Community ideas

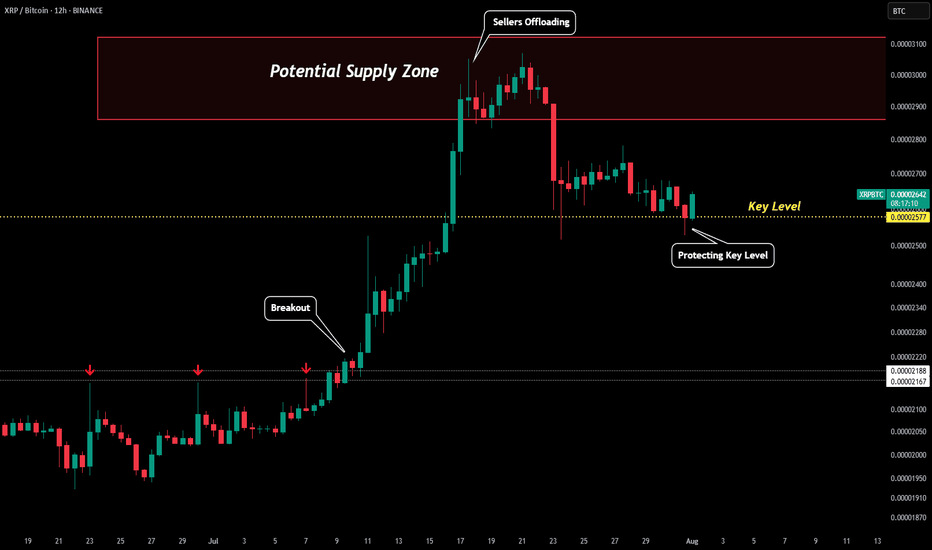

XRP/BTC - Perfect Prediction Please refer to our previous post:

After the XRP breakout we outlined that XRP/BTC was the most important pair to watch. Also, we outlined that the XRP/BTC pair was likely to push into our "potential supply zone" that ranges between around 0.0000285 and 0.000031.

This is exactly what happened with our XRP/BTC pair topping out around 0.0000307. Thus confirming resistance as sellers started offloading in this range. Once the pair broken down from the supply zone it tanked to our yellow dotted line "key level".

So far price has been respecting this key level with all candle bodies above. This has also been in alignment with the psychological $3 level. If XRP/BTC closes a 12H/1D candle body below the yellow dotted line the uptrend is likely not to stay in tact.

For now, with the pair respecting the yellow line a move back to test the bottom of our supply zone (0.0000285) is on the table.

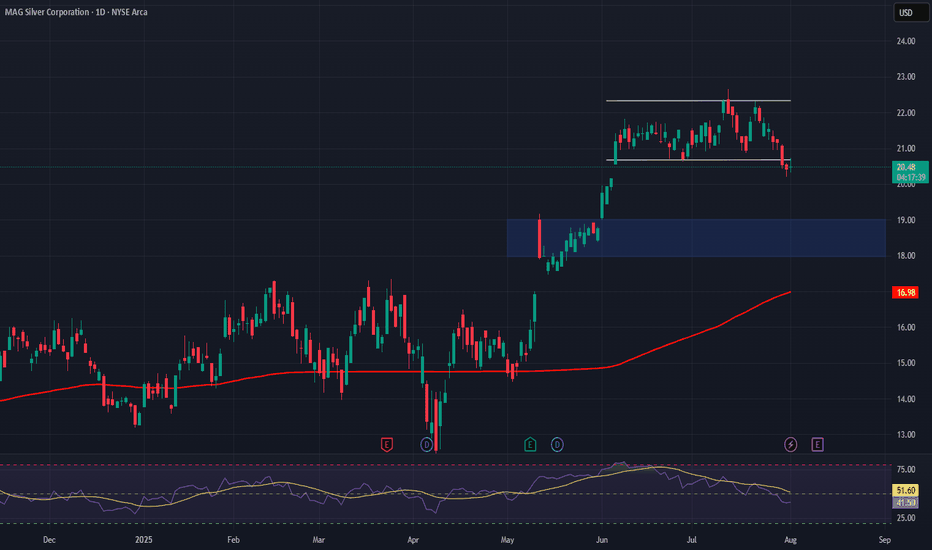

MAG Silver – A Pure-Play Winner in the Precious Metals RallyCompany Snapshot:

AMEX:MAG Silver is uniquely positioned as a high-beta play on silver and gold, with nearly all revenue tied to precious metals exposure—making it a standout in the current macro-driven metals bull run.

Key Catalysts:

High Leverage to Silver 🌐

With almost all income derived from silver and gold sales, MAG offers direct upside as investors flock to safe-haven assets amid inflation, rate uncertainty, and geopolitical risk.

Juanicipio Growth Engine ⛏️

Operated by top-tier partner Fresnillo, the Juanicipio project continues to scale efficiently, tapping into new high-grade zones that will further boost output and margins.

Financial Strength 💰

A debt-light balance sheet and healthy cash reserves give MAG financial flexibility, minimizing dilution risk and providing insulation during volatile market cycles.

Investment Outlook:

Bullish Entry Zone: Above $18.00–$19.00

Upside Target: $28.00–$29.00, driven by silver tailwinds, project scalability, and financial discipline.

🥇 MAG Silver stands out as a low-risk, high-reward name for investors seeking direct exposure to silver’s breakout.

#SilverStocks #Gold #MAGSilver #SafeHaven #PreciousMetals #Juanicipio #Fresnillo #CommodityRally #HardAssets #MiningStocks #InflationHedge #Geopolitics #MetalBulls

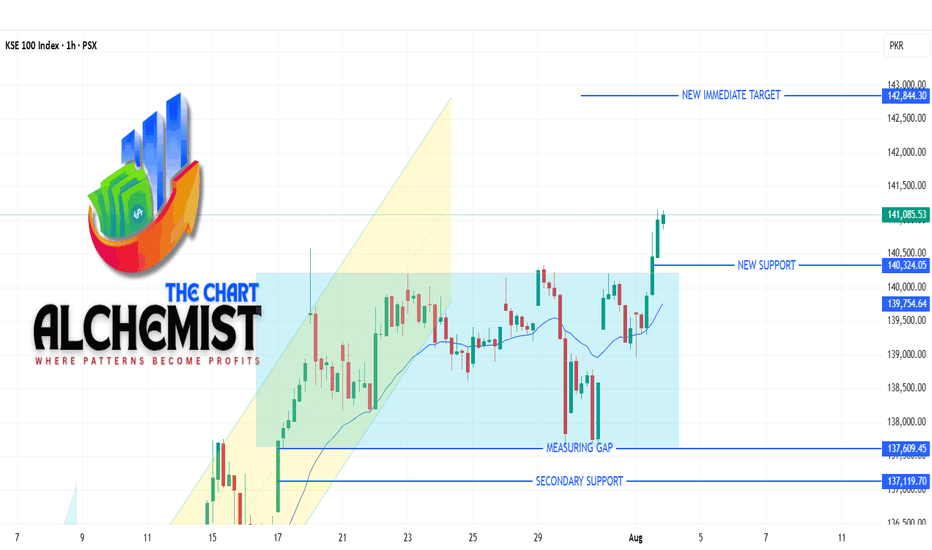

KSE 100 Technical Analysis 01-08-2025KSE 100 Technical Analysis | 01-08-2025

The KSE 100 index has formed a trading range between 136000 and 140200. After breaching the previous resistance at 13900, the index retested this level in the final hour of trading. We expect the index to rise from this level, cross the upper limit of the trading range, and move towards a new target.

Key Levels

- *Support*: 136000

- *Resistance*: 140200 (upper limit of the trading range)

- *Recent Breakout Level*: 139000 (successfully breached and retested)

Expected Movement

- Rise from current levels

- Breakout above 140200

- Target: 142775 (applicable after successful breakout)

Current Trend

- The index is still in a bullish trend, with potential for further upside.

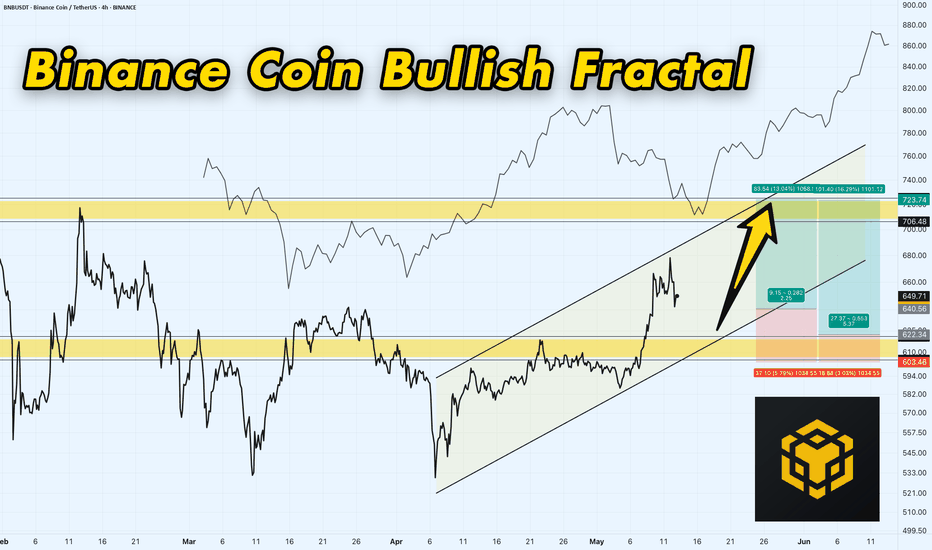

BNB/USDT 4H Chart: Rising Channel with Fractal Vibes!Hey traders! Binance Coin is showing some promising action that’s got me on the edge of my seat!

We’ve got a clear rising channel in play, with BNBUSDT moving beautifully in sync with a fractal line pattern shown above the chart — mirroring past price behavior like a roadmap! BNBUSDT is currently trading at $650 , I think price will continue bouncing between the channel’s support at $620-$600 and move upwards to the key resistance target at $700-$720 . A breakout above this resistance could send BNB soaring to new highs, potentially targeting $800 or beyond!

However, if BNB fails to break through, we might see a pullback to the channel support at $620-$600 .

Key Levels to Watch:

Resistance: $700-$720

Support: $620-$600

Breakout Target: $800+

Breakdown Risk: $600

Is BNB about to blast through $720, or will it retreat below support? Let’s hear your thoughts below!

2 Scenarios for BTCNow that the cup and handle formation has been reached and the correction finished, I think we have 1 more leg up.

It's also possible that we fall from here, but I think another fakeout upwards is likely as bearish divergence forms on the month, but isn't quite there yet (RSI needs 1 more higher high to confirm bearish divergence)

Either way, my short targets are the 0.618 fibs. I am expecting the typical -70-75% crash by 2027 before the next cycle begins

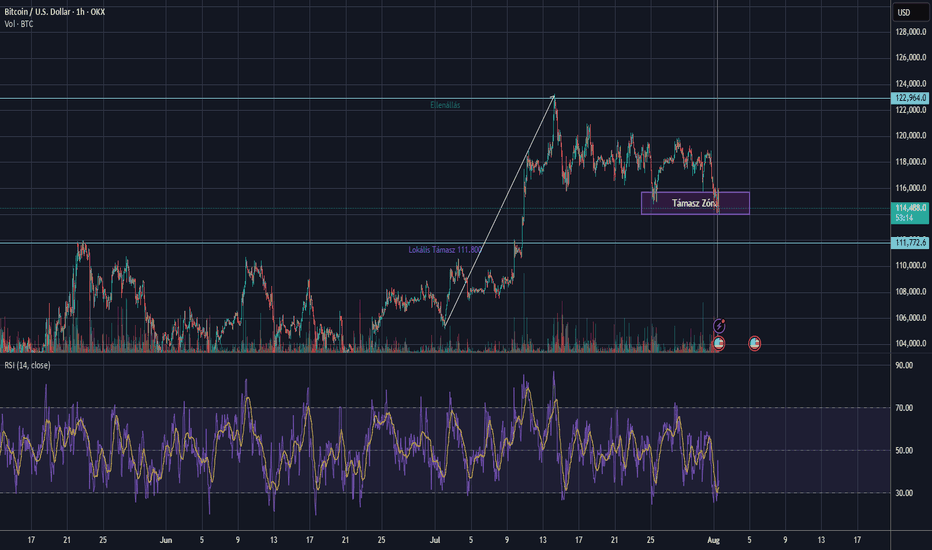

BTC Breaks Support – What's Next for Bitcoin?🧠 Bitcoin Technical Analysis – August 1st, 2025

📉 BTC/USD is under pressure, currently trading near $114,200, after dropping from the recent range highs. The chart shows a clear breakdown from a key consolidation zone between $114,000–\$115,500, marked as a crucial support zone.

🔍 Key Observations:

Major resistance remains at $123,000, where BTC topped mid-July.

A bullish trendline from early July has been broken — confirming momentum shift.

Local support sits at $111,800, a potential next landing zone if this breakdown continues.

The RSI (14) is now in oversold territory, below 30, signaling potential bounce or short-term relief — however, no bullish divergence is visible yet

---

🔎 Volume Spike & Momentum:

A noticeable volume spike has appeared alongside the breakdown, confirming strong selling pressure .

Short-term moving averages (e.g., 10 EMA) are now above price, adding to the b earish short-term bias.

🧭 Conclusion :

This region is critical for bulls — if BTC can reclaim the purple support box, it could invalidate the breakdown and trap aggressive shorts. Otherwise, \ $111,800 is the next area to watch for a reaction.

Let me know your thoughts below — Will this support hold or is \$110k next?

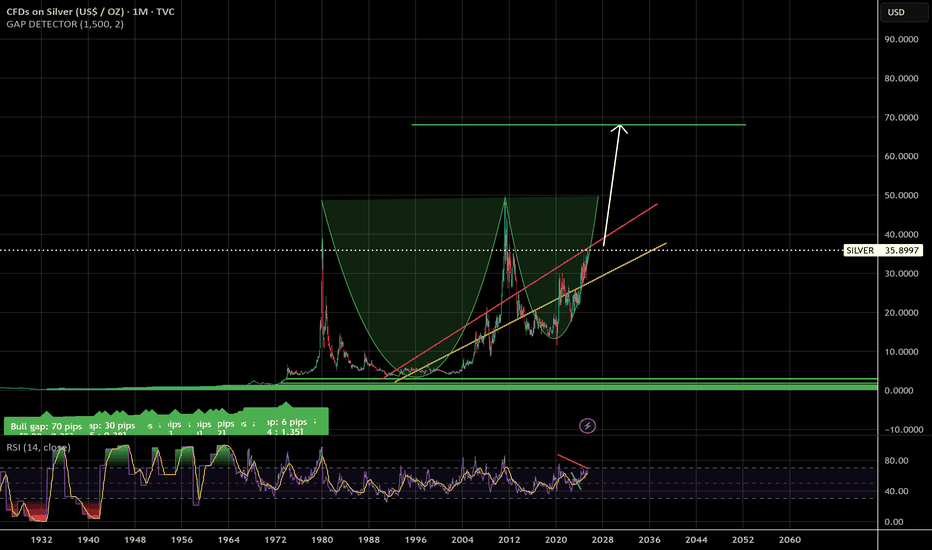

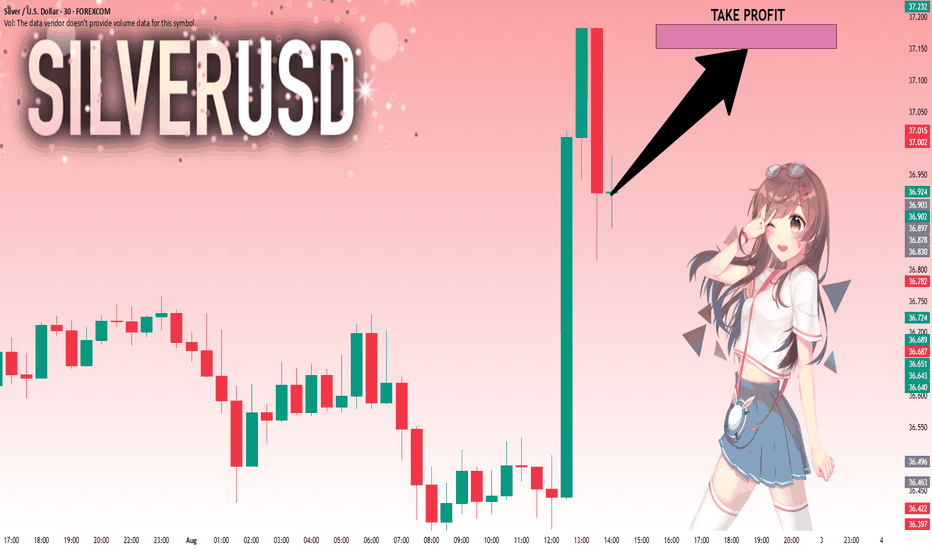

SILVER: Local Bullish Bias! Long!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 36.920 will confirm the new direction upwards with the target being the next key level of 37.150 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

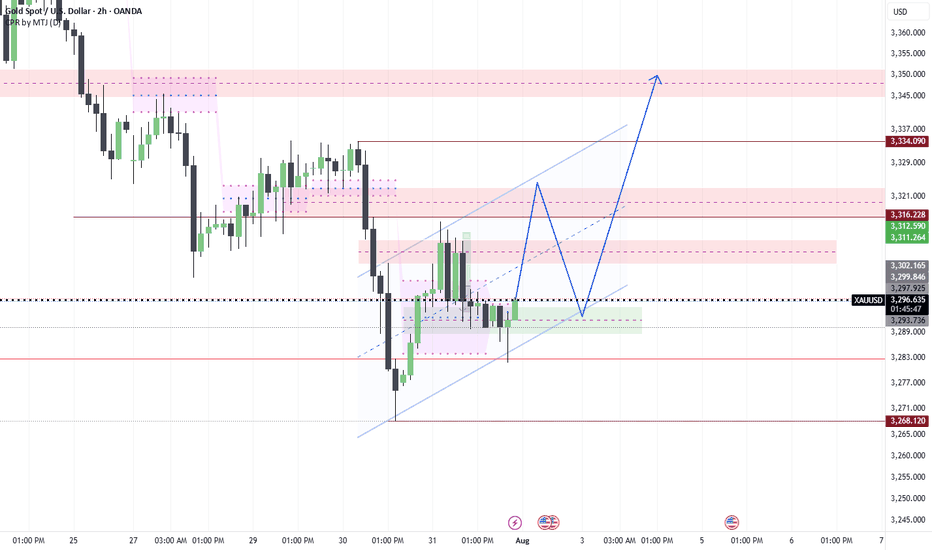

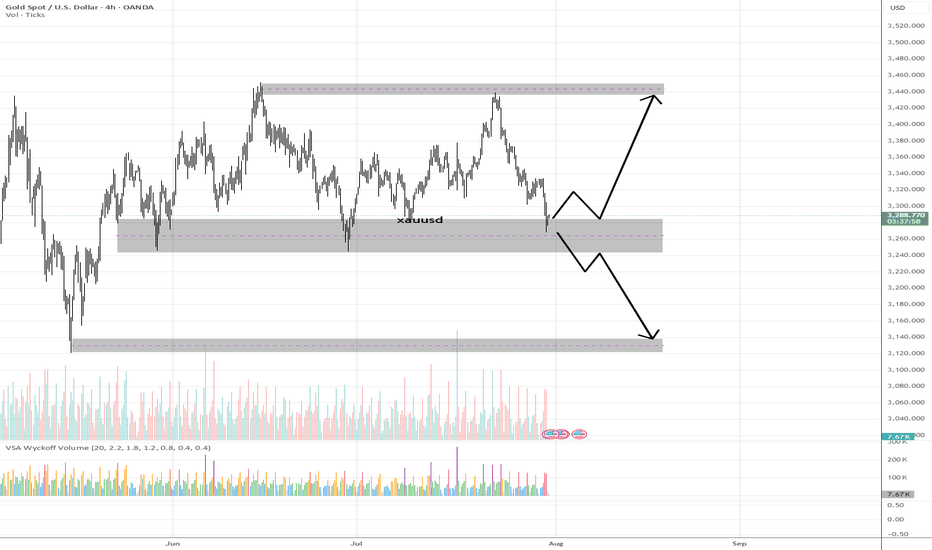

XAUUSD – Demand Zone Reaction & Potential Markup (VSA Analysis)💡 Idea:

Gold is testing a major 4H demand zone with early signs of smart money accumulation. VSA signals show supply exhaustion and potential for a bullish reversal toward upper resistance.

📍 Trade Setup:

Entry Zone: 3,265 – 3,285 (current demand zone)

Target 1: 3,380 – 3,400 (mid supply zone)

Target 2: 3,440 – 3,460 (major supply zone)

Stop Loss: Below 3,240 (to avoid false breakouts)

R:R Potential: ~3:1

📊 Technical Reasoning (VSA)

Stopping Volume Detected

On the recent drop into the demand zone, a wide spread down-bar on ultra-high volume appeared, followed by no further downside progress.

This is a classic stopping volume pattern where professional money absorbs selling pressure.

No Supply Confirmation

Subsequent candles inside the zone show narrow spreads on decreasing volume, indicating a lack of genuine selling interest.

Demand vs Supply Shift

Multiple attempts to break below 3,265 have failed, showing absorption of supply and positioning for markup.

If price rallies from here on increasing volume and wider spreads up, it would confirm demand dominance.

Structure Context

This demand zone has historically produced strong rallies.

Break above the minor resistance inside the zone could trigger a swift move toward Target 1, with momentum possibly extending to Target 2.

📌 Trading Plan:

Look for bullish confirmation bars with high volume before entry.

If price breaks below 3,240 on high volume, invalidate the long setup and watch for the next demand level around 3,140.

Partial profits can be taken at Target 1, and the remainder trailed toward Target 2.

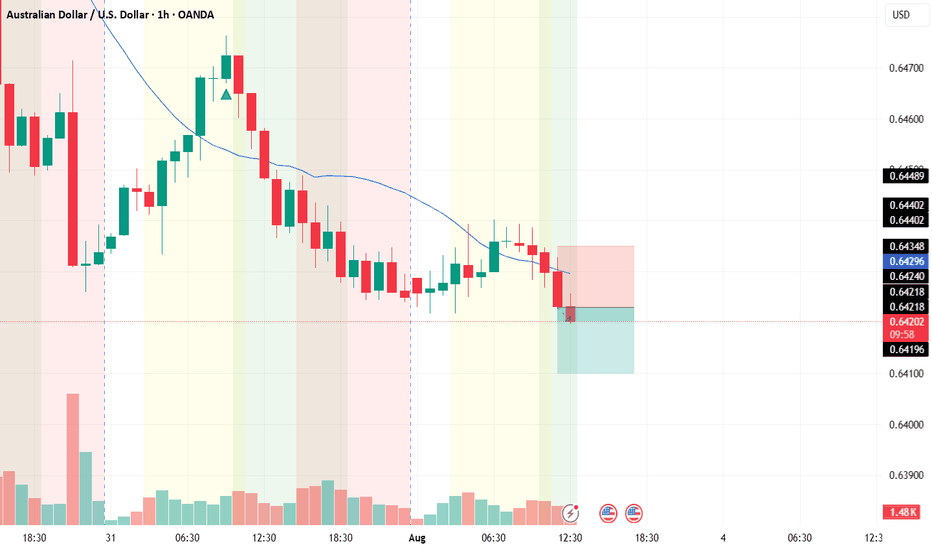

AUD/USDThis is a trade setup for AUD/USD, based on volume and trend analysis.

Entry Price: 0.64230

Stop-Loss (SL): 0.64350

Take-Profit (TP): 0.64100

The trade is intended to be executed instantly at the mentioned price, in alignment with both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.

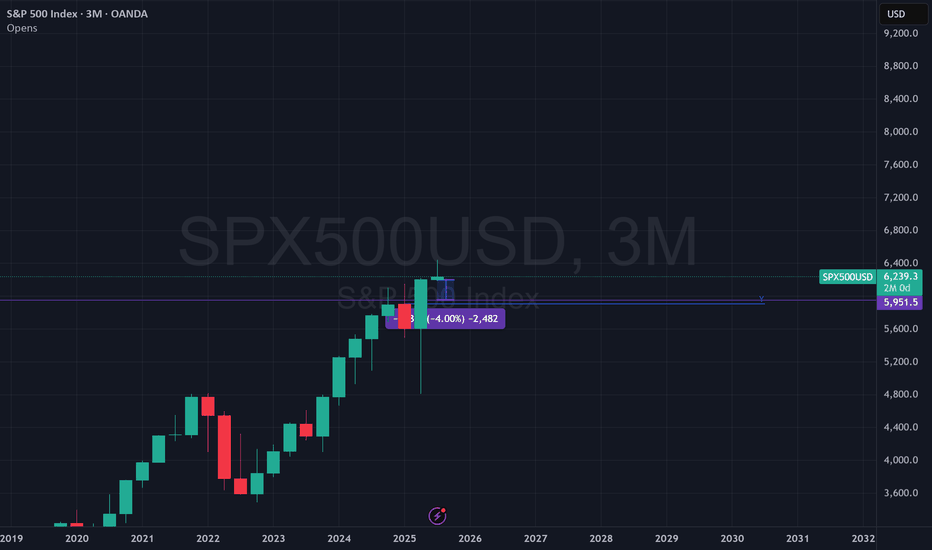

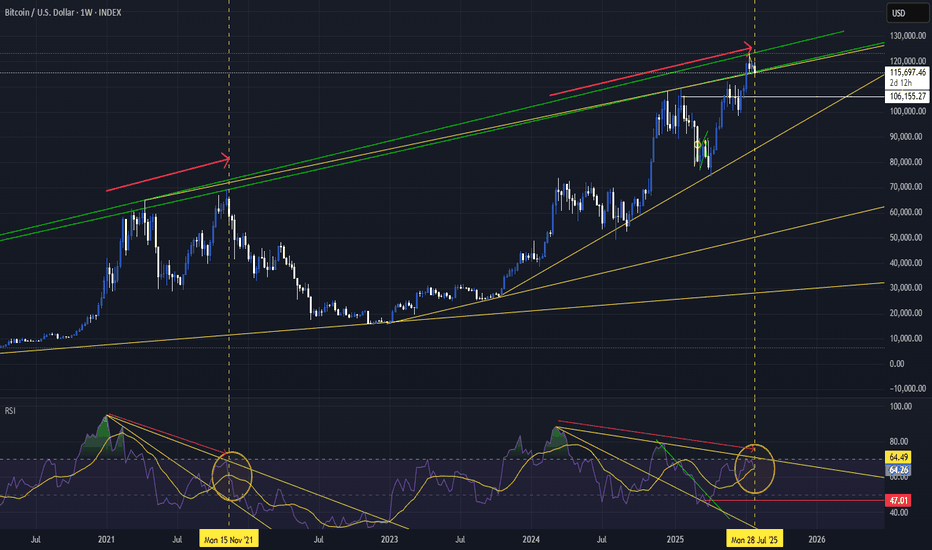

Could this be the end of the bull market? Caution requiredSo the green lines are the tops of the last 2 cycles.

We have wicked up to the top of the line, and got denied.

We have spent a week above the bottom GREEN line, suggesting that we want to hold it.

Weekly closes above the bottom line are an acceptance that the price is right and has movement potential to continue higher.

We can retest 106, hold above - and then see continuation higher. It is possible... but

IF you look at the RSI and compare to 2021, there is BEARISH DIVERGENCE that is clearly defined. This is a leading indicator, and often works out more than not.

We 100% need to get above the top yellow trend line to invalidate the bearish divergence.

Right now, RSI is testing the yellow moving average - this is the point last cycle where everything ended.

If price recovers, then i think we go higher (new ath again).

If Price does not, and RSI falls below the moving average, then i think its likely the bull cycle for btc is over..

BUT, its not all doom and gloom.

The RSI moving average has made a higher low, suggesting that the market is not finished its upwards momentum.

On a more fundamental understanding:

BTC has gone almost straight up from 16k to 121k. Its not healthy.

To get to higher highs, we need real adoption of btc.

I dont think BTC breaks and holds above 130k without some more kind of mainstream adoption.

We have institutional adoption - ETFS allow a constant buying pressure, pension funds have access to BTC now too! (I have a new btc exposed retirement annuity if anyone is keen... just dont think the % allowed is that reasonable at the moment).

Banks are starting to allow custody of BTC, meaning the average joe will be able to buy through their bank...

But i cant pay for my beers with btc, i cant use btc to settle debts with most merchants.

There is still more mainstream adoption to happen...

Countries are not piling into btc to make it a reserve asset in teh way i believe they will in teh future

The market will always move to hurt the most people.

Once everyone who wants to buy btc at the highs is done, then the price 100% will correct...

As btc matures, its volatility will drop. This means that the 80% retraces of the past are unlikely in my opinion.

There are big players wanting to buy for long term, this will make buy orders happen sooner than they have in the past.

As an indicator for the alt market - btc losing major psychological levels will create a risk off environment - aka more alt pain.

I had a look at the BTC.D, and on a quick inspection it looks like it could rise to even as high as 75%...

Which, as btc has a global use case as a store of value makes sense vs alt coins changing the world in the same time span.

If the price of BTC drops, alts will drop harder as they are riskier assets. Making BTC.D increase.

Alts are still close the lows, and they need a risk on environment to gain value.

The whole crypto market has changed compared to the old cycles.

Previously, the BTC believers would make huge money - and then at these peaks sell their btc to either tether and alt tokens.

This insane amount of money we received into the total market cap came from big institutions - blackrock etf etc, governments buying.

These players that made the money cant swop their btc to alt coins. They are locked into an etf where at most they can diversify into other traditional investments.

This is a real risk to total2+ receiving a real return...

But its not over, BTC will survive. We learn what we can to make sound financial decisions in the long term.

Stick with your long term plans. Dont but trash. Manage your risk. Manage your mental, dont be over exposed to risk when at the highs.

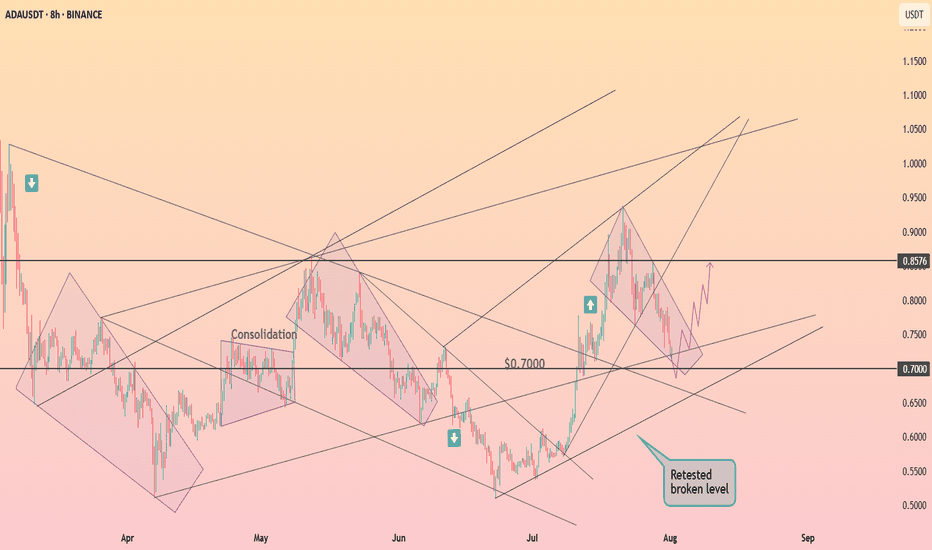

Cardano is forming the falling wedge ┆ HolderStatBINANCE:ADAUSDT is testing the $0.70 level after a clean breakout from previous consolidation. The current retracement channel indicates a controlled pullback, likely to flip into bullish continuation if $0.70 holds. Watch for a move toward $0.8576 once the pattern breaks upward.

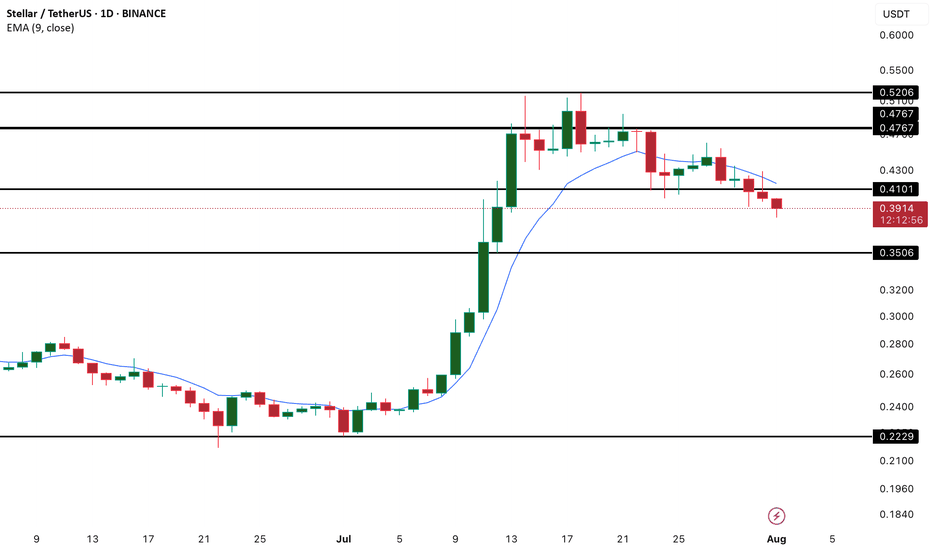

XLM/USD Analysis – Bearish Momentum Builds Below 20-Day EMA

XLM has taken a notable hit, with recent price action showing a sharp drop that has dragged the token below its 20-day Exponential Moving Average (EMA). Currently sitting at $0.40, the 20-day EMA now acts as a dynamic resistance level, capping potential upside in the short term.

This development signals a clear shift in short-term sentiment. The 20-day EMA, which reflects average pricing over the last 20 sessions with an emphasis on recent moves, typically supports bullish outlooks when the price remains above it. However, XLM's break below this level suggests growing sell-side pressure and a loss of bullish control.

With momentum weakening and bearish signals intensifying, traders may want to exercise caution, especially if the price fails to reclaim the EMA in the near term. Further downside could follow if buyers don't step in to reverse the trend.

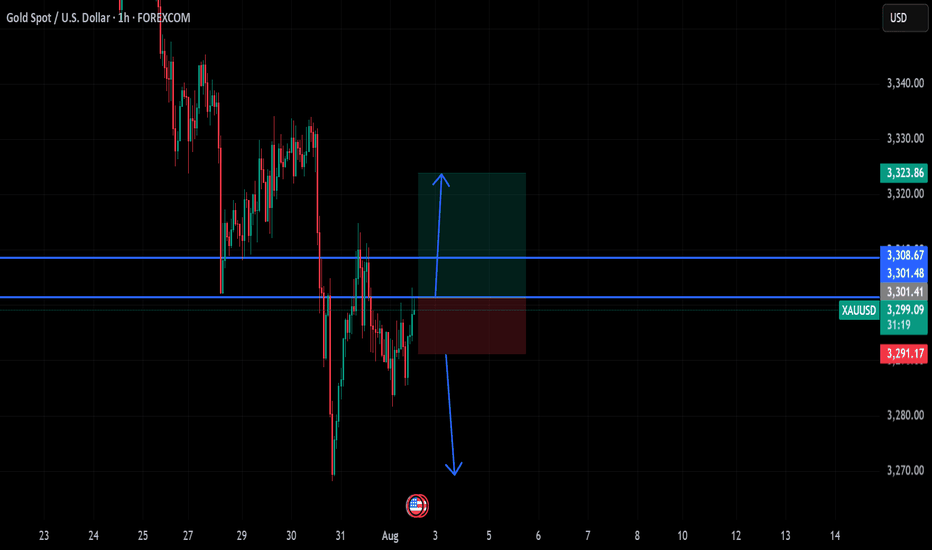

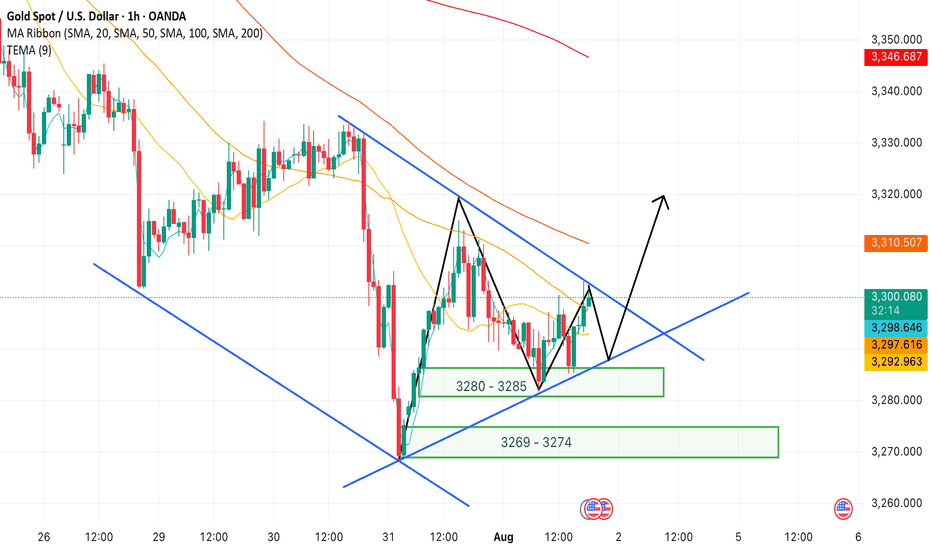

XAUUSD Gold Trading Strategy August 1, 2025

Yesterday's trading session, gold prices recovered to the 3315 area and then continued to decrease to the 3281 area. Currently, gold prices are fluctuating quite unpredictably due to the impact of tariff news and investor confidence.

Basic news: The Federal Reserve FED continues to maintain the federal funds benchmark interest rate in the range of 4.25% - 4.50%, in line with policy since 2025. Chairman Powell did not give any signal about the next interest rate cut on September 16 - 17.

Technical analysis: After falling sharply to the 3269 area, gold prices are showing signs of recovery. In the current downtrend channel, there has been a higher bottom than the bottom at H1. We can see that if the bullish pattern at H1 is confirmed, combined with the reversal candlestick appearing at H4, the possibility of gold bouncing back to reach the resistance area of 3330, even 3350 is completely possible. In the weekend trading session, we will wait at the support zones to trade.

Important price zones today: 3280 - 3285 and 3269 - 3274.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3283 - 3285

SL 3280

TP 3288 - 3300 - 3310 - 3330.

Plan 2: BUY XAUSD zone 3269 - 3271

SL 3266

TP 3274 - 3284 - 3300 - 3320.

Wish you a safe, favorable and profitable trading day.🥰🥰🥰🥰🥰

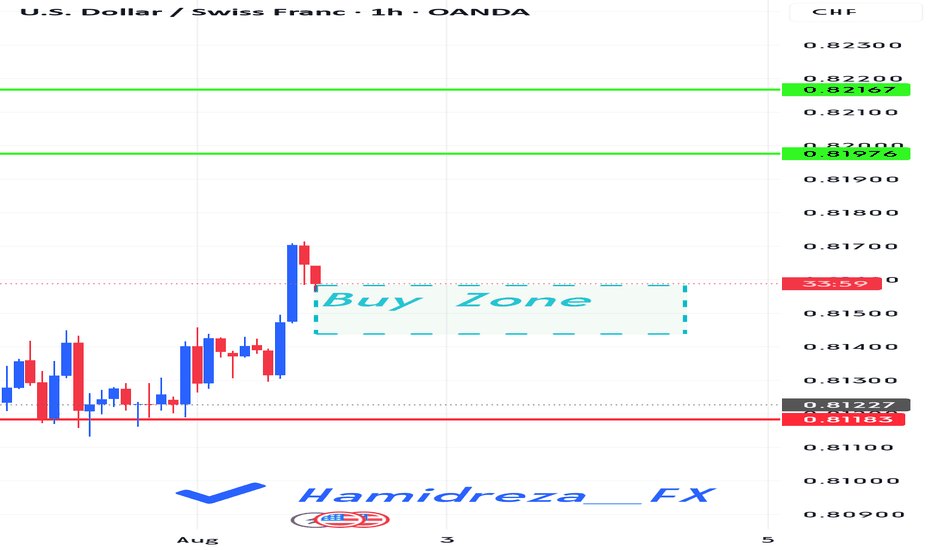

Will USDCHF remain bullish?

Hi dears

We are at your service with the analysis of the Swiss Franc against the US Dollar. It seems that we should continue to see the strengthening of the US Dollar. It is possible that we will see the growth of the African Dollar against the opposite currency pairs.

What do you think?

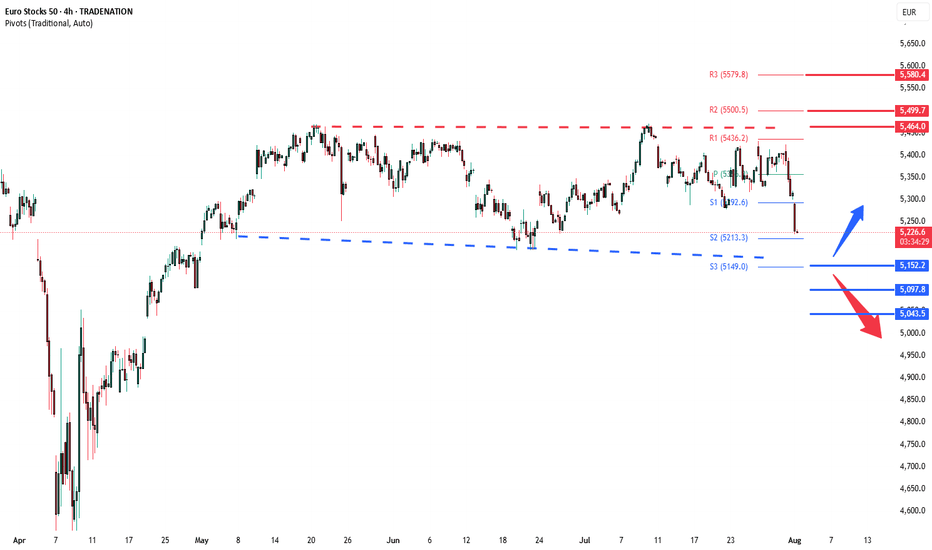

Stoxx sideways consolidation Key Support and Resistance Levels

Resistance Level 1: 5464

Resistance Level 2: 5500

Resistance Level 3: 5580

Support Level 1: 5152

Support Level 2: 5097

Support Level 3: 5044

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

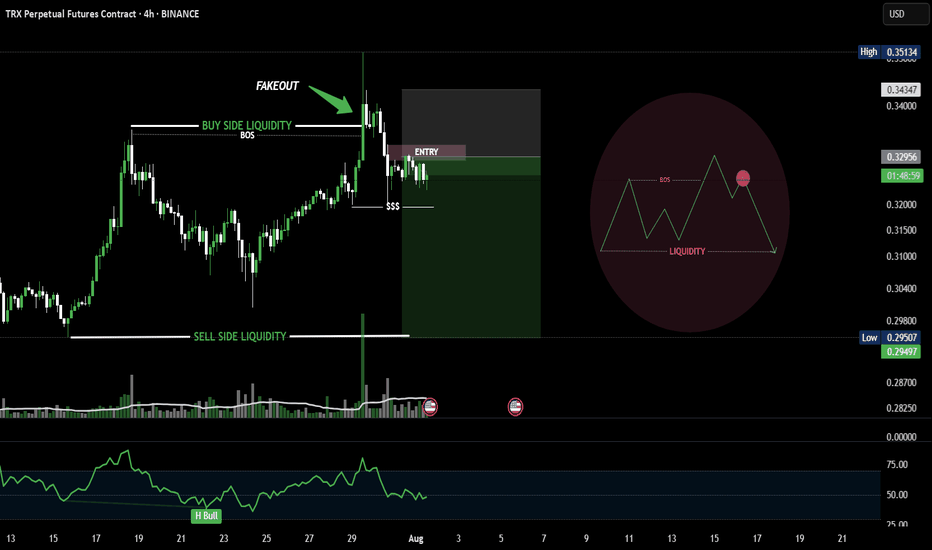

Classic Liquidity Trap on TRX -TRXUSDT-4HPrice hunted buy-side liquidity with a sharp fakeout move, trapping breakout traders.

After breaking structure (BOS) and forming internal liquidity, the short setup was confirmed.

Entry placed on the mitigation of the order block with clear risk defined above the fakeout.

Targeting sell-side liquidity for maximum R:R. Clean and calculated.