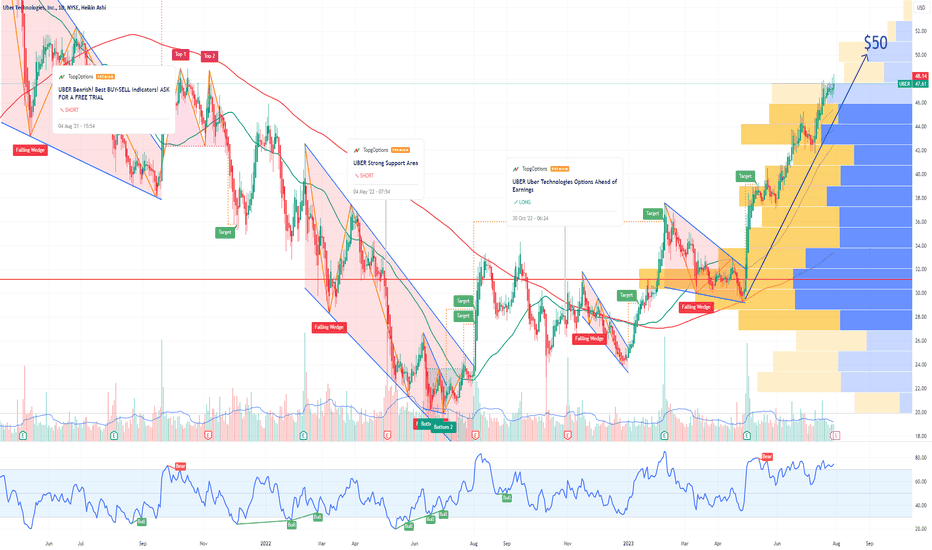

UBER Technologies Options Ahead of EarningsIf you haven`t sold UBER here:

or reentered here:

Then analyzing the options chain and the chart patterns of UBER Technologies prior to the earnings report this week,

I would consider purchasing the 50usd strike price Calls with

an expiration date of 2023-8-18,

for a premium of approximately $1.66.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Optionstrader

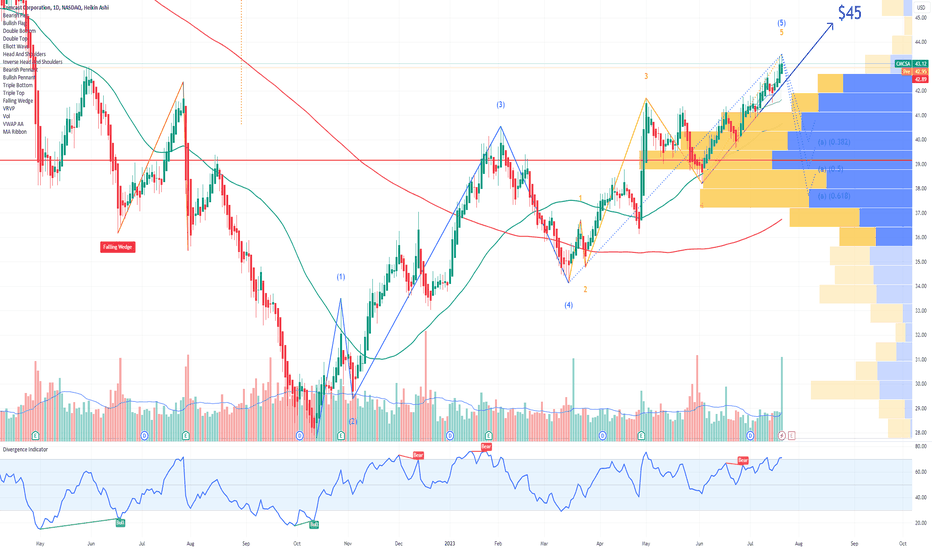

CMCSA Comcast Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CMCSA Comcast Corporation prior to the earnings report this week,

I would consider purchasing the $45 strike price Calls with

an expiration date of 2023-8-18,

for a premium of approximately $0.47.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

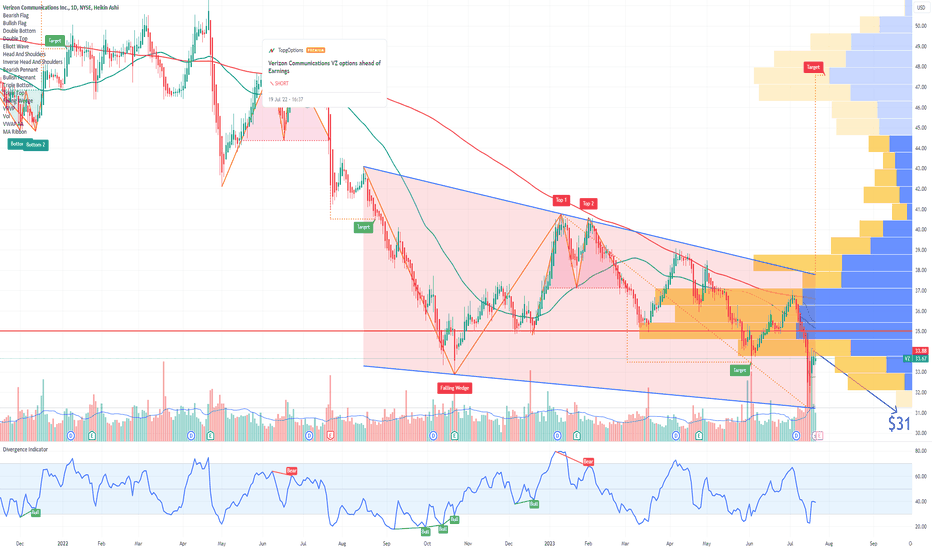

VZ Verizon Communications Options Ahead of EarningsIf you haven`t sold VZ here:

Then analyzing the options chain and chart patterns of VZ Verizon Communications prior to the earnings report this week,

I would consider purchasing the 31usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $1.08.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

NEM Newmont Corporation Options Ahead of EarningsAnalyzing the options chain of NEM Newmont Corporation prior to the earnings report this week,

I would consider purchasing the 42.5usd strike price Calls with

an expiration date of 9/15/2023,

for a premium of approximately $1.11.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

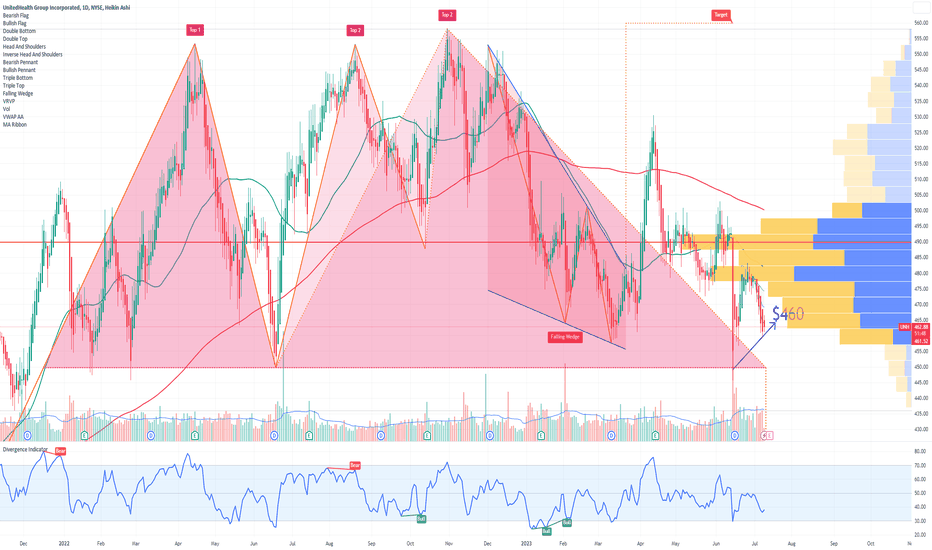

UNH UnitedHealth Group Incorporated Options Ahead of EarningsIf you haven`t sold UNH here:

or here:

Then analyzing the options chain of UNH UnitedHealth Group Incorporated prior to the earnings report this week,

I would consider purchasing the 460usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $36.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

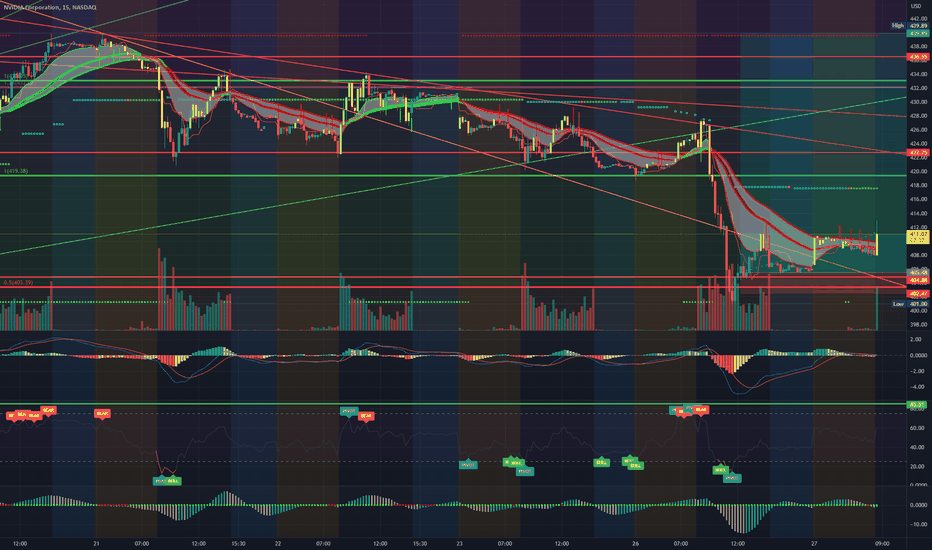

NVDA Calls - MyMI Option PlayzAfter making some decent profits from the NVDA PUTs we purchased last week, we have since purchased CALLs on NVDA to retest those $426 & $439.89 ATHs before finally losing steam unless it pushes beyond that ATH due to everyone fleeing to Tech Stocks, AI Stocks to be more specific. Will be traveling for the next few days so will keep up with this as much as I can over the next few days.

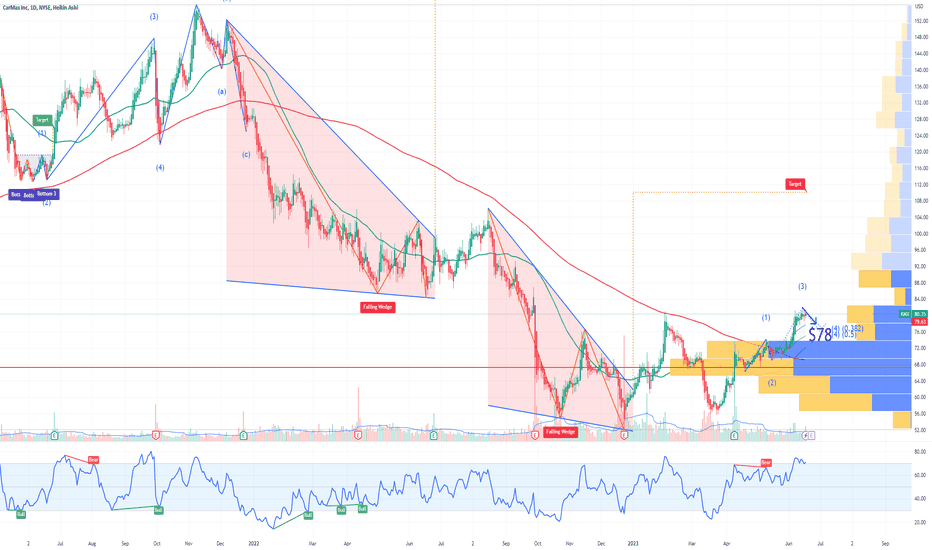

KMX CarMax Options Ahead of EarningsAnalyzing the options chain of KMX CarMax prior to the earnings report this week,

I would consider purchasing the 78usd strike price in the Puts with

an expiration date of 2023-6-30,

for a premium of approximately $3.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

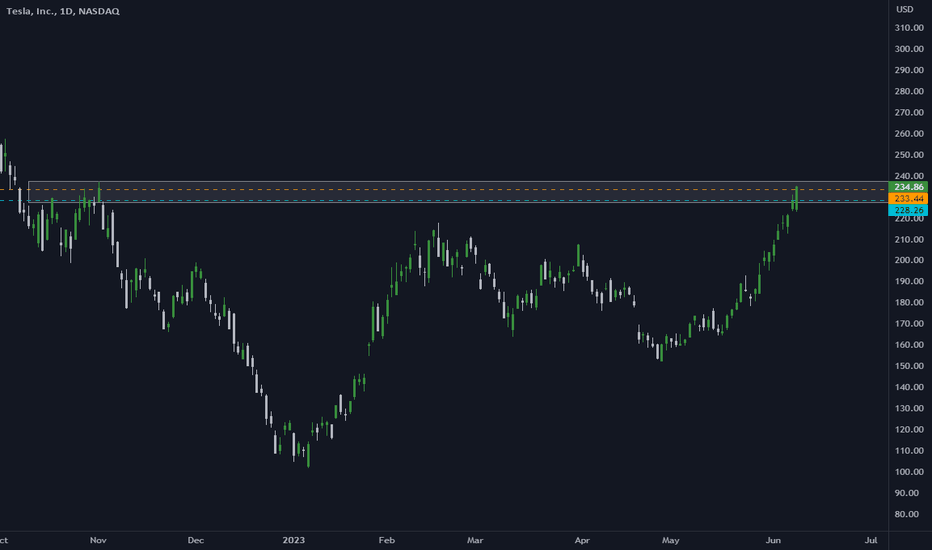

FADE THE POP on news. Tesla to the ground!NASDAQ:TSLA pops after hour on news, running up to as high as $246: "General Motors will follow crosstown rival Ford Motor in partnering with Tesla to use the electric vehicle leader’s North American charging network and technologies."

We often see stocks pop on news, which gives us a chance to fade the selloff. Beware, just as you should not try to catch a falling knife, you should not try to hold down a rocket ship. That's why I give a short time to declare itself.

NASDAQ:TSLA is pushing into the daily supply between $227-$237 from back in 11/2022. If buyers cannot hold, we have a long way down for the rest of the year with good risk to reward.

Buy time. An early entry is below $233.44 which is proven support/resistance and a sure confirmation of seller strength is a daily hold below $228.36

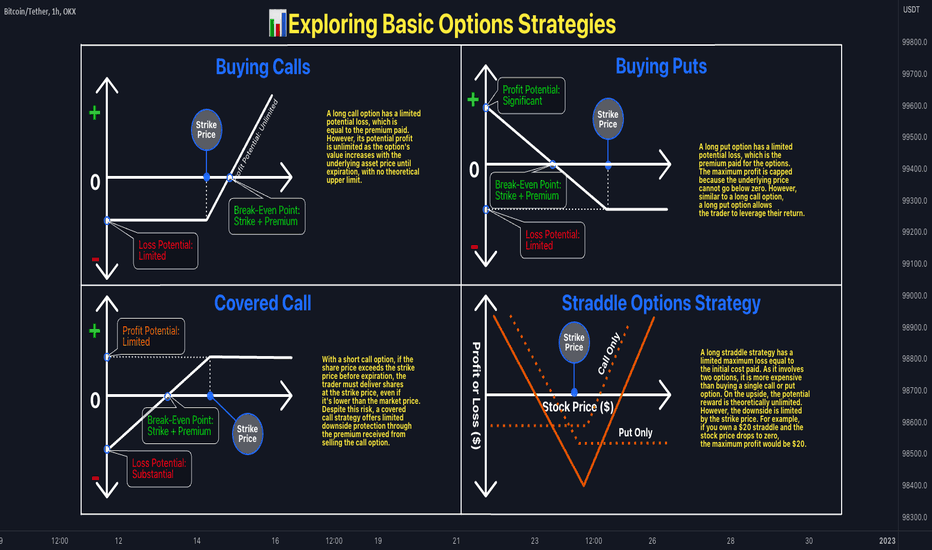

📊 Exploring Basic Options StrategiesOptions are contracts that grant buyers the right, but not the obligation, to buy or sell a security at a predetermined price in the future. Buyers pay a premium for this privilege. If market conditions are unfavorable, option holders can let the option expire without exercising it, limiting potential losses to the premium paid. Options are categorized as "call" or "put" contracts, allowing buyers to purchase or sell the underlying asset at a specified price. Beginner investors can employ various strategies using calls or puts to manage risk, including directional bets and hedging techniques.

🔹 Buying Calls (Long Calls)

Trading options offers advantages for those who want to make a directional bet in the market. It allows traders to buy call options, which require less capital than purchasing the underlying asset, and limits losses to the premium paid if the price goes down. This strategy is suitable for traders who are confident about a specific stock, ETF, or index fund and want to manage risk. Additionally, options provide leverage, enabling traders to amplify potential gains by using smaller amounts of capital compared to trading the underlying asset directly. For example, instead of investing $10,000 to buy 100 shares of a $100 stock, traders can spend $2,000 on a call contract with a strike price 10% higher than the current market price.

🔹 Buying Puts (Long Puts)

Put options provide the holder with the right to sell the underlying asset at a predetermined price before the contract expires. This strategy is favored by traders who hold a bearish view on a specific stock, ETF, or index but want to limit their risk compared to short-selling. It also allows traders to utilize leverage to capitalize on declining prices. Unlike call options that benefit from price increases, put options increase in value as the underlying asset's price decreases. While short-selling also profits from price declines, the risk is unlimited as prices can theoretically rise infinitely. In contrast, if the underlying asset's price exceeds the strike price of a put option, the option simply expires without value.

🔹 Covered Calls

A covered call strategy involves selling a call option on an existing long position in the underlying asset. This approach is different from simply buying a call or put option. Traders who use covered calls expect little or no change in the underlying asset's price and want to collect the option premium as income. They are willing to limit the upside potential of their position in exchange for some downside protection.

🔹 Risk/Reward

A long straddle strategy involves purchasing both a call option and a put option simultaneously. While the cost of a long straddle is higher than buying either a call or put option alone, the maximum potential loss is limited to the amount paid for the straddle. On the other hand, the potential reward is theoretically unlimited on the upside. However, the downside is capped at the strike price. For example, if you own a $20 straddle and the stock price drops to zero, the maximum profit you can make is $20.

👤 @QuantVue

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

⚖️OPTIONS TRADING: What are the Greeks?The Greeks are a set of mathematical measures used in options trading to assess and quantify various factors that influence the price and behavior of options.

📌 VEGA :

Vega is a measure of how much an option's premium will change in response to a 1% change in implied volatility. Implied volatility represents the market's expectation of the underlying security's future movement. When implied volatility is high, options tend to be more expensive, and when it is low, options are cheaper. Vega is particularly influential for options with longer expiration dates, as volatility has a greater impact on their prices. As an option approaches expiration, Vega decreases, while it increases as the underlying security moves closer to the strike price. Essentially, Vega is highest when the option is at-the-money and decreases as it goes out-of-the-money or in-the-money.

📌GAMMA

Gamma, represents the rate of change between an option's Delta and the price of the underlying asset. Higher Gamma values indicate that even small price changes in the underlying stock or fund can cause significant changes in the option's Delta. At-the-money options have the highest Gamma because their Deltas are most sensitive to underlying price movements. For instance, if XYZ is priced at $100.00 and a XYZ $100.00 call option is considered at-the-money, any price movement in either direction will push the option into either in-the-money or out-of-the-money territory. This high sensitivity to stock movement is reflected in the option's Gamma, making Gamma higher for at-the-money options.

📌THETA

Theta represents the theoretical daily decay of an option's premium, assuming all other factors remain constant. As time passes, options gradually lose value, and this loss is known as time value decay. The decay of time value is more significant as the expiration date approaches, particularly for near-the-money options. Theta does not behave linearly; instead, it accelerates as expiration nears. A higher Theta indicates that the option's value will decay more rapidly over time. Short-dated options, especially those near-the-money, tend to have higher Theta because there is greater urgency for the underlying asset to move in a favorable direction before expiration. Theta is negative for long (purchased) positions and positive for short (sold) positions, regardless of whether the option is a call or a put.

📌RHO

Rho measures an option's sensitivity to changes in the risk-free interest rate and is expressed as the amount of money the option will gain or lose with a 1% change in interest rates. Changes in interest rates can affect an option's value because they impact the cost of carrying the position over time. This effect is more significant for longer-term options compared to near-term options. Higher stock prices and longer time until expiration generally lead to greater sensitivity to interest rate changes, resulting in higher absolute Rho values. Rho is positive for long calls (the right to buy) and increases with the stock price. It is negative for long puts (the right to sell) and approaches zero as the stock price increases. Rho is positive for short puts (the obligation to buy) and negative for short calls (the obligation to sell).

📌DELTA

Delta is a measure that estimates how much an option's value may change with a $1 increase or decrease in the price of the underlying security. Delta values range from -1 to +1, where 0 indicates minimal movement of the option premium relative to changes in the underlying stock price. Delta is positive for long stocks, long calls, and short puts, which are considered bullish strategies. Conversely, Delta is negative for short stocks, short calls, and long puts, which are bearish strategies. A Delta of +1 is assigned to long stock shares, while a Delta of -1 is assigned to short stock shares. An option's Delta can range from -1 to +1, and the closer it is to +1 or -1, the more sensitive the option premium is to changes in the underlying security.

👤 @QuantVue

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

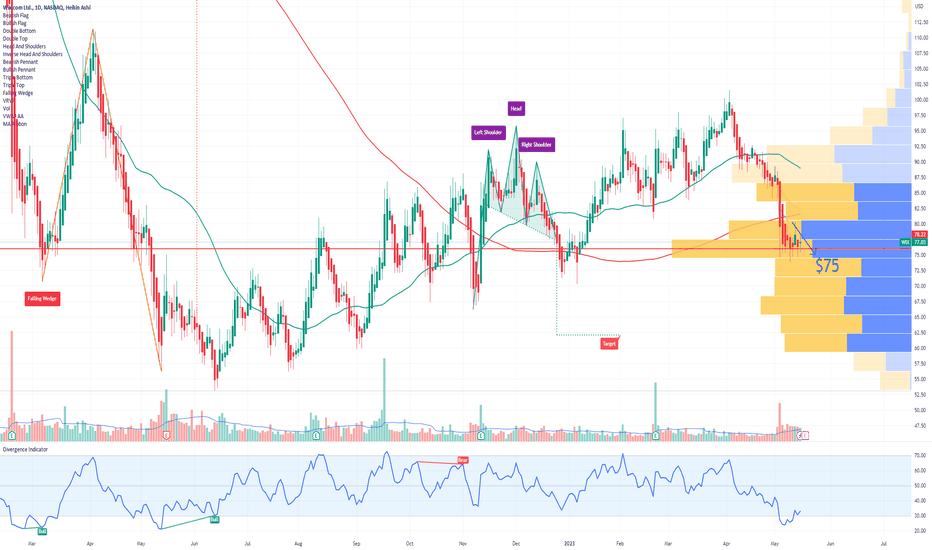

WIX Options Ahead of EarningsAnalyzing the options chain of WIX prior to the earnings report this week,

I would consider purchasing the 75usd strike price Puts with

an expiration date of 2023-5-19,

for a premium of approximately $1.70

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

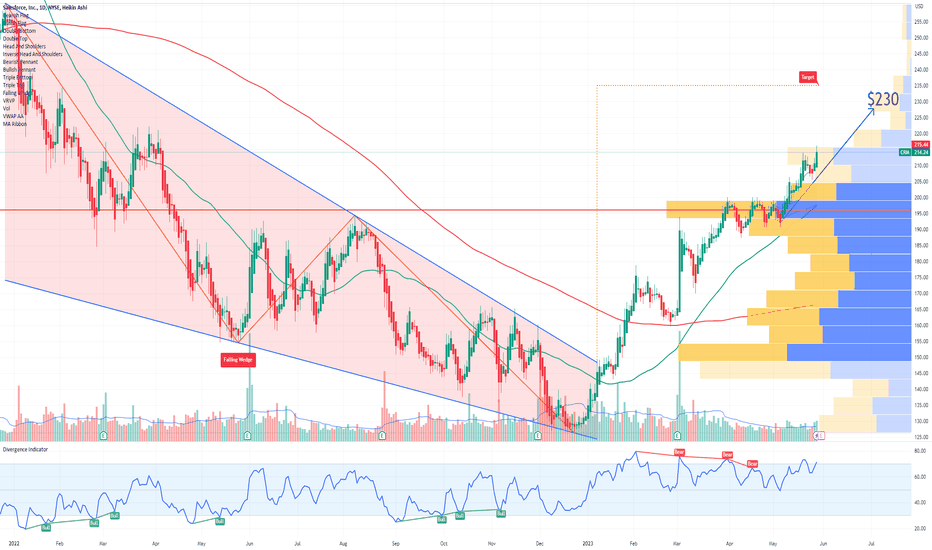

CRM Salesforce Options Ahead of EarningsIf you haven`t sold CRM here:

then Analyzing the options chain of CRM Salesforce prior to the earnings report this week,

I would consider purchasing the 230usd strike price Calls with

an expiration date of 2023-9-15,

for a premium of approximately $9.05

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

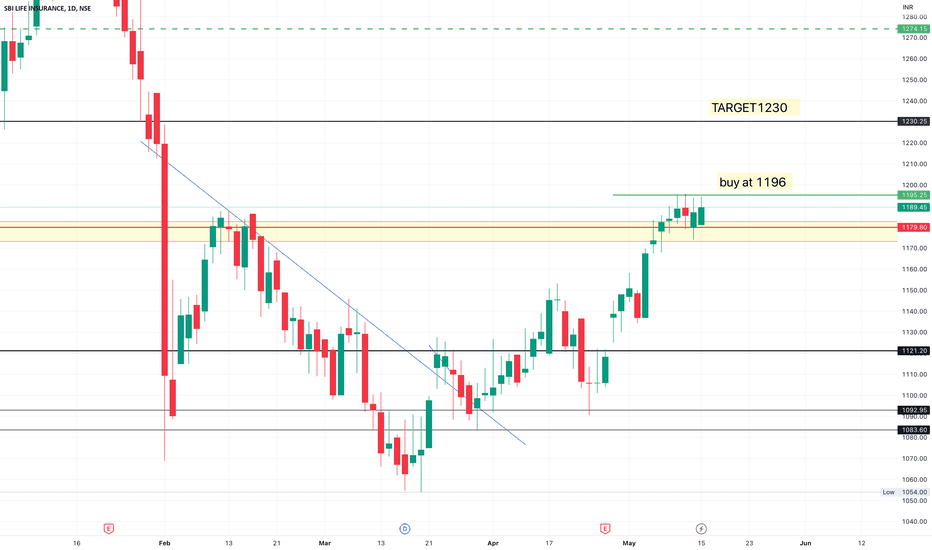

#SBILIFE... Looking good 16.05.23#sbilife.. ✅▶️

Intraday as well as swing trade

All levels given in charts ...

IF good potential seen then we work in options also

if activate then possible a huge movement Keep eye on this ...

We take trade only when it activates...

Possible to give good target

TRADING FACTS

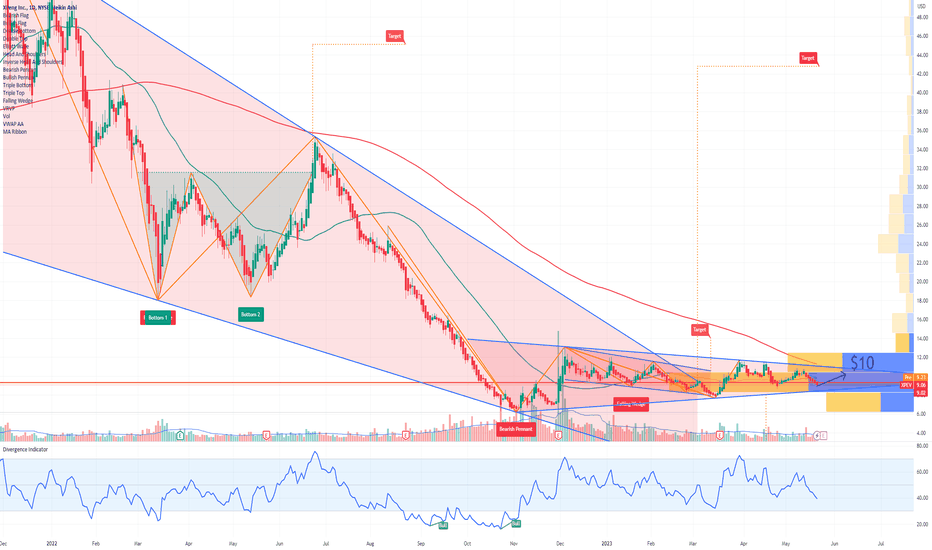

XPEV XPeng Options Ahead Of EarningsIf you haven`t bought XPEV here:

Then Analyzing the options chain of XPEV XPeng prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2023-7-21,

for a premium of approximately $0.68

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

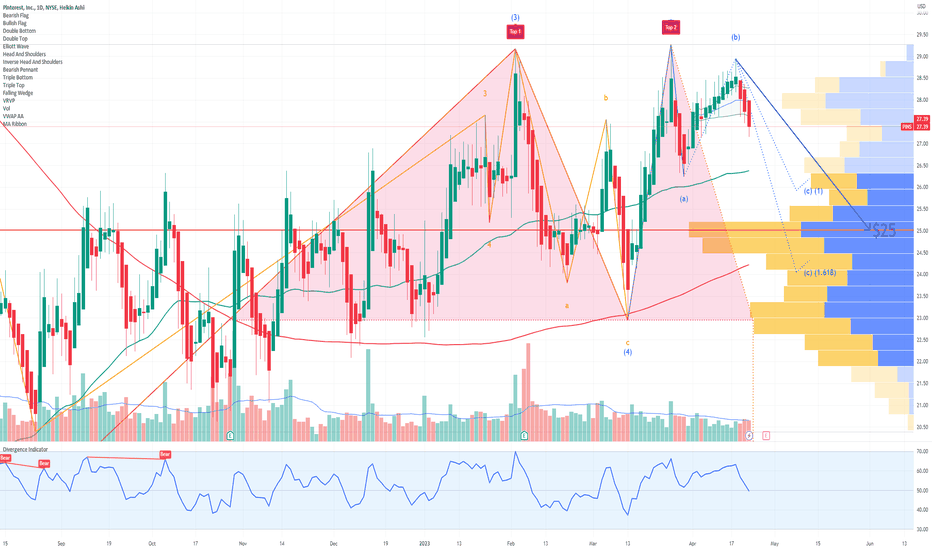

PINS Pinterest Options Ahead of EarningsIf you haven`t sold PINS here:

Then analyzing the options chain of PINS Pinterest prior to the earnings report this week,

I would consider purchasing the 25usd strike price Puts with

an expiration date of 2023-9-15

for a premium of approximately $2.17.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

I am interested to hear your thoughts on this strategy.

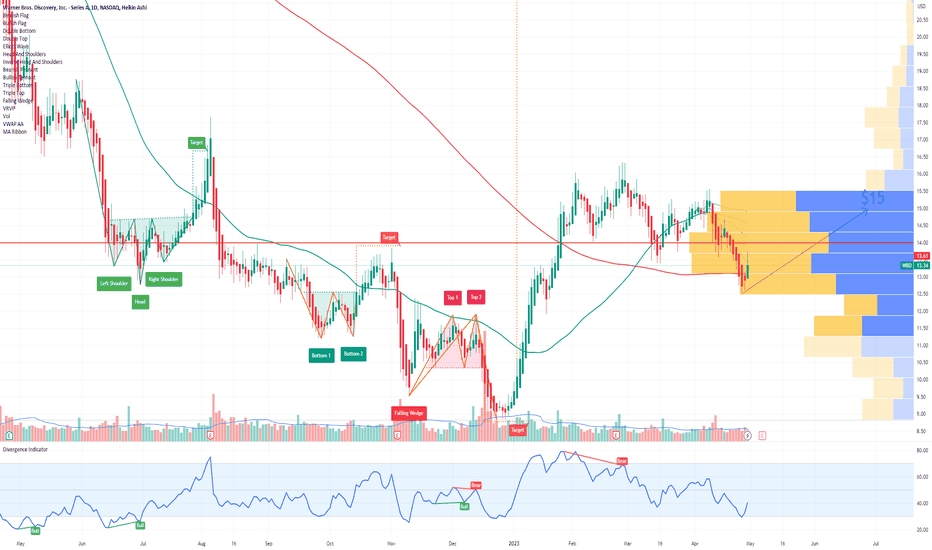

WBD Warner Bros Discovery Options Ahead of EarningsAnalyzing the options chain of WBD Warner Bros Discovery prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $2.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

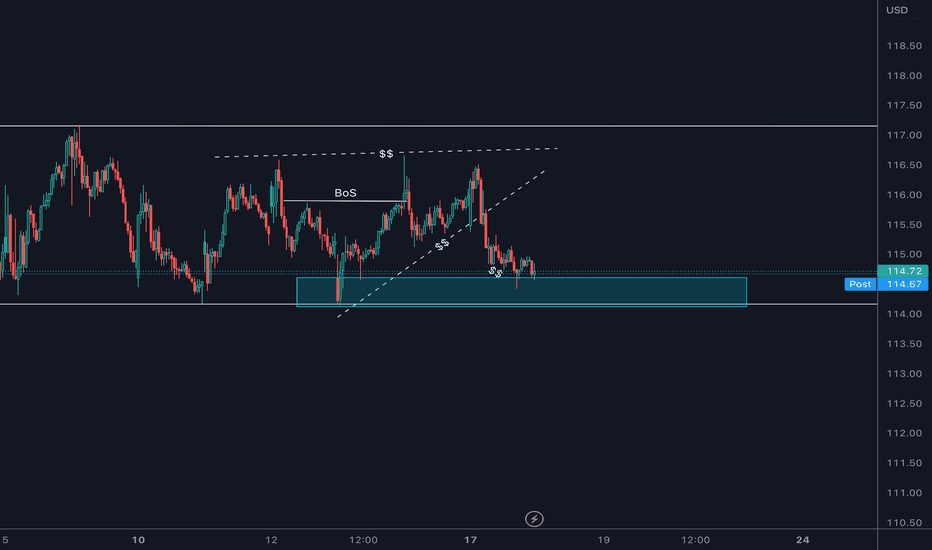

XOM: $117 Price Target?XOM has been ranging for a few weeks now, Getting back towards the HKEX:114 lows and it looks like that we have taken some liquidity and tested demand. Ideally, I'd grab a position from this demand zone but we will see what tomorrow brings us. Definitely wouldn't fight that HKEX:117 top and should be used as a target or potential short.

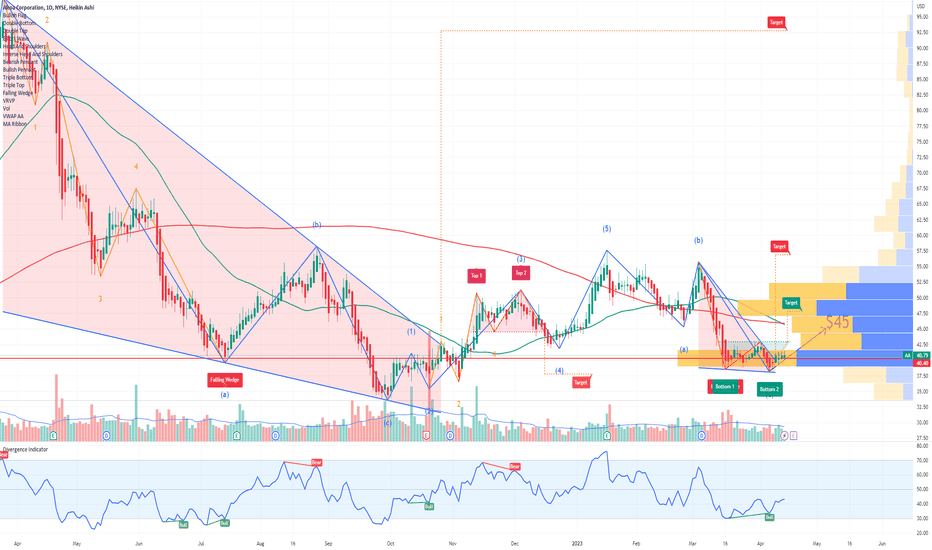

AA Alcoa Corporation Options Ahead of EarningsAnalyzing the options chain of AA Alcoa Corporation prior to the earnings report this week, I would consider purchasing

Calls with a 45usd strike price and an expiration date of 2023-5-19, for a premium of approximately $1.11.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

I am interested to hear your thoughts on this strategy.

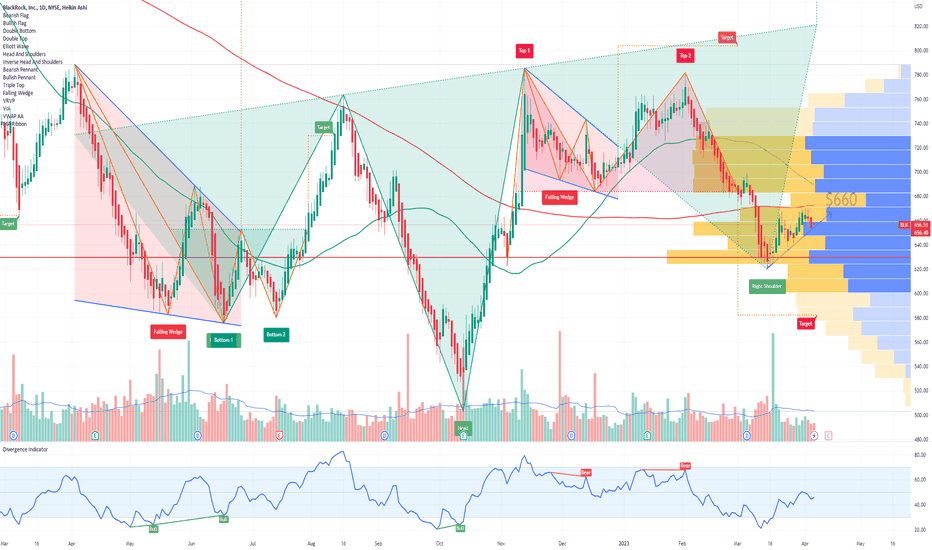

BLK BlackRock Options Ahead of EarningsAfter the last Price Target was reached:

Now looking at the BLK BlackRock options chain ahead of earnings , I would buy the HKEX:660 strike price Calls with

2023-4-14 expiration date for about

$12.05 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

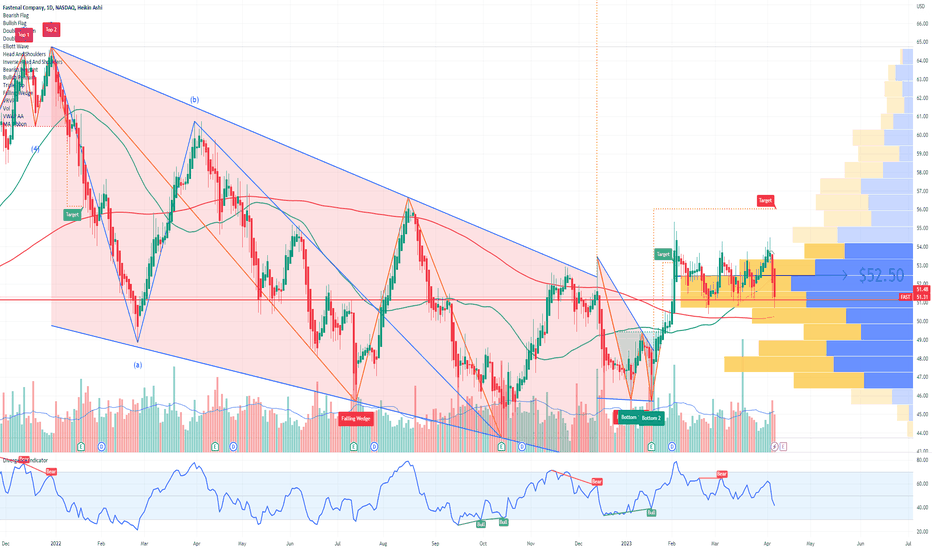

FAST Fastenal Company Options Ahead Of EarningsLooking at the FAST Fastenal Company options chain ahead of earnings , I would buy the $52.5 strike price In the Money Puts with

2023-8-18 expiration date for about

$3.80 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

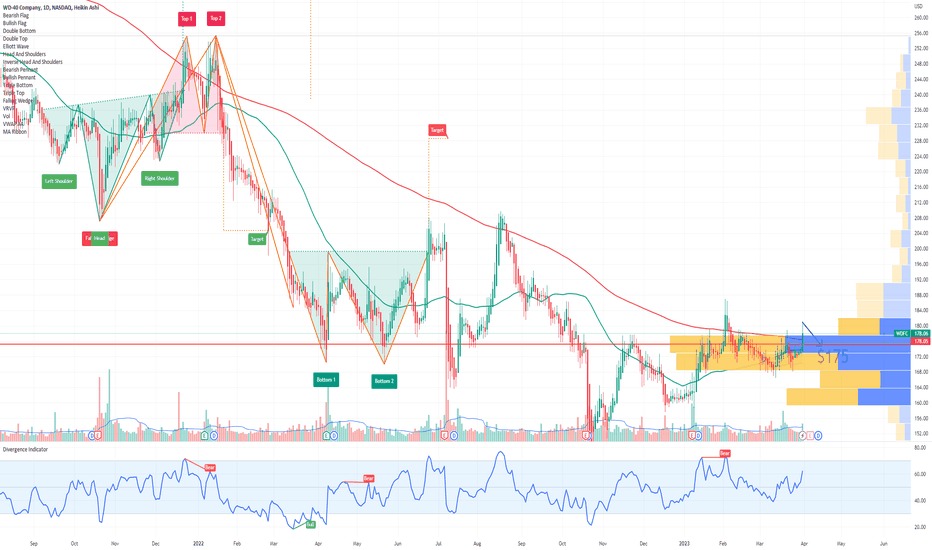

WDFC WD-40 Company Options Ahead Of EarningsLooking at the WDFC WD-40 Company options chain ahead of earnings , i would buy the $175 strike price Puts with

2023-4-21 expiration date for about

$6.40 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

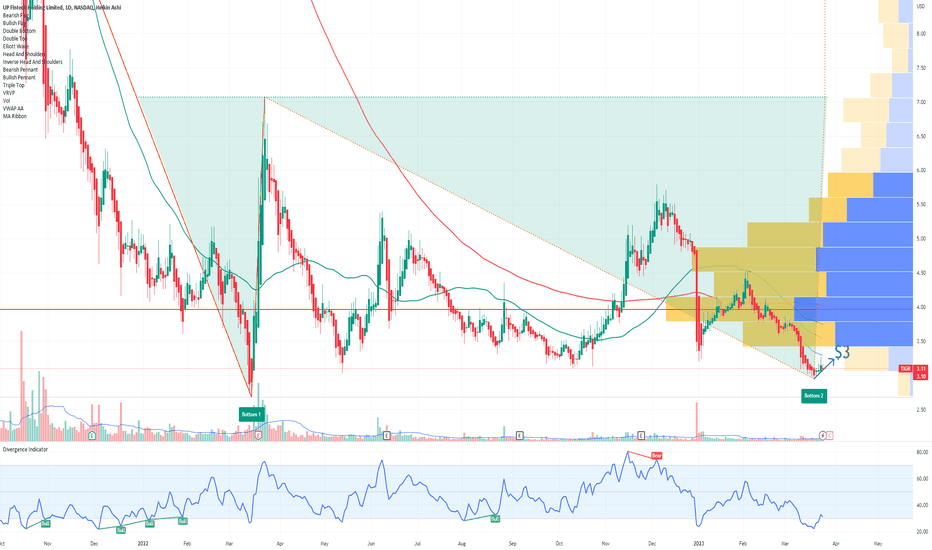

TIGR UP Fintech Holding Options Ahead Of EarningsIf you haven`t bought TIGR here:

Then you should know that looking at the TIGR UP Fintech Holding options chain ahead of earnings , I would buy the $3 strike price at the money Calls with

2023-4-21 expiration date for about

$0.24 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.