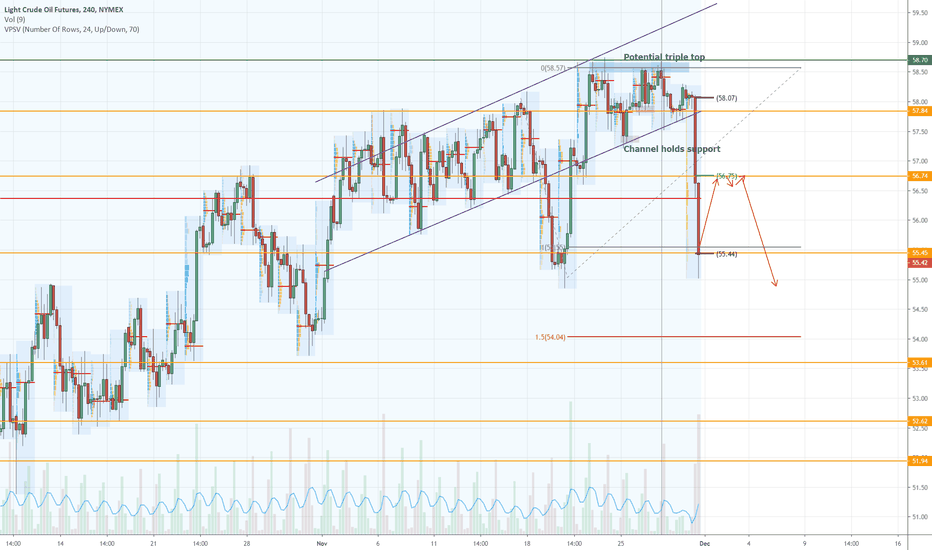

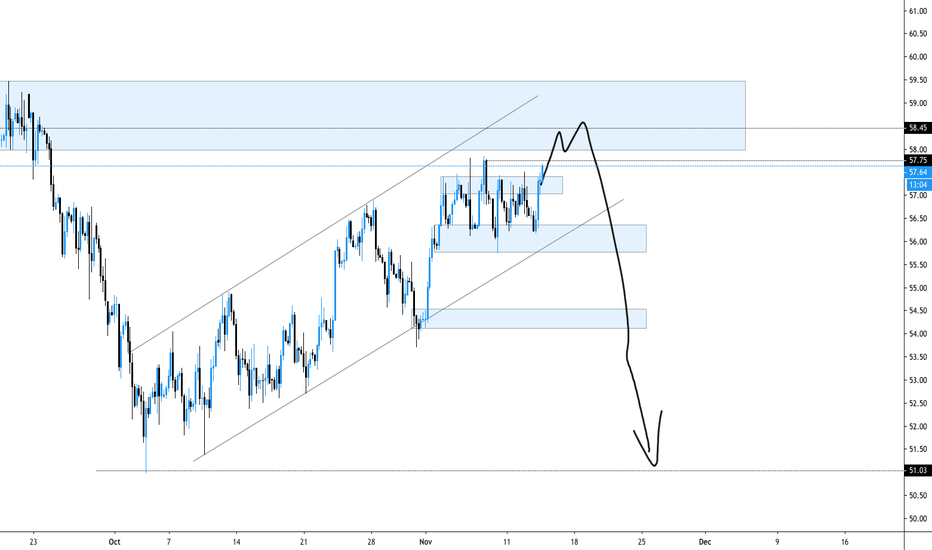

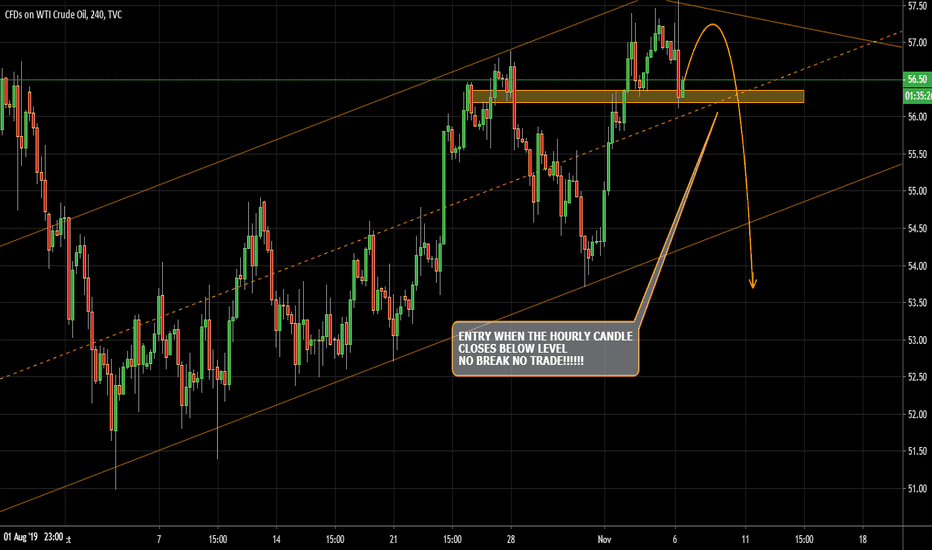

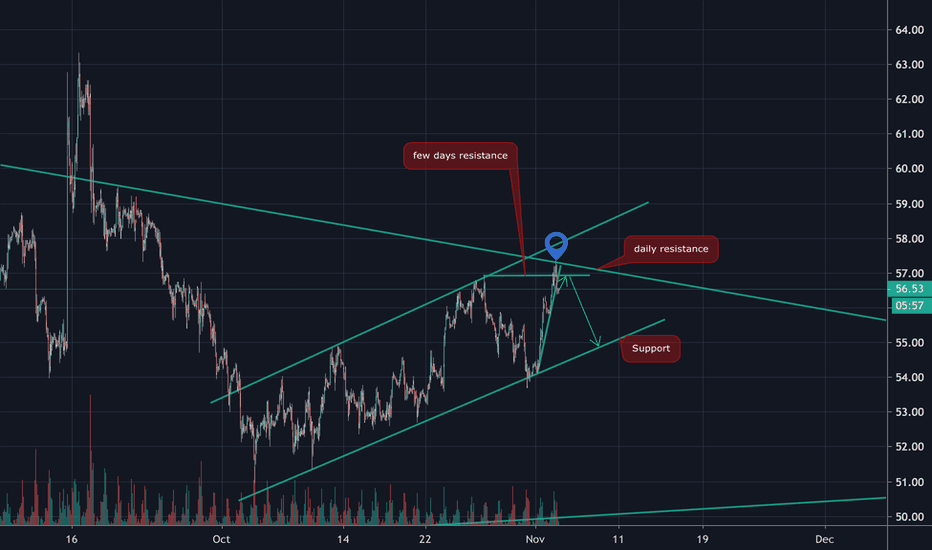

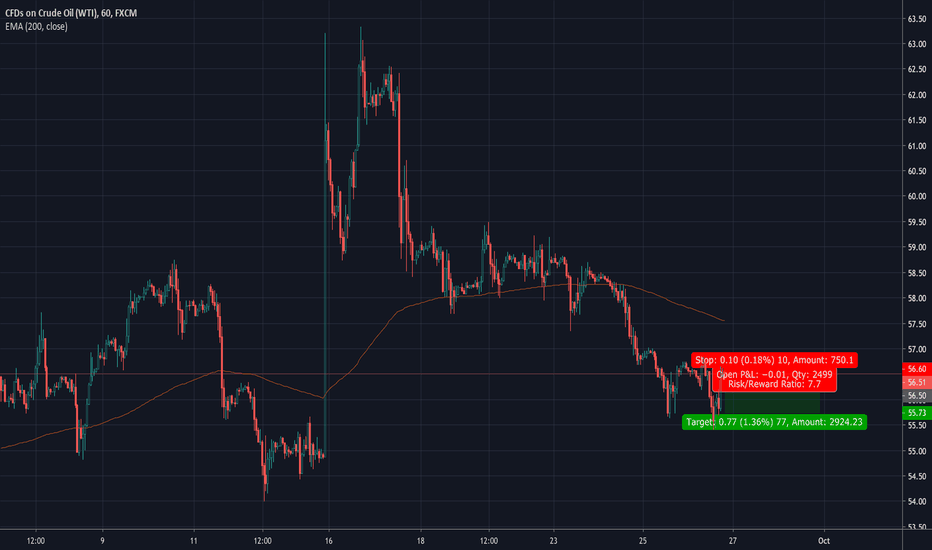

Crude Oil breaks bull structure, will we see $50.00 oil? Over the past few weeks, oil was making some gains slowly to push up from the lower $50.00 level and nearly into $60.00. There was some technical stagnation just under $59.00. A triple top had formed and we were waiting to see if support would hold for a push through resistance into $60.00, then the news came out from OPEC and OPEC+ that brought a strong 5% drop in the price. Through all support structure that was supposed to hold for upside. The bull trend is officially broken, which means we are looking for level at which to short CL to a move lower. The news is short-term however we may an extended move lower in the coming days or weeks. The first support level was $57.40, however price closed at $55.45 on Friday's close, right at support.

The next level for the retrace based on the market structure is around the 50% retrace move from the whole downside and the previous support level is broken ($56.75). The year to date POC is at $56.50 so there is a 25 cent range between those levels that could be a good area of resistance for the shorts. Above that, we may start looking for longs again. The target to the downside is $54.05.

Oilshort

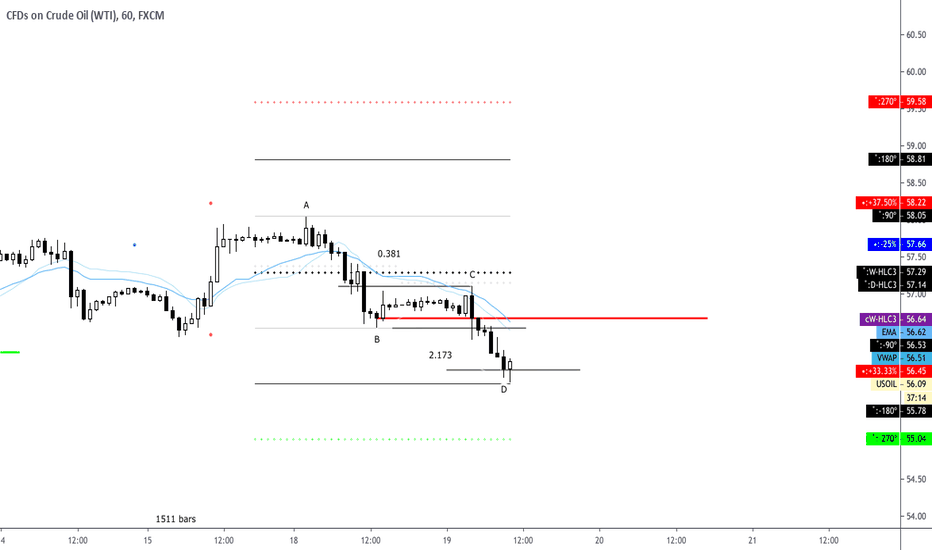

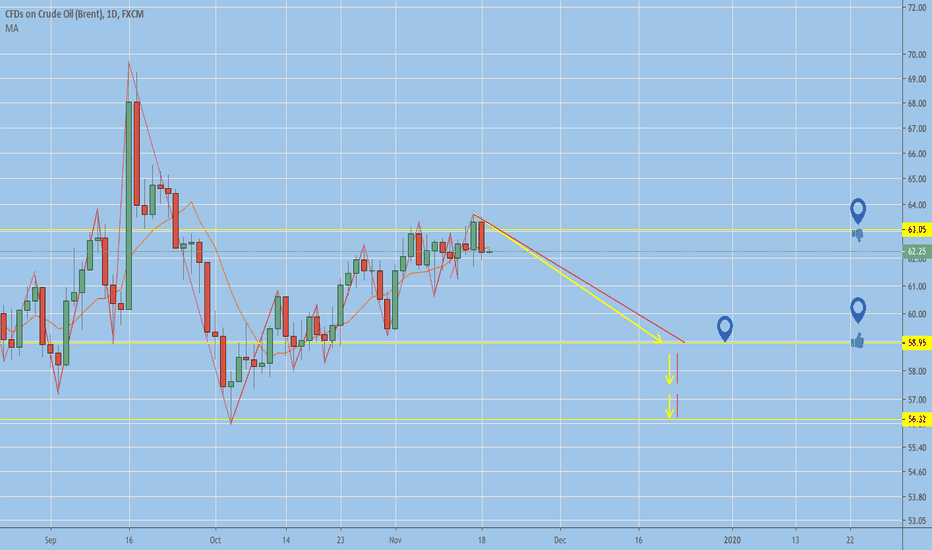

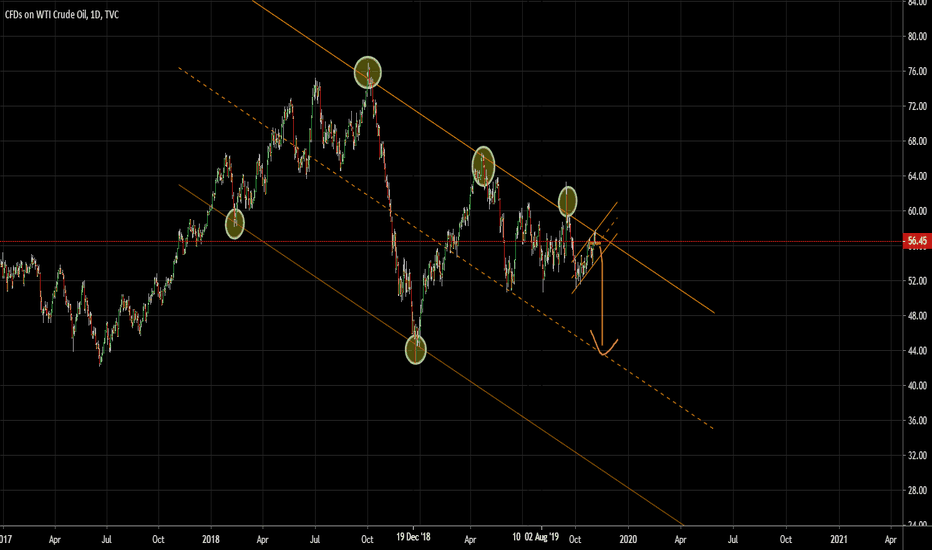

CLFO: Potentially Ready For A CorrectionSeemingly oil has completed a five-wave sequence. The structure seems odd, but overall this scenario seems to have some weight given the closing of the week where bulls decided to take profit. I expect that next week starts off red before another bullish leg. It makes sense to look for fading setups in the lower timeframes.

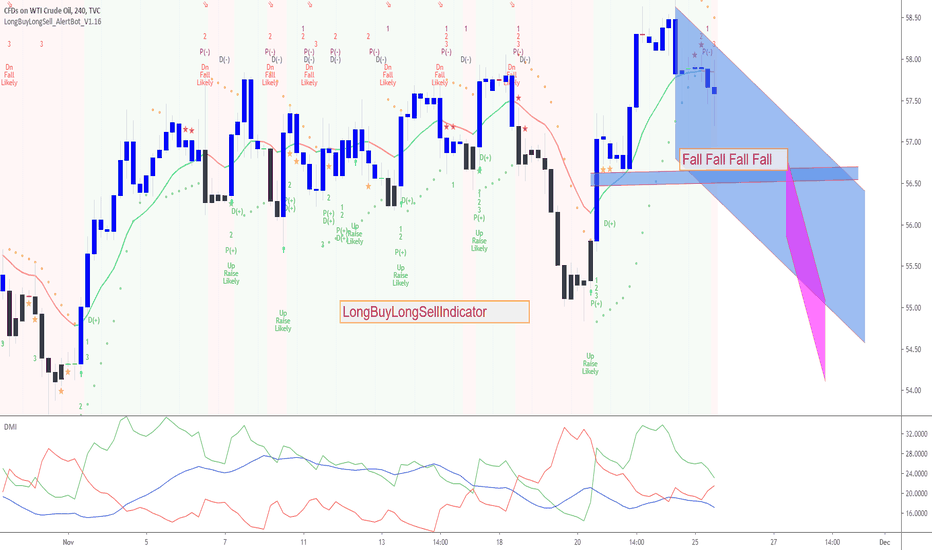

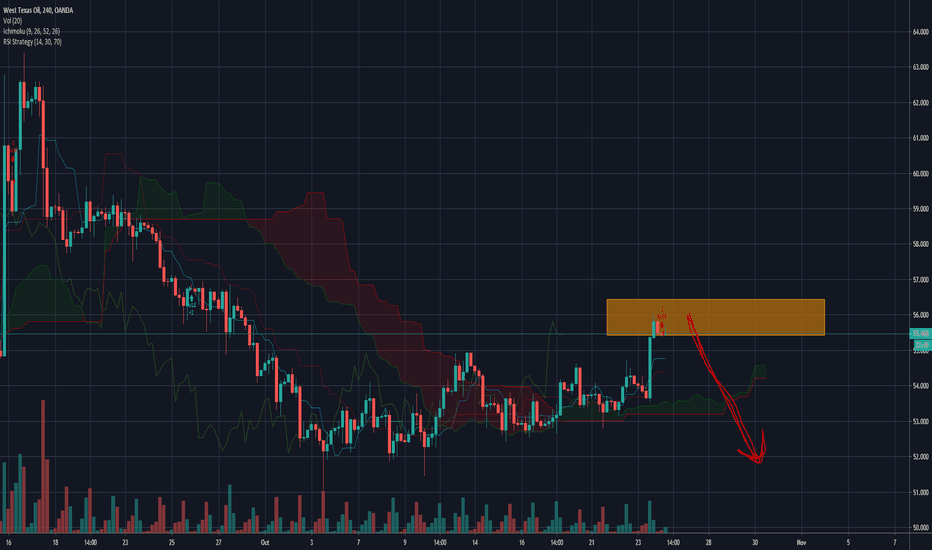

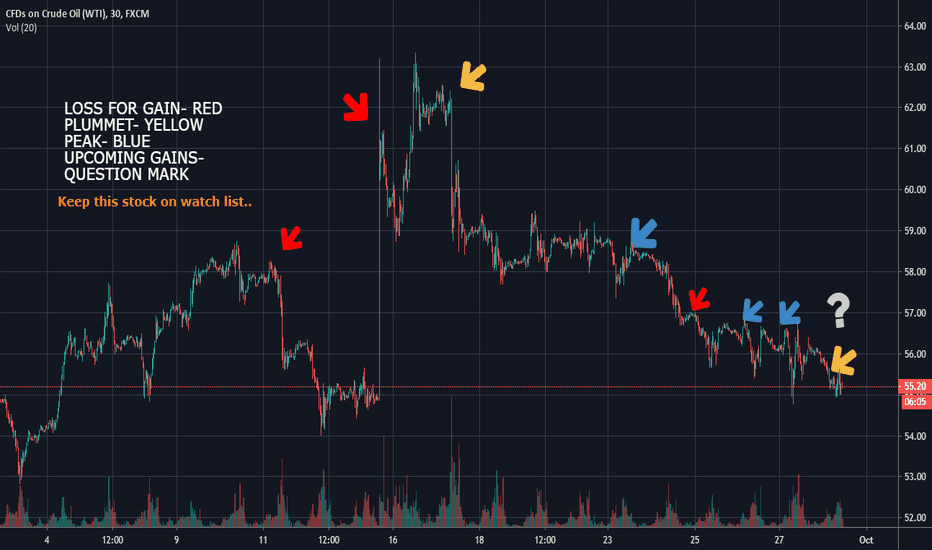

USOIL UKOIL BRENT OIL Fall is coming LBLS indicator AnalysisAs per the LongBuyLongSellIndicator

This is very clear Short is dominating the Long Power , Short is overruling the Long Haul

All the Oil price will get a huge drop from this level .Get Set Go !!!

Like ,Follow Comment and here is the details of the Script

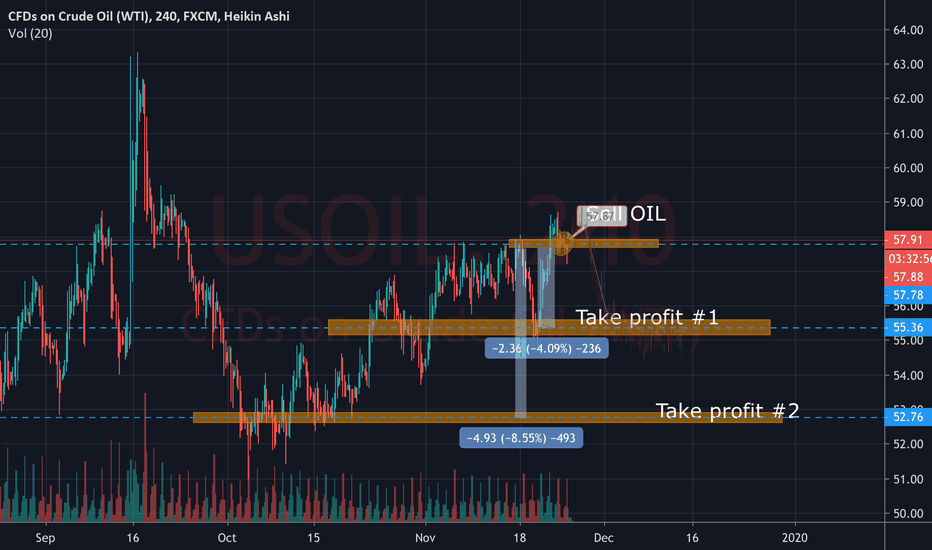

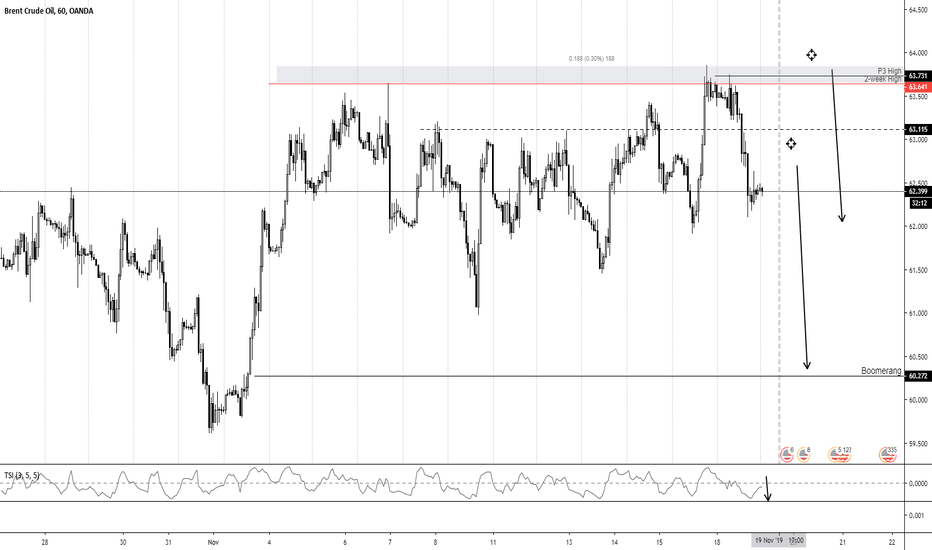

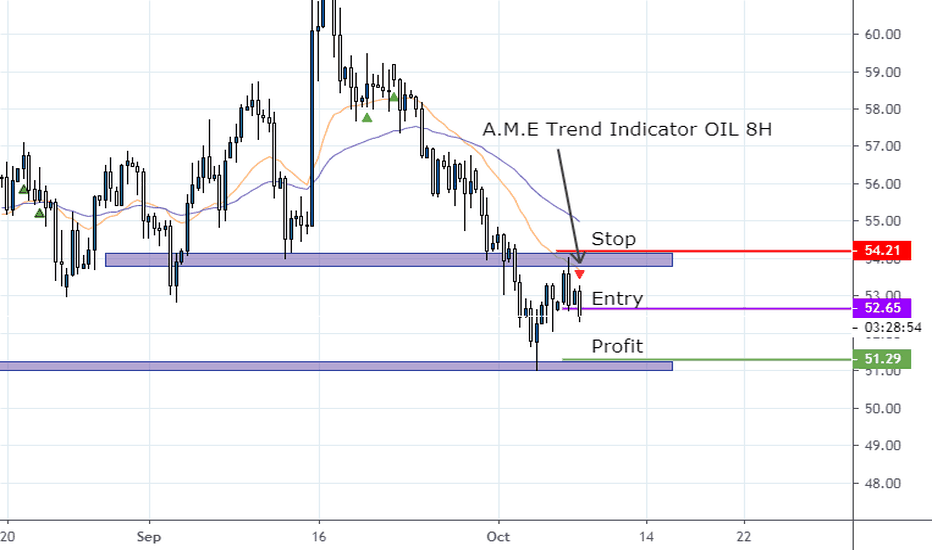

USOIL Shorting The Re-Test USOIL bears delivered a bearish gap, the first one in a while. Impatient shorts will cover at current measured move target level, which will apply pressure making bulls excited towards 5650 gap re-test. The retest area is a reasonable short with good odds as the context to the left favours bears currently.

Oil Forecast Today - Going All Short On Oil The US economy appears to be heading towards one of its worst quarters in recent memories, But amid signs that PMI readings are stabilizing in Europe and North America, relative to the backdrop of a hopeful resolution to Phase 1 of the US-China trade war deal, it seems that traders are otherwise treating disparaging economic data as red herrings. As traders remain distracted by the impeachment hearings, signs that the US-China trade negotiations are on uncertain ground has seemingly been ignored. For Me oil it's a short for now

USOIL (Gravy Train)Rough sketch but you get the picture. I'm fairly new to trading so I'm not sure of all the fancy wave names and the technical nomenclature but this is what the chart is saying to me. I'm just listening to what its saying (or moreso what I see). It's damn a near flip flop of how the directional trend got started.

Lets eat. Amen.

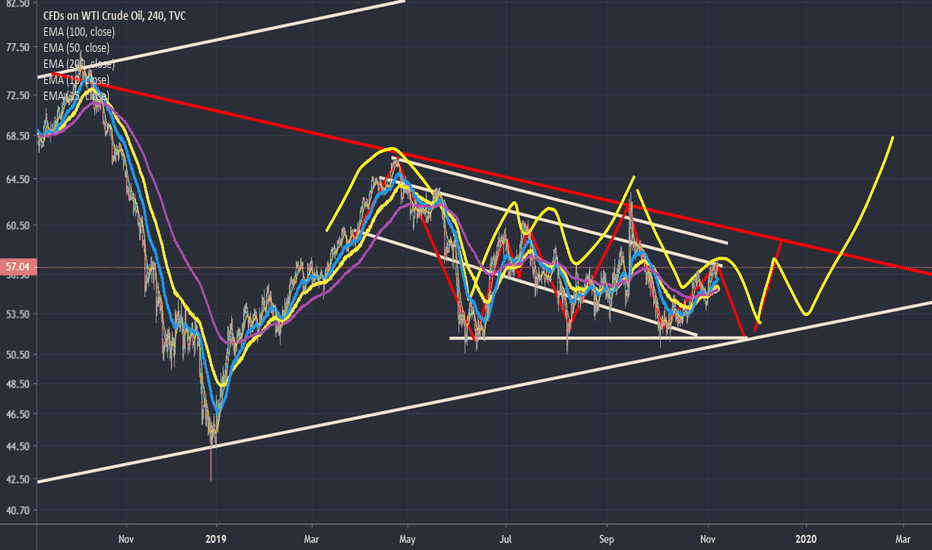

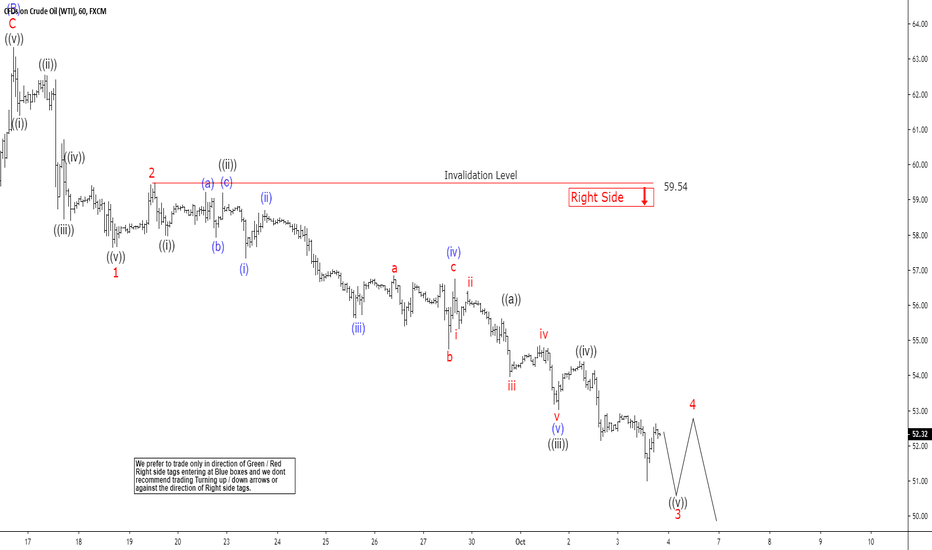

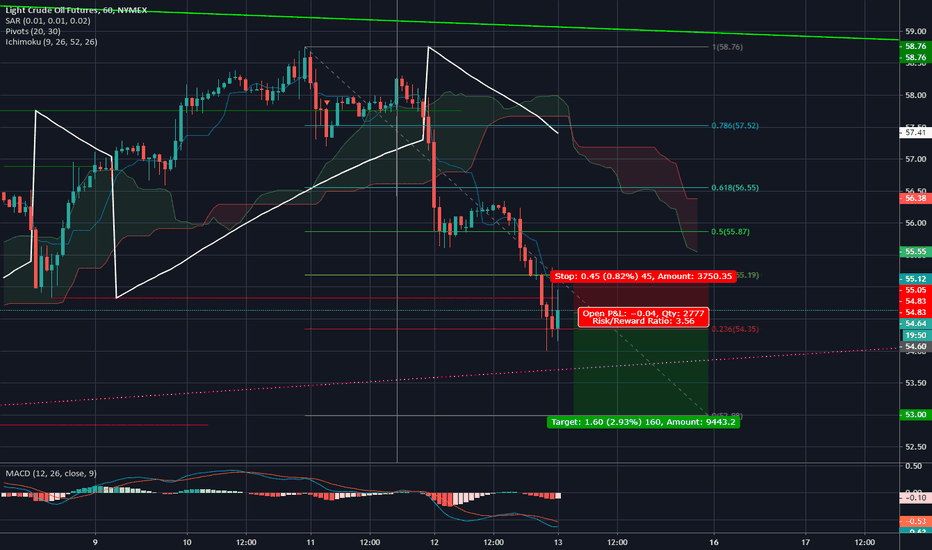

Elliott Wave View: Oil Resumes Lower ImpulsivelyShort term Elliott Wave view on Oil suggests wave (B) rally ended at 63.38 on September 17, 2019 high. The commodity has since turned lower within wave (C) which is unfolding as 5 waves impulse Elliott Wave structure. This view will get validation when it breaks below the previous low on August 7, 2019 low (50.52). Down from 63.38, wave 1 ended at 57.67 and the bounce to 59.54 ended wave 2. Oil then resumes lower in wave 3 which is extended and subdivides as an impulse in lesser degree.

Wave ((i)) of 3 ended at 58.01 and wave ((ii)) of 3 ended at 59.39. Wave ((iii)) of 3 ended at 53.05 and wave ((iv)) of 3 ended at 54.42. Near term, while bounce stays below 59.54, expect Oil to extend lower to continue the 5 waves move from September 17, 2019 high (63.38). We don’t like buying Oil and as far as pivot at 59.54 stays intact, expect any bounce to fail in 3, 7, or 11 swing.

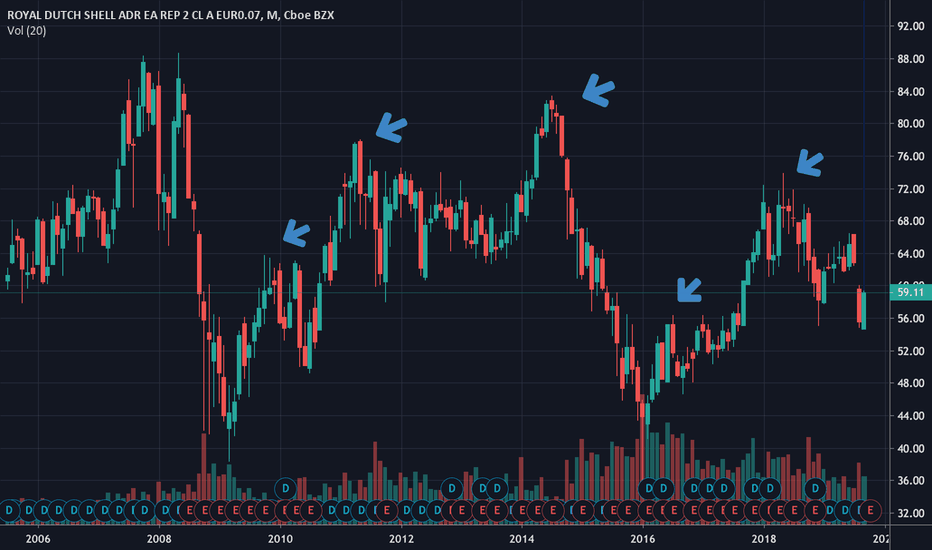

RoyalDutchShell (RDS.A) upcoming attractive oil stock dividend"The Company consists of the upstream businesses of Exploration & Production and Gas & Power and the downstream businesses of Oil Products and Chemicals. It also has interests in other industry segments such as Renewables and Hydrogen." right now Shell currently offers the highest dividend yield among the oil majors, at 6.5%. Moreover, that dividend is comparatively safe: Even during the oil price downturn of 2014 to 2017, Shell didn't cut its dividend like many independent oil producers. It is also trading at an attractive valuation right now,, a consistent payout.. its a gasoline play thats not about the gas,, this is to become an attractive dividend stock by far.

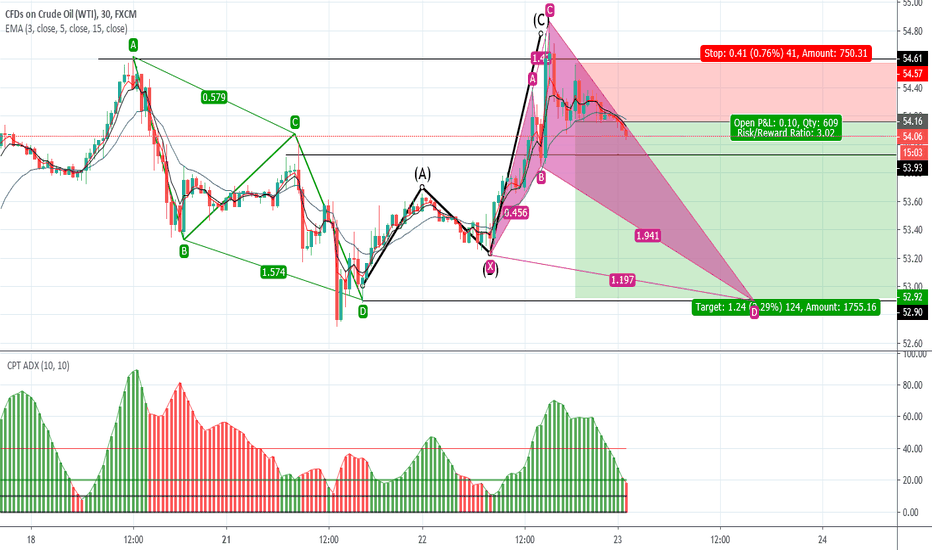

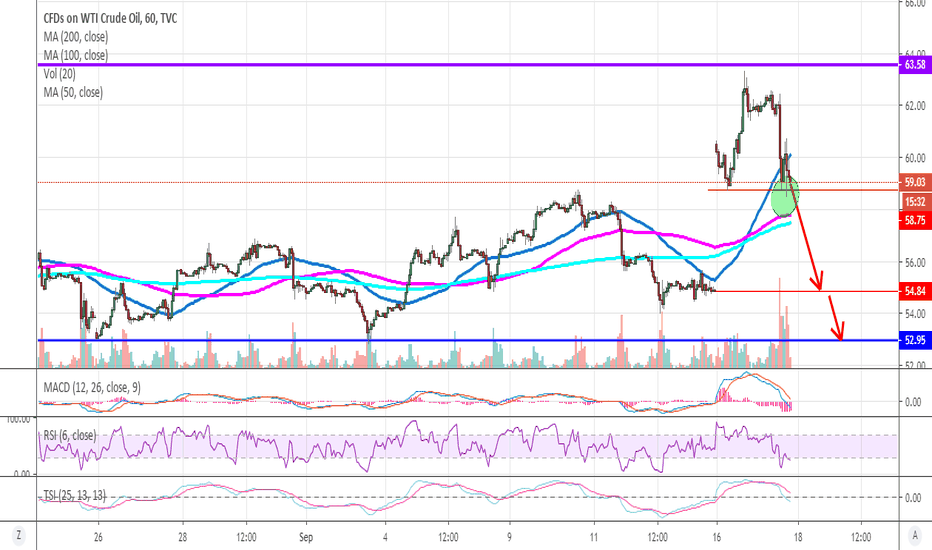

OIL - Mind the gapAfter the drone attacks oil opened with a gap on Monday morning,

but today instead of going higher it started to try to fill the gap again.

It also break below Monday mornings low so the chance is pretty high that it's going to

drop to 54,84 and fill the gap.

There is also a chance that it's going to tag the bottom of the range at 53$.

Today's volume is pretty high, let's see if we can fill the gap.