🤖 #BTCLIVE - 27.09 🤖🤖 #BTCLIVE - 27.09 🤖

TLDR:

Short-Term (-1 Day)

500:50- Bullish:Bearish

Mid-Term (1 Week+)

40:60

Bullish:Bearish

Long-Term (1 Month+)

40:60 - Bullish:Bearish

OVERVIEW:

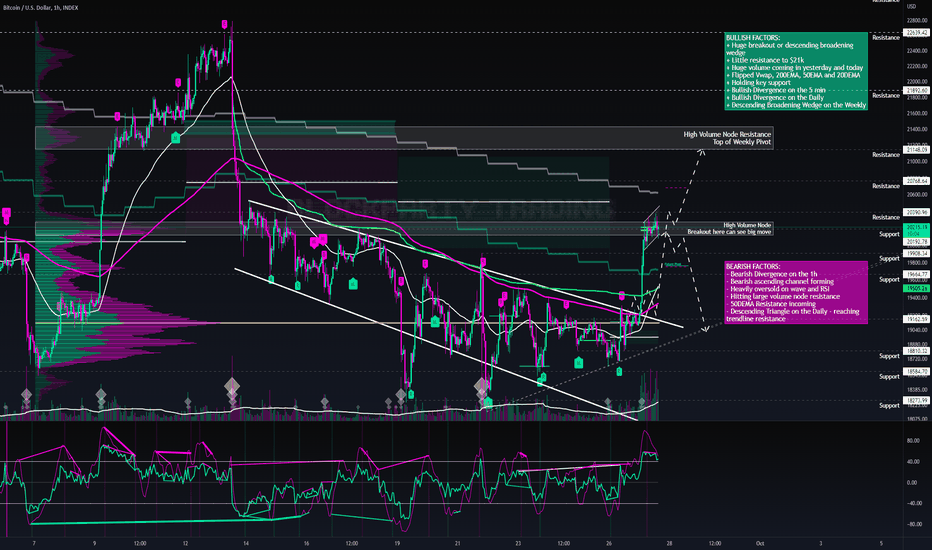

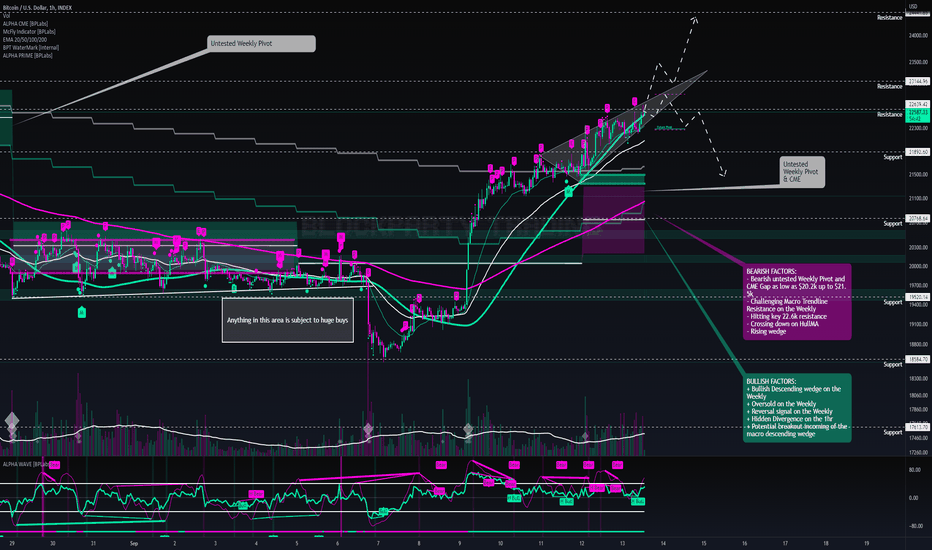

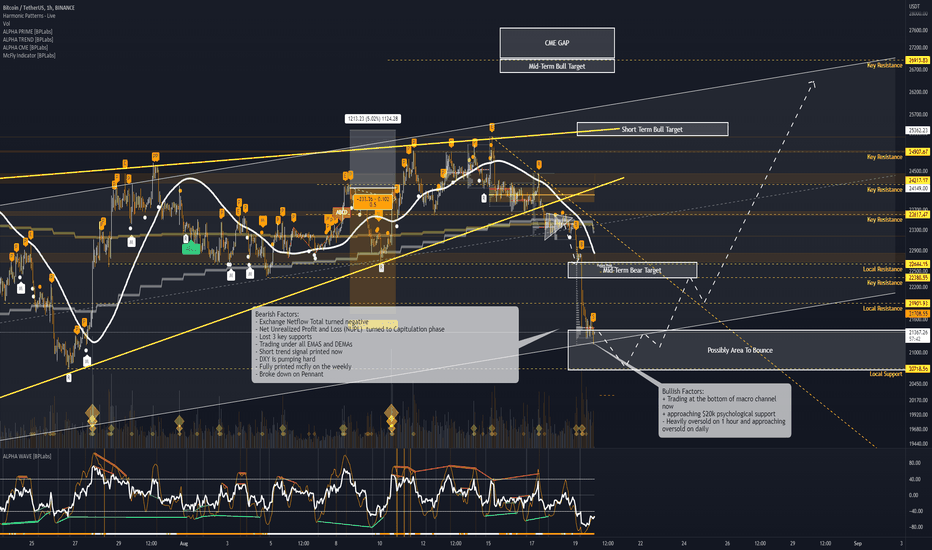

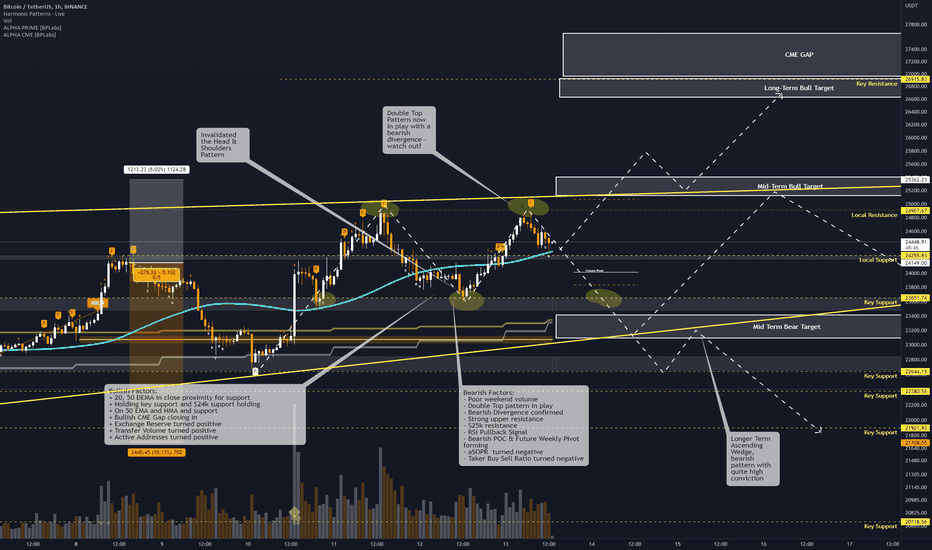

Huge break out last night with Binances biggest every BTC trading volume recorded. This is a big factor as to what it could mean. Ultimately my yesterdays analysis still stands albeit a little bit ahead of time with $21k as the immediate target with a very hard rejection to hit there. Currently hitting some resistance now with a significant volume node in play. We currently have a small ascending channel and bearish divergence on the 1hr although if we can hold then it is a pretty straight shot to $21k which will take us to the top of the weekly pivot and also macro trendline.

I am overall quite bullish in the short term to $21k and with an expected heavy rejection back to $18.7k losing $19.9k will likely see the start of the fall back to $18.7k - we may however sit and consolidate here for day or so. Friday options expiry will bring a huge amount of volatility.

TECHNICAL ANALYSIS:

BULLISH FACTORS:

+ Huge breakout or descending broadening wedge

+ Little resistance to $21k

+ Huge volume coming in yesterday and today

+ Flipped Vwap, 200EMA, 50EMA and 20DEMA

+ Holding key support

+ Bullish Divergence on the 5 min

+ Bullish Divergence on the Daily

+ Descending Broadening Wedge on the Weekly

BEARISH FACTORS:

- Bearish Divergence on the 1h

- Bearish ascending channel forming

- Heavily oversold on wave and RSI

- Hitting large volume node resistance

- 50DEMA Resistance incoming

- Descending Triangle on the Daily - reaching trendline resistance

NEWS:

Bull:

+ Volatile week ahead Bitcoin Futures Expiry

+ Revolut has registered with regulator to offer ₿itcoin and crypto services in the U.K

+ Yesterday saw the biggest day of BTC volume ever on Binance!

+ FTX reportedly wins $50 million bid to acquire assets of bankrupt #crypto lender Voyager Digital.

Bear:

- Volatile week ahead with Powell, Bitcoin Futures Expiry

MARKET SENTIMENT:

Fear & Greed Index - Sep 27, 2022:

Today: 20 (Extreme Fear)

Yesterday: 21 (Extreme Fear)

Avg. 1W: 22 😱

Avg. 2W: 23 😱

Avg. 1M: 24 😱

Avg. 2M: 29 😱

Avg. 3M: 27 😱

Avg. 6M: 23 😱

Avg. 1Y: 32 😣

🔸 #Bitcoin

Price: $19,211

24h Low: $18,709

24h High: $19,275

MC Change: $7.4B (2.0%)

Dominance: 37.7%

24h: 2.3%

7d: -1.8%

14d: -14.0%

30d: -4.3%

60d: -19.4%

200d: -51.3%

1y: -55.7%

Onchain

🤖 #BTCLIVE - 26.09 🤖🤖 #BTCLIVE - 26.09 🤖

TLDR:

Short-Term (-1 Day)

70:30- Bullish:Bearish

Mid-Term (1 Week+)

60:40

Bullish:Bearish

Long-Term (1 Month+)

40:60 - Bullish:Bearish

OVERVIEW:

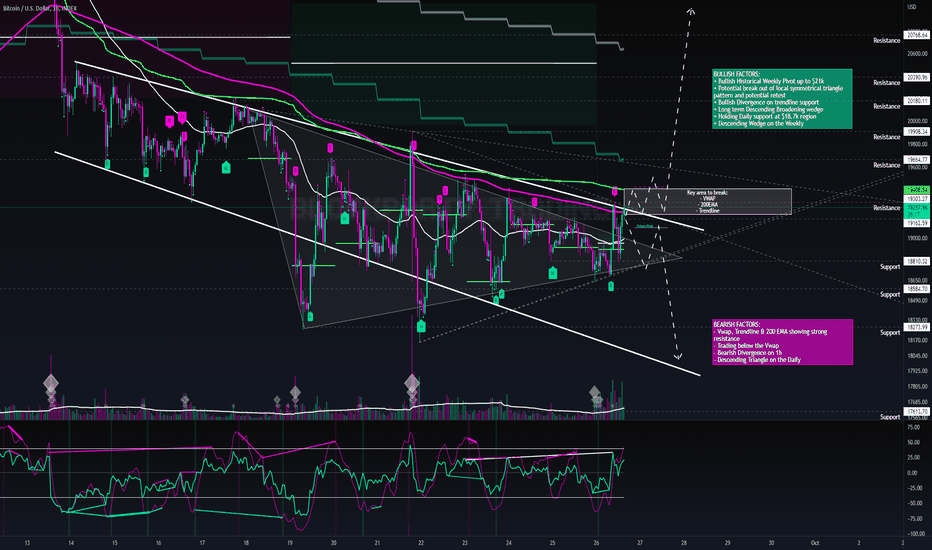

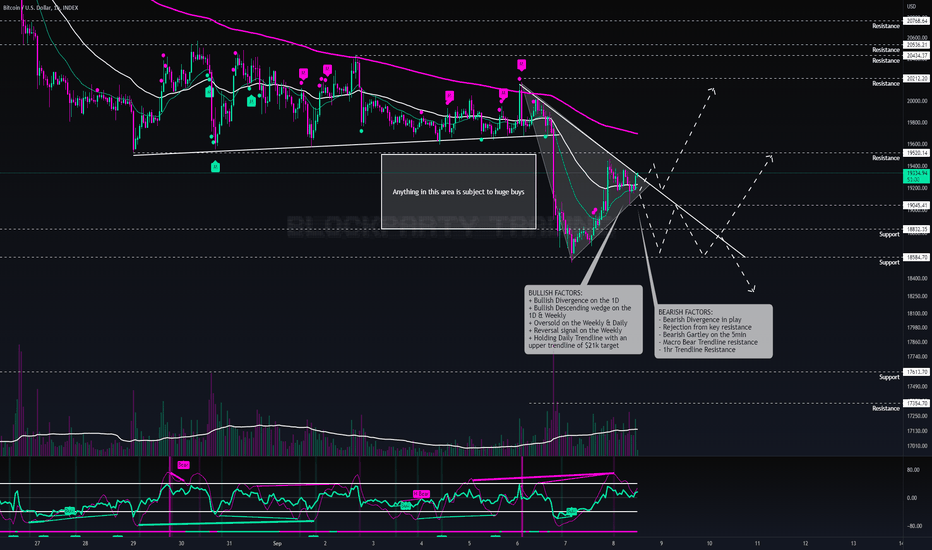

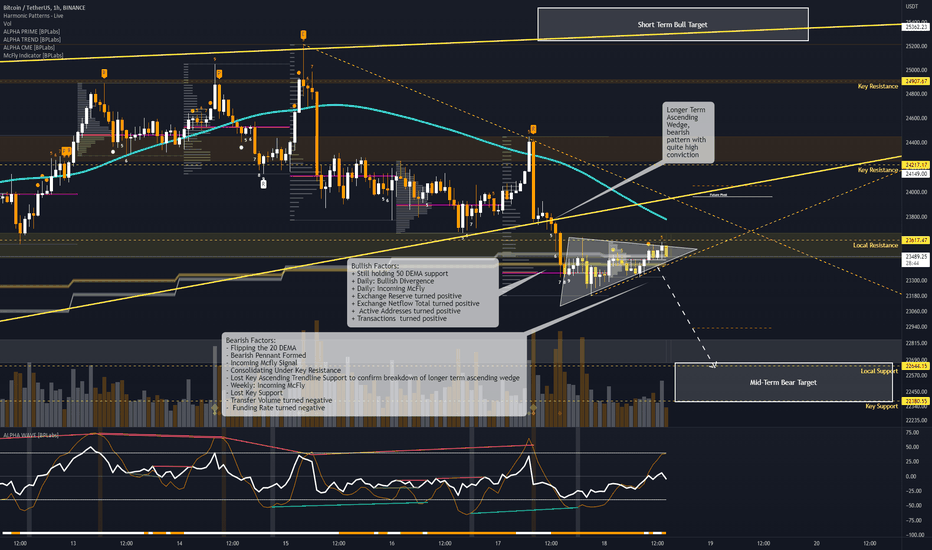

BTC is looking pretty strong short-midterm - with a target of approximately £$21k on the cards - core issue is breaking out of the immediate resistance specifically the 200EMA that has proved to be a significant issue. We are in a descending broadening wedge on the 1h which is a very bullish pattern so a break up is to be expected with a recent break up and retest of a local symmetical triangle it is looking positive. Unfortunately on the longer term timeframe further downside is to be expected as there is the lower trendline on the weekly descending wedge is still likely to be hit at approx. $16k possible a little lower. This route would make sense with the descneding triangle on the daily as we have been holding the 18.7k region for a long time with continual lower highs (quite a bearish pattern especially coming into it from a bearish trend) - this would marry up with the expected weekly descending wedge.

It looks like we have the potential for a bullish week up to $21k depending on what some of the fed comes out with along with the Bitcoin Futures Expiry and then a big rejection at $21k back to the $18.7k region with the possible start of the further downside as a long term lower low feels inevitable. Although once reached the target is to break out of the macro trendline which should put us at approx. $19k at that stage will signify the start of the bull run.

TECHNICAL ANALYSIS:

BULLISH FACTORS:

+ Bullish Historical Weekly Pivot up to $21k

+ Potential break out of local symmetrical triangle pattern and potential retest

+ Bullish Divergence on trendline support

+ Long term Descending Broadening wedge

+ Holding Daily support at $18.7k region

+ Descending Wedge on the Weekly

BEARISH FACTORS:

- Vwap, Trendline & 200 EMA showing strong resistance

- Trading below the Vwap

- Bearish Divergence on 1h

- Descending Triangle on the Daily

NEWS:

Bull:

+ Plan B’s stock-to-flow model predicts Bitcoin price has potential for 5x

+ Volatile week ahead with Powell, Bitcoin Futures Expiry

+ China orders state banks to buy stocks to prevent selling.

+ Disney is hiring an attorney to work on blockchain, metaverse, DeFi, & #NFT products.

Bear:

- Volatile week ahead with Powell, Bitcoin Futures Expiry

- DXY pumping GBP dropping

- Do Kwon arrest warrant issued

MARKET SENTIMENT:

Fear & Greed Index - Sep 26, 2022:

Today: 21 (Extreme Fear)

Yesterday: 24 (Extreme Fear)

Avg. 1W: 22 😱

Avg. 2W: 24 😱

Avg. 1M: 24 😱

Avg. 2M: 29 😱

Avg. 3M: 27 😱

Avg. 6M: 23 😱

Avg. 1Y: 32 😣

🔸 #Bitcoin

Price: $18,787

24h Low: $18,748

24h High: $19,142

MC Change: -$2.9B (-0.8%)

Dominance: 37.4%

24h: -0.8%

7d: -3.3%

14d: -13.6%

30d: -7.3%

60d: -18.0%

200d: -55.3%

1y: -56.2%

🤖 #BTCLIVE - 20.09 🤖🤖 #BTCLIVE - 20.09 🤖

TLDR:

Short-Term (-1 Day)

30:70- Bullish:Bearish

Mid-Term (1 Week+)

65:35

Bullish:Bearish

Long-Term (1 Month+)

70:30 - Bullish:Bearish

OVERVIEW:

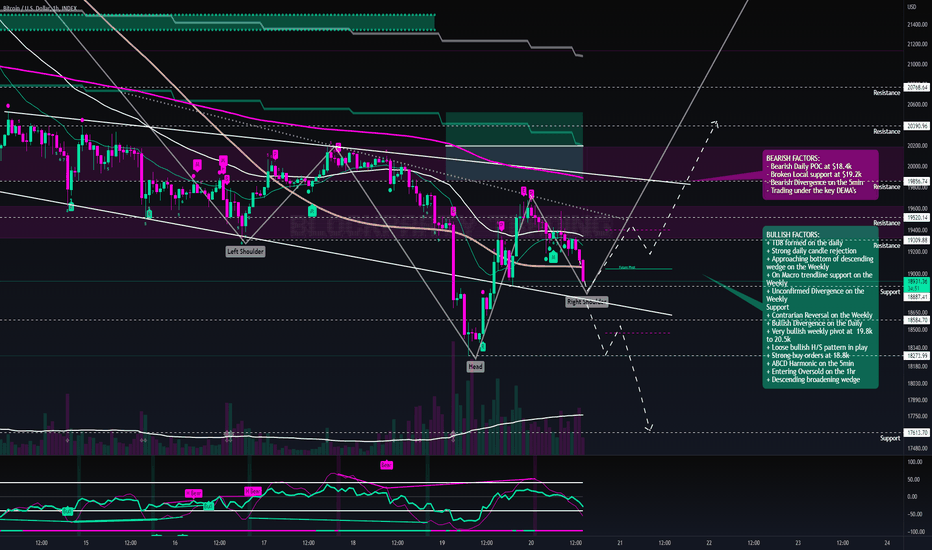

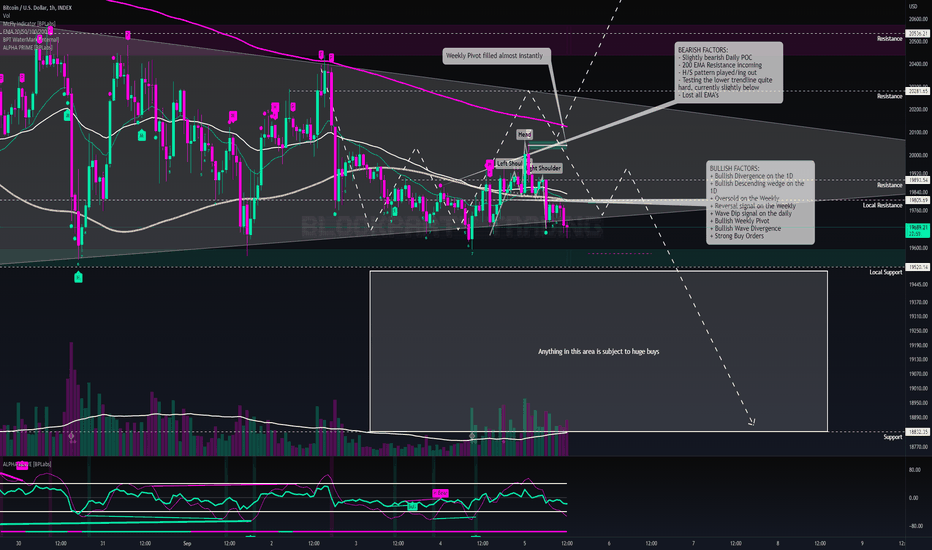

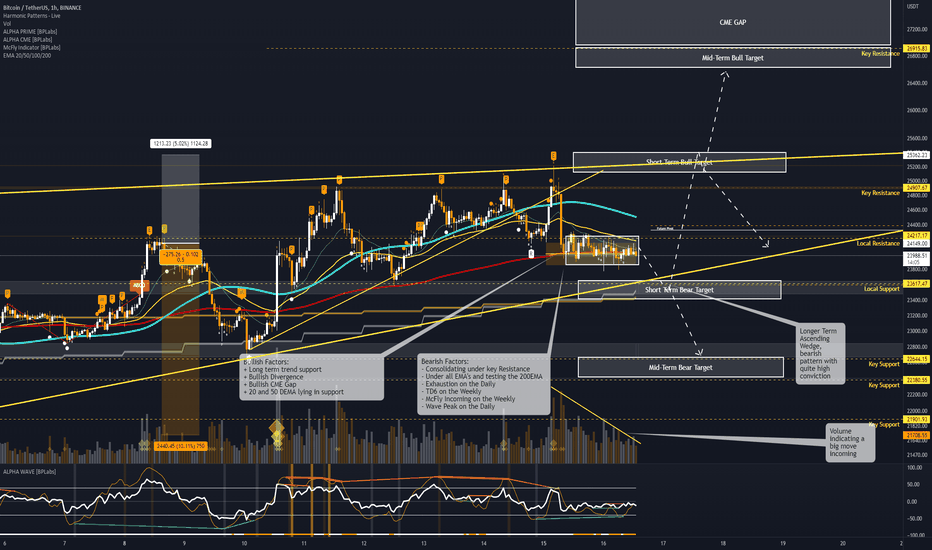

There are a lot of bullish metrics popping up - although the majority of this weeks movement is going to be dictated by the interest rates on Weds. Is it going to be 75 or is it going to be 100. Ultimately 75 would be deemed somewhat bullish. 100 will absolutely sink the market - 50 would send it potentially to the moon although that is EXTREMELY unlikely, so don't get your hopes up.

From a completely TA point of view there is quite a lot of the bullish sentiment gearing up for quite a big pump - this coupled with a high expectation of 82% 75 would suggest that a bullish close to the week is on the cards. Expecting a slight bearish close to the day leading into tomorrow with approx target of 18.7k where we could potentially see it hold and consolidate (most likely) and bounce from there to approx. $19.8 (The bottom of the weekly pivot) We are back below the 200EMA which has been a significant resistance although I do have a fair bit of conviction in the Inverse H/S.

Losing the support at $18.7k could see a bit of a free fall to $18.2k and depending on the bearish volume taking out the support and buys then on to $17.6k although I think this will indicate some potential inside information about the interest rates being leaked. There fore shorting would not be bad idea up on losing $18.7k.

TECHNICAL ANALYSIS:

BULLISH FACTORS:

+ TD8 formed on the daily

+ Strong daily candle rejection

+ Approaching bottom of descending wedge on the Weekly

+ On Macro trendline support on the Weekly

+ Unconfirmed Divergence on the Weekly

Support

+ Contrarian Reversal on the Weekly

+ Bullish Divergence on the Daily

+ Very bullish weekly pivot at 19.8k to 20.5k

+ Loose bullish H/S pattern in play

+ Strong buy orders at 18.8k

+ ABCD Harmonic on the 5min

+ Entering Oversold on the 1hr

+ Currently holding the future pivot support

+ Descending broadening wedge

BEARISH FACTORS:

- Bearish Daily POC at $18.4k

- Broken Local support at $19.2k

- Bearish Divergence on the 5min

- Trading under the key DEMA's

NEWS:

Bull:

+ 75 BPS expected for Wednesday announcement which is not positive but "relatively" good for BTC

+ NASDAQ announced plans for a for bitcoin custody

+ Ripple Says XRP Owners Have no Rights or Contract So Token is Not A Security

cryptopanic.com

+ #Binance has been granted a Minimal Viable Product license in Dubai.

+ CFTC commissioner visits Ripple offices as decision in SEC case looms

cryptopanic.com

Bear:

- MicroStrategy has purchased an additional 301 #Bitcoin ($5.7 million). (Always causes market to dump)

- Wintermute Loses $160M in Latest DeFi Hack

cryptopanic.com

- The Search For Do Kwon Intensifies As South Korean Prosecutors Ask Interpol To Issue Red Notice Against The Terraform Labs

- SEC claims all Ethereum transactions fall under US jurisdiction because the nodes are "clustered more de… t.co

- Indian crypto exchange CoinDCX's Twitter account has been hacked to post $XRP scam links.

- Crypto promoter Ian Balina labels SEC charge ‘frivolous’, turns down settlement

cryptopanic.com

MARKET SENTIMENT:

Fear & Greed Index - Sep 20, 2022:

Today: 23 (Extreme Fear)

Yesterday: 21 (Extreme Fear)

Avg. 1W: 24 😱

Avg. 2W: 25 😱

Avg. 1M: 25 😱

Avg. 2M: 30 😱

Avg. 3M: 26 😱

Avg. 6M: 24 😱

Avg. 1Y: 32 😣

🔸 #Bitcoin

Price: $19,549

24h Low: $18,421

24h High: $19,612

MC Change: $1.9B (0.5%)

Dominance: 38.0%

24h: 0.6%

7d: -10.1%

14d: -2.2%

30d: -6.7%

60d: -16.1%

200d: -55.6%

1y: -59.5%

🤖 #BTCLIVE - 14.09 🤖🤖 #BTCLIVE - 14.09 🤖

TLDR:

Short-Term (-1 Day)

55:45- Bullish:Bearish

Mid-Term (1 Week+)

30:70

Bullish:Bearish

Long-Term (1 Month+)

70:30 - Bullish:Bearish

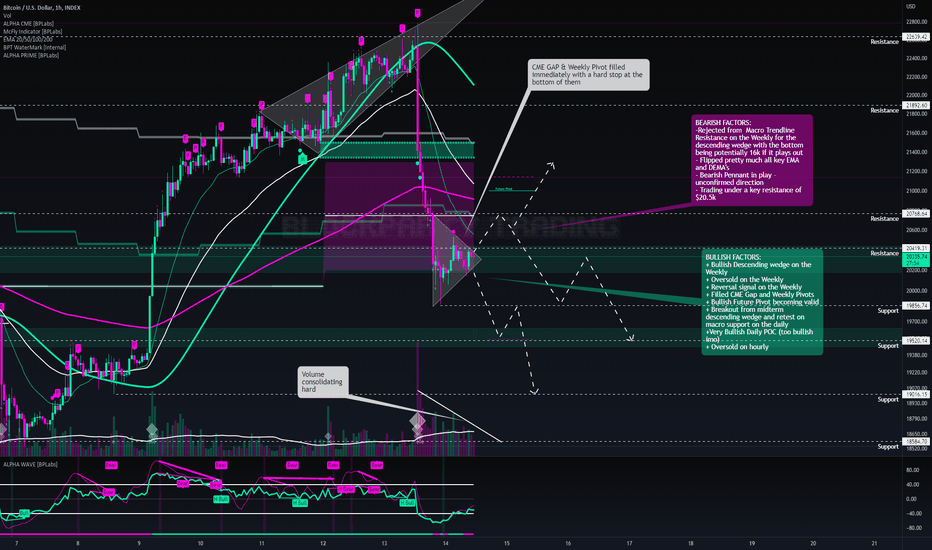

OVERVIEW:

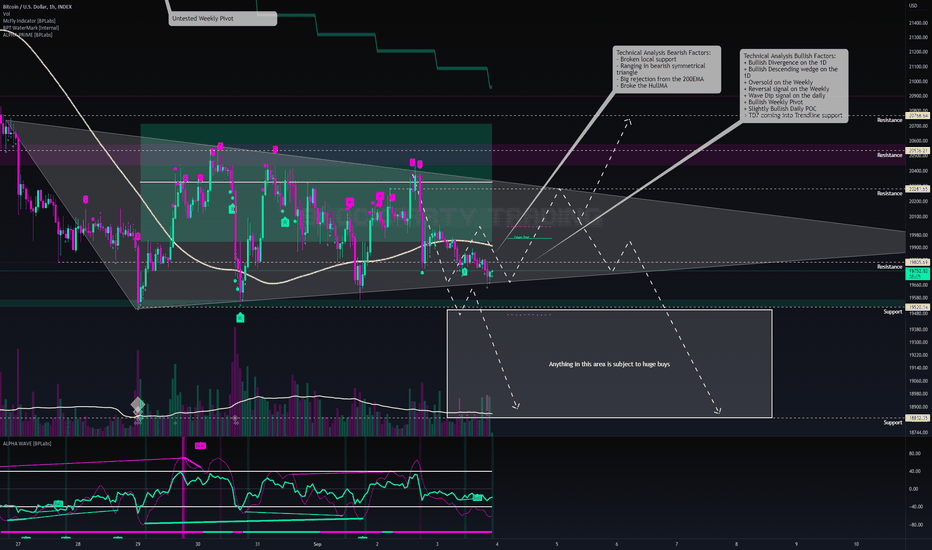

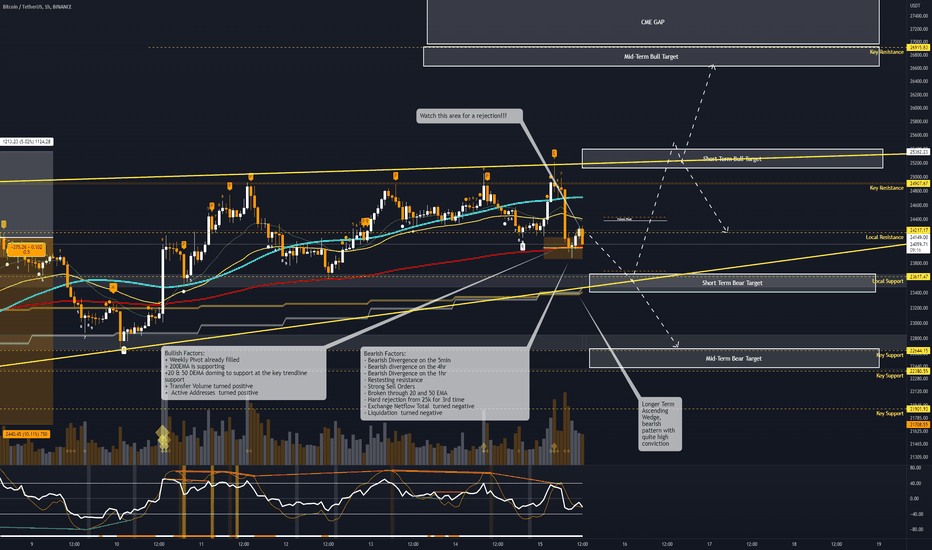

We told you...respsect the Weekly Pivots and CME Gaps. They got filled - and price came to a sudden support, this is not a coincidence. Although now we are here it looks like there is going to be consolidation until the announcements begin from the fed kicking off at 1.30pm UK time. This will likely give a directional bias to the market and coming out of this bearish pennant. We might see some relief bounce here if it is neutral to bullish i.e below 75 BPS. There is a case that even if 75 does come in that this may already be dialled in and expected so a resulting pump could occur anything higher then we can expect further dumpage. On a macro level a rejection here can put us on a trajectory to $16k region now to play out this descending wedge on the weekly.

The bullish scenario is sub 75 BPS and breaking up on the bearish pennant to $20.8k where will hit first resistance and then a push up or major rejection here - either to 21.2k region or heavily down to sub 20k.

The bearish scenario will be a little more brutal if the BPS comes out bad - and will be a likely free fall again to 19.5k region with potential dead cat bounce and then further drop to 19k.

TECHNICAL ANALYSIS:

BULLISH FACTORS:

+ Bullish Descending wedge on the Weekly

+ Oversold on the Weekly

+ Reversal signal on the Weekly

+ Filled CME Gap and Weekly Pivots

+ Bullish Future Pivot becoming valid

+ Breakout from midterm descending wedge and retest on macro support on the daily

+Very Bullish Daily POC (too bullish imo)

+ Oversold on hourly

BEARISH FACTORS:

-Rejected from Macro Trendline Resistance on the Weekly for the descending wedge with the bottom being potentially 16k if it plays out

- Flipped pretty much all key EMA and DEMA's

- Bearish Pennant in play - unconfirmed direction

- Trading under a key resistance of $20.5k

NEWS:

Bull:

+ Russian international crypto payment to begin 2023

+ #Bitcoin hash rate reaches new high AGAIN!

+ Investment giants’ Fidelity, Charles Schwab and Citadel crypto exchange goes live

cryptopanic.com

+ Bahrain central bank set to test Bitcoin payment processing solution

cryptopanic.com

Bear:

- PPI m/m (Expected to affect market)

- Core PPI m/m

- CFTC Chair Behnam Speaks (Likely to be mentions of Crypto)

- Sept 15: $ETH merge expected sell off

- Sept 16: Mt. Gox Claims Deadline

- Sept 21: FOMC rate hike decision

- #Bitcoin mining difficulty reaches 32.05 trillion, a new all time high.

- Odds of 100bps interest rate hike hits 48%.

- President Biden says "it’ll take more time and resolve to bring inflation down."

MARKET SENTIMENT:

Fear & Greed Index - Sep 14, 2022:

Today: 27 (Fear)

Yesterday: 34 (Fear)

Avg. 1W: 26 😱

Avg. 2W: 24 😱

Avg. 1M: 27 😱

Avg. 2M: 30 😱

Avg. 3M: 25 😱

Avg. 6M: 24 😱

Avg. 1Y: 32 😣

🔸 #Bitcoin

Price: $20,171

24h Low: $20,071

24h High: $22,654

MC Change: -$40.9B (-9.6%)

Dominance: 37.5%

24h: -9.7%

7d: 1.9%

14d: -0.7%

30d: -17.4%

60d: -2.0%

200d: -47.4%

1y: -56.3%

🤖 #BTCLIVE - 13.09 🤖🤖 #BTCLIVE - 13.09 🤖

TLDR:

Short-Term (-1 Day)

50:50- Bullish:Bearish

Mid-Term (1 Week+)

35:65

Bullish:Bearish

Long-Term (1 Month+)

90:10 - Bullish:Bearish

OVERVIEW:

Bitcoin showing strength although some big bear flags showing up with the ascending wedge, bearish weekly pivot and CME gap that have a high chance always of getting filled usually in the short term too. Additionally we are coming up to the Macro trendline resistance on the weekly which is going to be a huge marker if we breakout as it has been in place since November 2021. It is a likely a very large amount of volume is going to require to break out. This is possible depending on the CPI data that drops which is potential assumed to be bullish. This could help break out - although there is a lot of bearish factors weighing against it for at least a small retrace.

Losing $22.2k would likely see a continuation down to the CME gap and weekly pivot regions with a top of $21.5k and a painful scenario at $20.2k. A bullish scenario would need to breakout above $23k for a good confirmation then it can pump as high as $25k.

HOWEVER with all the news that is coming out this month with the merge, MT.Gox and multiple items in the economic calendar volatility is going to be high

TECHNICAL ANALYSIS:

BULLISH FACTORS:

+ Bullish Descending wedge on the Weekly

+ Oversold on the Weekly

+ Reversal signal on the Weekly

+ Hidden Divergence on the 1hr

+ Potential breakout incoming of the macro descending wedge

BEARISH FACTORS:

- Bearish untested Weekly Pivot and CME Gap as low as $20.2k up to $21.5k

- Challenging Macro Trendline Resistance on the Weekly

- Hitting key 22.6k resistance

- Crossing down on HullMA

- Rising wedge

NEWS:

Bull:

+ CPI data expected to be slightly positive

+ Fidelity rumoured to be shifting their retail customers in to Crypto soon

+ Russia's Prime Minister asks regulators to finalize regulations for cross-border #crypto payments.

+ Chamber Of Digital Commerce Calls Out The SEC, Argues The US Needs A Bitcoin ETF

cryptopanic.com

+ Google Adds Ethereum (ETH) Merge Countdown Feature as Worldwide Interest Skyrockets

cryptopanic.com

Bear:

- Sept 13: CPI data

- Sept 15: $ETH merge expected sell off

- Sept 16: Mt. Gox Claims Deadline

- Sept 21: FOMC rate hike decision

- Sept 22: $ADA Vasil Hardfork

- New White House Report Suggests A Ban On Bitcoin Mining In The U.S.

cryptopanic.com

MARKET SENTIMENT:

Fear & Greed Index - Sep 13, 2022:

Today: 34 (Fear)

Yesterday: 25 (Extreme Fear)

Avg. 1W: 26 😱

Avg. 2W: 24 😱

Avg. 1M: 27 😱

Avg. 2M: 30 😱

Avg. 3M: 25 😱

Avg. 6M: 24 😱

Avg. 1Y: 32 😣

🔸 #Bitcoin

Price: $22,336

24h Low: $21,578

24h High: $22,448

MC Change: $11.4B (2.7%)

Dominance: 38.5%

24h: 2.7%

7d: 11.8%

14d: 13.6%

30d: -8.5%

60d: 10.4%

200d: -40.2%

1y: -50.6%

🤖 #BTCLIVE - 08.09 🤖🤖 #BTCLIVE - 08.09 🤖

TLDR:

Short-Term (-1 Day)

30:70- Bullish:Bearish

Mid-Term (1 Week+)

40:60

Bullish:Bearish

Long-Term (1 Month+)

90:10 - Bullish:Bearish

OVERVIEW:

After a massive breakdown of market structure we have finally made the suggested $18.8k potential bottom. Things are not looking particularly bullish though and with Jerome Powells talking in the coming hours the market really could go anywhere. Likelihood is that it will go down a little further as we are slightly more bearish on the technical analysis side of things with a potential descending triangle forming if we break down on this pennant structure (which is technically bullish on the short term timeframe) although with bearish divergences and general bearish sentiment I am not holding much hope for it.

If we break down out of this pennant and below $19k then I would have a conservative stop at $18.5k to find support with a bounce there. Breaking up and retesting the support trendline/$19k could see a break up to and retest of $20k quite quickly. Incredibly volatile at the moment so watch out with trades.

TECHNICAL ANALYSIS:

BULLISH FACTORS:

+ Bullish Divergence on the 1D

+ Bullish Descending wedge on the 1D & Weekly

+ Oversold on the Weekly & Daily

+ Reversal signal on the Weekly

+ Holding Daily Trendline with an upper trendline of $21k target

BEARISH FACTORS:

- Bearish Divergence in play

- Rejection from key resistance

- Bearish Gartley on the 5min

- Macro Bear Trendline resistance

- 1hr Trendline Resistance

NEWS:

Bull:

+ Russian Central Bank & Finance Ministry agree to legalize cryptocurrency use for cross-border payments

+ Saudi Arabia's central bank has appointed cryptocurrency chief to advance digital goals.

+ Iran is now licensing #Bitcoin miners under new regulatory framework.

+ The ETH merge has begun, deposits and withdrawals being held

+ Switzerland’s SEBA Bank Launches Ethereum Staking Services for Institutional Clients

Bear:

- POWELL IS SPEAKING TODAY!

- Sept 13: CPI data

- Sept 15: $ETH merge expected sell off

- Sept 16: Mt. Gox Claims Deadline

- Sept 21: FOMC rate hike decision

- Sept 22: $ADA Vasil Hardfork

- Voyager To Liquidate Assets at Auction cryptopanic.com

- Coinbase, FTX, Binance and other exchanges fall under SEC jurisdiction, says SEC Chair

- IMF Executives Call for Global Crypto Regulatory Regime To Keep Consumers Safe

MARKET SENTIMENT:

Fear & Greed Index - Sep 08, 2022:

Today: 20 (Extreme Fear)

Yesterday: 24 (Extreme Fear)

Avg. 1W: 22 😱

Avg. 2W: 24 😱

Avg. 1M: 30 😱

Avg. 2M: 29 😱

Avg. 3M: 24 😱

Avg. 6M: 24 😱

Avg. 1Y: 33 😣

🔸 #Bitcoin

Price: $19,281

24h Low: $18,644

24h High: $19,479

MC Change: $8.1B (2.3%)

Dominance: 36.1%

24h: 2.3%

7d: -2.6%

14d: -10.6%

30d: -16.9%

60d: -11.8%

200d: -51.9%

1y: -63.4%

🤖 #BTCLIVE - 05.09 🤖🤖 #BTCLIVE - 05.09 🤖

TLDR:

Short-Term (-1 Day)

60:40- Bullish:Bearish

Mid-Term (1 Week+)

30:70

Bullish:Bearish

Long-Term (1 Month+)

80:20 - Bullish:Bearish

OVERVIEW:

We are holding on for dear life to this lower trendline and some local supports, the key support is still looking at $19.5k to hold there are some decent buy orders in play protecting this for now. With the US Markets closed today it could allow for a bit of relief away from the usual sell off when there is a bearish sentiment leading into it. From a macro perstpective things are looking pretty good although with some midterm bearish movement factored in. IF we can hold this support and get back above $19.8k then it should give a very good signal of continued movement to the $20.2k region. Losing $19.5k puts us firmly on track to $18.8k. We ideally also need the dollar to start losing some strength too to help some investment come into BTC

There is some pretty inspiring news from Russia and Iran and additionally Saudi Arabia bringing in a Crypto arm to the back - this is good news but probably won't see any effect from it for a while.

Thursday could bring absolutely anything with Powell speaking again so watch out.

TECHNICAL ANALYSIS:

BULLISH FACTORS:

+ Bullish Divergence on the 1D

+ Bullish Descending wedge on the 1D

+ Oversold on the Weekly

+ Reversal signal on the Weekly

+ Wave Dip signal on the daily

+ Bullish Weekly Pivot

+ Bullish Wave Divergence

+ Strong Buy Orders

BEARISH FACTORS:

- Slightly bearish Daily POC

- 200 EMA Resistance incoming

- H/S pattern played/ing out

- Testing the lower trendline quite hard, currently slightly below

- Lost all EMA's

NEWS:

Bull:

+ Russian Central Bank & Finance Ministry agree to legalize cryptocurrency use for cross-border payments

+ Nigerian Govt considering a 'special economic zone' for cryptocurrency businesses.

+ Saudi Arabia's central bank has appointed cryptocurrency chief to advance digital goals.

+ Iran is now licensing #Bitcoin miners under new regulatory framework.

Bear:

- Sept 13: CPI data

- Sept 15: $ETH merge expected sell off

- Sept 16: Mt. Gox Claims Deadline

- Sept 21: FOMC rate hike decision

- Sept 22: $ADA Vasil Hardfork

- stocks.apple.com

Russia cuts off gas exports to Europe via Nord Stream indefinitely

- Powell to talk on Thursday

- 🇺🇸 US Dollar Index hits 20-year high of 110.25

METRICS (Last 24 hours):

EXCHANGE:

- Exchange Reserve - As the exchange reserve continues to rise, it indicates higher selling pressure.

Last Value:

2,322,706.6

24H%:

0%

7D%:

+1%

+ Exchange Netflow Total - Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

Last Value:

1,423.02

24H%:

+176%

MINERS:

+ TURNED POSITIVE

+ Miners' Position Index ( MPI ) - Miners' are selling less holdings compared to its one-year average.

Holding

Last Value:

-1.0397

24H%:

+11%

/ TURNED NEUTRAL

/ Puell Multiple - Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.56831915

24H%:

+14%

ON-CHAIN:

- TURNED NEGATIVE

- aSOPR -More investors are selling at a profit. In the middle of a bull market, it can indicate a market top.

Realizing profit

Last Value:

1.0029

24H%:

+1%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0.42857142

24H%:

-

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Captulation

Last Value:

-0.09330793

24H%:

+4%

+ TURNED POSITIVE

+ Transfer Volume - The total number of coins transferred has increased by 148.00% compared to yesterday.

Last Value:

3,061,086.78

24H%:

+148%

+ TURNED POSITIVE

+ Active Addresses - The total number of active wallets used to send and receive coins has increased by 138.00% compared to yesterday.

Last Value:

1,137,186

24H%:

+138%

+ Transactions - The total number of transactions has decreased by -39.00% compared to yesterday.

Last Value:

214,340

24H%:

+110%

INVESTOR SENTIMENT

- TURNED NEGATIVE

Coinbase Premium - US investors' buying pressure is relatively weak in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

- TURNED NEGATIVE -

- Funding Rate - Short position traders are dominant and are willing to pay long traders.

Last Value:

-0.00607986

24H%:

-28%

- TURNED NEGATIVE

- Taker Buy Sell Ratio - Selling sentiment is dominent in the derivatives market. More sell orders are filled by takers.

Buy:

0.51493069

Sell:

0.48506931

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,820,290,269.98

24H%:

-1%

7D%:

+3%

- Liquidation - 6507028.91 of long positions were liquidated in the last 24 hours.

Long:

6,507,028.9

Short:

4,006,594.45

MARKET SENTIMENT:

Fear & Greed Index - Sep 05, 2022:

Today: 23 (Extreme Fear)

Yesterday: 20 (Extreme Fear)

Avg. 1W: 23 😱

Avg. 2W: 25 😱

Avg. 1M: 31 😣

Avg. 2M: 29 😱

Avg. 3M: 24 😱

Avg. 6M: 24 😱

Avg. 1Y: 33 😣

🔸 #Bitcoin

Price: $19,988

24h Low: $19,649

24h High: $20,021

MC Change: $3.0B (0.8%)

Dominance: 37.2%

24h: 0.8%

7d: -0.4%

14d: -5.6%

30d: -11.9%

60d: -1.0%

200d: -55.2%

1y: -60.0%

🤖 #BTCLIVE - 03.09 🤖🤖 #BTCLIVE - 03.09 🤖

TLDR:

Short-Term (-1 Day)

70:30- Bullish:Bearish

Mid-Term (1 Week+)

40:60

Bullish:Bearish

Long-Term (1 Month+)

80:20 - Bullish:Bearish

TECHNICAL ANALYSIS:

We seem to be holding the bottom of the sym. triangle quite nicely, with a fair few bullish factors lining up. I would be heavily committed to a long to at least $20.2k altough with it being Sunday and the market comign back online in a few hours still these movements can be quite misleading. When the Asian market comes on line it should be quite telling.

The key areas to watch are $19.5k as losing that not only confirms a break down out of the pattern but a break of a very key support and further downside is expected in the short term to potentially $18.8k although holding should comfortably see $20.2k although I am not particularly bullish beyond and expect a rejection there.

Technical Analysis Bullish Factors:

+ Bullish Divergence on the 1D

+ Bullish Descending wedge on the 1D

+ Oversold on the Weekly

+ Reversal signal on the Weekly

+ Wave Dip signal on the daily

+ Bullish Weekly Pivot

+ Bullish Wave Divergence

+ Regained trendline support and holding the sym. triangle pattern

+ Regained 20, 50 ema and HMA

+ MACD turning bullish

+ Bullish Weekly Pivot

Technical Analysis Bearish Factors:

- Slightly bearish Daily POC

- 200 EMA Resistance incoming

- Not fully broken local resistance

- TD6 showing

NEWS:

Bull:

+Nada

Bear:

- Zip

🤖 #BTCLIVE - 03.09 🤖🤖 #BTCLIVE - 03.09 🤖

TLDR:

Short-Term (-1 Day)

60:40- Bullish:Bearish

Mid-Term (1 Week+)

30:70

Bullish:Bearish

Long-Term (1 Month+)

80:20 - Bullish:Bearish

TECHNICAL ANALYSIS:

We are tracking at the bottom of the symmetrical triangle now, directly on the trendline support, currently showing a TD7 formed - currently diminishing volume. Breaking down on the triangle can lead to a much bigger drop with the significant support needing to hold sitting at $19.5k - key bear targets are sitting at $18.8 that are very achievable although I am expecting huge buys to appear any where between $20k and and $18.8k that could turn the tide to bullish quite easily. Although I am slightly bullish for the short term and don't think we will break down on this test yet so a bullish target of $20.2k before a bigger sell off I feel is very achievable from here.

General sentiment in the market with the Mt.Gox news and ETH merge dropping in September are looking like they could be leading to a sell off, coupled with the heavily bearish sentiment attached to September $18.8k wouldn't be too surprising.

Technical Analysis Bullish Factors:

+ Bullish Divergence on the 1D

+ Bullish Descending wedge on the 1D

+ Oversold on the Weekly

+ Reversal signal on the Weekly

+ Wave Dip signal on the daily

+ Bullish Weekly Pivot

+ Slightly Bullish Daily POC

+ TD7 coming into Trendline support

Technical Analysis Bearish Factors:

- Broken local support

- Ranging in bearish symmetrical triangle

- Big rejection from the 200EMA

- Broke the HullMA

NEWS:

Bull:

+

Bear:

- Sept 13: CPI data

- Sept 15: $ETH merge expected sell off

- Sept 16: Mt. Gox Claims Deadline

- Sept 21: FOMC rate hike decision

- Sept 22: $ADA Vasil Hardfork

- stocks.apple.com

Russia cuts off gas exports to Europe via Nord Stream indefinitely

METRICS (Last 24 hours):

EXCHANGE:

- Exchange Reserve - As the exchange reserve continues to rise, it indicates higher selling pressure.

Last Value:

2,316,182.55

24H%:

0%

7D%:

+1%

+ TURNED POSITIVE

+ Exchange Netflow Total - Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

Last Value:

982.3029

24H%:

+157%

MINERS:

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

1.7051

24H%:

-364%

+ Puell Multiple - Miner's revenue is decreasing significantly compared to the cost they put in. This could indicate that price is undervalued along with the increasing miner's motive to hold their coins.

Low revenue

Last Value:

0.44632367

24H%:

-5%

ON-CHAIN:

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Realizing loss

Last Value:

0.97674869

24H%:

+1%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0.42857142

24H%:

-

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Captulation

Last Value:

-0.0921114

24H%:

+12%

- Transfer Volume - The total number of coins transferred has decreased by -65.00% compared to yesterday.

- Active Addresses -The number of active wallets used to send and receive coins has decreased by -38.00% compared to yesterday.

+ Transactions - The total number of transactions has decreased by -39.00% compared to yesterday.

INVESTOR SENTIMENT

+ TURNED POSITIVE

+ Coinbase Premium - US investors' buying pressure is relatively strong in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

TURNED POSITIVE -

- Funding Rate - Short position traders are dominant and are willing to pay long traders.

Last Value:

-0.00504039

24H%:

+578%

+ Taker Buy Sell Ratio - Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers.

Buy:

0.51493069

Sell:

0.48506931

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,672,447,353.18

24H%:

+5%

7D%:

+3%

- Liquidation - 5861915.48 of long positions were liquidated in the last 24 hours.

Long:

5,861,915.48

Short:

772,838.74

MARKET SENTIMENT:

Fear & Greed Index - Sep 03, 2022:

Today: 21 (Extreme Fear)

Yesterday: 25 (Extreme Fear)

Avg. 1W: 24 😱

Avg. 2W: 26 😱

Avg. 1M: 32 😣

Avg. 2M: 29 😱

Avg. 3M: 23 😱

Avg. 6M: 24 😱

Avg. 1Y: 33 😣

🔸 #Bitcoin

Price: $19,969

24h Low: $19,771

24h High: $20,428

MC Change: -$3.2B (-0.8%)

Dominance: 37.4%

24h: -0.9%

7d: -1.5%

14d: -4.7%

30d: -12.6%

60d: -1.4%

200d: -53.2%

1y: -59.5%

🤖 #BTCLIVE - 02.09 🤖🤖 #BTCLIVE - 02.09 🤖

TLDR:

Short-Term (-1 Day)

25:75- Bullish:Bearish

Mid-Term (1 Week+)

50:50

Bullish:Bearish

Long-Term (1 Month+)

90:10 - Bullish:Bearish

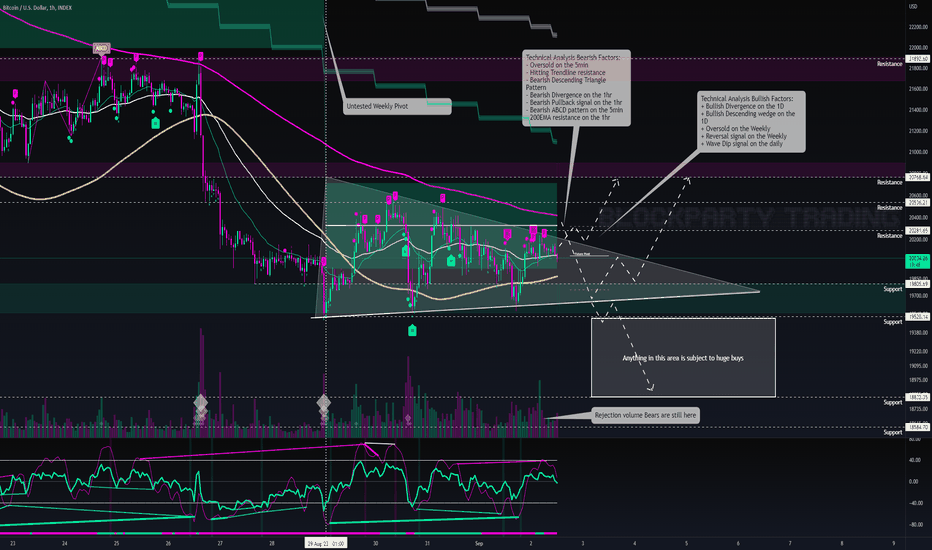

TECHNICAL ANALYSIS:

With the potential bearish announcement today we would expect some drop in BTC - trading at the top of the descending triangle would suggest this also if a rejection continues. Targets would be an initial 19.7k and then potential heavy drop to $18.8k as max pain price. Although I am not very confident we will spend that much time below $20k at all anymore. A break up out of this triangle just race up to $20.8k where the main resistance wand test will be if this is a proper bullish move.

Ultimately things are still pretty bearish short term although there are some huge bullish macro factors in play that are likely going to kick in soon, $18.8k is my current max pain although I am not doubting we will even see that as buyers seem to be picking up anything below $20k at the moment. We want to be breaking out fully from the is descending wedge on the daily and then it is off to the races with a pretty conservative $22k on the cards as initial target.

Technical Analysis Bullish Factors:

+ Bullish Divergence on the 1D

+ Bullish Descending wedge on the 1D

+ Oversold on the Weekly

+ Reversal signal on the Weekly

+ Wave Dip signal on the daily

Technical Analysis Bearish Factors:

- Oversold on the 5min

- Hitting Trendline resistance

- Bearish Descending Triangle Pattern

- Bearish Divergence on the 1hr

- Bearish Pullback signal on the 1hr

- Bearish ABCD pattern on the 5min

- 200EMA resistance on the 1hr

NEWS:

Bull:

+ Brazils largest bank unibanco hiring BTC software devs

+ ETH Merge moves closer

Bear:

- Unemployment Rate expected to remain level

Issue: Interest rates can only go up if the unemployment rate is fine. Which could cause a dump

- US dollar smashes 20 Year high, bad for BTC and all other stocks

- Saylor being sued for Tax Fraud

METRICS (Last 24 hours):

EXCHANGE:

TURNED NEGATIVE -

- As the exchange reserve continues to rise, it indicates higher selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

MINERS:

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Low revenue

Last Value:

0.47098618

24H%:

-6%

TURNED POSITIVE +

+ Puell Multiple - Miner's revenue is decreasing significantly compared to the cost they put in. This could indicate that price is undervalued along with the increasing miner's motive to hold their coins.

Moderate revenue

Last Value:

0.5305056

24H%:

-2%

ON-CHAIN:

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Realizing loss

Last Value:

0.96664604

24H%:

-2%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0.42857142

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Captulation

Last Value:

-0.07041003

24H%:

-14%

- Transfer Volume - The total number of coins transferred has decreased by -24.00% compared to yesterday.

TURNED NEGATIVE -

- Active Addresses -The number of active wallets used to send and receive coins has decreased by -40.00% compared to yesterday.

TURNED NEGATIVE -

+ Transactions - The total number of transactions has decreased by -40.00% compared to yesterday.

INVESTOR SENTIMENT

TURNED NEGATIVE -

- Coinbase Premium - US investors' buying pressure is relatively weak in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

TURNED POSITIVE +

+ Funding Rate - Long position traders are dominant and are willing to pay to short traders.

Last Value:

0.00315397

24H%:

-521%

+ Taker Buy Sell Ratio - Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers.

Buy:

0.60559476

Sell:

0.39440524

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,406,535,733.99

24H%:

+2%

7D%:

-1%

TURNED NEGATIVE -

- Liquidation - 14988488.82 of long positions were liquidated in the last 24 hours.

Long:

14,988,488.82

Short:

8,328,677.12

MARKET SENTIMENT:

Fear & Greed Index - Sep 02, 2022:

Today: 25 (Extreme Fear)

Yesterday: 20 (Extreme Fear)

Avg. 1W: 25 😱

Avg. 2W: 26 😱

Avg. 1M: 32 😣

Avg. 2M: 29 😱

Avg. 3M: 23 😱

Avg. 6M: 24 😱

Avg. 1Y: 33 😣

🔸 #Bitcoin

Price: $20,141

24h Low: $19,615

24h High: $20,188

MC Change: $1.7B (0.4%)

Dominance: 37.5%

24h: 0.6%

7d: -6.8%

14d: -13.4%

30d: -12.6%

60d: 4.3%

200d: -52.3%

1y: -58.7%

@FearGreedIndex

🤖 #BTCLIVE - 30.08 🤖🤖 #BTCLIVE - 30.08 🤖

TLDR:

Short-Term (<1 Day)

40:60- Bullish:Bearish

Mid-Term (<1 Week)

50:50

Bullish:Bearish

Long-Term (1 Month

80:20 - Bullish:Bearish

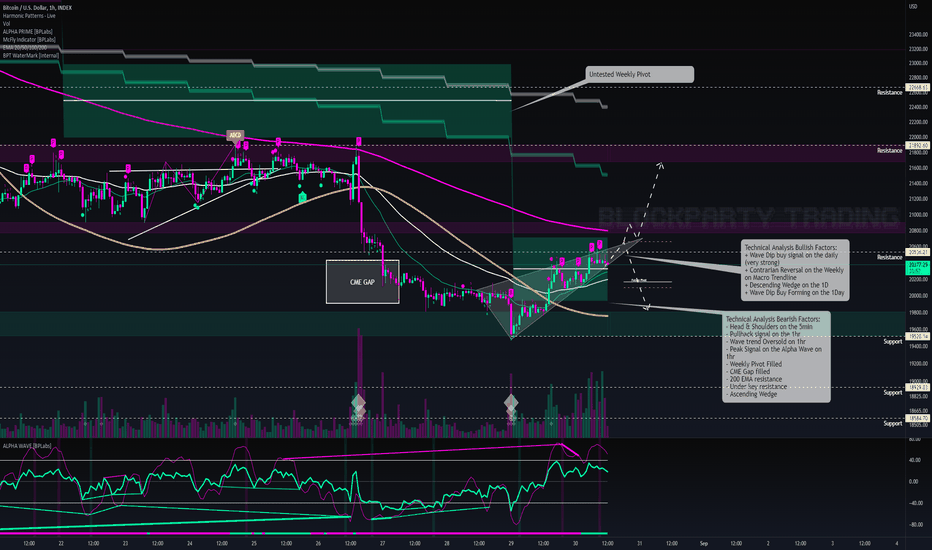

TECHNICAL ANALYSIS:

Alot of interesting data at the moment, in the short-term everything is looking quite stretched and oversold most notably with an ascending wedge forming, along with a few sell signals on resistance, we will need some volume to break up out of this at the moment it is holding, I am leaning quite bearish in the short term due to this with a break down of the triangle to potentially 19.5k - 19.8k area of support. A break up however will move to $21.7k with little resistance in the way.

The long term however is a different story with some big bullish signals showing now most notably the contrarian reversal signal on the weekly for alpha prime sat on a macro trendline support, this coupled with the newly formed descending wedge on the daily is telling me we are not far off an imminent push up over the next 4 weeks, this could be the start....bull rally loading!

Otherwise coming to the end of the consolidation now so biggish move expected.

Technical Analysis Bullish Factors:

+ Wave Dip buy signal on the daily (very strong)

+ Contrarian Reversal on the Weekly on Macro Trendline

+ Descending Wedge on the 1D

+ Wave Dip Buy Forming on the 1Day

Technical Analysis Bearish Factors:

- Head & Shoulders on the 5min

- Pullback signal on the 1hr

- Wave trend Oversold on 1hr

- Peak Signal on the Alpha Wave on 1hr

- Weekly Pivot Filled

- CME Gap filled

- 200 EMA resistance

- Under key resistance

- Ascending Wedge

NEWS:

Bull:

+ Iran passes law enabling Bitocin and crypto payments for imports

cryptopanic.com

+ Indonesia's biggest tech company, GoTo, just bought a Bitcoin exchange.

+ Qatar grants the country's first digital payments services license to iPay.

+ Singapore High Court grants #crypto lender Holdnaut protection from investors.

+ 7,507 $BTC ($151 million) has been taken off exchanges in the last 7 days.

+ The whales addresses controlling 1k to 10k BTC are starting to accumulate coins on-chain

Bear:

- Chinese police arrest over 200 people linked to one of the country’s largest banking scandals ever.

- FBI issues #DeFi crypto vulnerabilities warning.

METRICS (Last 24 hours):

EXCHANGE:

+ Exchange Reserve - As the exchange reserve continues to fall, it indicates lower selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

MINERS:

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

-0.90908933

24H%:

-10%

/ Puell Multiple -Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.5305056

24H%:

-2%

ON-CHAIN:

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Realizing loss

Last Value:

0.99056737

24H%:

-1%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0.28571428

24H%:

+100%

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Captulation

Last Value:

-0.05740991

24H%:

-35%

- Transfer Volume - The total number of coins transferred has decreased by -36.00% compared to yesterday.

TURNED POSITIVE +

+ Active Addresses - The total number of active wallets used to send and receive coins has increased by 19.00% compared to yesterday.

TURNED POSITIVE +

+ Transactions - The total number of transactions has increased by 24.00% compared to yesterday.

INVESTOR SENTIMENT

TURNED POSITIVE +

+ Coinbase Premium - US investors' buying pressure is relatively strong in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

- Funding Rate - Short position traders are dominant and are willing to pay long traders.

Last Value:

-0.00450709

24H%:

+101%

+ Taker Buy Sell Ratio - Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers.

Buy:

0.53551546

Sell:

0.46448454

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,591,474,245.29

24H%:

0%

7D%:

+1%

+ Liquidation - 19857239.24of short positions were liquidated in the last 24 hours.

Long:

3,734,557.07

Short:

19,857,239.24

MARKET SENTIMENT:

Fear & Greed Index - Aug 30, 2022:

Today: 27 (Fear)

Yesterday: 24 (Extreme Fear)

Avg. 1W: 26 😱

Avg. 2W: 29 😱

Avg. 1M: 33 😣

Avg. 2M: 29 😱

Avg. 3M: 23 😱

Avg. 6M: 24 😱

Avg. 1Y: 33 😣

🔸 #Bitcoin

Price: $20,327

24h Low: $19,617

24h High: $20,385

MC Change: $12.0B (3.2%)

Dominance: 37.7%

24h: 3.4%

7d: -6.0%

14d: -16.4%

30d: -14.8%

60d: 1.1%

200d: -54.2%

1y: -58.5%

🤖 #BTCLIVE - 27.08 🤖🤖 #BTCLIVE - 27.08 🤖

TLDR:

Short-Term (<1 Day)

60:40- Bullish:Bearish

Mid-Term (<1 Week)

60:40

Bullish:Bearish

Long-Term (1 Month

70:30 - Bullish:Bearish

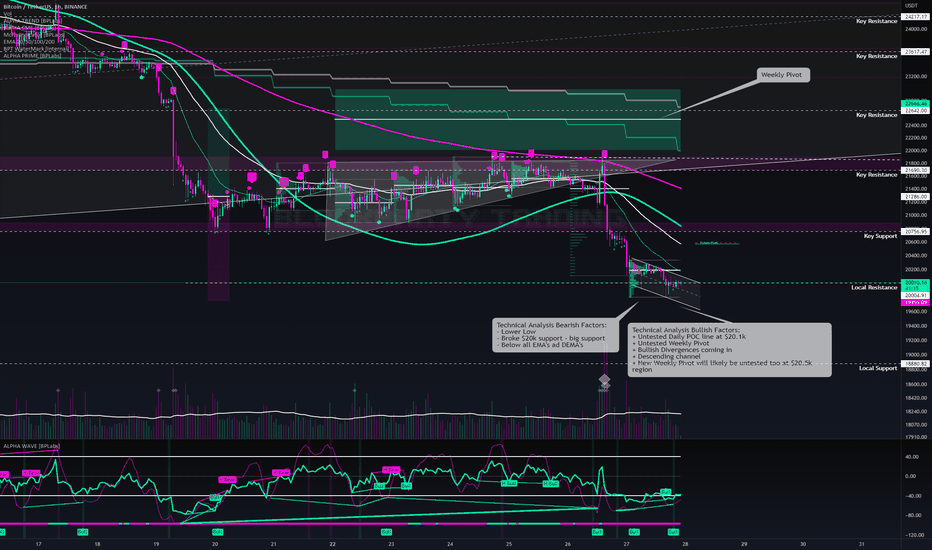

TECHNICAL ANALYSIS:

There are surprisingly a decent amount of bullish factors in play although there is a much larger bearish sentiment at play with Jerome Powells words still resonating and the additional FUD from the MT Gox Fake News turned the market bot below $20k Bitocin price and also below the critical $1T mark. In a macro sense on the 1 week chart the max pain price at the lower end of the descending wedge is looking a potential $16k which is looking a lot more realistic now that a week ago.

Currently it is a tough call with us sat right on $20k although leaning slightly towards losing it over the next 24 hours for some contuned pain for the bulls - It is looking like we will track down in this channel to around $19.6k before the next bounce or dump to a bigger bear target of $18.8k is still on the cards. Although we do see some quite unusual activity on Sunday's and a jump up out of this channel can also jump to $20.5k could be very realistic if only short lived.

Technical Analysis Bullish Factors:

+ Untested Daily POC line at $20.1k

+ Untested Weekly Pivot

+ Bullish Divergences coming in

+ Descending channel

+ New Weekly Pivot will likely be untested too at $20.5k region

Technical Analysis Bearish Factors:

- Lower Low

- Broke $20k support - big support

- Below all EMA's ad DEMA's

NEWS:

Bull:

+ Mt Gox news turned out to be fake

Bear:

- Fake Mt Gox Repayment News spread on Crypto Twitter, possible instigation of FUD

🤖 #BTCLIVE - 25.08 - #IDEA 🤖🤖 #BTCLIVE - 25.08 - #IDEA 🤖

TLDR:

Short-Term (<1 Day)

60:40- Bullish:Bearish

Mid-Term (<1 Week)

60:40

Bullish:Bearish

Long-Term (1 Month

60:40 - Bullish:Bearish

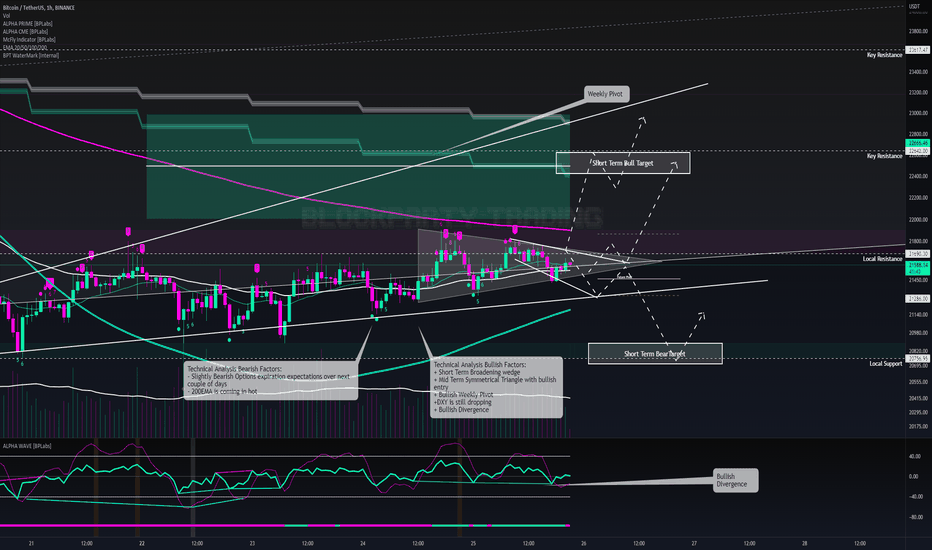

TECHNICAL ANALYSIS:

There is quite alot of factors pointing towards a bshort-term bullish move, broadening wedge on the short term and the bullish symmetrical triangle to suggest a little pump. Mainly I am looking at the bullish divergence that is in play, they have been extremely reliable in this past week. The DXY is dropping still too which is always bullish. There is additionally some nice bullish news floating around to help stop the fear. I think if we can hold $21k over the next 12-24 hours we should break up with an initial target of $22.5k

The bearish scenario here is simply losing $21k will be bad news , very quickly to support at $20.7k and given its proximity will likely not hold seeing a very likely $20k and maybe lower for the weekend.

Technical Analysis Bullish Factors:

+ Short Term Broadening wedge

+ Mid Term Symmetrical Triangle with bullish entry

+ Bullish Weekly Pivot

+DXY is still dropping

+ Bullish Divergence

Technical Analysis Bearish Factors:

- Slightly Bearish Options expiration expectations over next couple of days

- 200EMA is coming in hot

NEWS:

Bull:

+ Zero fee ETH trading - naturally bring new blood into the market

+ Russia & India no longer need the US Dollar

www.rt.com

+ Amendments to US commercial code differentiate crypto and ‘electronic money’ (cryptopanic.com)

+ Intel has struck $30B deal to build a new chip factory - part of which will be used to build #Bitcoin mining chips. 🙌

Bear:

- Options Expiry incoming - volatility definitely leaning slightly bearish

- Bitcoin price in limbo as Fed Chair prepares to address global central bankers (cryptopanic.com)

METRICS (Last 24 hours):

Bull

+ Active addresses turned positive

+ Transfer Volume turned positive

Bear

-

EXCHANGE:

+ Exchange Reserve - As the exchange reserve continues to fall, it indicates lower selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

MINERS:

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

-0.81844147

24H%:

-7%

/ Puell Multiple -Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.52463076

24H%:

-15%

ON-CHAIN:

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Realizing loss

Last Value:

0.98362702

24H%:

0%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0

24H%:

-

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Captulation

Last Value:

-0.00132546

24H%:

-422%

- Transfer Volume - The total number of coins transferred has decreased by -9.00% compared to yesterday.

+ Active Addresses - The number of active wallets used to send and receive coins has increased by -40.00% compared to yesterday.

+ Transactions - The total number of transactions has increased by -52.00% compared to yesterday.

INVESTOR SENTIMENT

- Coinbase Premium - US investors' buying pressure is relatively weak in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

- Funding Rate - Short position traders are dominant and are willing to pay long traders.

Last Value:

-0.00064535

24H%:

-82%

+ Taker Buy Sell Ratio - Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers.

Buy:

0.53838772

Sell:

0.46161228

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,461,545,292.51

24H%:

-3%

7D%:

-11%

+ Liquidation -6168430.89 of short positions were liquidated in the last 24 hours.

Long:

6,168,430.88

Short:

5,432,935.55

MARKET SENTIMENT:

#BOTPARTY

Assign your Max Active Deals based on the 7 Day Fear & Greed Average Accordingly.

F&G Filter:

0 - 20 - 100% Max Active Deals

20 - 40 - 80% Max Active Deals

40 - 60 - 60% Max Active Deals

60 - 80 - 40% Max Active Deals

80 - 100 - 20% Max Active Deals

Fear & Greed Index - Aug 25, 2022:

Today: 25 (Extreme Fear)

Yesterday: 25 (Extreme Fear)

Avg. 1W: 28 😱

Avg. 2W: 35 😣

Avg. 1M: 34 😣

Avg. 2M: 28 😱

Avg. 3M: 22 😱

Avg. 6M: 25 😱

Avg. 1Y: 34 😣

🔸 #Bitcoin

Price: $21,394

24h Low: $21,211

24h High: $21,800

MC Change: -$2.8B (-0.7%)

Dominance: 38.1%

24h: -0.7%

7d: -10.5%

14d: -7.8%

30d: -5.4%

60d: 0.6%

200d: -48.7%

1y: -56.8%

🤖 #BTCLIVE - 24.08 - #IDEA 🤖🤖 #BTCLIVE - 24.08 - #IDEA 🤖

TLDR:

Short-Term (<1 Day)

80:20- Bullish:Bearish

Mid-Term (<1 Week)

50:50

Bullish:Bearish

Long-Term (1 Month

60:40 - Bullish:Bearish

TECHNICAL ANALYSIS:

There is alot pointing towards a bullish move here, most notably the ascending triangle pattern, the perceived incoming rejection for DXY, USDT Dominance breaking down on pennant and ALT market cap showing a bull flag. All of these factors are suggesting some bullish pressure to come in. BTC is holding its local trendline support and formed a new ascending trendline support. There is still a huge macro trendline resistance to breakthrough which means this push will not likely be sustained but targets of $22k - $23k seem quite achievable. There incoming 20 DEMA and 200 EMA is not ideal. There is also finally some nice well spread out and consistent bullish news circulating with strong applications to money into market that further enhances a break up chance.

On the bear side, a break down of around $21.2k would be really bad news for bulls and the same old targets of $20.8k down to $20k are what will be looking realistic in the short term.

Otherwise coming to the end of the consolidation now so biggish move expected.

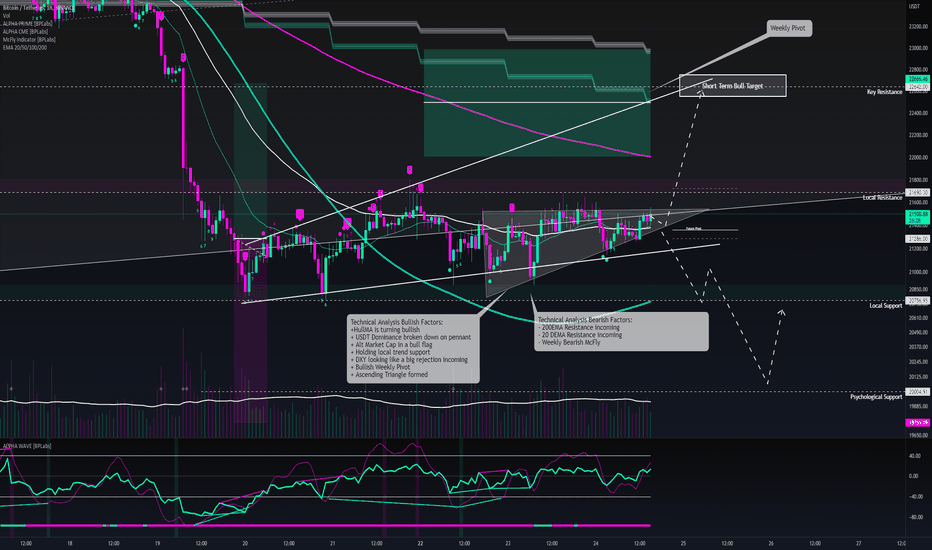

Technical Analysis Bullish Factors:

+HullMA is turning bullish

+ USDT Dominance broken down on pennant

+ Alt Market Cap in a bull flag

+ Holding local trend support

+ DXY looking like a big rejection incoming

+ Bullish Weekly Pivot

+ Ascending Triangle formed

Technical Analysis Bearish Factors:

- 200EMA Resistance incoming

- 20 DEMA Resistance incoming

- Weekly Bearish McFly

NEWS:

Bull:

+ Zero fee ETH trading - naturally bring new blood into the market

+ Sullivan Bank has partnered with Bakkt to offer #Bitcoin and #Ethereum trading for customers.

+ Valour’s Binance Coin ETP to start trading on Germany’s largest stock exchange (cryptopanic.com)

+ Mastercard CEO says they’re working with Binance to let people spend crypto at more than 90,000,000 stores… (cryptopanic.com)

+ Malaysia's largest independent Investment Bank is developing a super-app with #Bitcoin trading!

Bear:

- Kucoin security breach

METRICS (Last 24 hours):

Bull

+

Bear

- Funding Rate turned negative

EXCHANGE:

+ Exchange Reserve - As the exchange reserve continues to fall, it indicates lower selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

MINERS:

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

-0.88430103

24H%:

+6%

/ Puell Multiple -Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.61491857

24H%:

+20%

ON-CHAIN:

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Realizing loss

Last Value:

0.98419828

24H%:

+1%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0

24H%:

-

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Captulation

Last Value:

-0.00900459

24H%:

-43%

- Transfer Volume - The total number of coins transferred has decreased by -78.00% compared to yesterday.

- Active Addresses - The number of active wallets used to send and receive coins has decreased by -20.00% compared to yesterday.

- Transactions - The total number of transactions has decreased by -23.00% compared to yesterday.

INVESTOR SENTIMENT

- Coinbase Premium - US investors' buying pressure is relatively weak in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

- Funding Rate - Short position traders are dominant and are willing to pay long traders.

Last Value:

-0.00641179

24H%:

-1,543%

+ Taker Buy Sell Ratio - Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers.

Buy:

0.55464148

Sell:

0.44535852

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,572,156,239.51

24H%:

+1%

7D%:

-8%

+ Liquidation - 9109325.51 of short positions were liquidated in the last 24 hours.

Long:

8,308,068.08

Short:

9,109,325.51

MARKET SENTIMENT:

Fear & Greed Index - Aug 24, 2022:

Today: 25 (Extreme Fear)

Yesterday: 28 (Fear)

Avg. 1W: 29 😱

Avg. 2W: 36 😣

Avg. 1M: 35 😣

Avg. 2M: 27 😱

Avg. 3M: 22 😱

Avg. 6M: 25 😱

Avg. 1Y: 34 😣

🔸 #Bitcoin

Price: $21,541

24h Low: $20,955

24h High: $21,618

MC Change: $3.9B (1.0%)

Dominance: 38.1%

24h: 0.6%

7d: -10.9%

14d: -9.6%

30d: -4.3%

60d: 2.1%

200d: -41.9%

1y: -56.3%

🤖 #BTCLIVE - 23.08 - #IDEA 🤖🤖 #BTCLIVE - 23.08 - #IDEA 🤖

TL:DR:

Short-Term (<1 Day)

60:40- Bullish:Bearish

Mid-Term (>1 Day)

40:60

Bullish:Bearish

Long-Term (1 Month

60:40 - Bullish:Bearish

TECHNICAL ANALYSIS:

Testing the underside of the Macro channel is the key issue here as we are slowly confirming this long term bear flag - although trendlines can be quite subjective so we may also be slightly on the inside of it and holding support either way there is consolidation occurring and a biggish move will be incoming. The encouraging bullish factors are the triple bottom on the short term with divergences and also the TD7 now forming on the daily. We have a natural cross section for a target at $22k with psych. resistance, bottom of the weekly pivot likely where the 200EMA on the 1hr and the topside of the broad. wedge pattern trendline. We are seeing some pushes and volume coming in, not a huge amount but enough to break this local resistance. Notably also there are no significant sell orders on the books. I feel this will be a target and either a big rejection back to the lower of the broad. wedge at similar levels to where we are at now or a potential huge breakout. which would put a target like $23.6k in our sights.

A rejection here would be pretty brutal and could put us on the path to $20k and then ultimately $18.8k. We seem to be surprisingly light on news and especially FUD which is pretty unexpected, there is some announcements coming on Friday (PCE Price Index) that could shape the next week although it is not dependant on this just a catalyst.

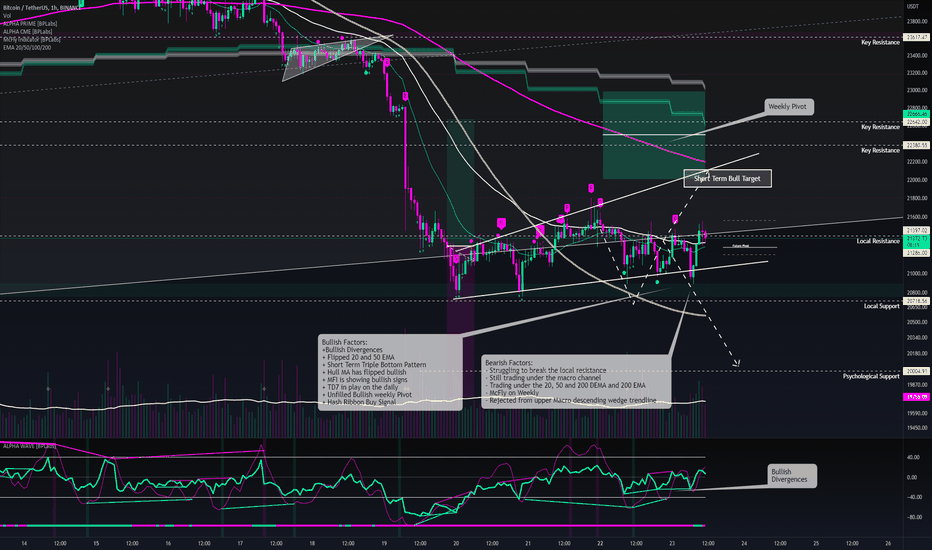

Bullish Factors:

+Bullish Divergences

+ Flipped 20 and 50 EMA

+ Short Term Triple Bottom Pattern

+ Hull MA has flipped bullish

+ MFI is showing bullish signs

+ TD7 in play on the daily

+ Unfilled Bullish weekly Pivot

+ Hash Ribbon Buy Signal

Bearish Factors:

- Struggling to break the local resistance

- Still trading under the macro channel

- Trading under the 20, 50 and 200 DEMA and 200 EMA

- McFly on Weekly

- Rejected from upper Macro descending wedge trendline

NEWS:

Bull:

+ #Crypto exchange Huobi has been granted a money services business registration license in Canada.

+ EURO is at a 20 year low against the Dollar

+ Crypto.com has been granted a SOC 2 Type II certification.

Bear:

- EURO is at a 20 year low against the Dollar

- One-third of estimated 115M Indian crypto users concerned about regulations

cointelegraph.com

METRICS (Last 24 hours):

Bull

+ Taker Buy Sell Ratio turned positive

+ Liquidation turned positive

Bear

- Transfer Volume turned negative

- Active Addresses turned negative

- Transactions turned negative

EXCHANGE:

+ Exchange Reserve - As the exchange reserve continues to fall, it indicates lower selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

MINERS:

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

-0.83540481

24H%:

+6%

/ Puell Multiple -Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.51428537

24H%:

-1%

ON-CHAIN:

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Realizing loss

Last Value:

0.9727934

24H%:

-2%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0

24H%:

-

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Capitulation

Last Value:

-0.01028571

24H%:

-59%

- Transfer Volume - The total number of coins transferred has decreased by -41.00% compared to yesterday.

- Active Addresses - The number of active wallets used to send and receive coins has decreased by -18.00% compared to yesterday.

- Transactions - The total number of transactions has decreased by -9.00% compared to yesterday.

INVESTOR SENTIMENT

- Coinbase Premium - US investors' buying pressure is relatively weak in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

+ Funding Rate - Long position traders are dominant and are willing to pay to short traders.

Last Value:

0.00137447

24H%:

-290%

+ Taker Buy Sell Ratio - Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers.

Buy:

0.53247521

Sell:

0.46752479

+ Liquidation - 15933087.29 of short positions were liquidated in the last 24 hours.

Long:

10,784,253.12

Short:

15,933,087.28

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,514,395,337.34

24H%:

+1%

7D%:

-7%

MARKET SENTIMENT:

Fear & Greed Index - Aug 23, 2022:

Today: 28 (Fear)

Yesterday: 29 (Fear)

Avg. 1W: 31 😣

Avg. 2W: 37 😣

Avg. 1M: 35 😣

Avg. 2M: 27 😱

Avg. 3M: 22 😱

Avg. 6M: 25 😱

Avg. 1Y: 34 😣

🔸 #Bitcoin

Price: $21,413

24h Low: $20,961

24h High: $21,553

MC Change: -$5.2B (-1.3%)

Dominance: 38.3%

24h: -0.6%

7d: -11.9%

14d: -7.7%

30d: -5.7%

60d: 7.2%

200d: -42.1%

1y: -56.2%

🤖 #BTCLIVE - 22.08 - #IDEA 🤖🤖 #BTCLIVE - 22.08 - #IDEA 🤖

TL:DR:

Short-Term (<1 Day)

60:40- Bullish:Bearish

Mid-Term (>1 Day)

30:70

Bullish:Bearish

Long-Term (1 Month

80:20 - Bullish:Bearish

TECHNICAL ANALYSIS:

Bounce nicely off this new trendline that is forming at $20.9k after break down of the ascending wedge to start to a new ascending broadening wedge - although it is in a downtrend here, these are historically pretty bearish. We have just formed a nice bullish divergence as well. With these 2 factors TA wise is looking like a potentially rise to the top end of this new Broad.Asc.Wedge which puts us at $21.9k on the nose. This is also the bottom of the Weekly pivot and notably where alot of new Sell Orders are sitting "coincidentally". It is looking like we might see some bullish relief to these levels before the next big rejection which would likely be to $21k and possibly lower if it breaks through, to about 20.7k and then $20k.

If we lose $21k again from here then this could spell very bad news for bulls and see $20k very quickly - which deeper targets down to potentially $18.5k region.

On a macro level I feel we are reaching the last phase of this bear cycle. with a preferred path of slow down ward consolidation to approx 18.5k before a huge pump up - which would be a very similar scene to the Jan 19 bear exit. This would coincide quite nicely with the DXY coming up to key resistance and a potential big rejection.

Bullish Factors:

+ Bullish Weekly Pivots sitting between $22k to $23k

+ Similar looking pattern on the daily to Jan 2019 that formed the end of the bearish phase.

+ Still holding the $20.7k support

+ Bullish Divergence in play

Bearish Factors:

-Broken down on ascending wedge, bounced and on retest

- Showing same pattern from 18th August that broke down

- Rejected from the 20 and 50 EMA

- Forming an ascending broadening wedge in down trend - bearish

- Challenging the $21.4k resistance

- Large Sell orders at $21.4k and $21.9k

NEWS:

Bull:

+ A new UK Bill can bring crypto into the scope of local payment regulation

+ Breaking: Ethereum Merge Officially Starts, Client Releases Bellatrix And Mainnet Update

bit.ly

+ US, Ukraine, and UK lead in overall use of crypto globally, new study reveals (cryptopanic.com)

Bear:

- Bored Apes Approaching Mass Liquidation On BendDAO, Can This Crash Entire NFT Market?

- Euro falls equivalent to the US Dollar for the second time this year.

METRICS (Last 24 hours):

Bull

+ Transfer Volume turned positive

+ Funding Rate turned positive

Bear

- Coinbase Premium turned negative

- Taker Buy Sell Ratio turned negative

EXCHANGE:

+ Exchange Reserve - As the exchange reserve continues to fall, it indicates lower selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

MINERS:

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

-0.7857449

24H%:

+3%

/ Puell Multiple -Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.51784085

24H%:

-1%

ON-CHAIN:

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Realizing loss

Last Value:

0.9940512

24H%:

+1%

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

Low long-term holders' movement

Last Value:

0

24H%:

-

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

Captulation

Last Value:

-0.0212289

24H%:

+48%

+ Transfer Volume - The total number of coins transferred has increased by +178.00% compared to yesterday.

+ Active Addresses - The total number of active wallets used to send and receive coins has increased by 15.00% compared to yesterday.

+ Transactions - The total number of transactions has increased by 7.00% compared to yesterday.

INVESTOR SENTIMENT

- Coinbase Premium - US investors' buying pressure is relatively weak in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

DERIVATIVES

+ Funding Rate - Long position traders are dominant and are willing to pay to short traders.

Last Value:

0.00074996

24H%:

-109%

- Taker Buy Sell Ratio - Selling sentiment is dominent in the derivatives market. More sell orders are filled by takers.

Buy:

0.489591

Sell:

0.510409

- Liquidation - 12551393.40 of long positions were liquidated in the last 24 hours.

Long:

12,551,393.39

Short:

9,587,725.04

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,422,356,344.99

24H%:

-1%

7D%:

-8%

MARKET SENTIMENT:

Fear & Greed Index - Aug 22, 2022:

Today: 29 (Fear)

Yesterday: 27 (Fear)

Avg. 1W: 33 😣

Avg. 2W: 38 😣

Avg. 1M: 35 😣

Avg. 2M: 27 😱

Avg. 3M: 22 😱

Avg. 6M: 25 😱

Avg. 1Y: 34 😣

🔸 #Bitcoin

Price: $21,535

24h Low: $21,127

24h High: $21,665

MC Change: $8.7B (2.1%)

Dominance: 38.4%

24h: 1.8%

7d: -11.9%

14d: -6.3%

30d: -7.0%

60d: 4.0%

200d: -44.5%

1y: -56.2%

🤖 #BTCLIVE - 21.08 - #IDEA 🤖🤖 #BTCLIVE - 21.08 - #IDEA 🤖

Snapshot:

Short-Term

60:40- Bullish:Bearish

Long-Term

80:20 - Bullish:Bearish

Technical Analysis:

Bullish Scenario:

Breaking up out of this ascending wedge is key - a good confirmation for this would be breaking above $21.7k with volume or a confirmed retest. The next target puts $22.4k on the board. This would be quite a bullish sentiment overall - the key focus here is to stay within the macro channel as breaking down will cause a big drop. Ultimately we will likely see alot of consolidation and ranging around the mid channel here at a round $22.8k region.

Bearish Scenario:

Breaking down on the ascending wedge will be quite a bearish sentiment - at a about $21.2k this will be breaking down on the ascendign wedge and back out of the macro channel. Likely retest of $20.7k and breaking that will take us to $20k. I am slightly more in favour of this scenario

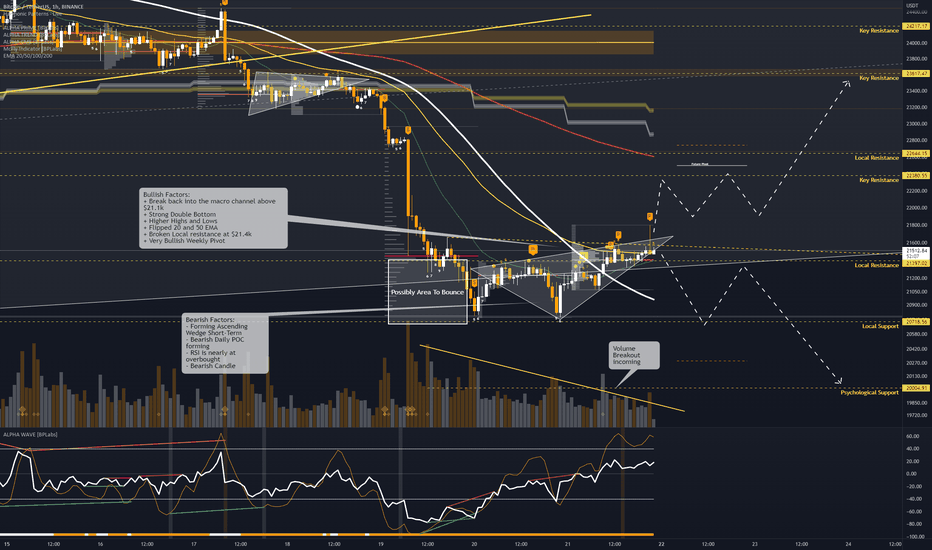

Bullish Factors:

+ Break back into the macro channel above $21.1k

+ Strong Double Bottom

+ Higher Highs and Lows

+ Flipped 20 and 50 EMA

+ Broken Local resistance at $21.4k

+ Very Bullish Weekly Pivot

+ Active Addresses turned positive

+ Transactions turned bullish

Bearish Factors:

- Forming Ascending Wedge Short-Term

- Bearish Daily POC forming

- RSI is nearly at overbought

- Bearish Candle

- Transfer Volume turned negative

Key News:

Bull:

+ A new UK Bill can bring crypto into the scope of local payment regulation

Bear:

- Bored Apes Approaching Mass Liquidation On BendDAO, Can This Crash Entire NFT Market?

Exchange

+ Exchange Reserve - As the exchange reserve continues to fall, it indicates lower selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

Miners

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

-0.76351231

24H%:

-385%

/ Puell Multiple -Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.5230772

24H%:

-19%

On-Chain

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

- Transfer Volume - The total number of coins transferred has decreased by -73.00% compared to yesterday.

+ Active Addresses - The total number of active wallets used to send and receive coins has increased by 23.00% compared to yesterday.

+ Transactions - The total number of transactions has increased by 14.00% compared to yesterday.

Sentiment

+ Coinbase Premium - US investors' buying pressure is relatively strong in Coinbase.

- Korea Premium -Korean retail investors' buying pressure is relatively strong.

- Fund Premium - Investors in funds and trusts including Grayscale have relatively weak buying sentiment.

Derivatives

- Funding Rate - Short position traders are dominant and are willing to pay long traders.

+ Taker Buy Sell Ratio - Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers.

- Liquidation - 11133298.76 of long positions were liquidated in the last 24 hours.

/ Open Interest - As OI increases, it indicates more liquidity, volatility , and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend

Last Value:

8,545,444,735.4

24H%:

+2%

7D%:

-9%

Fear & Greed Index - Aug 21, 2022:

Today: 27 (Fear)

Yesterday: 29 (Fear)

Avg. 1W: 36 😣

Avg. 2W: 38 😣

Avg. 1M: 35 😣

Avg. 2M: 27 😱

Avg. 3M: 22 😱

Avg. 6M: 25 😱

Avg. 1Y: 35 😣

🔸 #Bitcoin

Price: $21,169

24h Low: $20,849

24h High: $21,354

MC Change: $4.1B (1.0%)

Dominance: 38.5%

24h: 1.5%

7d: -13.3%

14d: -8.9%

30d: -9.2%

60d: 2.6%

200d: -45.1%

1y: -54.7%

@FearGreedIndex

🤖 #BTCLIVE - 20.08 - #IDEA 🤖🤖 #BTCLIVE - 20.08 - #IDEA 🤖

Snapshot:

Short-Term

30:70- Bullish:Bearish

Long-Term

80:20 - Bullish:Bearish

Technical Analysis:

Bullish Scenario:

$20.7K is key to hold if there is any chance at a bullish rally - currently the double bottom is a pretty good sign but a break above $21.4k is required dor the first confirmation and targets will be $21.8k - no predictions beyond that.

Bearish Scenario:

Losing $20.7k then it will be a drop $20k with likely bounce and potential consolidation although high chance of breakdown to $18.8k Weekend volume is erratic at best so wait for confirmation of new week to asses true trajectory.

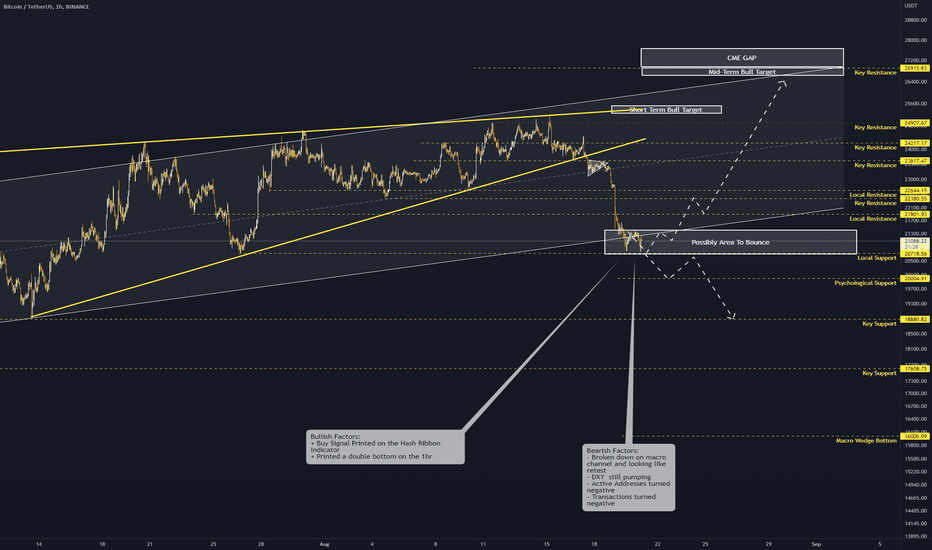

Bullish Factors:

+ Buy Signal Printed on the Hash Ribbon Indicator

+ Printed a double bottom on the 1hr

Bearish Factors:

- Broken down on macro channel and looking like retest

- DXY still pumping

- Active Addresses turned negative

- Transactions turned negative

Key News:

Bull:

+ US FED says cryptocurrencies present opportunities to banks, customers, and the whole financial system!

+ Starlink ( Elon Musk company) and World Mobile will be working together

Bear:

-

Exchange

+ Exchange Reserve - As the exchange reserve continues to fall, it indicates lower selling pressure.

- Exchange Netflow Total - Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

Miners

/ Miners' Position Index ( MPI ) - Miners' are selling holdings in a moderate range compared to its one-year average.

Moderately selling

Last Value:

0.26747583

24H%:

-139%

/ Puell Multiple -Miner's revenue is in a moderate range, compared to its one-year average.

Moderate revenue

Last Value:

0.6446955

24H%:

+15%

On-Chain

+ aSOPR - More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom.

+ Binary CDD - Long term holders' movement in the last 7days were lower than the average. They have a motive to hold their coins

- Net Unrealized Profit and Loss (NUPL) -Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

+ Transfer Volume - The total number of coins transferred has increased by 38.00% compared to yesterday.

- Active Addresses - The number of active wallets used to send and receive coins has decreased by -52.00% compared to yesterday.

- Transactions - The total number of transactions has decreased by -56.00% compared to yesterday.