OPUSD

Optimism (OP)Optimism (OP) is a layer-two blockchain on top of Ethereum. Optimism benefits from the security of the Ethereum mainnet and helps scale the Ethereum ecosystem by using optimistic rollups. That means transactions are trustlessly recorded on Optimism but ultimately secured on Ethereum.

The trading volume of Optimism (OP) is $576,616,329 in the last 24 hours, representing a 16.76% increase from one day ago and signaling a recent rise in market activity.

The highest price paid for Optimism (OP) is $2.50, which was recorded on Jan 25, 2023 (19 hours). Comparatively, the current price is -12.6% lower than the all-time high price.

The lowest price paid for Optimism (OP) is $0.402159, which was recorded on Jun 18, 2022 (7 months). Comparatively, the current price is 442.7% higher than the all-time low price.

The newly formed Optimism ecosystemHello?

Traders, welcome.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day.

-------------------------------------

------------------------------------------

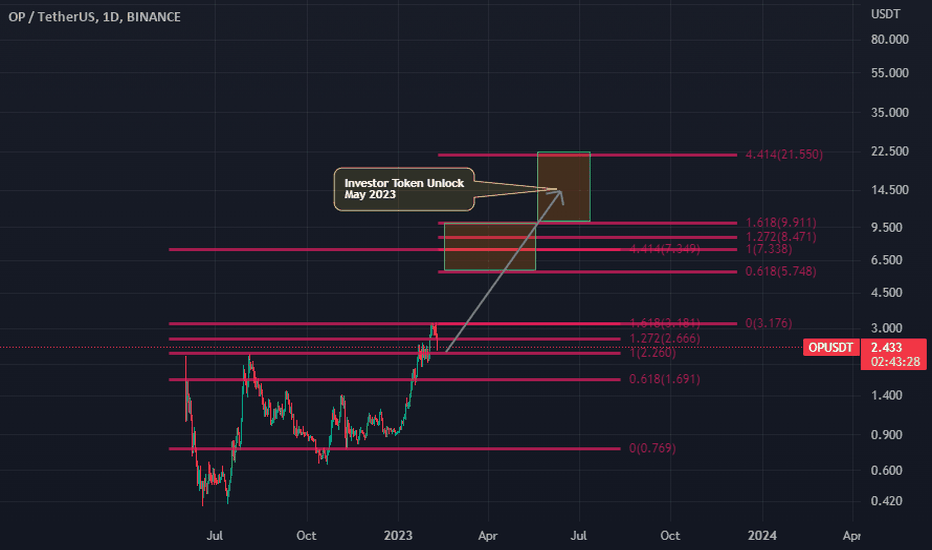

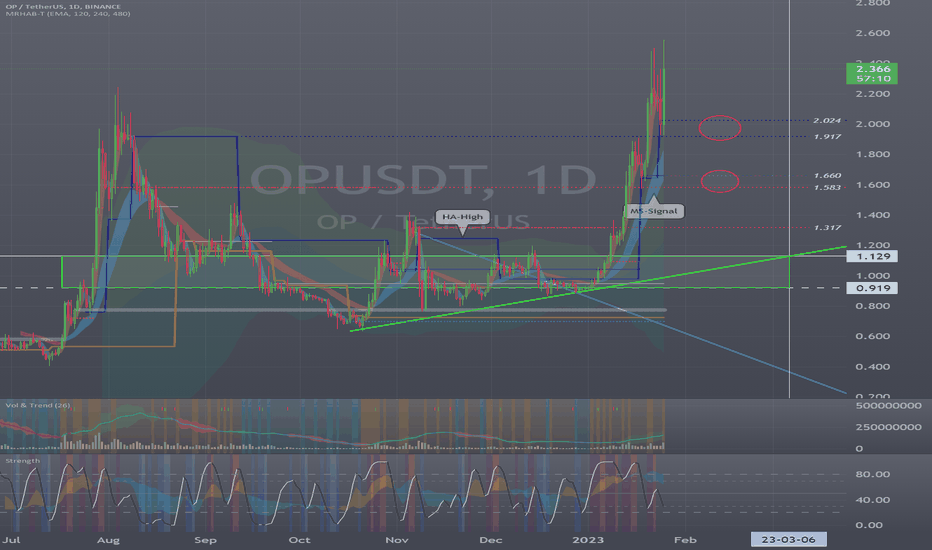

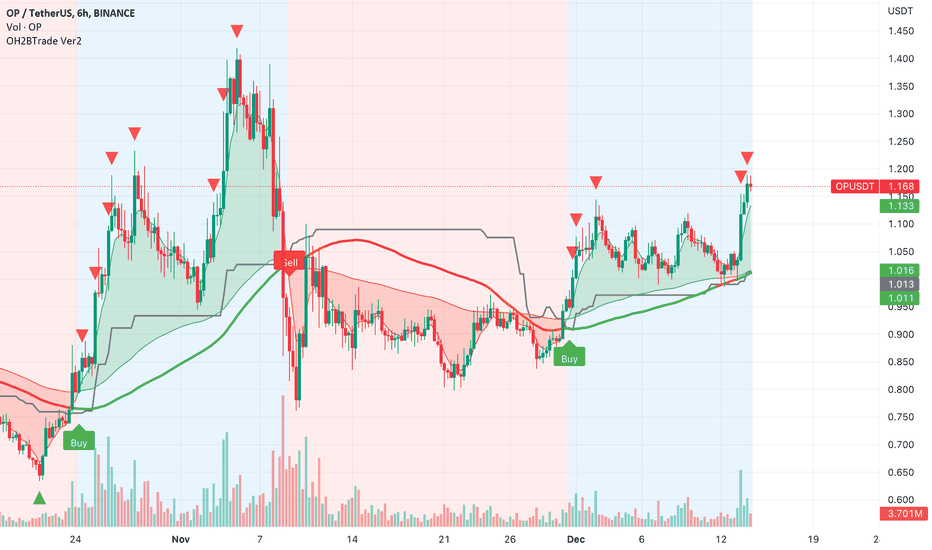

(OPUSDT 1W Chart)

Not long after the chart was created, not much is known.

It can be seen that a volume profile section is formed over the 0.919-1.129 section in the short, medium and long term.

(1D chart)

The current declared price (ATH) has been updated.

Buying under these circumstances is unthinkable.

Therefore, it is better to wait and see if the price moves down from this rise and converges in some area.

It is necessary to check whether it is supported in the 1.917.-2.024 section formed by the HA-High indicator point, or in the 1.583-1.660 section.

We need to make sure that the newly formed Optimism ecosystem can continue to expand.

Therefore, it is necessary to increase the number of coins (tokens) corresponding to profits while recovering the principal amount of the newly formed coins in the coin ecosystem as much as possible.

Otherwise, it is highly likely that you will suffer greatly if you proceed with the transaction by leaving the principal amount as it is.

-------------------------------------------------- -------------------------------------------

** All descriptions are for reference only and do not guarantee profit or loss in investment.

** If you share this chart, you can use the indicators normally.

** The MRHAB-T indicator includes indicators that indicate points of support and resistance.

** Check the formulas for the MS-Signal, HA-Low, and HA-High indicators at ().

** HA SRRC indicators are displayed as StochRSI (line), RSI (columns), and CCI (bgcolor).

** The CCI indicator is displayed in the overbought section (CCI > +100) and oversold section (CCI < -100).

(Short-term Stop Loss can be said to be a point where profit or loss can be preserved or additional entry can be made by split trading. This is a short-term investment perspective.)

---------------------------------

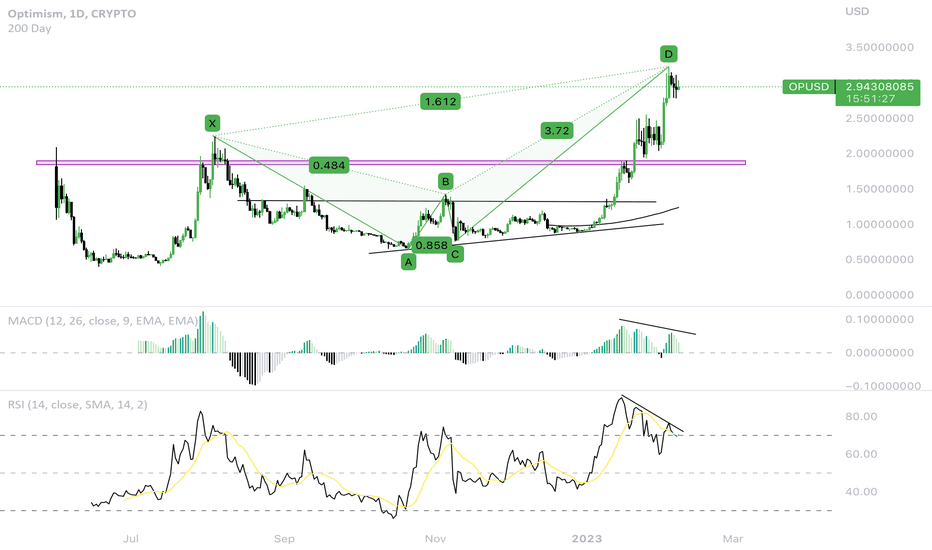

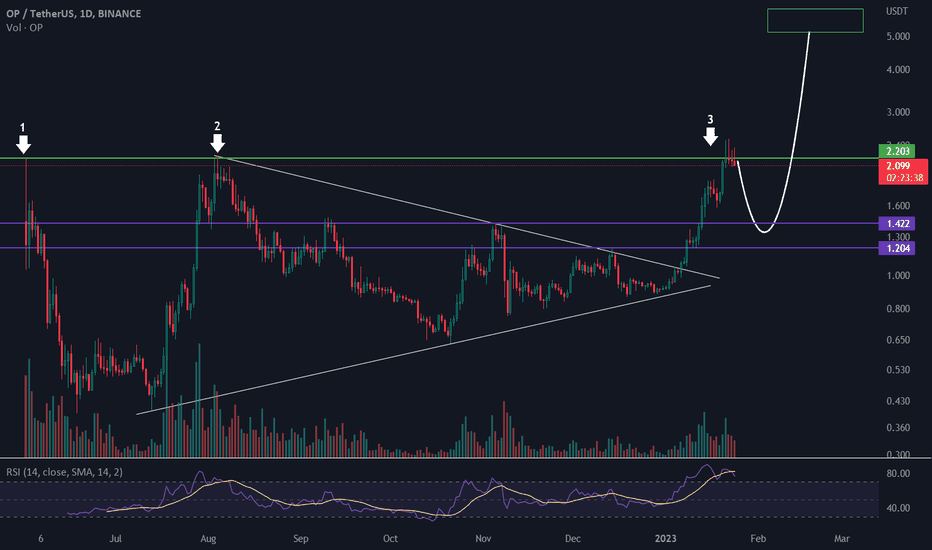

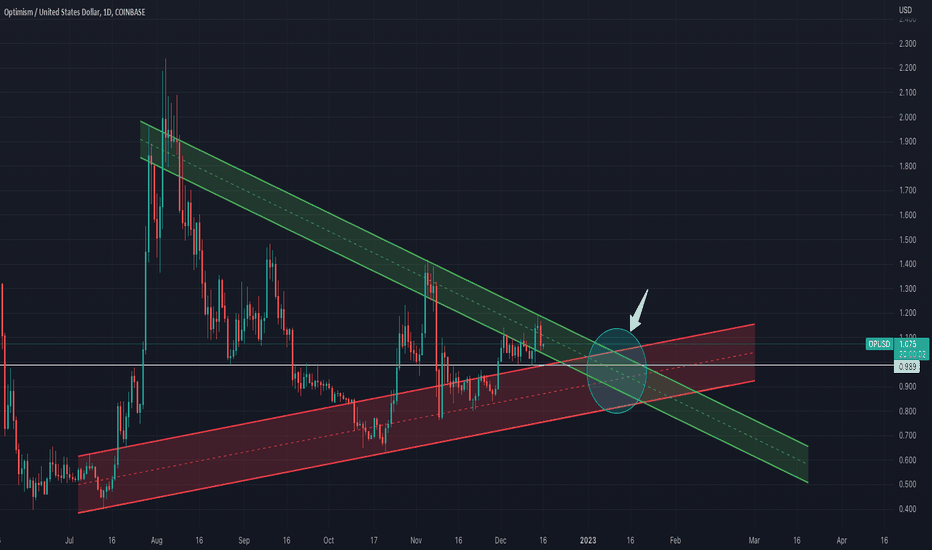

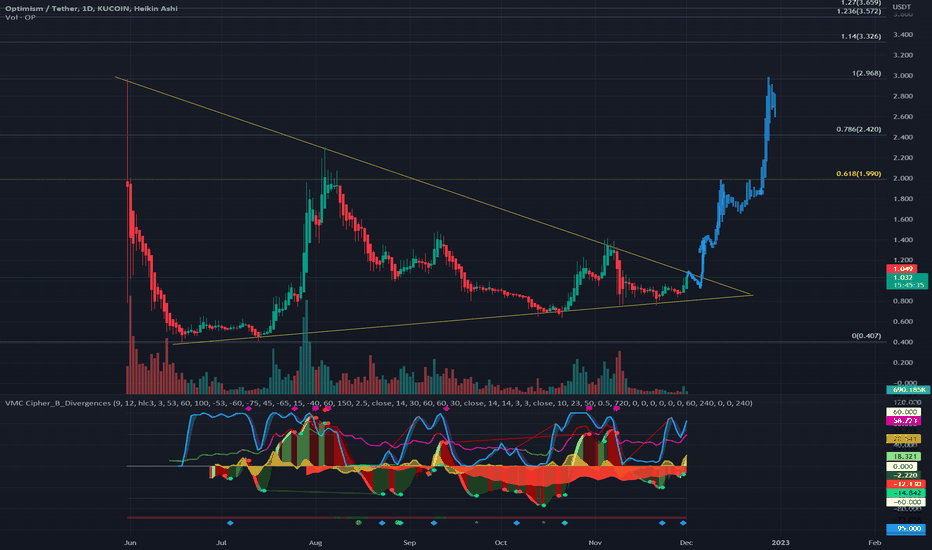

OPUSD one last High left. Next opportunity upon a pull-back.Optimism (OPUSD) broke above its All Time High Resistance of 2.32500 as well as the 2.0 Fibonacci level of the Channel Up that is being formed. Since the Resistance broke, the Channel Up has the technical capability to make a Higher High on the next available Fib at 2.5. The increasingly overbought levels don't render it a buy opportunity beyond that level.

Best strategy involves entering on the next pull-back wave. Potential targets the cluster of the (green) Support Zone, the 1D MA50 (blue trend-line) and the RSI Buy Zone. The upside potential is enormous on this gem and our long-term target is 3.400.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

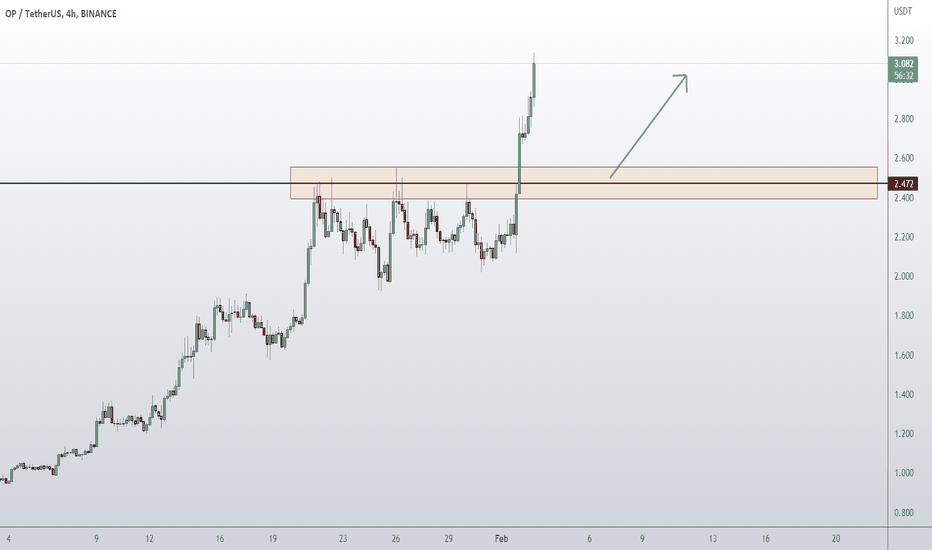

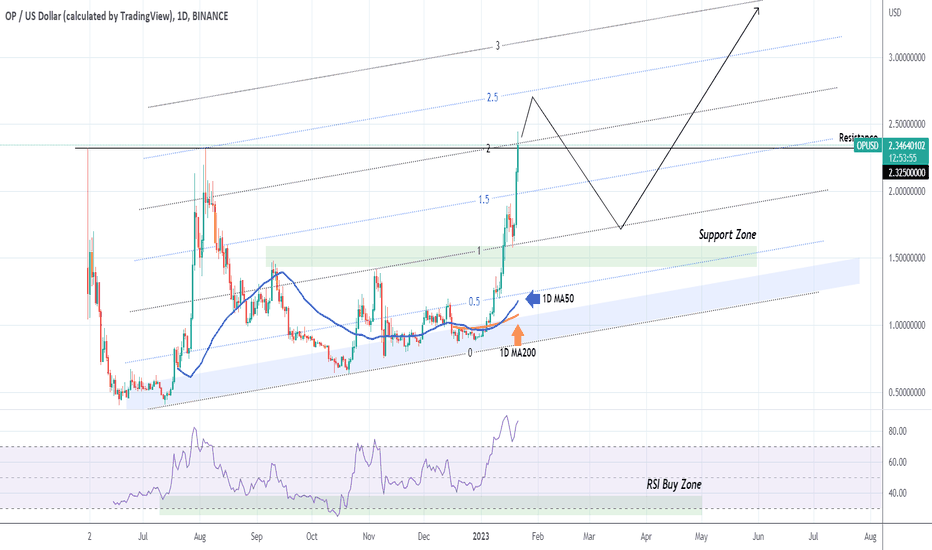

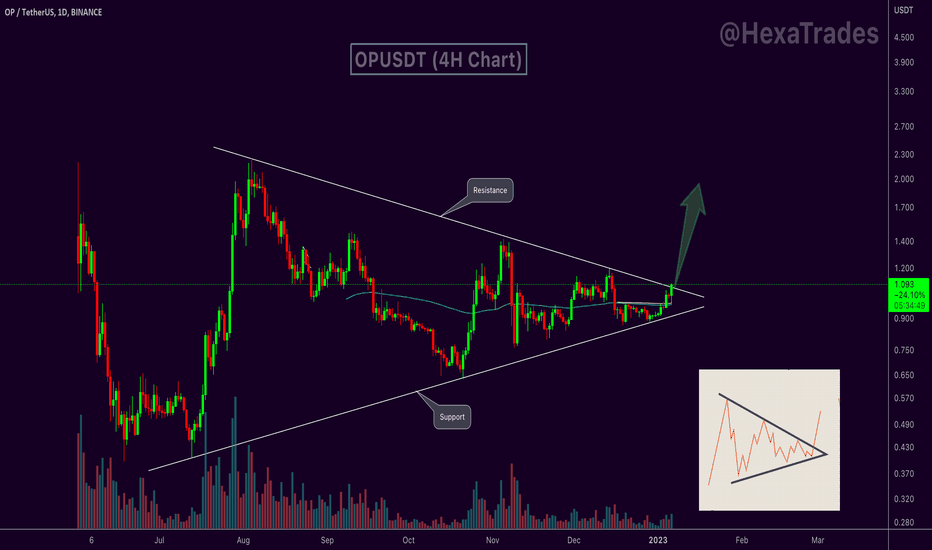

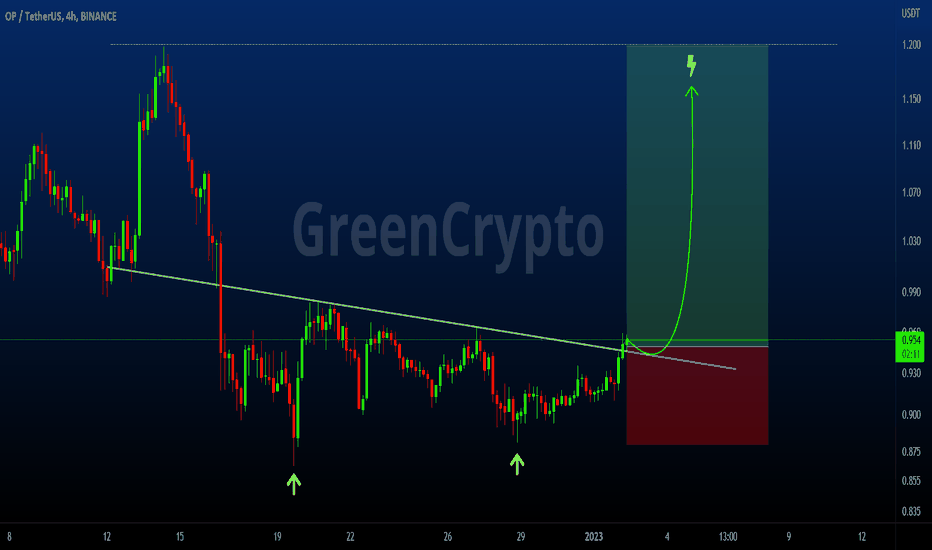

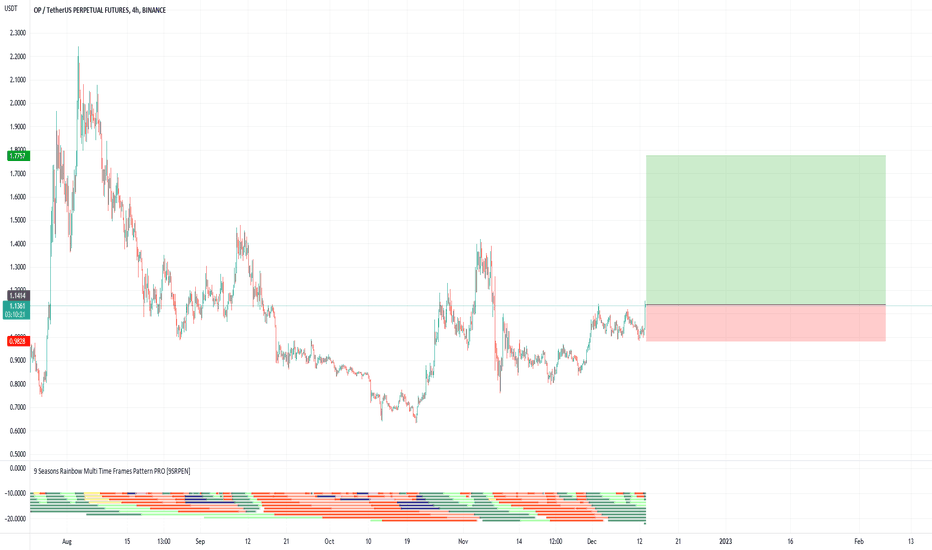

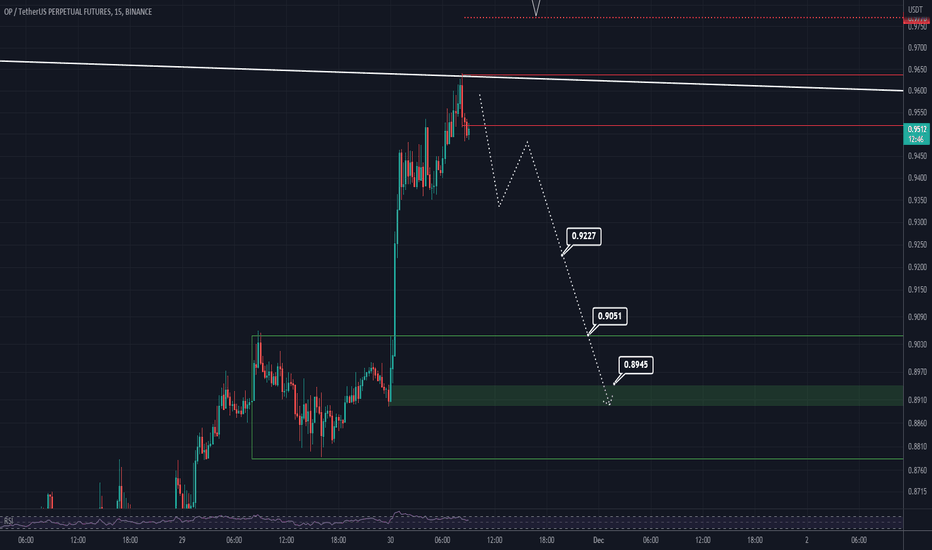

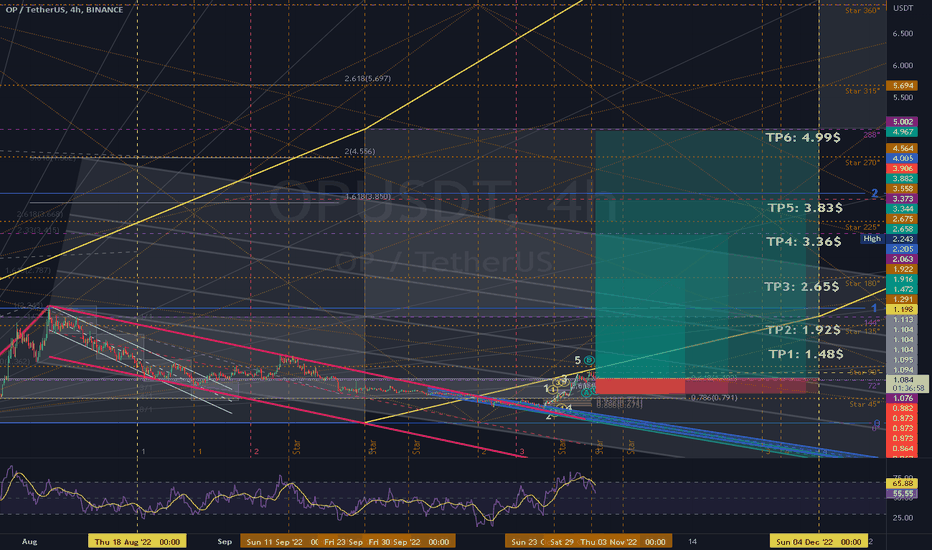

OPUSDT - Buy Setup!!OPUSDT (4h Chart) Technical analysis

OPUSDT (4h Chart) Currently trading at $0.95

Buy level: Above $0.95

Stop loss: Below $0.88

TP1: $0.98

TP2: $1

TP3: $1.12

TP4: $1.2

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

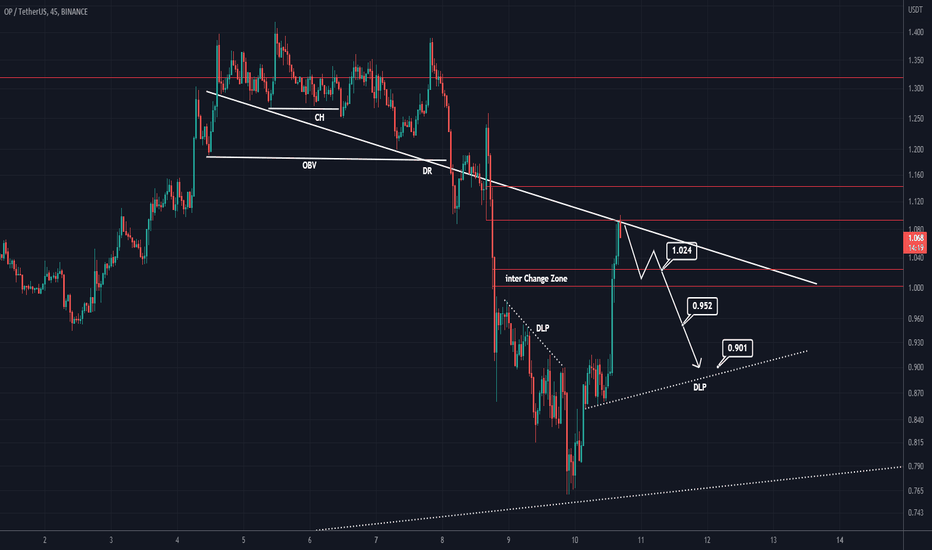

OP CAN DROP AGAINI hope you are fine

We have a swap zone. I think the price is pulling back to this area. After pullback, we can look for short positions. In the higher time frame, we are in a diametric, which I think we are at the top of the falling wave e

Comment if you have any questions

Thank You

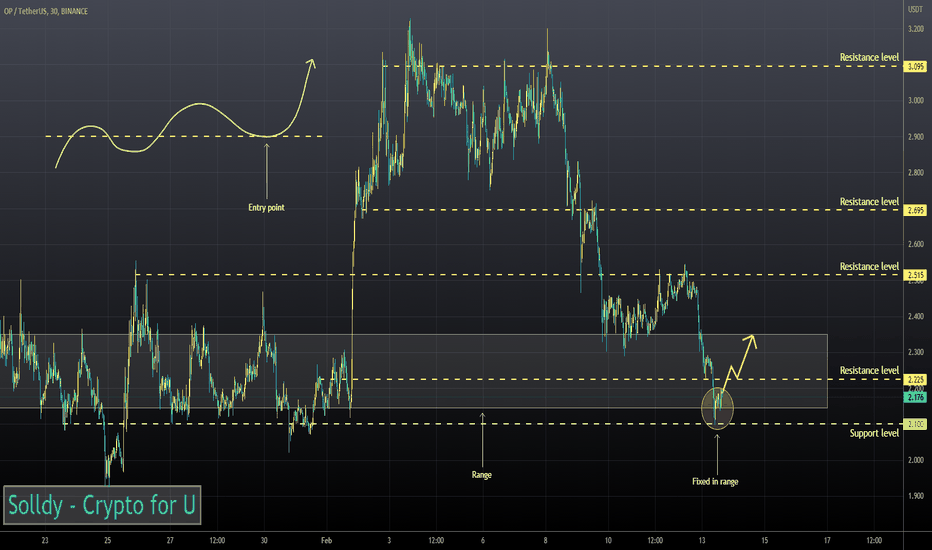

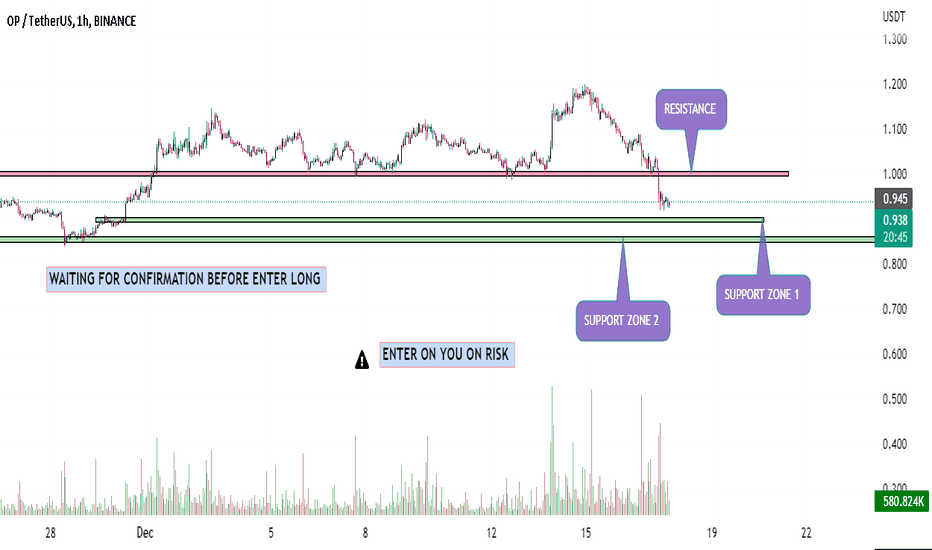

OPUSDT 1H TIME FRAME IDEAHELLO GUYS THIS MY IDEA 💡ABOUT OPUSDT is nice to see strong volume area....

Where is lot of contract accumulated..

I thing that the buyers from this area will be defend this LONG position..

and when the price come back to this area, strong buyers will be push up the market again..

UP TREND + Resistance from the past + Strong volume area is my mainly reason for this long trade..

IF you like my work please like and follow thanks

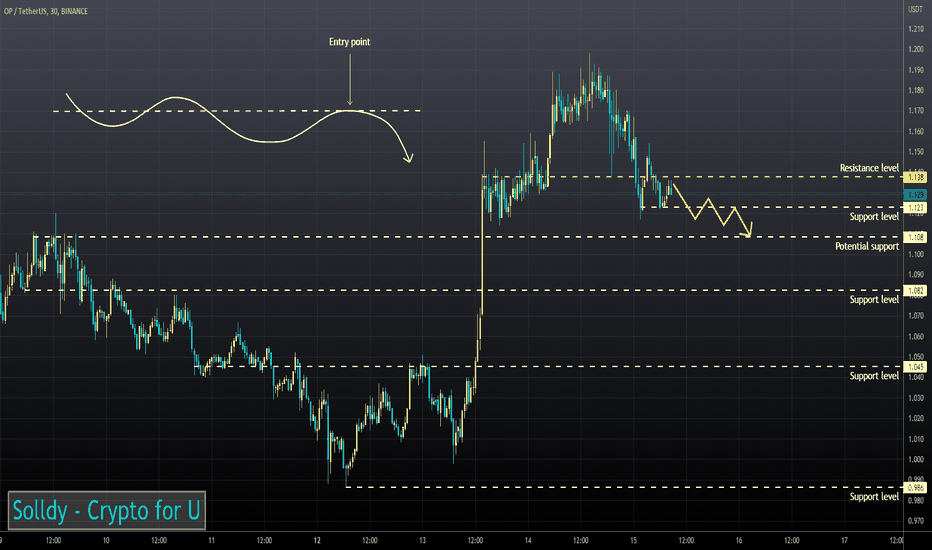

OPUSD ❕ bearish divergenceOP trades near liquidity levels.

Price and RSI chart have formed a bearish divergence (4H, 1H and 30m TFs)

TD Sequential has formed a reversal signal downwards (4H TF)

RSI returned to the sellers area (1H and 30m TFs)

I expect further price declines if the asset fixes below the support level.

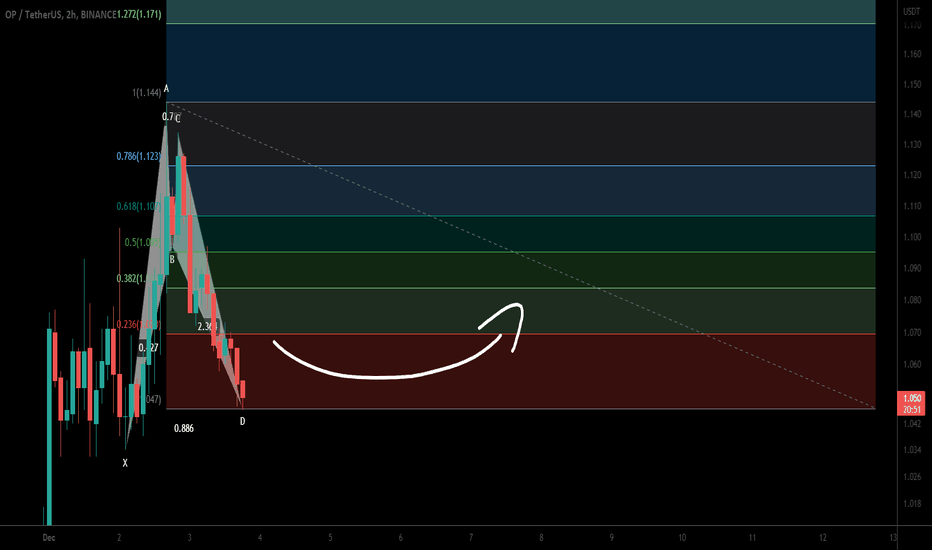

Optimism (OP) formed bullish BAT | A good buy opportunityHi dear friends, hope you are well and welcome to the new trade setup of Optimism (OP) with US Dollar pair.

Previously we priceline of OP moved slightly down than PRZ level, however, then pumped well.

Now on a 2-hr time frame, OP has formed a bullish BAT pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

OP SCLAP SHORT SETUPHello, dear traders. how are you ? Today we have a setup to SELL/SHORT the OP symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

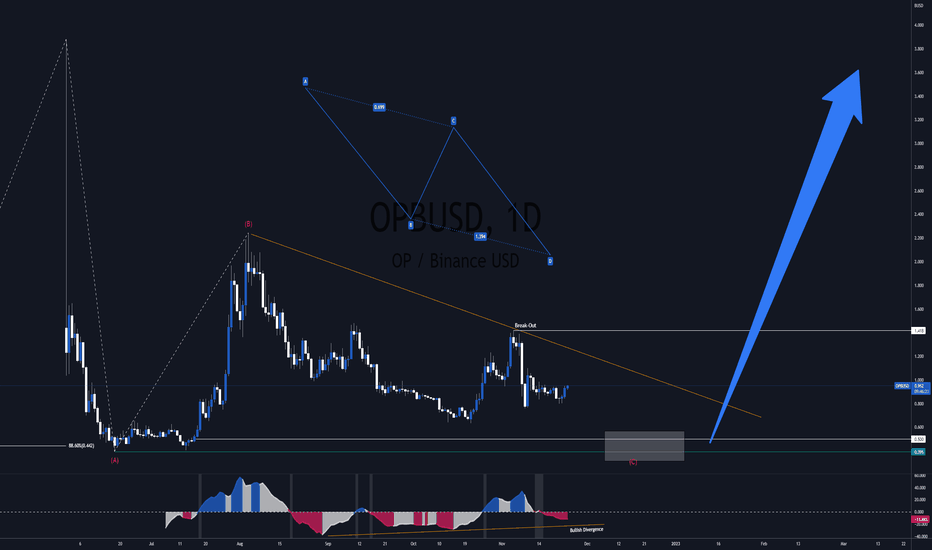

Optimism OP - New Poop Coin Going BullOptimism heard about the ETH rush and wants to piggy-back.

By looking at it, it has potential.

Nice project, however, I am not so keen on these newly grown "mushrooms" right after the rain.

But, you asked.. so, I deliver.

Levels of Interest: $0.5 , $0.35 , $0.1 .

Optimism OP ( OPUSDT , OPUSD , OPBUSD ) Tech. Analysis:

* A-B-C Elliott Wave Correction

* Harmonic Pattern: AB=CD

* 88.6% Fibonacci Retracement

* 61.8% Fibonacci Extension

* Bullish Divergence

* Descending Wedge or Ending Diagonal

Thanks for HODLing ..

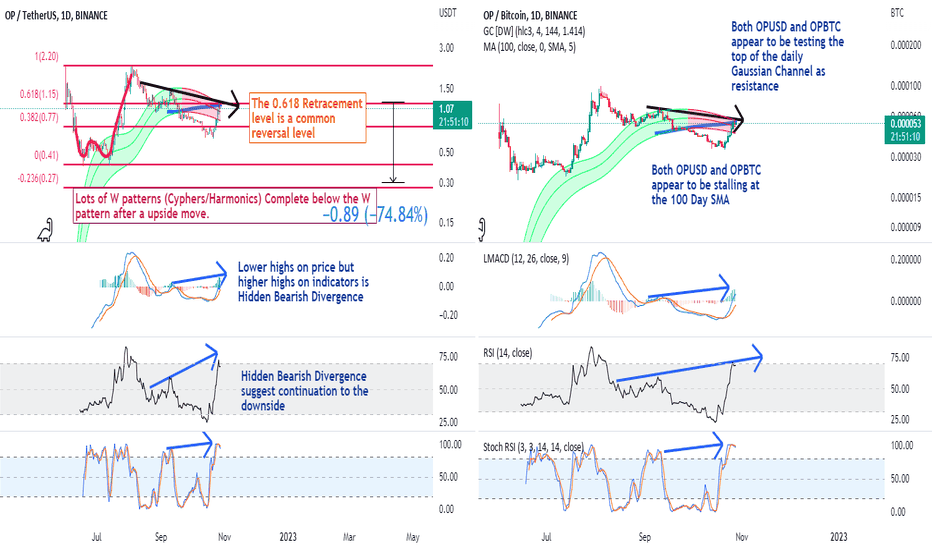

Optimism poised for a 75% draw downTLDR: Lots of well established TA suggests OP takes out the previous lows at 0.41.

Analysis

I am going to begin with the divergence primer just in case a reader is unfamilar with the divergences and what they mean.

Divergence Primer

Classic Divergence (Trend Reversal)

Bearish: Higher highs on price action but lower highs on the indicator

Bullish: Lower lows on price action but higher lows on the indicator

Hidden (Trend Continuation)

Bearish: Lower high on the price action and higher highs on the indicator

Bullish: Higher low on the price action and a lower low on the indicator

As the chart shews both OPUSD and OPBTC both have great deal of hidden bearish divergence on the Log MACD (and histogram) as well as the RSI and Stochastic RSI.

The Gaussian channel is pretty powerful as support and resistance and generally speaking I get excited to buy beneath a red Gaussian channel or when I see price action powering its way through. Not so much with OP right now, with the hidden bearish divergences. I expect the top of the channel will continue as resistance.

Likewise the 100 Daily Moving Average is right above price action and I assume it will continue to act as resistance as well.

The volume situation doesn't look good to me either. With price breaking out above the Value Area of the VPVR to create all time highs and coming back in on both OPUSD and OPBTC I think we are going to see more typical behavior and the value area will act as resistance, especially on OPBTC.

The On Balance Volume has set virtually equal highs with this current peak and the peak from September. That is a sign of bullish exhaustion. It is also concerning that both the 10 and 20 SMA are below the 100. If the OBV regresses to the mean (the 10 or the 20) then that dip would get me deep into the money. Not all the way to target, but deep enough I can have a fairly profitable stop loss.

Here is a similar move on Matic over two years ago where Matic dupped and took out what looked like strong support at the 0 line before rallying up to just above the 0.618 retracement before crashing. From there it went 400x

If OP has a similar run then I will be quite pleased. Also, if OP crashes down to about the 0.28c I will go in full accumulation mode and hopefully we will see it run in another year or so.

Macro I still think a lot of the equities indices are mostly done with their downside. I also like a lot of the "OG" crypto currency coins like XMR, Dash, XPR, BCH and I think a lot of the nu-crypto coins that were the top runners of 2021 are going to crash at bit more before going into long consolidation. That is a lot of moving parts for me to hopefully get right.

OP SHORT SETUPHello, dear traders. how are you ? Today we have a setup to sell/short the op symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You