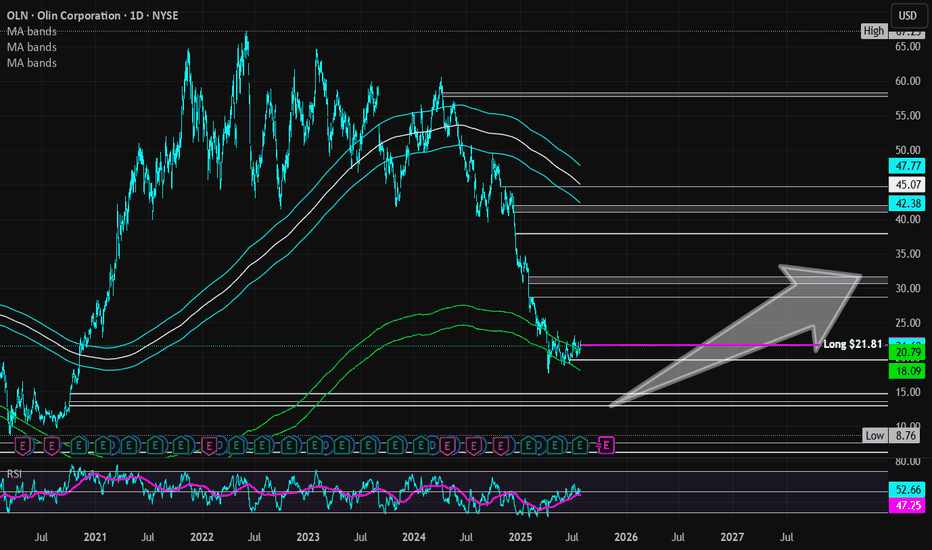

Olin Corporation | OLIN | Long at $21.81Olin Corp NYSE:OLN is currently trading within my "crash" simple moving average area (green lines on the chart). Historically, the price trades within this area for the company, consolidates, and then moves up. After today's earnings, which were relatively positive, the stock may gain some traction and move up. However, I am cautious a media-heightened economic downturn could send NYSE:OLN (a global manufacturer of chemical products and ammunition) to $13 to close the existing price gaps on the daily chart. Regardless, it's a strong company that has been trading on the US stock exchange since the mid-1970s - it's seen rough times before. While 2025 is likely to be a tough year, future earnings projections predict robust earnings growth. Time will tell...

Thus, at $21.81, NYSE:OLN is in a personal buy-zone with noted caution if there is an economic downturn down to $13 a share. The price gap around $19 may also be closed in the near-term.

Targets into 2028:

$28.00 (+28.4%)

$31.50 (+44.4%)

Olnanalysis

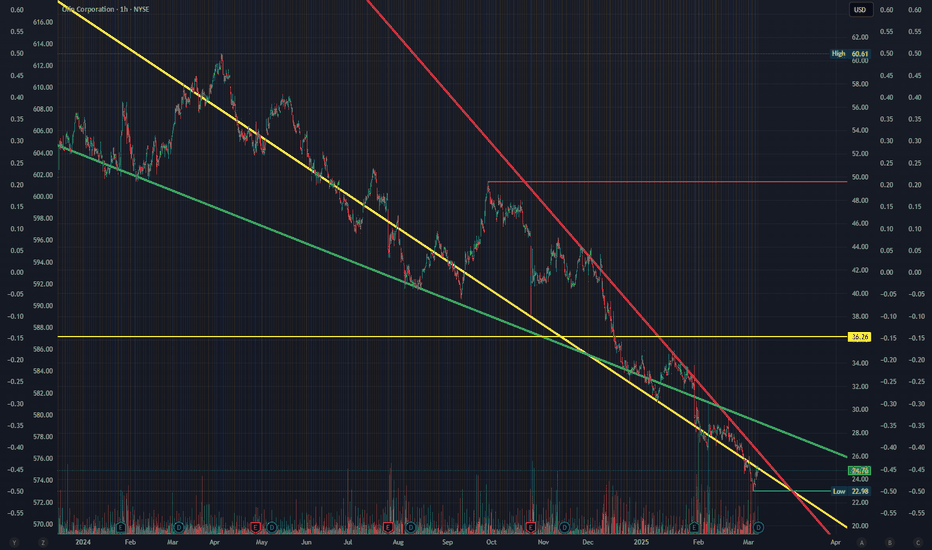

Pre-Market Update: OLNOLIN bounced off of the $22.98 after breaking/retesting Downward Trend Support Levels that have been support since Sept 2024. We are looking for a Top-Level Resistance breakout back to the $28 - $ 30s for a decent 20-30% in the Trade. If not, back to the 50% Retracement around the $36.26 over a longer timeframe if the company can reverse the recent stock pullbacks. Analysts have a $33 Price Target on this as well so potential for a quick breakout play here.