Is Digital LiDAR the Eye of Autonomy's Future?Ouster, Inc. (NYSE: OUST), a key player in the small-cap technology landscape, recently experienced a significant boost in its share price following a crucial endorsement from the United States Department of Defense (DoD). This approval of Ouster's OS1 digital LiDAR sensor for unmanned aerial systems (UAS) validates the company's technology. It highlights the growing importance of advanced 3D vision solutions in both defense and commercial sectors. Ouster positions itself as a foundational enabler of autonomy, with its digital LiDAR distinguishing itself through enhanced affordability, reliability, and resolution compared to traditional analog systems.

The DoD's inclusion of the OS1 sensor within its Blue UAS Framework represents a strategic victory for Ouster. This rigorous vetting process ensures supply chain integrity and operational suitability, making the OS1 the first high-resolution 3D LiDAR sensor to receive such an endorsement. This approval significantly streamlines procurement for various DoD entities, promising expanded adoption beyond Ouster's existing defense engagements. The OS1's superior performance in weight, power efficiency, and rugged conditions further underscores its value in demanding applications.

Looking ahead, Ouster actively develops its next-generation Digital Flash (DF) Series, a solid-state LiDAR solution poised to revolutionize automotive and industrial applications. By eliminating moving parts, the DF series promises enhanced reliability, longevity, and cost-efficient mass production, addressing critical needs for autonomous driving and advanced driver-assistance systems (ADAS). This forward-looking innovation, combined with the recent DoD validation, firmly establishes Ouster as a pivotal innovator in the rapidly evolving landscape of autonomous technologies, driving its ambition to capture a substantial share of the $70 billion total addressable market for 3D vision.

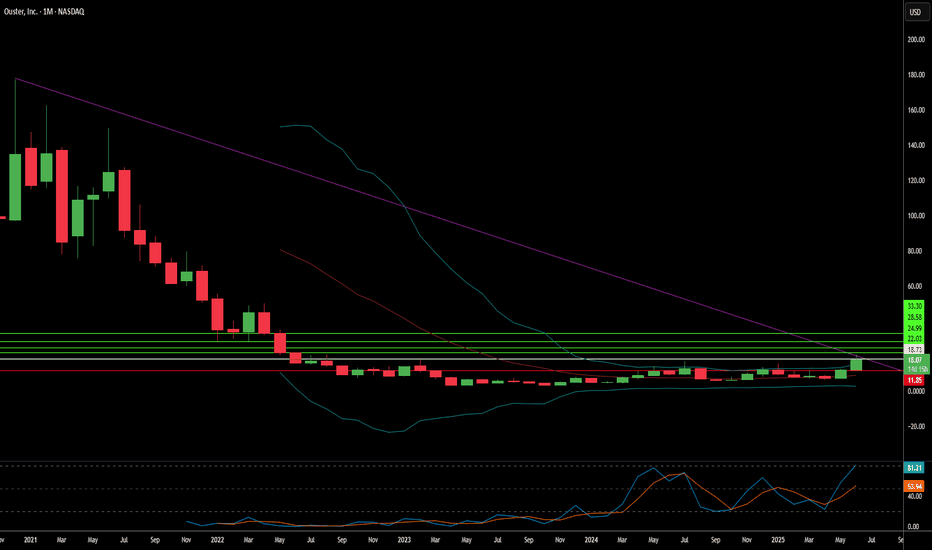

Oust

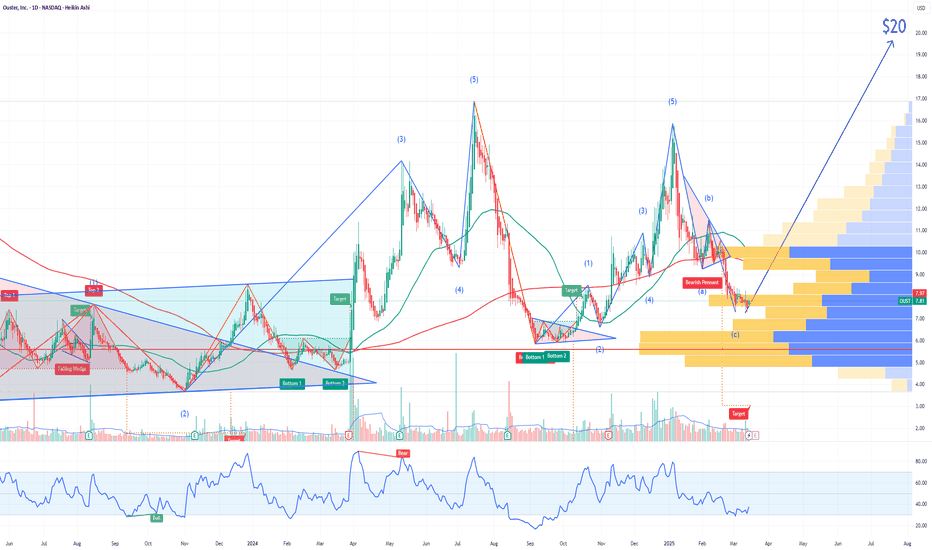

OUST Ouster Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OUST Ouster prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $0.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

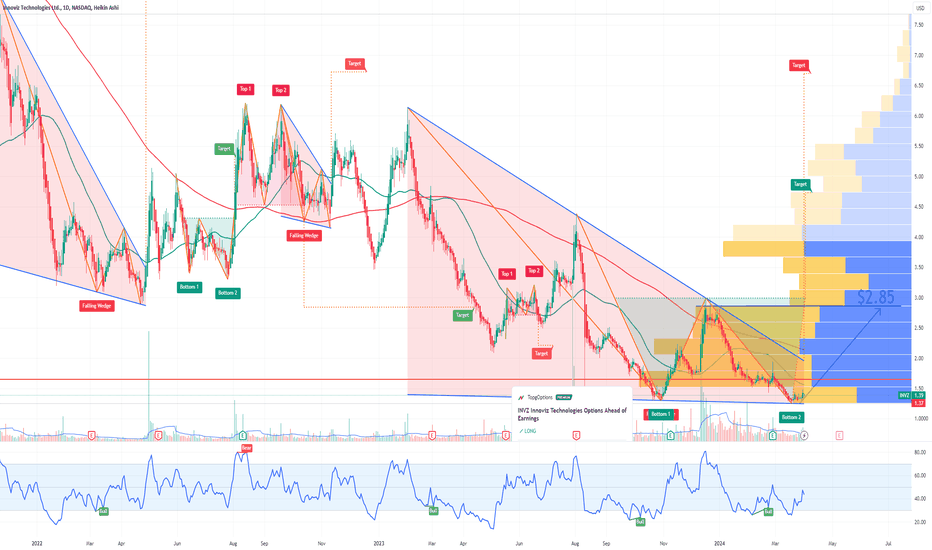

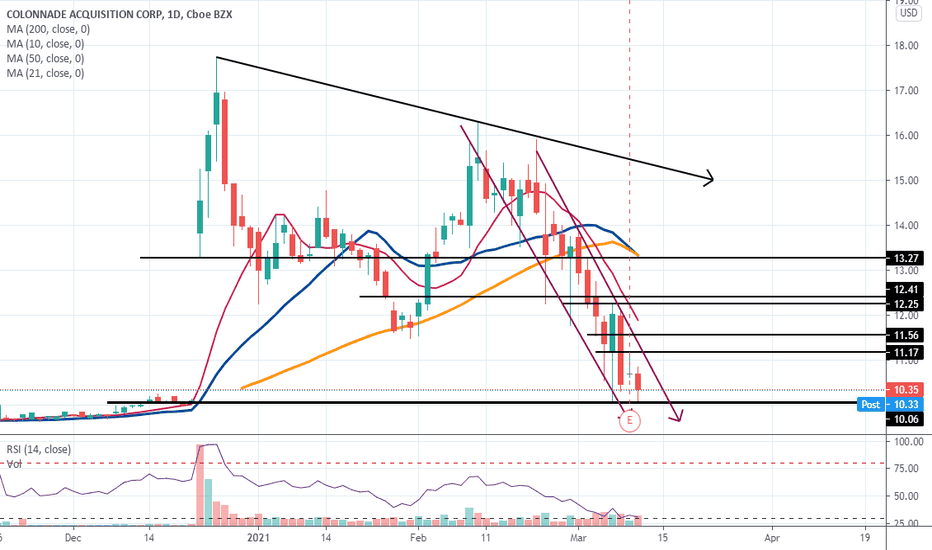

INVZ Innoviz Technologies Buy OpportunityI believe this could be a Premium idea, but let's wait and see how it unfolds:

In March, INVZ saw some unusual out-of-the-money calls valued at over $1 million with a $2.5 strike price, expiring on April 19th.

Upon reviewing the chart, it resembles a double bottom pattern, suggesting a potential price target of $2.85 if a reversal occurs.

Recently, OUST, a rival company, announced record revenue for the fourth quarter and its stock price doubled. Similarly, INVZ reported record revenue and has a partnership with the industry giant Mobileye.

OUST's results underscore the importance of Lidar companies expanding beyond the automotive market.

Lidar technology can serve various purposes, such as enabling cars to navigate highways for adaptive cruise control or assisting humanoid robots in performing basic tasks with AI.

Some of the robots seen at Nvidia's recent event had eyes provided by Ouster lidar, according to Ouster.

Considering these factors, I speculate that the $2.5 calls on INVZ may be linked to a significant upcoming catalyst, possibly even a buyout.

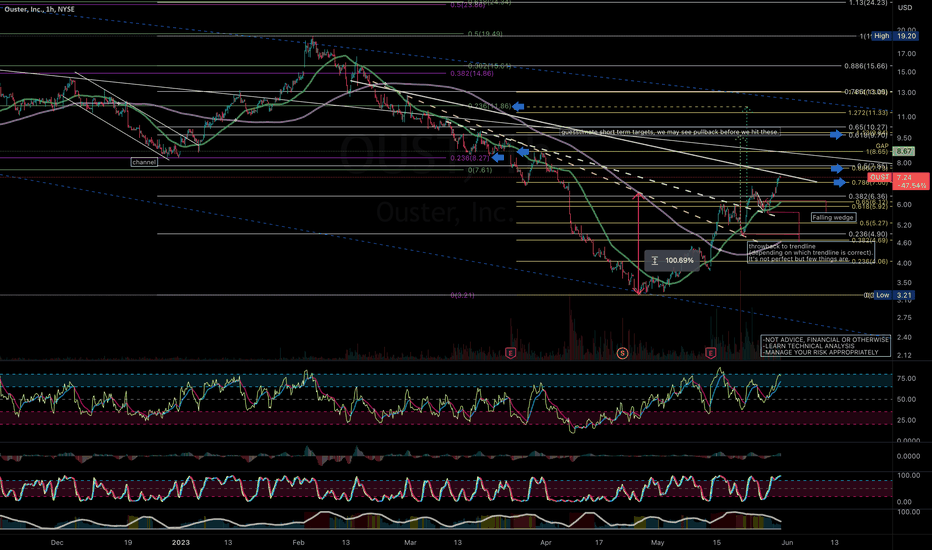

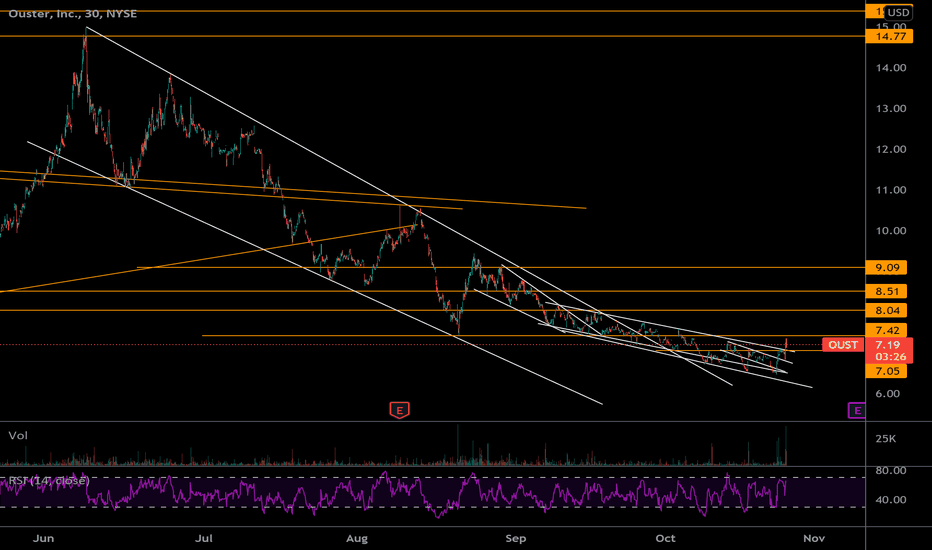

$OUST possible bump and run reversal bottomIt's not perfect but it may be close. Let's see how it plays out now. I still expect some corrections/check backs if it heads higher, but so far it is playing out nicely.

Disregard the solid diagonal white trend line, not sure what I was trying with that one. Maybe it will be a point of resistance, maybe not.

Relevant fibs of support and resistance also shown.

Two trendlines for the bump and run are drawn (dashed lines) - I'm not quite sure which one is more accurate to be honest.

Had a decent amount of insider buying (IIRC) as well as being driven into the dirt with a low float of ~30M shares...

Still seems undervalued, but what do I know.

Final Notes:

It would be nice to hold $7; if not that, then 6.36 or 5.92. Seems pretty volatile and a potentially good candidate for active trading if you manage risk appropriately.

RSI is turning around on 1hr and lower TF, and it looks like a possible bearish harmonic (crab?) may be on the 15 min.

Looking for possible re-entries around $5-6 if it can retain its upward momentum.

References:

thepatternsite.com

Bulkowski's Encyclopedia of Chart Patterns, Chapter 14.

OUST breaks out of falling wedge and bull flag channelBeen tracking OUST for a long time as it sets up some pretty monster patterns. It appears at the moment that it has broken out of a bull flag channel which pushed sideways from a rather large falling wedge. First targets shown on chart, but this could potentially go up much higher.