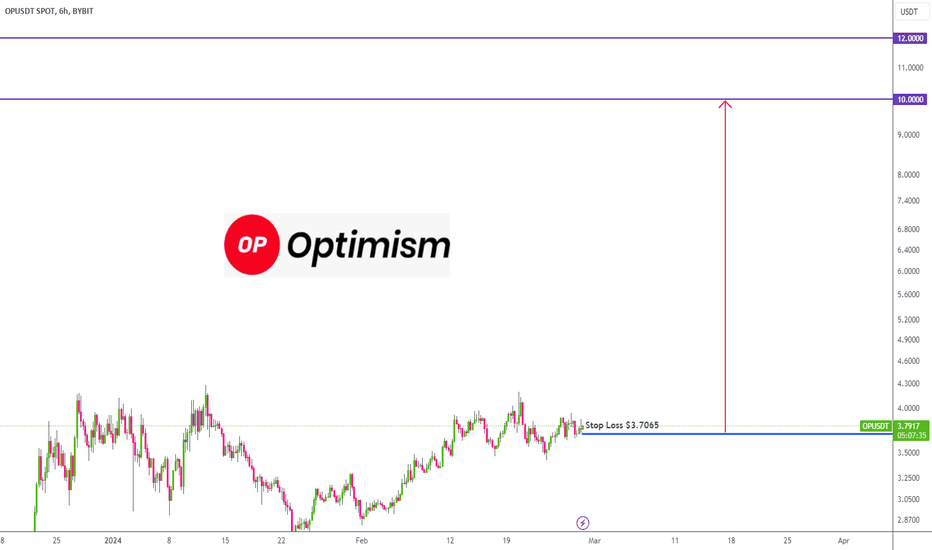

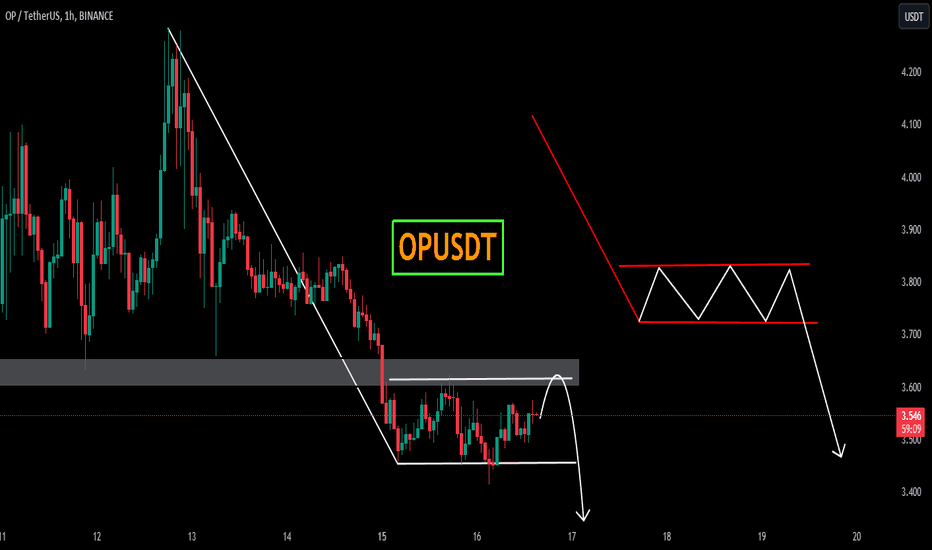

OP after breaking above the range bound will continue to go upOP after breaking above the range bound will continue to go up

🔵Entry Zone 3.710 - 3.855

🔴SL 03.409

🟢TP1 4.168

🟢TP2 5.904

🟢TP3 6.515

Risk Warning

Trading Forex, CFDs, Crypto, Futures, and Stocks involve a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results.

If you liked our ideas, please support us with your likes 👍 and comments.

OPUSDT

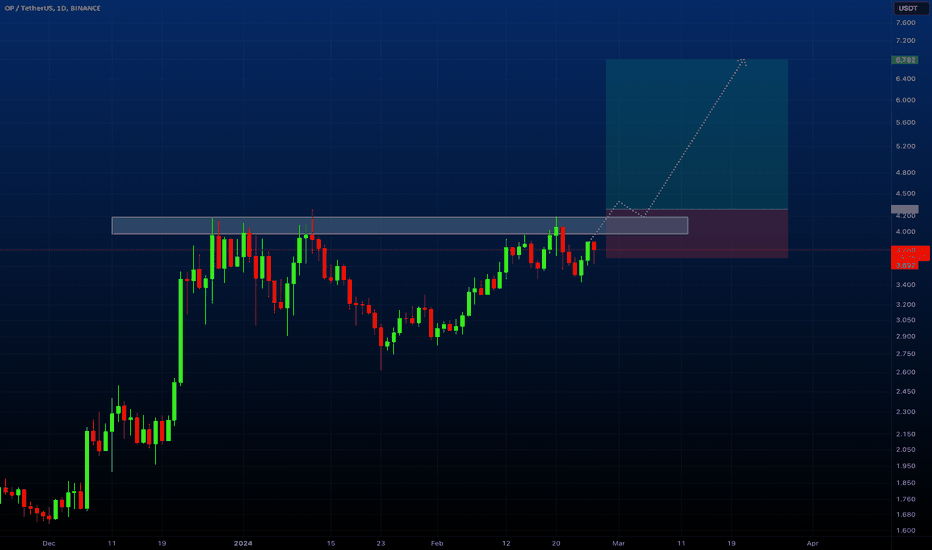

OP - Breakout waiting to happenBINANCE:OPUSDT (1DH CHART) Technical Analysis Update

OP is currently trading at $3.777 and showing overall bullish sentiment and waiting to breakout from the resistance zone.

Breakout from the resistance zone will definitely fuel to bull run of the OP. OP is also one of the fundamentally strong coin so we cannot go wrong with the LONG entry for this coin while we wait for bull run continue.

Entry level: $ 4.292 (candle close above this)

Stop loss level: $ 3.697

Target 1: $ 4.597

Target 2: $ 5.061

Target 3: $ 5.571

Target 4: $ 6.610

Target 5: 6.792

Max Leverage: 2x

Don't forget to keep stop loss.

Follow Our TradingView Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

Cheers

GreenCrypto

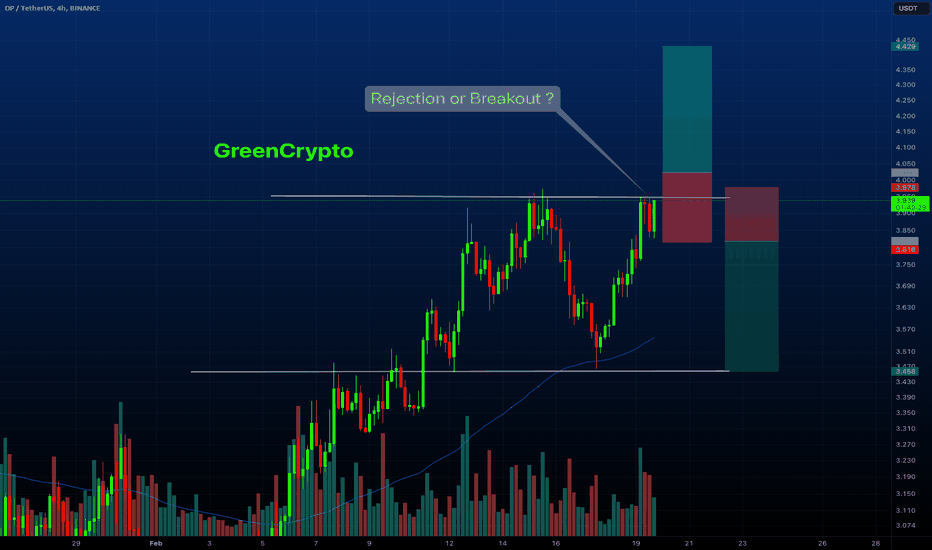

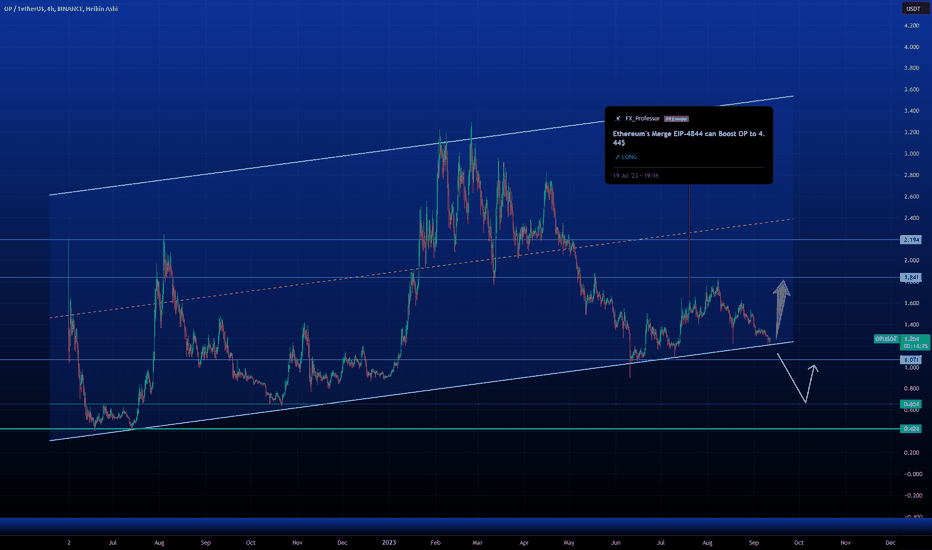

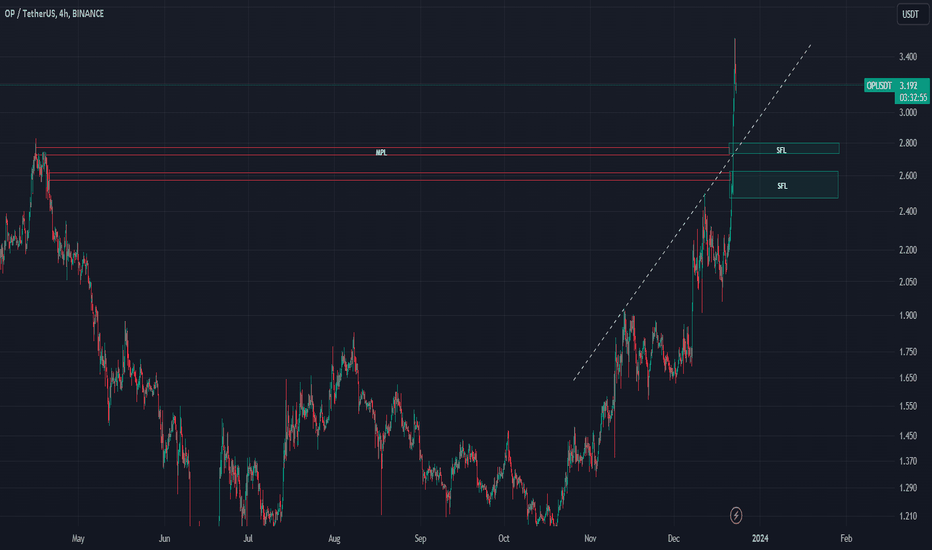

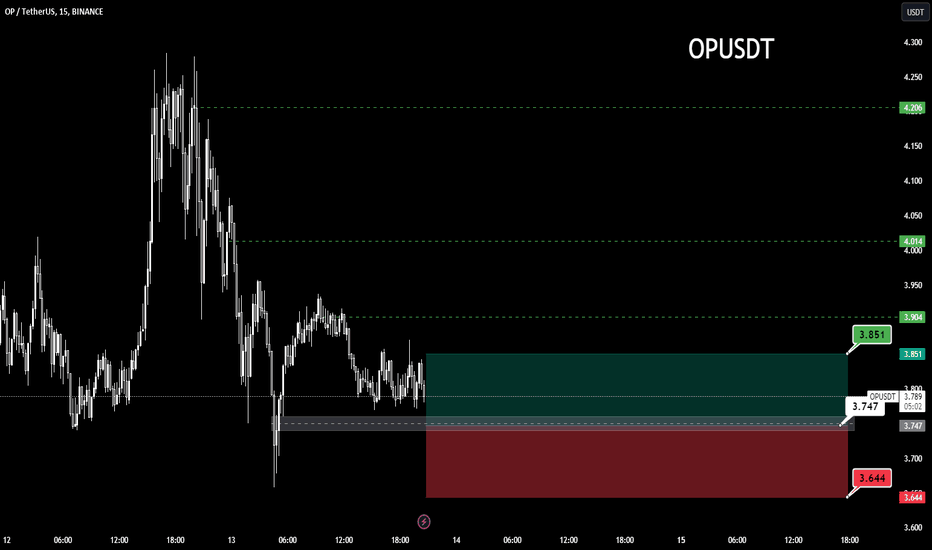

Rejection or Breakout for OP/USDT ? BINANCE:OPUSDT (4H CHART) Technical Analysis Update

OP is currently trading at $ and currently price is at the resistance line

We can expect price to either breakout from the resistance or get rejected from the resistance. We will enter trade based on whether price will get rejected or not.

LONG Trade Details (only after confirmed Breakout)

Entry level: $ 4.023

Stop loss level: $ 3.818

Target 1: $ 4.122

Target 2: $ 4.217

Target 3: $ 4.429

SHORT Trade Details (only after confirmed Rejection

Entry level: $ 3.818

Stop loss level: $ 3.978

Target 1: $3.723

Target 2: $3.623

Target 3: $3.458

Max Leverage: 5x

Stay tuned for updates on breakout or rejection.

Don't forget to keep stop loss.

Follow Our TradingView Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

Cheers

GreenCrypto

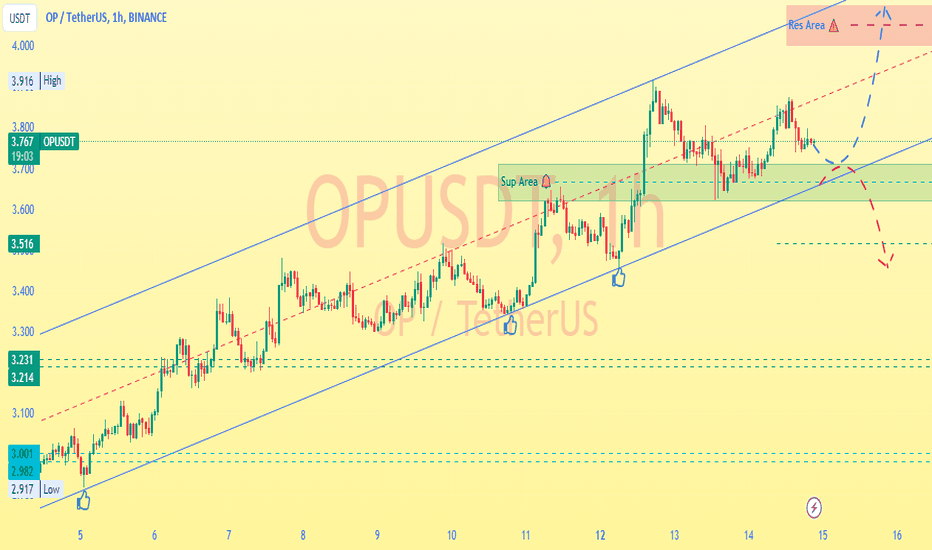

Alikze → #OP | Pullback to broken resistance In time h1, after the failure of the resistance, which has now turned into support, and in dealing with the dynamic trigger, which has had a positive reaction several times and caused the price to grow. Now it is approaching the dynamic trigger as well as the support area. Therefore, if the current area encounters a reversal candle, it will have the ability to grow to the next supply and resistance area.

In addition, if the range of the green box is broken, at least correction up to 3.50 can be imagined.

If the behavior and structure of the currency changes, the post will be updated.

🟩Sup: 3.70

⛳️Tp 3.90

⛳️ Tp2 :3.95

⛳️ Tp3 : 4.10

-----------------

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Sincerely.❤️

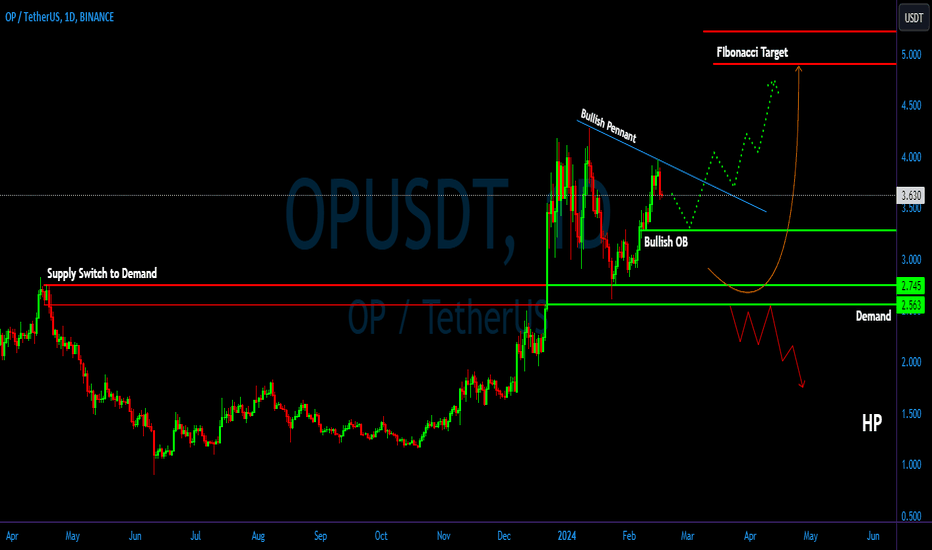

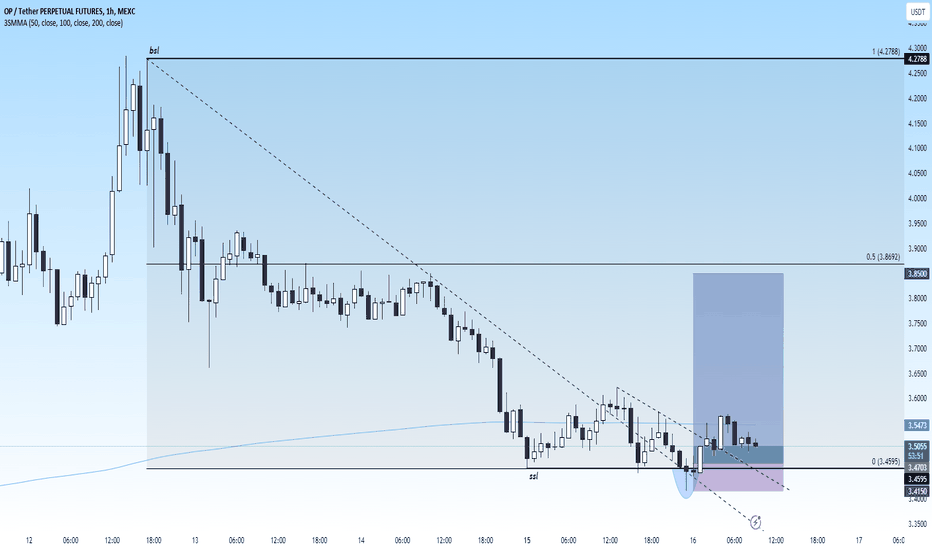

OP/USDT Keep an eye on the Bullish OB! Price will bounce and UP.💎 OP has recently demonstrated notable market dynamics. After a perfect bounce from the demand area, the price faced rejection in the vicinity of an all-time high.

💎 Currently, the price is positioned to move downward towards the Bullish Order Block (OB) area for retesting, potentially creating new momentum for an upward movement.

💎 If OP successfully bounces from the Bullish OB area, the price can resume its upward trajectory and break the current pattern, Probability facilitating an easy movement toward our target area.

💎 However, if OP fails to bounce upon retesting the Bullish OB area and breaks below it, it could signify a bearish development. This scenario would lead to continued downward movement, with the next significant support level being the demand area.

💎 The demand area holds crucial significance, as it has historically acted as a pivotal zone for price reversals. If OP fails to bounce from this area, it would confirm a shift back to bearish sentiment, potentially resulting in further downward movement.

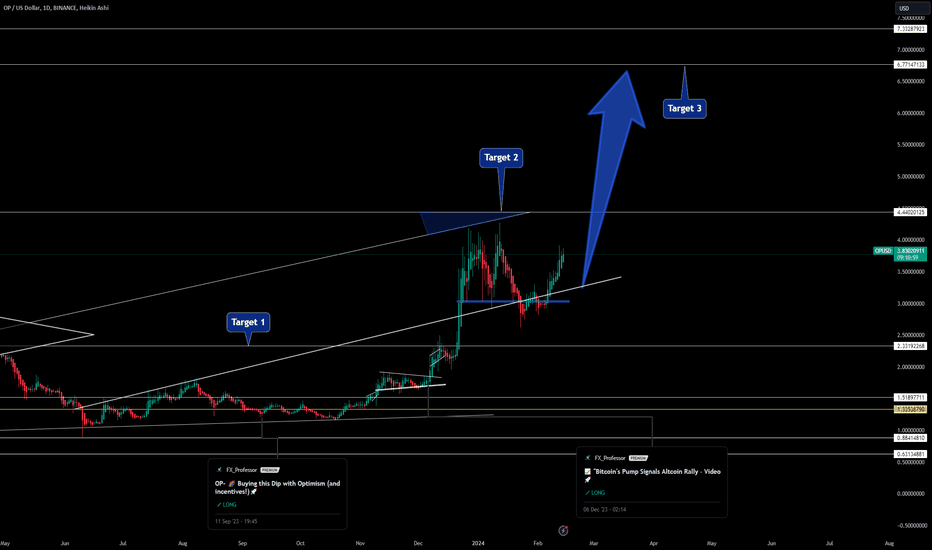

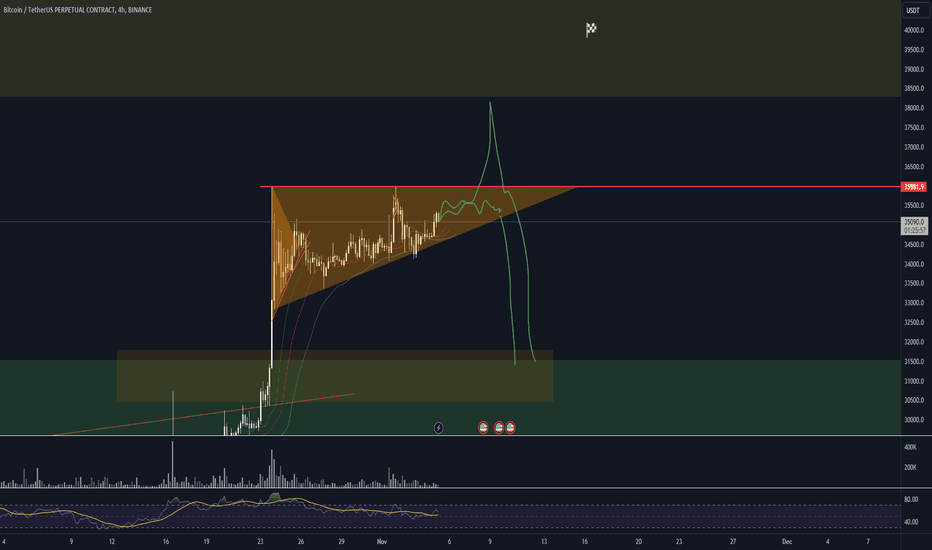

OP-Ready for Higher🌟 Bitcoin's Breakout Surge: Professor's Big Charts Revealed 🌟

📈 Live Analysis Incoming!

Prepare for an in-depth journey through Bitcoin's latest surge as we go live on TradingView. Get ready for a session packed with insights and the unveiling of the Professor's big chart. Join us: Live Stream: tradingview.sweetlogin.com

🚀 The Breakout Chart Breakdown

Witness the bullish momentum as Bitcoin smashes past the $47,650 barrier. With my analysis, we're looking at a bull run targeting $59.9K,

69K

, and the ambitious $79K. 🎯 Stay bullish and watch as the charts unfold the story live!

💹 Historic Patterns: A Roadmap to $79K

Reflect on the last breakout at $31,100 and its staggering rise to $46,000. Our charts have been the compass leading us to these profitable winds. Don't miss out as we dissect the potential climb to $79K, live!

🔍 Last Year's Chart: The Trendline Triumph

Cast your minds back to January 2023, when Bitcoin was a humble $18,000. Fast forward, and we're witnessing a breakout reminiscent of December 2020's rally from $7,500 to $24,000. Could we be on the cusp of reaching new all-time highs? Let's explore together.

⏱️ Halving Cycles: This Time It's Different

Every cycle writes its own story, and this one's no exception. We're approaching the halving with a market more aware and ready to advance. Tune in as we analyze why we might see an all-time high sooner than the previous cycles.

🌐 Join the Live Stream for the Full Picture

There's much more to cover, from halving cycles to breakout patterns. Ensure you're part of the live session for a comprehensive analysis that could redefine your trading strategy.

Catch the full live session and secure your front-row seat to Bitcoin's exciting journey: Join the Live Stream: tradingview.sweetlogin.com

One Love,

The FXPROFESSOR 💙

OP- 🌈 Buying this Dip with Optimism (and incentives!)🚀Amidst today's Crypto dip, I'm diversifying my portfolio with a strategic move into Optimism (OP). Here's the lowdown:

📈 Volume Surge: Optimism's recent token incentives led to a jaw-dropping 23-fold surge in trading volume. That's not just noise; it's a liquidity bonanza.

🌿 Sustainable Growth: Optimism isn't just another flash in the pan. They're in it for the long haul, funding public goods and focusing on ecosystem longevity.

🛠️ Technical Robustness: As a robust Ethereum L2 solution, Optimism offers scalability and cost-efficiency, perfectly aligning with Ethereum's long-term vision.

🎯 Why Now?: Given these strong fundamentals, Optimism is a compelling investment, especially when the market's down. It's not just about quick gains; it's about backing a protocol with a solid future.

🔮 Future Outlook: If you recall how well MATIC performed for us a few months back, Optimism has similar potential.

🚀 Ethereum Synergy: Don't overlook the impact of Ethereum's upcoming Merge EIP-4844. It could be the rocket fuel that sends OP to $4.44. EIP-4844 Analysis:

📈Chart:

Massive Channel, on support= LONG with SL just below it 💙😎 LFG!

My Targets are 2.4 and 3.5$.

One Love,

The FXPROFESSOR 💙

#Optimism #InvestmentStrategy #CryptoMarket 💎

OP Bearish Flag You don't have to believe me, just trust yourself. My setup is enough. On the chart we can see that it has descended from its peak and formed a short-term uptrend, forming a bear pattern. flag combined with above There is supply pushing the price down but you can wait for a breakout from the 10 LINE before entering a position and a reversal from the candlestick or a divergence signal will be confirmed. To be more precise, don't thank me for lying.

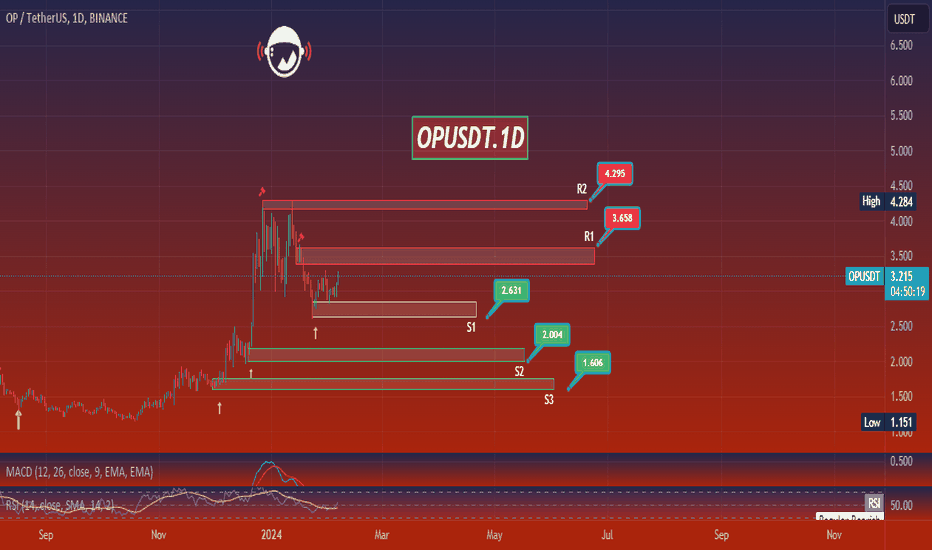

OPUSDT.1DBased on the provided market data, the OP cryptocurrency is currently priced at 3.23 USDT. The Relative Strength Index (RSI) for 4 hours, 1 day and 7 days are 67.67, 53.33, and 63.93 respectively. The RSI values indicate that the currency is neither oversold nor overbought, but the 4-hour RSI is on the higher side which indicates a bullish trend.

The Moving Average Convergence Divergence (MACD) for 4 hours, 1 day, and 7 days are 0.057, -0.048 and 0.450 respectively. The positive MACD for 4 hours and 7 days suggests bullish momentum, while the negative MACD for 1 day indicates a bearish trend.

The Bollinger Bands (Bb) for 4 hours, 1 day, and 7 days are 3.288, 3.272, and 4.012 respectively. The price is currently below the upper band for all the three periods suggesting a potential pullback or a period of lower volatility.

The support levels for 4 hours, 1 day, and 7 days are 3.072, 2.841, and 2.33 respectively, while the resistance levels are 3.396, 3.611, and 4.288 respectively. The price is currently closer to the resistance levels, indicating a possible upward trend if it breaks the resistance.

In conclusion, the technical analysis indicates a mixed trend with bullish tendencies in the short term (4 hours) and long term (7 days), but a bearish trend in the intermediate term (1 day). As an investor, it's crucial to keep an eye on these changing trends and adjust your strategy accordingly. Lastly, remember that investing in cryptocurrencies always come with risks, so it's important to only invest what you can afford to lose.

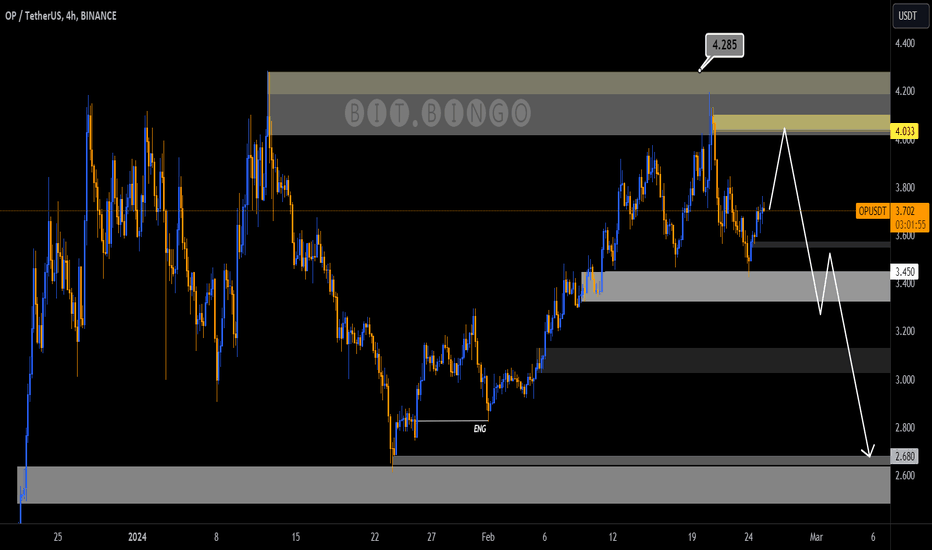

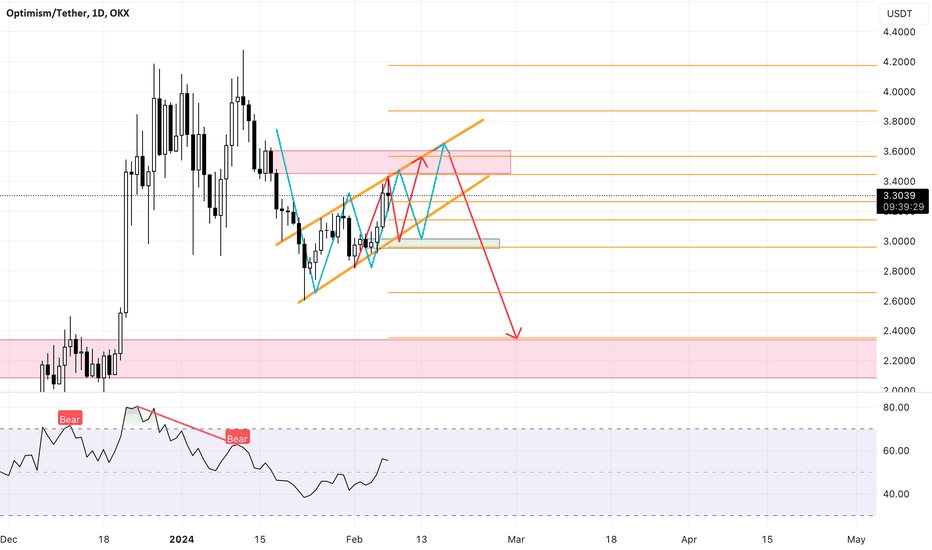

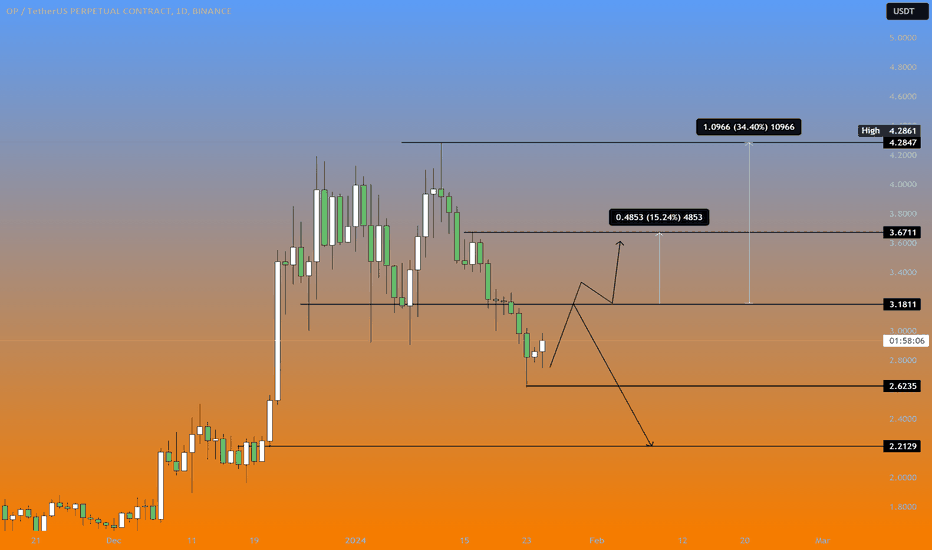

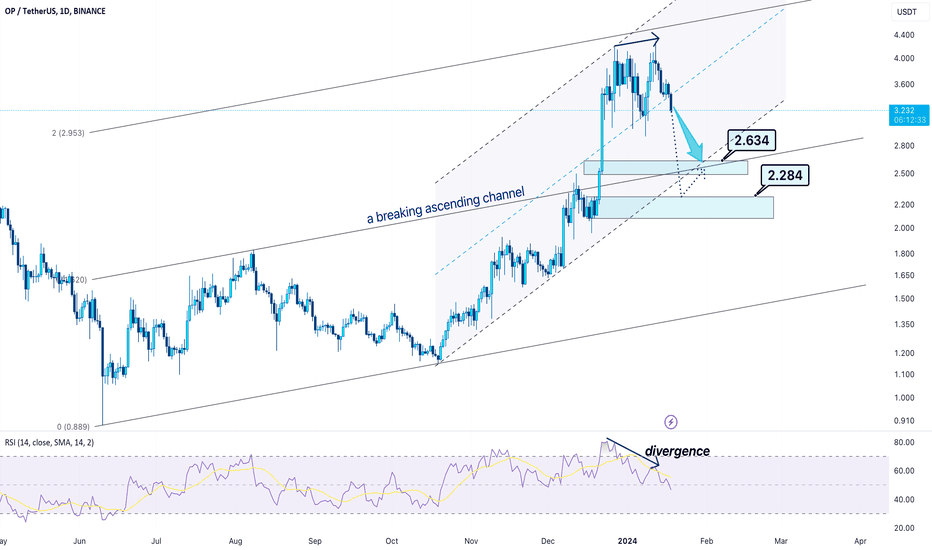

OP ⇒ a possible downward patternhello guys...

A few reasons show us OPUSDT will experience downward movement at least until 2.634:

1-the first reason:

touched the top line of the second channel.

2-the second reason:

divergence in the RSI indicator.

3-the third reason:

broke down the midline of the sharp channel.

4-the final reason:

a possibility of forming the double top pattern.

______________________

always do your research.

If you have any questions, you can write them in the comments below, and I will answer them.

And please don't forget to support this idea with your likes and comment

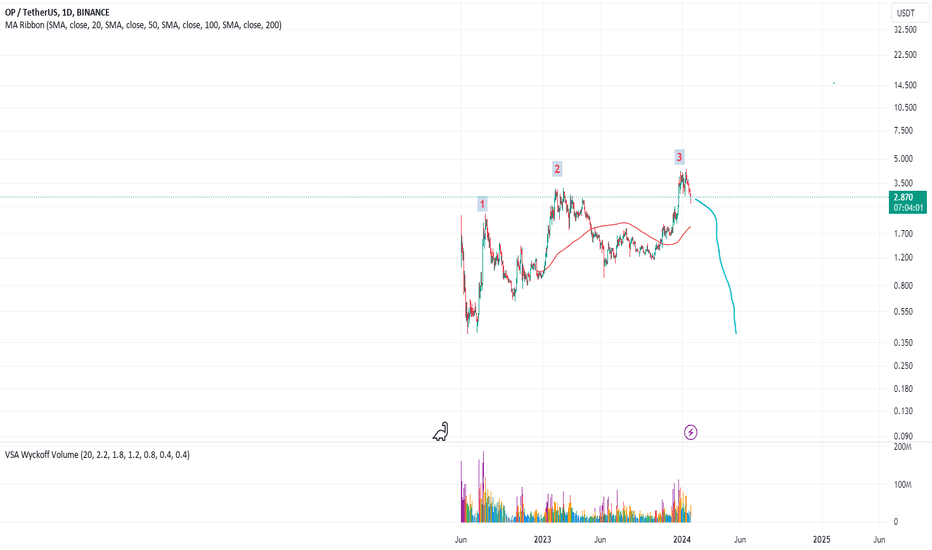

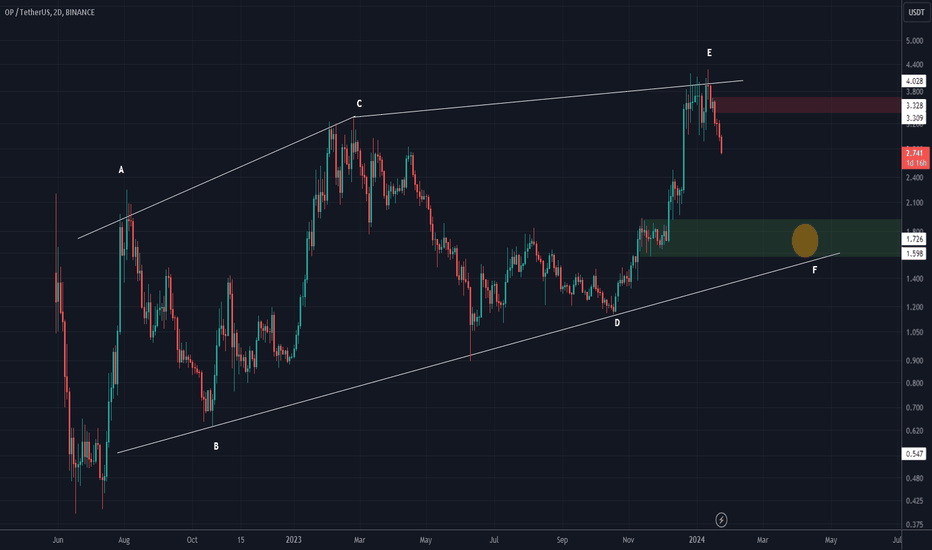

OP LOOKS BEARISH (2D TF)First, pay attention to the time frame. The time frame is large.

It seems that we have a diametric on the chart that the E wave of this diametric is ending.

We expect to drop to the green range to complete the F wave.

Closing a weekly candle above the red level will violate the analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

buy by R/1 (OP)📊Analysis by AhmadArz:

Trade in low level of renge.

🔍Entry: 3.747

🛑Stop Loss: 3.644

🎯Take Profit: 3.851

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!