Are Markets Overvaluing These 3 Stocks? LULU, NFLX, SQTwo recent stock events have called into question how markets are pricing stocks. The first event is the OG meme stock, Tesla (NASDAQ: TSLA), hitting a one trillion-dollar market cap. And the second event is EV newcomer Rivian Automotive (NASDAQ: RIVN), surpassing the valuation of Ford Motor Company (NYSE: F) after listing on the NASDAQ.

One way to gauge how overvalued a stock may be is to find its multiple (aka, Price-To-Earnings ratio). In the case of Tesla, it’s multiple, as of writing, is ~350. In the case of Rivian, it doesn’t have any sales to speak of, so a multiple for this Company is not discernible (as reported by Bloomberg; “Rivian is now the biggest US company with no sales”). Investors can be concerned about high multiples if the Company in question is unlikely to grow its profitability to a level that better reflects the stock’s current price. Tesla and Rivian are just two companies that analysts (incl. Tesla’s CEO Elon Musk) commonly point out as overvalued.

Keep reading to learn what other 3 stocks market analysts commonly categorise as overvalued.

Are Markets Overvaluing These 3 Stocks? LULU, NFLX, SQ

Lululemon Athletica (NASDAQ: LULU)

Several outlets, including Forbes, noted the athleisure wear company to be overvalued in the first half of 2021. Yet, difficult to discourage, investors have continued to support the Company and further bumped up the stock’s price. LULU is currently trading at an 15% premium above its first-half peak price (US $404 vs US $465). Its current valuation places its multiple at ~74x earnings.

The momentum behind the stock is driven by its consistent earnings report beats and ambitious sales targets set by management, which are being hit or surpassed with surprising frequency. The Company’s outlook is buoyed by a growing (and incredibly loyal) customer base and higher margins. In this way, Lululemon stock may well be within a fair valuation if it continues to ride the growth momentum in which it is currently swept up.

Netflix (NASDAQ: NFLX)

Numerous Analysts were calling Netflix overvalued in 2020, even as the streaming giant reported subscriber growth beats during quarantine lockdowns and beyond. Bearish comments would call attention to the cash-burn needed by Netflix for the foreseeable future to maintain its industry leadership and satisfy its growing user base.

Bullish sentiment could counter this argument by pointing to the Company improving operating margins (e.g., Netflix has improved its operating margin from 16% to 23.5% YTD). However, Netflix does not include content generation spending as an operating cost. Instead, it is considered a fixed cost for the business. Yet, suppose Netflix is going to be burning cash producing content for the foreseeable future. In that case, the improving operating margin might be considered no more an accounting trick than a meaningful metric.

As of writing, Netflix shares are trading at US ~$690, indicating a multiple of approximately ~62 earnings.

Square (NYSE: SQ)

The digital payment provider Square appears to be firmly in the camp of overvalued tech stock. At least, according to Morningstar analysts, SQ is trading at more than double its “fair value estimate” (US ~$230 vs. $112) with a Price-To-Earnings value of ~240. SQ shares have not traded at US $112.00 or below since July 13, 2020.

While SQ does deliver on growth, it still has a very long way to go to justify its ~240x multiple. Square’s dubious long-term outlook is compounded by the increasingly tense competition from PayPal (NASDAQ: PYPL) and Fiserv’s (NASDAQ: FISV) Clover application. While younger than Square’s payment solution, the latter is already processing more payments across the US, and importantly, growing at a faster pace.

Overvalued

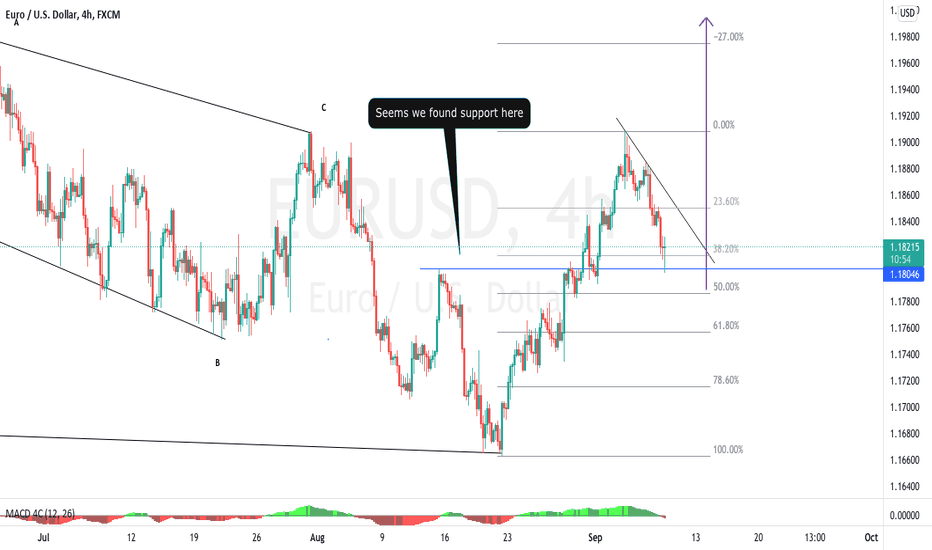

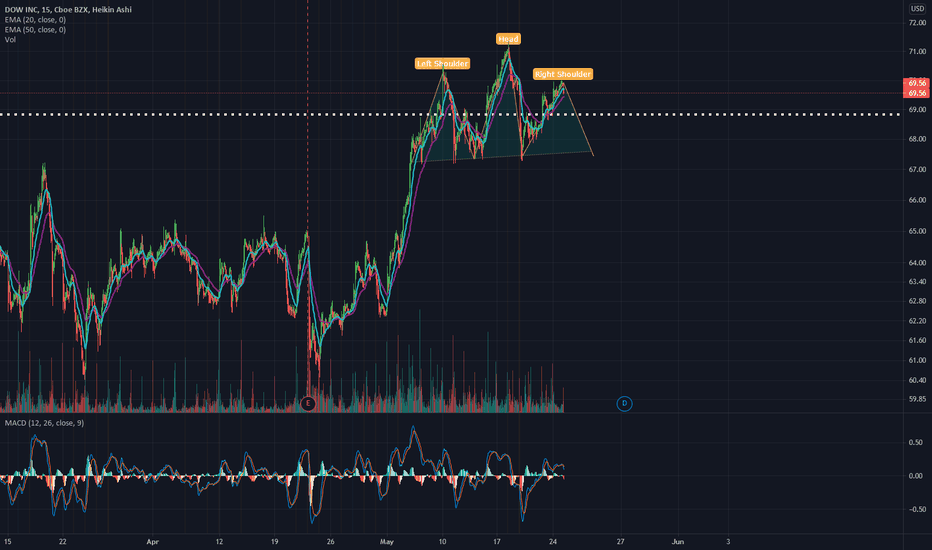

DOW head and shouldersTypical head and shoulders pattern.

Bearish is set for a small amount of time, before we see the next rise.

__________________________________________________________________________________

Please like and follow us on Tradingview and Twitter , to stay up to date our latest analysis.

Check out our Website as well, for trading tools for part and full time traders.

(Check Twitter feed for currently 30% coupon for all products)

__________________________________________________________________________________

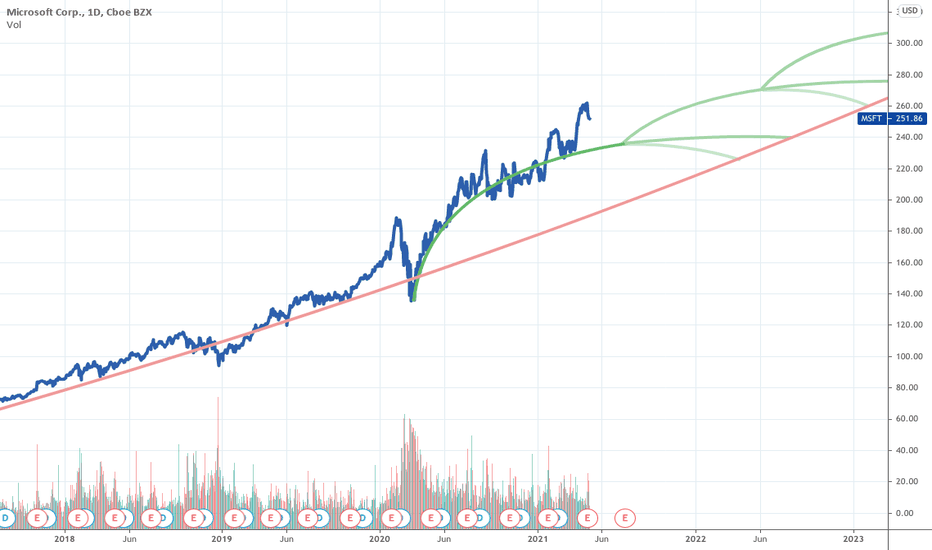

MSFT: Possible future trends The falling of share price and slowness to rebound after Microsoft posted stellar earnings last week suggests MSFT is highly overvalued and correction or stagnation is likely for the near future. This model posits some possible future trends that are more optimistic than not, but emphasizes the likelihood of corrective stagnation keeping runaway price tethered to underlying intrinsic value.

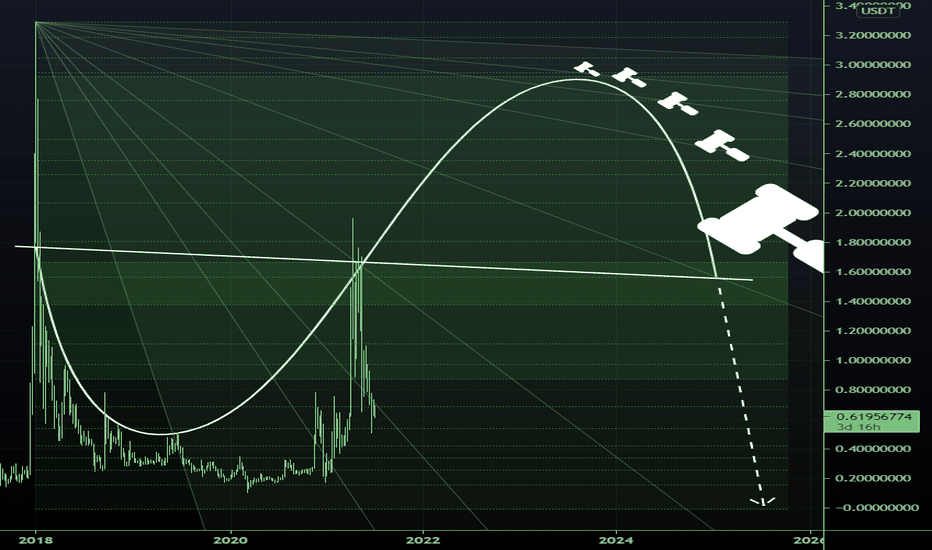

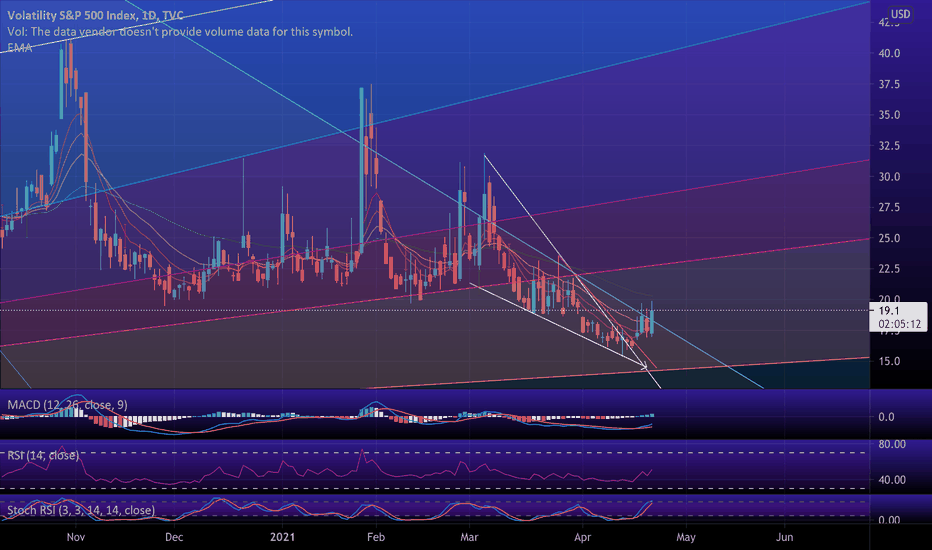

VIX BREAK OUT Successfully broke out of this descending wedge and breaking past the 1/1 Gann fan barrier indicating possibly the start of higher moves to come if closes above barrier.

What Biden just announces about raising capital gains tax definitely was a good little match to start a fire in uneasy markets.

What this does is incentivize selling this year but we have to see if this will pass congress.

This is going to be something to watch closely.

That's all folks

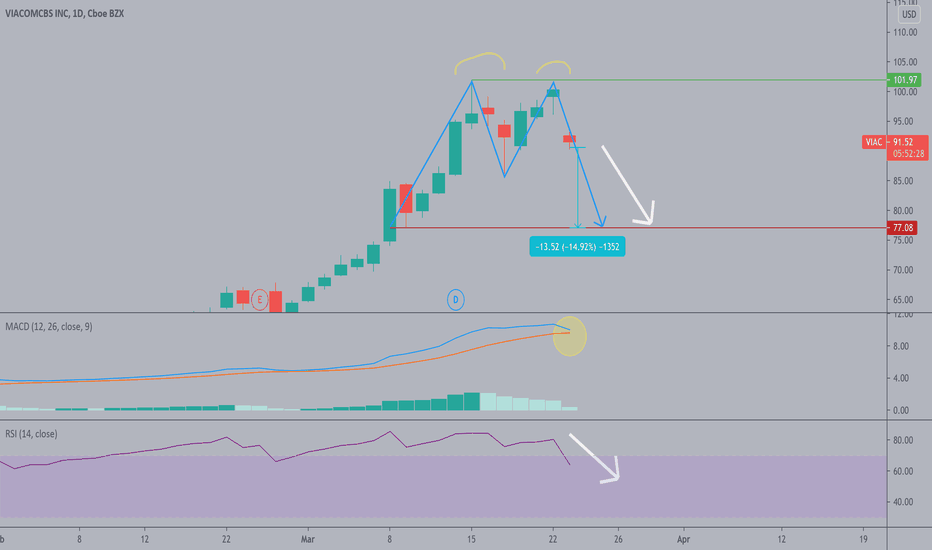

Double top in VIACVIAC announced new shares will be issued diluting the current value of their already overvalued shares. A double top has formed on the chart. Correction ahead as there are multiple options for the underwriters to buy more shares after the initial offering, meaning the dilution could continue.

When a company sells its shares, it's essentially recognizing its share price is higher than it should be and they are taking advantage of it. Take profits and buy puts to take advantage on the investor end.

Bearish MACD cross appearing on the daily chart.

"The company is offering $2 billion of Class B common shares and $1 billion of a preferred stock that is convertible into the Class B common, ViacomCBS said Monday. The shares are the company’s nonvoting equity. The newly issued stock will start trading on March 24, Bloomberg News reported."

"Morgan Stanley and JPMorgan Chase & Co. are managing the offering. ViacomCBS granted them options to purchase up to $450 million in additional shares."

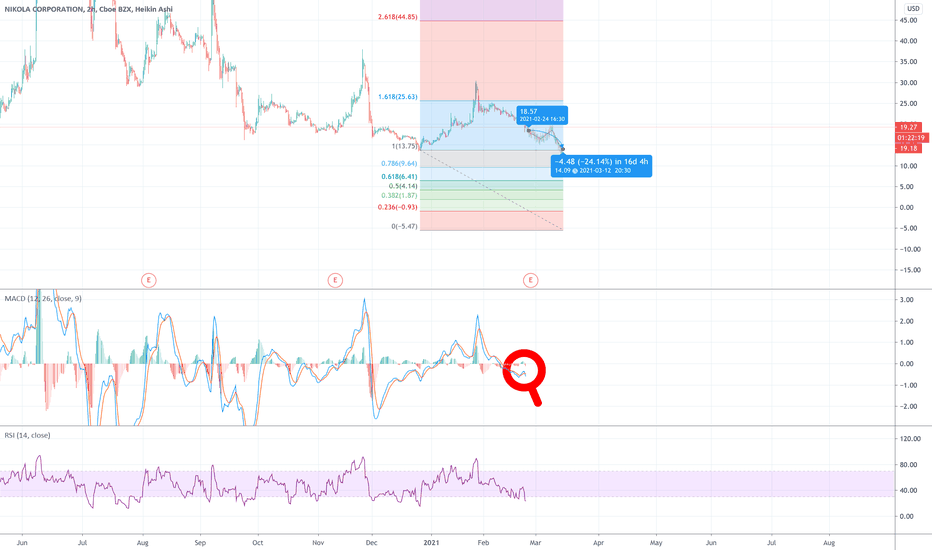

Hedge losses by Shorting NKLAShort-term play.

As we know Nikola Motors is far from a revenue-generating period, so it would be logical to short.

Based on increasing short volume again - Check Fintel.io

And the fact earnings are coming out, we could expect a dip to 13$ or below.

Personally, I think this is a good play and overvalued IMO so correction is inevitable.

Didn't pay much attention to the scandal last year but we seem to be due for a drop.

NASDAQ:NKLA

Besides, the trend is bearish so you may as well take advantage of that.

Entry price @18-19$

TP @13-15$

SL @21

(Disclaimer)

(This is not financial advice, just my opinion)

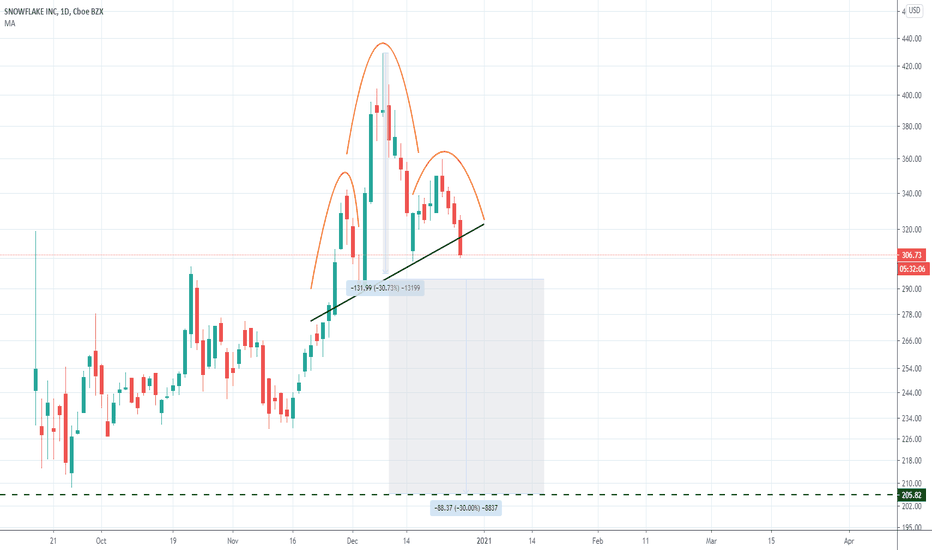

No snow for SnowflakeNYSE:SNOW is one of the most overpriced companies you can find right now.

After post IPo rally, stock is struggling lately with poor relative strengh to Nasdaq.

Potential breakdown of Head&Shoulders gives potential for new lows at $200 right now.

However, its not low risk entry idea, so prepare for some volatility.

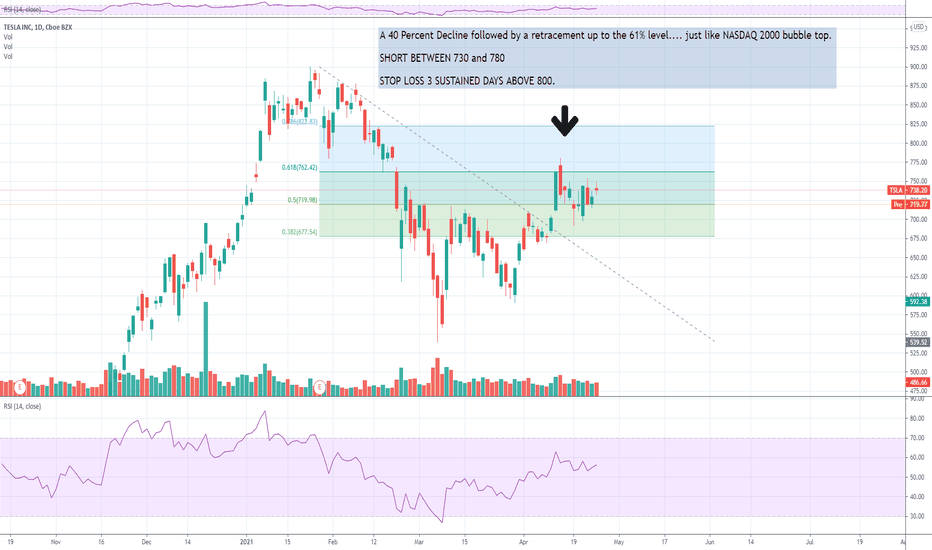

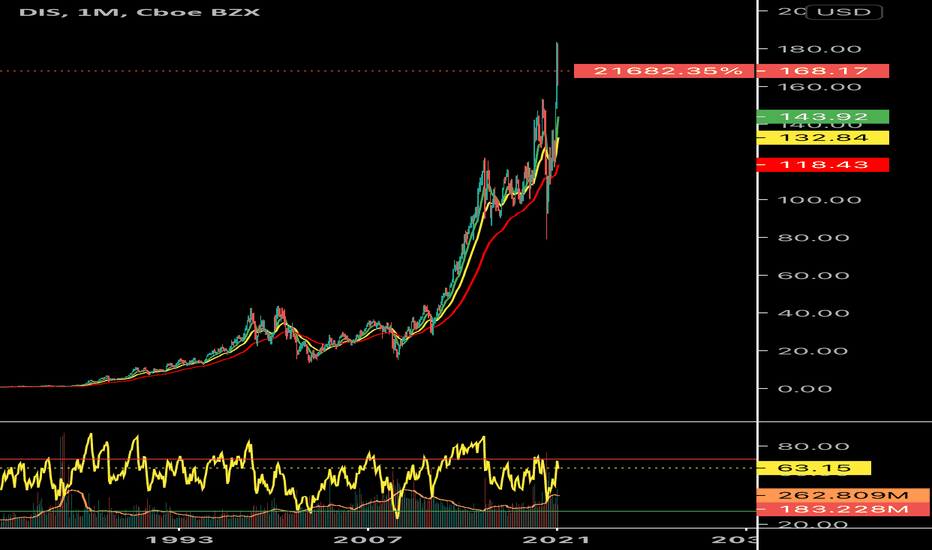

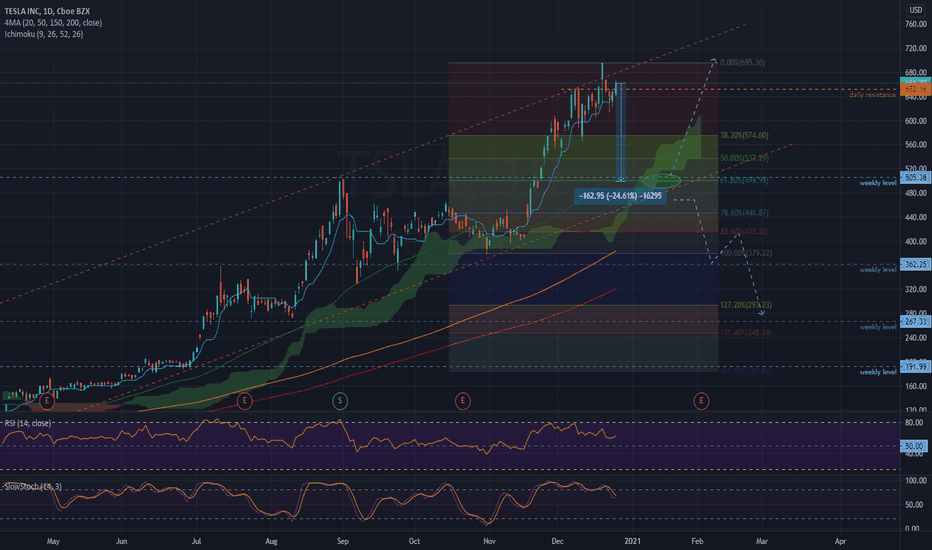

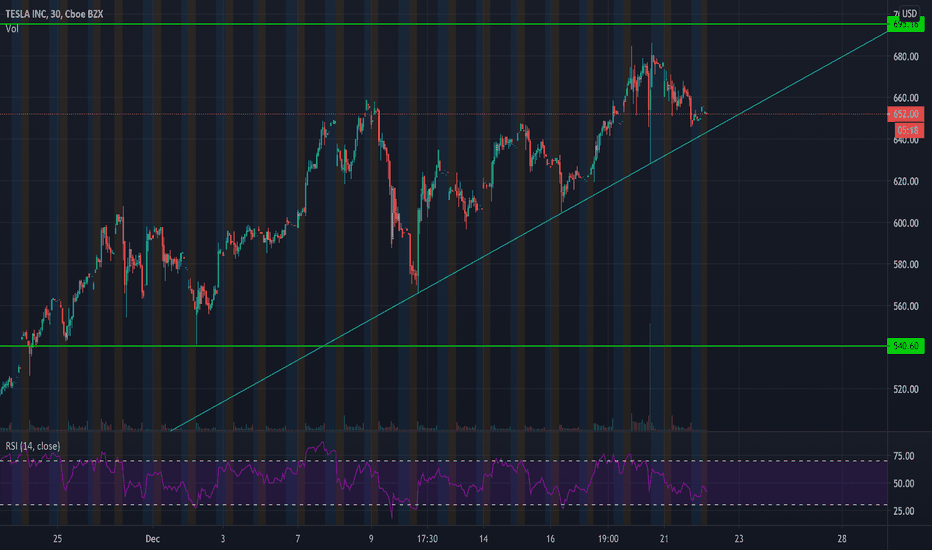

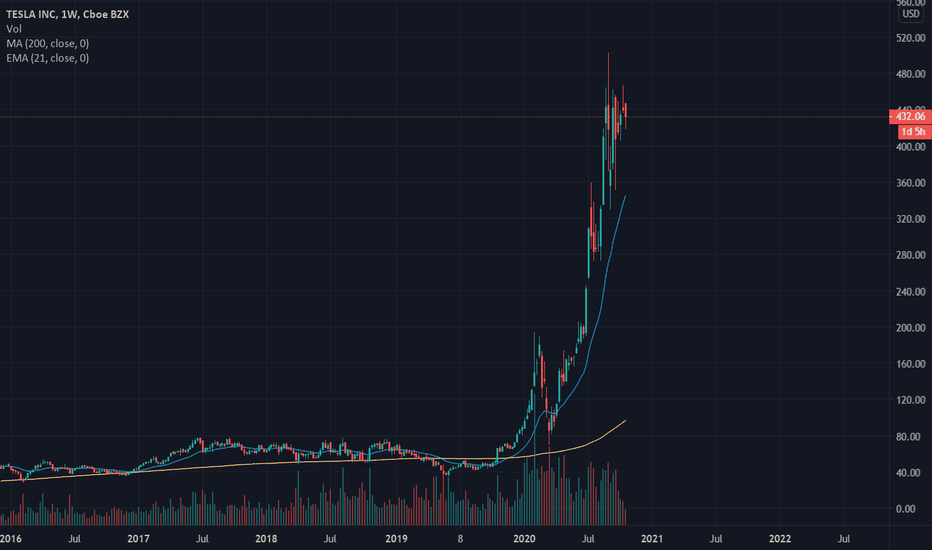

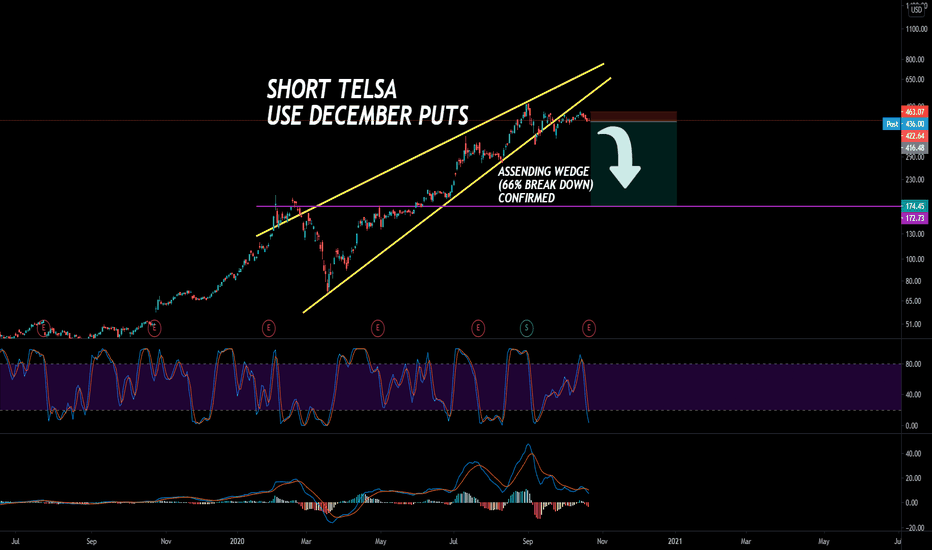

Could we see a drop soon?As we saw $695 on the TSLA chart a few days ago, a S&P 500 inclusion has helped develop a new uptrend channel for TSLA.

While we have seen this channel hold so far, we have a couple catalysts on the horizon specifically Q4 delivery numbers and stimulus boost.

For this channel to hold TSLA must remain above $630. A drop below and we could see as low as $540. Considering the current price action to be weak, TSLA also has a history of consolidation and breakout patterns over the last couple months. That being said TSLA just broke out to new highs last week and could see a drop before more consolidation.

Keep an eye out for the near term support and look out for more news.

TSLA is a stock that has defied technical analysis before and could do it again. But if looked at closely, both sides can be played very well.

Trade responsibly!

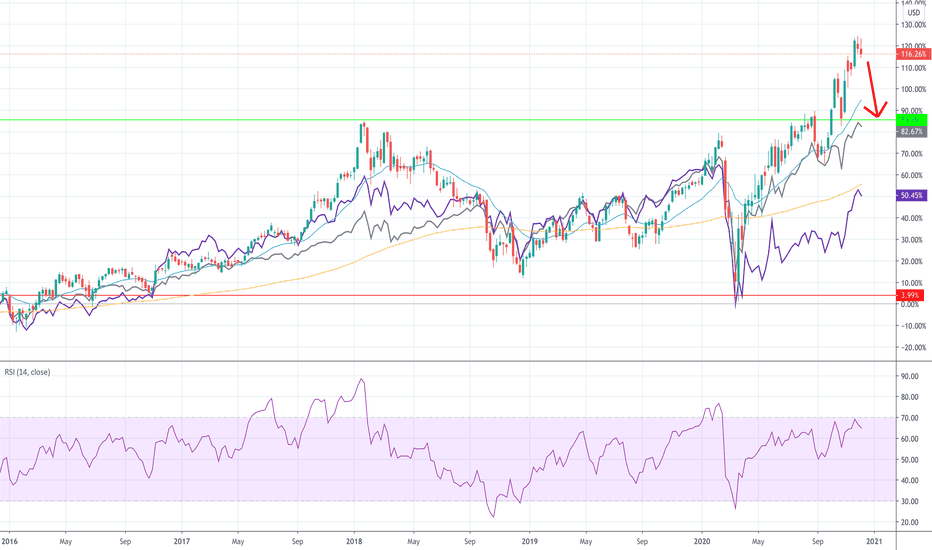

Blackrock ShortI have highlighted the XLF representing the broader financial sector in purple and the S&P 500 index in gray. As you can see it has outperformed the financial sector by a longshot and outperformed the S&P 500 index.

Since Blackrock’s bread and butter is asset management with nearly 8 trillion AUM, the overall concern with overvaluations in the markets combined with BLK’s significant outperformance to its peers and to the broader market in which it invests; I’d say it is time for a pullback.

I would expect it to correct to its previous highs as seen with the green line. I do not expect it to head down towards the XLF, but it is possible it could correct all the way to where the S&P is. It is trading at about 21x earnings.

Community Health Systems Overvalued Those who have been following Community Health Systems since the firm's stock tumbled in October 2016 following the $7.6B merger with HMA may be wondering if the hospital giant has found its footing after three consecutive quarters of being EPS positive, rallying stock prices to a 52-week high record of $11.04/share. Today, I am here to tell you that this stock is very much overpriced compared to the firm's current market value.

Highlights (Quarter by Quarter Fundamental Analysis)

Short-term assets such as Cash and Cash equivalence have increased again by 17% to 1.8B, while receivables and inventory have decreased, signaling that Community Health Systems could be improving their asset turnover or we will see a decrease in net income next quarter. Total assets have slightly increased while debts have slightly decreased resulting in a 2% decrease in debt-to-assets, however, the firm has continued the trend of financing assets with more debt with a 5% increase in debt-to-equity from 28.1% to 29.5%. CYH also maintains an enterprise value far greater than their market cap value. CYH has continued the trend of cutting SGA expenses. Although we see a reduction in FCF, it remains positive.

Using the DCF model, we have a fair-market-value of about $6.30/share.

(One-year Chart using Technical Analysis)

Upon reviewing the charts, we will most likely see a decline in the stock's price. The RSI and MACD are bearish while the price is testing the 20 EMA. Analyzing the volume, we are seeing that the bulls are starting to lose momentum.

Short/put - $5.70 (low confidence) to $6.30 (high confidence)

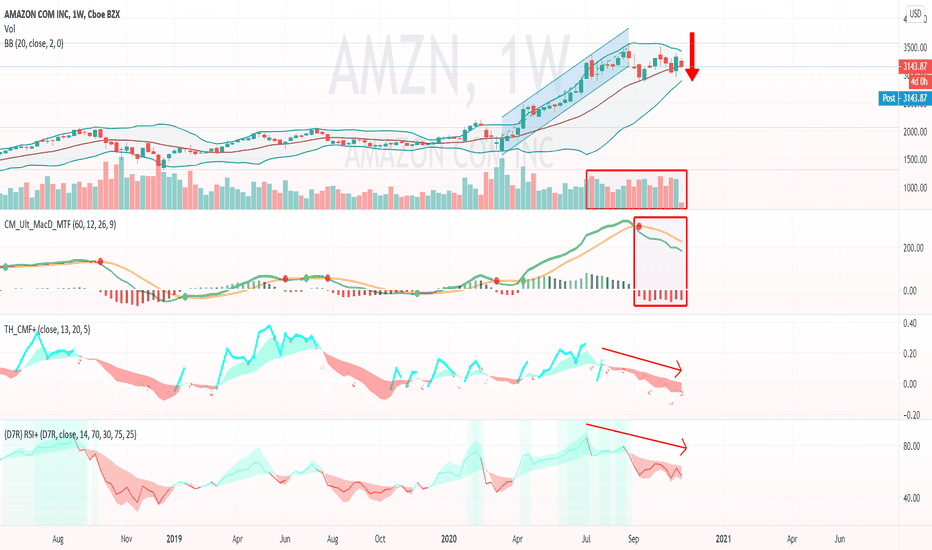

WHAT'S WRONG WITH AMAZON?Please hit like and share your support :-)

One word: price.

That’s because the company falls in the top-10% of most expensive U.S. companies.

To justify its current value, Amazon would have to compound growth at 14% over 10 years. The company would also have to slow working capital growth significantly, netting its capital requirements to zero over the long run.

Amazon is still a great business: investors should expect Amazon to win massively in e-commerce, cloud computing, and digital media. A decade from now, Amazon will almost certainly still dominate the global retail industry.

But when it comes to the company’s stock, investors should keep in mind that AMZN is currently overvalued and overbought. By any conventional measure Amazon (NASDAQ:AMZN) is overvalued. With a market cap of $1.66 trillion, AMZN stock is being valued at over four times its potential 2020 revenue of $400 billion. That's based on its second quarter sales of $101 billion.

As with the other Cloud Czars — Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet, and Facebook (NASDAQ:FB) — Amazon’s current price is built on the COVID-19 market and the Fed. It’s not based on Amazon’s performance. And that is the biggest concern for price support at these high levels.

Thank you for taking the time to read and please hit like,

Ev

Sources: Investorplace

SHORT Signal: YFI is overvaluedYFI has gained x10 over the past few weeks. it just recently got added on Coinbase which is a home for most retail traders so it pumped EVEN MORE! and that happened after a short break! In my opinion, this market has to CALM DOWN! It's not like this can rise forever and the way it rose is NOT NORMAL. Many investors are eventually going to take their next step which is CASHING OUT!. Think smart before buying. Many retail traders will get trapped by this while all you gotta do is DUMP IT!!!

Stop: 41000

Enter: 34000-36000

TP: 18000-21000