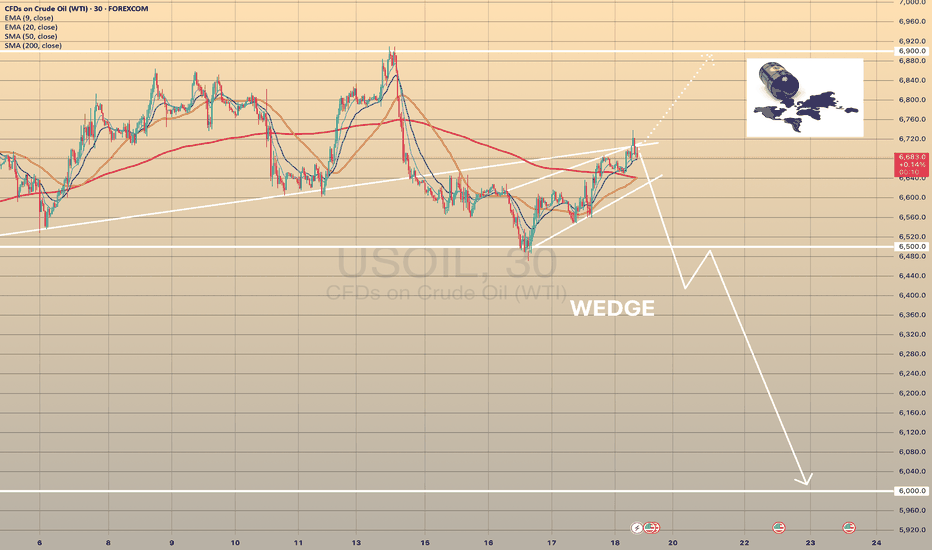

BRENT CRUDE OIL FORMED A BEARISH WEDGE. ANOTHER POSSIBLE DECLINEBRENT CRUDE OIL FORMED A BEARISH WEDGE. ANOTHER POSSIBLE DECLINE?📉

USOIL has been trading bullish within the last couple of days, supported by prospects of tighter supply and an improved demand outlook. US crude inventories dropped last week, which indicates firm demand despite the rising output.

Still, technically, oil looks bearish. It has formed a bearish wedge and is currently testing the former trendline from below. The most probable scenario is that wee see the bearish impulse towards 6,500.00 with further decline. Another option is that the rise will continue towards 6,900.00 level.

Oildaily

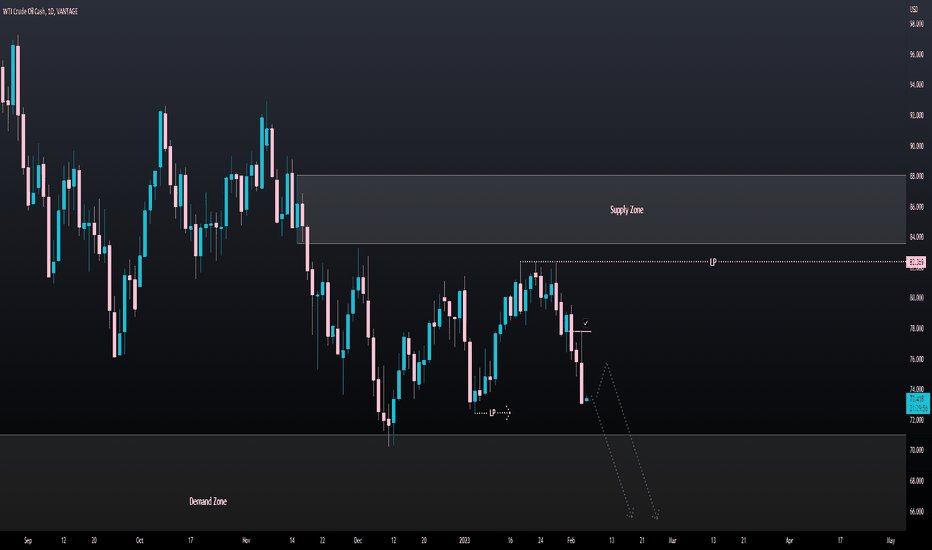

USOUSD (Crude Oil) Daily: 06/02/2023: Does it fall more?

Main idea:

According to the weekly analysis, we expect a bear market.

In this case, there is a liquidity pool below 72.42 that can be defined as a first target. There is good support at 72.05, if the price can break this support, the price can fall to 67.5.

After collecting liquidity under 72.42, the price may have a short-term upward move. We can define 74.83- 75.7 as a supply zone that can push the price down.

💡Wait for the update!

🗓️06/02/2023

🔎 DYOR

💌It is my honor to share your comments with me💌

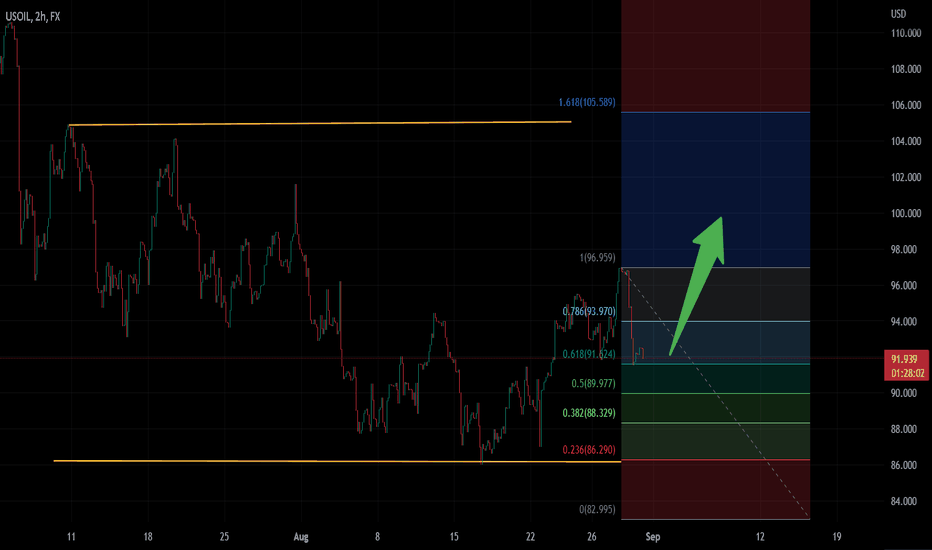

USOIL 100.00 The chart shows the uptrend.

USOIL on the 4-hour chart bounced for the second time above the 91 - 92 area.

The market after testing the 0.618 Fibonacci support is now trading for further resistance.

Technical analysis - daily time frame RSI is bullish. In general, the daily-weekly time frame is bullish.

DISCLAIMER: This review is not intended to encourage the buying or selling of any particular security. Also, it should not be a basis for any trading action by an individual investor. Therefore, your own due diligence is highly recommended before entering into a trade.