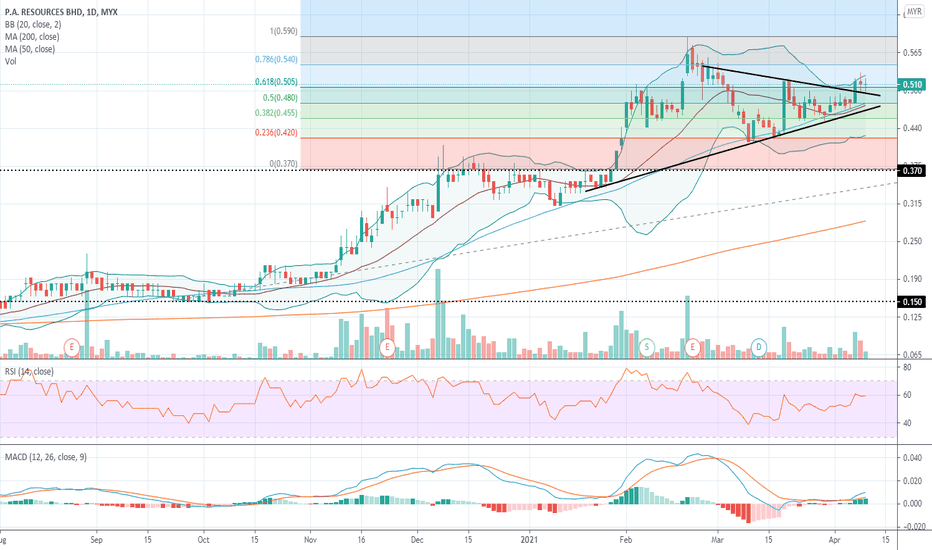

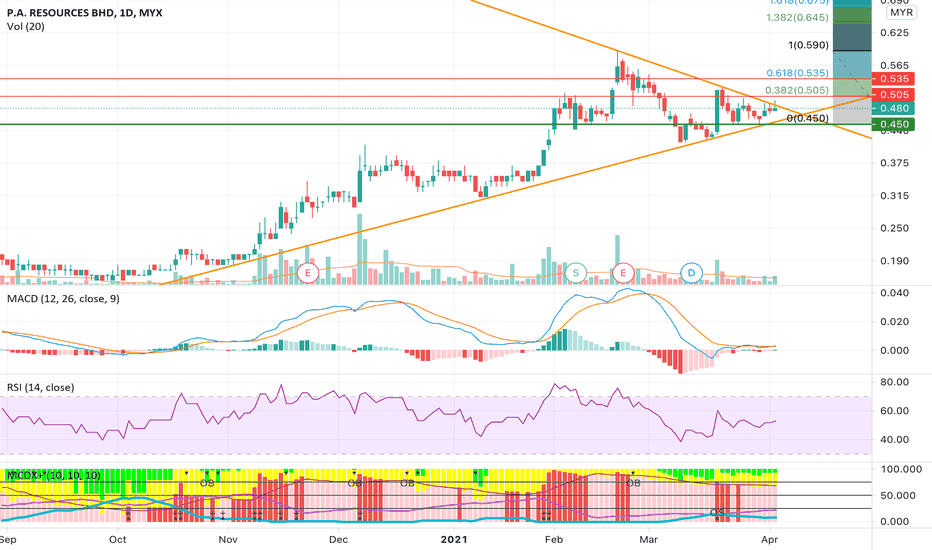

PA

PA Consolidation BO possibleLast bullish candle showed it was trying to breakout from downtrend line resistance to end its consolidation phase. Positive indicators: MACD golden cross and RSI has much room to go. Banker at 68%.

Support at 450, resistances at 505 and 535.

Disclaimer: Trade at your own risk.

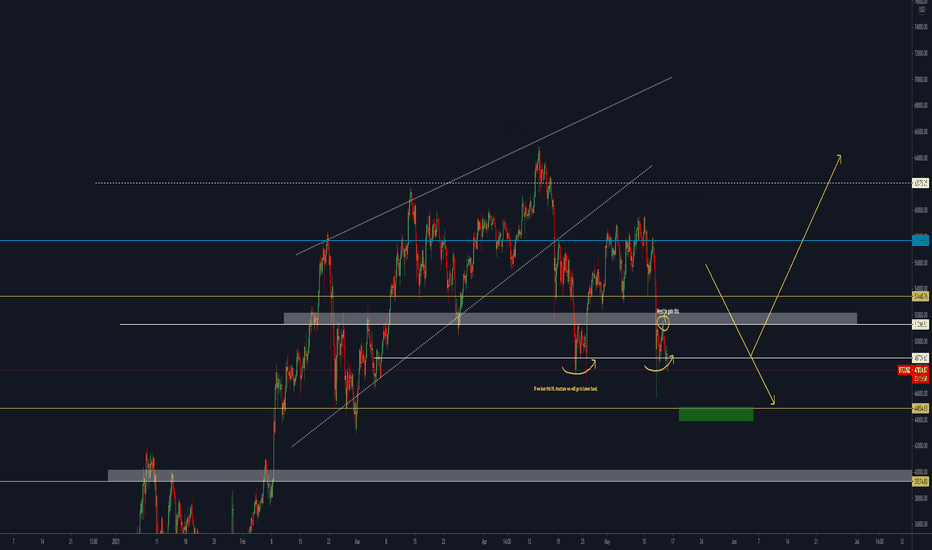

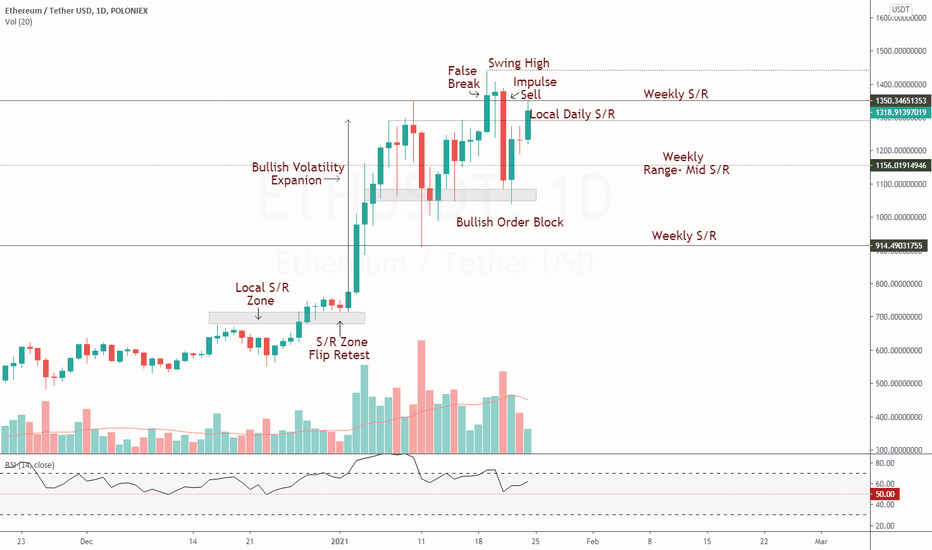

ETH Approaching a NEW All-Time HighPoints to consider

ETHUSDT on the daily is looking quite bullish with a clear objective of taking out the Local Daily S/R. Exceeding this level will increase the probability of testing the Weekly S/R. Being a highly critical level, an influx in volume must be present as this will indicate a true break backed with momentum.

The lead up is considered quite bullish with consecutive S/R Flips followed by a strong bullish volatility expansion. A bullish order block is evident that has supported price with a strong buy-back. This has allowed price action to maintain a bullish market structure leading up to an all-time high break.

The initial attempt of breaking the Weekly S/R resistance failed with an impulsive sell. A solidified grind backed with increasing volume will greatly surge the probability of entering price discovery. At the time, it will be important to monitor the volume profile. An influx in volume must be above average for a true breakout.

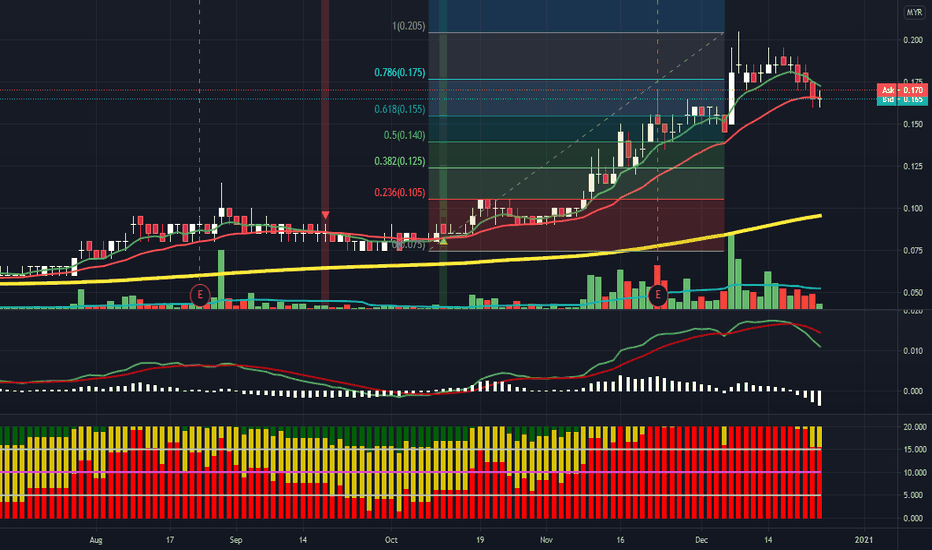

PA situasi semasaPrice masih lagi bermain di support 0.165, kelihatan market lebih cenderung hanya untuk membuat sedikit penurunan

sebagai langkah tawaran kepada pelabur kecil, Garisan fibo 0.618 belum ditembusi oleh harga, secara keseluruhan market masih lagi dalam keadaan Uptrend, dijangkakan harga mampu mencecah 0.205, sekiranya harga 0.205 ditembusi harga mampu mencecah 0.285. apa apa pun market boleh berubah!

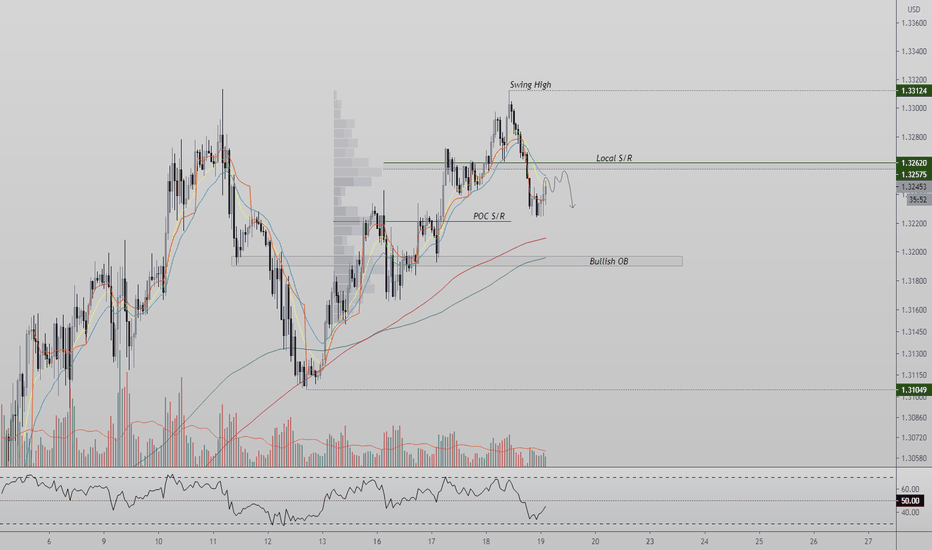

GBPUSD Local S/R| Swing High| POC S/R| Bullish OB| Price ActionEvening Traders,

Today’s Analysis – GBPUSD- breaking Local S/R with an impulse, test of Bullish OB is probable,

Points to consider,

- Price Action Impulsive

- Bullish OB Support

- POC Support

- Local S/R Resistance

- RSI Bearish Control Zone

- Volume Declining

GBPUSD’s immediate price action is trading below key Local S/R, failure of a reclaim will allow us to have a bearish bias.

The Bullish OB is likely to be tested, holding this area is critical, failure will project lower bearish targets.

Price Action is currently being respected by the POC, a short term bounce into Local S/R for a bearish retest is probable.

The RSI is currently in its bearish control zone, remaining in these regions will project weakness in the market. Furthermore, the immediate volume is below average, indicative of an influx being probable when testing key trade locations.

Overall, in my opinion, GBPUSD is a valid short with defined risk, price action is to be used upon discretion/ management.

Hope this analysis helps!

Thank you for following my work

And remember,

Beginner’s luck often stifles growth. Losses and failure are good for you. Kahlin Gibran

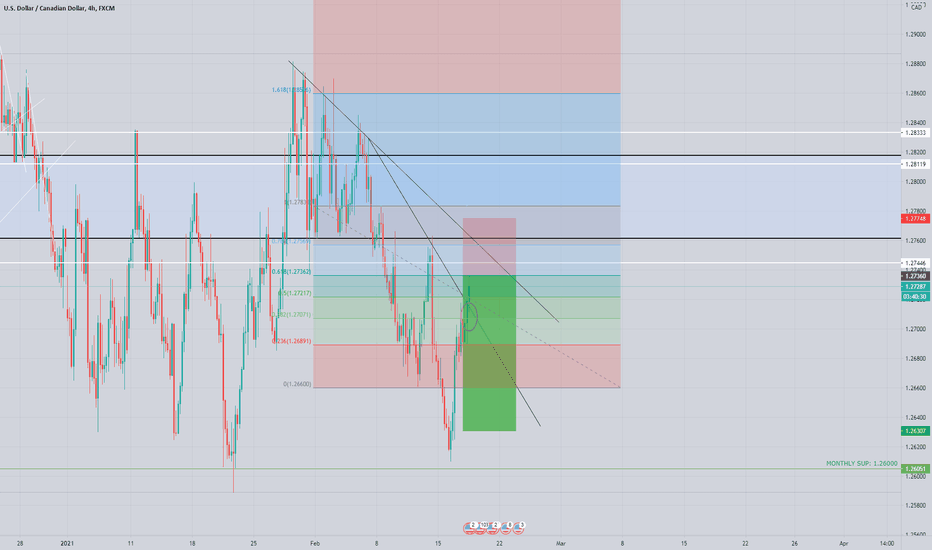

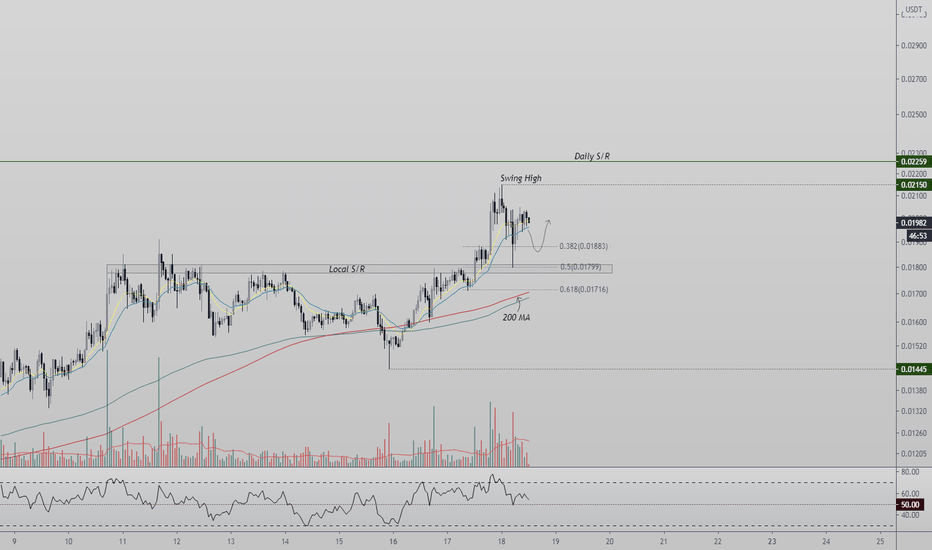

RSRUSDT Local S/R| Swing High| Daily S/R| Price ActionEvening Traders,

Today’s analysis- RSRUSDT – trading above local resistance with a back test of the .50 Fibonacci,

Points to consider,

- Price Action Impulsive

- Local S/R Support Confluence

- Daily S/R Target

- Swing High Objective

- RSI Bullish Control Zone

RSRUSDT’s immediate price action is impulsive, confirming an S/R Flip Retest of local S/R, this allows us to have a bullish bias on the market.

The Local S/R is in confluence with the .50 Fibonacci, price has evidently respected this level.

The Daily S/R is immediate target after clearing swing high objective; price exceeding Daily S/R will lead to an impulse volatility expansion.

Current RSI is trading in its bullish control zone respectively, maintaining these levels are indicative of strength in the market.

Overall, in my opinion, RSRUSDT is a valid long with defined risk; price action is to be used upon discretion/ management.

Hope this analysis helps!

Thank you for following my work

And remember,

“You have power over how you'll respond to uncertainty.”

― Yvan Byeajee

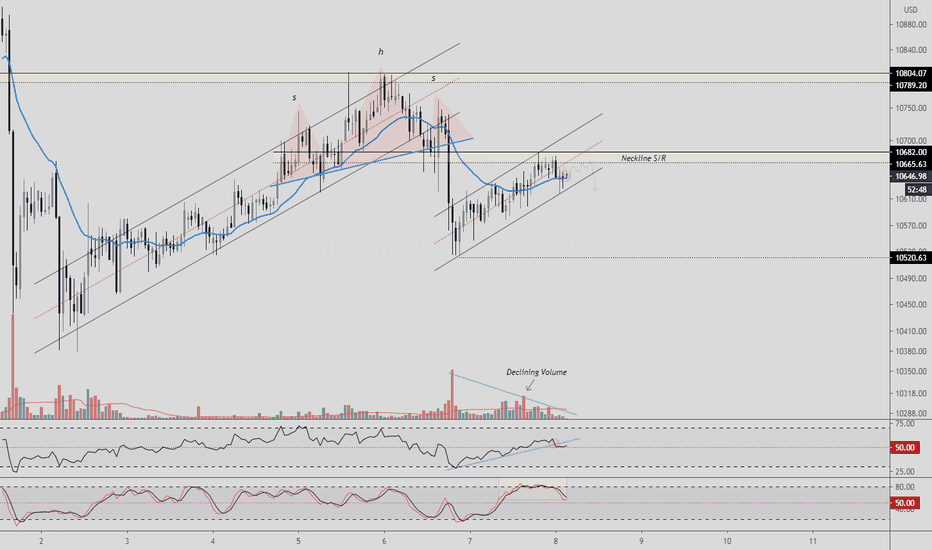

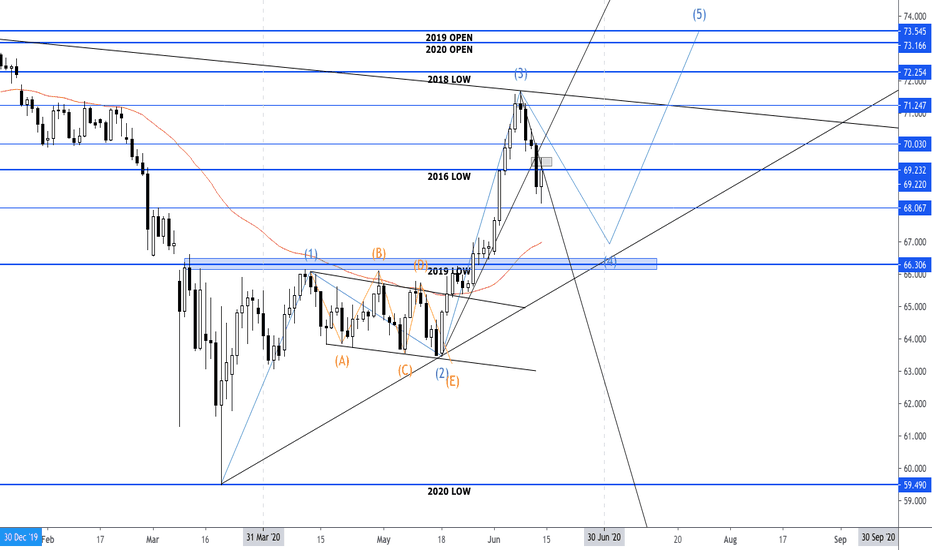

BTCUSD Rising Channel|21 MA|Neck Line S/R|Declining Volume| PA Evening Traders,

Today’s Analysis – BTCUSD – trading at a key pivot point with bearish price action, key region to watch is around $10650 -$10680.

Points to consider,

- Bearish PA

- Neckline Resistance

- Channel Support

- RSI Trend Break

- Stochastic Sell Cross

- Declining Volume

BTCUSD’s immediate price action is bearish with a confirmed psychology of a head and shoulders. This allows us to have a bearish bias on the market in the immediate short term.

The current Neckline S/R is resistance, price has respected it on first attempt, breaking this level will negate our bearish bias.

The immediate support is the Channel S/R, this creates a respective apex in correspondence with the Neckline S/R. BTC will break out of this apex in the coming hours.

Both oscillators are showing weakness, the RSI has broken its dynamic support whilst the stochastics has a valid sell cross. This is indicative of immediate momentum shifting in the market.

Volume is considerably low; this is suggestive of a volume influx, most likely to coincide with the break of the apex break.

Overall, in my opinion, BTCUSD is a valid short with defined risk; price action is to be used upon discretion/ management of trade.

Hope this analysis helps

Thank you for following my work!

And remember,

“The big ones take the psychology out of the game. Have a game plan, and stick to it.” Tim Erber

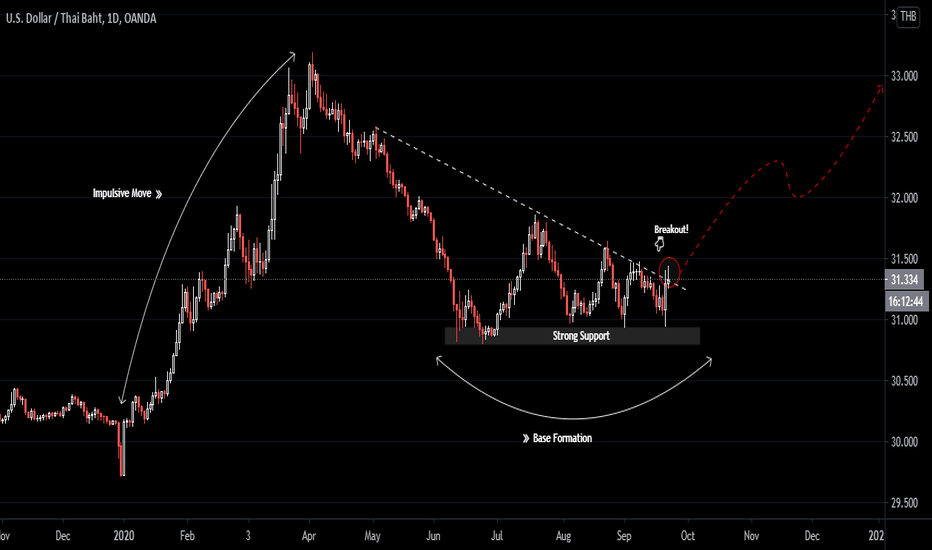

RidetheMacro| USDTHB Market Commentary 2020.09.21As the drivers of exports and tourism continue to be missing in action, the negative GDP growth trend is here to stay for the rest of the year, and perhaps beyond. Rising political uncertainty is another reason why we expect the Thai baht to remain one of Asia's weakest currencies over the remainder of the year.

🦠 Thailand has been one of Asia’s Covid-19 success stories. It was the first Asian country outside China to report infections but also the first one to have the outbreak under control.

⚡ However, the economy hasn't been spared from the fallout of this global Covid-19 pandemic. A 12% GDP plunge in 2Q was the steepest since the Asian crisis in 1998. Without vigorous exports and a recovery in tourism, a couple more quarters of negative growth remains our baseline.

📌 High unemployment and weak demand have pushed inflation into negative territory. Inflation should continue to be a non-issue for the economy and for policy throughout 2021-2021.

📍 Covid-19 stimulus worth a total of 14.5% of GDP places Thailand in the ranks of the big spenders throughout in this cOVID-19 crisis. A little over half of this comprises a genuine boost.📉

🔑 The economy is sinking into a recession. The recovery is going to be even slower than the most recent crisis.

Thanks for keeping the feedback coming 👍 or 👎

Ridethemacro

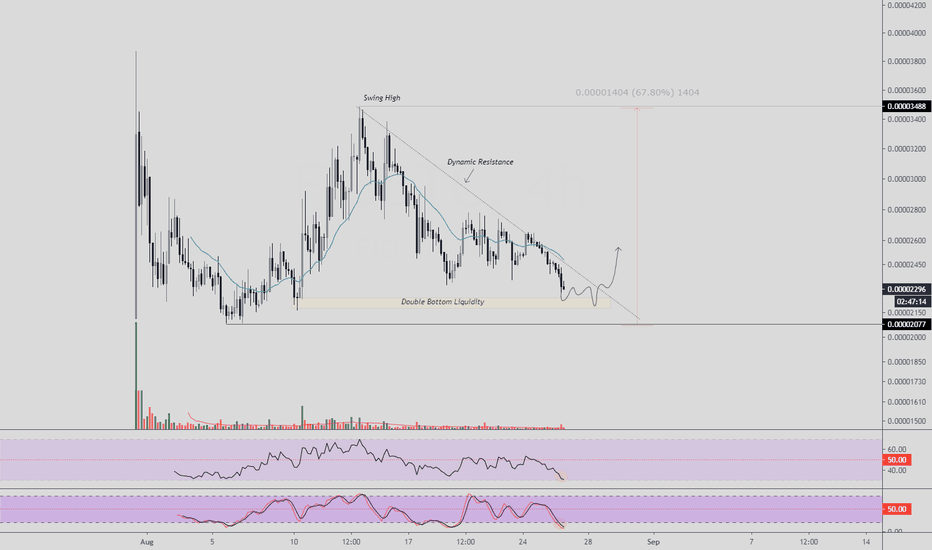

FIOBTC Double Bottom| Liquidity Run| Dynamic Resistance| PAEvening Traders,

Today’s analysis, FIOBTC trading towards a probable double bottom structure, confirmation will be on the break of dynamic resistance.

Points to consider,

- PA approaching trade location

- Equal lows (liquidity run)

- Key dynamic resistance

- Oscillators over-extended

- Swing high target

FIOBTC’s price action is approaching a key trade location where a pivot bullish is probable. This will establish a double bottom in the market structure.

The equal lows increases the probability of a liquidity run, price action closing above with a wick will be indicative.

Breaking the dynamic resistance will confirm trend reversal with the immediate target swing high.

Oscillators both are overextended reaching oversold conditions; this indicates an oversold bounce being probable as price reaches liquidity.

Overall, in my opinion, FIOBTC breaking dynamic resistance will allow for a valid long into swing high. Price action is to be used upon discretion/ management of trade.

What are your thoughts?

Thank you for following my work!

And remember,

“If you can learn to create a state of mind that is not affected by the market’s behavior, the struggle will cease to exist.” – Mark Douglas

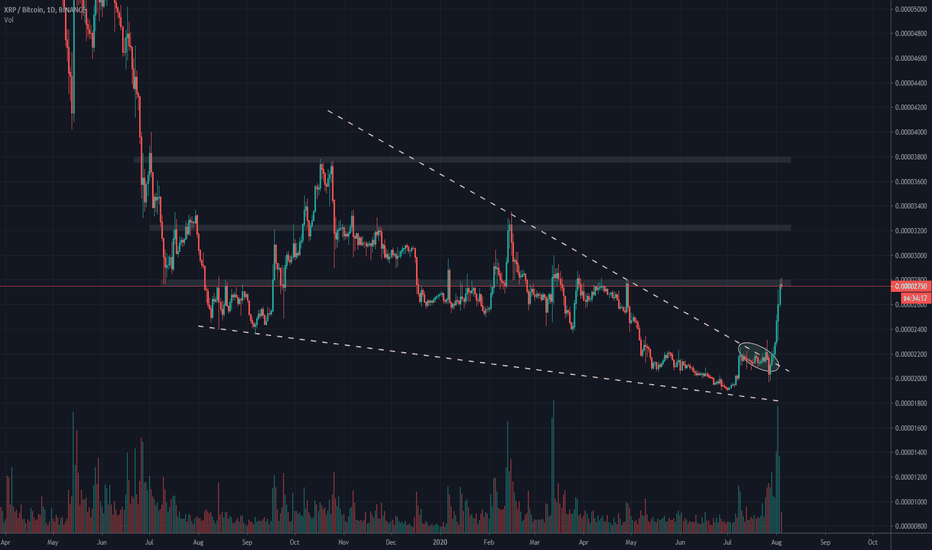

XRP Bullish wedge & Trendreversal?Welcome fellow Tradingviewers,

In this analyses we are going to show you our view on the current market situation for Ripple .

As a lot of our members and followers know, we are usually against buying shitcoins like XRP, but hey when opportunity arises we need to take place in the action.

The XRP chart was one of the best looking charts a week ago and below we will describe what we see, saw and plan to do with this cryptocurrency.

We will be analysing XRP using a top-down strategy , including candlestick patterns , indicators and price patterns.

Monthly :

- The last monthly candle closed as a bullish engulfing one.

- This was the first bullish sign for XRP in a long time.

- The MACD is showing bullish signs (for as far as it is to be seen)

Weekly :

- The last weekly candle closed as a bullish engulfing .

- We can see that we broke out of the bullish wedge .

- We closed just above the 50MA

- The MACD has formed a bullish divergence and seems to be breaking out at the moment.

Daily :

- Last 3 daily candles were bullish engulfing candles, demolishing all Ma resistances.

- This daily candle is also looking like it is going to close as a bullish engulfing one.

- We can clearly see the bullish wedge from this timeframe therefore we present the chart for you from the daily.

- Testing the 2800 resistance.

(- Possible golden cross in +/- 3 days)

In summary:

We can see clear distribution against the wedge resistance which lead to this massive price increase.

We are now at TP 1 for the bullish wedge , the other TP's can be found around 3K, 3.2K and 3.6K.

Bullish wedges are known reversal patterns and often outperform their targets, therefore 4K resistance could be touched in this next month.

Dont forget the XRP army, if the FOMO begins, other altcoins keep rising and Bitcoin keeps rising things could go really fast and TA might get difficult.

This might be the bottem for XRP atleast for the short term.

The monthly close gives XRP bullish momentum for the longer term, which is confirmed by the weekly and Daily timeframe .

The XRP chart is one of the most bullish in the crypto space ATM and if you disagree and need us to review a coin, drop them in the comments!

This analyses is only intended to share my idea, to educate and entertain you guys.

This should not be considered as financial advice.

I hope you guys enjoyed this analyses, if you did don't forget to leave a Like!

If you want to share your thoughts, please do so in the comments below!

Kind Regards,

Frank | Forallcrypto

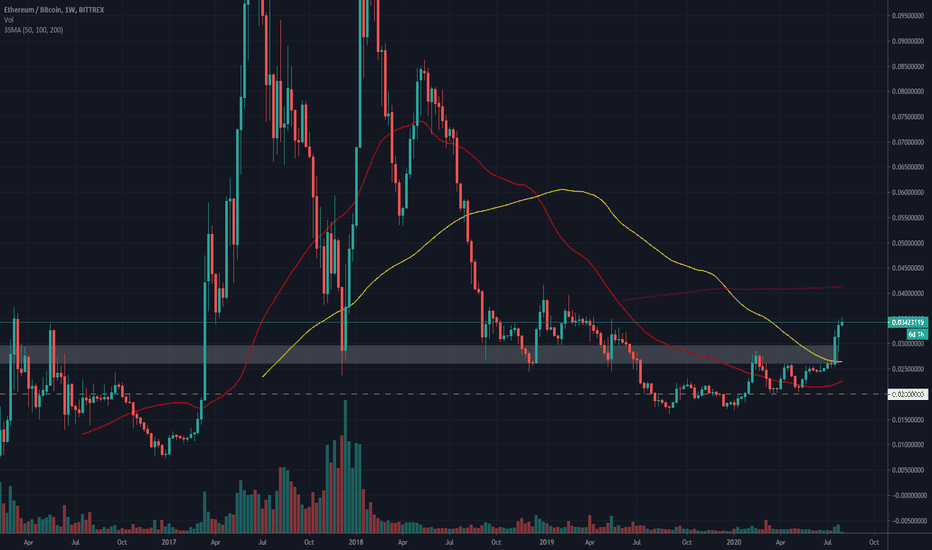

ETH ready for 0.04BTC? Welcome fellow Tradingviewers,

In this analyses we are going to show you our view on the current market situation for Ethereum .

There has been a lot going on around Ethereum, Ethereum 2.0 and Defi which has all helped to the current bullish view that a lot of traders have on Ethereum.

We will be analysing ETH using a top-down strategy , including candlestick patterns , indicators and price patterns .

Monthly:

- Bullish engulfing close above the previous stated 3K important resistance.

- MACD crossed Bullish.

- Now testing the 0.035 Resistance.

- Below the 50Ma. (located at 0.04)

Weekly:

- Last candle closed as a bullish engulfing candle.

- We are now well above the 50 and 100 MA. (and seem ready to test the 200MA?)

- The MACD is clearly showing a bullish divergence.

- The MACD crossed bullish.

Daily:

- The last daily candles closed as bullish engulfing candles.

- We had our support tested and confirmed at 0.03.

- We are now well above all MA's.

- We have a bullish MACD cross.

- Testing the 0.035 resisttance.

In summary:

The monthly and weekly timeframes suggest that more upwards momentum is coming our way, so the long term is bullish.

For this bullish momentum to sustain however, we do need a break and confirmed support at 0.035 (BTC), this resistance is vital to try and reach the 0.04 area.

The 0.04 area is key because a lot of strong resistances are coming together: Monthly 50 MA, Weekly 200 MA and the Daily horizontal resistance line.

Overtaking the 0.04 resistance and therefore reclaiming the weekly 200 MA would support a bullish trend for the long run.

The volume seems to be supporting the bullish view for now so lets see what this month is going to give us!

This analyses is only intended to share my idea, to educate and entertain you guys.

This should not be considered as financial advice.

I hope you guys enjoyed this analyses, if you did don't forget to leave a Like!

If you want to share your thoughts, please do so in the comments below!

Kind Regards,

Frank | Forallcrypto

LTCBTC not giving up yetWelcome fellow Tradingviewers,

In this analyses we are going to show you our view on the current market situation for Litecoin.

We will be analysing LTC using a top-down strategy , including candlestick patterns , indicators and price patterns .

Monthly:

- The monthly close was a bullish engulfing candle.

- We are still below all Ma's

- MACD is still bearish (with potential)

Weekly:

- We had a darth maul close. (showing indecisiveness)

- Litecoin just missed becoming a bullish engulfing on this weekly.

- Bullish MACD divergence.

- MACD in bullish territory.

- Below all MA's.

Daily:

- The last couple of signals (boxed) we're hard to read but seemed bullish, we had a bullish engulfing, then an inside candle and a bullish engulfing darth maul candle where we tested the 200 MA.

- We are above 100 and 200 MA.

- MACD is bullish.

In summary:

The monthly close for LTC seems to be indicating more bullish momentum, we do however first need extra validation before thinking of way higher grounds.

LTC has been lagging behind in the market at the moment, last month LTC even declined to the 10th place in all cryptocurrencies, where in the previous Bullruns, LTC led the market.

LTC hashrate seems to be climbing back towards normal levels.

The Weekly bullish MACD divergence seems real and if this continues upwards then we might start to think about a possible trendreversal.

The Daily signals also seem pretty bullish.

The short term is bullish but for the longer term we still need confirmation!

So LTC has not given up yet and there are some signals that LTC might start following the rest of the market sooner than later, however nothing is decided yet so this month should be an interesting one!

This analyses is only intended to share my idea, to educate and entertain you guys.

This should not be considered as financial advice.

I hope you guys enjoyed this analyses, if you did don't forget to leave a Like!

If you want to share your thoughts, please do so in the comments below!

Kind Regards,

Frank | Forallcrypto

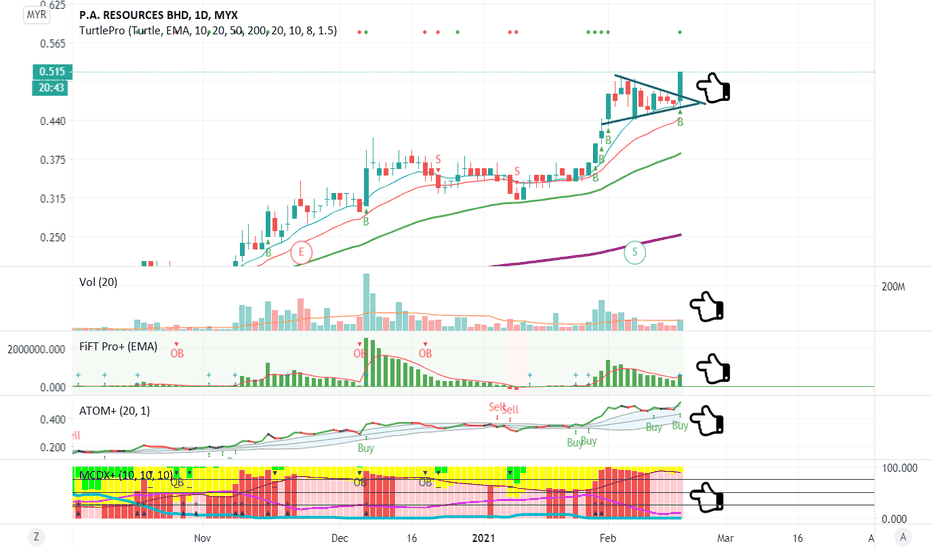

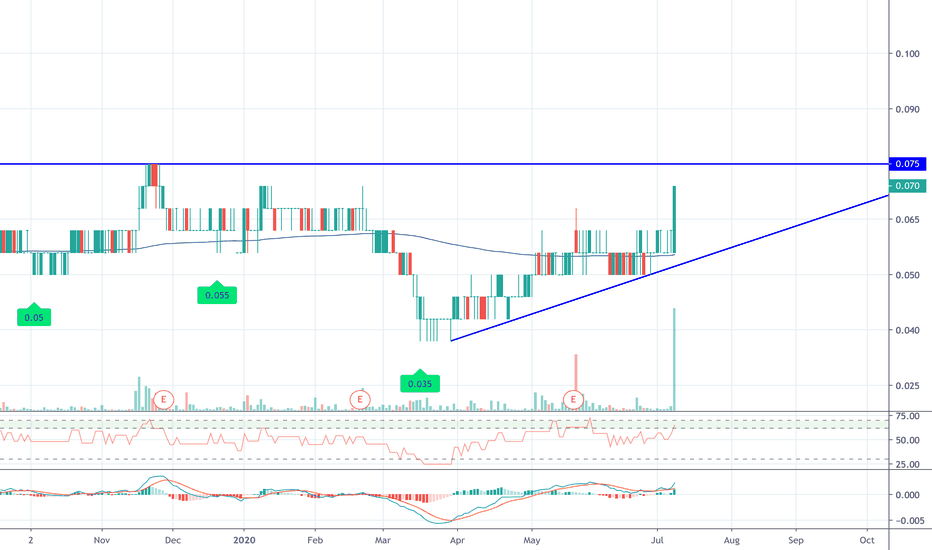

ALL IN MY CASH TO THIS STOCKPA or P.A RESOURCE a manufacturer company that produce aluminium billets. it is category in metal sub sector. This stock is a super penny stock but there is something brewing for sure. In term of fundamental, this is not really a strong company to invest, however from technical analysis it is something we all should looking at, and take opportunity from the short term bullish for this stock. Plus, shareholder keep acquired the shared.

I would say, fair price to entry is 0.065. target price?

Im looking at around 0.120. But when you decide to invest in penny. Patience is the key for your success, and when you decide to BUY. BUY BIG!!

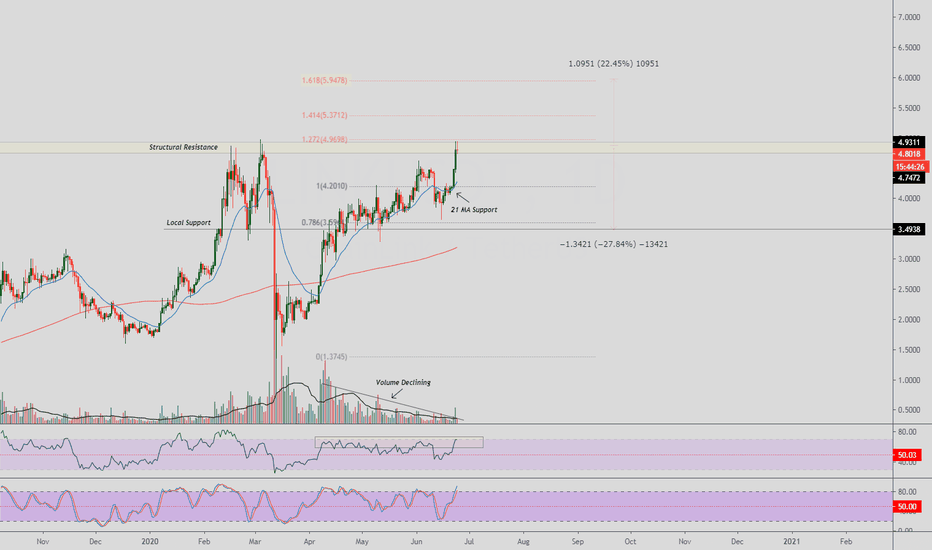

LINKUSDT Key Pivot Point|Structural Resistance|Blue Sky BreakoutEvening Traders,

Today’s Analysis – LINKUSDT – trading at a key structure, breaking above current resistance will initiate a blue sky breakout.

Points to consider,

- Strong bull impulses

- 21 MA visual support

- Major structural resistance

- RSI not officially oversold

- Volume overall declining

LINKS immediate trend is impulsive; trading at a key structure where breaking out will put in a higher high.

The 21 MA has been supporting price, acting as a clear visual support, multiple candle closes below will be bearish.

Price is currently trading at a major structural resistance zone. How price action forms here will be indicative of the trends direction.

The 1.272 Fibonacci Extension is in confluence with structural resistance, a clear break above will be very bullish, as this shows price strength.

The RSI is not officially overbought, whilst the stochastic is still projecting up, this in an indication of further upside before being overextended.

Volume profile is still generally declining; price breaking in either direction from this resistance cluster needs to be backed with volume to avoid any fake outs.

Overall, in my opinion, the price of LINKUSDT is at a key structure. Breaking above will establish a blue sky breakout (price discovery), Fibonacci extensions will be targets.

Breaking bellow will further solidify the significance of the structural resistance level, local support will then be the immediate target.

What are your thoughts?

Thank you for following my work !

And remember,

“If you don’t respect risk, eventually they’ll carry you out.” – Larry Hite

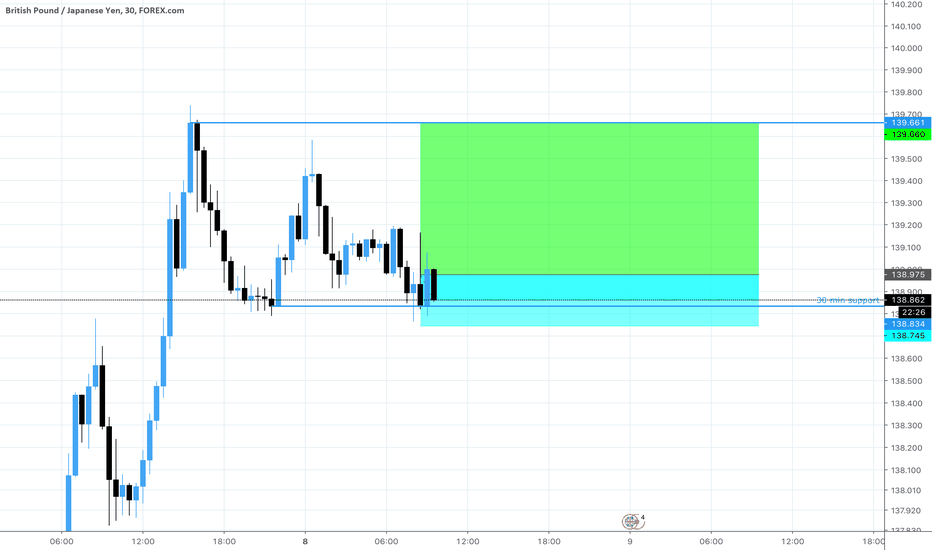

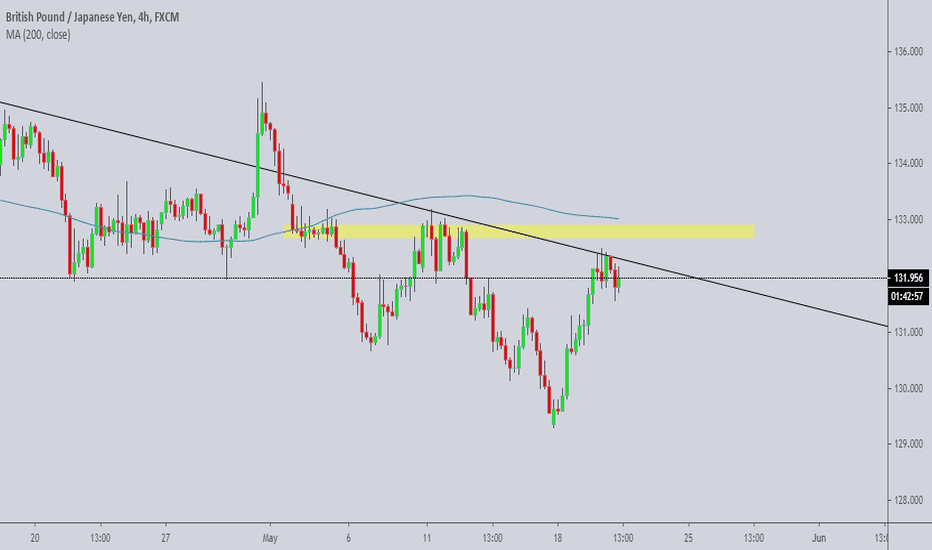

GBPJPY AnalysisPrice is entering a period of consolidation at a resistance area at a descending trendline. At the moment, we are trading around the 132 key psychological level but 100pips north we have another resistance level which also lines up with the 200MA. Selling at current levels with stops above this area could offer a good R/R but be aware of some price manipulation and false breakouts to the 133 resistance area.

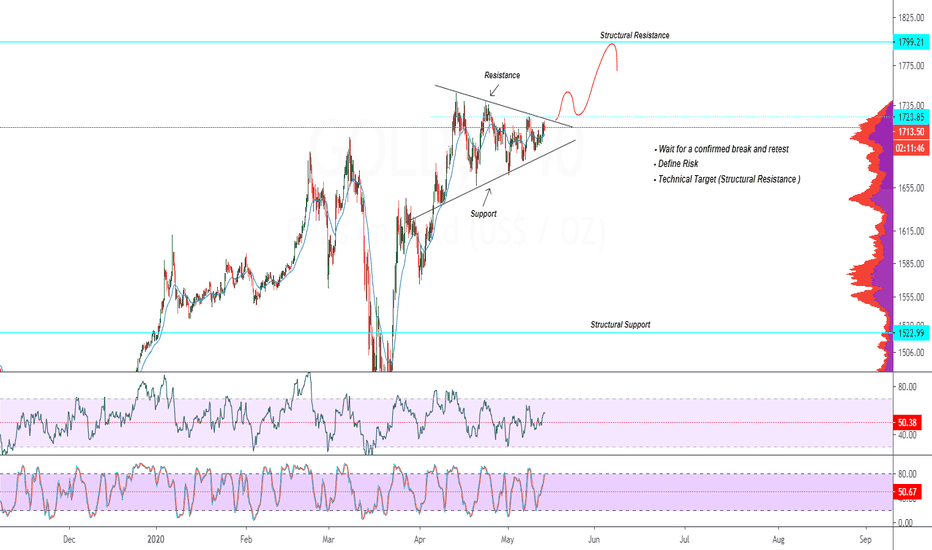

GOLD Equilibrium| Structural Resistance| Trade Set UpToday’s Technical Analysis – GOLD – trading in an equilibrium likely to retest high time frame resistance upon a break

Points to consider,

- Confirmed break and retest for validation

- Define risk at recent swing low

- Technical target at HTF resistance

- Price action to monitor

Gold needs to break its current resistance and establish a retest which will allow for a long entry.

Risk will be associated with the most recent swing low as this is a breakout trade with a quick invalidation.

The technical target is association at structural resistance, strong pivot area where price action can help with the directional bias.

Overall, in my opinion, GOLD will break out of this equilibrium; a long trade will be valid upon a bullish break with the technical target being structural resistance.

A break below support will invalidate the trade setup

What are your thoughts?

Please leave a like and comment,

And remember,

By risking 1%, I am indifferent to any individual trade. Keeping your risk small and constant is absolutely critical.” Larry Hite.