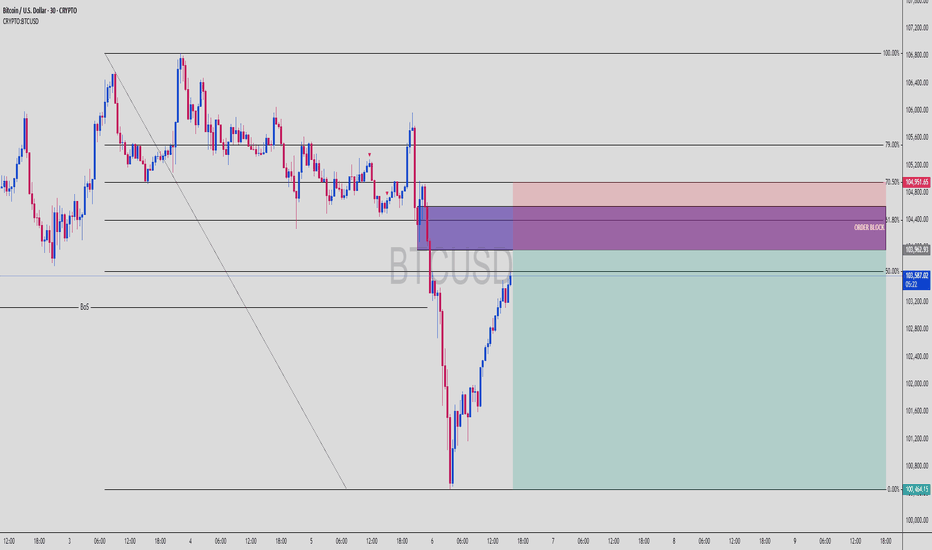

BTC Short Setup! Break of Structure + OB + 70.5% Premium TapBitcoin (BTCUSD) | 30-Min Chart – Clean Bearish SMC Setup

BTC just delivered a textbook Break of Structure (BoS) to the downside, and price is now retracing into a high-confluence premium zone packed with Smart Money signals: a bearish Order Block (OB), Fair Value Gap (FVG) alignment, and multiple Fibonacci retracement levels. This setup is precision-crafted for patient traders who wait for institutional footprints before striking.

🔍 Trade Breakdown:

🔺 Market Structure Shift:

Price broke decisively below the internal range, forming a clear BoS (Break of Structure). The lower low confirms bearish intent. Any retracement into premium is now a potential short opportunity.

📉 Bearish Order Block:

Marked just above the 61.8% Fib

Originated the strong bearish impulse that created the BoS

This is where Smart Money likely entered the move — we look to join them

🟣 Fair Value Gap (Imbalance Zone):

Gap within the OB

Price is likely to rebalance this inefficiency before continuing the bearish trend

📐 Fibonacci Levels (Swing High to Low):

50%: 103,617 (current price)

61.8%: 103,963

70.5%: 104,800

79%: 105,200

This premium zone (104,400–104,951) overlaps with the OB and FVG — massive confluence.

🧠 Smart Money Playbook:

🔹 Entry Zone:

From 103,963 to 104,951 — OB + FVG + 61.8–70.5% retrace = sniper entry window

🔻 Stop Loss:

Above 105,000 (protect against OB invalidation and final liquidity sweep)

📉 Take Profit:

100,464 — aligned with the low of the full fib swing and prior liquidity pocket

⚖ RRR:

Over 1:4 — clean sniper risk-reward with clear structure validation

📉 Bearish Continuation Expectation:

Price enters OB → taps imbalance → reacts at 70.5% level

Expected move: Sell-off toward the discount zone + full swing completion

Look left — no major support zones until the 100,400–100,600 level, making it a liquidity magnet and realistic TP zone.

💬 Ninja Wisdom:

Structure + Liquidity = Foundation

OB + FVG + Fib = Precision Tools

Trade where Smart Money enters — not where retail hopes. 🥷💸

📍 Save this chart – this setup could play out fast

🔁 Share your thoughts: will BTC respect the OB or break above?

👣 Follow @ChartNinjas88 for daily sniper-level BTC/ETH/Gold trades

Orderblocktrading

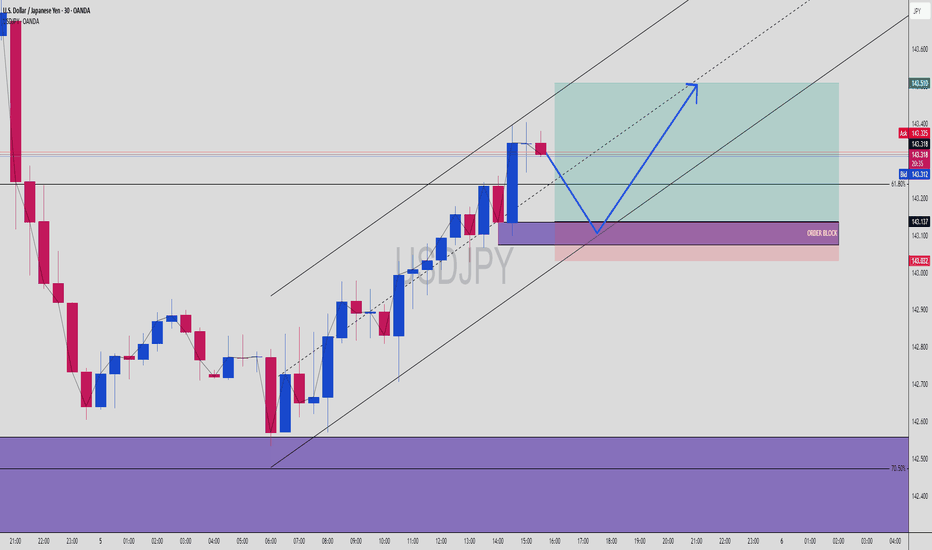

USDJPY Buy Setup! OB + 61.8% Fib + Trend Channel ConfluenceUSDJPY | 30-Min Chart – High Probability Buy Setup in Progress

USDJPY is currently respecting a bullish market structure within a well-defined ascending trend channel. Smart Money Concepts (SMC) traders are watching for a precise reaction at the confluence of a key Order Block (OB), Fibonacci retracement levels, and mid-channel support.

🔍 Trade Breakdown:

Bullish Market Structure

Price has shifted from bearish to bullish after forming a key higher low and continuing with higher highs within the trend channel. The structure is being respected with multiple taps on both upper and lower channel boundaries.

Internal Liquidity & Order Flow:

Price previously swept sell-side liquidity below the recent swing low and sharply reversed, confirming internal liquidity engineering and institutional involvement.

Currently, we’re seeing price stall after rejecting the upper channel and OB zone. A retracement into the discount zone is anticipated before continuation.

🟣 Order Block Zone (OB): 143.032 – 143.137

A clear bullish OB formed after a strong impulsive move, marking the last down candle before the bullish break of structure.

Located just above the 61.8% Fibonacci level — strong confluence.

📐 Fibonacci Levels from Last Swing Low to High:

61.8% = 143.137

70.5% = 143.032

Potential reaction zone aligns perfectly with OB + trendline + psychological round level (143.000 area)

📊 Buy Setup Expectation:

USDJPY is expected to retrace into the OB/Fib confluence zone before a bullish continuation toward the upper boundary of the trend channel and beyond.

🔵 Projected Path:

Price dips into OB → reacts to 61.8–70.5% retracement → bullish reversal → break to fresh highs near 143.510 or higher

🧠 Chart Ninja Entry Plan:

🔹 Entry Zone: 143.032 – 143.137 (OB + 61.8–70.5% Fib)

🔻 SL Below: 143.000 (beneath OB and psychological level)

📈 Target: 143.510 (channel top + previous supply zone)

⚖️ RRR: Approx. 1:3+ — high precision Smart Money entry

💬 Ninja Wisdom:

Patience before profit. Wait for price to return to the zone where institutions left footprints — the OB at equilibrium pricing. Combine OB + Fib + channel and you're trading like the banks.

Retail buys the breakout. Smart Money buys the pullback. 🥷📚

📍 Save this chart before the setup triggers!

🧠 Do you see the same confluence? Comment your entry/TP/SL plans ⬇️

👣 Follow @ChartNinjas88 for more sniper setups on major FX pairs every session!

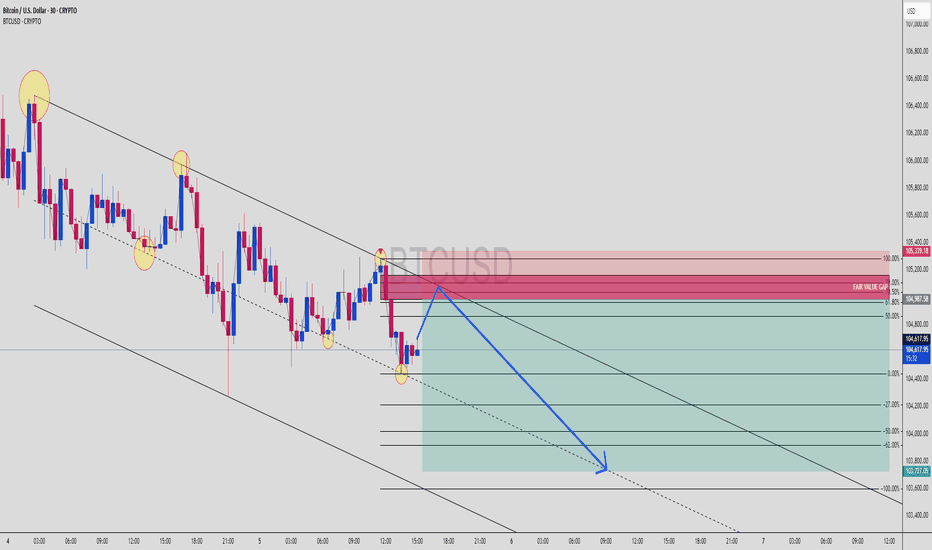

BTC Short Setup! OB + Fair Value Gap + Trend Channel ConfluenceBitcoin (BTCUSD) | 30-Min Chart – High Probability Sell Setup

Bitcoin continues to respect bearish structure inside a descending trend channel, creating prime opportunities for Smart Money traders to strike at optimal levels.

🔍 Trade Breakdown:

Bearish Market Structure

Price is forming lower highs and lower lows

Channel structure is being respected with multiple taps on both the upper and lower bounds

Liquidity Sweeps & Internal Range

Multiple yellow-highlighted zones show liquidity engineering — both buy-side and sell-side have been swept

Recent sweep + demand failure confirms bearish intent

Premium Entry Zone Setup:

🔴 Order Block Zone (OB): 105,200 – 105,400

🟣 Fair Value Gap (FVG): Overlapping with OB – perfect imbalance correction

📐 Fib Levels:

61.8% = 104,987

70.5% = 105,298

79% = 105,388

🔺 This is the kill zone — premium retracement + inefficiency fill = high confluence

Bearish Continuation Expectation:

BTC likely to react at OB zone and continue bearish leg

Projection into discount fib levels:

-27% = 104,000

-62% = 103,800

-100% = 103,727

Channel Respect = Structure Confidence:

Every key swing is aligning with channel resistance/support

Blue arrow shows expected path: liquidity sweep ➝ OB/FVG tap ➝ drop to channel low

🧠 Chart Ninja Entry Plan:

🔹 Entry Zone 105,280 – 105,388 (OB + FVG + 70.5–79% Fib)

🔻 SL Above 105,400 (above OB)

📉 Target 103,727 (channel + -100% Fib extension)

⚖️ RRR Over 1:4 — sniper-grade RR setup

💬 Ninja Wisdom:

You're not chasing moves — you're waiting where liquidity pools.

Fair Value Gaps + OB + Trend Channels = institutional signature.

Trade like Smart Money. Let retail chase candles. 🥷💸

📍 Save this setup before the market plays out

🔁 Share your thoughts below – entry, TP, SL?

👣 Follow @ChartNinjas88 for more sniper BTC setups daily

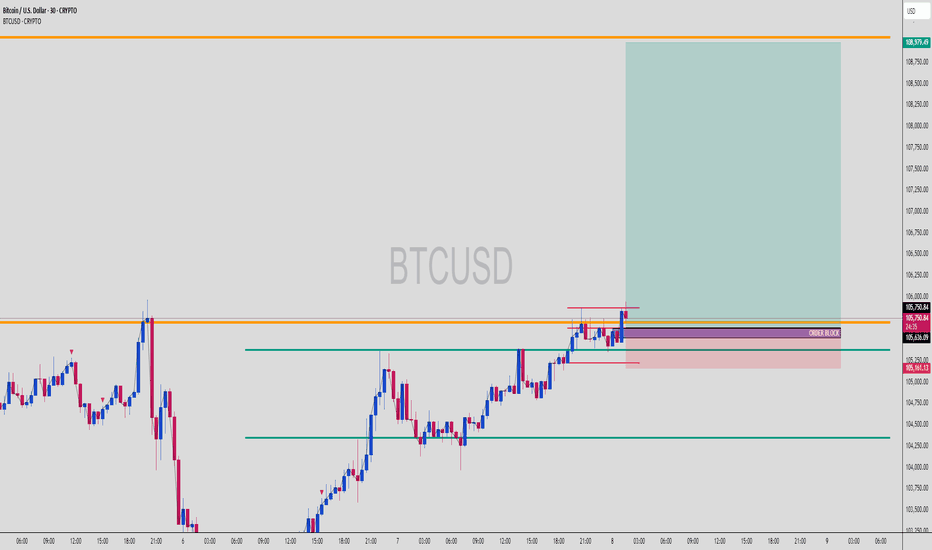

BTC Long Triggered from OB, Smart Money Played This Perfectly!BTCUSD | 30-Min Chart – Long Setup Execution

Bitcoin has just activated a clean long entry from a well-defined bullish Order Block at a key structural level. This move follows textbook Smart Money Concepts (SMC) — the kind of play institutional traders thrive on.

🔍 Setup Breakdown:

🔹 Order Block (OB):

Identified near 105,636 — aligned with previous support

Precise reaction zone after consolidation, showing institutional interest

OB respected after fakeout below short-term liquidity

🔸 Liquidity Sweep:

Quick wick below 105,250 acted as a stop hunt for early shorts

Price reclaimed the OB immediately after → classic Smart Money trap

🟩 Entry Zone (OB Zone):

105,636–105,250 range

Confluence with minor bullish imbalance and structure support

Price barely tapped the zone before launching higher

📈 Upside Target:

TP marked at 108,979 — prior liquidity pocket and untested highs

Large green zone shows ideal RR (approx. 1:6)

First obstacle: minor resistance at 106,750, but momentum looks strong

🟥 SL Placement:

Safely below OB at ~105,161

Below liquidity sweep zone = strong invalidation

🧠 Why This Setup Works:

✔ Price moved impulsively into the OB

✔ OB lines up with previous structure support

✔ Rejection + strong bullish candle = confirmation

✔ No significant resistance until higher liquidity zones (108K+)

This is classic SMC execution: trap, sweep, OB tap, and send. Let retail panic — we follow footprints.

💬 Ninja Wisdom:

"Smart Money doesn’t chase price — it traps and collects."

This was a clean confirmation of a bullish continuation after reclaiming control from liquidity grabs.

📍 Save this chart – this setup could explode into a full bullish swing

💬 Drop your thoughts: Are we headed to 109K or pausing at resistance?

👣 Follow @ChartNinjas88 for more sniper-level BTC/ETH/Gold plays

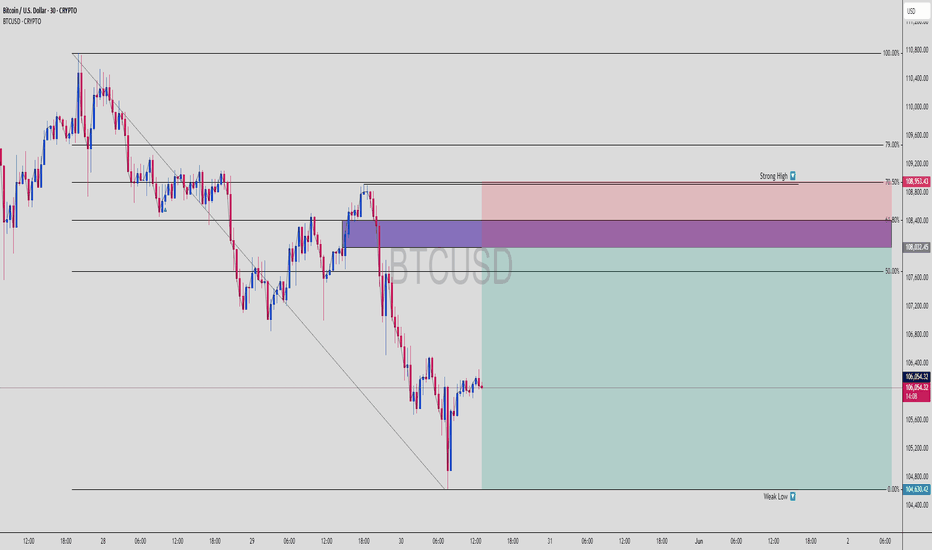

BTCUSD SMC Short | 70.5% Fib + OB Rejection Incoming?BTCUSD | High Risk-Reward Setup at Key Supply Zone 🔥

This Bitcoin setup is setting up for a potential clean short opportunity, right from a key Order Block zone confluenced with 61.8–70.5% Fib retracement and a Strong High liquidity magnet above.

🧠 1. Why This Trade Setup is 🔥

This BTCUSD chart shows Smart Money preparing a trap:

🔺 Impulse down ➝ forming market structure shift

📉 Retracement back to a refined OB (purple zone)

📍 Aligned perfectly with:

✅ 61.8–70.5% Fib retracement zone

✅ Strong High = liquidity trap

✅ Bearish engulfing rejection from supply zone

This is textbook SMC confluence. Price could sweep the high one more time, then tank hard.

📌 2. Zone Breakdown

OB Entry Zone (purple): ~108,000 to 108,400

SL Above Strong High: ~109,000

TP at Weak Low: ~104,600

✅ Entry around 108,000

✅ RRR: ~1:5 👑

📈 3. Market Structure

HTF Bias: Bearish

LTF Structure: Retracing to premium zone

Expecting BOS downward if rejection confirms

⚙️ 4. Trade Plan

Wait for price to tap 61.8–70.5% zone

Look for M5/M15 bearish structure break

Enter on pullback to M15 OB

SL = Above the High

TP = Weak Low (104,630)

🛑 5. Risk Management Tips

Never enter blindly at 61.8%

Always wait for confirmation on LTF (M5/M15)

If price blows past 70.5%, let it go — don’t chase 🧘

🧠 Save this trade plan

📈 Comment “BTC SMC ENTRY” if you caught this

👀 Follow for more Smart Money chart breakdowns

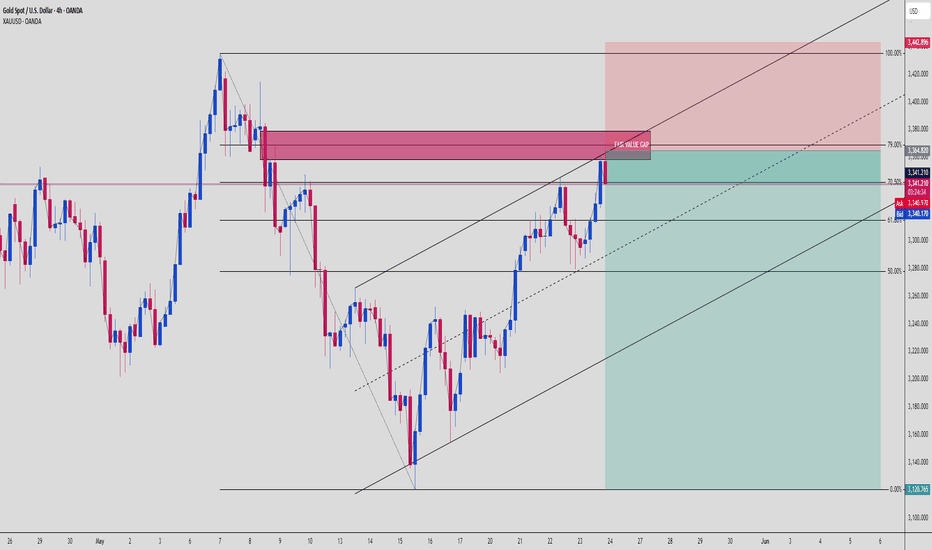

GOLD is About to COLLAPSE from a Fake Pump!📊 GOLD SMC Analysis (XAU/USD 4H)

Gold just tapped into a major Fair Value Gap + Premium OB Zone, aligning with the 79% retracement level. Market structure shows exhaustion, and a perfect short setup is forming.

🔍 Smart Money Narrative:

Strong prior bearish move = institutional sell-off ✅

Clean retrace into FVG (Fair Value Gap) and OB (Order Block) = sell zone 💯

Price tapped into 3,351 – 3,364 range (marked red)

That level aligns with the 79% Fib + channel resistance 🚨

The confluence = Smart Money liquidity grab ➡️ expect dump

📍 Key Confluences:

✅ FVG: clear imbalance filled (great trap zone)

✅ Order Block: bearish origin of last impulse

✅ 79% Fib Level: classic retracement kill zone

✅ Bearish Trendline + Channel Top: dynamic resistance

✅ 3:1+ RRR short idea in play

📉 Trade Plan (Sell Setup):

Entry Zone: 3,351 – 3,364

Stop Loss: 3,442 (above swing high)

Take Profit:

TP1: 3,280 (61.8% level)

TP2: 3,120.76 (full move, 0% Fib)

RRR: 1:3 to 1:4 🤑🔥

🧠 Institutional Logic:

Retail is chasing breakout highs 😬

Smart Money is selling into OB + FVG → trap those late longs

Next? Smash weak lows and rebalance price with a deep pullback

💬 “Gold’s headed for a cliff dive?” Drop a 💰 or ‘XAU’ if you’re riding this wave down!

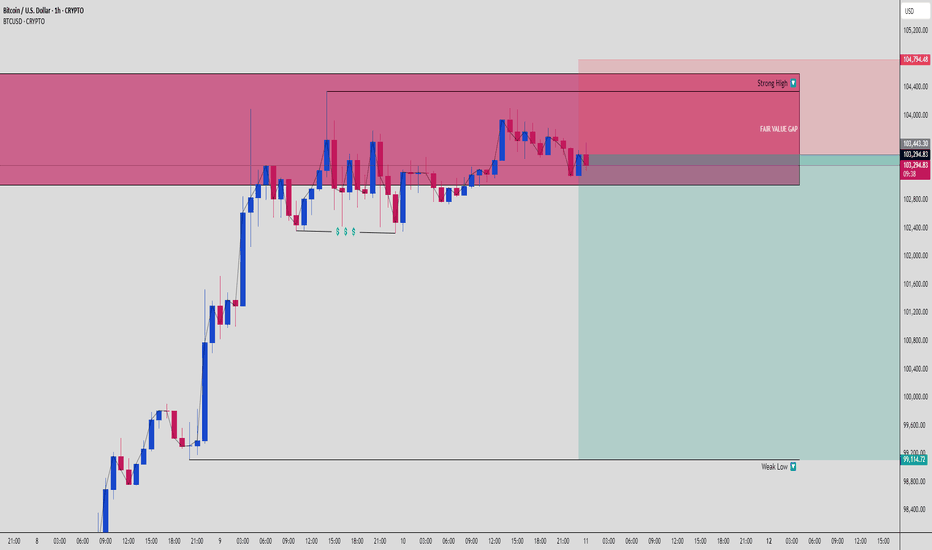

BTCUSD Supply Zone Play: Smart Money Dump in Progress!🚨 Bitcoin (BTCUSD) is playing the classic Smart Money trap — and you’re either the bait or the sniper.

Let’s decode this fresh 1H chart with laser precision 👇

📈 Market Structure:

BTC had a clean rally with momentum, but notice what happened next — price tapped directly into a 1H Bearish Order Block and Fair Value Gap (FVG) combo.

That red zone? That’s where smart money was waiting.

Now, price is consolidating and rejecting inside that OB. This isn’t just sideways action — this is distribution. 📉

📉 Liquidity Engineering:

See those equal lows below? 👀

Retail sees them as support.

Smart money sees them as liquidity to be harvested.

✅ Triple tap lows (marked by $$)

✅ Buy-side liquidity swept at the strong high (104.79k)

✅ Fair Value Gap left open as inefficiency magnet

This screams: "Trap the breakout chasers, then dump."

🔥 Smart Money Setup:

Entry was timed post-rejection inside the OB after tapping the Fair Value Gap.

This is distribution at premium pricing, exactly where big players unload while retail buys the top.

✅ OB Rejection

✅ Inside Premium

✅ Strong High respected

✅ Perfect Risk-to-Reward opportunity

🎯 Targets:

TP1: Local support flip or structure break near 101.2k

TP2: Full move into Weak Low / imbalance fill at ~99.1k

SL: Above OB / strong high @ 104,794.48

Risk-Reward? Solid 1:4+ sniper-grade setup 🔥

🧠 Psychology Tip:

Most traders get chopped here by overtrading or entering too early.

Be the sniper — not the machine gun. 🧘♂️💥

Wait for price to enter premium, show weakness, then strike with precision.

🚀 Summary of Confluences:

OB + FVG stacked

Strong High as invalidation

Distribution signs within premium

Weak Lows begging to be swept

Clear imbalance toward 99.1k

BTC is delivering textbook SMC setups — your job is to stop chasing and start planning like Smart Money.

➡️ Comment “BTC READY” if you're watching this setup!

➡️ Save this post for your backtesting journal! 🔥

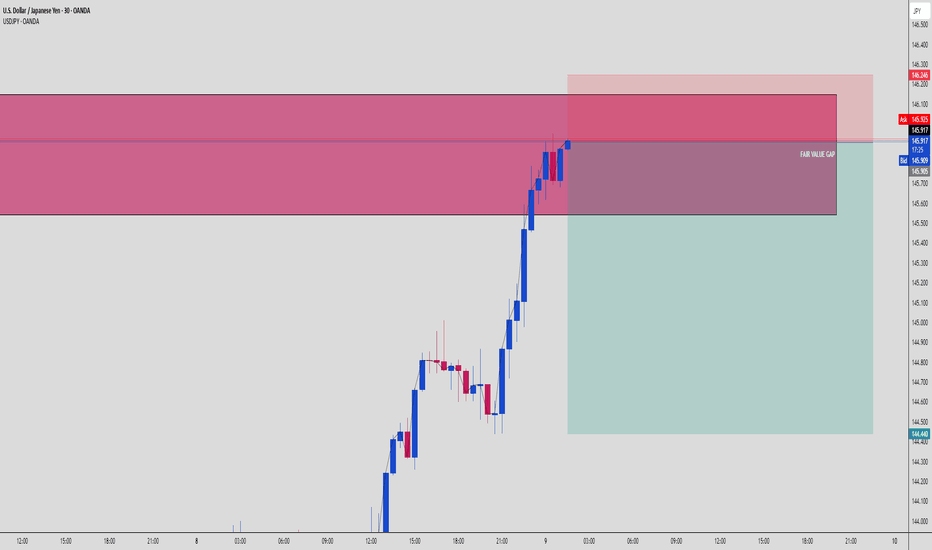

USDJPY Smart Money Short Setup | 30m OB + FVG Reaction🧠 USDJPY 30m SMC Setup | May 9, 2025

We’ve got a high-probability short brewing as price taps the premium zone and aligns with multiple Smart Money Concepts. A clear Fair Value Gap (FVG) is sitting inside a bearish Order Block, with price aggressively wicking into it — right where institutions unload.

🔍 KEY CONFLUENCES:

🧱 Bearish Order Block rejection in premium

⚡ Fair Value Gap filled at 145.910

💰 Risk-to-Reward ~1:4+, targeting discounted zone

🧲 Liquidity sweep + FVG fill = SM distribution trigger

⏳ Entry timing aligned with NY session reaction

📊 Setup Specs:

Pair: USDJPY

Timeframe: 30 min

Entry: 145.910 (after FVG fill)

SL: ~146.246

TP: ~144.440

RR: Approx. 1:4.5

💡 Smart Money Logic:

Price filled a clean imbalance zone, ran liquidity from earlier highs, and instantly showed distribution behavior. If momentum confirms with a bearish break, this becomes a high-conviction short.

📈 Chart Ninja Note:

“FVG + OB is where the banks sell while the crowd buys… don’t be the crowd.”

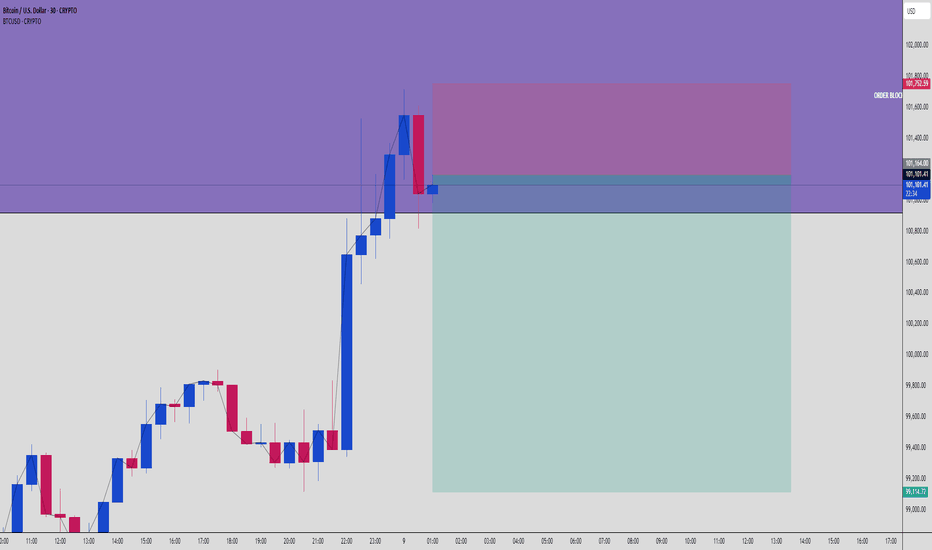

Bitcoin Short Setup | 30m SMC OB Rejection + Clean RR💣 Bitcoin (BTCUSD) 30-Min SMC Short | May 9, 2025

We just caught BTC’s premium tap into a 30m bearish Order Block, followed by a strong rejection candle. This is a classic Smart Money play, where price fills inefficiency and instantly rejects the institutional footprint.

🔍 KEY CONFLUENCES:

📦 Bearish Order Block tapped at $101,752

📈 Strong bullish impulse followed by hard rejection

🎯 Short from premium into discount zone (~$99,114 target)

🔺 Clean Risk-to-Reward: ~1:5+

💰 High-probability Smart Money setup

📊 Setup Specs:

Timeframe: 30min

Direction: Short

Entry Zone: $101,752

TP: $99,114

SL: ~$102,000

RR: Approx. 1:5+

💡 Trade Logic:

Price made a liquidity grab + FVG fill before tapping a 30min Order Block. The sharp red engulfing candle at the top confirms SMC presence and intention to sell-off. This zone represents premium pricing, ideal for institutional distribution.

🎯 Chart Ninja Note:

“Smart Money never chases price… they wait for the retest where the fear begins.”