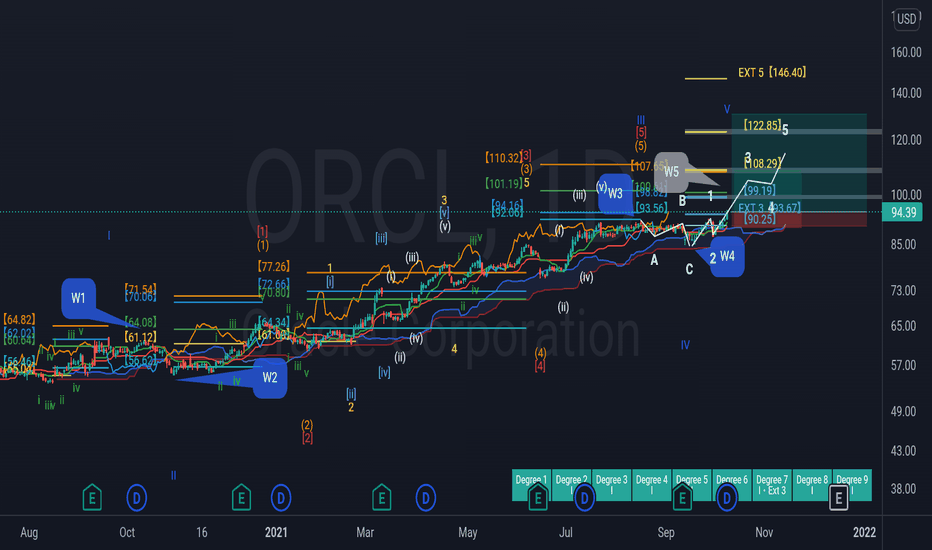

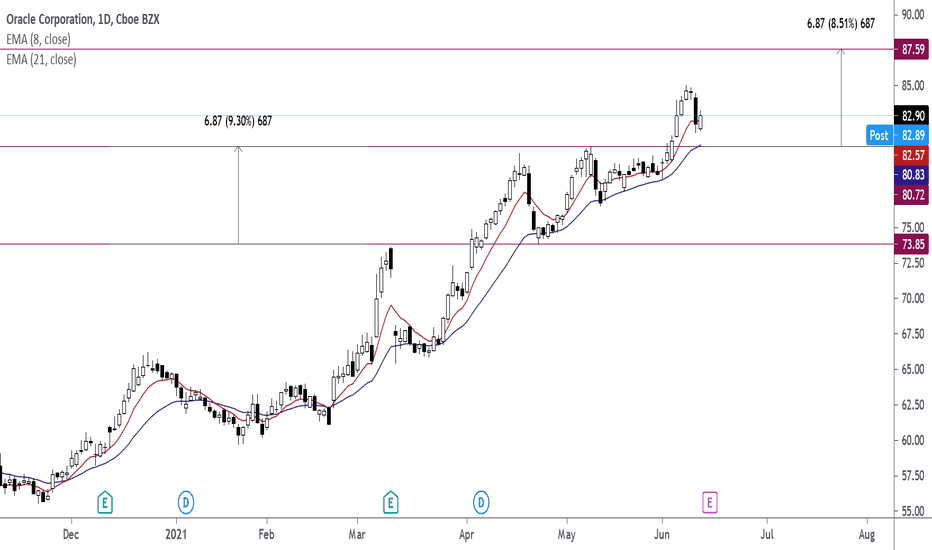

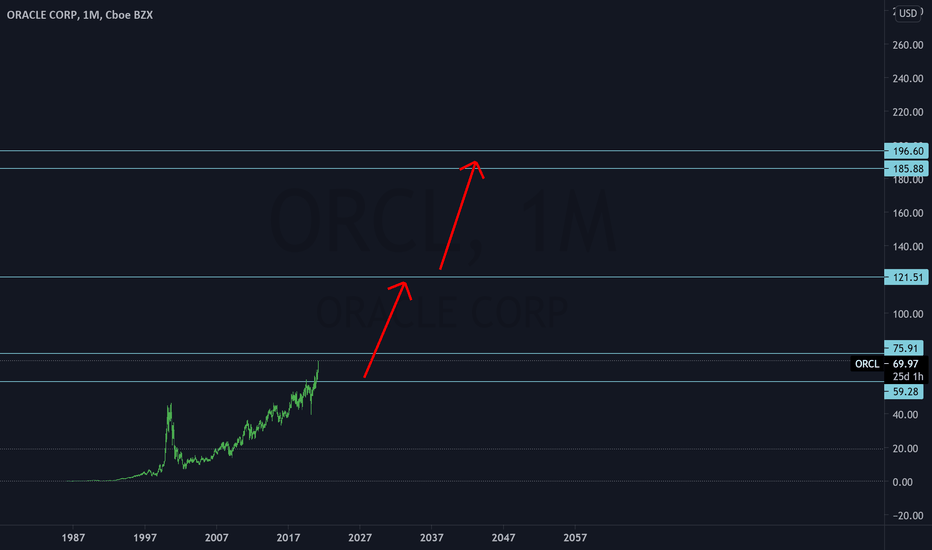

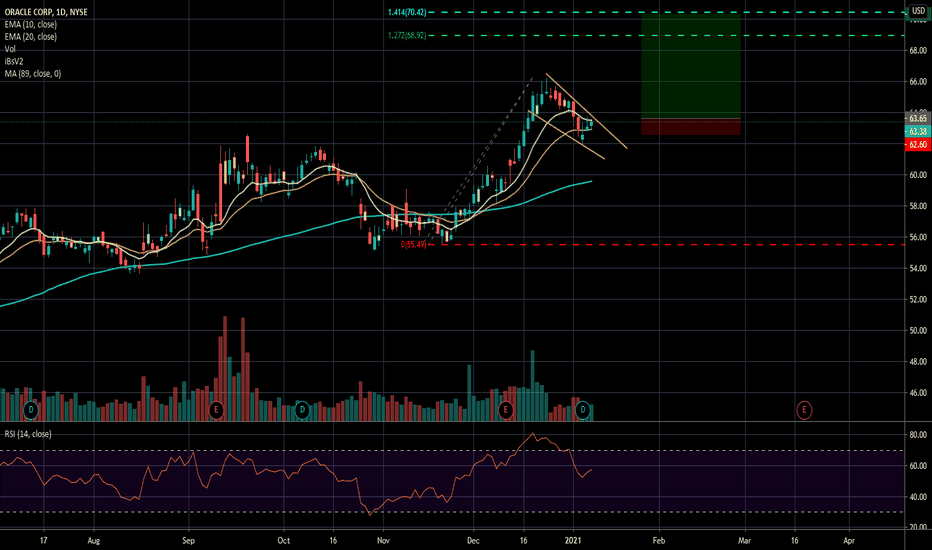

ORCL 🚀🔥😲 Elliott wave analysis Daily ChartAbout Elliott wave, after a clear beautiful 5 wave move of wave 3 and each leg have nice 5 wave advance, and currently we made a 4 with clear abc correction mark the low then gain strength. As we can see we in wave 5, after wave 1 we have a nice correction look like wave 2 retest wave b and w formation and broke through last high, we quite confident that now we are in 3 of wave 5.And target We can take target zone of Elliott wave and take profit like above chart.

About ichimoku tenkan sen and kijun sen up, kumo up, chikou span break consolidation, everything is bullish, further more last correction was supported by kijun sen and kumo, so high possibility that price will go up. And target zone of ichimoku quite fit with Elliott wave target like chart above you can take it too.

If you have any questions or tickers you want me to take a look comment below.

ORCL

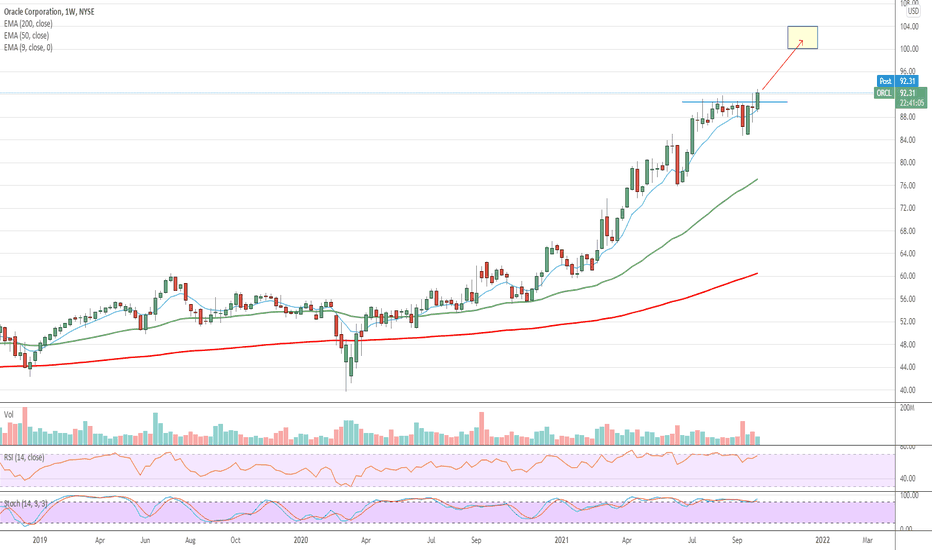

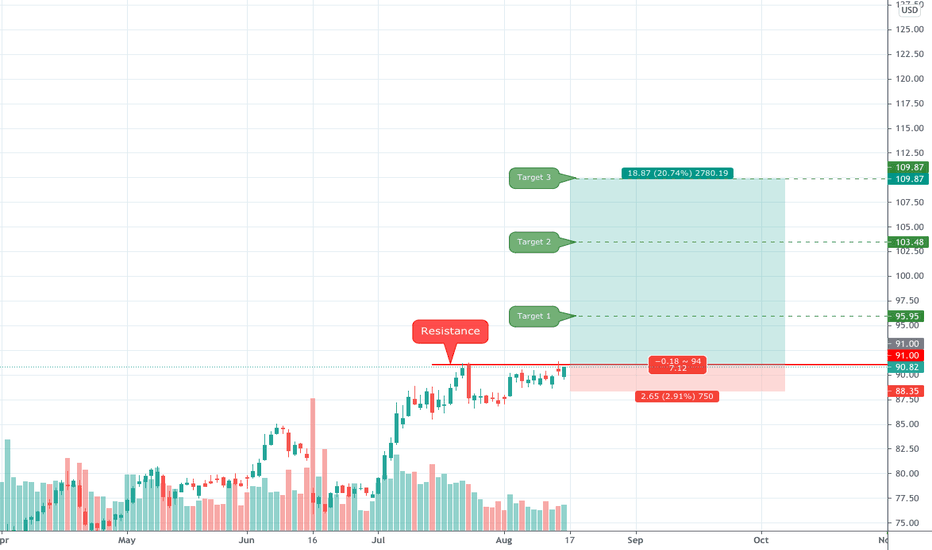

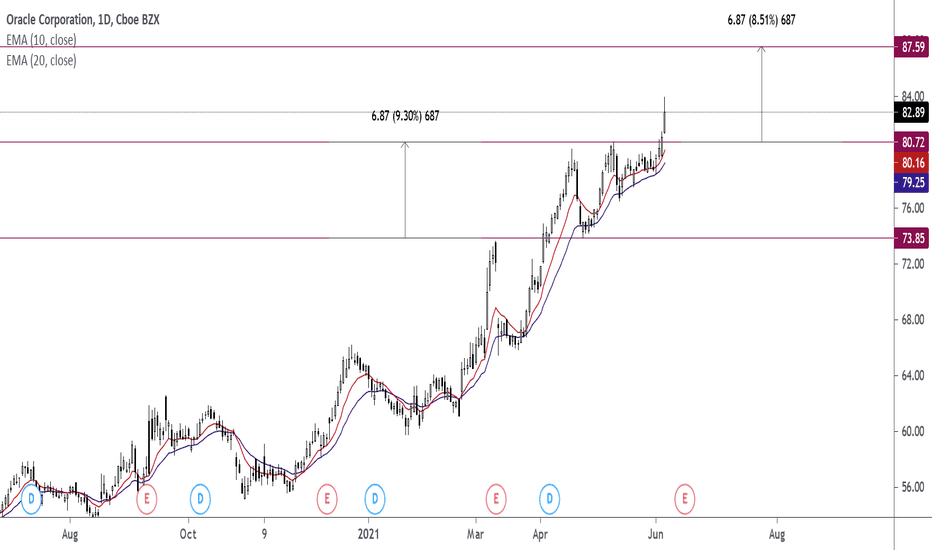

$ORCL LT Breakout, Bullish Options Flow$ORCL Long-term Breakout on Weekly Chart - look for a close above $91 this week for confirmation.

Unusual options activity today...

$11M in Jan'2023 deep in-the-money $30.00 LEAP calls bought today (11x open interest)

Medium term target: $100-$104 range by early December

Note: This is NOT investment advice. Educational only.

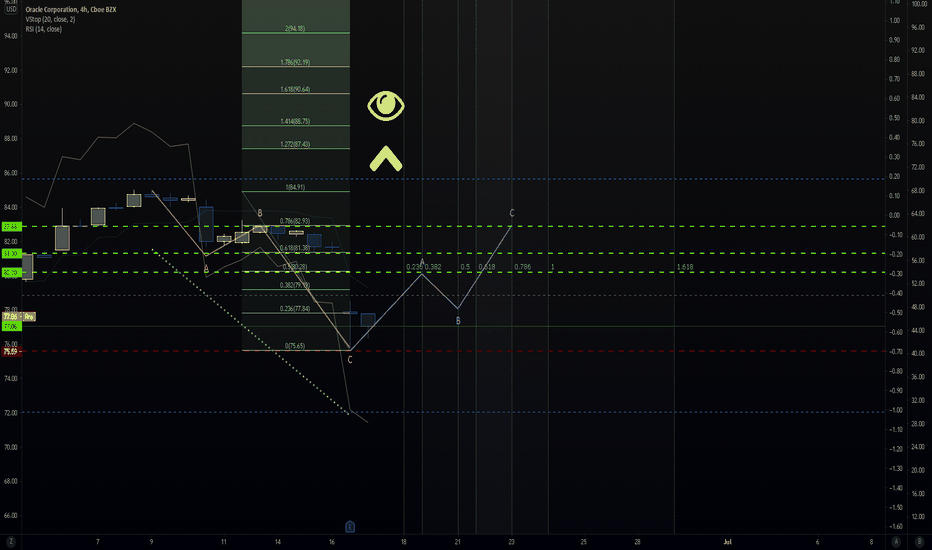

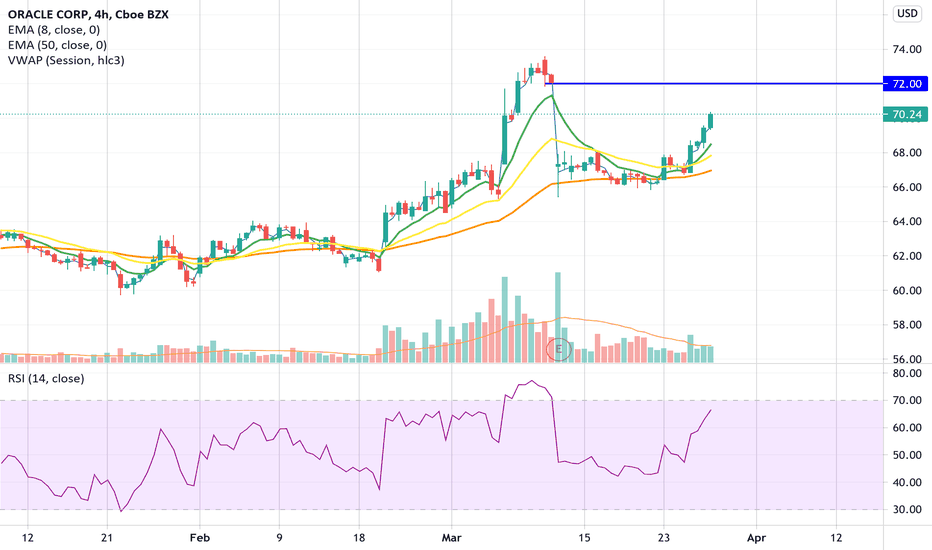

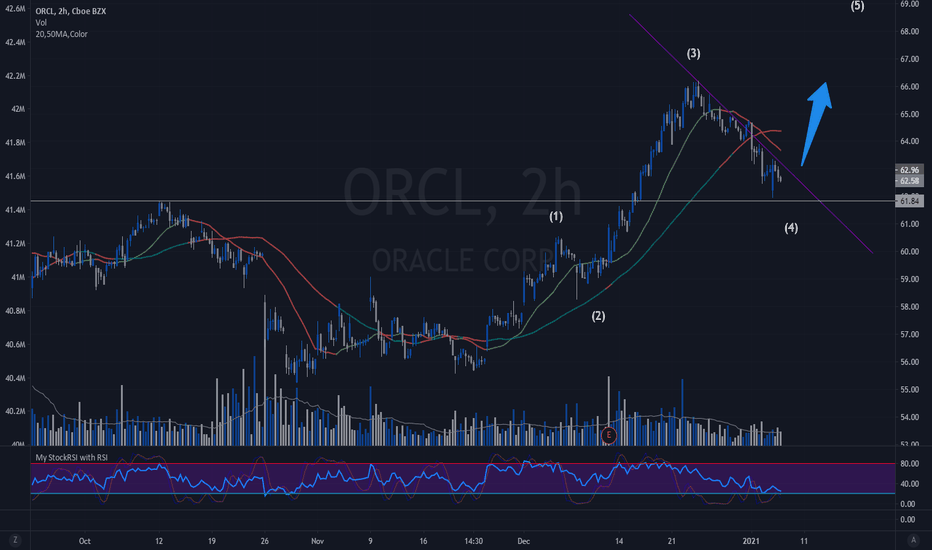

Local recovery for Oracle. ORCLVery short term outlook in this idea in an otherwise bearish tangent. Oracle Pivoted a while ago without yet establishing the lowest of lows.

Fibonacci goals are in green, and invalidation is in red. We know of no more powerful tool in analyzing the markets other than NeoWave/Elliott Wave theory when correctly combined with a few tools in out belt. Make sure to remember that this is not financial advice, and we never give financial advice on this channel. It is your job to create or seek out your own. Good luck out there and be smart!

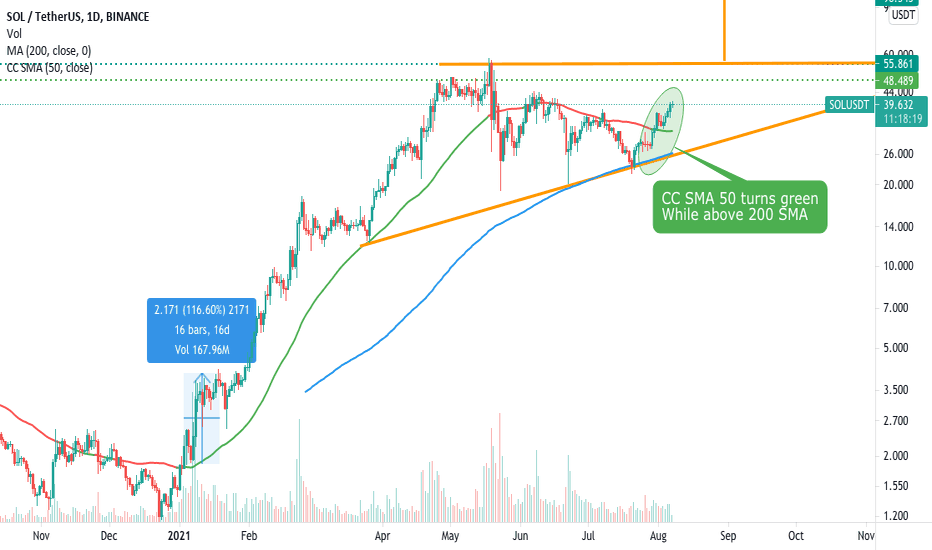

Last time this happened, SOL moved higher by 116% in 16 days!The last time this happened in SOL - it moved higher by 116% in 16 days!

This matches with my fundamental value analysis and relative value analysis that SOL is at least mispriced by half and should be double the value it is today considering the 300+ dApps it has already rolled out and the WORLD CLASS dev team they boast - probably a top 3 dev team I've seen of all projects I've studied.... maybe even the best.

Anyways, the crypto market sentiment is nearly the same today as it was the last time the CC SMA 50 turned green in SOL and SOL moved 116% higher in 16 days.

There was a lot of doubt in the markets back in December 2020 and early January 2021 about whether Bitcoin would sustain a run above $20k. I think something similar will happen here as well. The senate in all likelihood looks like they will vote for the better of the two proposed amendments - the Toomey/Wyden/ Lumis version rather than the one that ironically favors PoW mining. Ironic b/c Washington DC has been telling the world for decades that they are here to save the environment and here they are positing an amendment in a bill that would favor PoW mining!

I know the virtue signaling will get to them as callers into their office will remind them today how the bill would favor high energy intensity protocols if passed. At any rate, it's clear to me that the Senate will in the end favor the bill that is agnostic as to picking winners and losers and this could set BTC off into a mini bull run, setting the stage for SOL's next 116% gain in 16 days.

A very wonderful merger b/w technicals and fundamentals.

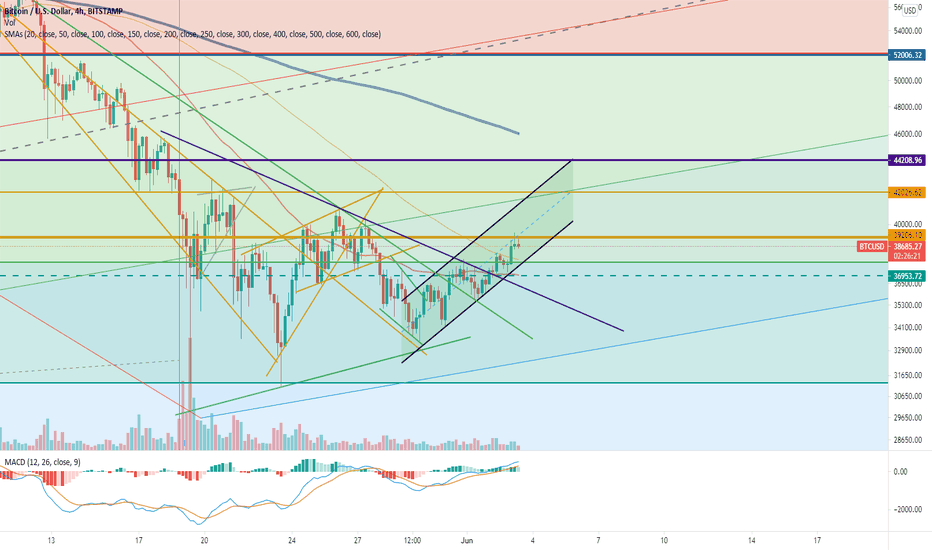

BTC:Confirmed 4H Candle above 0.5 Fib Retrace, Next 0.382 @$44kBTC has confirmed 2 4H candles closing above the 0.5 Fib retracement and the longer we stay in this Fib retracement zone, the better. The next target naturally speaking is the 0.382 Fib Retracement level at $44k.

Notice, BTC is also confirming a breakout from the symmetrical triangle with an upside PT of $49k which also coincides with the a Fib extension price target I projected 2 weeks ago. See my link below for details:

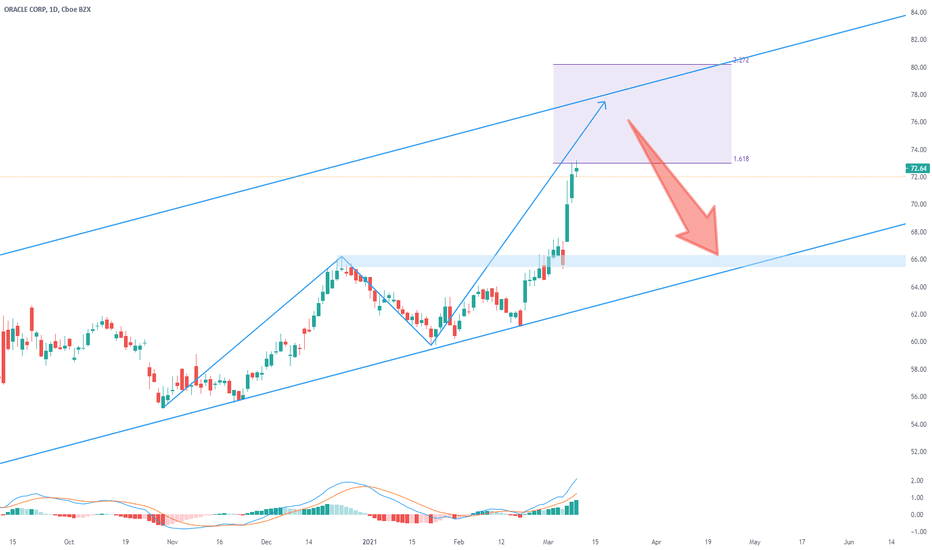

ORACLE : PRICE ACTION 1D TIMEFRAME - PRICE READY TO FALL ! 🔔Hello Everyone ! ! I hope you'll Appreciate our Advanced Analysis on Price Action !

Check the Link on BIO and If you LIKE this analysis, Please support our page by hitting the LIKE👍 button

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

Strategy : BEARISH ABCD PATTERN

Have a Good Take Profits ! ! !

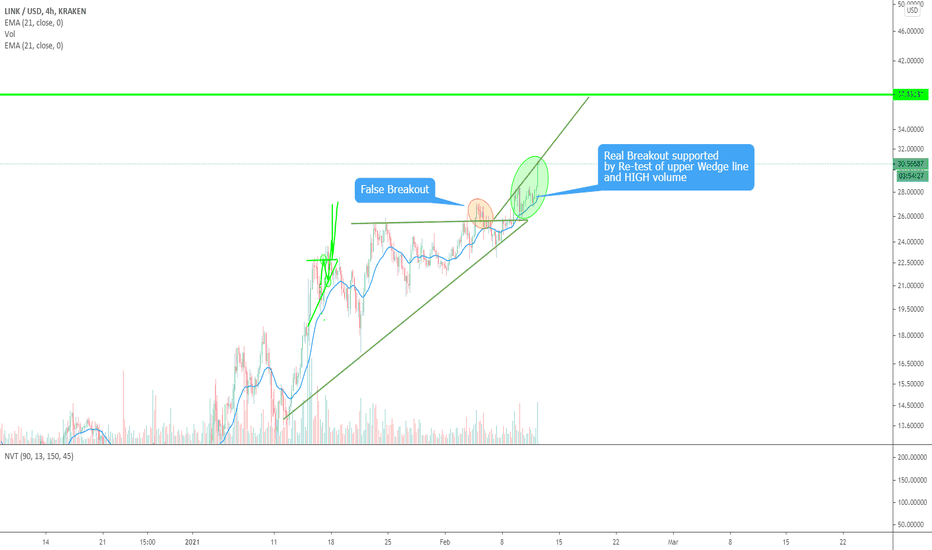

Wedge Breakout - Initial Target $38 - $100 by MarchPer my previous publication on the wedge structure that LINK was trading in - LINK has officially broken out to upside and will continue to first target of $38 where it can either consolidate or continue to higher upside targets of psychological $40, $50, $60 levels .... could impulse much higher but my March $100 target remains on schedule.

Considering the massive fundamentals in LINK from providing the DeFi space with literally everything it needs to function properly to winning Plasma (PolkaDot's) latest endorsement with a full integration - there are much more bullish news items to come.

Read my previous idea on the wedge structure here:

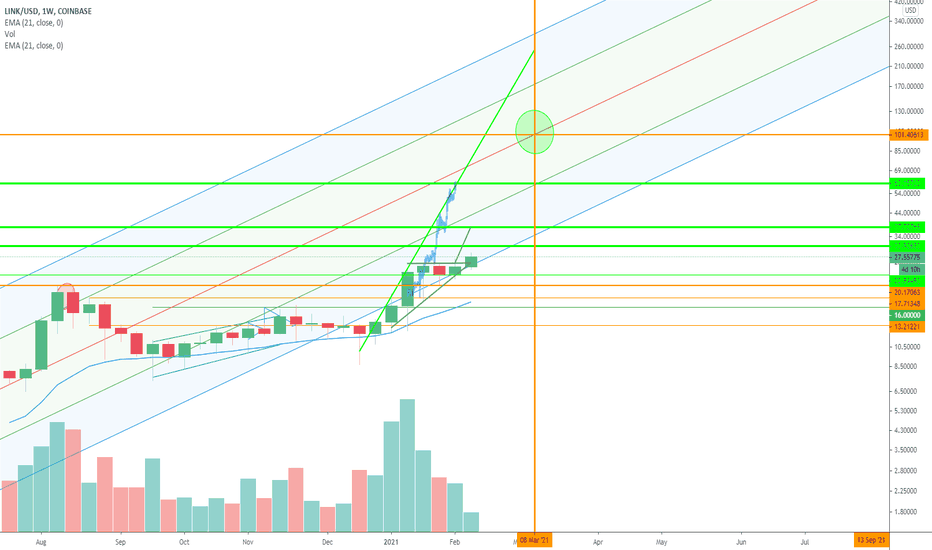

LINK Pitchfork Mid-Line target of $100 by MarchLINK is still massively undervalued and the Pitchfork shows this out. The mid-line alone still has LINK in the $100 range by March.

If you don't think this is possible in LINK then I suggest you take a look at UNI's chart when it moved from $3 to $20 in the span of a couple weeks. Considering the spate of recent news out in LINK from:

1) NASDAQ ETF - www.theblockcrypto.com

2) China's BSN network integrating LINK on Mainnet - medium.com

3) Kraken launching a full LINK node for DeFi price feeds - www.theblockcrypto.com

4) Oracle Corp Executive confirming to me on twitter that they are still collaborating with LINK team on the project "Every Startup in the Blockchain with ChainLink and Oracle Cloud"

twitter.com

The TA and the Fundamentals are strongly aligning for a massive move in LINK coming in the next 2-4 weeks. Stay tuned!

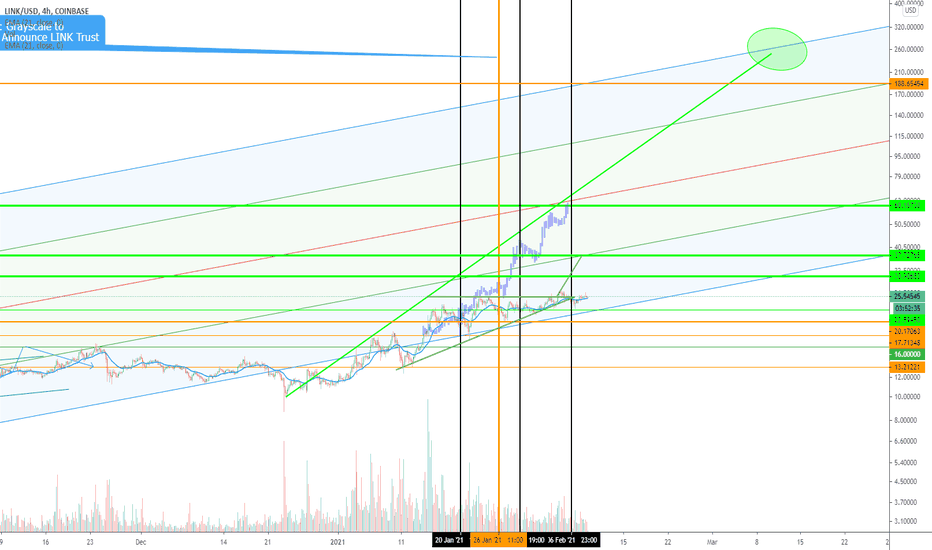

ORCL Corporation Investor Presentation on Integrating LINKIt's only a matter of time before a major F50 Corporation such as ORCL publicly announces a full integration LINK "publicly", just as it was a matter of time for BTC and TSLA (and additional F50s) to eventually announce using their balance sheet to invest in BTC .

twitter.com

When a F50 corporation finally publicly announces a full integration of LINK - LINK will melt faces and my short-term $250 price prediction will look conservative for LINK

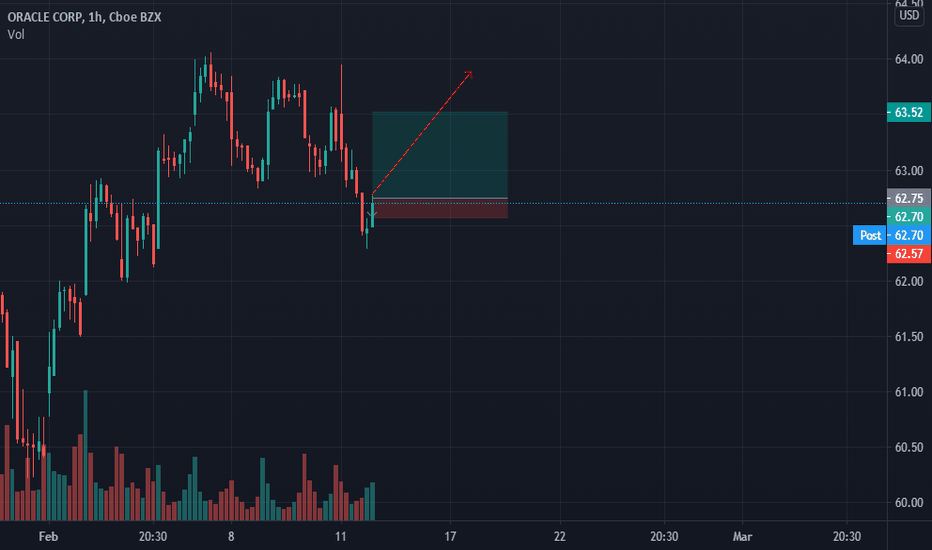

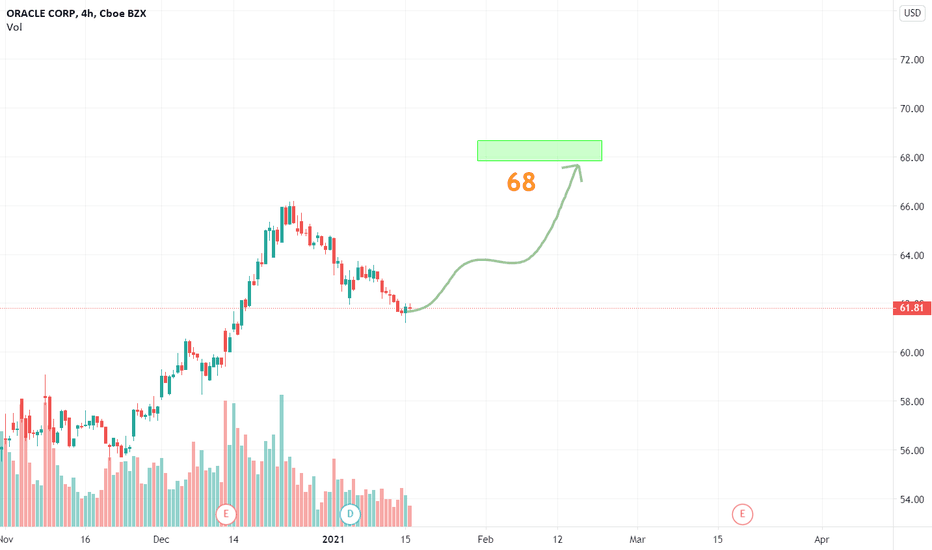

ORCLBull Flag Idea. I would Buy on breakout $64.00 with a stop loss at $62.60 and take profits at the fib extensions . If breakout is hit within the first 30 minutes of market open id wait for a break of that 30 minute high to buy to avoid possibly getting faded to the downside after open. If it takes off running at the open and explodes higher i wouldn't chase it and idea would be void