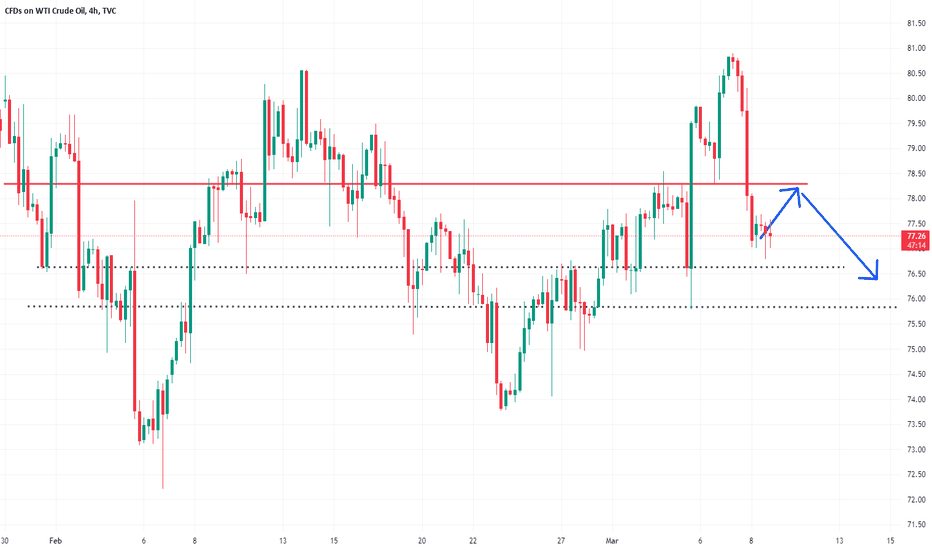

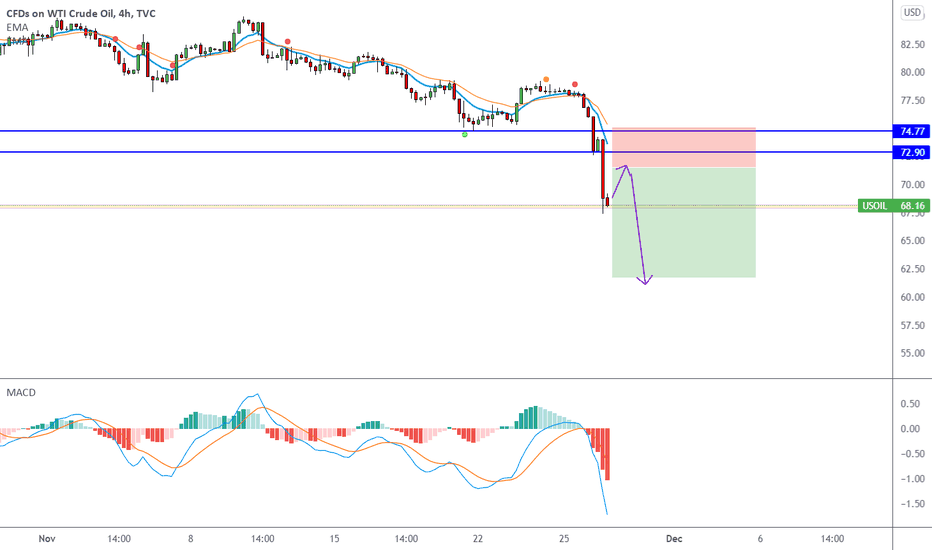

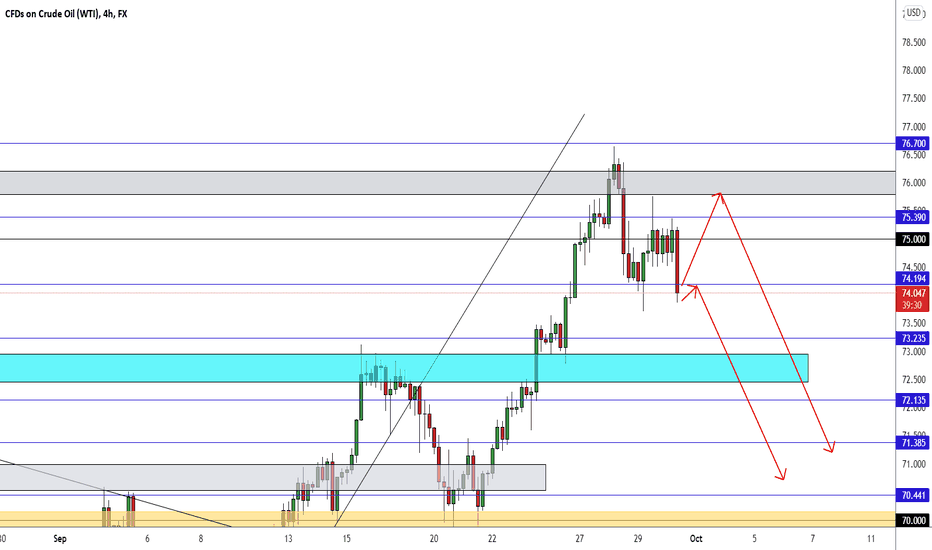

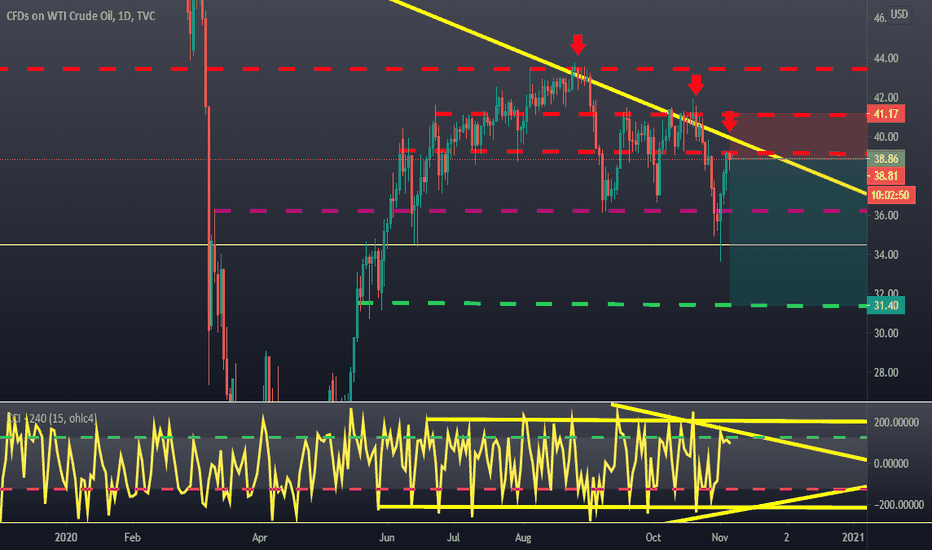

Oil prices have stopped falling, and the bulls are back?Crude oil was suppressed by fundamentals and high pressure. Yesterday, the daily line fell all the way, and finally the daily line closed the negative line. Crude oil currently continues to maintain a wide range of oscillations on the daily line. The 4-hour level trend is also after a continuous decline. The current deviation rate is slightly too large, and the technical patterns on the small-cycle trend are also beginning to be gradually repaired, and there is a high probability that there will be some room for rebound and repair in the short-term trend.On the news side, short-term attention will be paid to Powell's further remarks and EIA data within the day.

Operationally, crude oil is recommended to be short at 78.3, below the target of 76.6.

In order to facilitate you to continue to follow up on my analysis and sharing, you can like and follow me. In addition, you can enter my channel for free in the following ways to follow real-time views and operational strategies.

TVC:USOIL TVC:GOLD FOREXCOM:XAUUSD

Oilsell

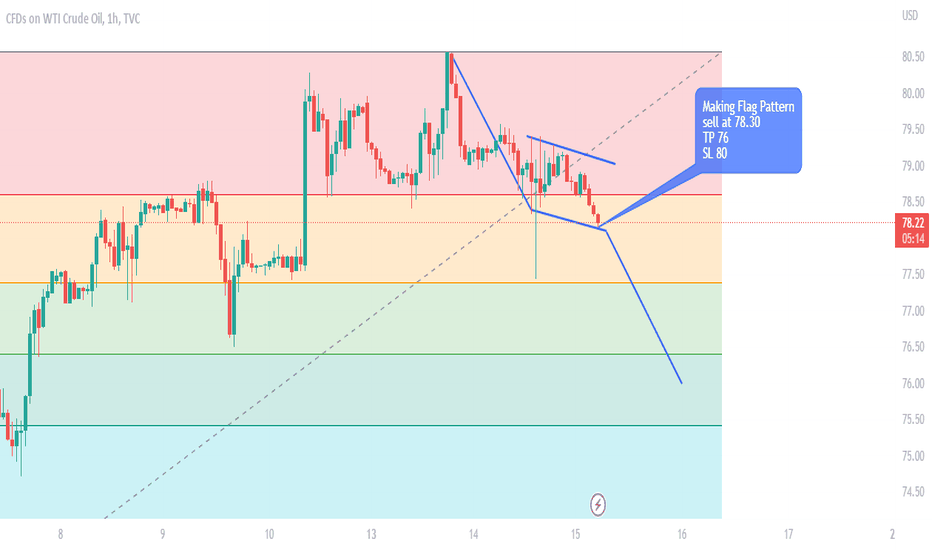

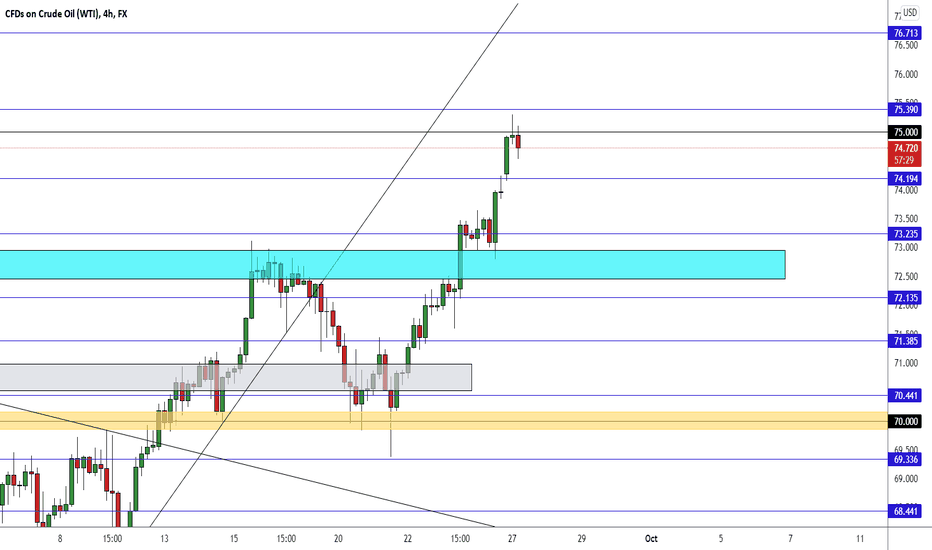

WTI CRUDE OIL WAITE FOR CONFARMANATION...

Hello Traders, here is the full analysis for this pair,

let me know in the comment section below if you have any questions,

the entry will be taken only if all rules of the strategies will be

satisfied. I suggest you keep this pair on your watch list and see if

the rules of your strategy are satisfied.

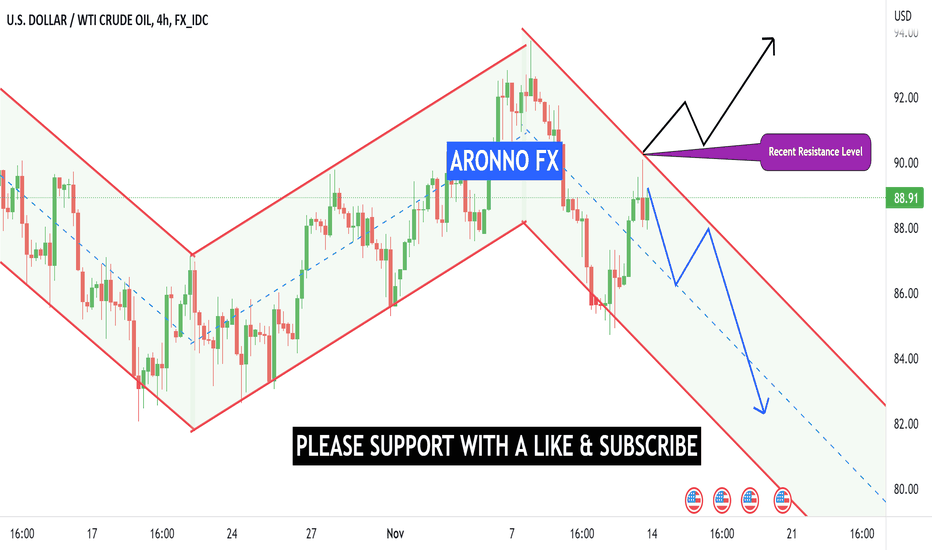

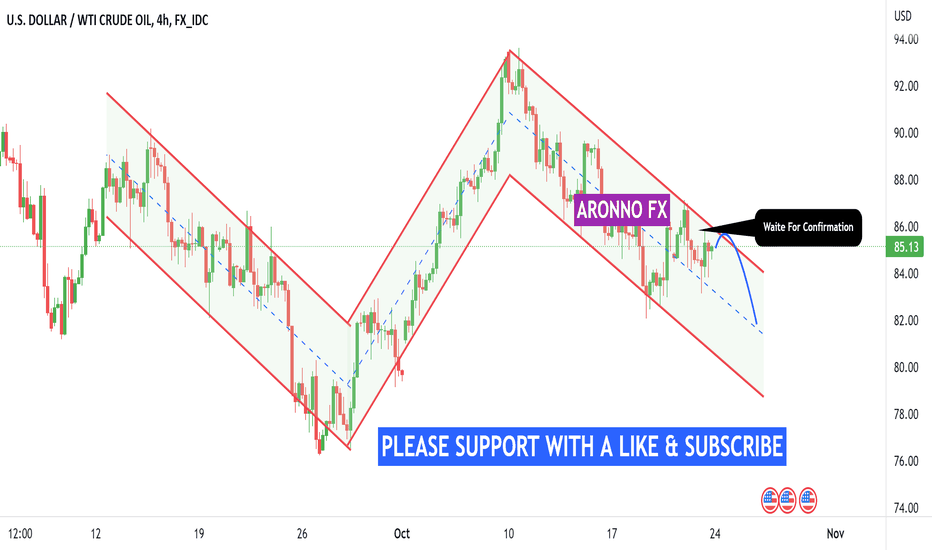

Dear Traders,

If you like this idea, do not forget to support with a like and follow.

PLZ! LIKE COMMAND AND SUBSCRIBE.

WTI CRUDE OIL POSSIBLE TO GO DOWN

AronnoFX will not accept any liability for loss or damage as a result of

reliance on the information contained within this channel including

data, quotes, charts and buy/sell signals.

If you like this idea, do not forget to support with a like and follow.

Traders, if you like this idea or have your own opinion about it,

write in the comments. I will be glad.

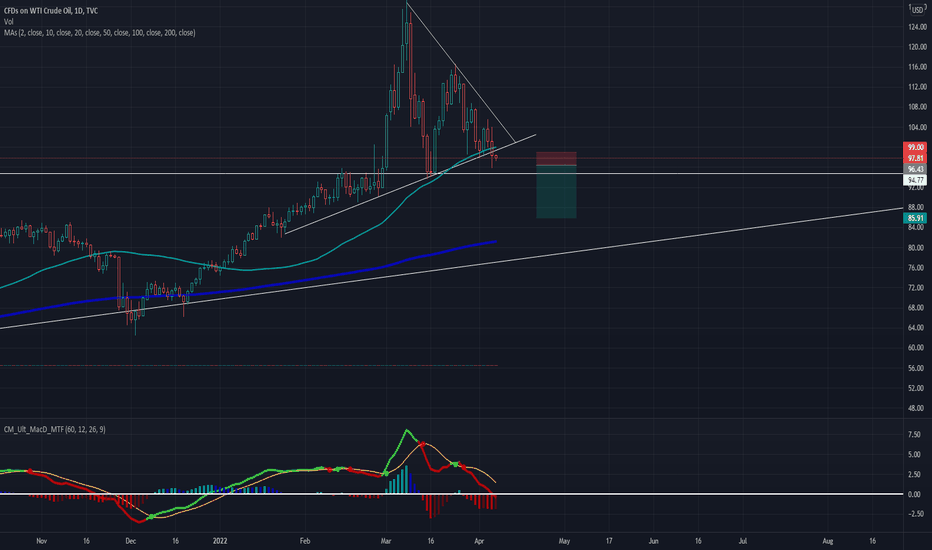

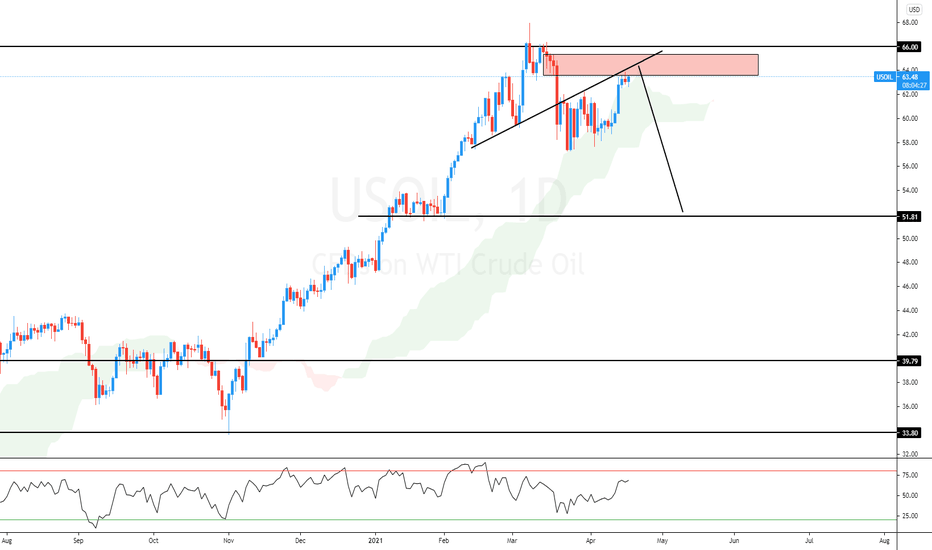

WTI BEARISH OUTLOOKWTI reached its 8 months low, after the spike in price from the invasion in Ukraine. Investors are afraid that combination of increasing interest rates and high inflation will slow down the economy, from there and the demand for crude oil. The economic slow down of China has also put a down pressure on the oil price.

Technical indicators are also placing WTI into bearish scenario, with MACD under the 0 line and RSI under the 50 neutral line.

If the trend continues, the price might reach levels of 67.5 In opposite scenario, however, the price might test its previous high of 89.5

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

OIL-NEUTRAL SELLWe likely will trade lower in the medium-term. Short-term we are supported at 93.93 and we have resistance at 98.50 above.

The MACD is starting to go negative (lagging) and therefore SELL strategy is the way to go. One would either SELL near resistance 98.50 (perhaps 97.75 when seen) or SELL current 95.00-96.00 and place stop-loss @ 99.00. Take profit 84.75.

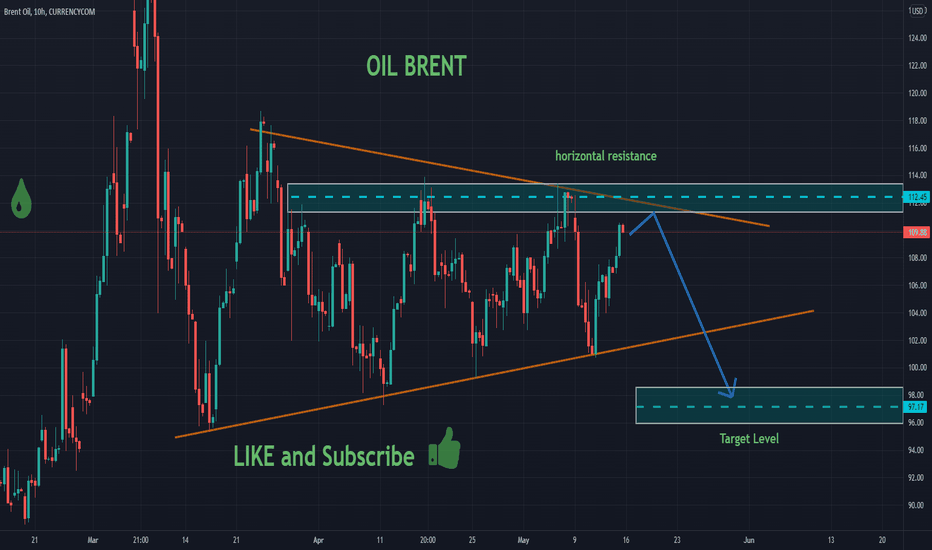

OIL BRENT Local Short!!OIL_BRENT is trading in a narrwing wedge

And will soon retest a horizontal resistance at 112.45

A bearish move down will follow

However, IF the resistance is broken to the upside

The setup is invalid

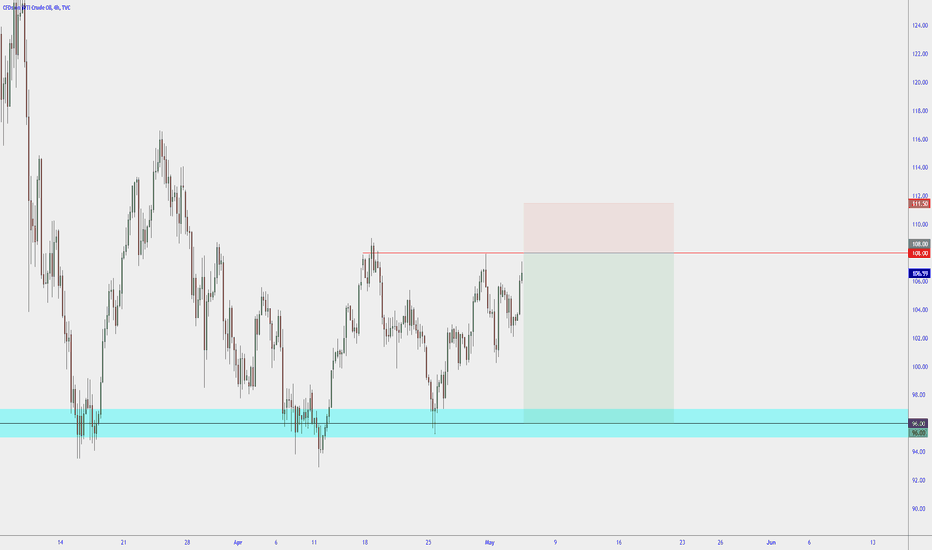

Oil Short From 108$ Oil has been propped up in recent days on the back of EU embargo on Russian oil rumours. It seems as if there might be a consensus among the member states but most are requesting exemptions for at least a matter of years before they are forced to get off it. China are also struggling with COVID-19 implications, lockdowns and seems as though the supply chain link to the U.S. is also becoming strained once again. On the back of that demand decline in China, potential slowdown in the U.S. as a result of that and combination of higher rates.

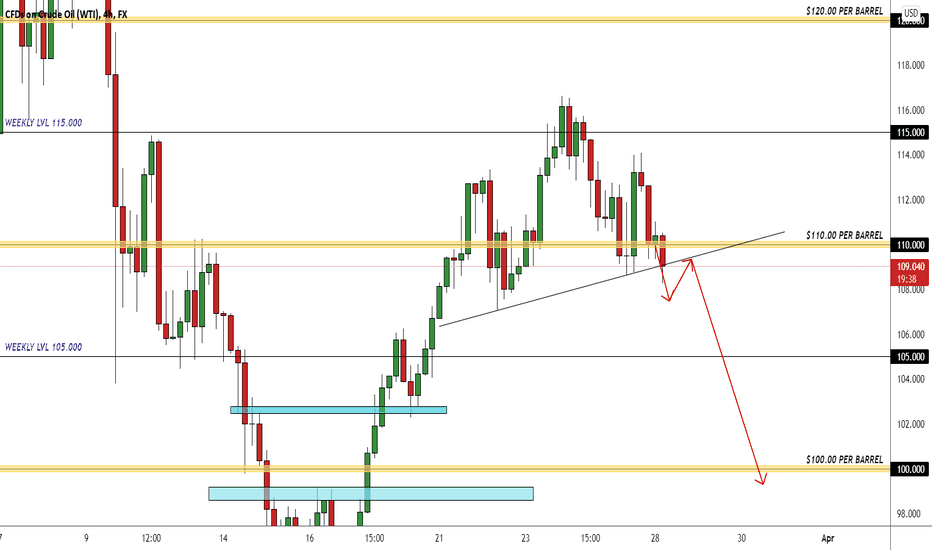

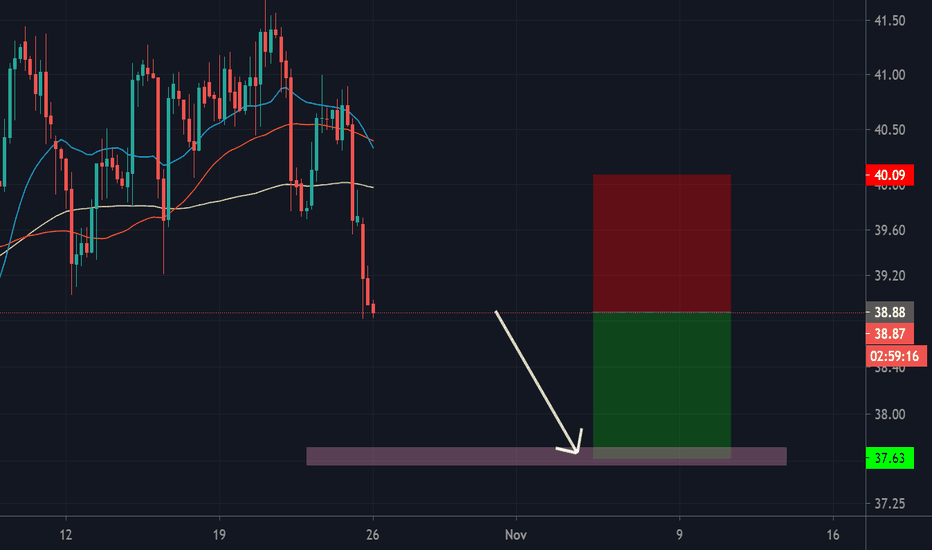

OIL SHORT BACK TO MAIN TREND IF CLOSE OUTSIDE 50 MOVING AVERAGEHi there,

As you see on the chart, OIL has closed below the 50MA on the daily time frame. We need to see a full candle close below 50MA for short. It is still above the 200MA so still a bullish trend up. But we may want to catch the fall back to the main trend. You can see our entry and profit target.

Profit target = next support point.

Entry Point = Ideally we should wait for a retest and reject from the 50MA to enter for the fall.

Indicator:

> MACD = showing sell but need more sellers

> RSI = below 50, need more strength to the down side

We don't want to see OIL close inside the symmetric triangle.

kind regards

USOIL Made Head&Shoulders Pattern , Short Setup To Get 500 PipsThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

crude oil

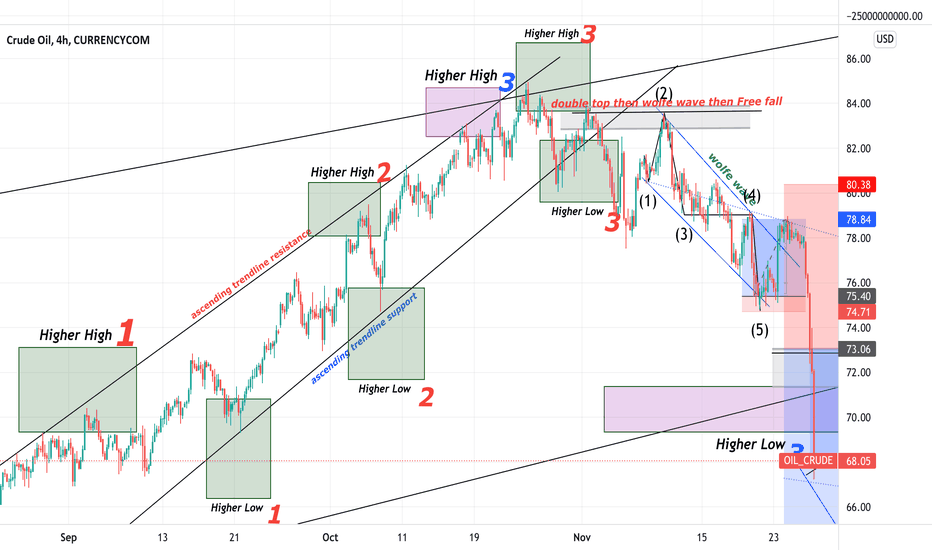

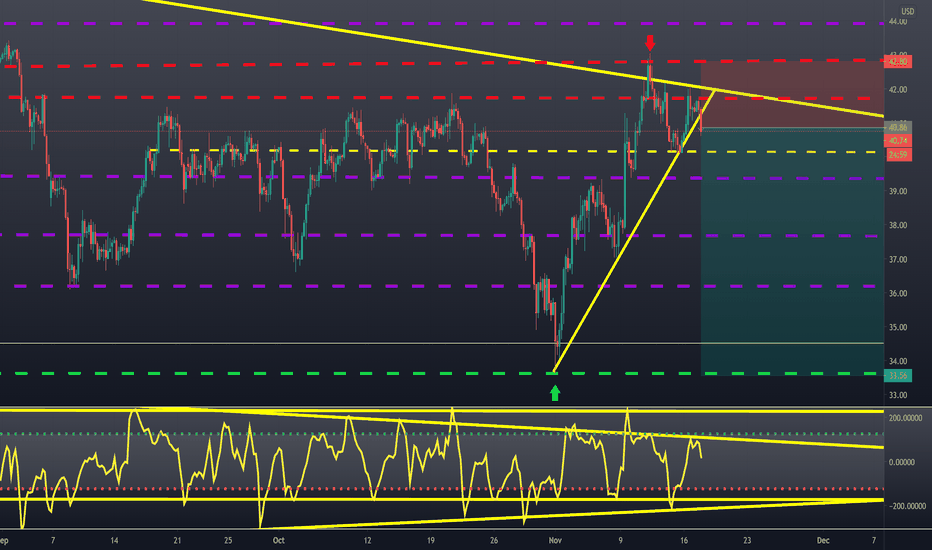

Since history always repeats itself, we expect oil to drop to levels 38, 34 , as you see there are 2 ascending triangles , one big and the other small, look at the small one, after the price broke the third higher low , the price retested it by forming double top then descending wolfe wave formed ,then the price free fall fell so we are expecting the same path for the big ascending triangle , zoom out to see it now the price broke the third higher low in big ascending triangle , we expecting the price to retest it the form a descending wolfe wave the free fall to 34 ,In addition to fears of an inflated global excess supply of crude in the first quarter of next year, due to lower demand.

Take your profit & RUN! 🏃♂️

I hope you all have a brilliant trades 💖

Stay safe ✌️

USOILUSOIL - this is base on news and other fundamental analysis . to gain the liquidity big traders must close there for small retracement in market. Travel ban to Africa will loose some demand for oil. Anyway COT says the same thing. lets enjoy the ride. these analysis are not trade signals or advice to take the trade this is only for my improvement but still if anyone want to pick some idea you are welcome.

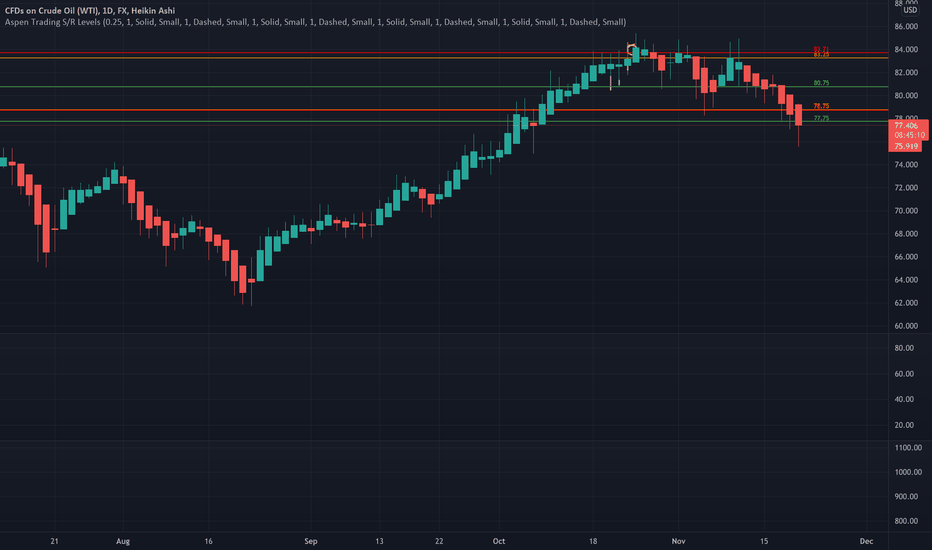

Oil is headed down in 60s rangePrices of oil have a direct impact on the inflation. The higher oil prices have started impacting the consumers across the globe.

We have used Aspen Trading Support & Resistance Levels to analyse the oil prices trend. It has clearly broken down the short-term support levels at 77.75 and most probably could lead to further down side.

As the the oil production ramps up, the oil prices could stabilise at the pre-covid levels in the range of 60s.

Note - Aspen Trading S/R levels are invite only. They can be accessed through my profile information.

Disclaimer: This analysis is for information purpose only and does not constitute any investment advice.

OIL Running In 300 Pips From Last Entry , New Entry Added This is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

USOIL Full Analysis , 2 Short Setups Valid To Catch 500 Pips !This is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

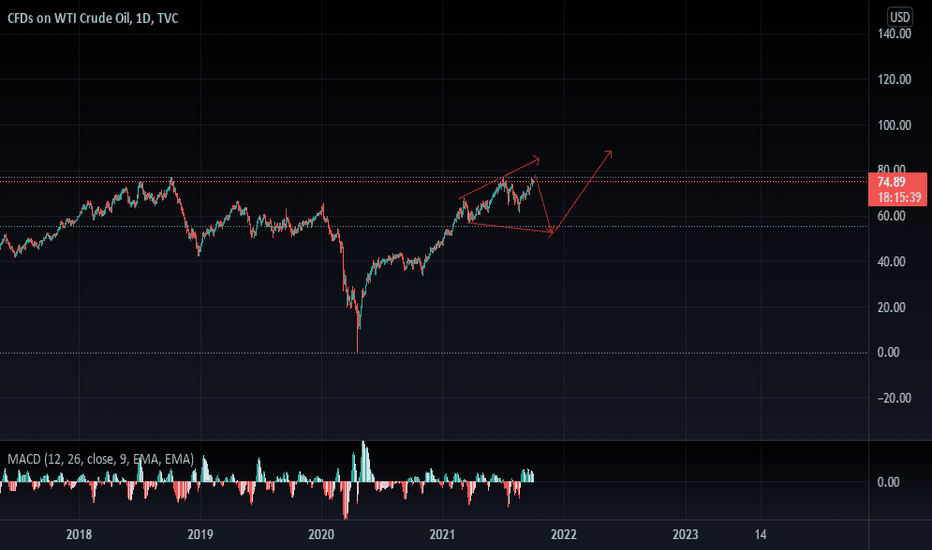

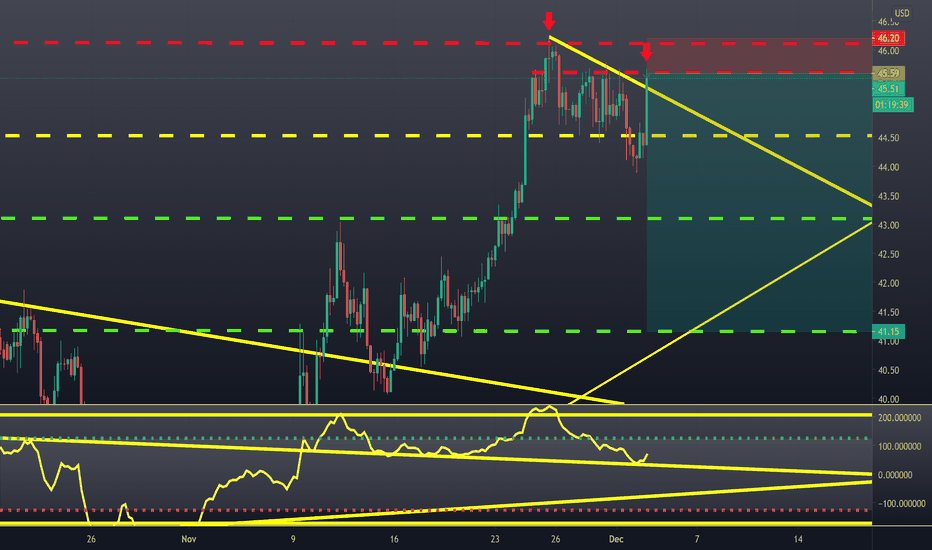

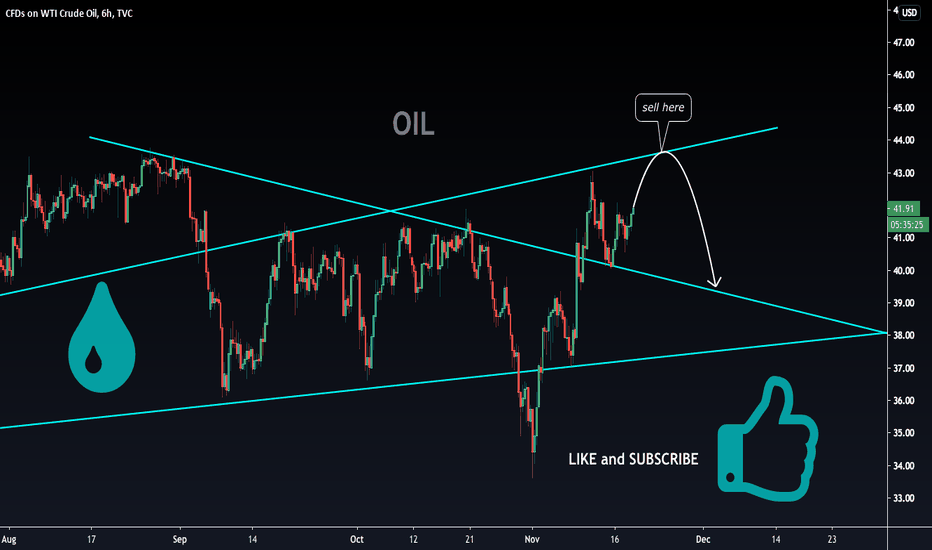

OIL will rise a bit more, then fall. Sell!

Hello, Traders!

OIL is going UP on the fundamentals.

Improved outlook on the economic Recovery rate

Based on the vaccine successes

Consequently improves outlook on oil demand

Therefore we see a price increase.

However, On the technical side

We see a strong rising resistance ahead.

That is my target short spot

From which I expect oil to retest falling support

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!