NZDUSD Bullish Bias on October 29, 2024: Fundamental Analysis !Overview: NZDUSD Daily Analysis with Slight Bullish Bias on 29/10/2024

As of October 29, 2024, the NZDUSD (New Zealand Dollar to US Dollar) currency pair shows a slight bullish bias. This outlook is driven by a combination of factors, including recent economic data releases, interest rate expectations, and external influences on both the New Zealand and U.S. economies. In this analysis, we'll look at the critical fundamental drivers affecting NZDUSD today and explore why a bullish trend could be more favorable.

Key Drivers for NZDUSD Bullish Bias

1. Strong New Zealand Economic Indicators

- Recent data releases from New Zealand have shown resilience in GDP growth, robust employment numbers, and strong retail sales figures. These economic indicators collectively suggest that the New Zealand economy is maintaining a steady recovery trajectory.

- The Reserve Bank of New Zealand (RBNZ) has emphasized stability in its interest rate policies, which lends some support to the NZD in the near term, especially as the markets anticipate other global currencies might experience higher volatility.

2. Dovish Tone from the Federal Reserve

- The Federal Reserve's current stance has been notably cautious. Although inflation has shown signs of moderation, the Fed is maintaining a watchful approach toward interest rate hikes, which has softened USD demand.

- With Federal Reserve members expressing concerns over slower growth, the likelihood of further rate increases seems limited, which could weigh on the U.S. Dollar’s strength, creating favorable conditions for NZDUSD.

3. Market Sentiment and Risk Appetite

- Risk sentiment remains an influential factor for NZDUSD, as the New Zealand Dollar is often viewed as a “risk currency.” Recently, global markets have seen heightened interest in risk assets as investors seek higher returns, which typically benefits the NZD.

- Stock market trends also point to a cautious risk-on sentiment today, supporting currencies like the New Zealand Dollar over safe havens, including the USD.

4. Commodity Prices and the Impact on NZDUSD

- As a commodity-linked currency, the New Zealand Dollar often correlates with commodity prices. The slight uptick in dairy prices—a primary export for New Zealand—has bolstered the currency, offering additional support against the USD.

Technical Factors Supporting NZDUSD

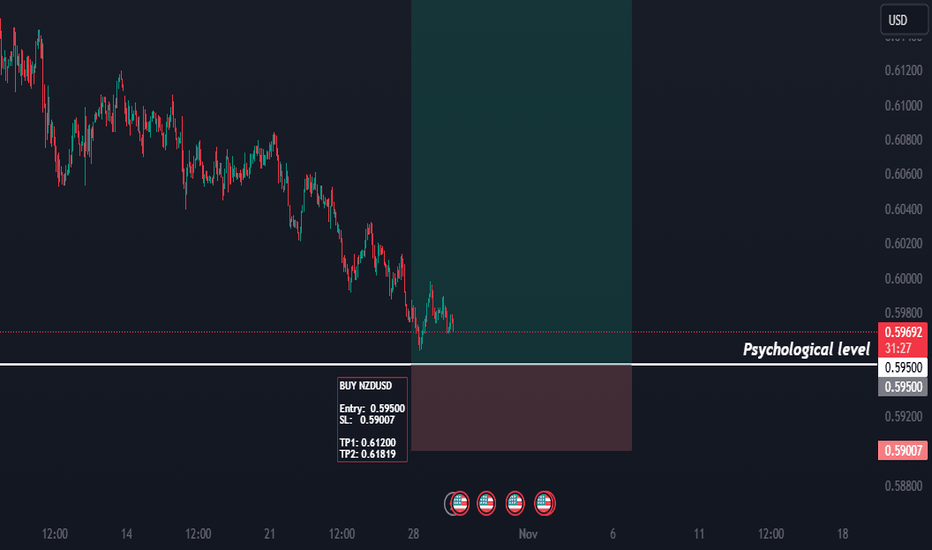

On the technical front, NZDUSD is showing strong support levels around the 0.5900 mark, with a potential resistance near 0.6050. This support-resistance band aligns with current market sentiment, allowing room for potential upside movement. A breakout above the resistance level could confirm the bullish bias and potentially attract more buyers.

Conclusion: Why Today’s Market Conditions Favor NZDUSD

The current market conditions and fundamental indicators suggest that NZDUSD may see a slight bullish bias throughout October 29, 2024. New Zealand's strong economic outlook, combined with the Fed’s cautious tone and positive risk sentiment, all contribute to a favorable environment for the New Zealand Dollar. However, traders should monitor any breaking news that could shift market sentiment and potentially affect NZDUSD.

---

Seo-Keywords:

1. NZDUSD analysis

2. NZDUSD forecast

3. New Zealand Dollar outlook

4. Forex trading strategies

5. NZDUSD bullish trend

6. Federal Reserve impact on USD

7. NZDUSD technical levels

8. Forex market insights

9. October 2024 NZDUSD

Nzdusdtechnicallevels

NZDUSD: Potential for Slight Bullish Bias Amid Key Fundamental !NZDUSD: Potential for Slight Bullish Bias Amid Key Fundamental Drivers (25/10/2024)

Today, the NZDUSD currency pair shows potential for a slight bullish bias, influenced by a blend of fundamental factors and evolving market conditions. Let's dive into the primary drivers impacting the New Zealand Dollar to US Dollar (NZDUSD) pair today and assess whether the bullish sentiment could hold.

1. New Zealand's Economic Data and RBNZ Stance

The Reserve Bank of New Zealand (RBNZ) has maintained a balanced tone on interest rates amid recent economic data. Despite slower-than-expected growth figures, the New Zealand economy demonstrates resilience in key sectors like exports and services, which might provide support for the NZD. Market expectations for RBNZ’s neutral-to-hawkish stance add a slight bullish outlook for the NZD, as investors anticipate steady policy moves that avoid aggressive tightening while also signaling confidence in the economy’s fundamentals.

2. US Dollar Moderation Amid Potential Fed Pause

The US Dollar Index (DXY) has shown signs of consolidation as Federal Reserve officials continue to weigh the potential for a pause in rate hikes. Recently, the USD’s bullish momentum has softened, with investors focusing on US inflation data that suggests a gradual cooling, potentially easing pressure on the Fed to maintain a tight monetary policy stance. This development could limit the USD’s strength, lending support to a slight upside for NZDUSD as investors look for alternative assets.

3. China’s Economic Resilience and Impact on NZD

China, as New Zealand's primary trading partner, influences the NZD through commodity prices and trade flows. Recent signs of resilience in China’s economy, particularly in industrial production and retail sales, may boost market sentiment for currencies like the NZD, as stronger demand for New Zealand’s exports could improve trade dynamics. This positive external factor indirectly supports the NZD, making NZDUSD slightly more appealing in today’s trading landscape.

4. Technical Levels and Market Sentiment for NZDUSD

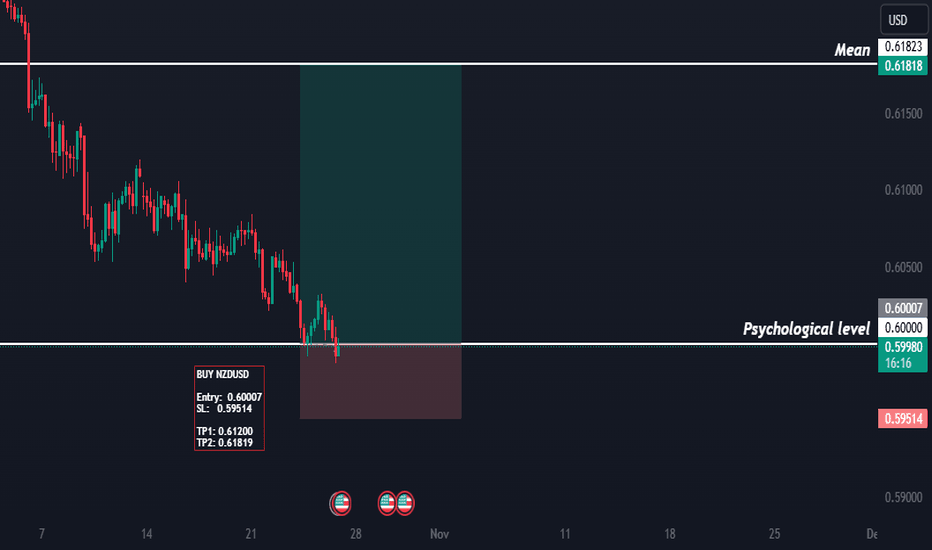

On the technical analysis front, NZDUSD has shown support near the 0.5850 level, with a potential resistance zone around 0.5950. Should the pair break above the 0.5900 mark, we could see momentum strengthening, bolstered by the factors discussed. RSI indicators are also neutral, suggesting room for upward movement without immediate overbought concerns. A slight bullish bias may prevail, provided these technical and sentiment indicators remain supportive.

Summary: Slight Bullish Bias for NZDUSD

In summary, NZDUSD could hold a slight bullish bias today, with influences from New Zealand’s resilient economy, a softer USD, and supportive technical indicators. Traders might find opportunities if bullish momentum strengthens, keeping an eye on US Dollar trends, RBNZ announcements, and China's economic performance for additional cues.

Keywords:

1. NZDUSD forecast

2. New Zealand Dollar analysis

3. US Dollar impact

4. RBNZ policy stance

5. NZDUSD technical levels

6. Forex trading insights

7. Federal Reserve impact

8. China economy influence

9. NZDUSD bullish bias

NZDUSD Slightly Bullish Bias on October 22, 2024 !NZDUSD Slightly Bullish Bias on October 22, 2024: Key Drivers and Analysis

As of October 22, 2024, the NZDUSD pair is showing signs of a slightly bullish bias in the forex market. This article will explore the fundamental factors influencing the New Zealand Dollar (NZD) and the US Dollar (USD) and why the Kiwi may have a slight edge today. Traders looking to capitalize on the current market conditions should closely monitor the following key drivers:

1. RBNZ Interest Rate Decision Impact on NZD

The Reserve Bank of New Zealand (RBNZ) has recently kept interest rates unchanged at 5.50%, signaling a neutral to slightly dovish stance. While there was no immediate hike, Governor Adrian Orr suggested the bank is maintaining a vigilant approach to inflationary pressures. New Zealand's economy has shown resilience, and the RBNZ’s cautious optimism has bolstered investor sentiment towards the NZD.

The decision to hold rates was expected, but the RBNZ's language about controlling inflation while keeping an eye on global growth has strengthened the Kiwi. Higher inflation control and an improving outlook could lead to more confidence in New Zealand's economy, giving the NZD some support.

2. US Dollar Strength Weakening

On the other side of the pair, the US Dollar has recently shown some weakness due to a combination of soft economic data and concerns over the future path of Federal Reserve policy. With inflation moderating and signs of a potential slowdown in the US economy, market participants are beginning to price in fewer interest rate hikes for the rest of the year.

Recent reports have shown softer-than-expected retail sales and housing market data in the US, which have dampened the USD's strength. Risk sentiment is turning slightly positive as traders look for opportunities in higher-yielding currencies like the NZD, which tend to benefit when the USD pulls back.

3. Commodity Prices Supporting the NZD

New Zealand’s economy relies heavily on the export of commodities, particularly dairy products, meat, and wool. Commodity prices have stabilized in recent weeks, providing underlying support for the NZD. Dairy prices, a key export, have remained robust, and any further uptick in commodity prices could push the Kiwi higher.

A slight improvement in global risk appetite is also benefiting commodity currencies like the NZD. The stabilization in China’s economic outlook, one of New Zealand's largest trading partners, is another bullish signal for the NZD. China's recovery from its slowdown earlier in the year could help support demand for New Zealand’s exports, giving the NZDUSD pair additional upside momentum.

4. Technical Analysis and Market Sentiment

From a technical analysis perspective, NZDUSD is approaching a key support level around 0.5850, and recent price action suggests that buyers are stepping in. The pair has been consolidating in a range between 0.5800 and 0.5900, and if it breaks above the 0.5900 resistance level, it could signal further gains.

Market sentiment, as reflected by the Commitment of Traders (COT) report, shows that speculators have slightly increased their long positions in the NZD, indicating growing confidence in the Kiwi’s potential for upside movement.

5. Global Risk Sentiment and Geopolitical Factors

Geopolitical tensions, particularly in the Middle East and concerns over global trade, are playing a role in shaping risk sentiment. However, the current environment is less focused on extreme risk-off scenarios, allowing risk-sensitive currencies like the NZD to perform well in the short term. As long as global markets remain relatively calm, we could see further upside for the NZDUSD pair.

Conclusion: NZDUSD Outlook for October 22, 2024

In summary, the NZDUSD pair is expected to maintain a slightly bullish bias today due to a combination of factors including stable commodity prices, the RBNZ's cautious optimism, and US Dollar weakness. Traders should watch key levels such as 0.5900 on the upside, as a break above this level could indicate a more extended bullish move.

For those trading NZDUSD today, consider the broader fundamental factors and technical levels to capitalize on potential opportunities in this currency pair. Keep an eye on any surprises from the US economic data later in the day, as this could add volatility to the market and potentially influence the USD’s performance.

Keywords for SEO:

- NZDUSD analysis October 2024

- NZDUSD forecast today

- New Zealand Dollar fundamental factors

- RBNZ interest rate impact on NZD

- USD weakness 2024

- Commodity prices and NZDUSD

- Forex market analysis NZDUSD

- NZDUSD technical levels

- NZDUSD trading strategy October 22 2024

- Forex trading NZD