Option

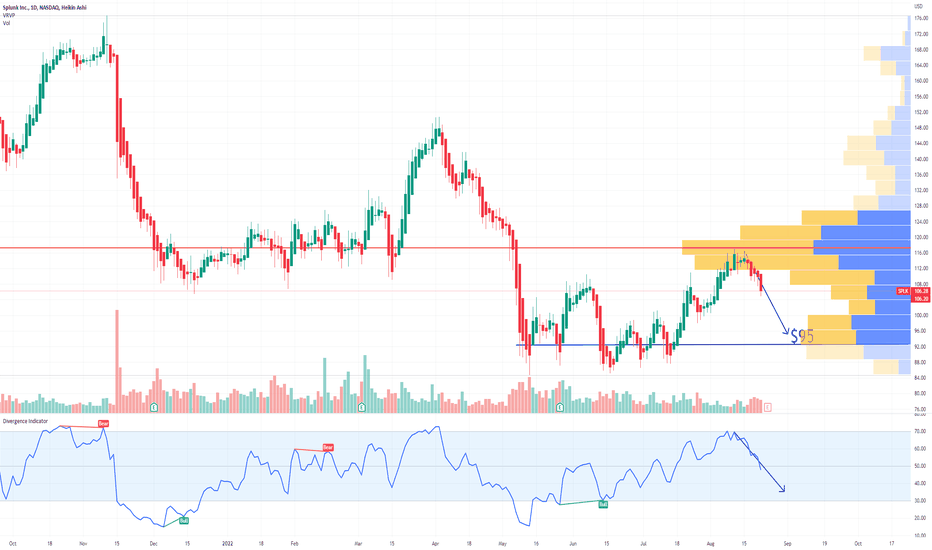

SPLK Splunk Options Ahead Of EarningsLooking at the SPLK Splunk options chain, i would buy the $95 strike price Puts with

2022-9-2 expiration date for about

$1.89 premium.

Looking forward to read your opinion about it.

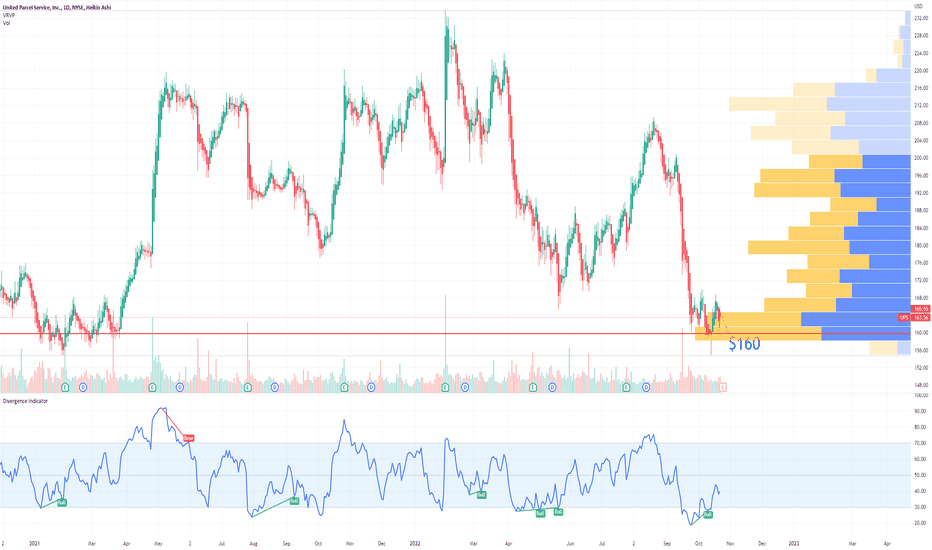

UPS United Parcel Service Options Ahead of EarningsMy recent experience with those global package delivery companies was extremely painful. The have raised their prices a lot, on some occasions you pay the same price to send something to another country than taking the trip yourself and deliver that package in person.

So i have tried to avoid UPS, like many of you, and go for smaller unknown companies. I think this attitude will reflect in the upcoming earnings.

Looking at the UPS United Parcel Services options chain, i would buy the $160 strike price Puts with

2022-11-4 expiration date for about

$4.85 premium.

Looking forward to read your opinion about it.

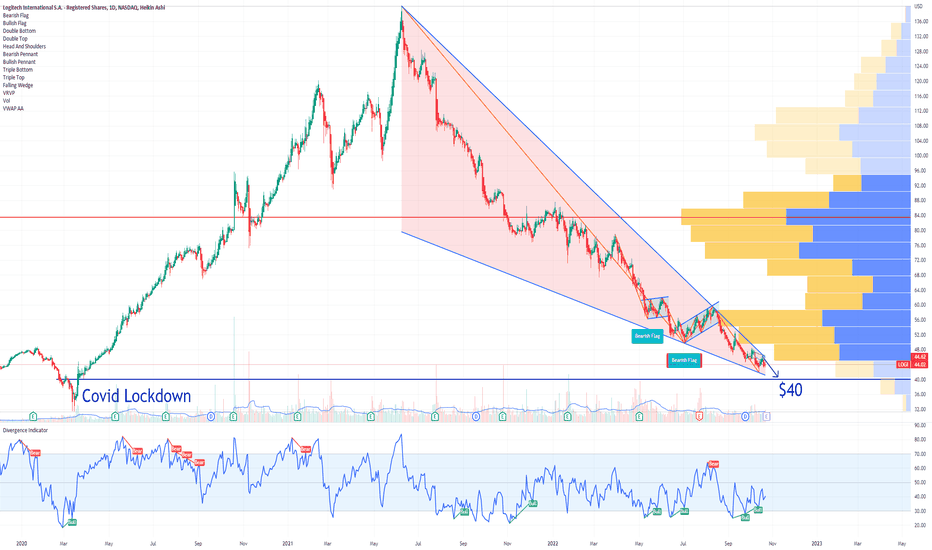

LOGI Logitech International Options Ahead of EarningsIf you haven`t bought puts or shorted the stock here:

then you should know that looking at the LOGI Logitech International options chain, i would buy the $40 strike price Puts with

2022-11-18 expiration date for about

$1.18 premium.

Looking forward to read your opinion about it.