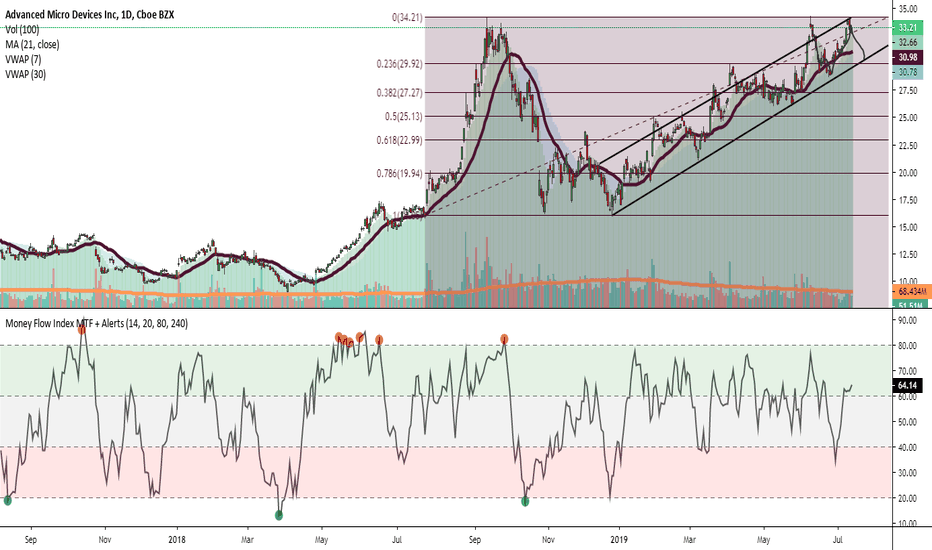

AMD Long Position (Naked Call)

AMD can offer a tremendous profit opportunity on the daily chart if you are patient and enter at the right time. The strategy I am using on it is buying long on any pull backs to its Fibonacci levels. These opportunities can offer 30%+ in price appreciation over a 60 day period in its current channel up from December 2018.

- AMD is currently in a nice channel up pattern and has been respecting this since about December 2018

- At market close 7-Day VWAP is trading about the 30-Day VWAP which is a positive sign of price appreciations

- Price is also trading above the 21-Day EMA which can indicate the stock is in an uptrend

- We can also see how price respect the retracement level and we just bounced of the upper trend line of the channel

- We can see a potential negative divergence on the MFI which could indicate we will go back and test the previous Fibonacci and lower trend line of the channel

- I will be looking for this scenario to play out in the next couple weeks or so.

- I will post any updates as they develop

Yours in Mastery,

Khalil

Optiontrading

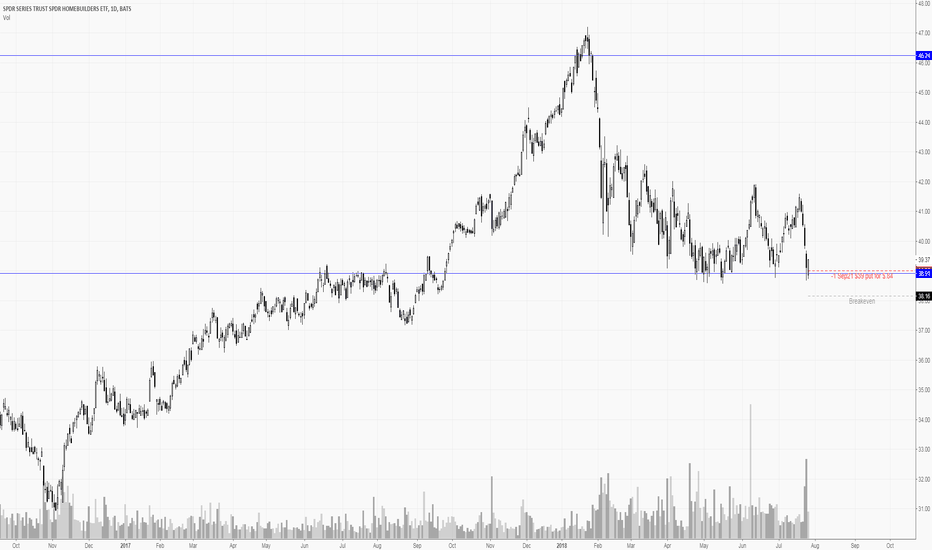

MCD - McDonaldsMCD has sold off quite a bit here in the last few months and is hovering above this longer term support level. I decided to go with a asymmetrical set up using a call spread for this play.

+1 Dec21 155/170 call spread for $5.38 db.

Risk: Try to let price action stop me out at the project stop or manage near a 50% loser to keep the risk small.

Profit: Target hit (initially)