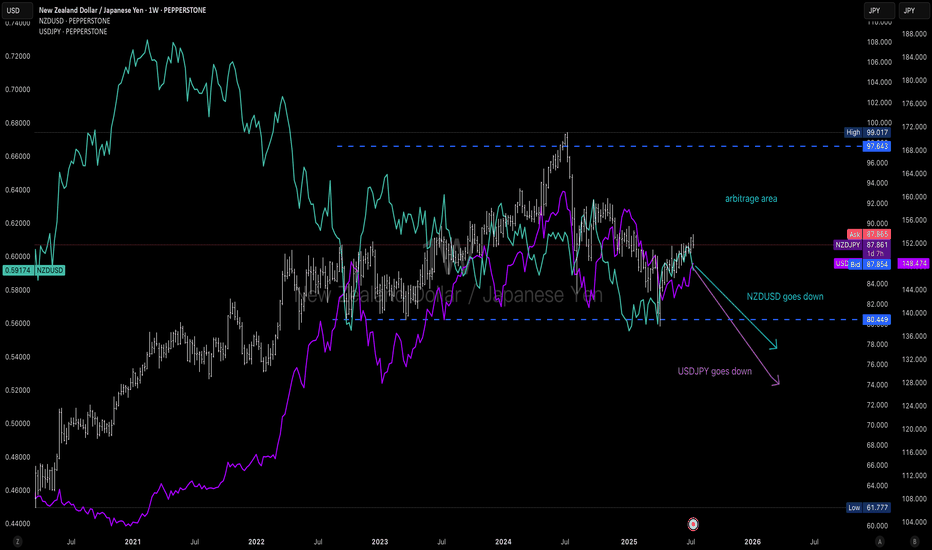

An arbitrage chance: NZ Dollar goes down & JP Yen goes upDue to economies trends and currency policies, USDJPY is going down in a long term (3 to 5 years) and NZDUSD is also going down in the next 3 years

Except for trend following trade for these 2 pairs, you can also set buy limit at the bottom of a value box for NZDJPY and sell limit at the top boarder of this box. Will take good P/L and good win rate positions for this crosspairs

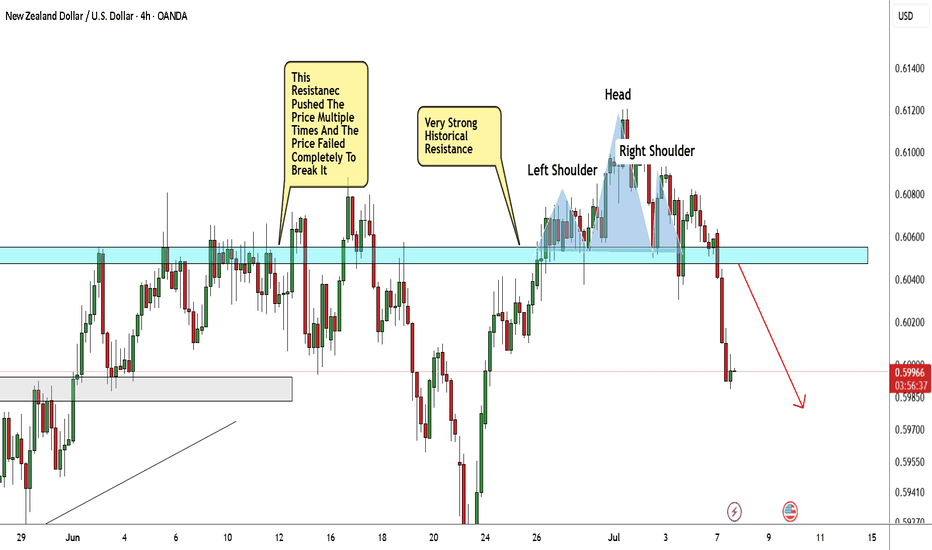

NZD/USD H&S Reversal Pattern Clear,Short Setup To Get 150 Pips !Here is my opinion On NZD/USD On 4H T.F , If we checked the chart we will see that we have a very strong Historical res that forced the price many times to respect it and stay below it and now we have another good confirmation , we have a perfect reversal pattern and we have a clear closure below our neckline so the pattern already confirmed , i`m waiting the price to go up a little to retest my broken neckline and then we can enter a sell trade . only 1 case i will avoid this idea , if we have a daily closure agin above my res with clear closure .

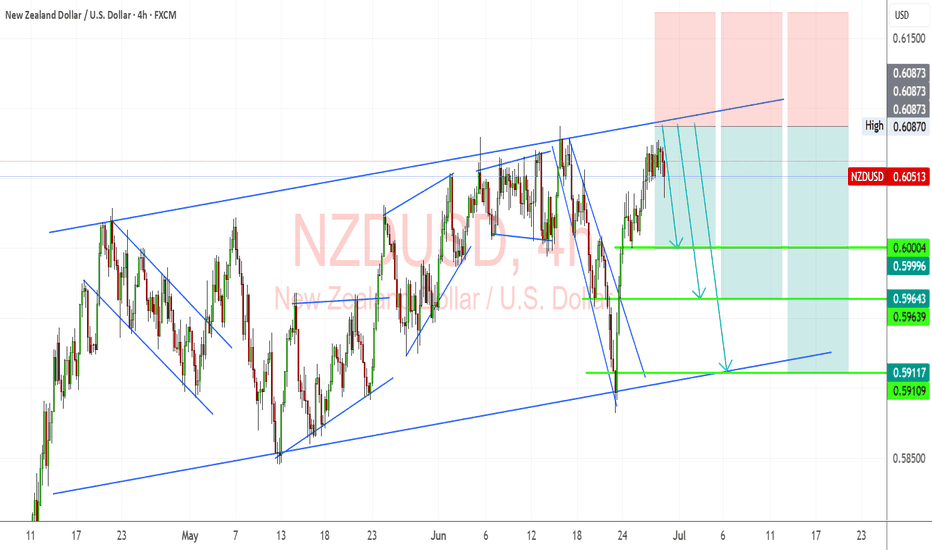

NZDUSD Hits Channel Top Bearish Momentum BuildingNZDUSD pair has touched a key resistance zone near the top of its rising channel and is showing early signs of rejection. This technical inflection point aligns with weakening New Zealand economic sentiment and renewed strength in the US dollar. The stage is set for a bearish rotation, with several support targets now in focus if momentum continues to build to the downside.

📉 Current Bias: Bearish

NZDUSD has failed to break above the 0.6085–0.6090 resistance area, marking repeated rejections at the channel’s upper boundary. Price action and structure suggest a potential move back toward 0.6000 and deeper levels such as 0.5960 and 0.5910 if support fails.

🔍 Key Fundamentals:

RBNZ on Hold and Dovish Leaning: The Reserve Bank of New Zealand has paused its tightening cycle, with Governor Orr signaling no urgency to hike further amid weakening domestic demand and subdued inflation momentum.

US Dollar Support: The USD is gaining traction amid Fed officials maintaining a hawkish hold tone, and with markets paring back bets on near-term rate cuts due to sticky inflation and resilient labor data.

NZ Economic Weakness: New Zealand’s growth has stagnated, with recent trade and retail data underwhelming. Business sentiment remains subdued, adding to downside Kiwi pressure.

⚠️ Risks to the Trend:

Soft US Data: Any major downside surprise in upcoming US labor market or inflation figures could reignite Fed rate cut bets and weigh on the dollar, lifting NZDUSD.

China Rebound: As China is a major trading partner for New Zealand, any strong recovery signs or stimulus headlines out of Beijing could buoy NZD on improved trade expectations.

Unexpected RBNZ Hawkishness: If the RBNZ pivots back to a more aggressive tone due to inflation persistence, NZD could find renewed strength.

📅 Key News/Events Ahead:

US PCE Inflation (June 28): Core metric closely watched by the Fed; any surprise will directly impact USD flows.

NZIER QSBO Survey (July 2): Offers insight into New Zealand business confidence.

US ISM Manufacturing & NFP (July 1–5): Major USD drivers with implications for broader market sentiment.

⚖️ Leader or Lagger?

NZDUSD is currently a lagger, often following directional shifts in USD majors like EURUSD and AUDUSD. However, due to its sensitivity to Chinese data and Fed rate expectations, it may accelerate moves once broader USD sentiment is established.

🎯 Conclusion:

NZDUSD looks poised for a bearish pullback from the channel top, with a confluence of macro and technical factors suggesting pressure toward 0.6000, 0.5960, and potentially 0.5910. While downside momentum builds, attention must remain on US data, China headlines, and RBNZ commentary for any sentiment shift. Bears hold the upper hand for now, but risk events ahead could challenge the momentum.

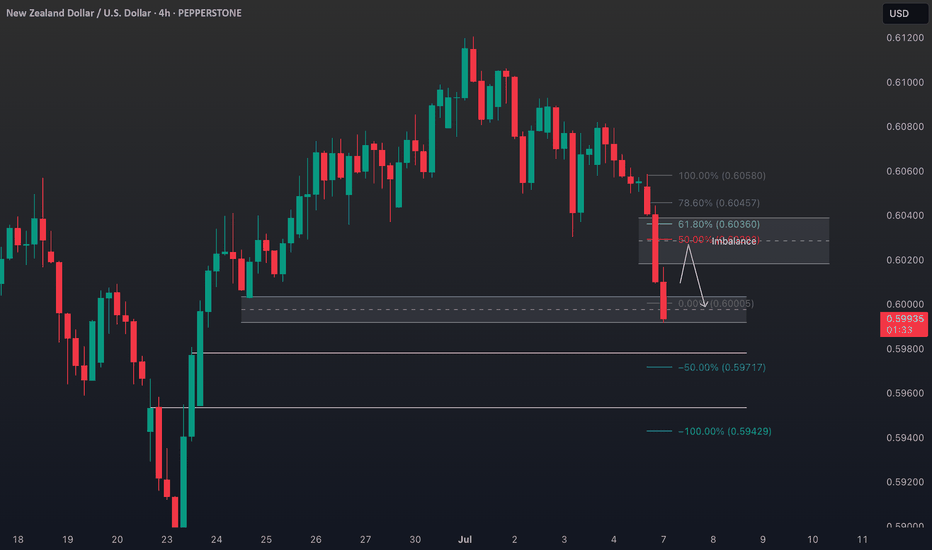

NZDUSD Trade Idea. Key Levels for a Potential NZD/USD Short📉 NZD/USD is trending strongly bearish, and I’ve just posted a new breakdown on TradingView 🎥. The current price action looks overextended, and the pair remains under heavy selling pressure 🔻.

I’m watching for a potential retracement into the Fibonacci 50%–61.8% zone 🔄 — the equilibrium area where I’ll be eyeing a possible short entry 🎯.

The video covers entry ideas, stop-loss placement, and target levels 🎯📍.

⚠️ This is not financial advice — for educational purposes only.

NZDUSD to find sellers at market price?NZDUSD - 24h expiry

Price action looks to be forming a top.

Further downside is expected.

Risk/Reward is ample to call a sell from current levels.

A move through 0.5910 will confirm the bearish momentum.

The measured move target is 0.5875.

We look to Sell at 0.5975 (stop at 0.6005)

Our profit targets will be 0.5900 and 0.5875

Resistance: 0.5950 / 0.5960 / 0.5975

Support: 0.5910 / 0.5900 / 0.5875

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

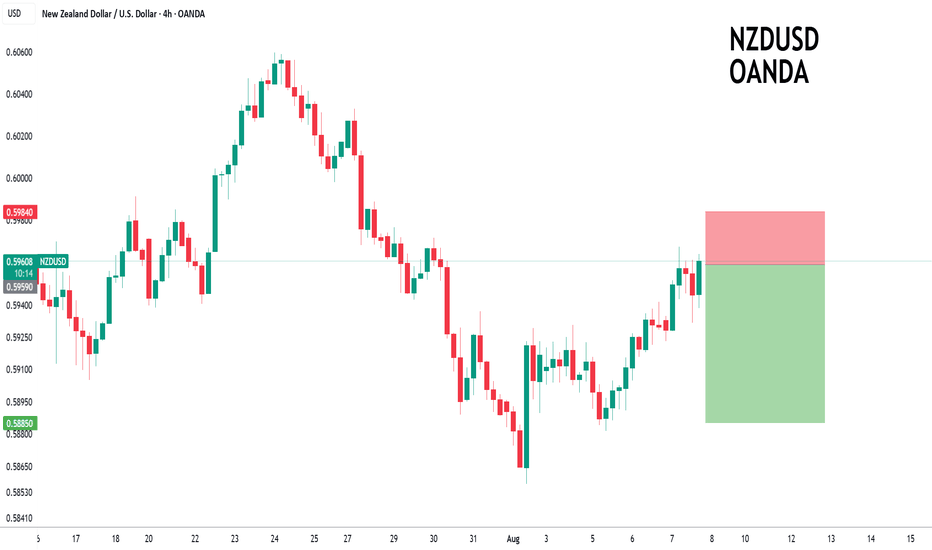

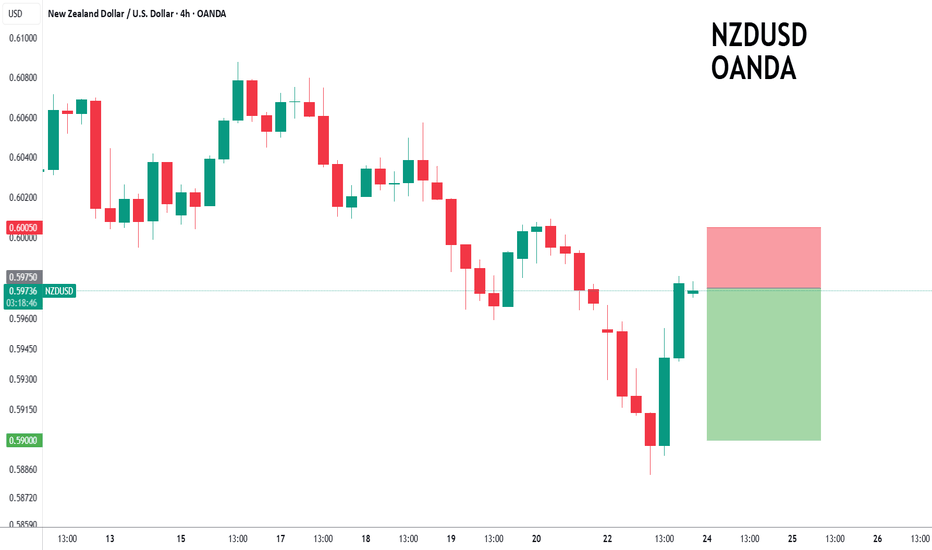

NZDUSD POSSIBLE TRADE SETUPPotential Trade Setup on NZDUSD

NZDUSD is on a strong 3-week rally correction that almost got broken to the downside last week and successfully retested on Friday

That said, I am still quite anticipating for a possible continuation of the bearish trajectory that started last week to continue towards the MAY low at 0.5880

Trading Plan:

1. SELL: is currently in play, and a further downside movement can be well followed through in the 4H chart.

2. BUY: if the resistance is broken and the retest is successful.

Targets:

1. Can be 1:2 for either entry.

NZDUSD - Expecting Bearish Continuation In The Short TermH1 - Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

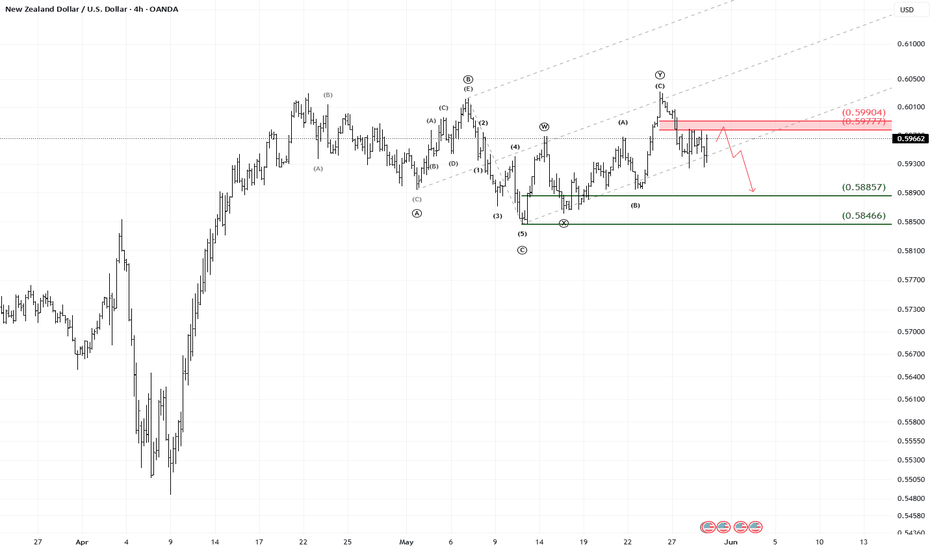

NZD/USD – Bearish Reversal Expected Below 0.5990–0.5977 ResistanThe NZD/USD pair is approaching a key resistance zone at 0.5990–0.5977, which has been tested multiple times and aligns with the upper boundary of a potential corrective structure.

🔹 Elliott Wave Context:

The price action appears to be completing a corrective wave (C) structure, indicating that upside momentum may be limited.

This scenario suggests a potential bearish reversal from the resistance zone.

🔹 Targets & Levels:

Resistance: 0.5990–0.5977

First support target: 0.5885

Next major support: 0.5846

📌 Trading Plan:

Watching for bearish confirmation (rejection candlesticks or reversal pattern) below 0.5990–0.5977

Potential short entries targeting the support levels

A break above 0.5990 would invalidate the bearish setup and suggest continuation to the upside

This chart offers a clear bearish bias while price remains below the resistance zone, supported by Elliott Wave context and previous price action behavior.