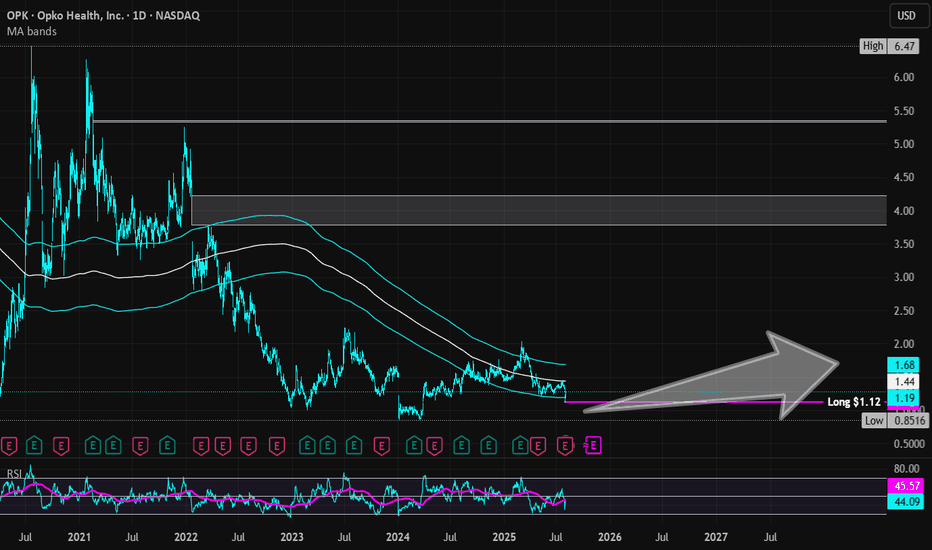

OPKO Health | OPK | Long at $1.12OPKO Health finally closed the price gap on the daily chart between $1.11 and $1.12. There are no more price gaps below the current price (bullish). In the past year, insiders (primarily the CEO), have purchased over $4.7 million of shares at an average price of $1.55. Historically, this stock is very cyclical, and I believe we are near the bottom before the next cycle up. I have no idea when this will occur (may trade sideways for a while or dip below $1 in the near-term), but the insider purchases tell me they are preparing for a move. Average analyst price targets are between $2.75 and $3.99 right now, depending on the source. Book value = $1.66. As with any biopharmaceutical and diagnostics company, NASDAQ:OPK is purely speculative at this stage - yet raking in over $600 million in annual revenue.

My personal buy for NASDAQ:OPK was triggered at $1.12 and I hope to see more insider buying at this level.

Targets into 2028:

$1.40 (+22.8%)

$1.66 (+45.6%)

Squeeze for any reason = $5.00 (+338.6%)

Opko

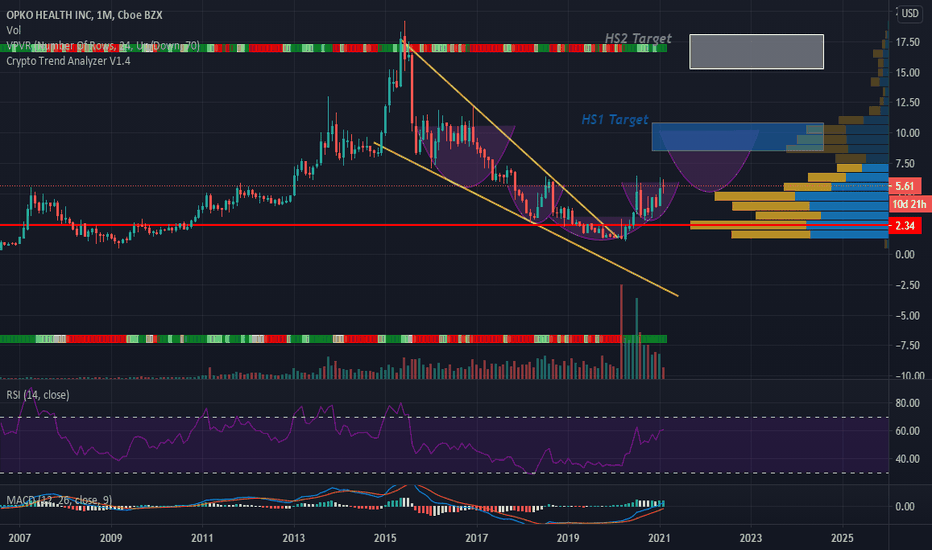

OPKO Head and ShouldersIt's looking like we have an Inverted HS pattern that would potentially continue into yet another Inverted HS. Indicator movements to consider would include a bullish MACD cross, RSI confirming strength and high volume following through at the moment. This is a long term play that might have some good scalps to consider, potential plays on lower time frames. This is not financial advice.

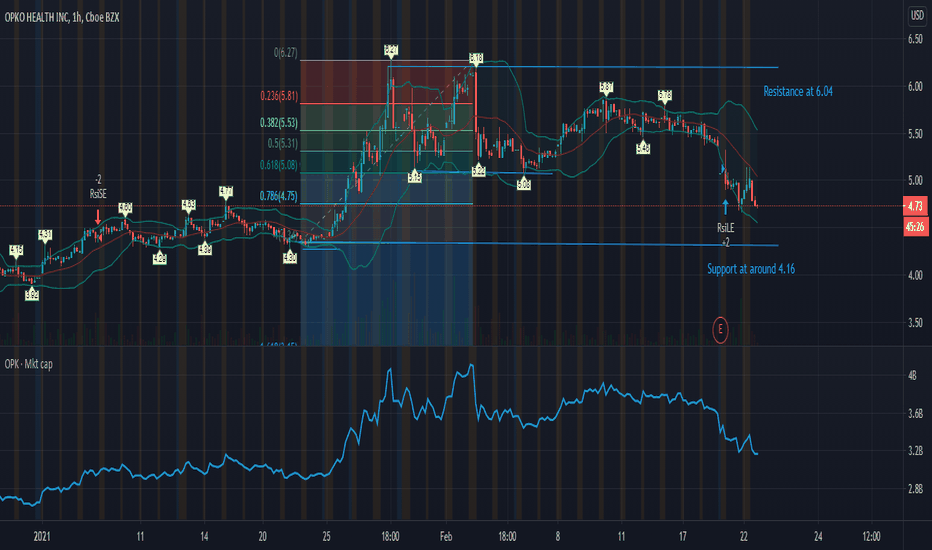

Finally some bullish momentum for $OPK ?Keeping an eye on $OPK.

The shares price just crossed previous 2.90$ which was both resistance and 52 weeks high.

If the price remain above previous resistance and become the new support, we could see the price spike up!

Long term still not sure, but there is bullish momentum on this stock IMO

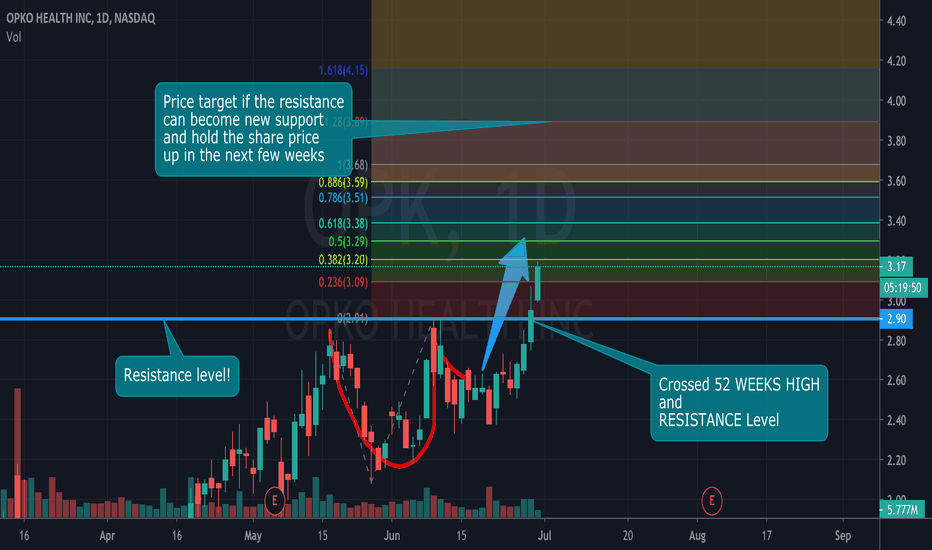

$OPK Potential Long Breakout SetupOPKO Health is a medical testing company based on diagnostics and pharmaceuticals. They also have a COVOID-19 testing kit.

During week of June 6th, Insider buying occurred with CEO, Chairman and 10% Owner Phillip Frost buying 200,000 shares at the average price of $2.35.

With COVOID-19 infections slowly ticking up in the US, we might see more demand in the company's testing kits.

$OPK recently retook the 100 day MA on the weekly chart which hasn't been crossed since 2017 which could mark a strong trend coming soon.

$OPK is also looking at a breakout past the hourly resistance at $2.91 and also a potential gap fill at $3.00 to a target of $3.30

Also high short interest at 29%

Keep in mind I am not a financial advisor and this information is strictly for educational purposes only.