Optionstrader

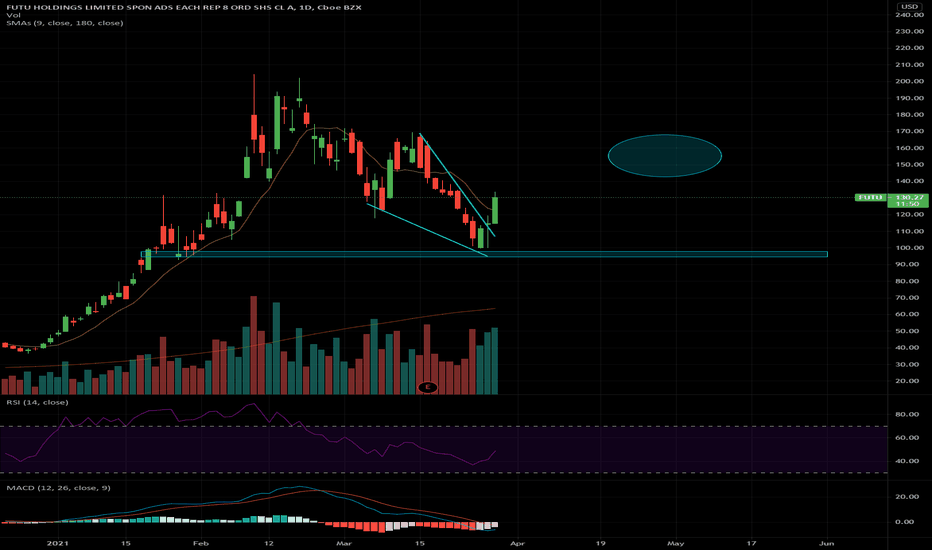

Naked PUT for $TME crash with 87% Probability of ProfitMy tasty pick for yesterday: Tencenrt Muc Entertainment big crash.

(1) Prev. support holds

(2) Fibo resistance at fast fall holds

Max profit: $120

Probability of Profit: 87%

Profit Target relative to my Buying Power: 31%

Max loss with my risk management: ~$150

Req. Buy Power: $380 (max loss without management at expiry, no way to let this happen!)

Tasty IVR: 104 (ultra high)

Expiry: 56 days

Sell 2 TME May21' 15 Put

Short put option for 0.6 cr each.

Stop/my risk management : Closing immediately if daily candle is closing BELOW the box, max loss in my calculations in this case could be 150$. Probability of loss in this way: ~7% (!!!)

Take profit strategy: 60% of max.profit in this case with auto sell order at 0.24db. Probability of profit this way: ~85%.

Of course I'll not wait until expiry in any case!

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW , and for fresh option ideas FOLLOW ME( @mrAnonymCrypto ) on tradingview !

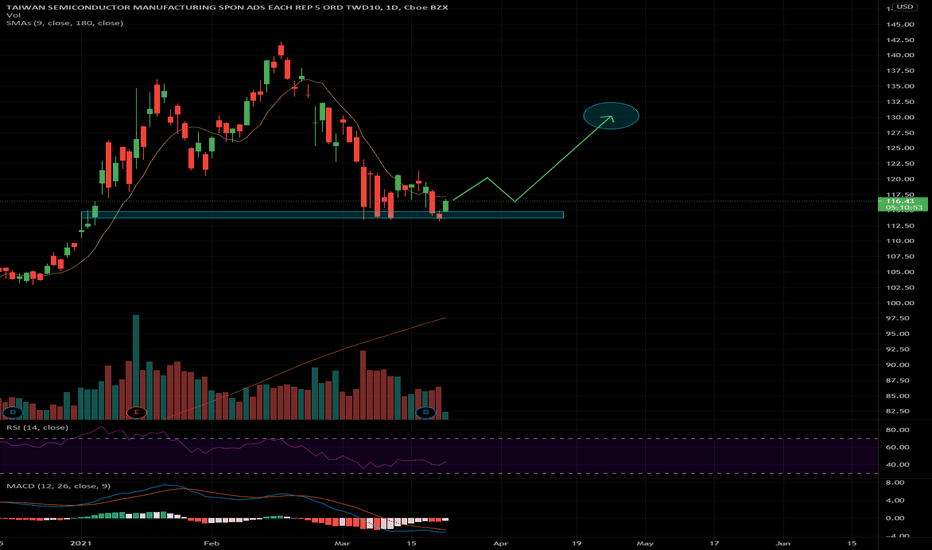

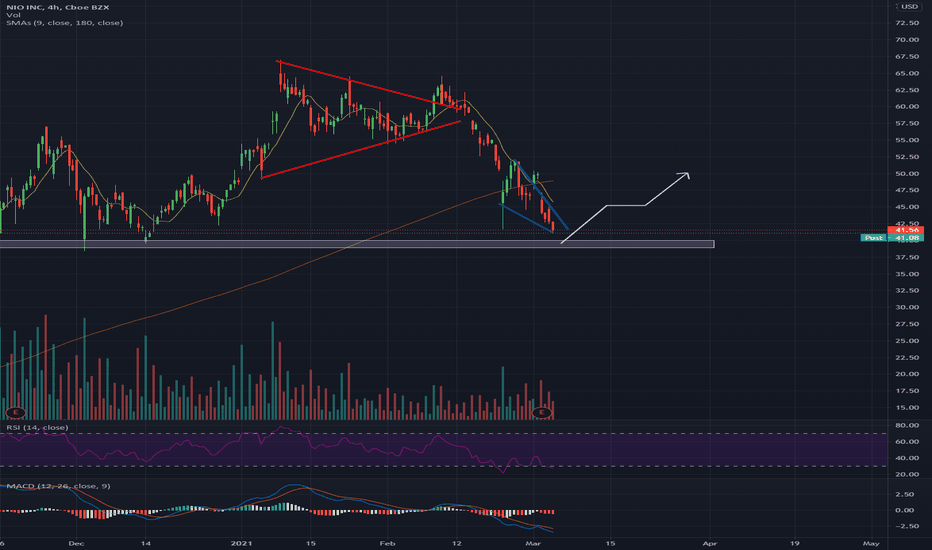

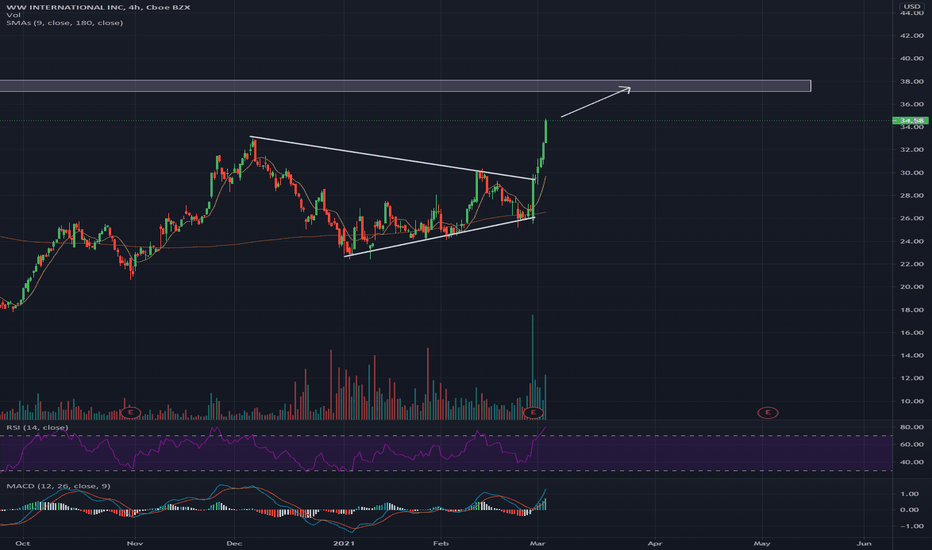

PLTR DEMO DAY RUN UP (April 14th)$PLTR 4hr and 1hr. $20.96 is a super key level that we bounced from.

Support: $20.96

Resistance: $23.19 ,$25.17, $26.95,

Overall PT $30 (gap)

Should run up the closer we get to demo day (April 14th)

1hr chart

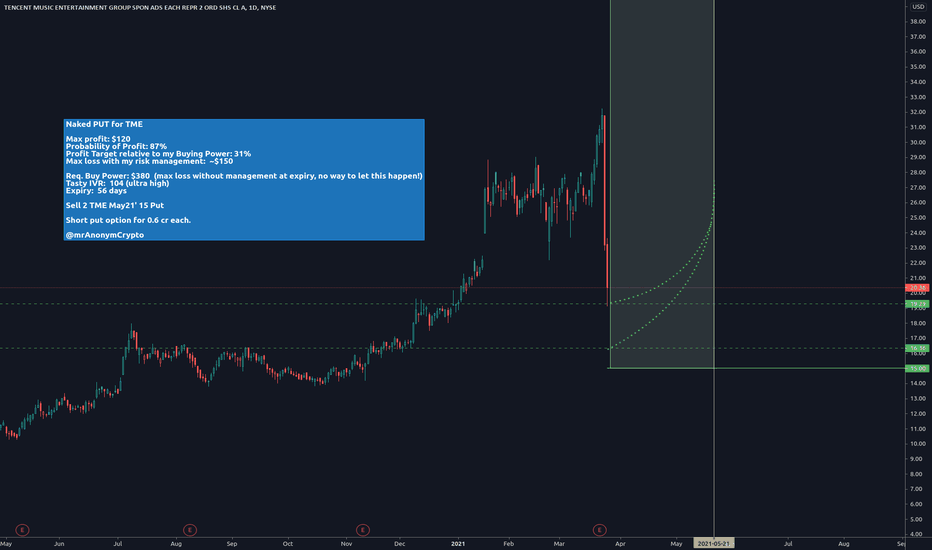

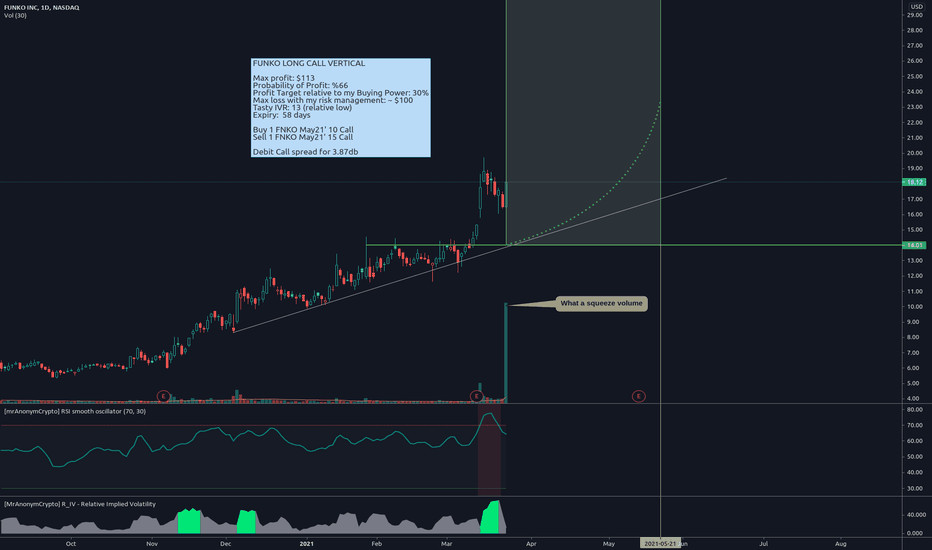

FUNKO LONG CALL VERTICAL: high PoP (66%) and good ROI (30%)Look at that volume in uptrend!

Max profit: ......................................................... $113

Probability of Profit: .............................................66%

Profit Target relative to my Buying Power: ......30%

Max loss with my risk management: ...................~ $100

Buy Power: $387 (max loss without management at expiry, no way to let this happen!)

Tasty IVR: 13 (relative low)

Expiry: 58 days

Buy 1 FNKO May21' 10 Call

Sell 1 FNKO May21' 15 Call

Debit Call spread for 3.87db, because IVR is relative low.

Stop/my risk management : Closing immediately if daily candle is closing BELOW the box, max loss in my calculations in this case could be 100$. Probability of loss in this way: ~15% .

Take profit strategy: 60% of max.profit in this case with auto sell order at 4.55cr. Probability of profit this way: ~85%.

Of course I'll not wait until expiry in any case!

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW , and for fresh option ideas FOLLOW ME( @mrAnonymCrypto ) on tradingview !

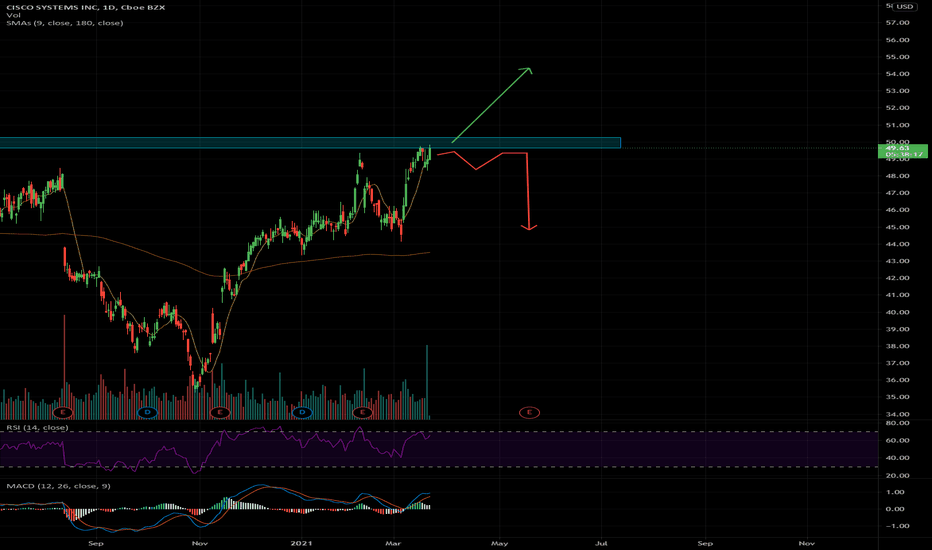

CSCO possibility to retest 54$Two options for CSCO before the next earnings. First option if CSCO is able to close above 50-51$ we will be able to see it run towards 54$ before having some resistance. Second option if it fails to stay above 50-51$ then most likely it will continue on some sideways trading and probably flush on earnings towards 45$. But I wouldn't suggest playing the earnings since its a 50/50 coin flip.

Keep it on your watchlist!

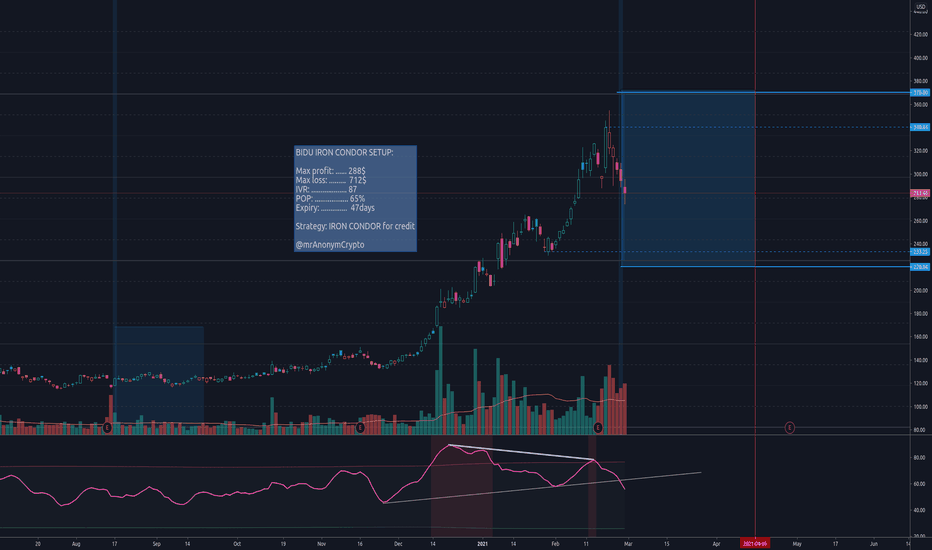

BIDU IRON CONDOR with high Probality of ProfitHi everybody!

After a very big break - MrAnonymCrypto back on board!

The past year I'm spent for learning and developing my new trading system and indicator pack and full trading strategy system for option trading of the us stock market. I'm tired to waiting for any bitcoin daytrades and unregulated price moves: those instruments eated my life and time.

Ever since I’ve only been dealing with the stock market for up to an hour a day: my life has changed - in a positive direction.<3

Today I'm releasing the first live tradig publication of my indicator: the Iron Condor Hunter . // If you are new in the option's world I'm recommending to learn options first via tastytrade youtube videos //

More about my Iron Condor Hunter script in advance:

This script is for neutral credit strategy trades. This script indicates the secure Iron Condor setups automatically on any liquid+volatile instrument, based and calculated with auto Murrey Math level script and current price actions, and IVR. (MurreyMath is my other script, telling more later) If the script indicates new potential setup: you can see a blue background with the levels of the Iron Condor wings, automatically! You can check the success rate of the script for the past with same setup I've designed this indicator for 45-60 days expirations, (because you can exit automatically at 50% profit in 30 days, if the instrument stays inside your original range!)

And now, let's look an today live example: BIDU

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

REASONS

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

(1) Backtesting the indicator

17 Iron Condor detected in the past 10 years, with 100% succes rate, with exact range detection at the beginning.

Today I'm catched another signal, so I'm grabbing the opportunity!

(2) The trading range & IVR

Today Iron Condor Hunter script detected the 372-221 range for safe-play this setup.

Because the most volatile expriation is the April 16th in the 45-60day range: I'm playing this for credit.

The (tastytrade) IVR is high (above 80) - this is very high Implied Volatility Rank - safe for credit play, the instument is liquid.

Good Defined Strikes:

Sell 1 BIDU Apr16' 220 put Buy 1 BIDU Apr16' 210 put

Sell 1 BIDU Apr16' 370 call Buy1 BIDU Apr16' 380 put

(3) Divergence on my oscillator

As you can see: the very obvious divergence is detected at the overbought levels.

This and the formation meaning for me: some correction started.

No kind of event ( divident ) coming in the next 60 days, so I'm not expecting more significant price movement.

(4) Define safe zones

At Iron condor setups I'm always define some "safe-zone" : for upside and downside too.

Safe zones meaning for me: I can sleep peacefully until the price is moving between these edges.

BUT! If the safe zone beaks: my eyes on the final strikes.

Another seat beld is the 0.618 fib-retrace level, because if the price is falling straight down: at this level we are expecting some resistance. But in current case: the fib 0.618 level is inside our range.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

SUMMARY - MY TRADE SETUP

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Max profit: $288 Max loss: $712 IVR: 87 Probability of Profit: 68% Expiry: 50 days Strategy: 67.7% wide delta neutral Iron Condor for credit Risk management : I'm closing the trade immediately - if the daily bar closing outside my strikes - and I'm cutting my loss. (no matter what I'm believing)- usually I'm losing mutch less than my max profit in this case.

Profit management: I'm sending an order at the 50% of max profit, immediately after my position successfully opened

Welcome any comments:

* whether about the options, my indicators in the future.

* in private, I will be happy to help you with any questions about the option for free.

* are you interesting in options, or only "when bitcoin moon"?

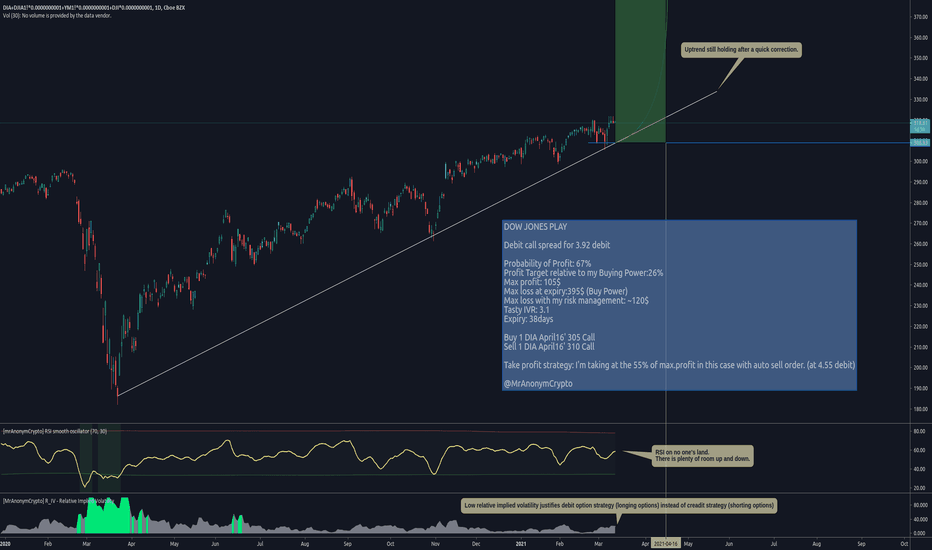

DOW JONES debit spread play with good chanceI've opened a LONG CALL VERTICAL spread yesterday end of day for Dow Jones.

Correction maybe consolidated, I'm expecting some short squeeze soon.

Otherwise the probability of profit is godd, and the trade is manageable because of lower strikes.

(1) Relative Implied Volatility is low

I'm using my Relative implied volatility indicator to determine the credit/debit type of option trades.

Low relative implied volatility justifies debit option strategy (longing options) instead of creadit strategy (shorting options)

(2) Neutral RSI - no oversold or overbought

Uptrend still holding after a quick correction.

My Smooth RSI indicator is in no one's land.

There is plenty of room up and down.

(3) Observing other Down Jones instrument

Every Down Jones instrument pretty same indicator values for RSI and RIV too: DJI, YM, DJIA, DIA

CONCLUSION:

I'm using LONG CALL VERTICAL -

Buy 1 DIA April16' 305 Call Sell 1 DIA April16' 310 Call

Debit call spread for 3.92 debit

Probability of Profit: 67% Profit Target relative to my Buying Power: 26% Max profit: 105$ Max loss at expiry: 395$ (Buy Power) Max loss with my risk management: ~120$ Tasty IVR: 3.1 Expiry: 38days

Stop/my risk management: Closing immediately if daily candle is closing below $309

Take profit strategy: I'm taking at the 55% of max.profit in this case with auto sell order. (at 4.55 debit)

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW, and follow my fresh ideas ( @mrAnonymCrypto on tradingview ).

Using VXX as VIX alternative with good P/L

Yesterday I've played an alternative VIX instrument.

I've tired to searching good ROI or P/L rates at VIX $20 VIX support, so I've searched some alternative, but VIX related instrument.

Lets see what can give us this BARCLAYS BANK VIX Short ETN (=VXX)

(1) Yearly support + incoming buy volume

The lowerst value of the previous year was $13.

In the past month significant buy volume arrieved.

Combined this two reason could lead into sidewalking or bounceback from this level.

VXX is a Trust, so we see volume displayed (unlinke in the case of the VIX)

(2) VIX play ROI vs VXX ROI

You could see VXX like an ETN alternatative of the VIX.

Same dates for big edges, and melting down between the big edges.

Compared this two instument's ROI: the conclusion is obvious.

VXX ROI at support $13 for April with vertical spread: 37/63 = 58%

VIX ROI at support $20 for April with vertical spread: 20/80 = 25%

CONCLUSION

I'm buying a few call spreads for April, because the IVR not so high.

I think this is a very good P/L rate with a very high probability of profit!

Target: ............. 52% Max profit: ...... $111 Max loss: ......... $189 IVR: ................... 20 POP: .................. 65% Expiry: .............. 44days

Strategy: long call vertical spread (average IVR)

Sell 3 VXX April 16' $13 call Buy 3 VXX April 16' $12 call

Stop: Closing immediately if daily candle is closing below $13.

Take profit strategy: I'm taking at the 65% of max.profit in this case.

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW, and follow my fresh ideas ( @mrAnonymCrypto on tradingview ).

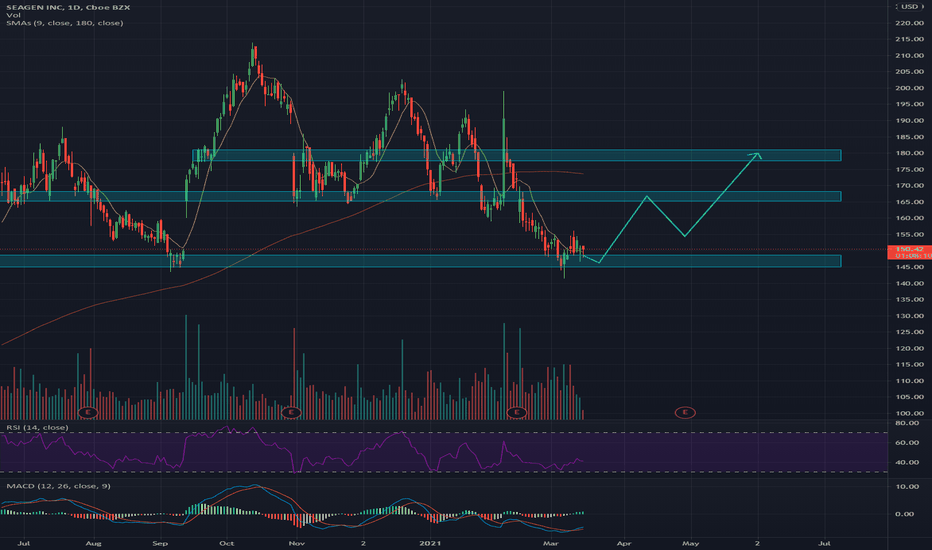

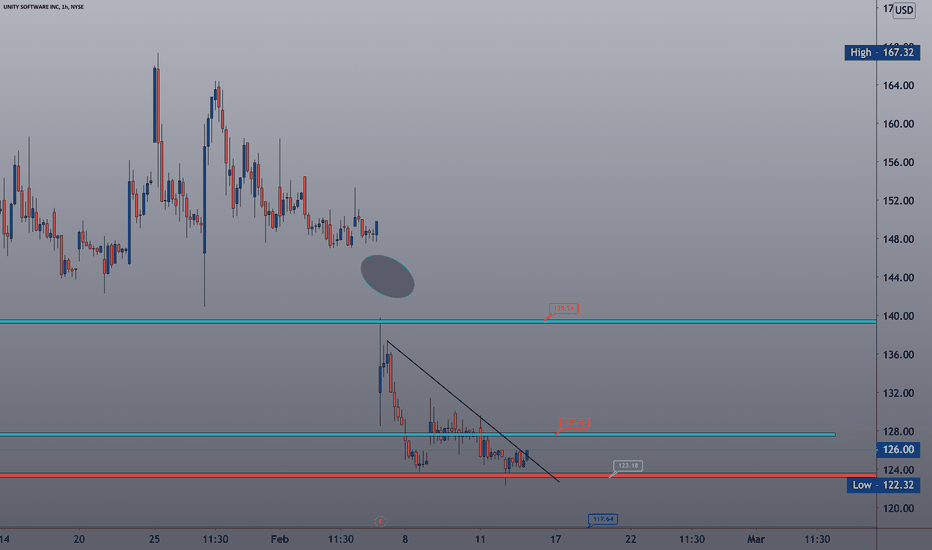

SGEN upside potential to 165$ and then 180$SGEN might deep a little lower towards the strong support of 145$ before retesting 165$ and 180$ previous resistance levels.

Earnings are in the way (29 APR) it might dip towards 145-155$ and continue towards 180$

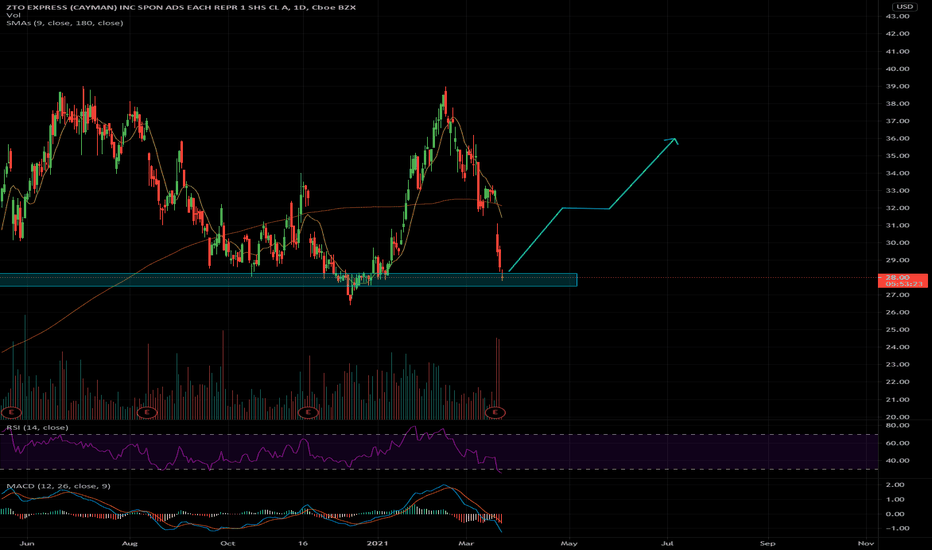

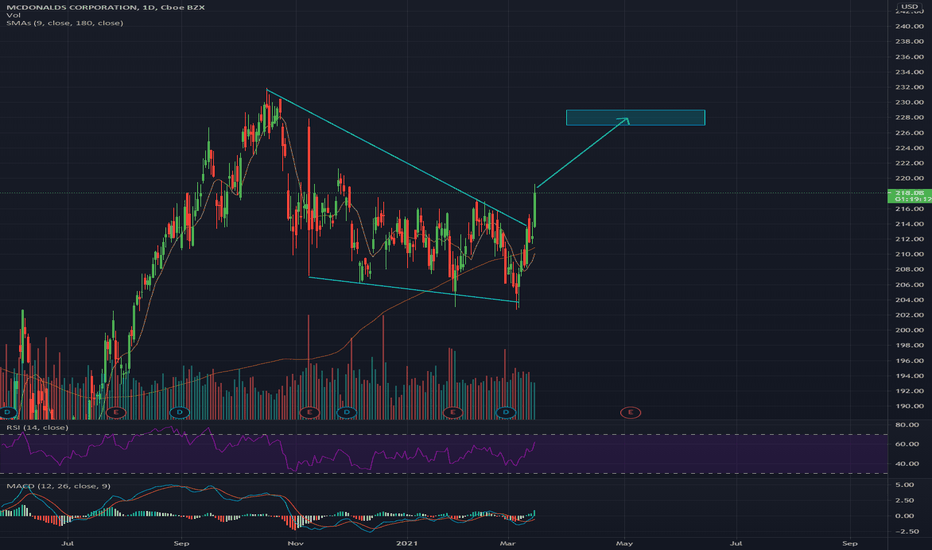

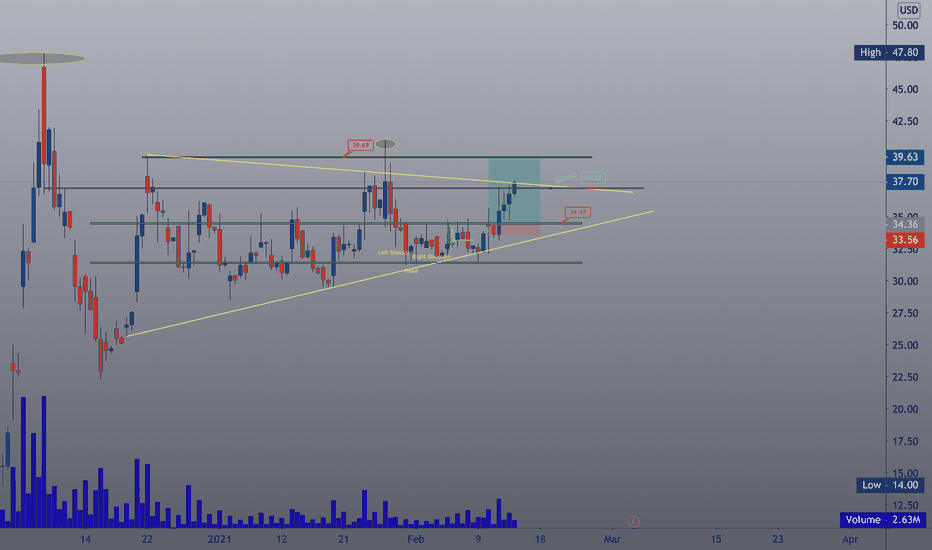

CCL possible retest of previous resistance level of 32$If CCL can stay above 28-29$ which are the most recent high and use it as support we could see it reach 32$ and possbily higher.

However we have earnings in the way (30 Mar) which might impact this price prediction since earnings are 50/50 coin flip. So we could see a pull back towards 28$ and continue towards 32$.

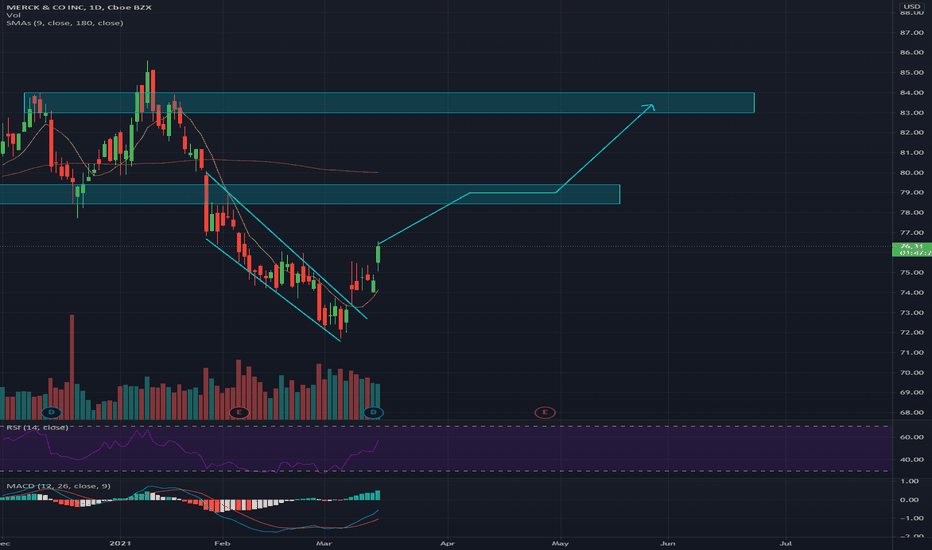

MRK broke out from downtrend on an uptrendBroke out from bearish trend that started on 12 Jan currently on an uptrend. Will be retesting previous support levels of 78-79$.

Once that level is reached possible boring sideways trading until we retest previous levels of 83-84$.

Keep it on your watchlist.

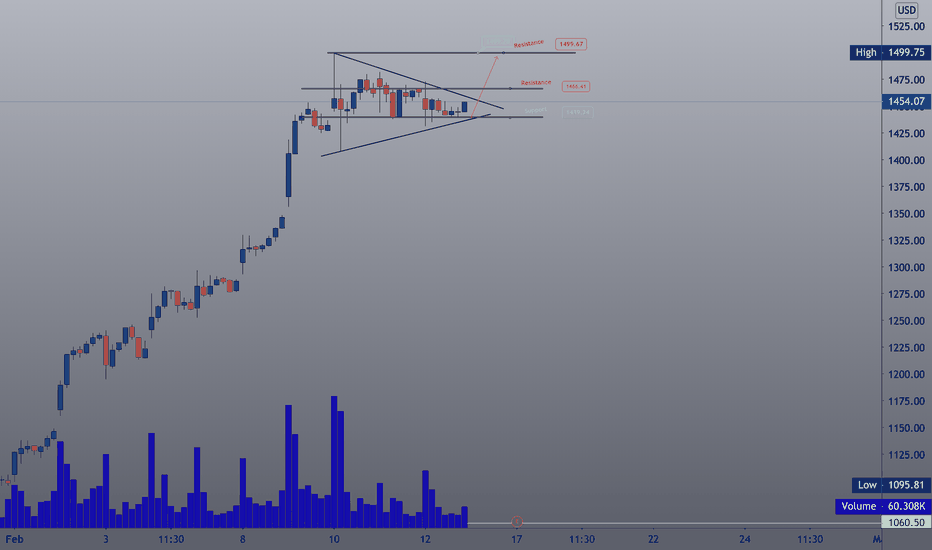

SHOP to $1499Shop is in a nice triangle. support is 1439.24 and first resistance is 1466.41 overall move is to 1499.67