Option

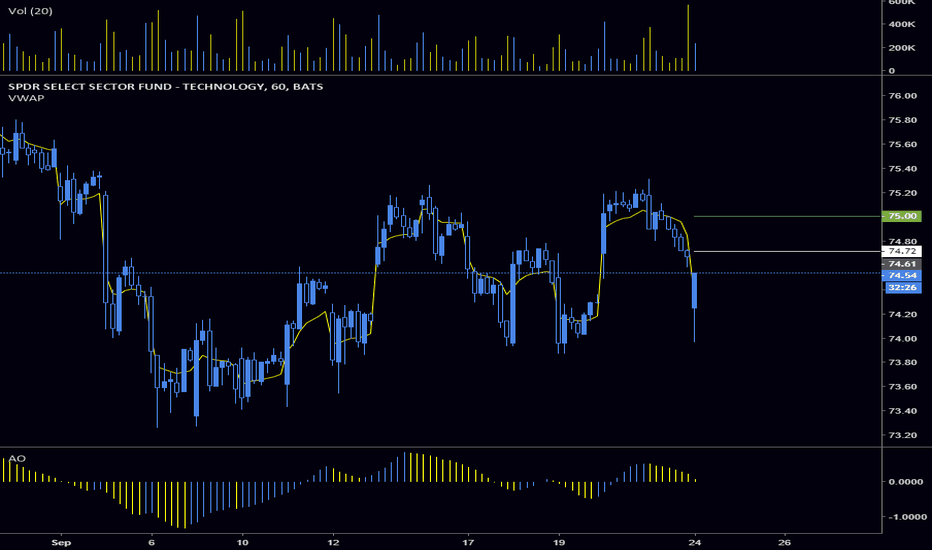

$XLK bullish credit spread for this #FridayHigh risk bullish credit spread on XLK . Solid gap down in tech this morning, but not showing signs of continuation bearish. This is one of the set-it and forget-it spreads as we will let it go all the way till exp.

Entry 74.33

Break even 74.72

Max profit 75

0.78:1 risk/reward

More info at wingtrades.com

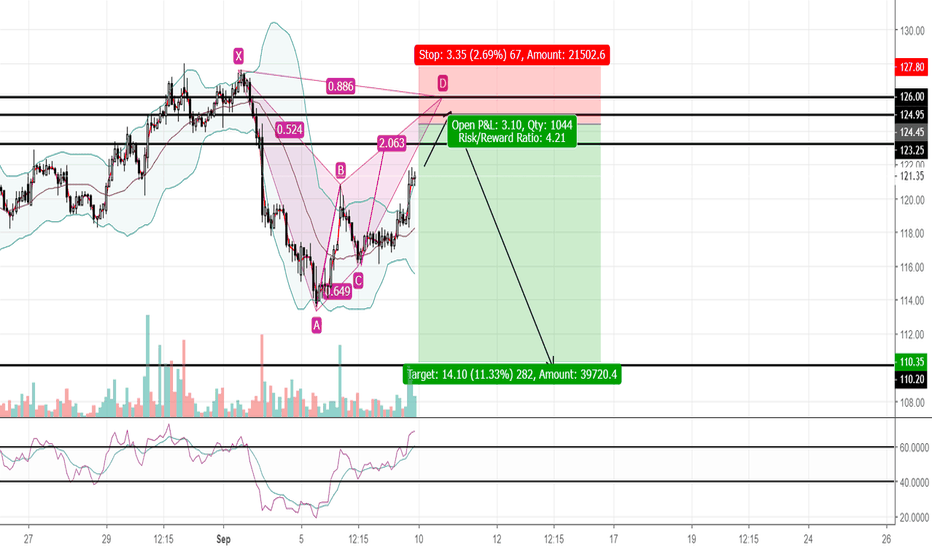

Bought ROKU Call Spread Jan 2020 55 C - Jan 2020 60C for $2.30/cEntered this Long Term Trade for $2.30/contract, since it completed a Long Term Breakout on a great percentage gain of more than 5%.

I will hold onto this trade until it is either close to max profit of $2.70/contract, which would yield 117% in about 15 months, or until the debit spread is cut in half.

First level of resistance is about $67 and after that $75.

Happy Trading

Lindosskier

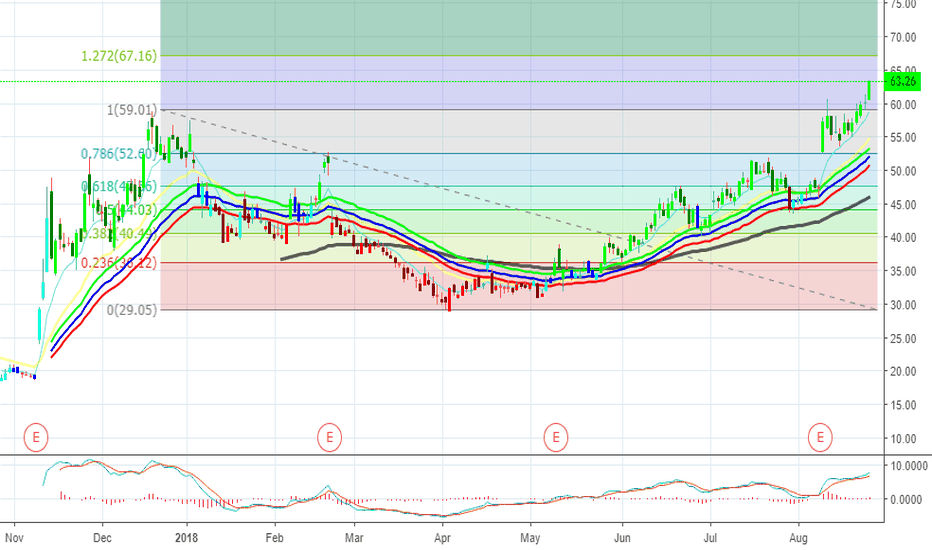

1 million dollar bullish option bet on twitterSomeone bought 10,000 February 27 calls for $1.18 debit. That's a 1.180.000 dollar bullish bet with out of the money call options. On 8 Feb 2018 twitter will come out with earnings. Better than expected? Chart is looking good in my opinion twitter is breaking-out. Last quarter was the first profitable one, at the moment it looks like the turnaround is working.

BTCUSD dos opcionesUn posible escenario para el BTC podría ser este... una nuevo rebote en la resistencia de la linea de tendencia acelerada para ir en busca del soporte de los 6000 dando un pequeño impulso alcista antes de romper levemente el soporte para tomar fuerza y cambiar la tendencia. Otro escenario posible seria que rompa el soporte de los 6000 para ir a buscar definitivamente el punto de los 4900 donde tocaria el punto fibonacci del 78%.

NVIDIA INDECISION!Right, I believe that a bullish stride on this stock is more than probable however we need to take into account the possibility of a false breakout.

We could potentially see prices rise to the upside target of 270.00 which is very achievable.

HOWEVER.

We need to also note that prices could break out of this ascending channel down to lows of 150.00 .

LET'S SEE WHAT HAPPENS NEXT, UPDATE COMING VERY SOON!

ROKU WHAT HAPPENED!Alright so this stock has plummeted down to the 30.00 Region.

It's very hard to tell where prices will go in the future, I believe that if prices break out of the 40.00 Region . We could gradually see prices going to the upside target of 60.00 . Wiping out all prior highs, I also believe that it's not farfetched anticipating a short on this stock down to lows of 20.00 .

I think you should stay out of this stock for now guys! Just my two cents of course!

STAY SAFE GUYS !

KEYCORP SHORT (UPDATE)So guys I'm not back tracking on my bias however I'm starting to think that my short bias on this stock is perhaps longer term. This stock simply doesn't have as much volume as a large cap company to support this sharp move down to our expected levels or perhaps breaking our lower bound. Of course adverse news about the company could help fuel this move however I'm not going to be banking on this. I say whilst we're still in the profit we pull back on our original bias and just go long on this soon, the big short on this stock is coming just not now. I don't believe our bias is short term at all.

Currently there's a chance to go long on this, potentially wiping out our current resistance. This could be a very lucrative trade however one thing to consider is the fact that our bias doesn't guarantee a profitable trade on this stock. It's ultimately the market's perception of this stock which will shape it's future.

HOWEVER.

Let's sit back and see what happens, expect more updates on this guys!

INTC - Possible double top formation Option short INTC seems forming a double top formation with strong negative money flow divergence. We think it provides a nice option trading opportunity, and we would consider July $44 Puts Currently $1.30

* Trade Criteria *

Date First Found- February 28, 2018

Pattern/Why- Possible double top formation

Entry Criteria- $44 July Puts @ $1.30 (Hit March 1, 2018)

Exit Criteria- $35.57

Stop Loss Criteria- N/A

Indicator Notes- Very strong divergence in the moneyflow

Special Note- Strong Twiggs money flow divergence

Please check back for Trade updates. (Note: Trade update is little delayed here.)

NETFLIX HAS BEEN PHENOMENAL, LET'S GO LONG AGAIN!So we may have an opportunity to go LONG once again on NETFLIX.

So as you can see, we're currently in between both our support and resistance region, I believe that we could potential retrace down to lows of 280.00 and shoot back up.

HOWEVER.

Something tells me that we're currently heading to the upside with full intent of penetrating our resistance zone. It wouldn't do any harm getting in at this point, our targets 360.00 & 380.00

TP: 360.00 & 380.00

PAYPAL GOING LONG?!PAYPAL HOLDINGS INC.

I believe that we have got an opportunity to go long here guys!

I would get in on this move around the 80.00 Region, up to highs of 83.00/85.00.

After that I would short my position down to the 75.00 Region !

Volume: 9.428M

EPS: 1.64

Market Cap: 94.657B

P/E: 48.83

TP: 83.00/85.00

DERM - Put Options Sold IV% for DERM options remains very high. I already have sold the 3/16 $25 Puts. I sold a couple more 3/16 $20 Puts. I will look for an opportunity to take partial gains on the $25P to reduce my overall risk exposure.

3/16 $20P @ $2.85

23 Days till expiration

DERM $27.22

D: -.0051

G: .0043

T: -.0011

V: .0008

IV: 245.42% (vs 49.92)

EL - Earnings option play, $97.50 August Puts currently $1.80EL is reporting before market tomorrow & we are looking for earnings option play here. It has heavy insider selling along with Twiggs moneyflow divergence. We think it has good downside potential with earnings, and we would consider $97.50 August Puts currently $1.80

* Trade Criteria *

Date First Found- August 17, 2017

Pattern/Why- Earnings Play (High Risk Trade); Upward channel

Entry Target Criteria- We would look for $97.50 August Puts currently $1.80

Exit Target Criteria- $92

Stop Loss Criteria- N/A

Please check back for Trade updates. (Note: Trade update is little delayed here.)

AMAT - Earnings option play, $42 August 18th/25th Puts $0.60/.76AMAT seems very good earnings play on the down side. It has good amount of insider selling. On the technical side it seems breaking down from an upward channel, and also looks like its forming a double top. Overall it seems it has good chance to decline with the earnings. To play this we would look for $42 August 18th or 25th Puts currently $0.60 and $0.76

* Trade Criteria *

Date First Found- August 17, 2017

Pattern/Why- Earnings Play (High Risk Trade); Upward channel breakdown, Double top

Entry Target Criteria- We would look for $42 August 18th or 25th Puts currently $0.60 and $0.76

Exit Target Criteria- $34

Stop Loss Criteria- N/A

Please check back for Trade updates. (Note: Trade update is little delayed here.)