OKTA

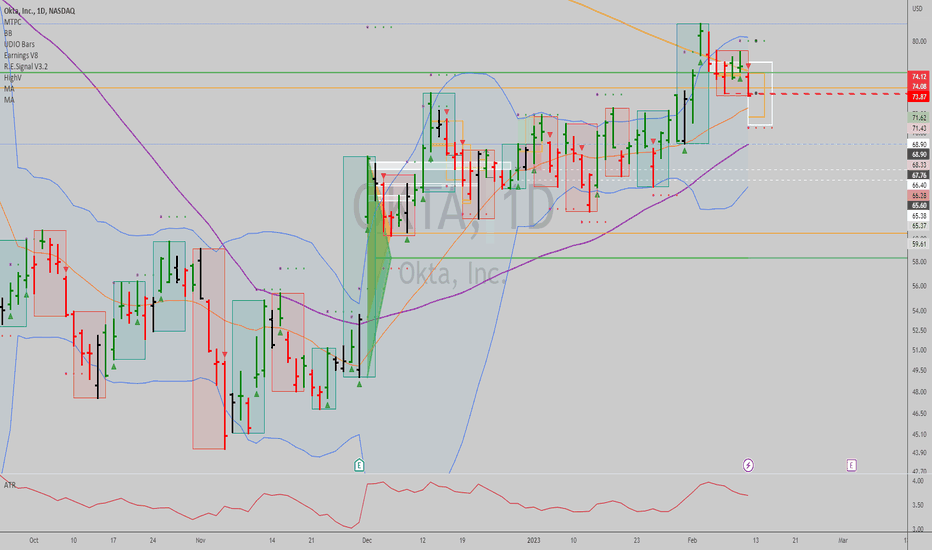

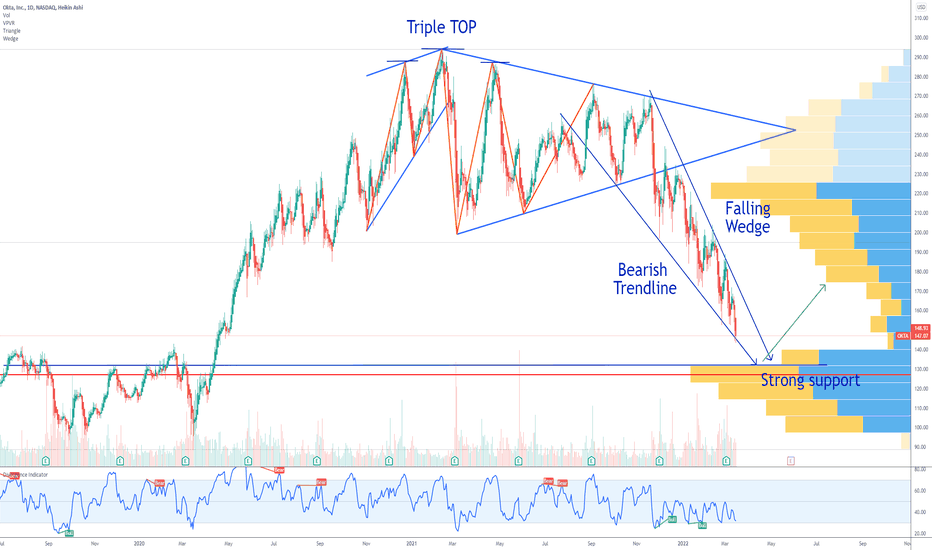

Okta in a flag?OKTA - 30d expiry - We look to Buy a break of 74.31 (stop at 68.78)

Short term bias has turned negative.

A break of the recent high at 74.31 should result in a further move higher.

Short term momentum is bullish.

Price action looks to be forming a bullish flag/pennant.

The bias is to break to the upside.

Our profit targets will be 86.96 and 87.96

Resistance: 74.18 / 78.00 / 87.50

Support: 66.00 / 62.40 / 60.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

15 Companies that have organic growth of financial resultsIt is good options to buy when the market is at the bottom (we think it is summer 2023, you can see our macro scenario here )

Type: growth stock

1. Okta – operates in the Identity Management market (identification protocols). It sells its products to individual companies and as part of integration with the other industry leaders (Zscaler). Organic growth is expected due to a low penetration of Identity Management in corporate environment (20% now). The market could reach the value of 70 bln, according to McKinsey. We anticipate revenue to expand by ~30% over the next few years.

Downside: 1) The company regularly dilutes equity to finance R&D and marketing.

Upside 1) Has a positive EBITDA margin, will have a positive FCF as soon as 2024.

2. Twilio – operates in the CPaaS market. The valuation already reflects negative expectations from the slowdown of the CPaaS market amid shrinking advertising budgets (weak consumer). We expect revenue to expand by 25%+ over the next few years, which is also reflected in the company’s long-term valuation.

Downside: 1) The company regularly dilutes equity to finance R&D and marketing. The emergence of various solutions in the market that are powered by GPT-3 (a neural network), which generates human-like responses based on the learning of the target audience. These solutions are less costly for companies; however, major companies aren’t bent on integrating it just yet. I believe that Twilio could integrate it in its own product, as GPT-3 has an open source code.

Upside 1) Has a positive EBITDA margin, will have a positive FCF as soon as 2024.

3. Zscaler. The company operates in the narrowly specialized SSE market. Industry leader. Organic growth is expected due to the current low penetration in corporate solutions (around 3%). We anticipate the company will practically double its cash flow every year over the next 2 years + it’s profitable

4. Paypal. In the third quarter PayPal demonstrated again that the company’s strategy is bearing fruit even as the global economy is slowing down.

The multipronged development of PayPal’s services remains key for its organic growth. What used to be a fairly narrow-focused service to pay for goods and services is adding ever more new functions: PayPal continues to cooperate with Apple and is expanding the opportunities for contactless payment, while also working to increase engagement with the audience through the Braintree payment system. Therefore, even in the middle of an unfavorable macroeconomic environment and faced with declining consumption in the cyclical sectors, the company is seizing ever more market share.

Upside: the management plans to boost operating margin by about 100 bps next year by developing infrastructure and reducing transaction costs.

5. Tesla. Tesla publishes fairly strong reports: Revenue and operating profit grow by 50-60% y/y. unlike other players, Tesla also improves its business margins.

When China ends lockdowns, the issue of downtime at Tesla’s Chinese plant, its largest, will go away. Also, as soon as this quarter (the fourth quarter) Tesla will share access to its FSD and release it to the mass market.

In general, the company is feeling well. Its stock price has fallen ahead of the market amid Musk’s purchase of Twitter and the current perturbations at Twitter. Also. Musk sold some of his Tesla shares to fund the purchase of Twitter. Musk’s current share is ~13%.

Type: cyclical stocks

1. Livent. The company is moving ahead in line with our forecast. The company has several growth projects that start as soon as 1Q 2023, and also in 4Q 2023. They will add 100% of lithium carbonate production. Lithium prices, give or take, are set to remain near their current levels as demand from the EV industry continues to be strong (even as consumption is low, the market cannibalizes ICE models).

Downside: 1) Poor reporting on sales volumes. Chemicals prices continue to hold high. If lithium prices turn around, that will erase the margin.

Upside: 1) The company operates with a high gross margin. Its costs are $7,000 per 1 ton of production while the price now is about 80,000 a ton.

2. Darling. The company has piled up a lot of cash on the balance sheet. It now uses it for strategic precision purchases, which fuel its growth. + 30% of EBITDA comes from DGD, the growth of operating metrics will largely happen in 2023, so by 2024 operating metrics will rise by 50%. The stock took a lot of hammering as Biden seeks to revise the 17-year-old EPA and shift the program toward biogases. EBITDA will get a strong boost due to declining agricultural commodities prices.

Downside: 1) Margin is tamped down because of the acquisition spending (temporary impact) + agricultural commodities prices could hold above our expectations, which means EBITDA wouldn’t get as much of a boost

Upside 1) core business is stable

3. Crocs. the company grows fast in terms of operating metrics (physical shipments of footwear of its own brand and HeyDude), and has been able to switch to air freight delivery, which has been immediately reflected in EBITDA, as was expected. Crocs is now laser focused to consolidate the Asian rubber footwear market, as it regards it as the main and priority market.

Downside: 1) High debt, which was taken out to buy HeyDude. However, they are paying it back as they are successfully integrating HeyDude in its organic structure.

Upside 1) They are able to pass a high share of costs on to the consumer (high gross margin). The average selling price of footwear is $25, while production costs are $10. The brand name is actively working for the company, advertising costs aren’t rising too much (the collaboration with stars that have audiences of millions of people does its part + go on advertising: let’s say, when you see a celebrity wearing Crocs out in the street, rather than on your phone screen, you want them, too.

4. Pinterest. In the third quarter Pinterest showed a net increase of monthly active users for the first time this year. It totaled 445 million people: 95 mln in the US and Canada and 350 mln in other regions.

Although the digital advertising market has taken a heavy blow in 2022 as economy slowed down and advertising budgets were downsized, Pinterest continues to show a stable growth of average revenue per user: The total ARPU reached $1.54 (+8.16% y/y) in 3Q, compared with our forecast for $1.59.

5. Ulta. As of now, organic growth is possible only through opening mini outlets at Target stores. The beauty industry, including Ulta, isn’t falling that much as the company/industry get the bulk of their revenue from beauty enthusiasts (who use cosmetics no matter what, even expensive ones). + the company continues to show a high pace of LFL sales growth due to foot traffic and the average ticket. For two straight quarters now, the company has beaten analyst expectations, but not ours for EPS, due to an increased efficiency of inventory accounting/arrangement of products per 1 square meter (essentially, every inch is used for commercial purposes).

6. Netflix. The business is essentially mature. What could breathe life into it is a strategy to acquire users in low-income markets + add-supported subscription.

7. Transocean. For a few straight quarters now, RIG has showed it’s getting new contracts, including long-term ones, at elevated prices. As long as the trend continues, we expect the company’s gross margin to expand because RIG, when it concludes contracts, includes the future growth of costs in the contract value. All the contracts have fixed revenue, rather than adjustable one, so that’s why. With oil price at $70+ and given underinvestment in the industry, RIG is sure to have demand for its ships.

Type: Chinese, Taiwanese stocks

1. TSMC. TSMC shows a stable growth of financial results and growing business margins. TSMC, in effect, has a monopolistic position in the market, with major companies in the US and China relying on its products.

If China seeks to maintain economic growth and improve the well-being of its citizens, then most likely nothing will happen to Taiwan before 2024 (the year of presidential elections in Taiwan). Therefore, 2023 will be a year of continued growth for TSMC, even amid a global recession.

2. Li Auto. Li Auto shares have been dumped amid the decline of its gross margin as demand skewed toward the more expensive EV. That’s the most expensive EV made in China and the strong demand for it demonstrates that the company’s revenue will continue to rise.

Li Auto is in the middle of an investment phase now, being busy boosting its R&D in EV software and various components in order to achieve a greater vertical integration. The company continues to expand in terms of capacity, dealerships, and invest in its autopilot.

The company holds substantial promise, just like Tesla. What’s more, Li Auto is on the party list as the third-largest EV producer.

3. Baidu. If China relaxes its lockdowns, Baidu’s core business – advertising – will gain pace, with revenue and operating revenue getting a boost. Baidu actively invests in its proprietary systems for AI-powered driving and digitalization of industrial businesses and state-owned companies. In 2024 Baidu is set to start manufacturing EVs jointly with Jidu.

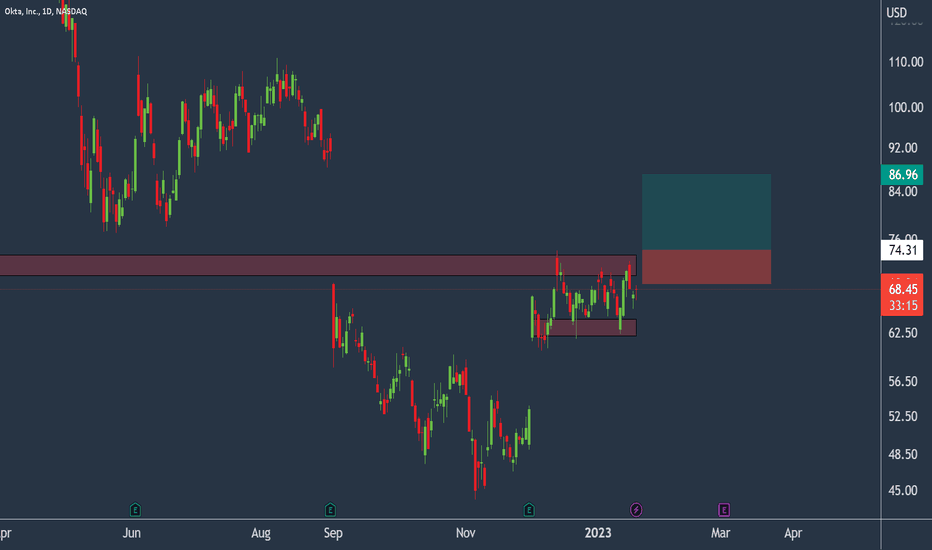

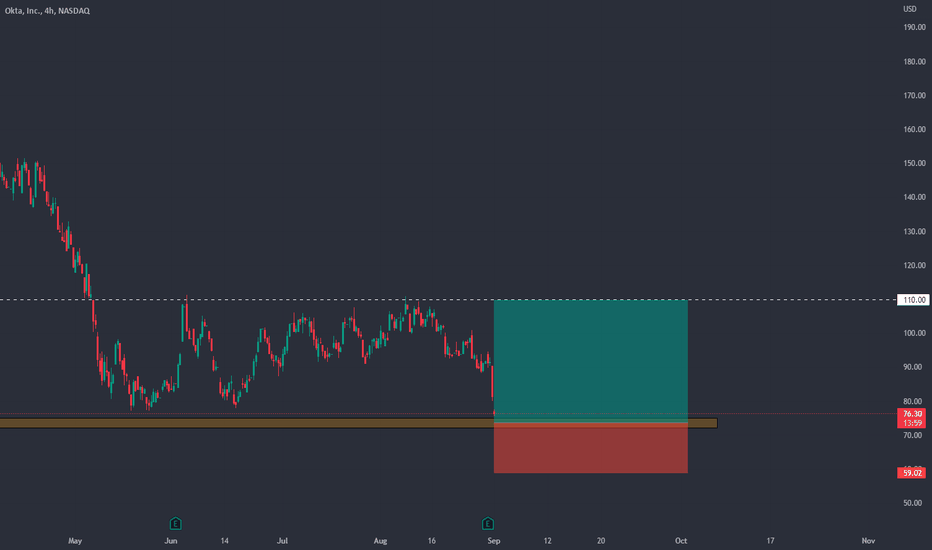

OKTA: Oversold?OKTA

Short Term - We look to Buy at 73.79 (stop at 59.02)

The medium term bias remains bearish. Trading close to the psychological 72.00 level. Support could prove difficult to breakdown. A higher correction is expected. We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher.

Our profit targets will be 109.67 and 120.00

Resistance: 110.00 / 139.00 / 200.00

Support: 72.00 / 50.00 / 30.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

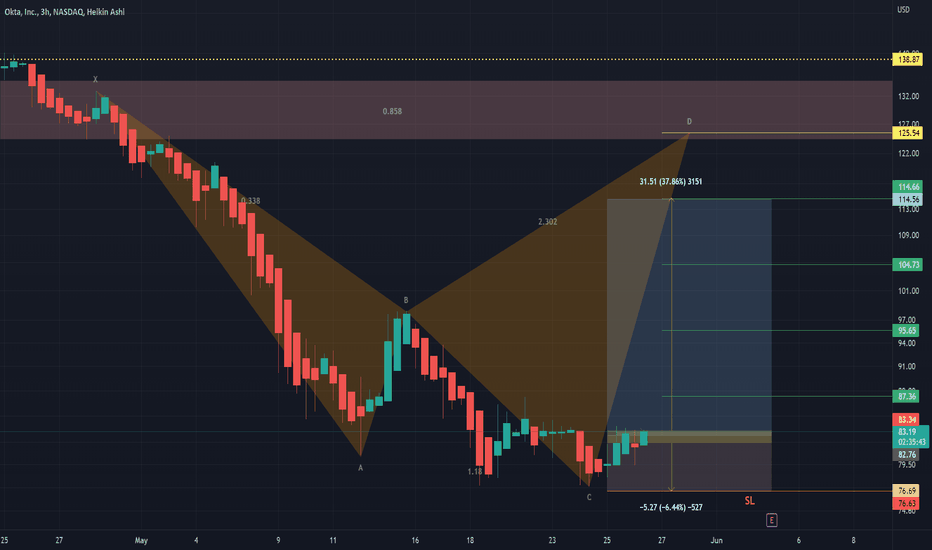

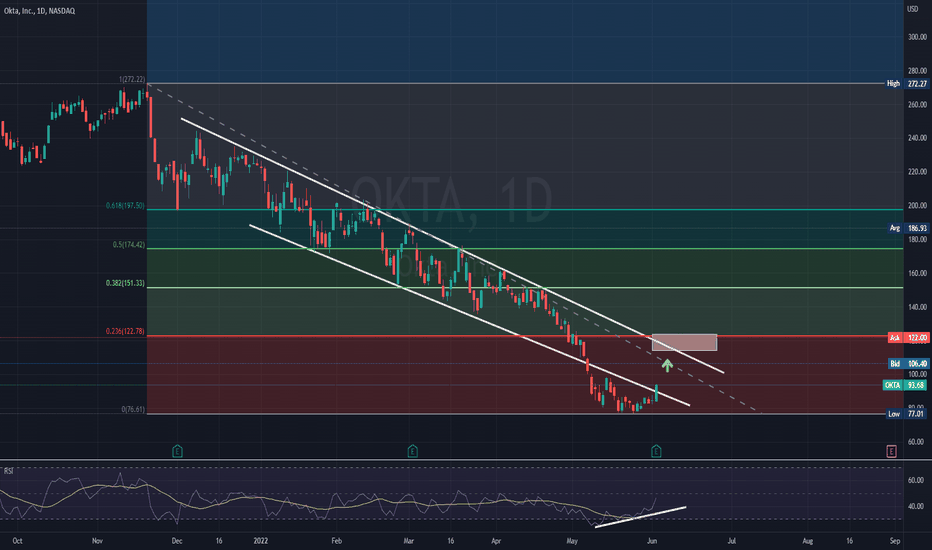

OKTA- BULLISH SCENARIOHuge volatility for OKTA

Yesterday the price closed with almost 11% gain for the session and added 18% more in the after-hours session after the release of the earnings report.

The next major resistance is located between $ 116 and 122. If the breakout of the 2nd resistance is successful the price will be pushed to 0.382 Fibo level or $ 150

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

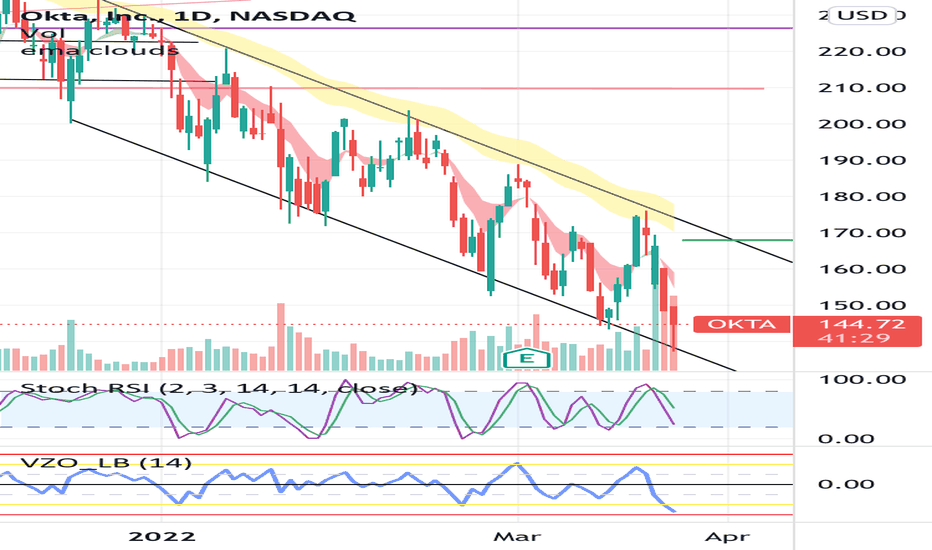

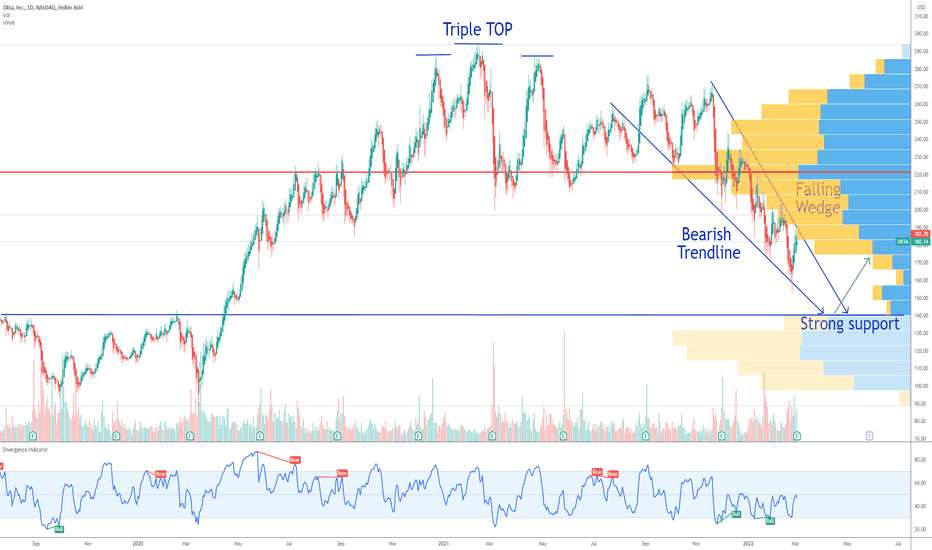

OKTA Falling Wedge and Losses Exceeding ExpectationsOKTA is bearish from both fundamental and technical perspectives.

The falling wedge has a price target of $140 before a bounce and the company said billings rose 91% to $603 million vs. estimates of $497 million.

Since the earnings are negative, 266Mil in 2021 and the Market Cap is high, 28.418Bil, OKTA is still a growth stock from which investors have high expectations.

When investors see weaker forecasts or expenses increase, on rising interest rates, they are tempted to sell.

In this case, my price target is the $140 support.

Looking forward to read your opinion about it.

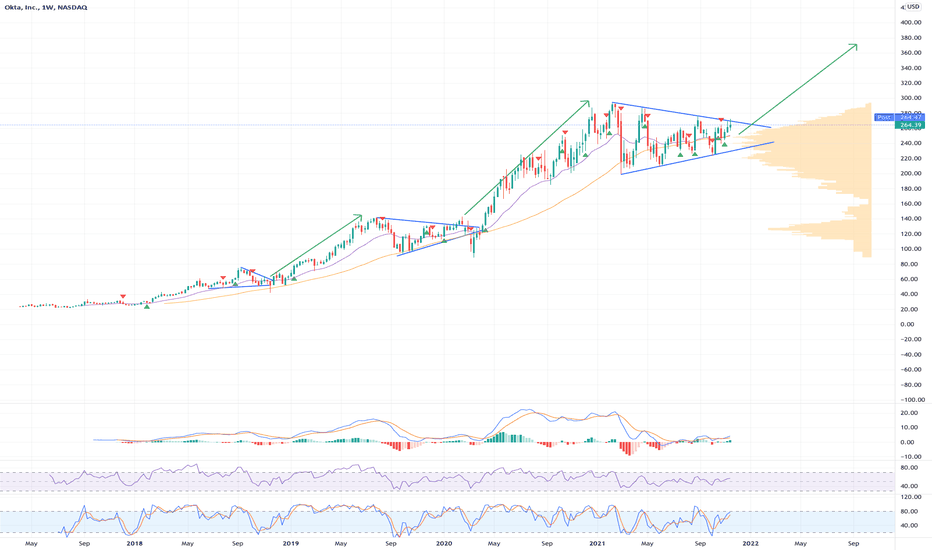

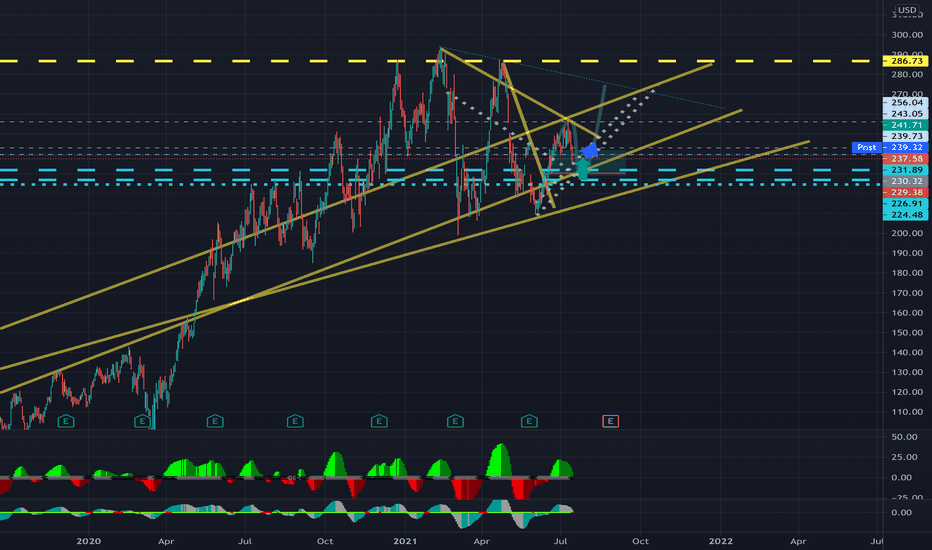

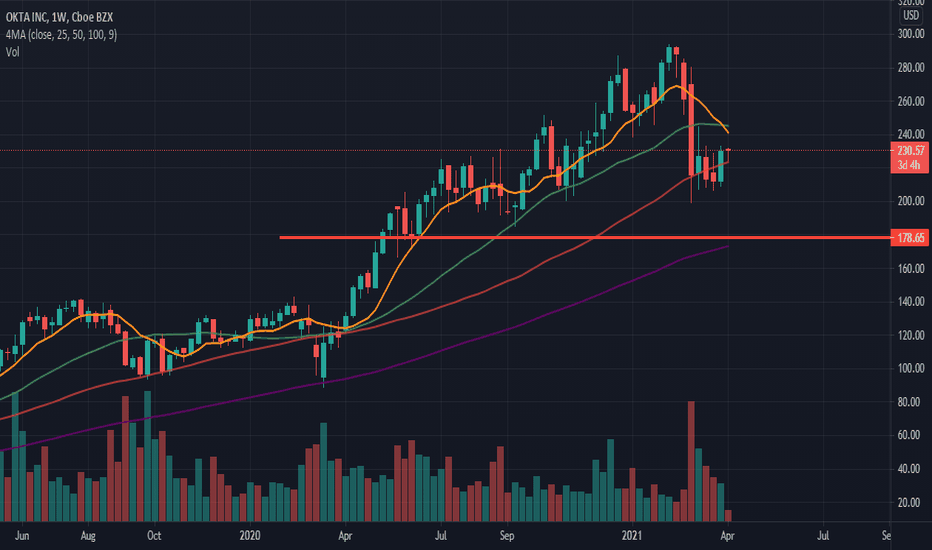

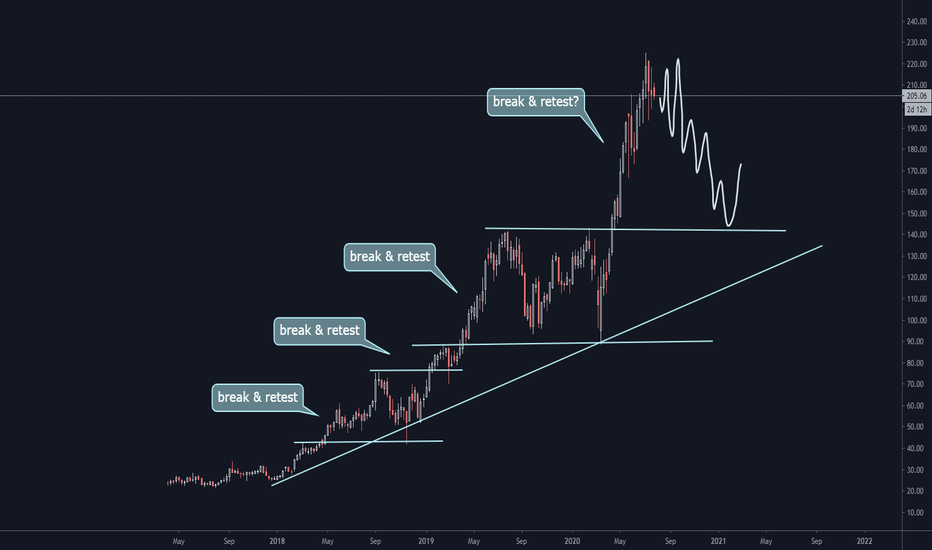

Long $OKTA - Ready for next leg upSince IPO Okta has maintained it's growth and it has done that in phases. Looking at weekly chart it looks promising and consistent in 4 year long uptrend.

In 2021 it has mostly consolidated and absorbed last years growth and gearing up for next phase of growth.

Okta has earnings on Dec 1, be careful about position sizing. Try to avoid earnings volatility.

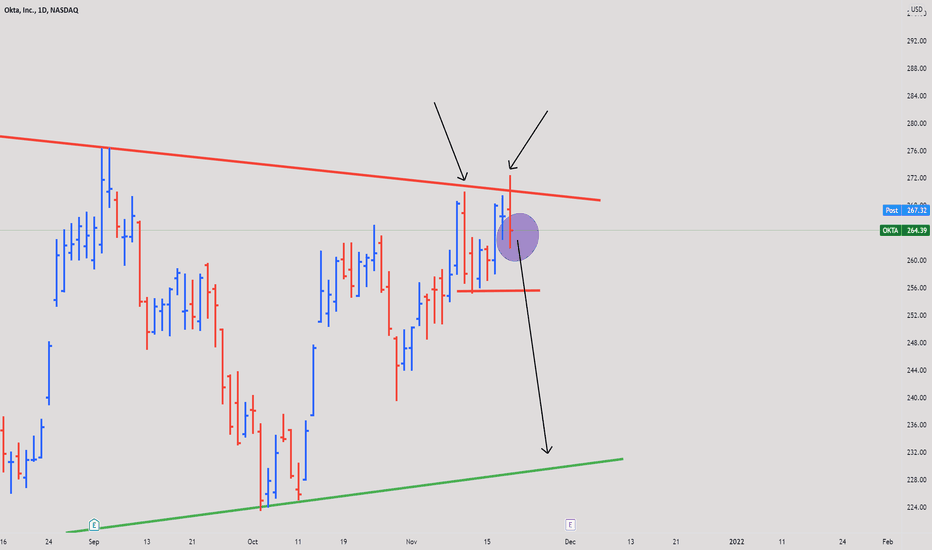

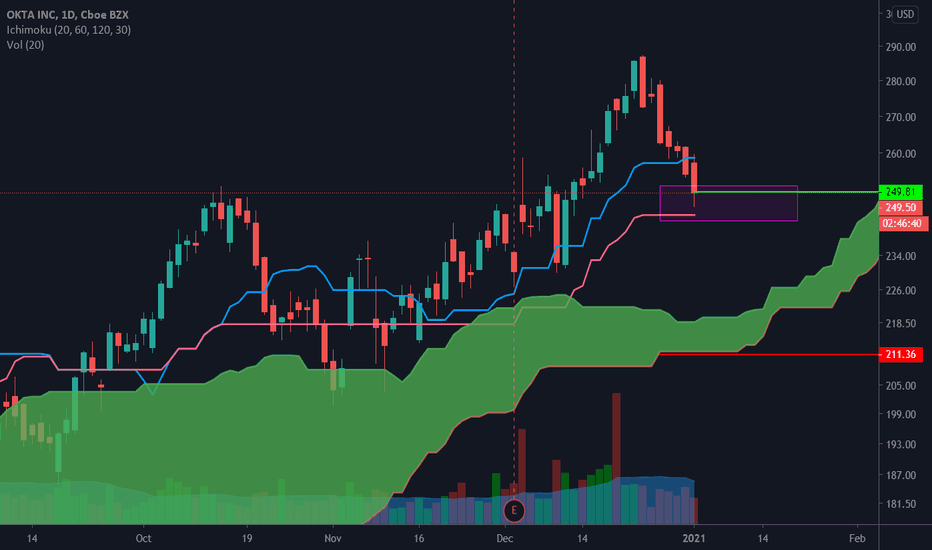

Okta Analysis 18.11.2021Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button.

Thank you for watching and I will see you tomorrow!

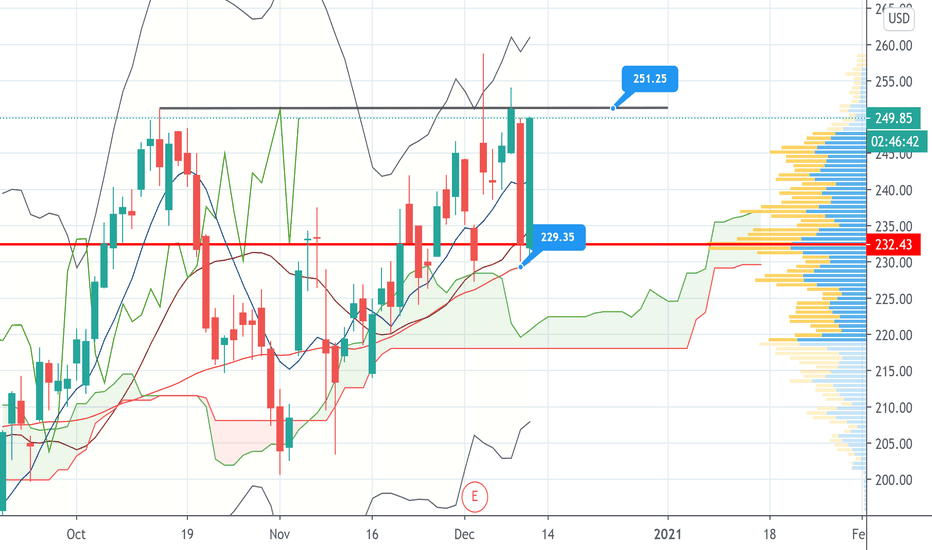

OKTA ANALYSIS 11.08.2021Hello Traders, here is a full analysis for this asset. The entry will be taken only, if all rules of your trading plan are satisfied.

Therefore I suggest you keep this pair on your watchlist and see if all of your rules are satisfied.

Leave your thoughts in the comment section, I will reply to every single one of them.

_____________________________________________________________________________________________________________________________________________________________________

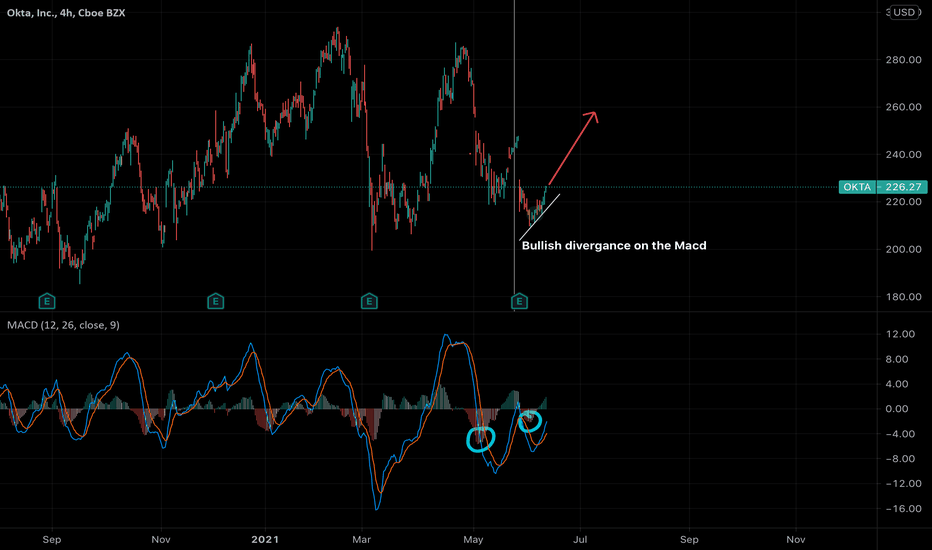

OKTA INTRADAY Scalp off of supportLately coming up with ideas for companies to trade just based on random stuff I have learned through the years .

I published an idea on ABNB and missed my target bounce price .

What I failed to account for in my idea was the supply zone right below - moving forward to this chart I identified the same scenario with OKTA.

Again , I am going verify with tape before taking on this trade but if it holds support and there isn’t heavy selling I expect to run significantly ,

my style is mainly scalping whether it be intraday or swings .

I post these charts so people can add to the idea or verify what I’m seeing .

Im a discretionary trader and most of my entries and exits are based on reading the tape and waiting for a bounce.

I will usually scalp into a position then hold runners if my idea is verified then move onto another similar setup .

Thanks for lookin.

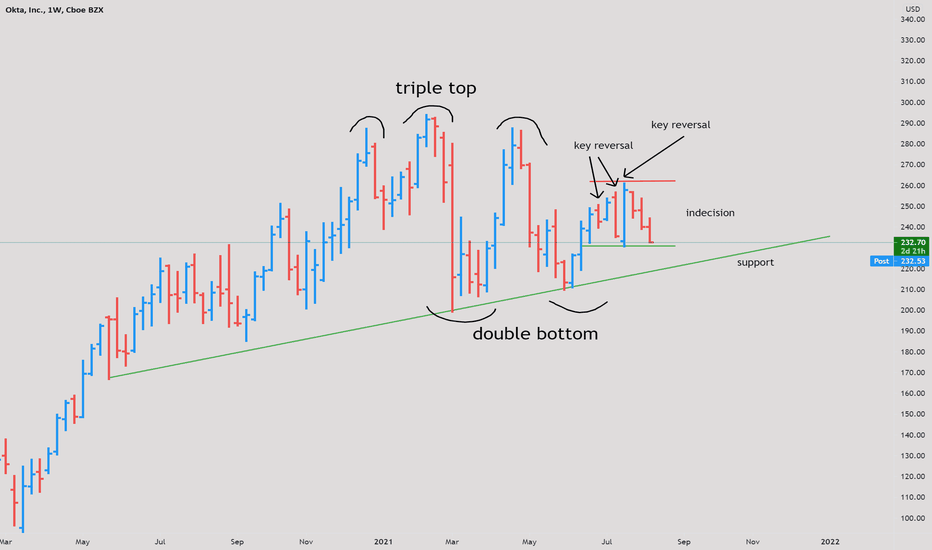

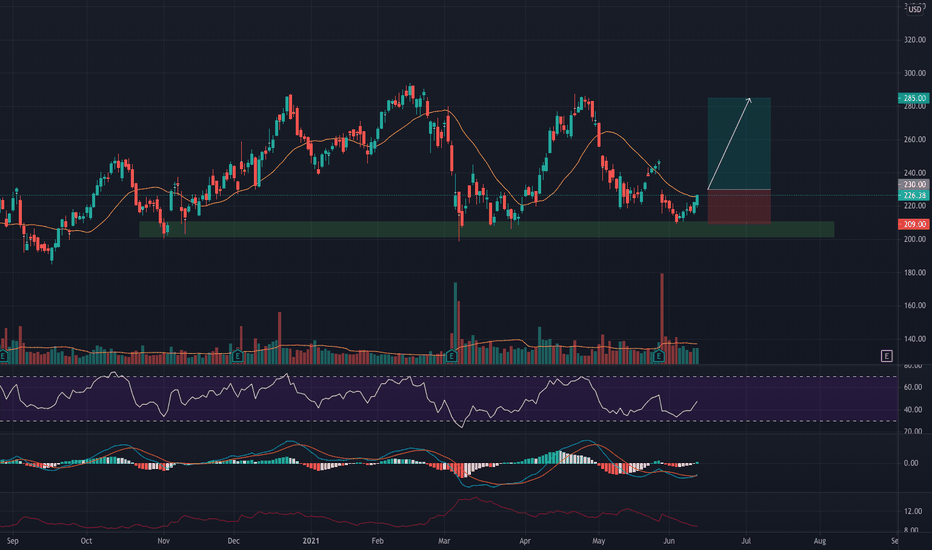

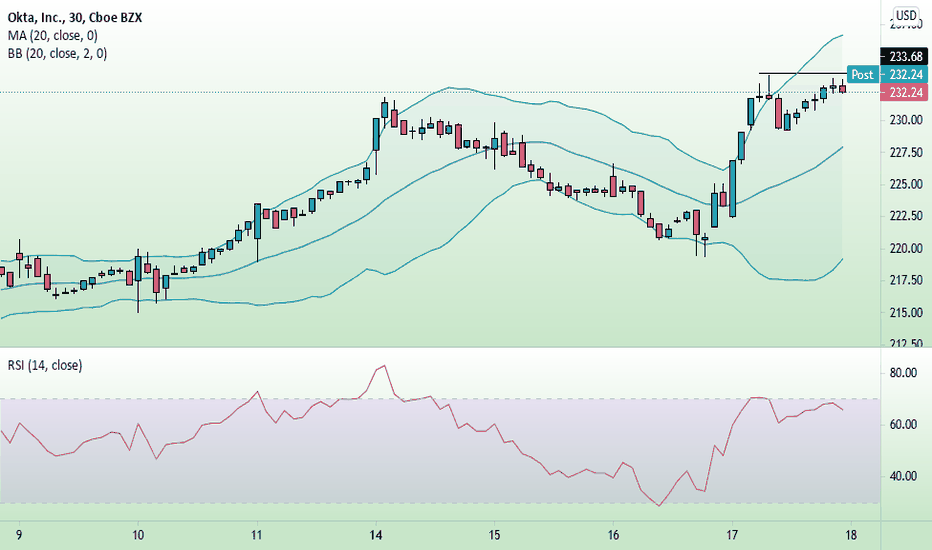

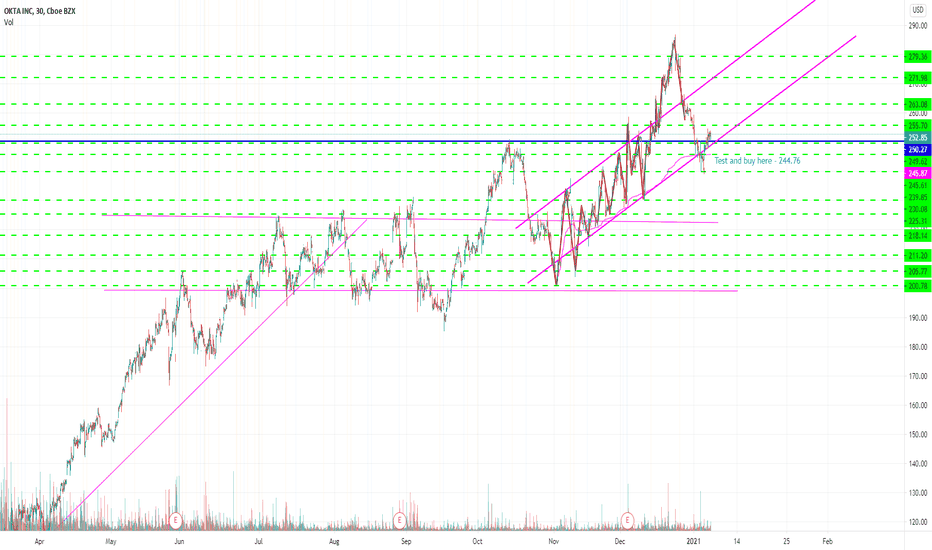

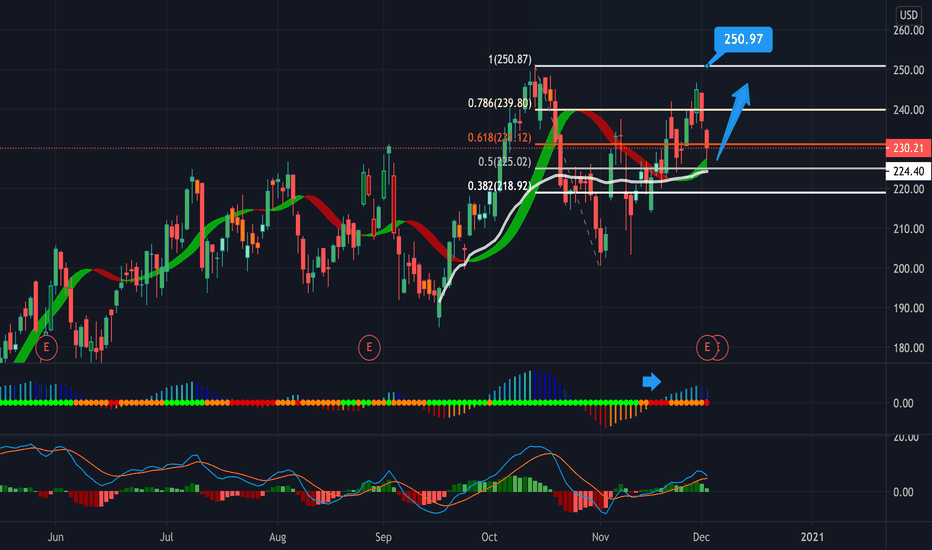

This might work on OKTA! 👍OKTA has a double top in the 30min, and an RSI divergence as well. This indicate weakness, but it is true that OKTA can do something pretty nice, especially if it drops again to the 20ma.

Things could go wrong if it loses the 20ma in the 4h chart. But OKTA ia almost breaking the pivot at 231.81, and this will make it close the gap at 245.

We see no RSI confirmation, but at least, no divergence too. This makes OKTA interesting, but let’s be careful, because it can drop in the 30min chart!

If you liked this trading idea, remember to click on the “Follow” button to get more trading ideas like this, and if you agree with me, click on the “Agree” button 😉.

See you soon,

Melissa.

Okta LONGHi i will be posting more ideas on crypto and stocks so follow, like, comment whatever you like :)

This idea is for #okta

Im longing from here, DCA (Dollar cost average) if you can get in near the orange line even better.

If it goes lower DCA more and hold for long term (I swing trade but this stock is good to hold mid/long term)

One of the stocks fool also recommends for long term.

Entry $220 or now if you dont want to wait (downside potential at current price)

Better Entry to DCA if it hits that price based on weekly timeframe =$180-200 however $210 has shown to be good support

Keep in mind this is a tech stock so use caution because rotations are happening is tech sector has been correcting.

Targets: $245, $290, 330

Long Term Target = +$400

OKTA is being used by plenty of employers and with covid this company became useful for employers and employees! Great tech overall.